Can You Make Money Day Trading?

Day trading means buying and selling financial items in one day to make a profit from small price changes. To succeed, you need to understand the markets, use technical analysis, and manage risks well. With the right skills, day traders can earn a lot, and learning quickly is key to success.

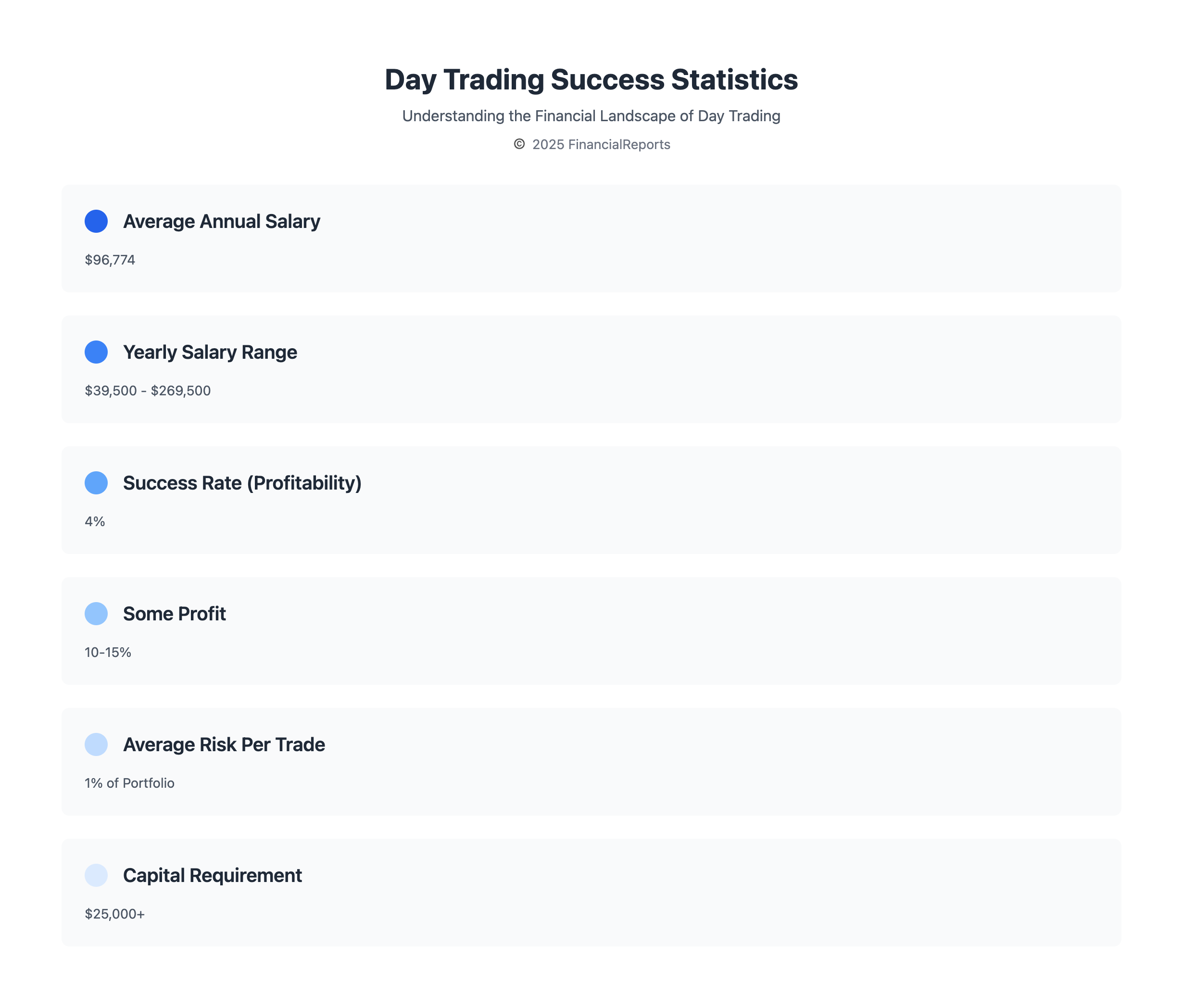

The salary for day traders varies, from $39,500 to $269,500 a year, with an average of $96,774 in June 2024. This shows how important a good trading plan is. Experts suggest risking only 1% of your portfolio on a trade. This helps avoid big losses and makes the most of small wins.

Key Takeaways

- Day trading requires a deep understanding of the markets, technical analysis, and risk management to can you make money day trading.

- The average day trader's annual salary ranged between $39,500 and $269,500 in June 2024.

