Master Options Trading with Our Expert Insights

Options trading can seem complex, but it's worth learning. Knowing the difference between call and put options is key. A call option lets you buy an asset later. A put option lets you sell it later. Our experts will teach you how to trade both, giving you the skills to succeed.

Options trading offers many benefits like leverage and flexibility. It also has the chance for high returns. We aim to give you a solid grasp of the markets and strategies. Whether you're into call or put options, our insights will help you trade with confidence.

Introduction to Options Trading

Investopedia says options trading needs a deep market and strategy understanding. Our experts will give you the knowledge to excel in options trading. With the right strategy, options trading can greatly benefit investors, providing leverage, flexibility, and high returns.

Key Takeaways

- Options trading can be complex, but with the right strategies, it can be a valuable tool for investors.

- Understanding the difference between call option vs put option is critical in options trading.

- Our expert insights will guide you through the process of how to trade options, including call options and put options.

- Options trading can offer numerous benefits, including leverage, flexibility, and the chance for high returns.

- Our goal is to provide you with a deep understanding of the markets, trading strategies, and risk management techniques necessary to master options trading.

- With the right approach, options trading can be a valuable tool for investors, providing numerous benefits and opportunities for growth.

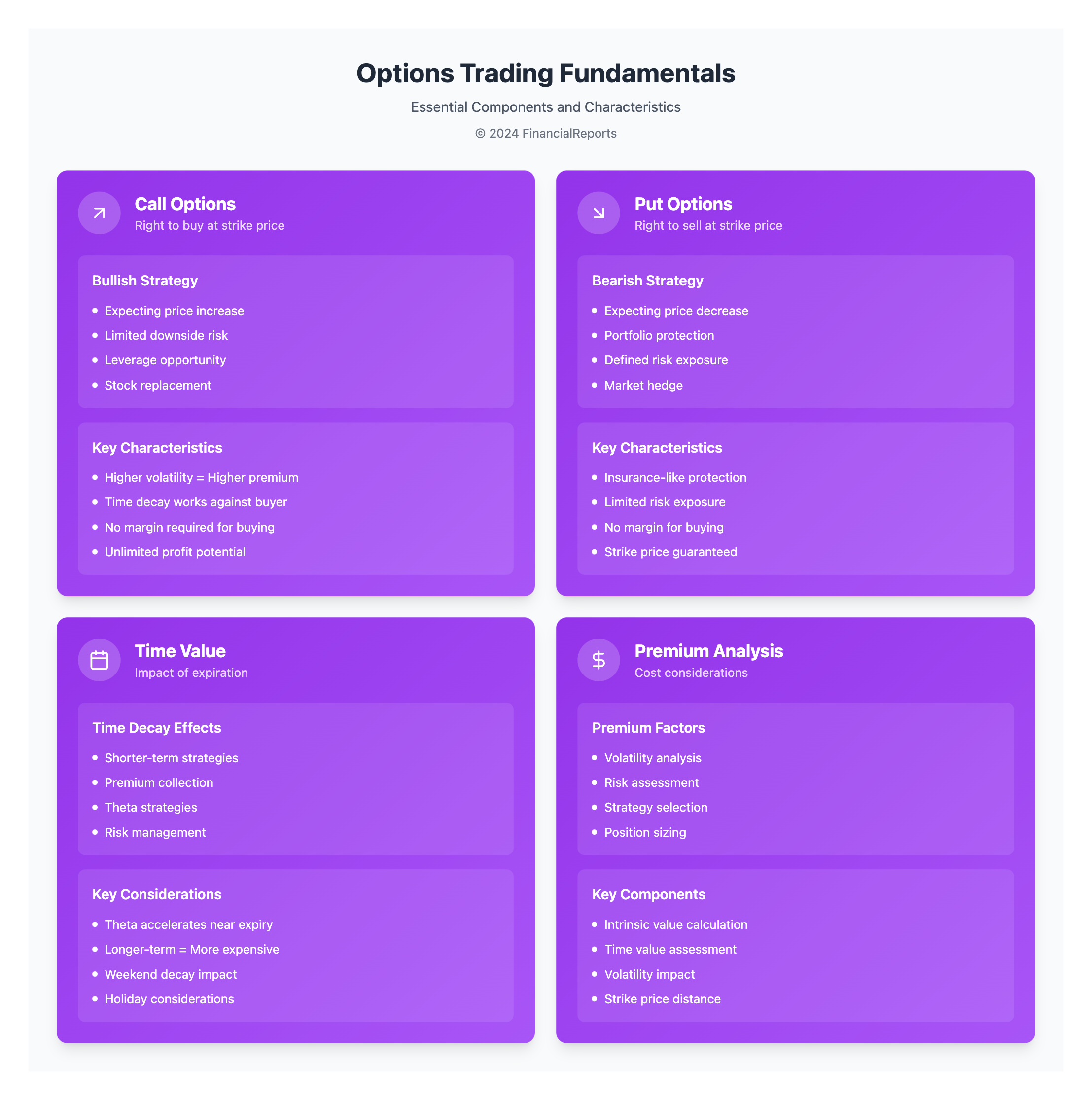

Understanding Options Trading Basics

Options trading is a complex yet rewarding investment strategy. It lets investors speculate on the price movement of underlying assets. For options trading for beginners, knowing the basics is key. This includes understanding call and put options.

