Investing for Beginners: Proven Strategies for Novice Investors

Investing is a great way to grow your wealth over time. But for beginners, it can seem complex and scary. It's important to start with the basics and understand how to begin investing.

Investing money for beginners needs a solid foundation. Knowing how to start investing can make a big difference. With the right strategies and knowledge, anyone can start investing and grow their wealth.

Bankrate’s 2024 Financial Regret Survey found that 22% of people regret not saving for retirement early. Most online brokers don't require a minimum amount to start investing. This makes it easy for anyone to begin investing and reach their financial goals.

Key Takeaways

- Investing for beginners requires a solid foundation and understanding of the basics

- Starting to invest early is key, as 22% of people regret not saving for retirement early enough

- Most major online brokers have no minimum account size requirement, making it easy to start investing with minimal funds

- Investing money for beginners requires a well-thought-out strategy and a understanding of how to begin investing

- Passive index investing can be a great choice for beginner investors, with broad diversification and lower costs

- Maintaining a consistent long-term investment strategy is essential to avoid reacting to short-term market fluctuations

- Having an emergency fund and diversifying your portfolio are key components of a successful investment strategy

Understanding the Basics of Investing

Investing is key to building wealth and financial stability. For beginners, knowing the basics is essential. This includes understanding what investing is, why starting early matters, and the various investment options. When looking for good investments for beginners, finding a balance between risk and return is important.

Starting early is critical. It lets investors benefit from compound interest and gives them time to handle market ups and downs. When choosing where to invest money to get good returns for beginners, mixing low-risk and high-risk assets is key. This can include stocks, bonds, and mutual funds.

What is Investing?

Investing means putting money into something to earn a return. You can invest in stocks, bonds, ETFs, mutual funds, or real estate. When picking the best investments for beginners, consider your risk tolerance, goals, and how long you can invest.

The Importance of Investing Early

Investing early is vital. It lets you use compound interest and gives you more time to handle market changes. Even small investments early on can help fight inflation and grow your wealth over time.

Different Types of Investment Options

There are many investment options, including:

- Stocks: give you a share of a company and the chance for growth and income.

- Bonds: offer a fixed income and are generally safer.

- Mutual funds: let you invest in a variety of securities at once.

- Real estate: can appreciate in value and provide rental income.

Setting Your Financial Goals

Investing with little money starts with setting clear financial goals. You might aim to save for a house, retirement, or a big buy. Knowing your personal investment goals is key to starting right.

First, understand your current finances and what you want to achieve. This will guide your investment plan. For example, saving for a house might mean choosing stable, short-term investments.

Short-term vs. Long-term Goals

Short-term goals, like saving for a house, need a different plan than long-term ones, like retirement. It's important to focus on your goals and use your money wisely. Here's what to keep in mind:

- Short-term goals: Look for stability and keeping your money safe, like for a house down payment.

- Long-term goals: Aim for growth, like for retirement or long-term investments.

Assessing Your Risk Tolerance

Knowing how much risk you can handle is vital in investing. This means figuring out what investments fit you best. Think about your goals, how long you can wait for returns, and your comfort with risk. This way, you can build a portfolio that matches your goals and comfort level.

Building Your Investment Portfolio

Building an investment portfolio starts with a solid base. For those new to investing, a good mix of low-cost index funds, stocks, and bonds is key. Think about your financial goals, how much risk you can take, and when you need the money.

A diverse portfolio can lower risk and boost returns. It includes various assets like stocks, bonds, and real estate. Stocks come in different sizes, from large to small cap. Bonds offer a safer choice with less ups and downs.

When creating your portfolio, keep these points in mind:

- Asset allocation: Find the right balance of stocks, bonds, and other investments based on your risk level and goals.

- Diversification: Spread your money across different types of investments to cut down on risk.

- Rebalancing: Check and adjust your portfolio regularly to keep it in line with your goals.

By following these tips and considering your own situation, you can craft a portfolio that meets your financial goals. This is true whether you're starting with a small amount or looking to improve your current portfolio.

Researching Investment Opportunities

Starting to invest means looking into different options. You'll want to check out stocks, bonds, and funds. Knowing what each offers, its risks, and possible gains is key to smart choices. For those with small amounts to invest, options like high-yield savings or index funds are a good start.

