Maximizing Returns: Investing in Government Bonds

Government bonds are a safe choice for investors. They offer a steady income and are less risky. Investors can pick from Treasury bills, notes, and bonds. Knowing how to buy these can help make smart choices.

These bonds are backed by the US government. This gives investors confidence in their investment. It's a good way to add stability to a portfolio.

Investing in government bonds is a smart move. It's a low-risk option that provides a steady income. The process of buying these bonds is easy. Investors can choose from different types, like Treasury bills and bonds.

Understanding how to buy these bonds is key. It helps investors make the best decisions. By investing in government bonds, investors can diversify their portfolio. This reduces risk and makes it a good choice for balancing investments.

Key Takeaways

- Government bonds offer a low-risk investment option with a steady income stream.

- Investors can choose from various types of government bonds, including Treasury bills, notes, and bonds.

- Understanding how to purchase T bills and how to buy treasuries is essential for making informed investment decisions.

- Buying government securities can provide a secure investment option, backed by the full faith and credit of the US government.

- Investing in government bonds can help investors diversify their portfolio and reduce risk.

- Starting yield matters significantly in determining success and generating positive returns in the bond market.

Understanding Government Securities

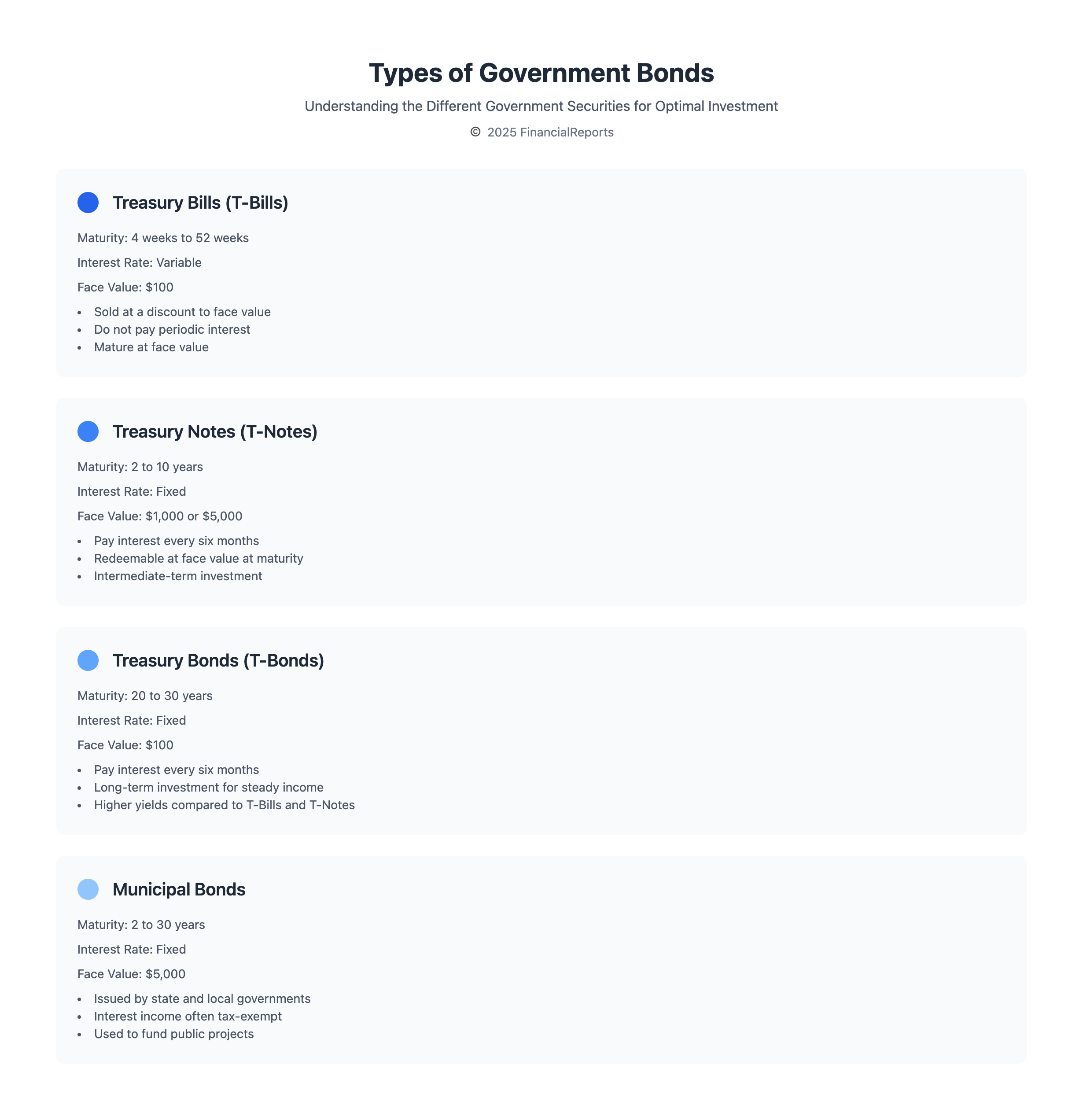

Government securities are debts the government issues to get money. They come in types like Treasury bills, notes, and bonds. Each has its own features and benefits.

Treasury bills last less than a year. Notes last 2 to 10 years. Bonds last more than 10 years, often 30 years.

Investors can pick from investing in treasury bonds, which offer a fixed return. To invest in treasury bills, you can bid in public auctions. The U.S. Treasury sells securities this way, and all bidders get the same rate.

Some key features of government securities include:

- Treasury securities' interest income is subject to federal taxes but exempt from state and local taxes

- Minimal risk as they're backed by the U.S. government's full faith and credit

- Interest rate changes affect long-term Treasury prices more

For those interested in investing in treasury bonds or other government securities, knowing the types and benefits is key. This knowledge helps investors make smart choices for their goals.