A call option lets the buyer buy a security at a set price. On the other hand, a put option lets the buyer sell a security at a set price.

In stock option trading, investors can hedge against losses or speculate on price changes. Options have key features like strike price, expiration date, and option premium. Knowing these is vital for success in options trading.

Some key points for options trading for beginners include:

- Buying calls to speculate on price increases

- Buying puts to speculate on price decreases

- Understanding the risks and possible rewards of options trading

By understanding these basics, investors can craft effective strategies for call and put options. This can lead to better investment outcomes in stock option trading. Whether using a call option or put option, the aim is to make informed decisions that match your investment goals.

The Benefits of Options Trading

Options trading brings many benefits, like leverage, flexibility, and ways to manage risk. Knowing about puts and calls is key to options trading. When looking at put vs call, it's important to understand their differences. Options trading explained simply means buying and selling contracts that let you buy or sell something at a set price.

To understand how does options trading work, we need to look at options contracts. Options trading lets investors manage risk and possibly make high returns. With the right plan, options trading can boost your investment portfolio. Some main benefits include:

- Leverage: Options trading lets you control more with less money.

- Flexibility: Options trading offers flexible strategies to adjust to market changes.

- Risk Management: Options can protect against losses or secure profits.

By grasping the benefits of options trading and how to handle puts and calls, investors can make smart choices. Options trading can be useful for managing risk or betting on market trends. It's a valuable tool for your investment strategy.

