Buying on Margin: A Complete Guide

Buying on margin is a smart way to invest. It lets investors borrow money from a brokerage to buy more. This is also called margin trading, where they use their securities as collateral. Knowing about margin accounts helps investors use their assets to get more returns. But, it's important to remember that this method can also lead to big losses.

Investors can use margin to grow their assets. It lets them borrow money to buy more, giving them more options. This strategy can lead to bigger gains because it's based on the total value of securities, not just the initial investment. It's a good choice for those who know what they're doing.

Key Takeaways

- Buying on margin allows investors to borrow money from a brokerage to increase their buying power.

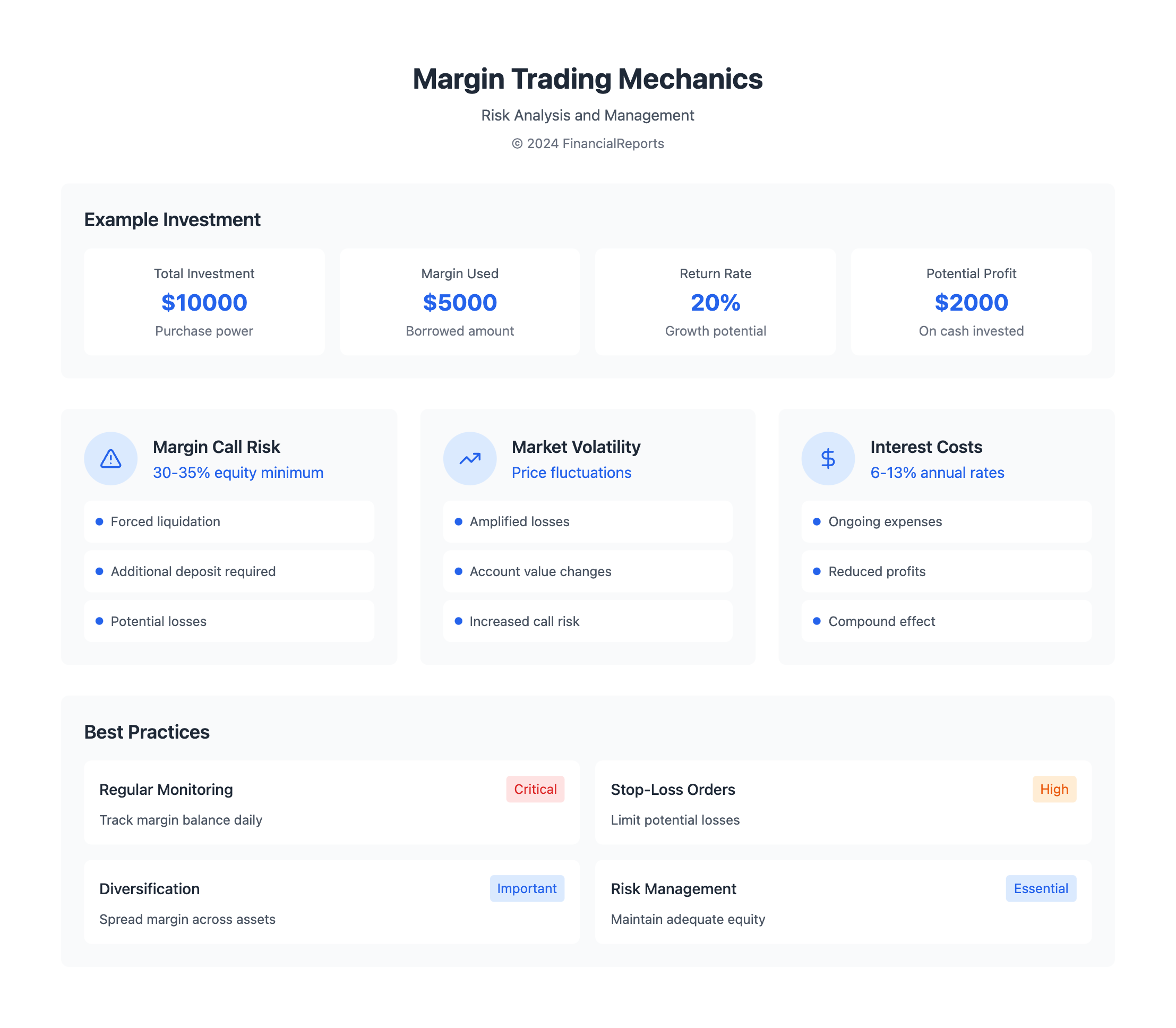

- A $10,000 stock purchase can be made with only $5,000 by using margin trading, representing a 40% return on the $5,000 cash investment if the stock price rises by 20%.

