Most Profitable Companies of 2023 Revealed

The top companies of 2023 have been named, with Saudi Arabian Oil Co. (Saudi Aramco) at the top. Six of the top 10 are from the United States. This shows the U.S. is a big player in the world economy.

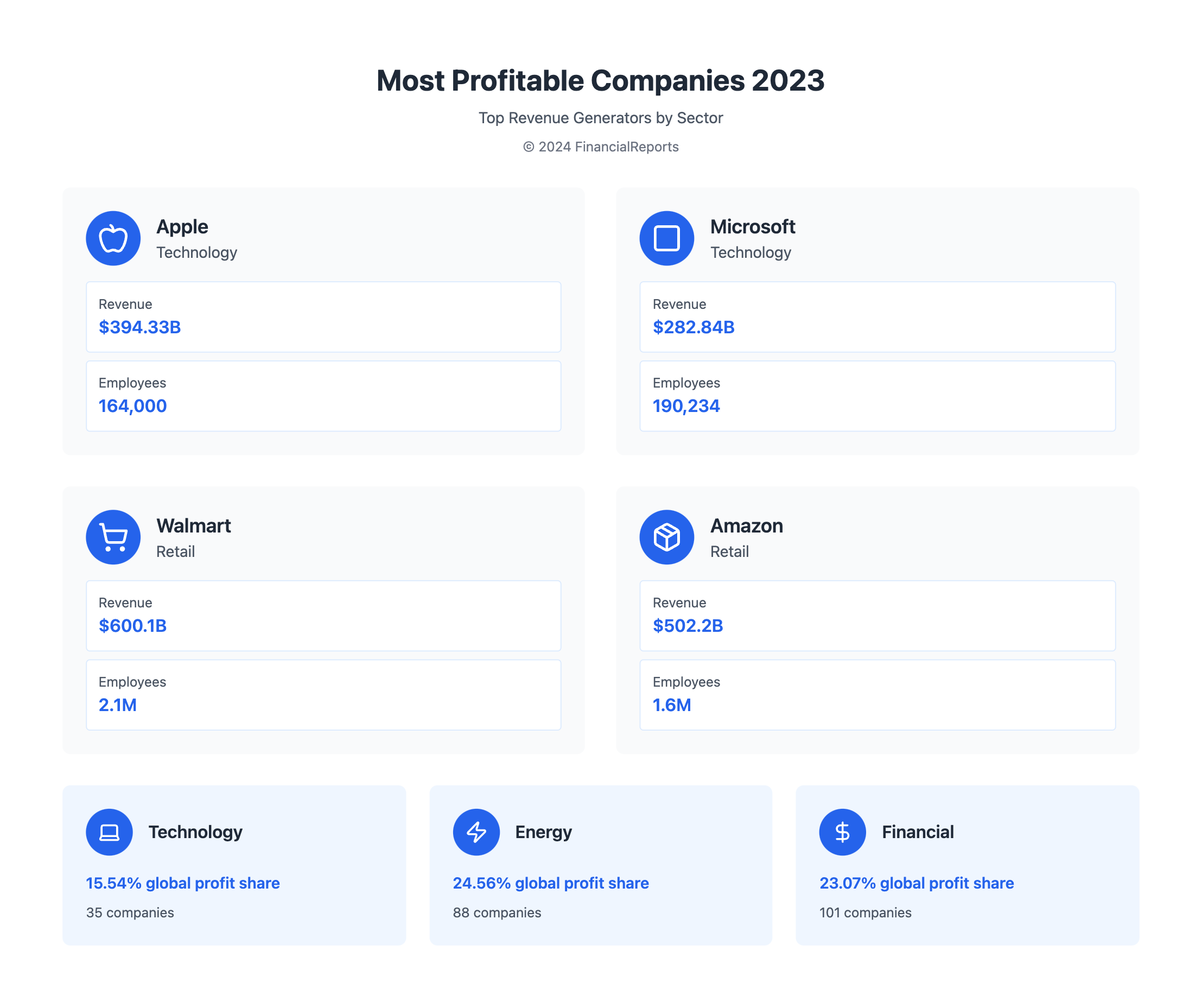

These companies made a lot of money, with the top 10 making $689.8 billion. The energy sector made 24.56% of the profit. The Finance sector was close behind.