| Security Type | Maturity | Interest Rate |

|---|---|---|

| Treasury Bills | 52 weeks or less | Variable |

| Treasury Notes | 2 to 10 years | Fixed |

| Treasury Bonds | More than 10 years | Fixed |

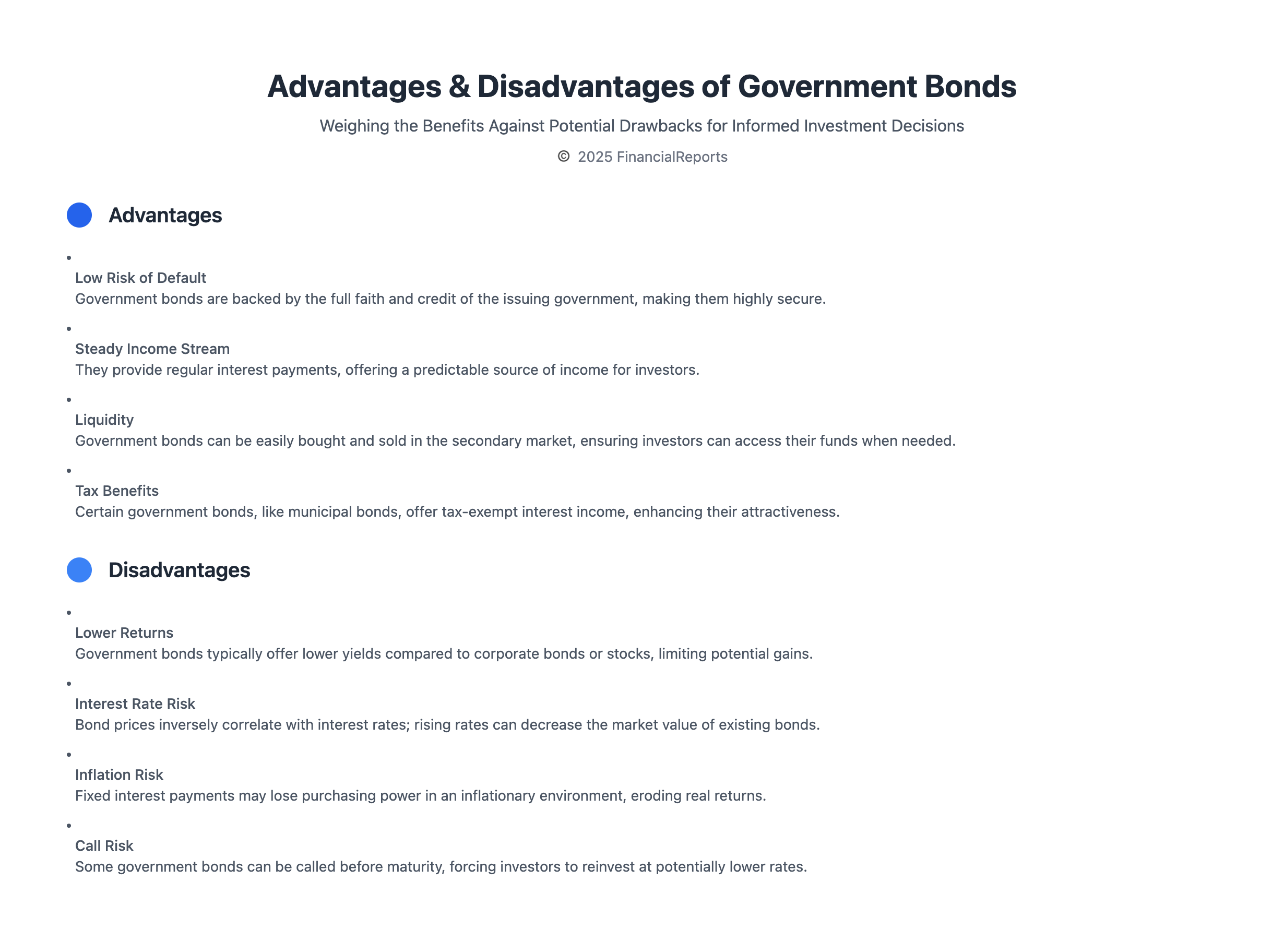

Advantages of Buying Government Bonds

Investing in government bonds is safe and secure. They are backed by the US government, making them a low-risk choice. This is key for those wanting to reduce risk. When looking at how to buy treasuries, knowing the different types is important. These include Treasury Bills, Treasury Notes, and Treasury Bonds.

Investing in treasury bonds means steady income. This is great for those needing regular returns, like retirees. Government backed investments also have a low risk of default, thanks to the US government. Here are some main benefits of investing in government bonds:

- Low risk of default

- Steady income stream

- Liquidity, as government bonds can be easily resold

Government bonds are a reliable choice, with a low but stable return. They might not offer the highest returns, but they are secure. By understanding the benefits of government bonds, investors can make better choices for their portfolios.

| Type of Bond | Maturity | Face Value |

|---|---|---|

| Treasury Bills | 4 weeks to 52 weeks | $100 |

| Treasury Notes | 2, 3, 5, or 10 years | $1,000 or $5,000 |

| Treasury Bonds | 20 to 30 years | $100 |

Disadvantages of Government Bonds

Buying government securities has its downsides. One major issue is the lower returns compared to other investments like corporate bonds or stocks. This can be a problem for those looking for bigger gains. Also, government bonds face interest rate risks, which can change their value.

When interest rates go up, bond prices often drop. This can lead to losses for investors. It's important for those interested in T-bills or treasury securities to know these risks.

Government bonds usually offer lower returns because they are seen as safer. But, this safety comes at the cost of lower earnings. To balance these risks, diversifying your investments is a good strategy. This means mixing government and corporate bonds in your portfolio.

Some key points to consider when investing in government bonds include:

- Lower returns compared to corporate bonds or stocks

- Interest rate risks that can affect bond values

- Importance of diversifying a portfolio to mitigate risks

Understanding these disadvantages helps investors make better choices. Whether buying T-bills or treasury securities, knowing the risks and rewards is key.

| Type of Bond | Return | Risk |

|---|---|---|

| Treasury Bond | Lower | Lower |

| Corporate Bond | Higher | Higher |

The Process of Buying Government Securities

Investors can buy government securities directly from the Treasury Department or through a broker. It's key to know the different ways to invest in treasury bonds. Government backed investments are a safe choice for those wanting to diversify their portfolio.

