Mastering Trading: Your Complete Guide to Getting Started

To start trading, you need to know the basics. This includes different trading strategies and how to manage risks. For beginners, trading can seem tough. But, with the right skills, you can succeed in the trading world.

Learning to trade begins with the basics. You should know about day trading, swing trading, and long-term investing. It's also important to understand the stock, Forex, and commodities markets. Knowing these basics helps you build a strong trading foundation.

Key Takeaways

- Mastering trading requires a deep understanding of the basics, including strategies and risk management.

- Trading can be challenging for beginners, but with the right skills, you can reach your financial goals.

- Knowing different trading strategies, like day trading, is key to success.

- Technical and fundamental analysis are vital for making smart trading decisions.

- Creating a trading plan and managing risk are essential for a successful strategy.

- Staying updated on market trends and news is important for making effective trading decisions.

- Discipline, patience, and a positive mindset are critical for a healthy trading mindset and long-term success.

Understanding the Basics of Trading

To begin trading, you need to know the market basics. This includes understanding trading strategies, key terms, and market concepts. Before you start, think about your financial situation, how much risk you can take, and your investment goals.

Learning about leverage, margin, and volatility is important. Leverage lets you use more capital than you have. Margin is the money needed to open a trade. Volatility shows market changes, which can help skilled traders.

To trade well, you must know the market and have a good strategy. Stay updated with market news, analyze trends, and make decisions based on data. By learning and adapting, you can succeed in trading.

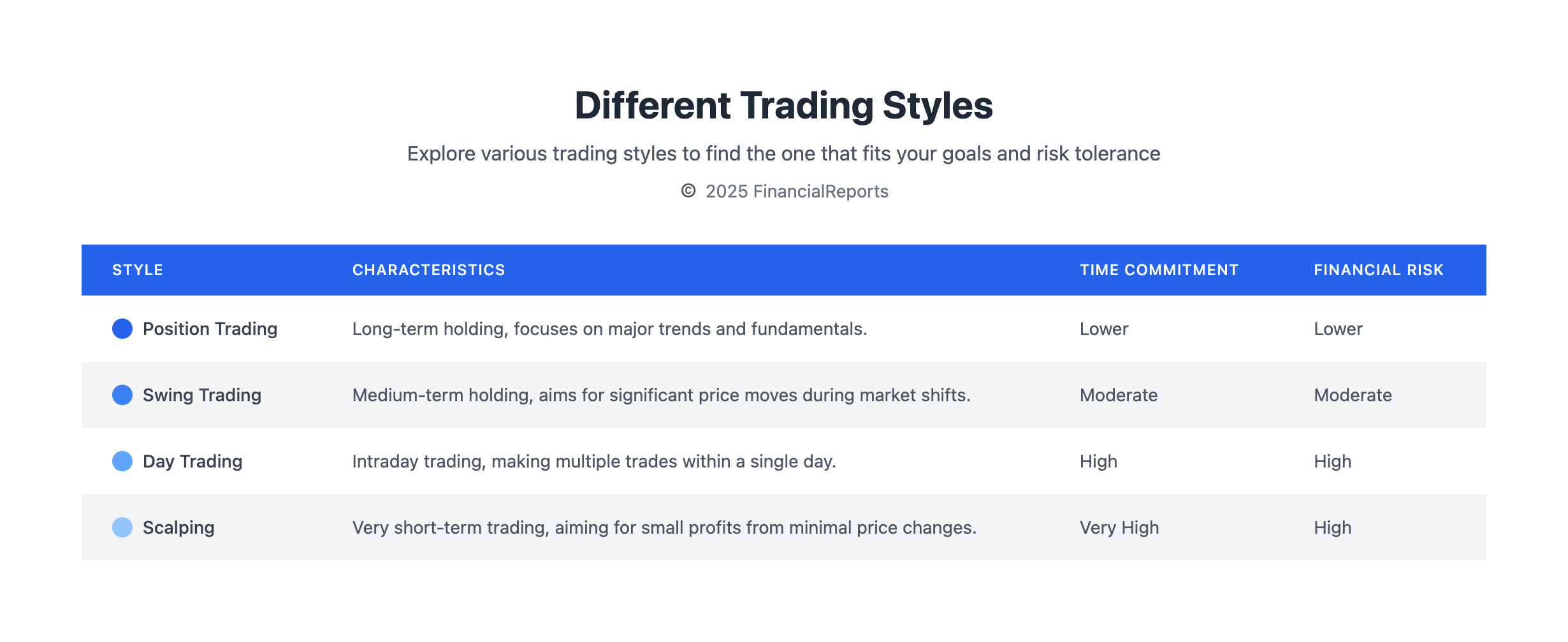

Choosing Your Trading Style

As a beginner trader, it's key to know the different trading styles. Learning how to trade involves exploring various approaches. This helps find the right style for your goals, risk level, and market analysis. If you're new to trading, start by learning about the four main styles: position trading, swing trading, day trading, and scalping.

