Mastering the Key Types of Options Trades

Options trading is not for beginners. It needs a deep understanding of the market. There are many types of trades, like calls, puts, spreads, and straddles. Each has its own risks and benefits.

When you trade options, you buy and sell contracts. These contracts let you buy or sell something at a set price before they expire. Knowing about these trades is key to making money in the markets.

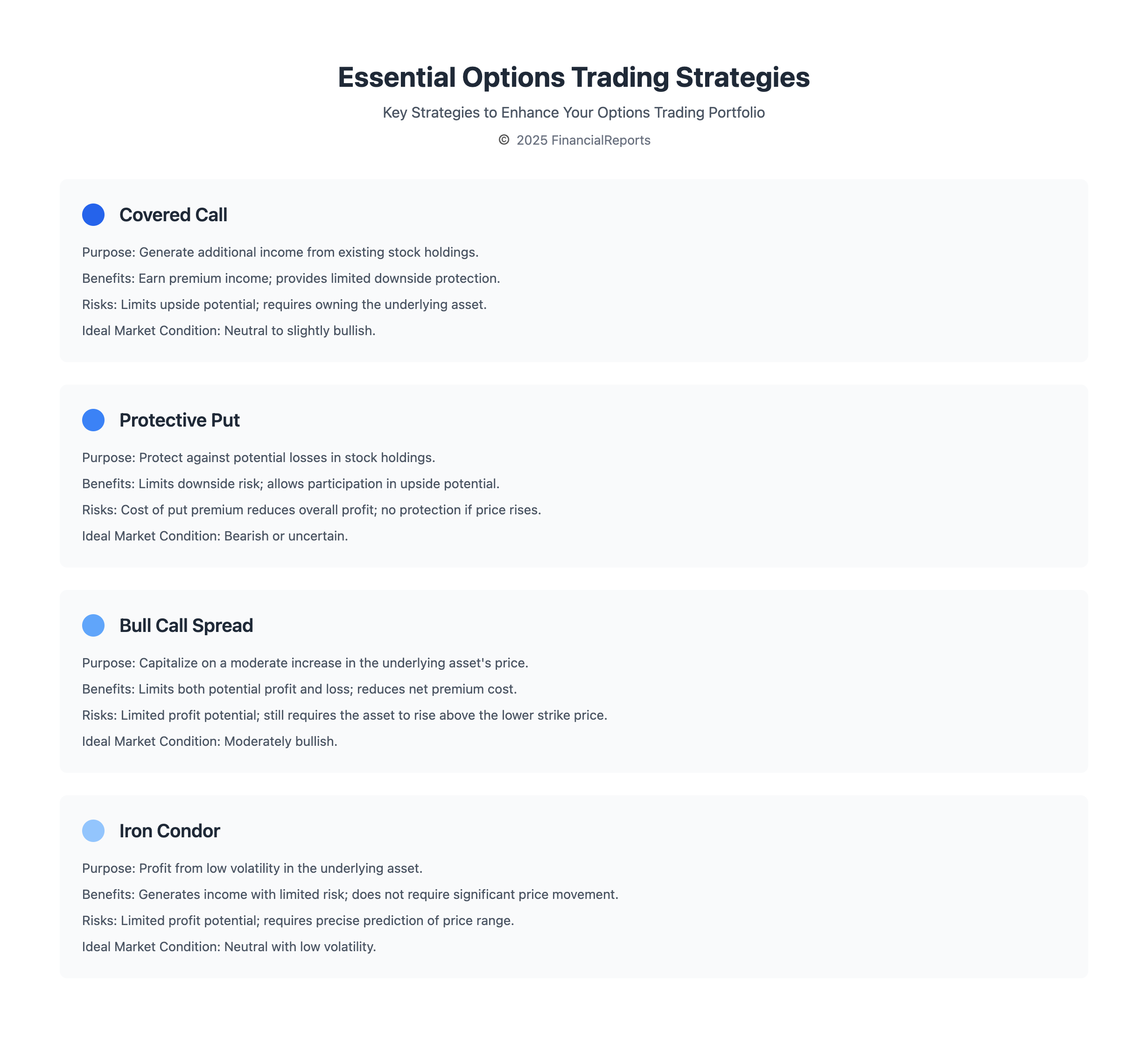

Investors use options to protect themselves or to bet on price changes. Strategies like covered calls and protective puts can lower risks and make money. Learning about these strategies helps investors make smart choices and build strong portfolios.

Introduction to Options Trading

Options trading uses many techniques, from simple calls and puts to complex spreads and straddles. Long straddles and strangles make money when prices move up or down. Bull call spreads and bear put spreads offer smaller profits.

It's important to understand these strategies to succeed in the options market. This knowledge helps investors reach their goals.

Key Takeaways

- Options trading strategies require a thorough understanding of the options market.

- Types of options trades include calls, puts, spreads, and straddles, each with unique characteristics and risks.

- Options trading involves buying and selling options contracts, which give the holder the right to buy or sell an underlying asset at a specified price.

- Option strategies, such as covered calls and protective puts, can help reduce risks and generate income.