- Margin trading offers increased buying power and flexibility in investment choices, but also increases the risk of losses exceeding the initial investment.

- Interest is applied on margin loans, which can accumulate over time, and margin calls can occur if the account's equity falls below a set maintenance level.

- Investors can benefit from buying on margin by understanding what is a margin account and how it works, as well as the possible risks and rewards.

- Buying on margin provides the chance for higher returns because gains are based on the total value of securities, not just the initial investment. This makes it appealing to seasoned investors.

- Investors should think carefully about their risk tolerance and investment goals before using margin. It's a high-risk, high-reward strategy.

What is Buying on Margin?

Buying on margin means investors borrow money from a broker to buy securities. This way, they can invest more than they have. But, it also brings more risks.

Definition and Basic Concepts

Buying on margin means using borrowed money to invest. Investors start with at least 50% of the cost of the security. This is to use what they already have to buy more, hoping to make more money.

How Margin Accounts Work

Margin accounts let investors borrow money from brokers. Here's how it works:

- Initial Margin: Investors start with at least 50% of the cost.

- Maintenance Margin: They must keep at least 25% to keep the account open.

- Margin Calls: If the value falls below 25%, brokers may ask for more money or assets.

It's important to know why we limit margin buying. This is to avoid too much risk and keep the financial system stable. Rules from the Federal Reserve help protect investors and banks.

