Mutual Funds vs Hedge Funds: Key Differences Explained

Financial experts and big investors often compare mutual and hedge funds. Both types pool money to diversify and aim for returns. Mutual funds are popular, with over 115 million investors and $22 trillion in assets.

Mutual funds are offered by big names like Vanguard and Fidelity. Hedge funds, on the other hand, are for the wealthy, with a minimum investment of $1 million. Top hedge funds include Citadel and Bridgewater Associates.

Key Takeaways

- Mutual funds are open to all, while hedge funds are for accredited investors.

- Hedge funds take bigger risks for higher returns, with fees of 1.37% management and 16.36% performance in 2020.

- Mutual funds charge a flat fee, usually 1% to 2% of assets.

- Hedge funds can invest in unique assets like cryptocurrency and private real estate.

- Mutual funds report daily with strict SEC rules, while hedge funds have less oversight.

- The S&P 500 outperformed the HFRI Fund Weighted Composite Index in recent years.

Understanding Mutual Funds

Mutual funds are a favorite choice for many, with over 115 million investors in 2022. They manage $22 trillion in assets, showing their big role in finance. The Investment Company Institute (ICI) tracks these numbers.

Unlike hedge funds, mutual funds are easier for regular people to get into. They need less money to start and offer more choices. Hedge funds, on the other hand, are only for those who meet strict criteria.

Here are some key points about mutual funds:

- Low minimum investment requirements

- Diversified investment portfolios

- Professional management

- Regulatory oversight

When looking at hedge fund v mutual fund choices, knowing the differences is key. Mutual funds aim for steady growth and income over time. Hedge funds, though, are bolder, using unique strategies to make money.

Understanding Hedge Funds

Hedge funds are like mutual funds but are only available privately. They aim for higher returns by taking more risks. This means they might use options, leverage, and short-selling. Hedge funds charge more, with fees of 2% for management and 20% for performance.

Compared to mutual funds, hedge funds are pricier. But, investors often can't sell their shares for a year. This is because hedge funds ask investors to keep their money in for at least a year.

Key Characteristics of Hedge Funds

- Hedge funds are only offered privately

- They take higher-risk positions for potentially higher returns

- They use alternative strategies such as options, leverage, and short-selling

- They charge higher fees, with a standard 2% management fee and 20% performance fee

- Investors are often locked in for at least one year, known as the lock-up period

Hedge fund investors are seen as accredited. This is because hedge funds use risky strategies and derivatives. Accredited investors are those who are financially savvy and can invest in hedge funds.