| Year | Number of Options Traded |

|---|---|

| 1993 | 250 million |

| 2013 | 4.2 billion |

| 2018 | 5.2 billion |

| 2023 | 10.2 billion |

Essential Strategies for Options Trading

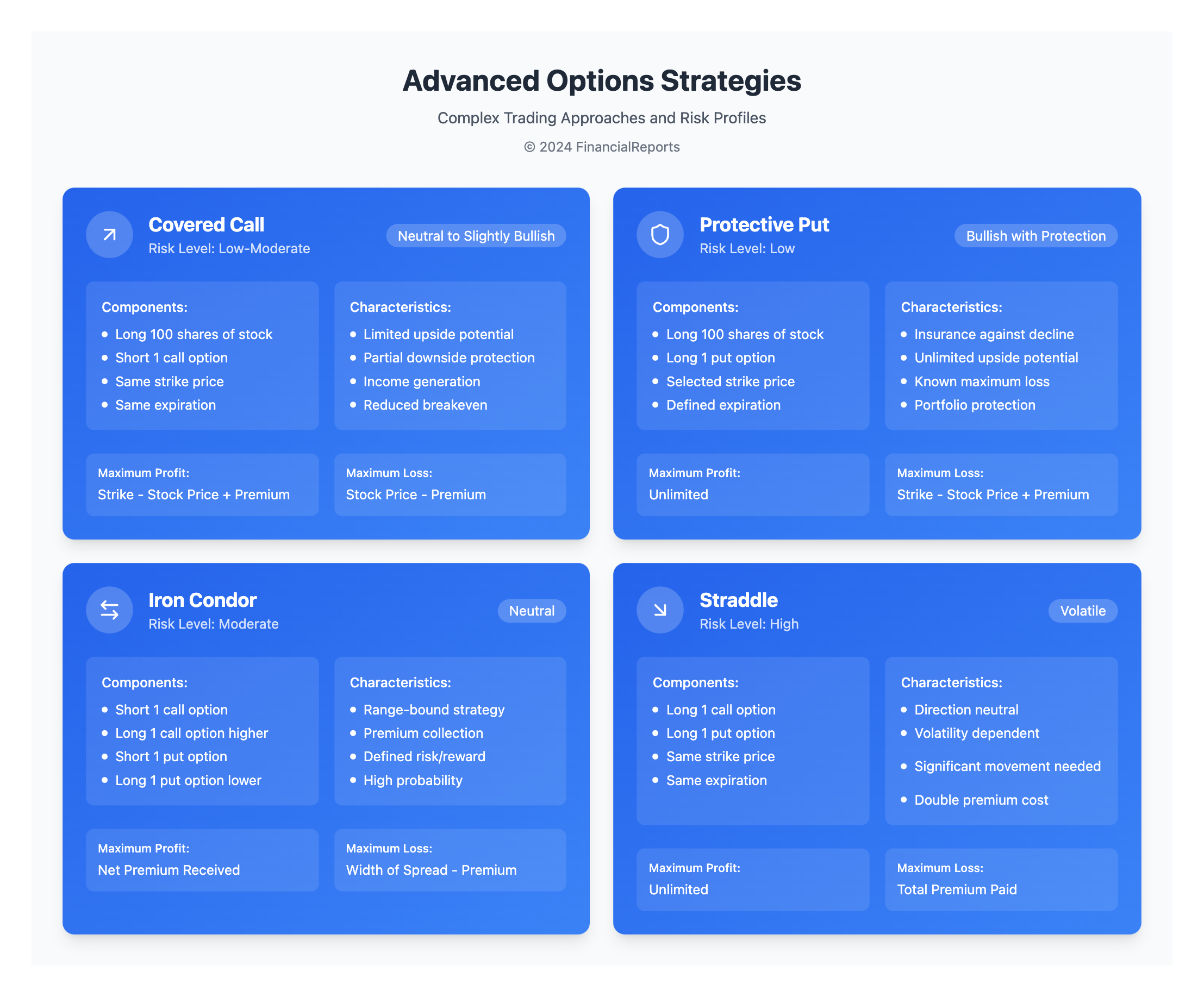

Options trading requires knowing different strategies for success. It's key to understand calls and how to buy options. Knowing the difference between call and put options is also important for making good trading choices.

The covered call is a popular strategy. It involves selling a call option against a long position in the underlying security. This can earn income from the premium. But, it's important to know how to buy options and manage risk. The protective put is another strategy. It involves buying a put option to protect against a drop in the underlying security's value.

Strategies like iron condors can capture range-bound markets. To learn more, it's vital to grasp the basics of options trading. This includes understanding how to buy options and what calls are. By learning these basics, you can make better decisions and create a successful trading plan.

| Strategy | Description |

|---|---|

| Covered Call | Selling a call option against a long position in the underlying security |

| Protective Put | Buying a put option to hedge against a possible drop in the underlying security's value |

| Iron Condor | Capturing range-bound markets by selling a call option and buying a put option with a higher strike price |

Understanding these essential strategies can boost your success in options trading. Always keep learning and stay current with market trends and analysis.

Analyzing Market Trends for Options

Options trading requires understanding market trends to make smart choices. Knowing about call and put options explained helps investors feel more confident. By spotting trends, traders can buy call sell put options better, aiming for higher returns.

There are many ways to analyze market trends. Fundamental analysis looks at a security's financials and industry trends. Technical analysis uses charts to predict price changes. Call and put options examples help show these methods and deepen market understanding.

A put option call option example shows how these options work. Buying a call option means betting the asset's value will go up. Buying a put option means betting it will go down. By studying trends and using strategies, investors can make better choices and possibly earn more.

| Options Trading Strategy | Description |

|---|---|

| Call Option | Betting on an increase in the underlying asset's value |

| Put Option | Betting on a decrease in the underlying asset's value |

Understanding market trends and using options strategies helps investors make better choices. Whether it's call and put options examples or put option call option example, analyzing trends is key to success in options trading.