- Understanding options trading strategies is essential for maximizing returns in the financial markets.

- Investors can use options options options to hedge against possible losses or bet on price changes.

Understanding Options Trading Basics

Options trading is a complex financial tool that needs a solid grasp of its basics. The option finance definition is a contract that lets the holder buy or sell an asset at a set price before it expires. To do well in options trading, knowing what is the best strategy to trade options is key. This means understanding the assets, market trends, and how to manage risks.

Important parts of options trading are the strike price, expiration date, and premium. The strike price is the price to buy or sell the asset. The expiration date is when the option can no longer be used. The premium is the option's price, made up of its intrinsic and time values. Options explained simply, are contracts that let the holder buy or sell an asset at a set price before it expires.

Some key stats for trading options include:

- Most option contracts are closed before they expire

- Option premiums have both intrinsic and time values

- On most U.S. exchanges, a stock option contract represents 100 shares of the underlying stock

Knowing these basics and option strstrategies helps investors make smart choices. It helps them navigate the complex world of options trading.

| Option Type | Definition | Example |

|---|---|---|

| Call Option | Gives the holder the right to buy an underlying asset | Buying a call option to buy 100 shares of stock |

| Put Option | Gives the holder the right to sell an underlying asset | Buying a put option to sell 100 shares of stock |

Types of Options: Calls vs. Puts

Investors have two main options: calls and puts. Knowing the difference is key for a good option trading technique. In options finance, calls and puts have different uses. The right choice depends on what you want to achieve and what you think will happen in the market.

Call Options Explained

Call options let the buyer buy an asset at a set price. People buy calls when they think the asset's price will go up. The profit comes from the price going above the strike price. Here are some important things to remember when buying call options:

- Call options can be used for speculation or hedging

- The buyer has the right, but not the obligation, to buy the underlying asset

- The profit is unlimited, but the loss is capped at the premium paid

Put Options Explained

Put options let the buyer sell an asset at the strike price. Investors buy puts when they think the asset's price will drop. The profit comes from the price going below the strike price. Here are some important things to remember when buying put options:

- Put options can be used for speculation or hedging

- The buyer has the right, but not the obligation, to sell the underlying asset

- The profit is limited, but the loss is capped at the premium paid

| Option Type | Buyer's Right | Profit | Potential Loss |

|---|---|---|---|

| Call Option | Buy underlying asset | Unlimited | Limited to premium paid |

| Put Option | Sell underlying asset | Limited | Limited to premium paid |

Single Options Strategies

Single options strategies involve buying or selling a single options contract. This can be a call or put option. Investors use this strategy when they think the price of an asset will go up or down.

For instance, if someone thinks a stock will rise, they might buy a call option. This way, they can profit from the price increase. On the flip side, if someone expects a stock to fall, they might buy a put option. This helps them profit from the price drop.

There are 4 types of options for single options strategies: call options, put options, long calls, and long puts. Each option has its own risks and benefits. The right strategy depends on the investor's goals and how much risk they can handle.

Buying call options or put options are common strategies. An example is buying a call option on a stock that's expected to go up. This shows how options can be used to speculate or protect against losses.

These strategies work in various markets, like stocks, commodities, and currencies. By learning about the different kinds of options, investors can find a best option trading strategy that fits their needs and risk level.

Multi-leg Options Strategies

Multi-leg options strategies mix several options contracts to reach a goal. They work well in various market conditions. Key to these strategies is option spread strategies. These involve buying and selling options with different strike prices or expiration dates.

In finance, options meaning can change based on the situation. Generally, options are contracts that let the buyer choose to buy or sell an asset at a set price. Good options strategies blend technical analysis, risk management, and market knowledge. Popular strategies include spreads, straddles, and strangles.

Spreads Defined

A spread means buying and selling options with different strike prices or expiration dates. For instance, a bull call spread might include buying a call option at $20 and selling one at $22.

Straddles and Strangles

A straddle is buying a call and a put option with the same strike price and expiration date. A strangle involves buying a call and a put with different strike prices and expiration dates. These strategies aim to profit from price changes, regardless of direction.

| Strategy | Description | Risk/Reward |

|---|---|---|

| Bull Call Spread | Buy call option with lower strike price, sell call option with higher strike price | Limited risk, limited reward |

| Straddle | Buy call option and put option with same strike price and expiration date | Unlimited reward, high risk |

| Strangle | Buy call option and put option with different strike prices and expiration dates | Unlimited reward, high risk |

Understanding and applying multi-leg options strategies can boost returns and manage risk. It's vital to grasp options meaning in finance and good options strategies to thrive in the markets.

Covered Calls Strategy

The covered call strategy is a well-known way to trade options. It involves selling a call option when you own the underlying asset. This method can bring in regular income and lower the cost of owning the asset. Options, like covered calls, help investors reach their goals.

It's key to know the good and bad sides of covered calls. They can protect you if the stock price falls. But, the biggest loss is the cost of the stock minus the call credits and fees. Picking the right strike price is vital for success. This way, you can boost your chances of making money.

