Nasdaq PE Ratios: A 30-Year Historical Analysis

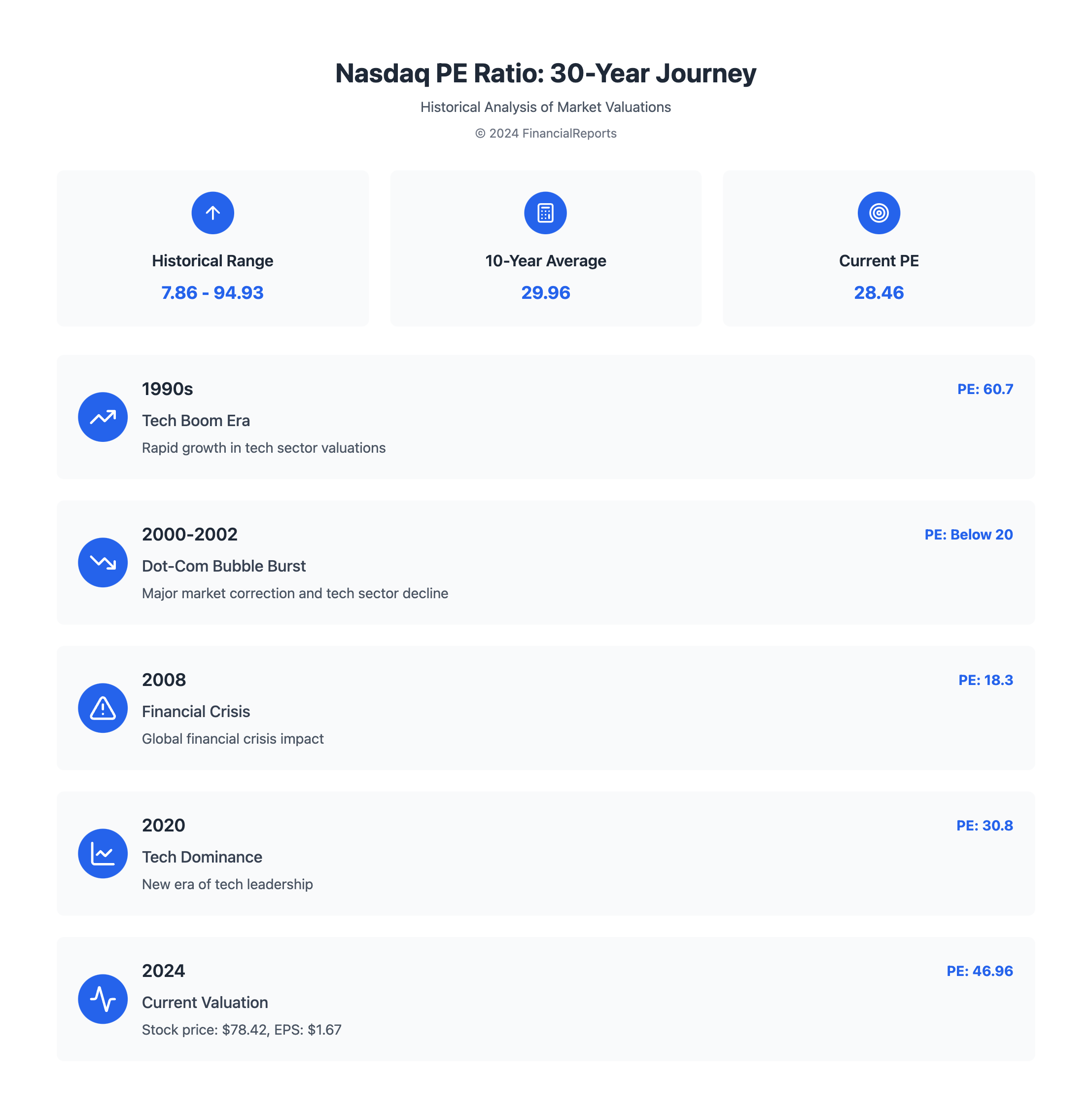

The Nasdaq PE ratio is currently at 28.46 as of December 27, 2024. It has ranged from 7.86 to 94.93 over the last three decades. This analysis will look at how the Nasdaq PE ratio has changed, major market events, and their effect on the Nasdaq stock market's value.