The Role of Volatility in Options Trading

Volatility is key in options trading, as it changes how much options cost. For options trading for beginners, knowing about volatility is essential. Implied volatility shows what the market expects in terms of volatility. It helps figure out an option's premium.

When you buy call option sell put option, you must think about implied volatility. It helps you make smart choices.

Market volatility greatly affects option prices. High volatility means higher premiums, and low volatility means lower ones. This is important for traders who buy call sell call buy put sell put. They need to know how volatility impacts their plans.

- Implied volatility goes up when options markets go down.

- It goes down when options markets go up.

- Big implied volatility means higher option prices.

Grasping volatility is critical for options traders. It helps them make smart choices when buying call options or selling put options. By understanding volatility, traders can better manage risks and increase profits.

| Volatility Type | Description |

|---|---|

| Implied Volatility | A measure of the market's expected volatility |

| Historical Volatility | A measure of the actual volatility of the underlying asset |

Risk Management Techniques in Options Trading

Understanding options trading explained means grasping risk management. How does options trading work to reduce losses? It's about planning trades with clear start and end points. This adds a number-crunching aspect to making decisions.

Traders use several methods to manage risk, including:

- Position sizing and diversification to spread risk across different assets

- Setting stop-loss orders to limit losses in a stock position

- Using options to hedge risks, like buying downside put options to protect against losses

For those new to how to trade options, knowing about risk management is key. These techniques help reduce losses and increase gains. With the right strategy and risk management, options trading can be very beneficial.

Tools and Resources for Options Traders

Options traders have many tools and resources to help them make smart choices. Understanding the difference between call vs put option is key. To learn how do options work, traders can use trading platforms and software for real-time data and analysis.

Popular trading platforms include tastytrade, Charles Schwab, Interactive Brokers, Webull, and E*Trade. These platforms offer competitive pricing, with fees ranging from $0.00 to $1.50 per contract. For example, Webull is great because it doesn't charge fees on stock puts contracts. Here's a table showing the fees for each platform:

| Platform | Account Minimum | Fees |

|---|---|---|

| tastytrade | $0.00 | $1.00 per option contract |

| Charles Schwab | $0.00 | $0.65 per option contract |

| Interactive Brokers | $0.00 | $0.65 per option contract |

| Webull | $0.00 | $0.00 per option contract |

| E*Trade | $0.00 | $0.65 per option contract |

Traders can also use educational resources and tutorials to get better. By using these tools and resources, traders can understand call options explained and how do options work better. This helps them make more informed investment choices.

Advanced Options Trading Strategies

For those eager to learn stock options trading, advanced strategies are key. These include complex options like straddles, strangles, and butterfly spreads. Straddles mix buying a call and a put with the same strike price. Strangles mix buying a call and a put with different strike prices.

Options trading can be tough for beginners, but knowing calls and puts explained is vital. Advanced tactics like calendar spreads and butterfly spreads help traders profit in various markets. By learn stock options trading and grasping these strategies, traders can make smart choices and manage risks well.

Straddles and Strangles

These strategies use call and put options with the same or different strike prices. They help profit from volatile markets or protect against losses.

Calendar Spreads: Timing is Everything

Calendar spreads involve buying and selling options with different expiration dates. This tactic profits from time decay and volatility changes.

Butterfly Spreads for Limited Risk

Butterfly spreads mix buying and selling options with different strike prices. They're good for stable markets with less risk.

Taxes and Regulations in Options Trading

It's key for investors to grasp the tax side of options trading. The IRS says 60% of gains or losses from certain options are taxed at long-term rates. The other 40% is taxed at short-term rates. This is important to know when you're learning how to trade options and getting into options trading explained ideas.

When diving into how does options trading work, remember the tax side. For instance, losses from straddles are put off until you close the matching position. You can also deduct any extra losses. Plus, qualified covered calls have different tax rules, depending on their type.

Some important tax points in options trading include:

- Options in Section 1256 contracts avoid wash sale rules.