First, figure out your financial goals and how much risk you can take. This will guide you to the right investments. For example, if you're looking short-term, CDs or money market funds might be better. But, if you're thinking long-term, stocks or ETFs could be the way to go. Remember, fees can cut into your earnings over time.

Evaluating Investment Options

When looking at investments, keep these points in mind:

- Risk level: Stocks are the riskiest, followed by funds, then bonds.

- Fees: Choose low-fee options, like index funds or ETFs.

- Time horizon: High-yield savings are good for short-term goals. Stocks or ETFs are better for long-term plans.

By researching and comparing different investments, you can make smart choices. Whether it's easy options like index funds or more complex ones like individual stocks, investing can help grow your retirement fund. It can also offer a chance for passive income.

The Role of Financial Advisors

Investing well starts with knowing the basics. A guide for beginners can be very helpful. But, sometimes, you need expert advice. A financial advisor can tailor a plan just for you.

Financial advisors are key in the investment world. They help manage risk and pick the right investments. They also make sure your portfolio is diverse. On average, they earn $71,943 a year, helping people reach their financial goals.

When to Consult a Professional

There are times when you should talk to a financial advisor. This includes big life changes like having a child or buying a home. They help set goals and adjust plans as needed. They also offer advice on dealing with inflation and retirement costs.

Choosing the Right Advisor

Choosing the right financial advisor is important. Look at their experience, fees, and credentials. A good advisor looks at all aspects of your finances, not just investments. They help with taxes, retirement, and risk management.

Working with a financial advisor has many benefits. They offer personalized advice, help with risk management, and assist with retirement planning. They also provide access to many resources and build long-term relationships.

- Personalized financial planning and guidance

- Help with managing risk and selecting investments

- Assistance with retirement planning and tax efficiency

- Access to a range of resources and expertise

| Service | Benefit |

|---|---|

| Financial planning | Personalized guidance and support |

| Investment management | Help with selecting and managing investments |

| Retirement planning | Assistance with planning for retirement income and expenses |