| Investment Type | Average Expense Ratio | Lock-up Period |

|---|---|---|

| Mutual Funds | 0.37% | No lock-up period |

| Hedge Funds | 2% management fee + 20% performance fee | Typically 1 year |

Key Differences Between Mutual Funds and Hedge Funds

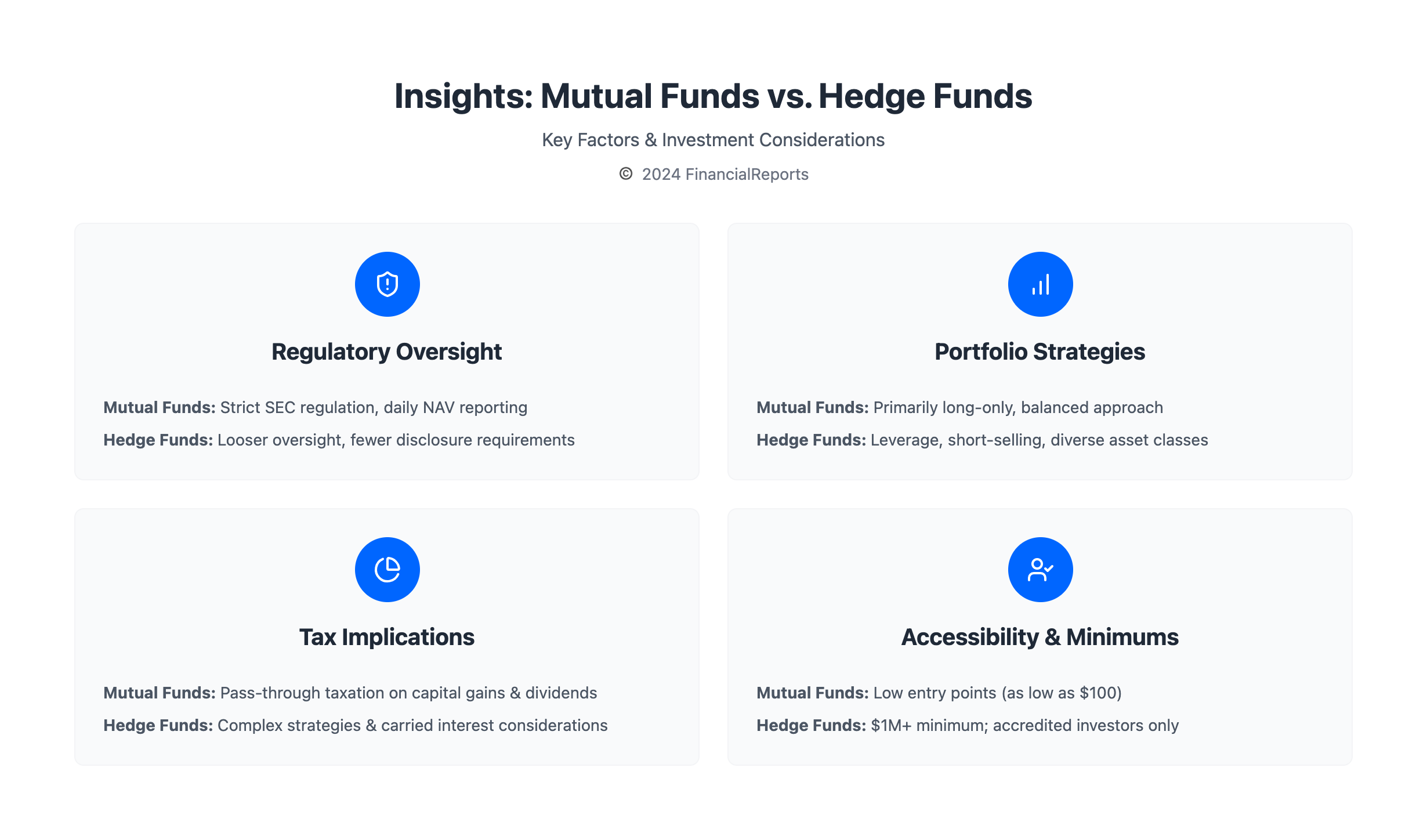

Mutual funds and hedge funds are two different ways to invest. Mutual funds are open to everyone, helping people with various incomes. Hedge funds, on the other hand, are for those with a lot of money and institutions. Mutual funds aim for steady growth, while hedge funds go for big gains with big risks.

Some key differences between mutual funds and hedge funds include:

- Investment strategy: Mutual funds focus on publicly traded securities for lower-risk, stable returns, while hedge funds adopt aggressive strategies like leverage and short selling for high-risk, high-return potentials.

- Risk and return profiles: Hedge funds are typically more aggressive than mutual funds, with the possibility of higher returns but also higher risks.

- Liquidity and redemption: Mutual funds offer high liquidity, allowing investors to buy or sell shares at net asset value daily, whereas hedge funds have lower liquidity with restrictions on withdrawals and possible lock-up periods.

Mutual funds usually have lower fees, a percentage of the assets managed. Hedge funds, though, charge more, including management and performance fees. When choosing between mutual funds and hedge funds, consider your risk tolerance, investment goals, and how quickly you need your money.

| Characteristics | Mutual Funds | Hedge Funds |

|---|---|---|

| Investment Strategy | Steady growth, publicly traded securities | Aggressive growth, high-risk strategies |

| Risk and Return Profiles | Lower risk, stable returns | Higher risk, potentially higher returns |

| Liquidity and Redemption | High liquidity, daily redemption | Lower liquidity, restrictions on withdrawals |

Regulatory Environment

The rules for mutual vs hedge fund investments are key to understand. Mutual funds face strict rules from the Securities and Exchange Commission (SEC). Hedge funds, on the other hand, have fewer rules to follow.