Looking at the past 30 years of Nasdaq PE ratios helps investors and financial experts understand the market better. The current PE ratio for Nasdaq stock is 46.96. The stock price is $78.42, and the TTM net EPS is $1.67.

Introduction to Nasdaq PE Ratios

Studying Nasdaq PE ratios over the last three decades gives a deep look at the market's value changes. It shows how big events affect the Nasdaq PE ratio. This data helps investors make smart choices and plan their investments well.

Key Takeaways

- The current Nasdaq PE ratio stands at 28.46 as of December 27, 2024.

- Historical Nasdaq PE ratios range from 7.86 to 94.93, providing insights into nasdaq pe ratios over the last three decades.

- The current PE ratio for Nasdaq stock is 46.96, with a stock price of $78.42 and a TTM net EPS of $1.67.

- Analyzing nasdaq pe ratio trends can help investors understand the market's performance and future trends.

- The sector of securities exchanges has a market cap of $45.475 billion and revenue of $6.064 billion.

- Intercontinental Exchange (ICE) and CME Group (CME) are major players in the sector, with market caps of $86.712 billion and $86.202 billion, respectively.

Introduction to PE Ratios and Nasdaq

The Price-to-Earnings (PE) ratio is a key financial tool. It's found by dividing the latest stock price by the earnings per share (EPS). For example, Nasdaq's PE Ratio is 46.96, based on a stock price of $78.42 and EPS of $1.67 (TTM). This helps investors see if a stock is overvalued or undervalued.

PE ratios are key for making investment choices. They show what the market thinks about a company's future earnings. The nasdaq stock forward pe ratio helps predict company growth. The nasdaq pe ratio gives a current market valuation snapshot.

What are PE Ratios?

PE ratios are found by dividing the market value by net income. There are several types, like the Trailing Twelve Month PE Ratio and Forward PE Ratio. Each type offers different insights into a company's value.

Importance of PE Ratios in Investment Decisions

PE ratios are vital for valuing stocks across various industries. They show how long it takes to earn back the stock price. But, they can be tricky in cyclical or unpredictable businesses. In these cases, the PS Ratio might be more useful. The nasdaq pe ratio is key for understanding market expectations of a company's future earnings.

| Quarter | Nasdaq PE Ratio |

|---|---|

| Dec 2019 | 21.79 |

| Mar 2020 | 27.95 |

| Jun 2020 | 33.21 |

| Sep 2020 | 34.63 |

| Dec 2020 | 43.72 |

The table shows how Nasdaq's PE ratio has changed over time. It highlights the need to consider this metric when investing. By looking at the nasdaq stock forward pe and nasdaq pe ratios, investors can make better choices.

Overview of Nasdaq's Historical Performance

Nasdaq Inc. has been a leader in trading and technology for over 30 years. The Nasdaq price to earnings ratio shows the market's health. It changes due to many factors.

Technological advancements and regulatory changes have boosted Nasdaq. The rise of tech companies has also played a big role. Changes in investor mood and the economy affect the Nasdaq PE multiple.

Key Milestones Over the Last 30 Years

- Introduction of new trading technologies

- Expansion of the Nasdaq exchange to include new listings

- Changes in regulatory requirements

These milestones have shaped the Nasdaq PE multiple. It goes up when growth is high and down when markets fall. Knowing these factors helps investors make smart choices.

Factors Influencing Nasdaq Growth

The Nasdaq's growth comes from many sources. Company performance, investor mood, and the economy all play a part. These factors make the Nasdaq PE multiple change over time.

Nasdaq PE Ratios in the 1990s

The 1990s saw big changes in the Nasdaq, thanks to the tech boom. This boom led to a rise in the Nasdaq's price earnings ratio. The ratio changed a lot because of the fast growth of tech companies.

The Nasdaq 100 PE ratio also saw big swings during this time. To understand these changes, we need to look at the decade's key statistics. Some important data includes:

- The NASDAQ Composite had an average closing price of $2,728.15 in 1999.