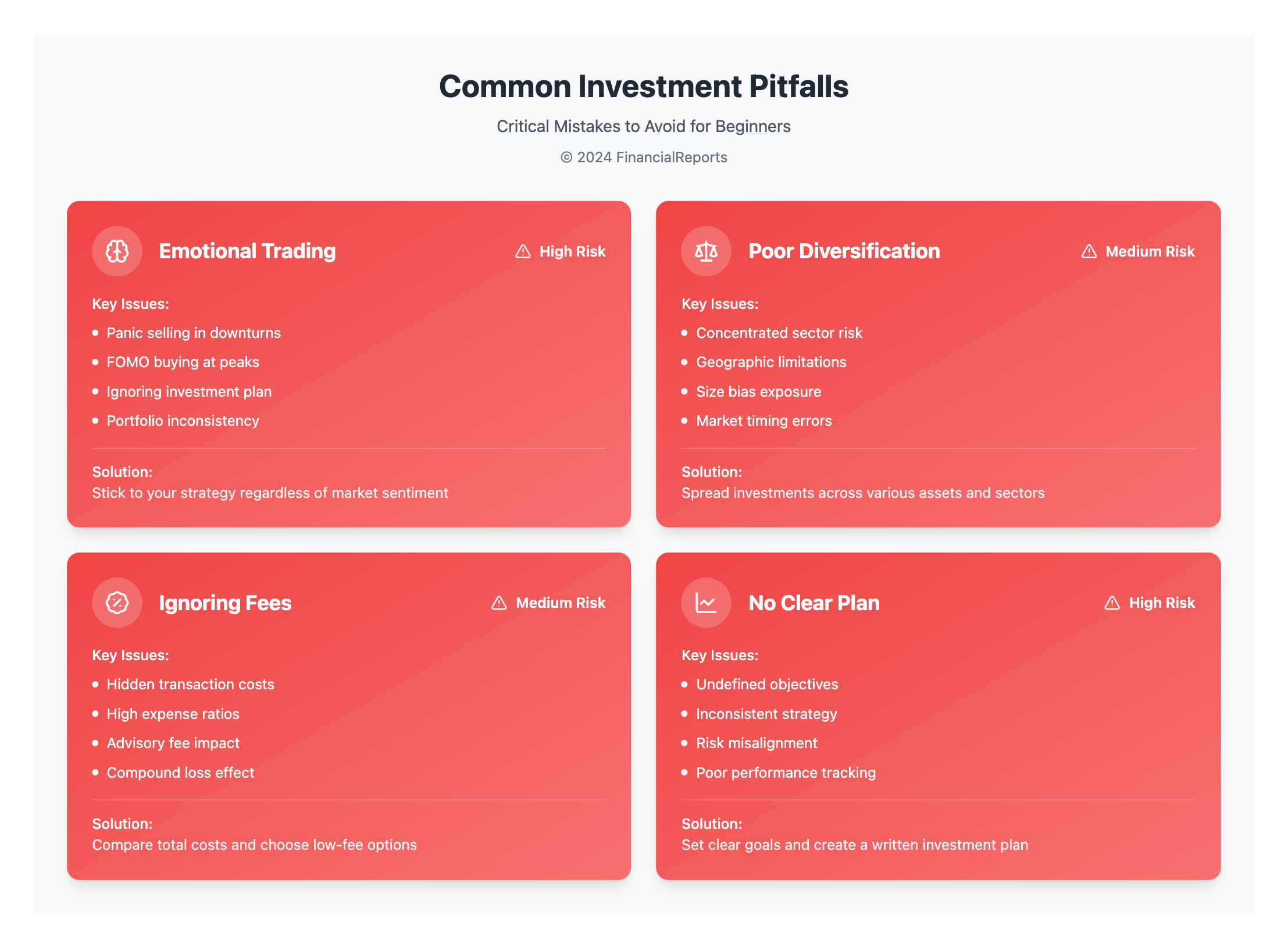

Common Investment Mistakes to Avoid

When you start investing, knowing common mistakes is key. These mistakes can hurt your returns. Emotional decisions are a big one, leading to choices based on short-term market changes.

Understanding diversification and setting clear goals is vital. Studies show that nearly 94% of portfolio return variations come from investment decisions, not market timing. Avoiding mistakes like not researching, making emotional decisions, and not diversifying can lead to long-term success.

Some common mistakes to steer clear of include:

- Not having clear investment goals

- Reacting emotionally to market fluctuations

- Ignoring fees and expenses

- Failing to diversify a portfolio

By knowing these pitfalls and investing wisely, you can reach your financial goals.

| Investment Mistake | Consequence |

|---|---|

| Emotional decision-making | Impulsive choices, possible losses |

| Ignoring fees and expenses | Reduced returns over time |

| Failing to diversify | Higher risk, possible losses |

The Impact of Economic Indicators

For beginners in investment accounts, knowing about economic indicators is key. These indicators, like market trends and interest rates, greatly affect investment choices. It's vital for those starting with small amounts to keep up with these indicators and adjust their plans.

To start investing with little money, understanding the economy is essential. Important indicators include the Gross Domestic Product (GDP), Consumer Price Index (CPI), and Producer Price Index (PPI). These give insights into the economy's health. Here are some critical economic indicators to watch:

- Gross Domestic Product (GDP)

- Consumer Price Index (CPI)

- Producer Price Index (PPI)

- Unemployment rate

- Nonfarm payrolls figure

By grasping these indicators, beginners can make better investment choices. Whether starting with little money or growing a portfolio, staying updated on economic indicators is key. It helps in reaching your financial goals.

| Indicator | Description |

|---|---|

| GDP | Measures the total value of goods and services produced in a country |

| CPI | Tracks the prices of goods and services bought by urban consumers |

| PPI | Measures the prices of goods and services from a seller's perspective |

Utilizing Technology in Investing

Investors can use technology to improve their investment plans. This is true when looking into how to start investing money and finding investment options for beginners. Knowing how much money do i need to start investing is key to making smart choices. Digital platforms offer many tools and resources to help manage investments.

Some main advantages of using technology in investing are:

- It's easy and affordable to invest

- You can find many investment products and services

- It lets you track and manage your investments in real-time

But, there are also some downsides to consider:

- It relies on technology, which can have problems

- You need to keep learning about new tools and platforms

- It can be hard to sort through all the information

| Investment Option | Benefits | Drawbacks |

|---|---|---|

| Robo-advisors | Low costs, diversified portfolios, and professional management | Limited control, possible technical issues |

| Online Brokerages | Convenient, cost-effective, and wide range of investment products | Potential for information overload, need for ongoing education |

Tax Implications of Your Investments

When you start investing, knowing about taxes is key. Taxes can affect how much money you make from your investments. For example, long-term gains are taxed at 0%, 15%, or 20% if you hold them over a year.