Each style has its own traits, benefits, and downsides. Position trading means holding trades for a long time, focusing on trends and fundamentals. Swing trading aims for bigger price moves as the market shifts. Day trading is all about making trades in one day, needing quick decisions. Scalping is the shortest term, requiring fast and precise actions.

When picking a trading style, think about the time needed, focus, and emotional control. For instance:

- Position trading: less time needed, less risk, good for patient people

- Swing trading: some time needed, some risk, best for strategic thinkers

- Day trading: lots of time needed, high risk, needs intense focus and quick decisions

- Scalping: a lot of time needed, high risk, needs instant decisions

Finding the right trading style is key to success. It must match your goals, risk tolerance, and market analysis. By understanding the different styles, beginners can make smart choices and create a trading plan that fits their needs.

| Trading Style | Time Commitment | Financial Risk |

|---|---|---|

| Position Trading | Lower | Lower |

| Swing Trading | Moderate | Moderate |

| Day Trading | High | High |

| Scalping | Very High | High |

Selecting a Trading Platform

Understanding how trading works is key to making smart choices. To start trading, picking the right platform is essential. With so many options, it's hard to know which one to choose. It's important to think about fees, commissions, and features when picking a platform.

Popular platforms like Interactive Brokers, Charles Schwab, and Fidelity have their own strengths. For example, Interactive Brokers has no minimum account requirement and no commissions for stocks and ETFs on TWS Lite. Fidelity also has no minimum account requirement and no fees for stock and ETF trades.

Choosing a platform depends on your trading style. Day traders need platforms that handle lots of trades quickly. Long-term investors need platforms with good research tools and low fees. Knowing how to study trading and picking the right platform is key to success.

Some important things to think about when picking a platform include:

- Fees and commissions

- Features and tools

- Mobile and desktop accessibility

- Customer support

By looking at these factors and understanding trading, traders can make a good choice. This ensures they find a platform that fits their needs.

Developing a Trading Plan

To succeed in trading, having a solid trading plan is key. This plan should outline realistic goals, risk management rules, and how to adjust based on performance. Understanding that a trading plan evolves over time is vital. It's not a one-time task but a continuous process.

A good trading plan includes market analysis, risk management, and trade management. Setting SMART goals is also important. These goals should be specific, measurable, attainable, relevant, and time-bound. For instance, aiming to increase your portfolio by 10% in 6 months requires effective trading skills and informed decisions.

When crafting a trading plan, starting with a strong foundation is essential. This means understanding different trading styles like day trading, swing trading, and position trading. Choosing the right style for your goals and needs is critical. A well-thought-out plan helps you stay focused, avoid emotional decisions, and reach your trading goals.

Some key elements of a solid trading plan include:

- Goal definition

- Trading style selection

- Strategy development

- Risk management rule development

- Trade management plan

By following these steps and regularly updating your plan, you can enhance your trading skills. This will help you meet your goals.