This difference affects investors a lot. Mutual funds share their financial details openly. Hedge funds don't have to do this. Here are some main differences in rules:

- Investor protection: Mutual funds have strong rules to keep investors safe. Hedge funds don't have to follow these rules as closely.

- Disclosure requirements: Mutual funds must share their financial info with everyone. Hedge funds don't have to do this.

- Investor eligibility: Hedge funds mainly accept money from big investors or companies. Mutual funds are open to more people.

It's important for investors to know these differences. The SEC's rules for mutual funds mean more safety and openness. Hedge funds, though, offer more freedom in how they invest and can give higher returns to those who qualify.

| Investment Type | Regulatory Oversight | Disclosure Requirements | Investor Eligibility |

|---|---|---|---|

| Mutual Funds | SEC regulation under the Investment Company Act of 1940 | Public disclosure of financial performance and transactions | Open to a broad range of investors |

| Hedge Funds | Exempt from most investor protection elements | No public disclosure requirements | Restricted to institutional investors, companies, or high net worth individuals |

Fees and Expenses

When looking at hedge funds vs mutual funds, knowing the fees is key. Mutual funds usually charge a management fee of 0.5% to 1.0% of the assets. Hedge funds, on the other hand, have a management fee of 2% and a performance fee of 10% to 20% of profits.

Hedge funds often use a 'two and twenty' fee structure. This means a 2% management fee and a 20% cut of profits. This fee structure makes the manager's pay depend on the fund's success. Mutual funds might also have performance fees, but they're lower.

Other costs like operational expenses and transaction fees are important too. Here's a table comparing the typical fees for both:

| Fund Type | Management Fee | Performance Fee |

|---|---|---|

| Mutual Funds | 0.5% - 1.0% | Lower rate (if applicable) |

| Hedge Funds | 2% | 10% - 20% |

Knowing the fees for hedge funds vs mutual funds helps investors make better choices for their money.

Investor Access

Investing in hedge fund v mutual fund means looking at who can get in. Mutual funds welcome everyone, with some needing just $100 to $10,000 to start. Hedge funds, though, are for those with a lot of money or a high income, as set by the SEC.

The rules for getting into hedge fund v mutual fund are different. Hedge funds are for the rich and the smart, thanks to fewer rules. Mutual funds, with their simpler rules, are for more people.

Who Can Invest in Mutual Funds?

Mutual funds are easy to get into, needing little money to start. This makes them great for those wanting to spread out their investments without a big upfront cost.

Who Can Invest in Hedge Funds?

Hedge funds, though, are for the big players. They need a lot of money and know-how. Here's what it takes to be a hedge fund investor:

- High net worth: $1 million or more

- Annual income: $200,000 or more

- Sophisticated investment knowledge

- Ability to withstand possible losses

Knowing who can invest in hedge fund v mutual fund helps you choose wisely. It's about matching your investment goals and how much risk you can take with the right vehicle.

| Investment Vehicle | Minimum Investment | Investor Requirements |

|---|---|---|

| Mutual Funds | $100-$10,000 | Open to retail investors |

| Hedge Funds | Varies | Accredited or institutional investors only |

Transparency and Reporting

Mutual funds and hedge funds have different rules for transparency and reporting. Mutual funds must register with the SEC and give investors detailed info. This includes financial statements and who manages the fund. Hedge funds, on the other hand, only need to register if they manage over $100 million.

Hedge funds' lack of transparency can make it hard for investors to keep track of their money. But, many hedge funds now ask managers to be more open. This change helps investors make better choices and improves how they talk to fund managers.

