Mastering Margin Formula in Excel Tutorial

Profit margins are key to any business's success. They show how much money is left after costs are subtracted from revenue. This helps make smart financial choices. To figure out these margins, knowing how to use the margin formula in Excel is vital. A margin calculator Excel plugin can also make this easier.

Financial experts and investors need to know how to use margin formulas in Excel. This skill helps them make choices based on data. By getting good at margin calculations, businesses can improve their financial analysis. This leads to better strategies and more growth. Learning the margin formula in Excel and using a margin calculator plugin are great ways to do this.

Key Takeaways

- Understanding profit margins is key to knowing a company's financial health and making smart choices.

- Knowing how to do margin formula in Excel is important for accurate calculations and smart decision-making.

- A margin calculator Excel plugin can make calculating profit margins easier.

- Mastering margin formulas in Excel can help businesses set better prices and work more efficiently.

- By using Excel's tools, companies can get important insights into their finances and make choices that help them grow.

- Using a margin calculator Excel plugin can help with financial analysis and give a competitive edge.

- Accurate margin calculations help with financial planning and forecasting. This enables businesses to make strategic decisions for long-term success.

Understanding the Concept of Margin in Business

Profit margin is key for checking how well a company does financially. It shows what percentage of sales is profit after expenses. To figure it out, businesses use the how to formula profit margin in excel. This involves subtracting costs from sales and then dividing by sales.

This formula is key for the profit percentage formula in excel. It helps companies check their pricing and make smart choices.

Knowing about margin is important for businesses. It lets them see how they're doing financially and make smart choices. The how to formula profit margin in excel helps figure out a company's profit margin. This way, businesses can tweak their pricing to boost profits.

Definition of Margin

Margin is the difference between what a product sells for and what it costs, as a percentage of the selling price. It's a key metric for businesses. It helps them check their pricing and make smart choices. The how to formula profit margin in excel is used to find the margin, which shows the profit percentage formula in excel.

Importance of Understanding Margin

Understanding margin is vital for businesses. It lets them see how they're doing financially and make smart choices. By using the how to formula profit margin in excel and calculating the profit percentage formula in excel, companies can find their profit margins. This helps them adjust to make more money.