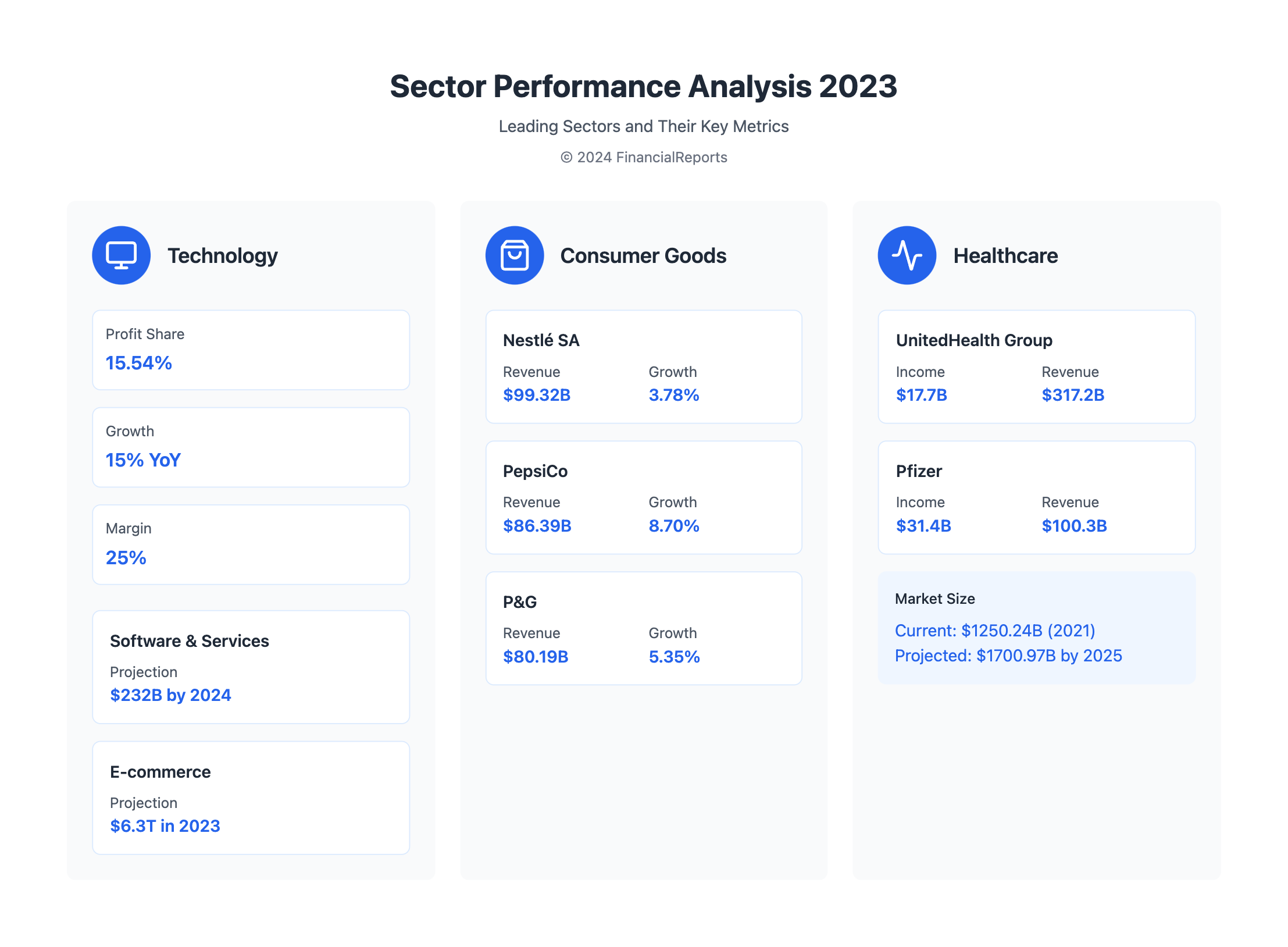

These companies did well for many reasons. The software and tech industry is growing fast. It's expected to hit $232 billion by 2024. The global e-commerce market is also booming, reaching $6.3 trillion in 2023. Companies like Apple, Microsoft, and Alphabet are leading the way.

Knowing who these companies are is important. It helps investors, market analysts, and business people understand the economy and corporate power.

Introduction to Profitability in the Corporate World

Profit is key to a company's success. The top three sectors in 2023 were Energy, Financials, and Technology. Together, they made $1.8 trillion, or 63% of the world's profit.

