Navigating the Technical Trading vs Fundamental Divide

Investors face a choice when analyzing stocks: technical trading vs fundamental analysis. Each method has its own strengths and weaknesses. Technical analysis, introduced by Charles Dow in the late 1800s, looks at stock price patterns and trends. It aims to predict future price movements.

Fundamental analysis, on the other hand, examines a company's financial health and management team. It also considers industry trends and competitive position to estimate a company's true value.

The debate between technical trading and fundamental analysis is key for investors. Technical analysis can be used on any security with trading data, like stocks, futures, and currencies. Fundamental analysis, though, looks at a company's intrinsic value and financial state.

It's vital for investors to understand these differences. This knowledge helps in creating effective trading strategies.

Key Takeaways

- Technical trading vs fundamental analysis are two distinct approaches to analyzing stocks.

- Technical analysis focuses on patterns and trends in stock prices and trading volumes.

- Fundamental analysis involves examining a company's financial health and competitive position.

- Technical analysis can be applied to any security with historical trading data.

- Combining technical and fundamental analysis can aid investors in gaining a more complete view of investment opportunities.

- Understanding the differences between technical trading and fundamental analysis is essential for developing effective trading strategies.

- Fundamental analysis vs technical analysis can help investors make informed decisions and navigate the technical trading vs fundamental divide.

Understanding Technical Trading Strategies

Technical trading uses charts and indicators to spot patterns in stock prices. It looks at statistical trends on charts to predict future prices. This method believes all information about a company is in its stock price.

When comparing fundamental analysis vs technical trading, it's key to know the differences. Technical trading vs fundamental analysis uses different tools and methods. Technical traders rely on indicators like moving averages and RSI to forecast trends.

Key Concepts in Technical Trading

Some important ideas in technical trading include:

- Trend lines and support and resistance levels

- Chart patterns like head and shoulders or double tops and bottoms

- Technical indicators like RSI and Bollinger Bands

Trading software, like MetaTrader or TradingView, helps technical traders analyze and trade. By grasping these concepts and using the right tools, traders can make better decisions and possibly outperform the market.

| Technical Indicator | Description |

|---|---|

| Moving Averages | Average stock price over a certain period |

| Relative Strength Index (RSI) | Measures stock's recent price changes to determine overbought or oversold conditions |

| Bollinger Bands | Volatility-based bands that move with the stock price |

The Foundations of Fundamental Analysis

Fundamental analysis is a way to value securities by looking at their true worth. It examines a company's financial health, management team, and industry trends. This method is different from technical analysis, which looks at price and volume trends.

When comparing fundamental vs technical investing, key metrics are important. These include revenue growth, earnings per share (EPS), and the price-to-earnings (P/E) ratio. Also, economic indicators like GDP growth and interest rates matter. News and events, like earnings announcements, can also affect stock prices.

- Revenue growth: A company's ability to increase its revenue over time.

- Earnings per share (EPS): A company's profit divided by its total number of shares.

- Price-to-earnings (P/E) ratio: A company's stock price divided by its EPS.

- Dividend yield: The ratio of a company's annual dividend payment to its stock price.

By looking at these metrics, investors can understand a company's financial health better. This helps them make smart investment choices. Fundamental analysis is key for long-term investors, helping them find undervalued stocks.

| Metric | Description |

|---|---|

| Revenue Growth | A company's ability to increase its revenue over time. |

| Earnings Per Share (EPS) | A company's profit divided by its total number of shares. |

| Price-to-Earnings (P/E) Ratio | A company's stock price divided by its EPS. |

| Dividend Yield | The ratio of a company's annual dividend payment to its stock price. |

Comparing the Two Approaches

Technical trading and fundamental analysis have their own strengths and weaknesses. Technical analysis is great for short-term trading, focusing on price trends and patterns. Fundamental analysis, on the other hand, is better for long-term investments, looking at a company's true value based on its financials.

Short-term, strong fundamentals don't always match technical patterns. But, combining both can give traders a full view of the market. Fundamental analysis looks at financial statements and economic conditions. Technical analysis uses past price and volume data to forecast future prices.

