Markup vs Profit: Understanding Business Margins

It's key for businesses to know the difference between markup and profit. This knowledge helps in setting the right prices and making sure they make money. Many confuse markup and profit, which can lead to wrong pricing and lower profits. We'll look into how markup and profit differ and their impact on business.

The link between markup and profit is complex. Knowing the difference is vital for reaching financial targets. A 50% margin means a 100% markup. This affects how a company prices its products and its overall profit. Understanding markup vs profit is important for staying ahead in the market.

Key Takeaways

- Knowing the difference between markup and profit is key for good pricing strategies.

- The price margin definition is vital for making smart pricing and profit decisions.

- A 50% margin equals a 100% markup, which greatly influences pricing and profit.

- Markup vs profit is a big deal in business finance. It's essential for reaching financial goals.

- Using advanced software like RIB Candy can improve bid accuracy and transparency. It helps in making better decisions about markup and profit.

- Understanding markup and profit helps avoid undercharging and missing out on profit.

- The markup percentage calculation is a big part of pricing strategy. It's essential for staying competitive.

What is Markup?

Markup is key in business, mainly in pricing. It's the extra amount added to a product's cost to set its selling price. In short, it shows how much more a company charges than what it costs. Knowing about markup helps businesses make money and stay ahead in the market.

Calculating markup is simple. For example, if a product costs $1.00 and sells for $1.30, the markup is $0.30. This means a profit of $0.30, or 23% of the cost. If a product costs $5.00 and sells for $6.50, the profit is $1.50, or 30% of the cost.

Definition of Markup

Markup is the selling price minus the cost price. The markup percentage is found by dividing the markup by the cost price. For instance, if a product costs $50 and sells for $80, the markup is $30. This gives a 60% markup percentage.

Calculation of Markup

The formula for markup percentage is: ((Sale price – Cost price) ÷ Cost Price)(100). This formula helps businesses set the right markup to reach their profit goals. Remember, markup percentages are higher than profit margins because they're based on cost, not revenue.

Importance of Markup in Pricing Strategy

Understanding markup and profit margins helps in pricing. Businesses can offer packages or bundles to increase profit margins. The goal is to balance markup and profit margins for growth and market competitiveness.

What is Profit?

Profit is key for any business, showing what's left after all costs are subtracted. It's important to grasp the idea of profit and how it ties to gross profit margin vs markup and profit markup. The formula for margin is Margin = (Sales Revenue – COGS) / Sales Revenue. This formula shows a business's profit level.

In business, profit margin is a key metric. It shows a business's health and net income. A good business should have a net profit of at least 8 percent. Margin and profit differ, with margin being the difference between selling price and cost. Profit is what's left after all costs are subtracted.

Definition of Profit

Profit is the money a business makes after all expenses are paid. This includes the cost of goods sold, operating expenses, and taxes. It's a key sign of a company's financial health and guides strategic decisions.

Types of Profit: Gross vs. Net

There are two main types of profit: gross and net. Gross profit is what's left after deducting the cost of goods sold. Net profit is what's left after all expenses, including operating costs and taxes, are subtracted. Knowing the difference helps in setting prices.

Calculating Profit Margins

Calculating profit margins is simple. You use the formula: Margin = (Sales Revenue – COGS) / Sales Revenue. For instance, if an item is sold for £15 and costs £10 to make, the margin is 33%. This helps in adjusting prices.

The Relationship Between Markup and Profit

It's key for businesses to know the difference between markup and profit. Markup shows how much money is made on an item compared to its cost. Profit margin, on the other hand, shows how much money is made compared to the total sales. To understand both, you need to calculate them.

Markup is found by subtracting the cost of goods sold from the retail price, then dividing by the cost of goods sold. Profit margin is found by subtracting the cost of goods sold from the retail price, then dividing by the retail price.

When looking at markup and profit, consider how much profit is made and how much is added to the cost for the selling price. Profit margin shows the profit made on sales. Markup shows the amount added to the cost for the selling price. Many think markup and profit are the same, but they are not.

How Markup Affects Profit

Small changes in markup can greatly affect the gross margin. For example, going from a 1.2 markup to a 1.3 markup can increase the gross margin from 17% to 23%. This shows how important it is to understand the link between markup and profit for pricing.