To cut down on taxes, look into special accounts like 401(k) or IRA. In 2025, you can put up to $7,000 in an IRA or $8,000 if you're 50 or older. You can also put up to $23,500 in a 401(k) or $30,500 with a catch-up contribution. These accounts save you on taxes but have limits and rules on when you can take your money out.

Some important things to remember when you're starting with little money include:

- Understanding the tax implications of your investments

- Exploring tax-advantaged accounts, such as 401(k) or IRA

- Being aware of the annual contribution limits and restrictions on withdrawals

| Account Type | Contribution Limit | Tax Benefits |

|---|---|---|

| 401(k) | $23,500 | Tax-deferred growth |

| IRA | $7,000 | Tax-deductible contributions |

By knowing about taxes and using special accounts, you can make smart choices. This helps you get the most out of your investments, even if you start with a small amount.

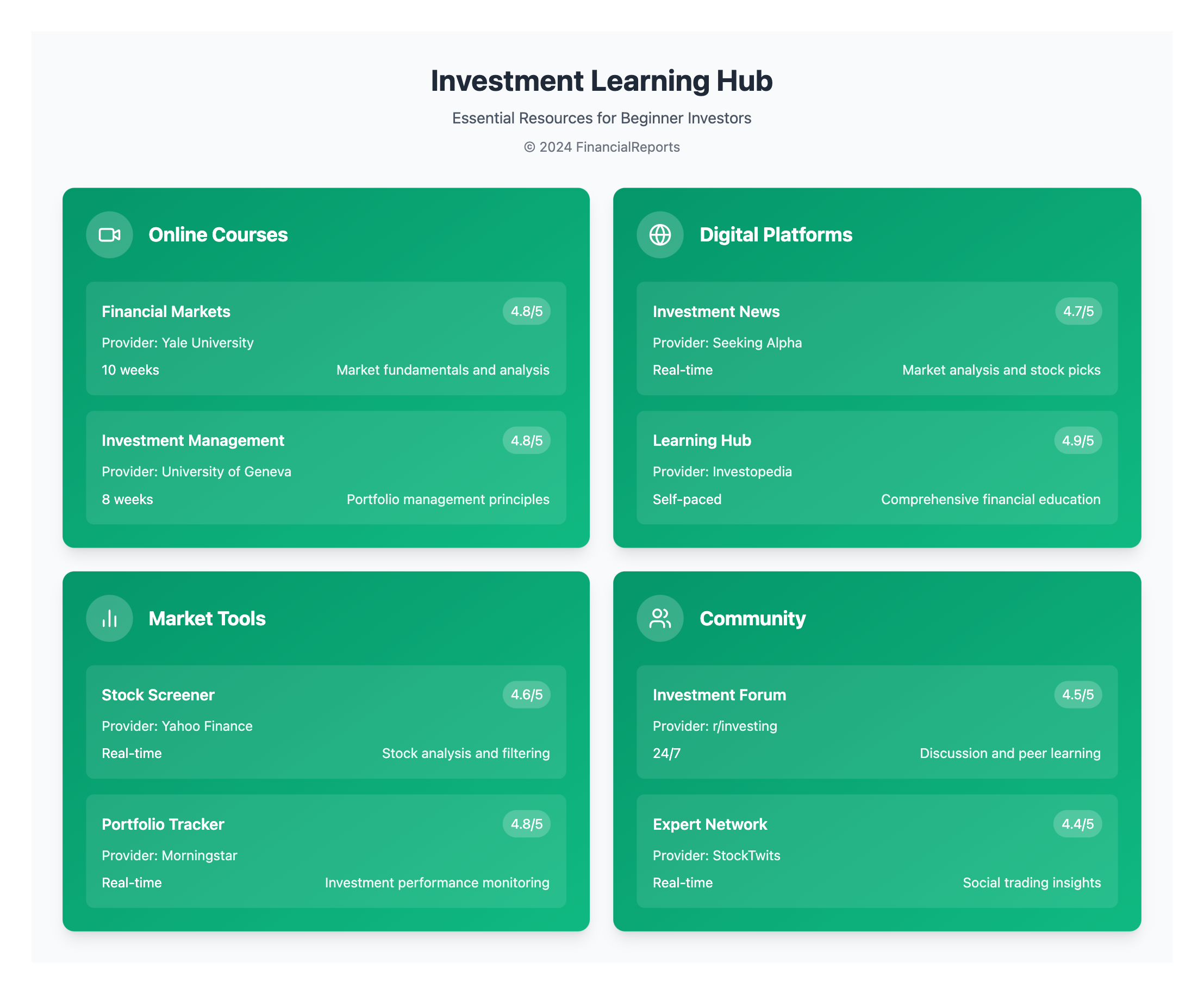

Continuing Your Investment Education

Investing for beginners is a journey that never ends. It's key to grasp the basics of investing. There are many resources out there to help you get started. Online courses, like Yale University's "Financial Markets" course, can teach you a lot. Books and articles also offer practical tips and strategies.

Some top online resources for beginners include:

- Investopedia: A vast online resource for investing and personal finance.

- The Balance: A website focused on personal finance, with investing advice.

- Seeking Alpha: A platform for news, analysis, and insights on stocks and the market.

Keeping up with financial news is also important. It helps you stay aware of market trends and economic indicators. By continuing to learn, you can make better investment decisions and build a successful strategy.

| Course | University | Rating | Reviews |

|---|---|---|---|

| Financial Markets | Yale University | 4.8/5 | 29,181 |

| Investment Management | University of Geneva | 4.8/5 | 6,158 |

| Investment and Portfolio Management | Rice University | 4.5/5 | 2,119 |

Developing a Long-term Investment Strategy

As an investing for beginners, having a solid long-term plan is key. Patience and discipline are vital when starting to invest. The average bear market lasts about 14 months, but those who stick to their plan win in the end.

It's important to regularly check and tweak your investment strategy. Asset allocation and diversification can reduce risk, but they can't prevent all losses. Keeping up with market trends and economic news helps you make smart choices. Successful investors look at a company's future, not just its past.