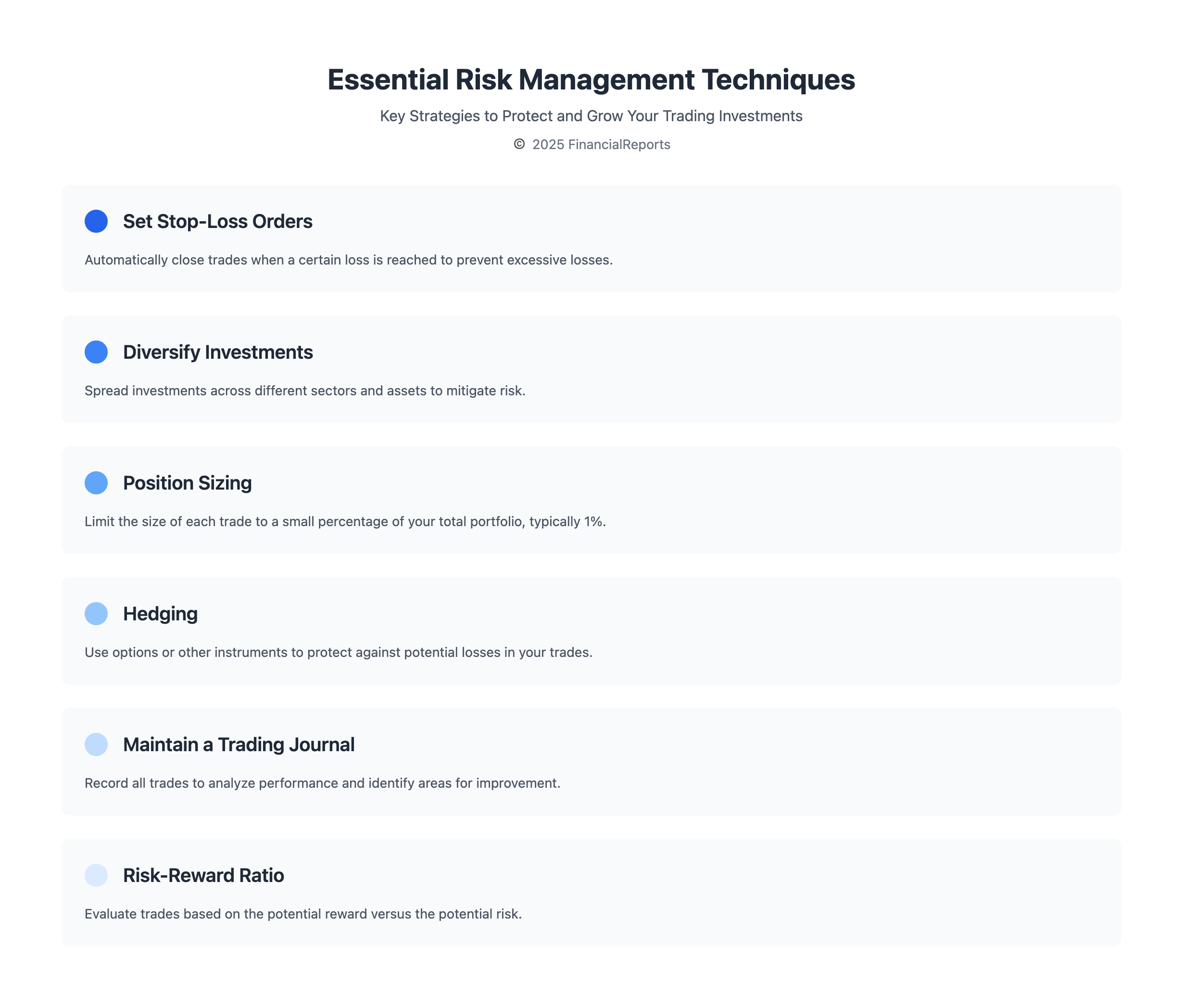

Risk Management Techniques

Effective risk management is key for traders. It helps cut down losses and boost gains. When starting to trade, learning about risk management is vital. This includes understanding risk vs. reward, setting stop-loss orders, and diversifying.

Understanding risk vs. reward is a big part of risk management. It means looking at the risks and rewards of a trade and making smart choices. Traders use tools like stop-loss and take-profit points to manage risk and increase returns. By risking a small part of their account on each trade, they can protect their money.

Key Risk Management Strategies

- Set stop-loss and take-profit points to limit losses and lock in gains

- Diversify investments across different asset classes and industries to reduce risk

- Use hedging strategies, such as options, to protect against possible losses

- Monitor and adjust risk management plans regularly to ensure they remain effective

By using these risk management techniques, traders can lower their risk and boost their chances of success. Whether you're new or experienced, having a good risk management plan is key. Remember, risk management is an ongoing process that needs constant checking and tweaking for the best results.

Technical Analysis Fundamentals

For a beginner trader, learning technical analysis is key. It involves looking at past data like price and volume to guess future trends. It's important to know the basics of technical analysis, like indicators and reading charts.

Technical analysis uses tools like moving averages and the relative strength index to spot trends. Many traders use technical analysis strategies to guide their trades. Mixing technical and fundamental analysis helps traders make better choices and increase their returns.