Differentiating Between Markup and Profit

To tell markup and profit apart, remember:

- Markup is the amount added to a product's cost to set its selling price.

- Profit margin is the profit percentage of the selling price.

- Markup is found by dividing profit by cost, while profit margin is found by dividing profit by selling price.

Common Misconceptions

Many think markup and profit are the same. But they are not. Knowing the difference is vital for businesses to price and cost correctly and stay profitable.

Examples of Markup in Retail

Markup strategies are key for retailers to boost profits. A smart markup plan can greatly improve a company's earnings. Let's look at the retail world, where markup methods differ by industry.

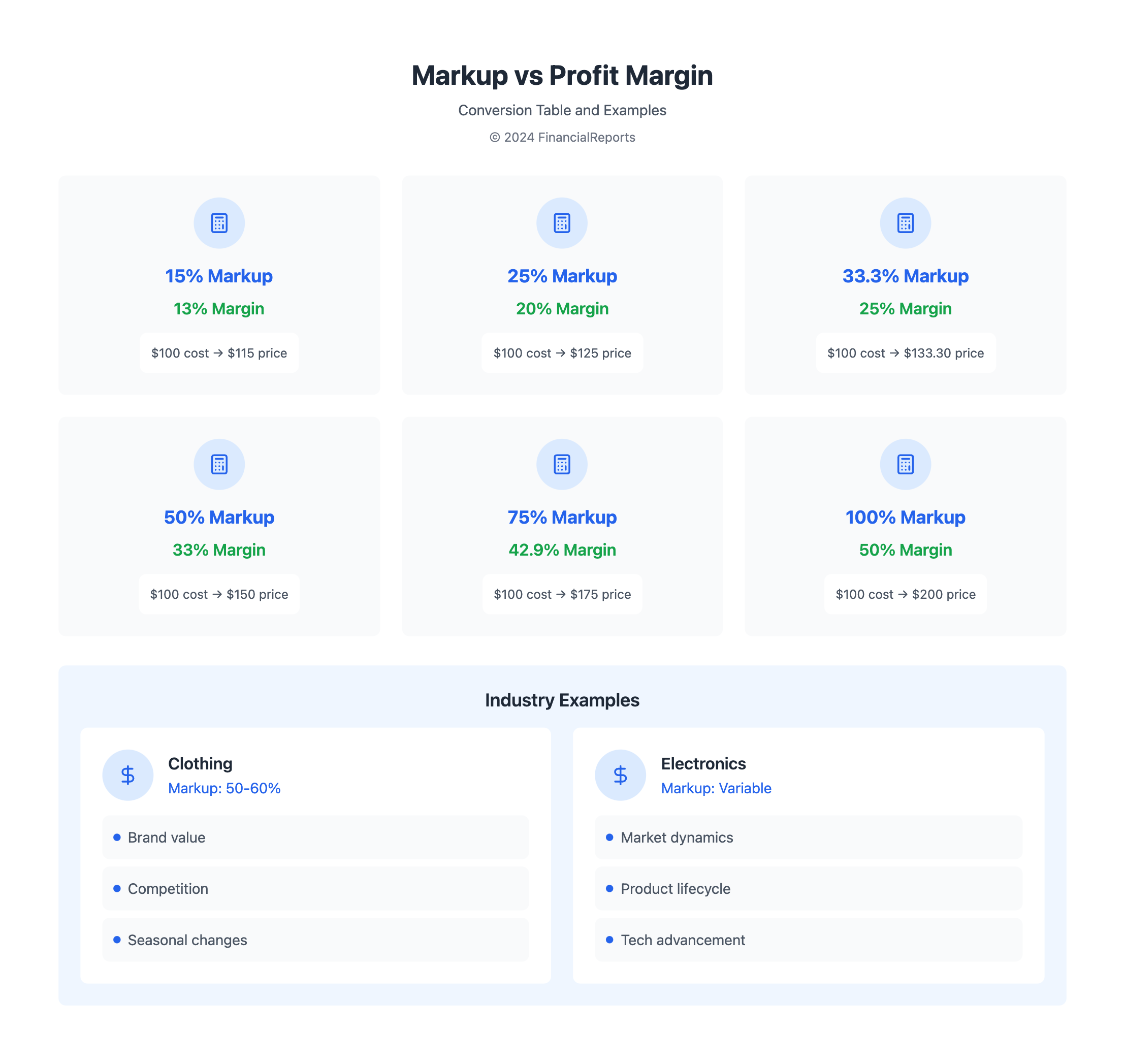

In clothing stores, markups can be between 50% and 60%. This depends on the brand and competition. The margin vs markup chart helps retailers see how these metrics relate. By studying the margin and markup table, businesses can tweak their prices to increase profits.

Markup in Electronics

The electronics sector sees fast changes and market shifts, impacting markup plans. Retailers use a margin vs markup chart to find the best prices for their items. They consider costs, demand, and competition to set markups that are both profitable and affordable for customers.