Types of Margins

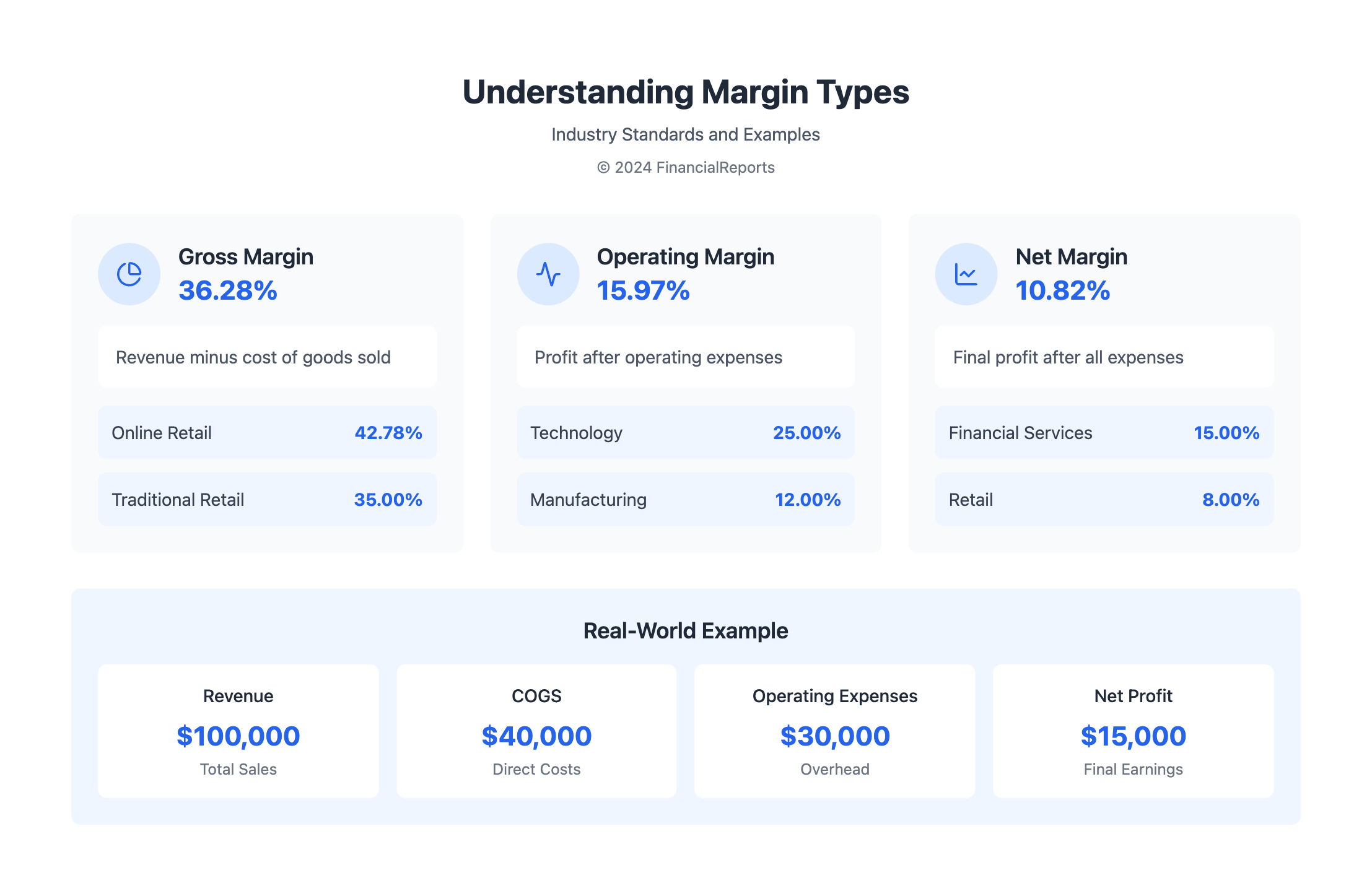

There are different kinds of margins, like gross margin, operating margin, and net margin. Each gives insights into a company's financial health. The how to formula profit margin in excel and profit percentage formula in excel help calculate these margins. This lets companies check their finances and plan better.

Setting Up Your Excel Spreadsheet

Excel is a great tool for financial work, helping you organize and analyze data. To calculate margins well, you need to set up your Excel right. This means starting a new workbook for financial tasks and arranging your data neatly.

For margin calculation in Excel, keep your spreadsheet tidy. Use different columns for revenue, cost of goods sold, and other costs. This makes it simpler to use the margin equation excel formula.

Creating a New Workbook

First, open a new workbook in Excel. Then, create a table with the right columns. This keeps your work organized and helps with accurate numbers. Important columns include:

- Revenue

- Cost of Goods Sold (COGS)

- Operating Expenses

- Net Profit

Organizing Data for Margin Calculation

After setting up your columns, start putting in your data. Keep it neat and easy to read. This makes it easier to use the margin equation excel formula. By doing this, you'll set up your Excel for precise margin calculation in Excel.

| Product | Revenue | COGS | Operating Expenses | Net Profit |

|---|---|---|---|---|

| Product A | $100 | $50 | $20 | $30 |

| Product B | $150 | $75 | $30 | $45 |

Using the Basic Margin Formula in Excel

To find profit margin in Excel, use the basic formula: (Net Profit / Revenue) x 100. This shows how much of your sales is profit. For example, to find how to calculate profit margin in Excel, this formula works well.

The gross margin formula Excel is also key. It's found by subtracting the cost of goods sold from total revenue. Then, divide by total revenue and multiply by 100. This formula helps see if a company is making money.

Margin Formula Explained

The margin formula is straightforward. You divide net profit by revenue and then multiply by 100. This turns the result into a percentage. For instance, with a net profit of $100,000 and revenue of $500,000, the profit margin is 20%.

Example of Simplistic Margin Calculation

Here's a simple example of margin calculation:

- Net Profit: $100,000

- Revenue: $500,000

- Profit Margin: (100,000 / 500,000) x 100 = 20%

This example shows how to use the basic margin formula in Excel. It helps figure out a company's profit and guide decisions.

| Company | Net Profit | Revenue | Profit Margin |

|---|---|---|---|

| Starbucks | $100,000 | $500,000 | 20% |

| Microsoft | $500,000 | $2,000,000 | 25% |

Using the basic margin formula in Excel makes it easy to calculate profit margin. It's vital for understanding a company's financial health and comparing different companies.