- Professional traders recommend risking no more than 1% of your portfolio on a single trade when learning how to trade to make money fast.

- Developing a solid trading strategy is key for success in day trading and to can you make money day trading.

- Continuous reflection on investment behavior helps day traders identify patterns, learn from past mistakes, and adapt strategies to market conditions.

- Successful traders have disciplined trading strategies in place, underlining the importance of sticking to the plan and not letting emotions drive decisions when trying to learn how to trade to make money fast.

- Day traders must have enough capital, on top of the $25,000 requirement, to make a profit and need access to an online broker or trading platform to can you make money day trading.

Understanding Day Trading Basics

Day trading is about making quick trades during market hours to earn money. It's key to know the basics, like what day trading is and important terms. Many ask is day trading profitable and do day traders make money. The answer is yes, if you make smart choices and manage risks well.

Day traders use tools like technical analysis to spot good trades and control risks. They stick to rules, like not losing more than 1% to 2% of their money per trade. They also pick stocks based on market activity and how easy it is to trade them.

What is Day Trading?

Day trading means buying and selling the same day to make money from quick price changes. It involves stocks, options, futures, and currencies. Traders use technical analysis to guess trends and make money from short-term patterns.

Key Terminology in Day Trading

Important terms in day trading include:

- Pattern day trader: a trader who does four or more day trades in five business days

- Leverage: the chance to trade up to four times more than the required margin

- Margin account: a special account for borrowing money to trade

Knowing these basics and terms helps day traders succeed. With the right knowledge, they can confidently say is day trading profitable and do day traders make money.

| Term | Definition |

|---|---|

| Day Trading | Buying and selling securities within the same day |

| Pattern Day Trader | A trader who executes four or more day trades within five business days |

| Leverage | The ability to trade up to four times excess maintenance margin |

Analyzing Market Trends

To succeed in day trading, understanding market trends is key. This means using technical analysis to spot patterns and trends. By combining chart analysis and fundamental analysis, traders can make better predictions and boost their earnings.

Technical analysis includes concepts like support and resistance levels, retracement, and breakout. These help traders find good trading opportunities and make smart choices. Tools like the Average True Range (ATR) and Fibonacci lines also help predict price ranges and market movements.

Traders can use strategies like scalping and swing trading to make money. But, day trading comes with risks. It's important for traders to know these risks before trading. By learning how to profit from trading and using the right tools and strategies, traders can improve their chances of success.

Some key statistics to keep in mind include:

- Only 4% of individuals are able to make a living through day trading with adequate capital and practice.

- Approximately 10% to 15% of traders can make some money, but not enough to pursue day trading as a full-time career.

- Women have exhibited a higher success rate compared to men in some proprietary trading firms.

Choosing the Right Brokerage

Choosing the right brokerage is key for day trading success. The right one can teach you how to trade and make money. But, the wrong choice can cause big losses. You need a brokerage with good prices, reliable platforms, and top-notch customer support.

Look for brokerages with low commissions and few fees. Also, a user-friendly trading platform is important. Interactive Brokers, Fidelity, and Charles Schwab are known for their competitive prices and solid platforms. Webull and Moomoo also offer free options trading and no commissions for stocks and ETFs.

Here are some key considerations when choosing a brokerage:

- Commissions and fees: Look for brokerages that offer low or no commissions and minimal fees.

- Trading platforms: Choose a brokerage with a user-friendly and reliable trading platform.

- Customer support: Opt for a brokerage with excellent customer support, including phone, email, and live chat support.

By picking the right brokerage, you can start your day trading journey on the right foot. Always keep profit and risk management in mind when making your choice.

| Brokerage | Commissions | Fees |

|---|---|---|

| Interactive Brokers | $0.005 per share | $0.65 per contract |

| Fidelity | $0 | $0.65 per contract |

| Charles Schwab | $0 | $0.65 per contract |

Developing a Trading Strategy

Thinking about is day trading lucrative means you need a good trading plan. Many traders spend a lot of money searching for the perfect strategy. But, making your own can save time and money and be fun.

First, pick a time frame that fits your schedule. Then, update your screens as stocks change to find good trades.

Creating a trading strategy also means figuring out if can you make money day trading with it. You should test your strategy with past data to see if it works. It's important to check how a trade did in the past to predict its future success.

Types of Day Trading Strategies

- Trend following: This strategy involves identifying and following the direction of market trends.

- Range trading: This strategy involves buying and selling within a specific price range.

- Scalping: This strategy involves making multiple small trades in a short period.