Key Differences

- Technical analysis is mainly for short-term trading, like day trading.

- Fundamental analysis is for long-term investing, like holding onto stocks for years.

- Short-term traders often use technical analysis, while long-term investors look at fundamentals.

The choice between technical trading and fundamental analysis depends on the trader's style and goals. Knowing the strengths and weaknesses of each helps traders make better decisions and develop effective strategies.

| Approach | Time Horizon | Focus |

|---|---|---|

| Technical Analysis | Short-term | Price trends and patterns |

| Fundamental Analysis | Long-term | Intrinsic value and financial performance |

Popular Strategies in Technical Trading

Technical trading looks at past market data to guess future prices. It's often paired with fundamental analysis for a full trading plan. The debate between technical and fundamental analysis is ongoing, each with its own benefits and drawbacks.

Technical trading offers several key strategies. These include:

- Trend following strategies, which track market trends

- Mean reversion strategies, which spot overbought or oversold conditions

- Breakout trading techniques, which look for support or resistance levels

These methods work in various markets like stocks, commodities, and forex. It's not about picking one over the other. It's about choosing what fits your trading style and market conditions. Mixing both approaches helps traders understand markets better and make smarter choices.

| Strategy | Description |

|---|---|

| Trend Following | Identifying and following market trends |

| Mean Reversion | Identifying overbought or oversold conditions and betting on a return to historical means |

| Breakout Trading | Identifying levels of support or resistance and trading on the expectation of a breakout |

The choice between fundamental analysis and technical trading depends on the trader's goals and risk level. Knowing the strengths and weaknesses of each helps traders find the right strategy for their needs and goals.

Insights into Fundamental Trading Practices

Fundamental trading looks at a company's financial health and management team. It also considers industry trends and competitive position. This helps investors find companies with real value. Fundamental analysis is key, helping spot undervalued companies with growth.

Value Investing Explained

Value investing aims to find companies that are cheaper than their true worth. It's about finding stocks that are underpriced. Investors use fundamental analysis to find these hidden gems.

Growth Investing vs. Value Investing

Growth and value investing are two different ways to invest. Growth investors look for companies that will grow fast. Value investors find companies that are cheap but have strong fundamentals.

- Growth investors focus on companies with high growth rates

- Value investors seek out undervalued companies with strong fundamentals

- Growth investing is often more volatile than value investing

Dividend Investing Strategies

Dividend investing focuses on companies that pay out consistent dividends. This strategy can provide steady income and reduce market ups and downs. Here are some key dividend strategies:

| Strategy | Description |

|---|---|

| Dividend Aristocrats | Investing in companies that have increased their dividend payments for 25 consecutive years |

| Dividend Yield | Investing in companies with high dividend yields |

| Dividend Growth | Investing in companies with a history of increasing their dividend payments |

Psychological Factors in Trading Decisions

When it comes to technical trading vs fundamental analysis, psychology is key. Emotions like fear or greed can lead to quick, impulsive trades for technical traders. At the same time, fundamental analysis vs technical analysis is also shaped by psychological factors, including biases.

Some common biases that affect traders include:

- Cognitive biases, such as confirmation bias and loss aversion bias

- Emotional biases, such as fear and greed

- Behavioral biases, such as overconfidence bias and self-control bias

To beat these biases, traders can use education, awareness, and objective research. By understanding these psychological factors, traders can make better choices. This leads to improved trading results. In the battle of technical trading vs fundamental analysis, knowing these biases is essential for success.

As the first source notes, "Technical Analysis, with its charts and patterns, offers real-time data insights." Yet, even with great data, psychology can influence trading decisions. By facing and tackling these factors, traders can enhance their performance. They can make smarter choices, whether they focus on fundamental analysis vs technical analysis or both.

The Impact of Market Conditions on Both Approaches

Market conditions greatly affect the success of fundamental analysis vs technical and technical trading vs fundamental methods. In unstable markets, technical trading is often favored. It focuses on quick price changes. Yet, fundamental analysis looks at a company's long-term value and future.

