Macro Hedge Funds: Innovations and Insights

Macro hedge funds look at big economic themes like interest rates and global trade. They find chances to invest and risks in the market. The first hedge fund was started by Alfred Winslow Jones in 1949. This was the start of a new way to invest.

Today, macro hedge funds are key in the world's finance. They focus on late-stage venture and crypto markets. This shows how they've grown and changed.

Over time, macro hedge funds have moved from old ways to new, data-based methods. They use advanced tech and tools to stay ahead. This makes them vital for investors looking at the global economy.

Key Takeaways

- Macro hedge funds analyze broad economic themes to identify investment opportunities and possible risks.

- The first hedge fund was created by Alfred Winslow Jones in 1949, marking the beginning of a new era in investment strategies.

- Macro hedge funds have evolved over the decades, from traditional methods to more sophisticated, data-centric approaches.

- Global macro hedge funds provide investors with a unique perspective on the global economy and possible investment opportunities.

- The use of data-driven investment strategies has revolutionized the industry, with many funds leveraging cutting-edge technologies and analytical tools.

- Many hedge funds today are focused on late-stage venture and crypto markets, opening up new chances for investors.

Understanding Macro Hedge Funds: A Comprehensive Overview

Macro hedge funds look at big economic themes. They study things like interest rates, government actions, global trade, and world events. This helps them find good places to invest and spot risks.

These funds let you bet on big ideas across many assets. This adds variety to your investment mix, beyond just stocks.

Global macro hedge funds bet on big economic or political issues. For example, before the Brexit vote in 2016, some funds made bets on the outcome. They aim to make money from market ups and downs.

The global macro hedge fund index doesn't always move with stocks or bonds. This shows how they can help spread out risk.

Key Characteristics of Macro Hedge Funds

- Higher initial investment requirements and lifetime fees compared to passively-managed funds

- High investment thresholds, making them less accessible to individual investors

- Use of higher leverage multiples compared to event-driven, equity, or credit funds

- Split into single-manager vs. multi-manager, discretionary vs. systemic ("quant") strategies

To do well in macro hedge funds, you need a background in sales & trading, hedge funds, or asset management. Skills in risk management and being flexible are also key. They help you handle the complex world of global macro hedge funds.

The Role of Data in Macro Hedge Fund Strategies

Macro hedge funds use data to make smart decisions in the global markets. They look at social media and web data to spot trends and make money from economic changes.

Top macro hedge funds like Element Capital Management and Bridgewater Assets show how data helps. Element Capital Management grew its assets by 17.3% in 2019. Bridgewater Assets saw a 14.6% increase in its Pure Alpha Strategy.

Macro hedge funds have some key traits:

- They don't often move with traditional assets, which helps diversify a portfolio.

- They don't need much outside money, which keeps their leverage low.

- They spread their risk across different strategies to lower losses and improve returns.

By using data and analytics, macro hedge funds can stay ahead. As the world economy changes, using data to make decisions will become even more critical.

| Macro Hedge Fund | Assets Under Management | Return on Investment |

|---|---|---|

| Element Capital Management | $55.88 billion | 17.3% |

| Bridgewater Assets | $124.7 billion | 14.6% |

Key Investment Strategies Employed by Macro Hedge Funds

Global macro hedge funds use many strategies to make money from market trends. These strategies aim to earn high returns with low risk. They rely on detailed analysis of economic indicators and market data.

Some key strategies include global macro investment strategies. These involve using macroeconomic trends to guide investment choices. Funds analyze economic data like GDP, inflation, and interest rates to spot good investment chances.

Global Macro Investment Strategy

This strategy helps funds profit from global economic trends. They use long or short positions based on economic, political, and market factors worldwide. By studying global rates and currencies, funds can find and invest in promising opportunities.

The Use of Currency and Interest Rate Analysis

Currency traders can use up to 100-1 leverage, leading to big gains but also big risks. Interest rate portfolio managers invest in global debt, like US Treasury and European debt. These are mainly traded by big institutions, banks, and investment banks.

Strategies for Commodities and Equities

Some hedge fund managers focus on commodities like oil, gold, and silver. These can be profitable during times of inflation or deflation. About 30% of hedge funds use equity strategies, with long/short equity being common. By spreading investments across different asset classes, funds can lower risk and boost returns.