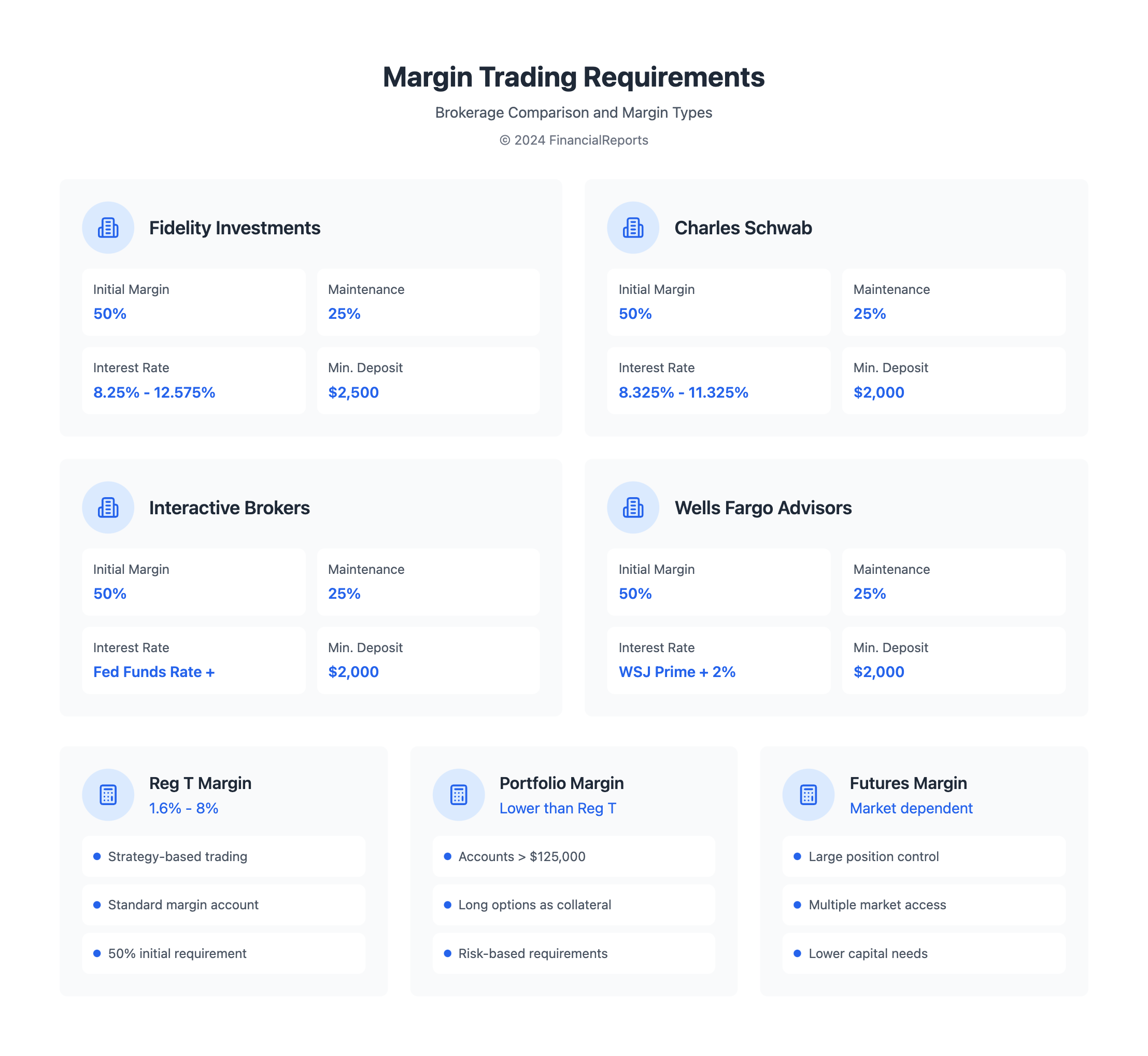

| Brokerage Firm | Initial Margin Requirement | Maintenance Margin | Margin Fees (%) |

|---|---|---|---|

| Fidelity Investments | 50% | 25% | 8.25 - 12.575 |

| Charles Schwab | 50% | 25% | 8.325 - 11.325 |

| Interactive Brokers | 50% | 25% | Varies with Federal Funds Rate |

Advantages of Buying on Margin

Margin investing has many benefits that can boost your portfolio. By knowing what buying on margin means, you can use your assets wisely. This can lead to bigger gains.

Increased Potencial Returns

One big plus of margin investing is the chance to make more money. For instance, with $10,000 and a 20% return, you'd make $2,000. But with margin, you can use more money, which could mean even bigger profits.

Leverage in Market Opportunities

Margin investing lets you quickly take advantage of market chances. You can invest more in stocks that are underpriced or in new trades. This flexibility is key in fast-changing markets where quick moves can pay off big.

| Benefit | Description | Data Point |

|---|---|---|

| Amplified Returns | Leveraging investments to increase profit. | $10,000 investment at 20% ROI yields $2,000 profit. |

| Market Leverage | Access larger trades and diversify portfolios efficiently. | Margin loan rates range from 6% to 13%, enabling significant leverage. |

| Portfolio Diversification | Use margin to invest in a wider range of assets. | Enhanced investment performance through diversified holdings. |

| Immediate Liquidity | Access cash instantly for timely investments. | Faster liquidity with interest costs. |

Risks Associated with Buying on Margin

Buying on margin comes with big risks that investors need to think about. It's important to know these risks to avoid big losses.

Market Volatility and Losses

Market ups and downs can affect investments a lot. For example, if someone borrows $10,000 to buy $20,000 worth of stocks and the value drops to $15,000, they lose a lot. This shows how how margin is affected by equity can cause big losses.

- Margin accounts usually need 30% to 35% equity.

- Changes in stock values can lead to big losses.

- High market turbulence increases the risk.

Margin Calls Explained

A margin call happens when the money in a margin account drops below 30%. Investors must add more money or sell assets to meet this requirement. Not paying a margin call can lead to the broker selling stocks without permission, which can cause more losses.

- Initial margin lets you borrow up to 50% of the price.

- Maintenance margin is usually 25%, but some brokers ask for more.