Experts agree that having various tools is key in changing market conditions. They say, "The stock market is always shifting. Having many tools helps you adjust your strategy as the market changes." Traders should consider:

- How market conditions influence technical trading vs fundamental methods

- Creating a strategy that uses both fundamental analysis and technical analysis

- Keeping up with market trends and news for better trading choices

By understanding how market conditions and trading methods interact, investors can improve their strategies. This leads to better decisions in the fundamental analysis vs technical debate.

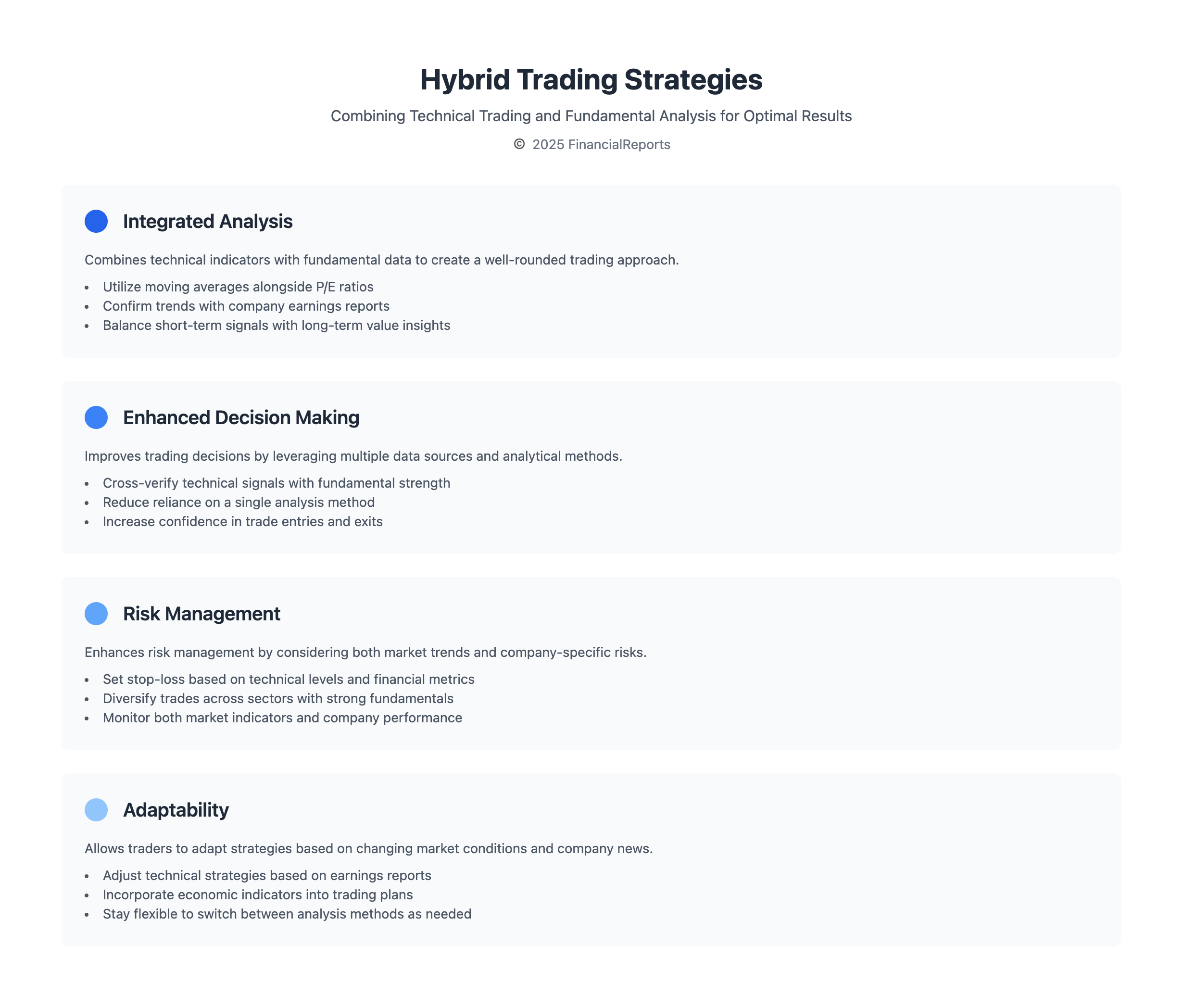

Hybrid Trading Strategies: A Balanced Approach

The debate between fundamental vs technical investing has been ongoing. Yet, many successful traders blend fundamental analysis and technical analysis. This hybrid method offers a deeper market understanding. It looks at both an asset's true value and its market trends.

A study by icoholder shows 80% of traders mix both methods. This hybrid strategy helps traders make better decisions and adjust to market changes. Key aspects for hybrid traders include:

- Quantitative analysis, including financial statements and ratios

- Qualitative research, including business models and industry positioning

- Technical indicators, such as moving averages and relative strength index

By merging these methods, traders gain a deeper market insight. As Benjamin Graham said, "Price is what you pay. Value is what you get." A hybrid approach helps uncover an asset's true value, leading to smarter investment choices.

| Analysis Type | Description |

|---|---|

| Fundamental Analysis | Examines a company's financial statements, management team, and industry trends to estimate its intrinsic value |

| Technical Analysis | Studies market trends and patterns to predict future price movements |

Conclusion: Finding Your Trading Niche

In the world of trading, you don't have to choose just one way. Both technical trading and fundamental analysis offer valuable insights. By knowing what each method does well, traders can create a strategy that fits their style and market knowledge.

Technical traders use quick, uniform analysis to spot trends and opportunities. Fundamental analysts look deeper into a company's value, management, and future. Mixing these views can lead to smarter, more complete trading choices.

Choosing between technical trading vs. fundamental analysis depends on your risk level, time frame, and market insights. Whether you like the data focus of technical indicators or the deep dive of fundamental analysis vs. technical analysis, the goal is to match your trading approach with your goals and market savvy. A balanced strategy lets traders use the strengths of both worlds, making them more confident and successful in the financial world.