- Losses from straddles are delayed until you close the matching position.

- Qualified covered calls have different tax rules based on their type.

It's wise for investors to talk to tax pros who know options well. They can help you understand the complex tax rules. Knowing these can help you make better choices and improve your trading plans.

| Contract Type | Tax Treatment |

|---|---|

| Section 1256 contracts | 60% long-term capital tax rates, 40% short-term capital tax rates |

| Straddles | Losses deferred until offsetting position is closed |

| Qualified covered calls | Taxed differently depending on category |

Common Mistakes in Options Trading

Options trading is complex and can trap even seasoned traders. A put option call option example shows why planning is key. Traders who buy call sell put without knowing the market face big risks.

Some common errors in options trading include:

- Overleveraging positions, which can result in significant losses if the trade does not work out

- Ignoring technical analysis, which can lead to poor trading decisions

- Failing to have a trading plan, which can result in impulsive decisions and significant losses

Using call and put options examples helps traders grasp the market better. This way, they can make smarter choices. By avoiding common pitfalls and staying updated, traders boost their success chances.

| Mistake | Consequence |

|---|---|

| Overleveraging positions | Significant losses |

| Ignoring technical analysis | Poor trading decisions |

| Failing to have a trading plan | Impulsive decisions and significant losses |

Options Trading and Psychological Factors

Options trading for beginners is not just about knowing the basics. It's also about understanding the psychological side of trading. Learning to trade stock options means more than just knowing the difference between call and put options. It also means mastering emotional control.

Research shows that fear and greed can greatly affect trading decisions. These emotions can lead to irrational choices, even when we know better. Traders often face biases like overconfidence and loss aversion. These can cause them to make quick, impulsive decisions.

For example, investors might hold onto losing trades too long. Or they might sell winning trades too soon. This is often due to psychological biases. To beat these biases, traders need to know their own limitations. They should create a clear trading plan and stick to it.

Here are some strategies to manage the psychological side of options trading:

- Creating a trading plan to stay focused and rational

- Practicing mindfulness to recognize and manage emotions

- Using stop-loss orders and diversifying to control risk

By tackling these psychological factors, traders can make better choices. This leads to more informed and disciplined trading. And ultimately, it can improve their trading results.

Getting Started with Options Trading

Starting your options trading journey means picking a good brokerage account. Look for one that fits your needs well. Top online brokers have great tools, low fees, and excellent customer service, as NerdWallet's ratings show.

Creating a solid options trading explained plan is key. It helps you set goals, manage risks, and choose a trading style that suits you. This plan should reflect your risk tolerance and market knowledge.

Learning and staying informed is vital in the fast-paced world of how does options trading work. Check out resources from the Options Industry Council (OIC). They offer tutorials and webinars to help you understand options trading better.

Keep up with market trends, economic news, and new rules. This knowledge helps you make smart choices and handle the options market's challenges.

FAQ

What are options?

Options are contracts that give you the right to buy or sell a security at a set price before they expire. There are two main types: call options and put options.

What are the benefits of options trading?

Options trading offers several benefits. It provides leverage, flexibility in trading strategies, and ways to manage risk.

What are some essential options trading strategies?

Key strategies include covered calls, protective puts, and iron condors. These help generate income, protect against losses, and profit from stable markets.

How can I analyze market trends for options trading?

Analyzing market trends involves fundamental and technical analysis. It also includes understanding market sentiment to make informed decisions.

How does volatility impact options trading?

Volatility greatly affects options trading. It influences option prices. Implied volatility measures the market's expected volatility, impacting option premiums.

What are some key risk management techniques for options trading?

Important risk management techniques include position sizing, diversification, and setting stop-loss orders. Using options to hedge risks is also key.

What tools and resources are available for options traders?

Options traders have many tools and resources. These include trading platforms, software, educational materials, and financial news tools.

What are some common mistakes in options trading?

Common mistakes include overleveraging, ignoring technical analysis, and lacking a trading plan.

How do psychological factors affect options trading?

Emotional discipline, managing fear, and greed are vital. They can greatly impact trading performance.

How do I get started with options trading?

Starting with options trading involves choosing a brokerage and developing a trading plan. It also means continuing to learn and stay updated on market trends.