Disclosure Requirements

Mutual funds face strict rules, like the Securities Act of 1933. They must share regular financial reports and how they're doing. Hedge funds, though, don't have to share their strategies or how they're doing. This makes it tough for investors to trust hedge funds.

Here are some key differences in how mutual funds and hedge funds report:

- Mutual funds must share regular financial reports and how they're doing

- Hedge funds don't have to share their strategies or how they're doing

- Mutual funds follow strict rules, like the Securities Act of 1933

- Hedge funds only need to register with the SEC when they manage over $100 million

| Fund Type | Registration Requirement | Disclosure Requirements |

|---|---|---|

| Mutual Fund | Must register with SEC | Must provide regular financial reports and performance disclosures |

| Hedge Fund | Only required to register with SEC once $100 million in assets under management is reached | Not obligated to publicly disclose investment strategies or performance reports |

In summary, mutual funds and hedge funds have big differences in how they report. Mutual funds follow strict rules and share lots of info. Hedge funds have fewer rules and don't have to share as much. As hedge funds grow, with over $1.2 trillion in assets, it's key for investors to know these rules.

Tax Implications

Investing in mutual and hedge funds comes with tax implications that can affect your returns. It's important to understand these to make smart investment choices. Mutual funds are taxed at the investor level, while hedge funds are taxed at the fund level.

Mutual fund gains are taxed based on how long you held the asset. Hedge funds use complex strategies, leading to different tax treatments for their gains. Hedge fund managers get carried interest, which is taxed at a lower rate.

Tax Treatment of Mutual Fund Gains

Mutual fund gains are taxed as capital gains. The tax rate depends on how long you held the asset. Long-term gains, held over a year, are taxed lower than short-term gains.

Tax Treatment of Hedge Fund Gains

Hedge fund gains are taxed differently due to their complex strategies. Carried interest, a big part of hedge fund manager pay, is taxed at a lower rate. But, this tax break is under debate and might change.

It's key for investors to know about these tax implications. This knowledge helps you make better choices in the world of mutual and hedge funds.

| Fund Type | Tax Treatment |

|---|---|

| Mutual Funds | Pass-through taxation, capital gains taxed at investor level |

| Hedge Funds | Taxed at fund level, carried interest taxed at lower capital gains rate |

Performance Measurement

When looking at mutual vs hedge funds, it's key to understand the benchmarks used. Mutual funds often compare themselves to indexes like the S&P 500. Hedge funds, on the other hand, might use different benchmarks based on their strategy.

A study looked at 566 hedge funds and 1542 mutual funds in emerging markets. It found that some hedge funds beat most mutual funds by a lot. The study covered 1995 to August 2008. It showed hedge funds usually outperform traditional benchmarks, but most mutual funds don't.

| Fund Type | Benchmark | Performance |

|---|---|---|

| Mutual Funds | S&P 500 | Varies |

| Hedge Funds | Custom benchmarks | Outperforms traditional benchmarks |

In summary, comparing mutual vs hedge funds requires looking at benchmarks and strategies. This helps investors choose the right fund for their goals.

Advantages of Mutual Funds

Mutual funds have many benefits for investors, like diversification and easy access. When looking at hedge funds vs mutual funds, it's key to see what each offers. Mutual funds give instant diversification, expert management, and cost savings. They are great for both new and seasoned investors.

Some main perks of mutual funds are:

- Diversification across different asset classes and sectors

- Professional management by skilled fund managers

- Economies of scale, cutting costs for individual investors

- Strict regulatory oversight, ensuring transparency and accountability

Compared to hedge funds, mutual funds are easier for retail investors to get into and offer better liquidity. Hedge funds are mainly for the wealthy and big institutions. But mutual funds are open to everyone, making them more welcoming. When deciding between hedge funds and mutual funds, think about your financial goals, risk level, and how long you can invest.

| Investment Type | Accessibility | Liquidity |

|---|---|---|

| Mutual Funds | Open to the general public | Higher liquidity |

| Hedge Funds | Limited to high net worth individuals and institutions | Lower liquidity |

Advantages of Hedge Funds

Hedge funds offer unique benefits compared to mutual funds. They can provide higher returns, even when markets are tough. Hedge funds use various strategies to offer diversification and returns not tied to traditional assets.