Calculating Gross Margin in Excel

To find the gross margin in Excel, use this formula: Gross Margin (%) = ((Total Revenue - COGS) / Total Revenue) * 100. This formula is key for seeing a company's profit clearly.

The gross profit margin formula in Excel is vital for businesses. It shows how well they make things and set prices. Companies can check their profit and make smart choices with this info. For example, all industries average a 36.28% gross profit margin. Online stores do even better, with an average of 42.78%.

Step-by-Step Calculation

To find gross margin in Excel, just follow these steps:

- Put the total revenue and COGS in different cells.

- Use the formula: Gross Margin (%) = ((Total Revenue - COGS) / Total Revenue) * 100.

- Plug in the numbers to find the gross margin percentage.

Let's say the total revenue is $100 and COGS is $60. The gross margin would be 40%. This shows how to use the gross profit margin formula in Excel.

| Total Revenue | COGS | Gross Margin (%) |

|---|---|---|

| $100 | $60 | 40% |

By using the gross profit margin formula in Excel, businesses can understand their finances better. This helps them grow and stay profitable.

Calculating Net Margin in Excel

To find net margin in Excel, you need to know the formula and its parts. Net margin is (Net Profit / Revenue) x 100. It shows how much profit a company makes from its sales after all costs and taxes.

For net margin in Excel, use the formula: Net Profit Margin (%) = (Net Profit / Revenue) * 100. For instance, with $100,000 in revenue, $40,000 in COGS, $30,000 in expenses, $5,000 in interest, and $10,000 in taxes, the net profit margin is 15%. You can start with the calculate gross margin excel and margin in excel formulas.

Formula for Net Margin

The net margin formula is simple but needs the right data. First, subtract all expenses from revenue to find net profit. Then, apply the net profit margin formula to get the percentage.

Example Calculation

Let's see how to find net margin in Excel:

- Revenue: $100,000

- COGS: $40,000

- Operating Expenses: $30,000

- Interest: $5,000

- Taxes: $10,000

- Net Profit: $15,000

- Net Profit Margin: 15%

This example shows how to use the formula and real data to find net margin in Excel. By understanding the margin in excel formula and its parts, you can check your company's profit well.

| Revenue | COGS | Operating Expenses | Interest | Taxes | Net Profit | Net Profit Margin |

|---|---|---|---|---|---|---|

| $100,000 | $40,000 | $30,000 | $5,000 | $10,000 | $15,000 | 15% |

Utilizing Excel Functions for Margin Analysis

Excel functions like SUM and AVERAGE make calculating margins easier, even with big datasets. Learning how to use these functions is key for better margin analysis.

The SUM function adds up revenue and costs across different cells or sheets. This makes it simpler to find margins. For example, with a margin calculator excel plugin, you can sum up total revenue and cost of goods sold. Then, you can use the margin formula to find the gross margin.

The AVERAGE function helps find average margins over time. This shows how profitable your business has been. Using SUM and AVERAGE with a margin calculator excel plugin gives you deeper insights into your business's finances. This helps you make better decisions.

Using Excel functions for margin analysis has many benefits:

- It makes margin calculations more accurate and efficient.

- It lets you analyze big datasets and spot trends.

- It helps you make better decisions with data-driven insights.

By using Excel functions like SUM and AVERAGE, and a margin calculator excel plugin, you can improve your margin analysis. This gives you an edge in the market.

Creating Margins with Multiple Products

To find margins for many products in Excel, start with a detailed product table. You'll need to list the cost, selling price, and revenue for each item. Use the formula: Margin = [(Selling Price - Cost) / Selling Price] x 100. This formula helps you find the profit percentage formula in excel for each product.

Here's an example of how to calculate margins for multiple products:

| Product | Cost | Selling Price | Margin |

|---|---|---|---|

| Product A | $100 | $150 | =((150-100)/150)*100 |

| Product B | $200 | $300 | =((300-200)/300)*100 |

With the how to formula profit margin in excel and profit percentage formula in excel, you can quickly find margins for many products. This helps you make smart business choices.