Commonly Used Indicators

Some common indicators are:

- Moving averages

- Relative strength index

- Bollinger Bands

These tools help traders find trends and when to buy or sell. For instance, when the 10-period moving average goes above the 50-period one, it's a sign of abullish trend.

Reading Price Charts

Understanding price charts is vital for traders. By studying price movements, traders can spot good trading chances. Candlestick charts are popular for showing price changes, and many use white and black candlestick bodies to show different price actions.

Utilizing Fundamental Analysis

Fundamental analysis is key for traders wanting to know a security's true value. To learn more about fundamental analysis, looking at financial statements and economic indicators is vital. This method helps find companies that are undervalued but have great growth chances. It's important for those learning to trade and starting to trade.

When checking a company, traders should look at important ratios. These include the price-to-earnings (P/E) ratio, earnings per share (EPS), return on equity (ROE), and debt-to-equity (D/E) ratio. These ratios show a company's financial health and how it's doing. Knowing how trading works means understanding these ratios and other basic data. Some key things to think about are:

- Revenue growth and profitability

- Competitive advantages and macroeconomic factors

- Management effectiveness and corporate governance

By looking at these points and using fundamental analysis, traders can better understand a company's growth chances. This helps them make smarter trading choices.

Resources for Continued Learning

To learn to trade well, you need good resources. This includes books and courses that teach trading strategies. Online trading communities are also great for connecting with experienced traders.

For those new to trading, webinars and workshops are perfect. They offer hands-on learning. The Orion Trading Academy, for example, teaches the ORION strategy in real market scenarios.

Some key resources for continued learning include:

- Recommended books: "Trading in the Zone" by Mark Douglas and "The Disciplined Trader" by Mark Douglas

- Online courses: The ORION Trading Academy's training program

- Online trading communities: Reddit's r/trading and r/investing

- Webinars and workshops: The ORION Trading Academy's webinars and workshops

| Resource | Description |

|---|---|

| Orion Trading Academy | Comprehensive training program covering the ORION strategy |

| Reddit's r/trading | Online community for traders to connect and share experiences |

| Mark Douglas' books | Recommended books for traders looking to improve their skills |

Staying Informed About Market Trends

Keeping up with the latest market trends is key for any

trader

, whether you're new or experienced. By following

market news

from trusted sources like CNN, Reuters, and The New York Times, you get important insights. These include economic conditions, industry updates, and trading chances.

Use strong

market research

tools like Google News, AP News, and alerts to get your info fast. News tickers and podcasts are great for staying updated on the move. Also, talking with other

traders

on forums, social media, and events can give you real-time tips and strategies.

To stay ahead, follow important

traders and analysts

on X (formerly Twitter) and LinkedIn. Their comments, analysis, and tips can give you new ideas. A balanced way to keep up with trends will help you succeed in trading.

FAQ

What are the different types of trading strategies?

Trading strategies vary. Day trading means opening and closing trades in one day. Swing trading holds positions for days to weeks. Long-term investing keeps positions for months or years.

What are some key trading terms I need to know?

Key terms include leverage, margin, and volatility. Also, support and resistance, and technical indicators like moving averages and RSI.

What are the characteristics of different trading styles?

Trading styles differ. Day trading is fast with small trades. Swing trading is medium-term. Long-term investing is slow and patient. Scalping focuses on small price movements.

How do I choose the right trading platform?

Look at platform features and mobile vs. desktop options. Also, consider commission structures and user experience. Compare to find the best platform for you.

What should I include in my trading plan?

Your plan should outline goals and risk management rules. It should also include market analysis and how to adjust based on performance. This helps make consistent, informed decisions.

What are some key risk management techniques?

Key techniques include understanding risk-reward ratios and setting stop-loss orders. Diversifying your portfolio is also important. Proper position sizing and leverage management are critical.

How do I use technical analysis effectively?

Technical analysis uses indicators like moving averages and RSI. It helps identify trends and patterns. Reading price charts is a key skill.

What is the role of fundamental analysis in trading?

Fundamental analysis looks at a company's financials and industry news. It helps assess an asset's value. It can complement technical analysis for better decisions.

What resources can I use for continued learning?

Use books, courses, online communities, webinars, and workshops for learning. Stay updated with market news and follow influential traders.

How can I stay informed about market trends?

Monitor market news and use technical and fundamental analysis tools. Follow respected traders and analysts to stay informed and make better decisions.