Success in global macro hedge funds depends on good risk-reward controls and watching economic and monetary factors. By using advanced analytics and real-time data, funds can quickly adapt to market changes. This helps them make better investment choices.

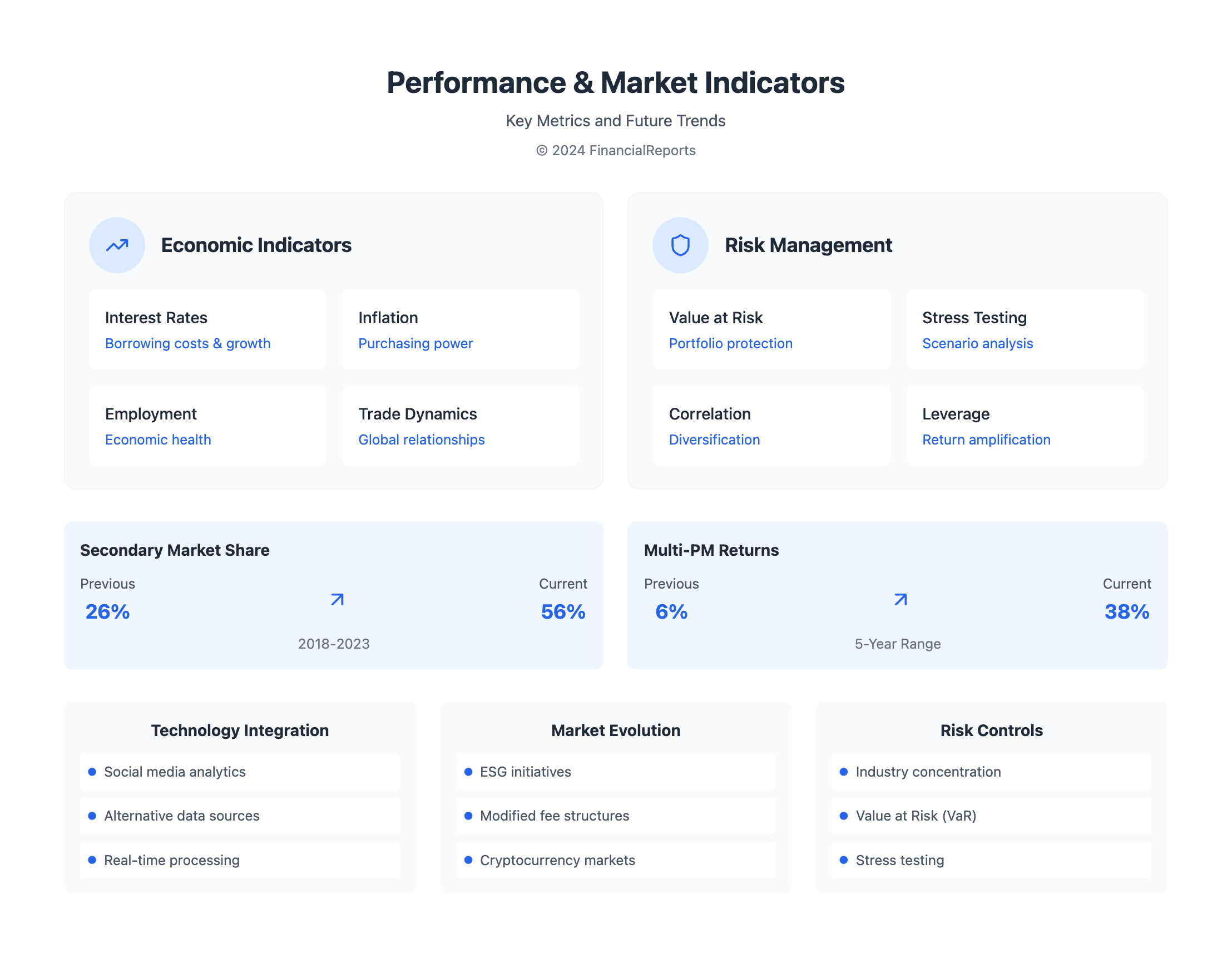

Risk Management Techniques in Macro Hedge Funds

Macro hedge funds use advanced methods to handle market risks. They use complex models and real-time data to spot dangers. This helps them stay ahead in changing markets.