Backtesting Your Strategy

Backtesting your strategy is key to its success. Risking 1% of your account per trade can lead to big gains. You can add 2% to 4% to your account in just one trade, quickly.

Start by risking 0.1% of your account per trade when you're new. Then, increase to 1% as you get more comfortable. This helps manage your risk.

Risk Management Techniques

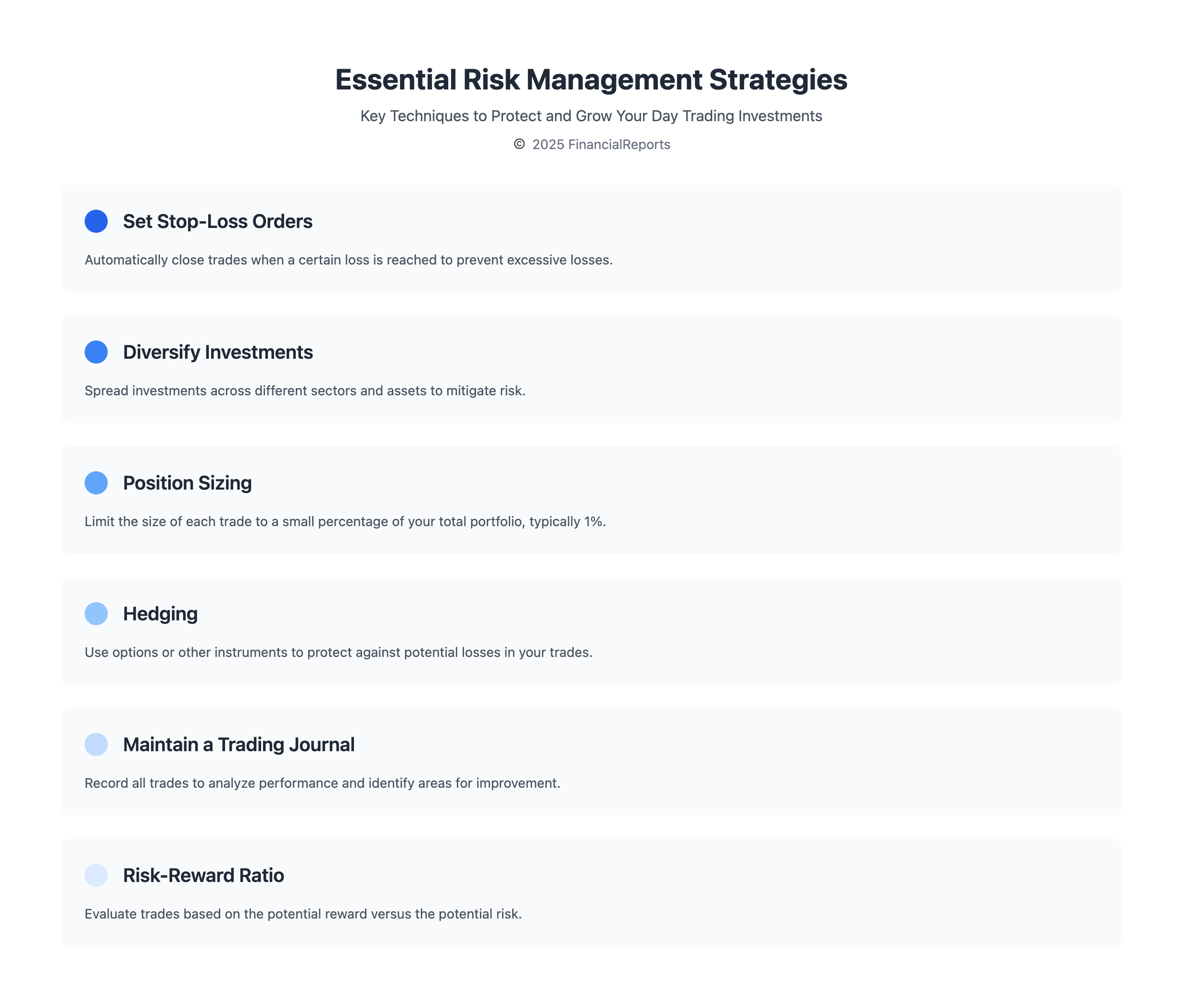

Day traders need to manage risks well to avoid big losses and keep profits safe. Learning how to trade profitably means understanding the importance of risk management. It helps balance the chance of making money with the risk of losing it. For beginners, mastering these techniques is key to reducing risks and increasing gains.

Setting stop-loss orders is a vital part of risk management. It means deciding how much money you can lose on a trade and setting an order to close it when that limit is hit. Diversifying your investments is also important. By spreading your money across different areas, you can lower the risk of losing everything.