- Margin loan interest adds to the cost.

It's key to manage risks well to deal with margin trading's challenges. This helps avoid the bad effects of market ups and downs and margin calls.

How to Open a Margin Account

To open a margin account, you need to meet certain requirements from brokerage firms. You also need to understand what margin trading is. This step is key to being ready for margin purchases.

Requirements for Opening an Account

To start margin trading, you must meet the broker's initial and maintenance margin needs. You usually need at least $2,000 to begin. The broker will check your credit to set your borrowing limit, which can be up to 50% of the security's price.

Choosing the Right Brokerage Firm

Choosing the right brokerage firm is essential for a good margin purchase. Consider these important factors:

- Interest rates tied to the WSJ Prime Rate

- Margin requirements and flexibility

- Customer support and service quality

- Regulatory compliance and reputation

For instance, Wells Fargo Advisors has competitive margin rates and various financing options. This makes it a good fit for many investors. By looking at these points, you can match your margin trading with your financial goals.

| Brokerage Firm | Minimum Initial Investment | Interest Rates | Customer Support |

|---|---|---|---|

| Wells Fargo Advisors | $2,000 | WSJ Prime Rate + 2% | 24/7 Support |

| Fidelity | $2,500 | WSJ Prime Rate + 1.5% | Business Hours |

| Charles Schwab | $2,000 | WSJ Prime Rate + 2.5% | 24/7 Support |

Strategies for Buying on Margin

When you trade on margin, using smart strategies is key. Knowing the right ways can boost your earnings and control risks in margin trading.

Identifying Growth Stocks

Picking the right growth stocks is vital for margin trading success. Look for companies with solid basics and big growth chances.

- Fundamental Analysis: Check financial statements, earnings growth, and market standing.

- Technical Analysis: Look at stock price trends, volume, and momentum signs.

- Sector Performance: Find sectors ready to grow based on economic signs.

Timing the Market Wisely

Knowing when to trade can greatly affect your margin trade results. Spot the best times to buy or sell to get the most profit.

- Economic Indicators: Watch GDP reports, job rates, and consumer confidence.

- Market Sentiment: See what investors think through surveys and news.

- Event-Driven Opportunities: Use events like earnings reports or new product launches for smart trades.

Using advanced tactics like pairs trading and margin pyramiding can improve your margin trading meaning. But, it's important to know the terms of your margin loan. Understanding what is the margin on a loan helps avoid risks like margin calls.

Regulations Surrounding Margin Buying

It's key to know the margin meaning in finance for those using margin accounts. Bodies like FINRA set rules to keep the market stable and protect investors.

Understanding FINRA Rules

FINRA requires a minimum deposit for margin accounts. This defines what is margin balance needed to hold positions. Important rules include:

- Regulatory Notice 19-21: Margin Requirements for Exchange-Traded Notes

- Regulatory Notice 17-28: Margin Requirements for Covered Agency Transactions

- Regulatory Notice 14-05: Consolidated FINRA Rules on Securities Loans and Borrowing

Margin Requirements by Brokerages

Brokerages have their own take on margin rules based on FINRA guidelines. This affects what is margin stock that can be traded on margin. Here's a look at typical margin needs at major brokerages:

| Brokerage | Minimum Margin Deposit | Maintenance Margin |

|---|---|---|

| Brokerage A | $2,000 or 100% of purchase price | 25% |

| Brokerage B | $2,000 | 30% |

| Brokerage C | $3,000 | 28% |

These rules show the term on margin means varying levels of risk and investment. Following these rules is essential for keeping a good margin balance and avoiding margin calls.

Evaluating Your Financial Situation

Before you define margin trading, it's vital to assess your financial readiness. Understanding the margin stock definition and how does margin work is key for smart investment choices.

Assessing Your Risk Tolerance

Looking at your risk tolerance means checking your investment goals, time frame, and financial health. Important things to think about include:

- Your investment goals and expected returns

- The length of your investment period

- Your current financial assets and debts

- Any past experience with risky investments

Calculating Margin Capital

Figuring out your margin capital helps you use your investments wisely. Here's how to do it:

- Find out the total amount you plan to invest.