Benefits of Covered Calls

Covered calls have many advantages. They can make you money and lower the cost of owning stocks. By selling a call option, you get a premium. This premium can help cover the cost of the stock.

They also offer protection if the stock price drops. The premium you get can help lessen losses. This makes covered calls a good choice for some investors.

Risks to Consider

But, covered calls aren't without risks. They limit your profit to the strike price of the option. If the stock price goes up a lot, you could lose a lot of money. It's important to think about these risks and if they fit your investment goals and risk level.

Understanding the pros and cons of covered calls helps investors make better choices. Options, like covered calls, can help achieve investment goals. But, it's important to weigh the risks and rewards before using this strategy.

Protective Puts Strategy

Investors use a protective puts strategy to reduce losses in their portfolios. This involves buying a put option while owning the asset. It's great for volatile markets where asset values can change a lot. This strategy helps investors limit losses and keep their assets safe from value drops.

There are many financial options and trading strategies to choose from. Protective puts are one way to protect against market drops. For example, an investor can buy a put option to guard against a stock's value falling. This can be part of a bigger investment plan that includes other options like calls and spreads.

How Protective Puts Work

Protective puts give investors the right to sell an asset at a set price (strike price) before the option expires. If the asset's market price drops below the strike price, the investor can sell at the higher strike price. This limits losses. It's a way to protect a portfolio from market downturns and secure profits.

When to Use Protective Puts

Protective puts are useful in various market conditions. Investors should weigh the pros and cons before using them. Important factors include the cost of the put option, the risks and rewards, and the investor's goals and risk tolerance. By combining protective puts with other strategies, investors can craft a detailed plan to meet their needs and goals.

Some key benefits of protective puts include:

- Limiting possible losses in a portfolio

- Protecting against market downturns

- Allowing investors to secure profits

- Offering flexibility and versatility in planning

The Role of Options in Investment Portfolios

Options are key in managing risk and boosting returns in investment portfolios. An options explanation helps understand how they can meet investment goals. Investors use stock option strategies to protect against losses or make money from market gains.

Investors have many different options like calls and puts. Calls help profit from stock price increases, while puts protect against price drops. Knowing how options work helps investors craft strategies that fit their goals and risk levels.

Some important things to think about include:

- Risk management: Options help protect against losses or gain from market moves.

- Return enhancement: They offer a chance to make more money from market gains.

- Flexibility: Options let investors adjust to market changes and tweak their strategies.

Advanced Options Strategies

Investors looking to improve their trading can try advanced options strategies. These involve mixing different options contracts to meet certain goals. They can help make money in various market situations, like when prices go up, down, or stay the same. Using option selling strategies can help increase earnings and control risks.

Strategies like iron condors, butterflies, and calendar spreads offer benefits. For example, iron condors mix a bear call spread with a bull put spread. This way, investors can make money when the market is stable.

Key Considerations

When using advanced options strategies, it's key to match them with your investment goals. Important things to think about include:

- Knowing the underlying assets and market conditions

- Managing risk through delta-hedging and adjusting portfolio delta

- Watching changes in implied volatility and adjusting positions as needed

By carefully looking at these points and using advanced options strategies, investors can boost their returns. These strategies need a good grasp of options trading basics, like option selling and stock option strategies.

Common Mistakes in Options Trading

Options trading can be very rewarding but also risky. Two big mistakes are overleveraging and not understanding volatility well enough.

Overleveraging Risks

Options trading lets you control big positions with a small amount of money. But, this can lead to big losses if the market goes against you. Beginners often don't realize how much risk they're taking on. This can cause huge losses.

Underestimating Volatility

Options prices change a lot because of the asset's volatility. If traders don't get volatility right, their options can lose value. Even if the asset moves as expected. It's key to understand and manage volatility well to do well in options trading.

FAQ

What are the key types of options trades?

The main types of options trades are calls, puts, spreads, straddles, and strangles. Each has its own risks and benefits.

What is the difference between call options and put options?

Call options let you buy an asset later. Put options let you sell an asset later. Investors use calls when they think prices will go up. They use puts when they think prices will go down.

What are the different single options strategies?

Single options strategies include buying call or put options. These aim to profit from price changes in the underlying asset.

What are the different multi-leg options strategies?

Multi-leg strategies include spreads, straddles, and strangles. They combine options to meet specific investment goals.

What is the covered call strategy?

The covered call strategy involves selling a call option on an asset you own. It can provide regular income and help lower the cost of owning the asset.

What is the protective put strategy?

The protective put strategy involves buying a put option on an asset you own. It can protect against price drops and limit losses.

How can options be used to manage risk and enhance returns in an investment portfolio?

Options can hedge against losses, acting as insurance against market drops. They can also increase returns by profiting from market gains.

What are some advanced options strategies?

Advanced strategies include iron condors, butterflies, and calendar spreads. They can profit from various market conditions, like rising, falling, or stable markets.

What are some common mistakes in options trading?

Common mistakes include taking on too much risk and underestimating volatility. Too much risk can lead to big losses if the market moves against you. Underestimating volatility can cause unexpected losses.