Key Risk Management Strategies

- Set stop-loss and take-profit points to plan trades

- Use the one-percent rule to limit risk to 1% of capital per trade

- Diversify investments across sectors, market caps, and geographic regions

- Hedge positions using options to protect against losses

Good risk management can greatly improve your chances of making money. It helps you avoid big losses and lets you take more risks until you find the right trades. Knowing how much you might lose helps you understand the balance between risks and rewards.

| Risk Management Strategy | Description |

|---|---|

| Stop-Loss Orders | Automatically close trades when a certain loss is reached |

| Diversification | Spread investments across different sectors, market caps, and geographic regions |

| Hedging | Use options to protect against losses |

The Role of Market Psychology

Market psychology is key in day trading. It affects trading choices and profits. Traders need to know their own and others' biases to trade better. Understanding market psychology helps develop day trading strategies for success.

Discipline and risk-taking are vital for a trader's success. Greed and fear drive trading decisions. Greed leads to risky moves, while fear makes traders cautious. To beat these biases, traders should set goals, manage risks, and stay disciplined.

Traders often face emotional biases like:

- Loss aversion bias

- Overconfidence bias

- Self-control bias

- Status quo bias

- Regret aversion bias

Recognizing and tackling these biases helps traders make better choices. This improves their trading performance.

Tools and Resources for Day Traders

Day trading for beginners needs the right tools and resources. These help make informed decisions and gain an edge. To start, choose the best trading software, books, and blogs for market updates.

Essential Trading Software

Key trading software includes Lightspeed Financial Broker, Capital Market Elite Group (CMEG), and Warrior Trading Scanners. These tools offer features like hot keys and fast executions. They are vital for day trading.

Recommended Books and Blogs

Day traders also benefit from books and blogs on strategies and analysis. Trading in the Zone and The Disciplined Trader are great resources. They offer insights and tips to improve skills and avoid mistakes.

When choosing day trading software, look for:

- Fast and reliable execution

- Advanced charting and analysis tools

- Real-time market data and news feeds

- Customizable trading platforms

Using the right tools and resources can boost day trading skills. It increases success chances in the competitive day trading world.

Creating a Trading Plan

A good trading plan is key for day traders. It keeps them focused and helps them reach their goals. It should include strategies and tips for day trading. Also, it should have trading objectives, risk management, and performance metrics.

When making a trading plan, setting realistic profit goals is important. It's also vital to review the plan often to keep it effective. This can be done by monitoring and managing trades with stops. Also, recording trades in a trading diary helps analyze decisions and find areas for improvement.

Key Components of an Effective Plan

A trading plan should include:

- Specific, measurable, attainable, relevant, and time-bound (SMART) goals

- Risk management strategies, such as risking less than 2% of total trading capital on each trade

- Performance metrics, including risk-reward ratios and win/loss ratios

Setting Realistic Profit Goals

To set realistic profit goals, traders should think about their trading style, risk tolerance, and market conditions. By using day trading strategies and tips, traders can make a detailed plan. Regularly reviewing and updating the plan is key for success in trading.

Staying Updated on Market News

To succeed in day trading, it's key to keep up with market news and trends. Follow financial news outlets and use social media for insights. This helps identify trends and stay ahead of market changes.

Following Financial News Outlets

Financial news outlets give day traders the latest on market trends and news. Bloomberg, CNBC, and Reuters are popular choices. They help traders make informed decisions and stay competitive.

Utilizing Social Media for Insights

Social media like Twitter and LinkedIn offer insights into market trends and news. Day traders can follow financial experts and analysts. It's also a chance to connect with other traders and share strategies.

Some key points to consider when staying updated on market news include:

- Following financial news outlets and social media platforms

- Staying informed about market trends and news

- Using information to make informed trading decisions

- Connecting with other day traders to share information and strategies

By keeping up with market news and trends, day traders can boost their success. Whether you're new to day trading or have experience, staying informed is essential. Day trading can be challenging, but with the right info, it can be rewarding.

| Resource | Description |

|---|---|

| Bloomberg | Financial news outlet providing up-to-date information on market trends and news |

| Social media platform used to gain insights into market trends and news | |

| Reuters | Financial news outlet providing news and analysis on market trends and developments |

Evaluating Trading Performance

To succeed in day trading, it's key to check your performance often. You should track things like profit/loss ratio, win/loss ratio, and risk-reward ratio. These help you see where you can get better and tweak your day trading strategies.

Keeping a trading journal is also important. It helps you record each trade and its result.