- Use the initial margin of 50%, as the Federal Reserve's Regulation T says.

- Make sure you have at least $2,000, as FINRA rules demand.

To buy $10,000 worth of securities, you need to put in at least $5,000. This keeps your equity at 25% or more, meeting FINRA's maintenance margin rule.

Best Practices for Managing Margin Investment

Managing margin investments well is key to getting good returns and avoiding risks. Knowing what is the margin on a loan and keeping a good margin balance are basic steps.

Monitoring Your Investments Regularly

Keeping an eye on your investments is important. It helps make sure your portfolio meets your financial goals. Use tools like Axos Invest to track:

- Current margin balance

- Equity levels

- Performance of margin stock

Knowing what's happening in the market lets you make quick decisions. This can help you avoid big losses.

Setting Stop-Loss Orders

Using stop-loss orders is a smart way to protect your investments. A stop-loss order sells a security when it hits a certain price. This limits your losses. For example:

- If a stock financed by margin drops by 10%, a stop-loss order can stop further loss.

- This is very useful in markets that change a lot.

Understanding the term on margin means picking the right stop-loss levels. This depends on how much risk you can take and your investment plan.

Keeping a good margin balance means checking your leveraged positions often. Make sure they don't go over what you can handle. Borrowing less and using short-term loans can save on interest and make investing easier.

| Margin Loan Type | Interest Rate Range | Key Features |

|---|---|---|

| Reg T Margin | 1.6% - 8% | Strategy-based, allows buying more shares with the same capital |

| Portfolio Margin | Lower than Reg T | For accounts > $125,000, uses long options as collateral |

| Futures Margin | Varies by market | Controls large positions with a fraction of capital, suitable for multiple markets |

| Forex Margin | Varies by broker | Enables trading in currency pairs with 24-hour market access |

Conclusion: Is Buying on Margin Right for You?

For most people, margin trading is too risky. It can increase your gains but also your losses. Before you start, think about your investment goals, how much risk you can handle, and your financial health.

Assessing Personal Investment Goals

If you want to grow your wealth over time with stocks and bonds, margin might not be right. The extra risk and complexity might not be worth it. But, if you're into quick trades, margin could work for you. Just make sure you know how to manage risks and have enough money.

Making Informed Decisions

It's key to learn about margin trading, its risks, and the rules. Start with a fake account to get used to it. With smart choices and careful risk management, you can use margin to boost your portfolio. But, always be aware of the risks.

FAQ

What is buying on margin?

Buying on margin means borrowing money from a brokerage firm to buy securities. This way, investors can use their current assets to buy more. It can help increase their returns.

How do margin accounts work?

Margin accounts let investors borrow part of the security's price, usually up to 50%. The borrowed money is called the "margin." The investor's own money is the "equity."

What are the advantages of buying on margin?

Buying on margin can lead to higher returns. It lets investors use their assets to take advantage of market chances. It also helps diversify their portfolios more efficiently.

What are the risks associated with buying on margin?

The main risks include more exposure to market ups and downs. There's a chance for big losses if the trade doesn't go well. Also, if the account's equity drops too low, the investor might get a margin call.

What are the requirements for opening a margin account?

To open a margin account, you need to meet the brokerage firm's credit standards. You also need to keep a minimum balance. Know the margin rules set by FINRA.

What are some advanced strategies for buying on margin?

Advanced strategies include pairs trading and market timing. Pairs trading uses margin to find statistical relationships. Market timing uses margin to grab specific market chances.

How are margin trading activities regulated?

Margin trading has rules from FINRA and the Federal Reserve's Regulation T. These rules cover things like minimum deposits, maintenance margins, and what counts as "margin stock."

How can I evaluate my readiness for margin trading?

Check if you're ready by looking at your risk tolerance, goals, time frame, and financial health. Make sure you have enough margin capital. It should fit with your investment plan.

What are some best practices for managing margin investments?

Good margin trading management means keeping an eye on your portfolio. Use stop-loss orders to limit losses. Keep your margin balances healthy. Know how loan terms affect your investments.