Seasonal Markup Variations

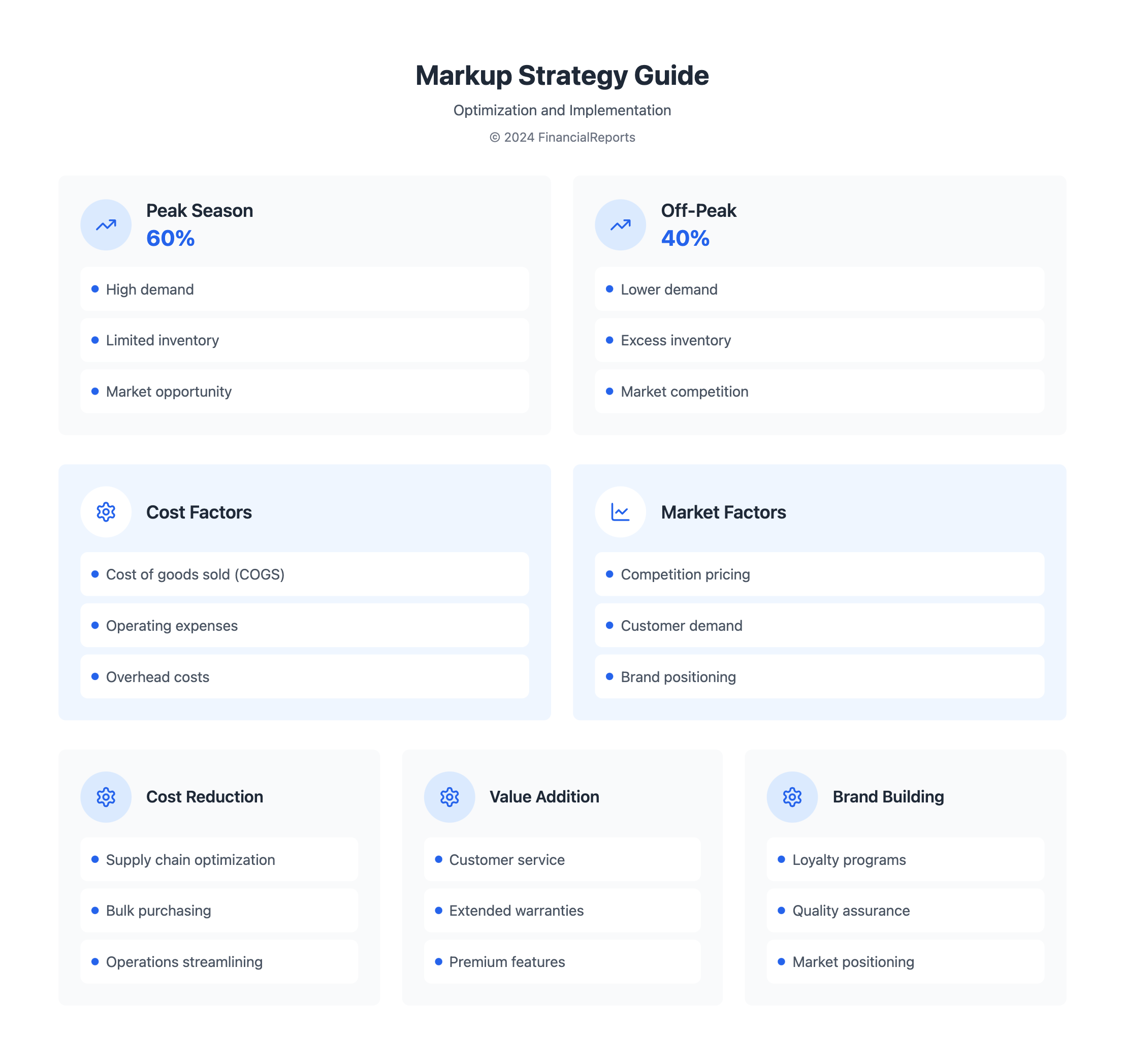

Seasonal changes in markup are vital for retail pricing. Retailers adjust their markups to make more money during busy times. Here's a table showing how markups change with the seasons:

| Season | Markup Percentage |

|---|---|

| Peak Season | 60% |

| Off-Peak Season | 40% |

By using smart markup strategies, retailers can grow their profits and business.

Examples of Profit in Business

Profit is key in any business. Knowing how to calculate it and what affects it is vital for success. We'll look at real examples from service, manufacturing, and real estate. To show the difference between markup and profit, we'll use a margin vs markup table.

Markup percentage plays a big role in profit. For example, a 25% markup means a 20% profit margin. A 33.3% markup gives a 25% profit margin. Here's a table that compares different markup percentages and their profit margins:

| Markup Percentage | Profit Margin |

|---|---|

| 15% | 13% |

| 25% | 20% |

| 33.3% | 25% |

| 40% | 28.6% |

| 50% | 33% |

| 75% | 42.9% |

| 100% | 50% |

The table shows that higher markup percentages lead to higher profit margins. But, it's important to understand the margin v markup table to avoid confusion. Knowing how markup and profit relate helps businesses set better prices and increase profits.

Key Factors Influencing Markup

When setting the right markup for a product, businesses must look at several important factors. It's key to understand what pricing margin and price margin definition mean. The cost of goods sold (COGS) is a big part of this, as it affects how much profit a product can make.

Market demand and competition also shape markup strategies. Knowing what competitors charge helps businesses set their prices right. Brand image also matters, as high-end brands can charge more because of their value.

Some key factors to think about when setting markup include:

- Cost of goods sold (COGS)

- Market demand and competition

- Brand positioning

- Price sensitivity or demand elasticity