As you keep learning about investing for beginners, remember to be patient and persistent. A disciplined, long-term approach helps you grow your wealth. Investing is a long journey, but with the right strategy, you can overcome market challenges and reach your goals.

FAQ

What is investing?

Investing means putting money into assets hoping to make income or profit.

Why is investing early important?

Starting early lets you use compound interest. It also gives you more time to handle market ups and downs.

What are the different types of investment options?

There are stocks, bonds, real estate, and mutual funds. Each has its own risks and benefits.

How do I set my financial goals?

Setting goals is key for beginners. It helps you know what you want to achieve. Short-term and long-term goals need different plans.

How do I assess my risk tolerance?

Knowing your risk tolerance is important. It helps you choose investments that fit your comfort level.

Why is diversification important?

Diversifying your investments is vital. It spreads risk across different types of assets, making your portfolio stronger.

What is asset allocation?

Asset allocation means dividing your investments based on your goals and risk comfort. Regularly rebalancing keeps your portfolio in check.

How do I evaluate stocks?

To evaluate stocks, look at financial reports, the management team, and industry trends.

How do I understand bonds and other securities?

Bonds and securities like mutual funds need understanding. Know their risks, benefits, and how they work.

When should I consult a financial advisor?

A financial advisor is helpful for personalized advice. They can guide on risk management and investment choices.

What are common investment mistakes to avoid?

Avoid emotional decisions, ignore fees, and don't react to short-term market changes.

How do economic indicators impact my investments?

Knowing market trends and interest rates is key. They affect your investment choices.

How can technology help with investing?

Technology offers tools and platforms for managing investments. Apps and online brokerages are great for beginners.

What are the tax implications of my investments?

Taxes on investments are important. Capital gains tax can reduce returns. But, tax-advantaged accounts can lower your tax bill.

How can I continue my investment education?

Keep learning about investing. Books and online resources are great. Stay updated with financial news to know market trends.

How do I develop a long-term investment strategy?

A long-term strategy is essential. Be patient and disciplined. Regularly review and adjust your strategy to match your goals and risk level.