FAQ

What is the difference between technical trading and fundamental analysis?

Technical trading looks at stock price patterns and trends. It aims to predict future prices. On the other hand, fundamental analysis checks a company's financial health and management team. It also looks at industry trends and competitive position to guess its true value.

What are some popular technical indicators used in trading?

Popular technical indicators include moving averages and the relative strength index (RSI). Bollinger Bands are also used. These tools help spot trends, overbought or oversold conditions, and support and resistance levels.

What are the key metrics used in fundamental analysis?

Key metrics include revenue growth and earnings per share (EPS). The price-to-earnings (P/E) ratio and dividend yield are also important. Analysts also consider economic indicators and news that can affect a company's stock price.

How do time horizons and trading style influence the choice between technical and fundamental analysis?

Technical trading is for short-term gains, while fundamental analysis is for long-term investments. Your trading style and risk tolerance also play a role in choosing between these approaches.

What are some popular technical trading strategies?

Trend following, mean reversion, and breakout trading are popular strategies. They use technical indicators to spot trends and overbought or oversold conditions. This helps identify when to buy or sell.

What are the different fundamental investing strategies?

Investing strategies include value, growth, and dividend investing. Value investors look for undervalued companies. Growth investors focus on companies with high growth. Dividend investing is about companies with a consistent dividend history.

How do psychological factors impact trading and investing decisions?

Emotions like fear or greed can lead to impulsive trading decisions. Behavioral biases, such as confirmation bias, can also influence analysis. Understanding these factors is key to a successful strategy.

How do market conditions affect technical and fundamental trading approaches?

Volatile markets often lead to more technical trading. But, fundamentals help with long-term views. Knowing how market conditions affect both approaches is vital for success.

What are the benefits of a hybrid trading strategy that combines technical and fundamental analysis?

A hybrid strategy offers a deeper market understanding. It combines technical and fundamental insights. This helps traders adapt to market changes and make better decisions.