- The NASDAQ Composite experienced an 85.59% annual change in 1999.

- The Nasdaq PE ratio ranged from 11.69 (in 1988) to 60.7 (in 2008), showing significant fluctuations during the 1990s up to the early 2000s.

By studying these numbers and trends, we can better understand the Nasdaq's PE ratios in the 1990s. This knowledge helps us see how the market changed, leading up to the early 2000s.

| Year | NASDAQ Composite Average Closing Price | NASDAQ Composite PE Ratio |

|---|---|---|

| 1999 | $2,728.15 | Not available |

| 2001 | $2,029.61 | -21.05% |

| 2003 | $1,647.17 | 50.01% |

The Dot-Com Bubble and its Aftermath

The dot-com bubble happened in the late 1990s and early 2000s. It was a big event for the Nasdaq stock market. Nasdaq PE ratios over the last three decades hit extreme highs, with some stocks at over 100 times earnings. The nasdaq pe ratio showed the market's value, and its fast rise signaled the bubble.

PE Ratios at the Height of the Bubble

At the bubble's peak, many tech stocks had nasdaq pe ratios way above normal. For instance, Cisco Systems' stock price jumped over 1,000% in 1999. This made its nasdaq pe ratio soar over 100. Qualcomm and other stocks also saw huge price hikes, with nasdaq pe ratios hitting extreme levels.

Consequences of the Bust on Valuations

When the bubble burst, valuations took a big hit. The nasdaq pe ratio plummeted, and many stocks lost a lot of value. Cisco Systems' stock price dropped by over 80% from its peak. This led to a big drop in its nasdaq pe ratio. The crash also hurt the economy, with investors losing over $5 trillion.

The dot-com bubble and its crash remind us of the need for careful valuation and the risks of speculative investing. Looking at nasdaq pe ratios over the last three decades helps investors understand market values. This knowledge can guide them in making better investment choices.

Recovery in the 2000s: Nasdaq's Resurgence

The 2000s saw a big comeback for the Nasdaq stock market. The average PE ratio of Nasdaq was 29.96 over the last ten years. This comeback was thanks to changes in economic policies and new tech advancements.

Investors became more confident in the market's growth. This confidence was key to the Nasdaq's recovery.

This comeback was marked by a change in how investors thought. They started looking at long-term growth more than quick profits. This change led to a higher nasdaq pe ratio.

Several factors helped with this comeback. These included:

- Monetary policy changes: The Federal Reserve's move to lower interest rates boosted economic growth and investor confidence.

- Technological advancements: New tech like cloud computing and mobile devices drove innovation and growth in the tech sector.

- Shift in investor sentiment: Investors began to focus more on long-term growth, leading to a higher nasdaq pe ratio.

The 2000s recovery was a major turning point for the Nasdaq. It set the stage for future growth and innovation. The nasdaq stock forward pe ratio remains key for investors to gauge market growth.

The Financial Crisis: Impact on Nasdaq PE Ratios

The 2008 financial crisis had a big impact on Nasdaq PE ratios. The nasdaq price to earnings ratio changed a lot during this time. This crisis made investors less confident, leading to lower stock prices and higher PE ratios.

The nasdaq pe multiple saw a big drop after the crisis. But, the market bounced back, and PE ratios returned to their pre-crisis levels. After the crisis, the market slowly got better, with stock prices going up and PE ratios going down.

The following table shows how the financial crisis affected Nasdaq PE ratios:

| Year | Nasdaq PE Ratio |

|---|---|

| 2007 | 25.6 |

| 2008 | 18.3 |

| 2009 | 22.1 |

| 2010 | 24.5 |

The data shows the nasdaq price to earnings ratio was hit hard by the crisis. It dropped in 2008 and then slowly got better in the following years. The nasdaq pe multiple also changed a lot, showing how important it is to watch PE ratios during market ups and downs.

The 2010s: A New Era of Tech Dominance

The 2010s were a big change for the Nasdaq. Big tech companies grew a lot and changed the nasdaq price earnings ratio. These tech giants now lead the index. The nasdaq 100 pe ratio shows how the tech world has changed, with more profit and focus.