They focus on diversification, with about 70% of funds using limits to spread out risks. Yet, some funds don't have a clear risk management plan. This is a big gap in their strategy.

Top funds like Bridgewater Associates and Renaissance Technologies excel in macro-hedging. They use derivatives and leverage to control risks. For instance, Singapore's PruLev Global Macro Fund made a 47% gain in 2017. This was thanks to Trump's policies and growth in China, Japan, and the Eurozone.

The table below shows some key facts about risk management in macro hedge funds:

| Statistic | Percentage |

|---|---|

| Hedge fund advisers using industry concentration limits | 70% |

| Respondents using Value at Risk (VaR) for portfolio risk | 69% |

| Respondents conducting both stress testing and correlation testing | 60% |

Macro hedge funds can thrive in tough markets with the right risk management. This approach helps them offer investors a strong advantage.

The Impact of Economic Indicators on Macro Hedge Fund Performance

Global macro hedge funds watch economic indicators closely. They use this data to shape their investment plans. For example, rising interest rates can make borrowing more expensive. This can hurt the economy and the fund's performance.

Looking at employment data is a big part of their strategy. It shows how well the economy is doing. By also considering inflation rates and global trade dynamics, fund managers can make smart choices. Here are some key economic indicators that affect these funds:

- Interest rates: Influencing borrowing costs and economic growth

- Inflation rates: Affecting the purchasing power of consumers and the overall economy

- Employment data: Providing insights into the labor market and economic health

- Global trade dynamics: Impacting international trade and economic relationships

By studying these indicators, global macro hedge funds can handle tough market situations. They can make smart investment moves. This skill helps them stand out in the world of finance.

| Economic Indicator | Impact on Global Macro Hedge Funds |

|---|---|

| Interest Rates | Influences borrowing costs and economic growth |

| Inflation Rates | Affects purchasing power and overall economy |

| Employment Data | Provides insights into labor market and economic health |

| Global Trade Dynamics | Impacts international trade and economic relationships |

Recognizing Top Macro Hedge Funds in the Market

Macro hedge funds play a big role in the investment world. They use data analytics and new technologies to stay ahead. About 300 fund managers share their views on the market every month.

Top funds like Bridgewater Associates and AHL Macro by Man Group lead the way. Bridgewater has $140 billion in assets, and AHL Macro has $139.5 billion. They often do well when stocks and bonds fall together, protecting investors' money.

When looking at macro hedge funds, it's key to check their risk-adjusted returns and Sharpe ratios. Their ability to perform well in all market conditions is very important. These funds have shown they can handle tough times, like when interest rates are high.

What makes global macro funds succeed? It's their forecasting skills, how they value assets, and their risk control. By studying successful funds, investors can learn from their strategies.

Regulatory Environment Affecting Macro Hedge Funds

The rules for global macro hedge funds are complex and always changing. These rules aim to stop financial institutions from failing during market crises. This helps avoid big problems in the financial markets.

The IOSCO report says the main goal is to stop big risks from hedge fund failures.

New rules include making hedge fund managers register to watch for risks. They also want managers to have their own risk teams. The US Treasury wants big hedge funds to register with the SEC and follow new rules. These steps aim to keep global macro hedge funds safe and open.

Some important numbers show why rules are key for global macro hedge funds:

- Hedge funds almost doubled their EGB deals in secondary markets from 2018 to 2023.

- In 2023, hedge funds made up 56% of secondary market deals, up from 26% in 2018.

These numbers show how big global macro hedge funds are in finance. They also highlight the need for good rules to avoid big problems.

Future Trends in Macro Hedge Fund Investing

As the financial world changes, macro hedge funds are keeping up with new trends and tech. They're using data from social media and surveys to make better choices. A Morgan Stanley study found that multi-PM platforms outperform traditional hedge funds, with returns from 6% to 38% in five years.

The role of advanced data analytics is growing in macro hedge fund investing. Tools like BofA Data Analytics help funds find new insights and keep up with trends. Some trends to watch include:

- ESG initiatives, with sustainable assets expected to gain further momentum in 2024

- A shift towards modified fee structures, with a focus on performance-based fees

- The increasing importance of cryptocurrency markets and decentralized finance (DeFi)

The industry is set to see more innovative ways to invest in macro hedge funds. By using the latest tech and trends, macro hedge funds can thrive in a changing financial world.