When buying government securities, investors have several types to choose from. These include Treasury bills, notes, and bonds. You can buy these online through the Treasury Department's website or through a brokerage firm. Investing in treasury bonds can offer a steady income and a safe investment.

Some important things to think about when buying government securities include:

- Minimum purchase amounts, which can vary depending on the type of security

- Interest rates, which can change based on market conditions

- Term lengths, which can range from a few weeks to several years

By understanding how to buy government securities, investors can make smart choices. They can decide how to invest in treasuries and government backed investments.

Key Considerations Before Investing

Before you buy government securities, think about your risk tolerance and how long you can invest. Understanding these can help you choose wisely. Government securities, like treasuries, are often seen as safe. But, it's important to know the risks.

Learning about different government securities is key. This includes knowing how to buy t bills or treasuries. You need to understand the bond's credit rating and the risks it carries.

Also, consider the bond's maturity date, interest rate, and call risk. These factors help you pick the right bond for your goals. Whether it's buying government securities or learning about t bills, these details matter.

Some important things to think about include:

- Assessing risk tolerance and investment horizon

- Evaluating credit ratings and possible risks

- Understanding bond maturity dates and interest rates

- Considering call risk and early repayment chances

By looking at these factors and learning about buying government securities, you can make smart choices. This way, you can increase your chances of getting good returns.

| Investment Option | Risk Level | Return Possible |

|---|---|---|

| Treasury Bills | Low | Low |

| Treasury Notes | Medium | Medium |

| Treasury Bonds | High | High |

The Role of Treasury Bonds

Investing in government-backed investments, like treasury bills, can feel secure. Treasury bonds offer a fixed return and are backed by the US government. It's key to know their features and benefits before investing.

Treasury bonds last for 20 or 30 years and pay interest every six months. You can buy them for $100, and you can add more in $100 increments. They are a good choice for those looking for secure investments.

Features of Treasury Bonds

- Treasury Bonds are sold for terms of either 20 or 30 years

- Bonds pay a fixed rate of interest every six months until they mature

- The minimum purchase for Treasury Bonds is $100, and purchases can be made in increments of $100

Benefits of Investing in Treasury Bonds

Investing in treasury bonds is low-risk and offers a fixed return. They are backed by the US government, making them secure. When looking at treasury bills, consider the benefits and features of Treasury bonds.

| Term | Interest Payment | Minimum Purchase |

|---|---|---|

| 20 or 30 years | Every 6 months | $100 |

Municipal Bonds: A Unique Option

Municipal bonds are a special kind of government security. They offer unique benefits for investors. When looking at buying government securities, municipal bonds are worth considering. They are issued by local governments to fund projects and initiatives.

Municipal bonds have a big advantage: they are tax-exempt. This makes them appealing to those wanting to lower their taxes. They come in various terms, from two to 30 years, and can be bought in $5,000 increments. This makes them accessible to many investors. For those interested in purchase t bills or the sale of treasury securities, municipal bonds are a good alternative.

Some key features of municipal bonds include:

- Low default risk compared to corporate bonds

- Stability for capital with low default rates

- Interest from municipal bonds is generally exempt from federal taxes

Municipal bonds can be a great addition to an investment portfolio. They offer a unique mix of benefits and advantages. By understanding what municipal bonds have to offer, investors can make smart choices about buying government securities and diversifying their portfolios.

How to Evaluate Government Securities

When looking into investing in treasury bonds, it's key to check their yield rates and credit ratings. This helps investors see the possible return and risk. First, they should know the different government securities, like Treasury bills, notes, and bonds. Each has its own time to mature and how interest is paid.

Treasury bills have the shortest times, from four weeks to a year. They are sold at a discount to their face value. Treasury bonds, on the other hand, have the highest interest rates. They are paid twice a year and sold in $100 increments at monthly auctions. By looking at these details, investors can choose wisely and diversify their government backed investments.