The United States and China made up 56% of the Fortune 500 companies' profit in 2023. U.S. companies made $1.1 trillion, or 37.56% of the profit.

Key Takeaways

- The top 10 most profitable companies generated $689.8 billion in profit in 2023.

- The energy sector leads in profit share, with 24.56% of the total global profit.

- The Finance sector follows closely, with a profit share of 23.07%.

- Technology secures a notable 15.54% profit share, with companies like Apple, Microsoft, and Alphabet leading the sector.

- The United States and China generated 56% of the Fortune 500 companies' profit in 2023.

- The global e-commerce market is projected to reach $6.3 trillion in 2023, driven by the growth of the software and tech industry.

- Understanding the most profitable companies is key for investors, market analysts, and business professionals to grasp global economic trends.

Introduction to Profitability in the Corporate World

Profitability is key to a company's success. Looking at the highest profit margin companies gives us insights into the market and economy. These top companies are in sectors like tech, oil and gas, and finance. They stand out because they make a lot of money compared to their costs.

It's important to track these profitable companies. This helps us understand how they make so much money. They do this through efficient operations, smart cost management, and innovative products. By looking at their profit ratios, we can see their financial health and investment chances.

- Gross Profit Margin: compares gross profit to sales revenue

- Operating Profit Margin: earnings as a percentage of sales before interest and taxes

- Net Profit Margin: compares net income to total revenue

- Return on Assets (ROA): shows net earnings as a percentage of total assets

These ratios give us a full view of a company's profit-making abilities. By studying the highest profit margin companies, we learn what drives their success. This knowledge helps us make better investment choices.

Importance of Tracking Profitable Companies

Tracking profitable companies is vital for understanding market trends and finding good investments. By looking at the financials of top profit companies, we can spot their strengths and weaknesses. This helps us decide where to put our money wisely.

The Role of Different Sectors in Profitability

Different sectors have different profit levels. For example, tech often has high profit margins, while oil and gas can be more unpredictable. Knowing this helps us make smarter investment choices and find growth opportunities.

Overview of the Most Profitable Companies in 2023

The top companies in 2023 come from tech, finance, and energy. These fields are leaders because they meet high demand and use new business ideas.

Criteria for Ranking Profitability

We ranked companies based on net income. This shows how much money they keep after all costs are paid. We also looked at other important signs like gross profit and EBITDA.

Key Metrics Used to Measure Success

In 2023, the top 10 companies made $689.8 billion in profit. The tech sector was the biggest contributor, making up 40% of the profit. These companies grew their revenue by 15% on average, with a net profit margin of 25%.

| Industry | Profit Share | Number of Companies |

|---|---|---|

| Energy | 24.56% | 88 |

| Financials | 23.07% | 101 |

| Technology | 15.54% | 35 |

These numbers show energy, finance, and tech are the most profitable. They lead in making the most money.

Top Tech Giants Leading in Profitability

The tech industry boasts some of the most profitable companies globally. In 2023, Apple, Microsoft, and Alphabet (Google's parent) are among the highest profit companies. They've reached high profits with innovative products, services, and investments in AI and cloud computing.

Some key statistics show these tech giants' success:

- Apple's revenue grew from $383.93 billion in 2021 to $394.33 billion in 2023.

- Microsoft's cloud computing and software-as-a-service model boosted its revenue.

- Alphabet's ad-driven business model brought in $282.84 billion in 2023.

These companies' large market values, revenue, and profit margins show their tech industry dominance. It's exciting to see how they'll keep their lead as most profitable companies as the tech world changes.

| Company | Revenue (2023) | Employees |

|---|---|---|

| Apple | $394.33 billion | 164,000 |

| Microsoft | $282.84 billion | 190,234 |

| Alphabet (Google) | $282.84 billion | 190,234 |

The Growing Financial Sector's Influence

The financial sector is becoming more important in the world economy. Top profit companies and those with the highest profit margins are leading the way. For example, JPMorgan Chase is one of the most profitable banks globally. It handles transaction values that are more than the U.S. budget every year.