Hedge funds can invest in many assets, unlike mutual funds. They can trade in stocks, derivatives, real estate, and more. This flexibility lets them find opportunities mutual funds can't.

Some key benefits of hedge funds include:

- Potential for higher returns: Hedge funds often beat mutual funds in certain markets.

- Flexibility: Hedge funds can invest in a wide range of assets, finding opportunities mutual funds can't.

- Diversification: Hedge funds offer diversification and returns not tied to traditional assets.

Hedge funds have advantages over mutual funds, like higher returns and flexibility. Mutual funds are limited by regulations and can only invest in publicly traded securities. Hedge funds, on the other hand, can trade in various assets, making them appealing for diversifying portfolios and seeking higher returns. The debate between hedge funds and mutual funds continues, with each having its own strengths and weaknesses. For investors looking for flexibility and potentially higher returns, hedge funds are worth exploring.

| Hedge Fund Strategy | Description | Potential Return |

|---|---|---|

| Long/Short Equity | A strategy that involves taking long positions in stocks that are expected to increase in value and short positions in stocks that are expected to decrease in value. | 10-15% |

| Global Macro | A strategy that involves investing in assets that are expected to benefit from macroeconomic trends, such as changes in interest rates or currency fluctuations. | 12-18% |

| Event-Driven | A strategy that involves investing in companies that are undergoing significant events, such as mergers or acquisitions. | 15-20% |

Conclusion

Mutual funds and hedge funds are different investment choices. Mutual funds are easier to get into and offer a wide range of investments. Hedge funds, on the other hand, might give you higher returns but come with more risk.

Choosing between mutual funds and hedge funds depends on your financial goals and how much risk you can take. Mutual funds are good for those who want to grow their money over time. They have lower fees and are watched over by regulators. Hedge funds are for those who are experienced and can handle higher risks, even though they cost more and are less liquid.

It's important to make smart choices based on good research and advice. The investment world is always changing, thanks to new technology. Investors need to keep up and adjust their plans as needed.

FAQ

What is the key difference between mutual funds and hedge funds?

Mutual funds and hedge funds differ in their investment strategies and risk levels. Mutual funds are more conservative and diversified. Hedge funds, on the other hand, use complex strategies and leverage to aim for higher returns but with higher risks.

Who can invest in mutual funds and hedge funds?

Mutual funds are open to many investors. Hedge funds, though, are only for high-net-worth and institutional investors. They have strict requirements and minimum investment amounts.

What are the typical fee structures for mutual funds and hedge funds?

Mutual funds charge management fees based on assets. Hedge funds have a two-part fee: a management fee and a performance-based fee, known as the "2 and 20" model. This means the manager gets a percentage of profits.

How do the transparency and reporting requirements differ between mutual funds and hedge funds?

Mutual funds must be very transparent and report regularly. Hedge funds, while they report, offer less transparency about their strategies and holdings.

What are the tax implications of investing in mutual funds and hedge funds?

Mutual fund investors pay taxes on gains, dividends, and interest. Hedge fund investors face more complex taxes, including higher rates on certain incomes.

How is the performance of mutual funds and hedge funds typically measured and compared?

Mutual fund performance is compared to market benchmarks. Hedge fund performance is harder to measure due to their diverse strategies. Metrics like Sharpe ratio and alpha are used to assess hedge fund performance.

What are the main advantages of investing in mutual funds?

Mutual funds offer instant diversification and professional management. They are also affordable for many investors. This makes them a convenient way to invest in a variety of securities.

What are the main advantages of investing in hedge funds?

Hedge funds offer the chance for higher returns and use various strategies. They can also protect against market downturns. Their flexible approaches and leverage make them appealing to certain investors.