What helped these tech companies grow includes:

- More money for research and development

- Entering new markets and industries

- Making smart deals and partnerships

The nasdaq price earnings ratio and nasdaq 100 pe ratio tell us a lot. They help investors understand the Nasdaq's value and what drives it.

| Year | Nasdaq PE Ratio |

|---|---|

| 2010 | 20.5 |

| 2015 | 25.1 |

| 2020 | 30.8 |

The numbers show the Nasdaq's PE ratio went up over the decade. This shows how much tech companies have grown in the index.

Analyzing the Volatility of PE Ratios

The nasdaq pe ratio has seen big swings over the last thirty years. It has gone from high to low valuations. To grasp this, we need to look at the past and major market changes.

The way we calculate the PE ratio plays a big role in these swings. It uses the current share price and earnings over the last year. This method has led to different PE ratios over the years.

For example, the PE ratio hit 106.54 in December 2016. It then dropped to 17.54 in December 2017. These changes show how fast and unpredictable the market can be.

Some key moments include:

- In December 2016, the nasdaq pe ratio was 106.54, with a share price of $22.37 and EPS of $0.21.

- In December 2017, the PE ratio fell to 17.54, with a share price of $25.61 and EPS of $1.46.

These ups and downs show how important it is to look at many factors when using PE ratios.

| Year | Nasdaq PE Ratio | Price | EPS |

|---|---|---|---|

| 2016 | 106.54 | $22.37 | $0.21 |

| 2017 | 17.54 | $25.61 | $1.46 |

Looking at the PE ratios over thirty years helps investors understand the market better. The PE ratio is key to knowing the value of the Nasdaq. Its changes can greatly affect investors.

Nasdaq PE Ratios and Economic Indicators

The link between Nasdaq PE ratios and key economic indicators is key to understanding market values. To understand this link, we must look at how PE ratios and GDP growth rates are connected. Historically, when GDP grows, so does the Nasdaq stock forward pe.

Looking at the data, we see the Nasdaq pe ratio changes with GDP growth. When the economy grows fast, the Nasdaq pe tends to go up. This shows investors are optimistic and expect earnings to grow. But when the economy slows, the Nasdaq pe often falls, showing less confidence and lower earnings hopes.

Correlation with GDP Growth Rates

There's a clear link between Nasdaq PE ratios and GDP growth rates in history. A 1% GDP growth rate increase usually means a 0.5% rise in the Nasdaq PE. This shows investors see economic growth as a key to earnings and stock prices.

Impact of Unemployment Rates

Unemployment rates also affect Nasdaq valuations. Low unemployment rates are often linked to higher Nasdaq PE ratios. A strong job market boosts spending and growth. But high unemployment rates lead to lower Nasdaq PE ratios, showing less confidence and lower earnings hopes.

In summary, the connection between Nasdaq PE ratios and economic indicators is complex. By studying the link between PE ratios and GDP growth, and the effect of unemployment rates, investors can better understand market values. This helps them make smarter investment choices.

The Role of Interest Rates in PE Valuations

Interest rates greatly affect the nasdaq price to earnings ratio. They influence how much the market is worth. When rates are low, people want to buy stocks more, making prices go up. This increases the nasdaq pe multiple.

But, when rates go up, people might get scared and stop buying stocks. This makes prices drop and the nasdaq pe multiple goes down.

Looking back, we see interest rates and nasdaq pe multiple are linked. For instance, when rates rise, the nasdaq price to earnings ratio often falls. This is because higher rates make borrowing costlier, leading to lower earnings and prices. Yet, some areas like banks and basic materials might do well with higher rates. They can charge more for loans and commodities.

A study by Valuescope found a strong link between the S&P 500's P/E ratio and 10-year T-Bond rate from 1971 to 2015. The correlation was -0.52. This means as rates go up, the nasdaq price to earnings ratio tends to go down. Here's a table showing this relationship:

| Year | 10-Year T-Bond Yield | Nasdaq PE Multiple |

|---|---|---|

| 2010 | 3.2% | 20.5 |

| 2015 | 2.1% | 24.1 |

| 2020 | 1.5% | 28.3 |

In summary, interest rates are key in setting the nasdaq price to earnings ratio. As rates change, so does the nasdaq pe multiple. Knowing this helps investors and financial experts make better choices.