Some of the key players in the financial sector include:

- Goldman Sachs, with a market capitalization of $116.32 billion as of August 2022

- Wells Fargo, with a market capitalization of $169.345 billion as of August 2022

- Charles Schwab, with a market capitalization of $138.40 billion as of August 2022

These companies use their global reach, tech, and risk management to stay at the top. As the financial sector grows, we can expect to see more profitable companies around the world.

| Company | Market Capitalization (2022) |

|---|---|

| Goldman Sachs | $116.32 billion |

| Wells Fargo | $169.345 billion |

| Charles Schwab | $138.40 billion |

Energy Sector Giants and Their Profit Margins

The energy sector is incredibly profitable, with many companies making a lot of money. In recent years, profits have soared due to higher oil prices and more energy demand. ExxonMobil, Chevron, and Shell are among the top earners in this field.

These giants have seen huge profits. ExxonMobil made $36,010,000,000 in net income by December 31, 2023. Chevron and Shell also reported impressive figures, with $21,369,000,000 and $19,360,000,000 in net income, respectively. Their earnings show the energy sector's immense profitability.

Several factors contribute to these companies' success:

- Rising oil prices

- Increased demand for energy

- Efficient operations and cost management

- Strategic investments in alternative energy sources

As the energy sector grows, more companies will likely make significant profits. The push for renewable energy and sustainability will favor adaptable and innovative businesses. The energy sector stands out for its innovation and expertise, making it very profitable.

Consumer Goods Leaders and Their Strategies

The consumer goods sector is led by giants like Procter & Gamble, The Coca-Cola Company, and Unilever. They own over 550 brands. These companies are among the most profitable companies globally.

Procter & Gamble, for instance, has brands like Pampers, Head & Shoulders, and Gillette. These brands bring in a lot of money. The company stays on top by focusing on loyalty, innovation, and market segmentation.

Other big names, like The Coca-Cola Company and Unilever, also have winning strategies. They grow by adding new products, using digital marketing, and tapping into new markets. Here are some key stats:

- Nestlé SA: net revenue of $99.32 billion, with a year-over-year change of 3.78%

- PepsiCo: net revenue of $86.392 billion, with a year-over-year change of 8.70%

- Procter & Gamble: net revenue of $80.187 billion, with a year-over-year change of 5.35%

These companies are among the most profitable companies in the sector. Their strategies offer lessons for others aiming to grow and make more money.

| Company | Net Revenue (2023) | Year-over-Year Change |

|---|---|---|

| Nestlé SA | $99.32 billion | 3.78% |

| PepsiCo | $86.392 billion | 8.70% |

| Procter & Gamble | $80.187 billion | 5.35% |

Retail Giants on the Top List

The retail sector is led by giants like Walmart and Amazon. They have become the most profitable through smart operations and new strategies. Walmart makes $600.1 billion, while Amazon makes $502.2 billion.

According to the most profitable retail companies, success comes from several areas. Key factors include:

- Efficient supply chain management

- Investments in e-commerce

- Strong brand loyalty

- Innovative marketing strategies

Amazon's diverse business, including its e-commerce and AWS, has boosted its growth. As a result, it's now a top profit company in retail, with a 5.5% net profit margin.

The table below shows the top retail companies by revenue:

| Company | Revenue (in billions) |

|---|---|

| Walmart | $600.1 |

| Amazon | $502.2 |

| Costco | $231.0 |

These retail giants have shown they can adapt and innovate. They have solidified their spots as the top profit companies in the industry.

Healthcare Companies Contributing to Profitability

The healthcare sector is booming, with leaders like Pfizer and UnitedHealth Group at the forefront. These companies have seen huge profits thanks to their innovative work in drugs and healthcare.

Pharmaceuticals spend billions on research and development. But the rewards are worth it, with the global market hitting $1250.24 billion in 2021. It's expected to reach $1700.97 billion by 2025.

Key Players in the Healthcare Sector

UnitedHealth Group is growing its services to boost profits. In 2022, it made $17.7 billion in net earnings. This shows it's a top earner in healthcare with a high profit margin.

The company uses data analytics and new healthcare models. This keeps it among the world's highest profit makers.

The table below shows the financial success of top pharmaceutical companies in 2022:

| Company | Net Income (2022) | Revenue (2022) |

|---|---|---|

| UnitedHealth Group | $17.7 billion | $317.2 billion |

| Pfizer | $31.4 billion | $100.3 billion |

These companies are fueling growth in healthcare, making it a top-profit sector. Their focus on innovation, research, and data-driven healthcare will keep driving profits.

Emerging Companies to Watch in 2023

New companies are popping up, leading in their fields. Tech giants like Tesla and Shopify are making big moves. Tesla is growing its electric car market, and Shopify is changing online shopping.