By carefully looking at these factors and understanding pricing margin, businesses can create good markup strategies. These strategies help balance making a profit with what customers want.

| Factor | Description |

|---|---|

| COGS | Direct costs associated with producing a product |

| Market Demand | Customer demand for a product or service |

| Brand Positioning | Perceived value of a brand in the market |

Analyzing Profit Margins

Understanding the difference between gross profit margin vs markup is key to assessing a company's financial health. The gross profit margin is found by dividing the gross profit by the sales price. On the other hand, markup is the selling price minus the cost of goods and services. To figure out the difference, we look at the cost of goods sold (COGS) and the selling price. For more details, check out this link.

The pricing margin defined is the selling price minus the cost of goods sold. This margin shows how profitable a product or service is. For instance, if a product costs $100 to make and sells for $125, the profit is $25. This means the markup is 25%.

The table below shows how markup and gross margin relate:

| Markup Percentage | Gross Margin Percentage |

|---|---|

| 25% | 20% |

| 33.3% | 25% |

As the table shows, a higher markup doesn't always mean a higher gross margin. Knowing the difference between gross profit margin vs markup helps in setting prices wisely. This way, companies can increase their profits.

Strategies for Maximizing Markup

To boost markup, businesses need a mix of cost cuts, value-added services, and keeping customers loyal. It's key to know how markup and profit work together. With smart strategies, companies can up their markup without losing out in the market.

One smart move is to cut costs. This can be done through better supply chain management and buying in bulk. For example, saving 10% on costs can lead to a bigger profit margin. Also, adding value to products or services can make them worth more. This could be through better customer support, longer warranties, or special services.