Visualizing Margin Data with Charts

Effective margin analysis in Excel goes beyond just numbers. It's about seeing trends and patterns in the data. Excel has many chart types to help, like bar charts, line graphs, and pie charts. The right chart can tell a clear story with your margin data.

A good chart can quickly show a company's financial health. For example, a column chart can compare profit margins between products or companies. A line chart can show how profit margins change over time. The right chart can help you share your margin data clearly with others.

Choosing the Right Chart Type

To pick the best chart, think about what you want to show:

- Column charts for comparing data across different categories

- Line charts for visualizing trends over time

- Pie charts for displaying the proportion of parts to a whole

Choosing the right chart makes your margin data easy to understand and analyze. This helps in making better decisions.

| Chart Type | Description |

|---|---|

| Column Chart | Used for comparing data across different categories |

| Line Chart | Used for visualizing trends over time |

| Pie Chart | Used for displaying the proportion of parts to a whole |

Analyzing Margin Trends Over Time

To understand margin trends, knowing how to calculate profit margin in excel is key. This helps businesses spot patterns in their data. Such insights are vital for performance and future plans.

Getting data ready for analysis is critical. Use Excel's tools, like the Turn and Earn Index, to track margin trends. These tools aid in making smart decisions and forecasts.

Data Preparation for Trend Analysis

To analyze margin trends, businesses should prepare their data by:

- Organizing data by date and product category

- Calculating profit margins using the formula: (Selling Price - Cost) / Selling Price * 100

- Applying the gross margin formula excel: (Revenue – Cost of Goods Sold) / Revenue × 100

Using Excel's Trendline Feature

Once the data is ready, use Excel's trendline feature to spot patterns. This can be done by:

- Creating a line chart or scatter plot of the margin data

- Adding a trendline to the chart to visualize the pattern

- Analyzing the trendline to identify areas for improvement and growth opportunities

Tips for Effective Margin Analysis in Excel

To do a good margin analysis in Excel, you need to pay close attention and follow the best ways. It's important to avoid mistakes and use strategies that work well.

Common Mistakes to Avoid

One big mistake is formula errors. Make sure your Excel formulas are right for gross profit margin formula in excel and how to calculate margin percentage in excel. Also, watch out for wrong data input, as it can mess up your results.

Best Practices for Accurate Calculations

To get the best margin analysis, use data validation. This means setting up cells with dropdown menus or rules. Also, use the right number formatting and decimal places. Following these tips will help you trust your gross profit margin formula in excel and how to calculate margin percentage in excel.

FAQ

What is the definition of margin in business?

Margin is the difference between what you sell something for and how much it costs to make or buy it. It shows how much profit you make from each sale.

Why is understanding margin important for financial analysis and decision-making?

Margin is key to knowing if your business is making money. It shows how well you're doing and helps you make smart choices about pricing and spending.

What are the different types of margins in business?

There are three main types of margins: gross, operating, and net. Each gives a different view of how profitable your business is.

How do I set up my Excel spreadsheet for efficient margin calculations?

Start by creating a new Excel workbook. Organize your data clearly and format it correctly. This makes sure your calculations are right.

What is the basic formula for calculating margin in Excel?

The basic formula is: Margin = (Revenue - Cost) / Revenue. It shows how much profit you keep after covering costs.

How do I calculate gross margin in Excel?

Use the formula: Gross Margin = (Gross Profit / Revenue) x 100. It shows how well your costs compare to your sales.

How do I calculate net margin in Excel?

The formula is: Net Margin = (Net Profit / Revenue) x 100. It looks at all costs, taxes, and interest for a full picture of profit.

What Excel functions can I use to enhance my margin analysis?

Use SUM and AVERAGE functions. SUM adds up revenue and costs easily. AVERAGE helps spot trends in margins over time.

How do I calculate margins for businesses with multiple products?

Create a detailed product table in Excel. Use formulas to calculate margins for each product efficiently.

How can I effectively visualize my margin data in Excel?

Choose the right chart type in Excel to show your margin data. This helps compare products or track trends over time.

How can I analyze margin trends over an extended period in Excel?

First, make sure your data is organized and dates are formatted right. Then, use trendlines to spot patterns in your margin data.

What are some tips for conducting effective margin analysis in Excel?

Avoid mistakes like formula errors and wrong data. Follow best practices for accurate calculations. Use data validation to keep your analysis reliable.