These companies are not just growing; they're getting more profitable too. They're focusing on new ideas, technology, and what people want. This puts them in a strong position to lead. Some companies to keep an eye on include:

- Tesla, with its electric vehicle market expansion

- Shopify, with its e-commerce platform revolution

- SoundHound, which raised $351 million in funding

- People.ai, which secured $200 million in funding

As these companies keep innovating, they'll likely shape their industries. They could become some of the most profitable companies globally. Their success and drive for new ideas make them exciting to watch in 2023.

| Company | Funding |

|---|---|

| Tesla | N/A |

| Shopify | N/A |

| SoundHound | $351 million |

| People.ai | $200 million |

The Impact of Global Economic Factors on Profits

Global economic factors like inflation and supply chain issues have greatly affected corporate profits. Sectors like technology and finance have seen big changes in their profit margins. Companies with over $1 billion in revenue now make up a big part of the GDP, accounting for 72 percent of the OECD economy.

The top profit-making companies have found ways to deal with these challenges. They've used strategies like vertical integration, diversification, and investing in technology. For example, Apple and Microsoft have spent a lot on research and development. This has led to big increases in their profit margins.

Recent data shows the average EBIT margin of US publicly traded firms has gone up. It rose from 9.6% before globalization to 10.7% after.

Some key statistics about the impact of global economic factors on profits include:

- Companies are responsible for 85 percent of technology investment and labor productivity growth.

- Labor income accounts for $0.25, supplier payments $0.58, and consumer surplus $0.40 per dollar of revenue for large corporations in the OECD.

- Foreign direct investments from multinational companies have increased by 64% in 2021 compared to the initial year of the COVID-19 pandemic, reaching USD 1.58 trillion.

| Category | Pre-Globalization | Post-Globalization |

|---|---|---|

| Average Aggregate EBIT Margin | 9.6% | 10.7% |

| Foreign EBIT Margin | 10.3% | 13.8% |

Conclusion: Future Outlook for Profitability in Business

Looking at the most profitable companies of 2023, we see a pattern. Businesses that focus on tech, sustainability, and being adaptable are set to keep making money. They can quickly change to meet new market needs.

New trends like e-commerce growth, renewable energy, and healthcare demand will shape profits. Companies that succeed will check their offerings, improve operations, and invest in new strategies. This will help them stay ahead and grow sustainably.

The most business that generates most money will use data, encourage innovation, and stay flexible. By focusing on profit and other important goals, companies can succeed for a long time. They will do well in a competitive world.

FAQ

What are the most profitable companies in 2023?

This article looks at the top companies in 2023. It includes tech giants like Apple, Microsoft, and Alphabet. It also covers financial, energy, consumer goods, and retail leaders.

Why is it important to track the most profitable companies?

It's key to understand market trends and the economy. Knowing who's making money helps investors and business experts. It shows what makes some companies stand out.

How are the most profitable companies determined?

We look at net income and other important metrics. The article also talks about the top sectors and what makes them successful.

What strategies do the top tech companies use to maintain high profitability?

We dive into Apple's diverse products and Microsoft's cloud success. Alphabet's ad business is also highlighted. Their tech investments are seen as keys to future growth.

How do financial sector giants like JP Morgan Chase and Goldman Sachs maintain high profitability?

The article focuses on the financial sector's big role in profits. It looks at JP Morgan Chase and Goldman Sachs' strategies. They use diverse models, global reach, and tech to stay profitable.

What role does the energy sector play in global corporate profitability?

The energy sector is big for profits, with companies like Saudi Aramco leading. The article explores their strategies for oil and renewable energy.

How do leading consumer goods and retail companies maintain high profitability?

Top consumer goods like Procter & Gamble focus on brands and innovation. Retail leaders like Walmart and Amazon use efficiency and diverse models to stay ahead.

What healthcare companies are among the most profitable, and what are their strategies?

Pfizer and UnitedHealth Group are highlighted for their healthcare success. Pfizer's vaccine work and UnitedHealth's data use are key to their profits.

Which emerging companies are disrupting traditional industries and showing promise for high profitability?

Tesla and Shopify are changing industries with electric cars and e-commerce. Their growth shows they could be very profitable.

How do global economic factors influence corporate profitability?

Global issues like inflation and supply chain problems affect profits. The article looks at how top companies deal with these challenges through strategy and tech.