Cost Reduction Tactics

- Efficient supply chain management

- Bulk purchasing and strategic sourcing

- Streamlining operations to reduce overhead costs

Building a strong brand can also help increase markup. This means creating a solid brand image, running loyalty programs, and giving top-notch service. When customers trust and value a brand, they're more likely to pay more. To maximize markup, businesses must understand their market, customers, and costs. They also need to be ready to change and improve as the market shifts.

Strategies for Boosting Profitability

To boost profitability, businesses need to manage expenses well, streamline operations, and invest in technology. It's important to know the difference between gross profit margin and markup. This knowledge helps in setting prices and calculating profits.

What is pricing margin, and how does it relate to markup? Pricing margin is the difference between what you sell something for and what it costs. Markup is the extra amount added to the cost to set the selling price. Knowing the difference is key to avoid mistakes in pricing and profit calculations.

Here are some ways to increase profitability:

- Regularly check markup and margin to keep profits healthy and costs covered

- Adjust markup percentages for different products to match market needs and conditions

- Review your pricing strategy every quarter to keep up with market changes, cost shifts, and consumer trends

By using these strategies and understanding the difference between gross profit margin and markup, businesses can make better decisions. This leads to growth and higher profits.

Tools for Calculating Markup and Profit

Businesses can use many tools to figure out markup and profit. These include software, spreadsheets, and reporting dashboards. A margin vs markup chart helps understand the difference between these two. With a margin and markup table, companies can see how different prices affect their profits.

Financial management software is popular for business analysis. It can do complex math and give insights. For example, a spreadsheet can help track pricing and costs. This way, companies can find ways to improve and set better prices.

Software Solutions for Business Analysis

Financial software helps businesses analyze and decide faster. It gives real-time data. This helps with pricing, inventory, and using resources well.

Spreadsheets for Manual Calculation

Small businesses or those with simple finances use spreadsheets. A margin vs markup chart in a spreadsheet makes it easy to see how these metrics relate. This helps in making quick changes.

Reporting Dashboards

Reporting dashboards give a full view of a company's finances. They show important numbers like gross profit margin and markup percentage. A margin and markup table in a dashboard helps spot trends and areas to improve. This leads to better decisions based on data.

| Markup Percentage | Margin Percentage |

|---|---|

| 50% | 33.33% |

| 60% | 37.5% |

| 70% | 41.18% |

Using these tools helps businesses understand their finances better. They can make smart choices about pricing, inventory, and resources. A good margin vs markup chart and margin and markup table are key for financial analysis and decision-making.

Conclusion: Prioritizing Business Success

Exploring the link between markup and profit shows that finding the right balance is key. Businesses need to align their markup strategies with profit goals for lasting success. This balance is vital for growth and staying competitive.

Improving gross margin can boost profitability and set a business up for success. It's about smart pricing and managing costs. Understanding the difference between profit margin and profit markup helps make better decisions. This leads to better revenue management and seizing market chances.

In today's fast-changing world, knowing how to handle markup vs. profit is critical. Companies that use data to set prices and stay flexible will grow. They will offer great value to their customers and stay ahead.

FAQ

What is the difference between markup and profit?

Markup is the extra amount added to the cost price to set the selling price. Profit is the money left over after selling the item, showing the business's earnings.

How is markup calculated?

To find the markup, add a percentage to the cost price. The formula is: Selling Price = Cost Price + (Cost Price × Markup Percentage).

What are the different types of profit?

There are two main profits: gross and net. Gross profit is the revenue minus the cost of goods sold. Net profit is what's left after all expenses are subtracted from revenue.

How does markup affect profit?

Markup directly affects a business's profit. Higher markups mean more profit, but businesses must consider market demand and competition to stay profitable.

What are some examples of markup strategies in retail?

Retailers like clothing and electronics use various markup strategies. These depend on brand, market competition, and seasonal trends to increase revenue and profit.

How can businesses calculate and analyze their profit margins?

Businesses can look at gross, operating, and net profit margins. These show how well a company is doing financially and how efficient it is.

What factors influence a business's markup decisions?

Important factors include the cost of goods, market demand, and brand positioning. Businesses must weigh these to find the best markup strategy.

What are some strategies for maximizing markup and boosting profitability?

To increase markup and profit, businesses can cut costs, offer more value, and use brand loyalty. They can also manage expenses, streamline operations, and invest in technology to boost profitability.