Performance Indicators for Evaluating Macro Hedge Funds

When we look at global macro hedge funds, we need to check many things. We look at their returns, how well they do compared to risk, and how they manage losses. It's key to see if they do well in all kinds of markets. This shows if they can handle different economic times.

Using advanced data analytics helps a lot. It makes our understanding of fund performance better. It lets investors and managers see how strategies might grow. Also, comparing funds to others in the industry helps us see who's doing well.

Here are some important things to watch when checking on global macro hedge funds:

- Absolute returns show how much money you make

- Risk-adjusted returns show how much you make compared to the risk you take

- Alpha generation shows if you beat the market

- Drawdown management shows how well you handle losses

By looking at these, investors can pick funds that fit their goals and how much risk they can take.

| Metric | Description |

|---|---|

| Absolute Returns | Total return on investment |

| Risk-Adjusted Returns | Returns adjusted for the level of risk taken |

| Alpha Generation | Ability to outperform the market |

| Drawdown Management | Capacity to mitigate losses during downturns |

Building a Career in Macro Hedge Funds: Skills and Opportunities

The macro hedge fund industry is growing fast, with many exciting career paths. To succeed, you need financial knowledge, data analysis skills, and the ability to keep up with new tech. These skills are key to a rewarding career in macro hedge funds.

Essential Skills for Aspiring Fund Managers

Knowing how to work with numbers and code is vital in macro hedge funds. Skills in data analysis, financial modeling, and programming languages like Python or R are in high demand. Also, being able to communicate well, understanding global economics, and managing risks are important.

Networking and Professional Development

Building a strong network and learning more are key to moving up in the macro hedge fund world. Going to conferences, workshops, and getting mentors can help a lot. It's also important to keep up with new rules, strategies, and tech in the field.

Job Roles within Macro Hedge Funds

Macro hedge funds have many job types, from research analysts to data scientists. Those who are good at analyzing data and know global markets well can be macro strategists. They find investment chances and manage risks. Data experts can work as quantitative researchers, creating new trading tools and risk models.

FAQ

What are macro hedge funds and how do they differ from traditional hedge funds?

Macro hedge funds use global market analysis to guide their investments. They differ from traditional hedge funds, which focus on specific areas. Macro funds aim to profit from big economic trends and market changes.

What are the key features and characteristics of macro hedge funds?

Macro hedge funds use many financial tools like currencies and bonds. They also use leverage and short-selling to increase their gains. This helps them build diverse portfolios.

How have macro hedge funds evolved over time?

Macro hedge funds have changed a lot, mainly in the last few decades. They moved from old, discretionary methods to new, data-driven strategies. Now, they use advanced tools to spot global market trends.

What is the role of data in shaping macro hedge fund strategies?

Data is key for macro hedge funds. They use new data sources like satellite images and social media. This helps them understand global trends and market conditions better.

What are the primary investment strategies employed by macro hedge funds?

Macro hedge funds use several strategies. They focus on global trends, currency trading, and interest rates. They aim to profit from big economic shifts and policy changes.

How do macro hedge funds manage risk in their portfolios?

Macro hedge funds use smart risk management. They diversify and do stress tests to reduce risks. They also use data analytics to spot and handle market threats.

What are some of the key economic indicators that influence macro hedge fund performance?

Macro hedge funds watch many economic signs. They look at interest rates, inflation, and global trade. Understanding these helps them make better investment choices.

What are some of the regulatory challenges facing the macro hedge fund industry?

Macro hedge funds face many rules. They must report, meet capital needs, and protect investors. Managing these rules well is a big challenge for fund managers.

What are the emerging trends and future directions in macro hedge fund investing?

The macro hedge fund world is changing fast. New tech like AI and blockchain will shape how they invest. They're also focusing more on ESG factors in their decisions.

What are the essential skills and career paths within the macro hedge fund industry?

To succeed, you need both financial knowledge and data skills. Jobs like research analysts and traders are in demand. Learning, networking, and mentorship are key for growing in this field.