Some important metrics to watch include:

- Average win size vs. average loss size

- Profit factor

- Sharpe ratio

- Win percentage

These numbers tell you about your trading skill, risk handling, and overall success. By looking at these, you can tweak your day trading tips and plans to get better results.

Traders can also use tools like performance graphs and reports. These help you see your progress and spot trends. By competing with yourself and aiming to boost your own profits, you can do well in day trading over time.

| Metric | Description |

|---|---|

| Average win size vs. average loss size | Compares the average profit per trade to the average loss per trade |

| Profit factor | Indicates the relationship between profits and losses |

| Sharpe ratio | Measures risk-adjusted returns |

Learning from Day Trading Mistakes

Day trading can be very profitable, but it needs hard work, discipline, and a willingness to learn from mistakes. To do well in day trading, it's key to know how to make money and have a good strategy, even if you're new. Experienced traders say only 4% of those who try day trading and keep learning and practicing make it profitable.

Some common mistakes to avoid include making quick decisions, not being disciplined, and not managing risks well. Successful traders spend time making a trading plan, setting achievable goals, and always improving their strategies. Here are some important stats to remember:

- 96% of day traders don't make enough to keep up with their time investment

- Traders who succeed take at least 6 months to start making good money

- Fast profits in day trading often come from luck or very good market conditions

To avoid mistakes and get better at trading, it's important to learn from failures and keep your eyes on long-term goals. This way, day traders can boost their success chances and create a profitable trading plan.

| Statistic | Percentage |

|---|---|

| Day traders who reach profitability | 4% |

| Day traders who do not make enough to sustain their time investment | 96% |

The Future of Day Trading

The world of day trading is always changing. New technologies like artificial intelligence and machine learning are coming in. These tools will help traders analyze data and make trades better.

But, there are also risks. Technology could lead to market manipulation. It might also make it harder for individual traders to compete with pros.

Regulations and how people invest are also changing. New rules could protect small investors but might make day trading less profitable. Despite this, the chance for quick wins and the excitement of trading will keep attracting new traders.

To do well in day trading, you need to keep learning and adapting. Use the latest tech, try different strategies, and focus on managing risks. This way, you can handle the market's ups and downs and reach your financial goals.

The future of day trading is not set in stone. But, if you're careful and dedicated, you can find great opportunities ahead.

FAQ

Can you make money day trading?

Yes, with the right skills and knowledge, day traders can make significant profits. Day trading involves buying and selling financial instruments within a single day. It requires a deep understanding of the markets, technical analysis, and risk management.

What is day trading?

Day trading is a popular trading strategy. It involves buying and selling financial instruments within a single day. It requires a deep understanding of the markets, technical analysis, and risk management.

What are the key terms in day trading?

Key terms in day trading include technical analysis and candlestick charts. Also, moving averages, relative strength index (RSI), and risk management strategies like stop-loss orders and diversification are important.

Why is technical analysis important in day trading?

Technical analysis is a key tool for day traders. It helps identify market trends and patterns. By analyzing charts and using various indicators, day traders can make informed trading decisions and find profitable trades.

What features should I look for in a day trading brokerage?

When choosing a day trading brokerage, consider commissions, fees, trading platforms, and customer support. A good brokerage should offer competitive pricing, reliable trading platforms, and excellent customer support.

What are some common day trading strategies?

Common strategies include swing trading, scalping, and momentum trading. Developing a trading strategy and backtesting it using historical data is key to its effectiveness.

How can I manage risk in day trading?

Effective risk management includes setting stop-loss orders and diversifying your portfolio. Understanding market psychology and avoiding emotional trading are also important.

What tools and resources are available for day traders?

Day traders can use charting platforms, trading simulators, and financial news outlets. These tools help improve trading skills and stay informed about market developments.

What should be included in a day trading plan?

A day trading plan should include your trading objectives, risk management strategies, and performance metrics. Setting realistic profit goals and regularly reviewing your plan is essential for success.

How can I stay updated on market news and developments?

Day traders can follow financial news outlets and use social media. This helps gain insights from other traders and market experts.

How can I evaluate my day trading performance?

Keeping a detailed trading journal and tracking key performance indicators is important. This helps evaluate trading performance and identify areas for improvement.

What are some common mistakes to avoid in day trading?

Common mistakes include emotional trading, lack of risk management, and inadequate market research. Studying failed traders can provide valuable insights and help develop effective strategies.

What are the emerging trends in the day trading industry?

The future of day trading looks promising. Advancements in technology and increased market accessibility will shape the industry. Day traders should stay informed about these developments to remain competitive.