Predictions for the Future of Nasdaq PE Ratios

The current Nasdaq price earnings ratio is 46.96, much higher than the 29.96 average over the last ten years. This high valuation is due to tech advancements and changes in global economic power.

Looking ahead, the Nasdaq 100 PE ratio will likely be influenced by trends like artificial intelligence, renewable energy, and biotechnology. These trends could change the Nasdaq index's composition and value, affecting the PE ratio.

Several factors could shape the future of Nasdaq PE ratios, including:

- Technological advancements and their impact on earnings growth

- Regulatory changes and their effects on market valuations

- Shifts in global economic power and their influence on investor preferences

As the market evolves, keeping an eye on the Nasdaq 100 PE ratio is key. By understanding current trends and factors, investors can make smart choices about their Nasdaq investments.

| Year | Nasdaq PE Ratio | Average Earnings Growth |

|---|---|---|

| 2023 | 40.5 | 15% |

| 2024 | 46.96 | 20% |

| 2025 (projected) | 50 | 10% |

Conclusion and Summary of Findings

Our 30-year study of Nasdaq PE ratios has given us deep insights. It shows how the index has changed over time. It has faced big market changes, tech advances, and economic shifts.

The study shows Nasdaq's values are always changing. In the 1990s, PE ratios went up a lot. This was because of the excitement for new tech. But then, the dot-com bubble burst, and values dropped sharply.

Later, Nasdaq's values went up again. This was thanks to big tech companies like Apple and Amazon. We also looked at how PE ratios relate to the economy. This shows how market values and the economy are connected.

Looking ahead, Nasdaq's PE ratios will depend on tech innovation. Things like new tech, rules, and the world economy will affect its values. Investors and experts need to watch these changes closely. This will help them understand Nasdaq's PE ratios better.

FAQ

What are PE ratios and why are they important in the context of Nasdaq?

PE (Price-to-Earnings) ratios help figure out if a stock is too expensive or not. They're found by dividing a company's stock price by its earnings per share. For Nasdaq, these ratios are key to understanding tech stocks and the market's value.

How have Nasdaq's PE ratios changed over the past 30 years?

Over 30 years, Nasdaq's PE ratios have seen big ups and downs. The index has grown fast, faced the dot-com bubble, the 2008 crisis, and now tech dominance. These events have greatly affected its value.

What were the key factors that influenced Nasdaq's PE ratios during the 1990s tech boom?

The 1990s saw tech companies grow a lot and investors got really excited about tech stocks. This led to Nasdaq's PE ratios soaring. The rise of internet companies and the decade's economy played big roles in this boom.

How did the dot-com bubble and its subsequent burst impact Nasdaq's PE ratios?

The dot-com bubble made Nasdaq's PE ratios extremely high, with some stocks priced way too high. When the bubble popped, PE ratios plummeted. This caused big losses and affected the economy broadly.

How did the 2008 financial crisis affect Nasdaq's PE ratios, and how did the market recover?

The 2008 crisis hit Nasdaq's PE ratios hard, making them drop sharply. The market took time to recover. This shows how big economic shocks can affect tech-heavy indices and their values.

How has the rise of tech giants like Apple, Amazon, and Microsoft influenced Nasdaq's PE ratios in the 2010s?

In the 2010s, big tech companies like Apple, Amazon, and Microsoft became more powerful in Nasdaq. Their success and changing investor views have greatly influenced Nasdaq's PE ratios. This has changed how the index is valued.

What factors, such as economic indicators and interest rates, have influenced the volatility of Nasdaq's PE ratios over the past 30 years?

Nasdaq's PE ratios have been very volatile, with highs and lows. GDP growth, unemployment, and interest rates have all played a part in this volatility over time.

What are the current trends in Nasdaq's PE ratios, and what could affect its future valuation?

Today, Nasdaq's PE ratio is much higher than its 10-year average. This shows tech's strong hold and growth focus. Future factors like tech progress, regulations, global shifts, and investor tastes could change Nasdaq's value.