Important things to think about when checking government securities include:

- Yield rates: The return on investment, which changes with the security type and market.

- Credit ratings: How trustworthy the issuer is, which is usually very high for government securities.

- Maturity periods: How long until the security is due, ranging from weeks to 30 years.

By carefully looking at these points, investors can make smart choices aboutinvesting in treasury bondsand other government securities. This helps them build a portfolio that fits their goals and risk level.

Strategies for Investing in Government Securities

Investors looking to manage risk and boost returns can use several strategies. One key method is diversification. This means spreading investments across different government securities to lessen risk. It's about mixing Treasury bills, notes, and bonds, and also looking into municipal bonds.

When buying T bills or treasuries, think about your investment goals and how much risk you can handle. Treasury bills are short-term, lasting from four weeks to a year. They're great for those who want quick access to their money and low risk. Treasury notes and bonds, with terms from two to 30 years, offer steady income for those willing to hold them longer.

Diversification Techniques

- Investing in a mix of Treasury bills, notes, and bonds to spread risk

- Exploring other government-backed securities, such as municipal bonds

- Considering the use of bond ladders to manage interest rate risk

Reinvestment Strategies

Investors can also use reinvestment strategies to boost their returns. For instance, they can reinvest interest payments from Treasury securities into new ones. This way, they can benefit from compound interest to grow their investments over time. Using TreasuryDirect or the Commercial Book-Entry System can also help manage and reinvest principal and interest payments.

| Security Type | Term | Interest Rate |

|---|---|---|

| Treasury Bills | 4 weeks to 1 year | Varies |

| Treasury Notes | 2 to 10 years | Varies |

| Treasury Bonds | 20 to 30 years | Varies |

By knowing the different government securities and using smart investment strategies, people can make better choices. This helps them reach their financial goals.

Keeping Track of Your Investments

It's important to check your investment portfolio often. This makes sure your investments are doing well and meet your financial goals. Tools like how to invest in treasury bills, investing in treasury bonds, and government backed investments help track your net worth and investment performance.

Looking at your account statements and using apps to track your portfolio is key. This way, you can keep up with your finances and make smart choices about your investments. Always check your portfolio at least once a year. Or, do it more often if the market changes a lot.

FAQ

What are government securities?

Government securities are debt instruments issued by the government. Examples include Treasury bills, notes, and bonds. They are seen as low-risk investments, providing a steady income for investors.

What are the different types of government securities?

There are several types of government securities. Treasury bills are short-term, lasting up to one year. Treasury notes and bonds have longer terms, from 2 to 30 years.

Why should I invest in government securities?

Government securities are low-risk due to government backing. They offer a steady income and are a safe choice during market volatility.

What are the disadvantages of investing in government bonds?

Government bonds have lower returns than stocks. They also face interest rate risks. Changes in interest rates can affect bond value and investor returns.

How do I purchase government securities?

You can buy government securities through brokers, online, or directly from the government. Mutual funds and ETFs also offer these investments.

What should I consider before investing in government bonds?

Before investing, consider your risk tolerance and investment time frame. Look at yield rates and credit ratings when choosing bonds.

What are the features and benefits of Treasury bonds?

Treasury bonds are issued by the U.S. Treasury Department. They offer a fixed interest rate and are very safe. This makes them a popular choice for steady income.

How do municipal bonds differ from Treasury bonds?

Municipal bonds are issued by state and local governments. Treasury bonds are federal. Municipal bonds often offer tax-advantaged returns, appealing to some investors.

How can I evaluate the performance of government securities?

Evaluate government securities by looking at yield rates and credit ratings. This helps assess return and risk of different bonds.

What strategies can I use to invest in government securities?

Use diversification and reinvestment strategies for government securities. These help manage risk and maximize returns.

How can I monitor and reevaluate my government securities investments?

Regularly check your government securities and adjust your portfolio as needed. Use tools and resources to track performance and make changes.