Intro to Investing: A Guide for Beginners

Investing can seem scary, but it's not. With the right info, anyone can start investing and reach their money goals. This guide will introduce you to investing, covering the basics and different types of investments. Knowing these basics is key to making smart choices in the investment world.

For beginners, remember investing is a long-term game. It's important to know about stocks, bonds, mutual funds, and ETFs. An intro to investing should also talk about risk, spreading out your investments, and managing your portfolio. By learning these, you can set yourself up for success and reach your financial goals.

Key Takeaways

- Investing is a long-term strategy that requires patience and discipline

- Understanding investing basics is essential for making informed decisions

- Diversification and risk management are key to investment success

- Intro to investing should cover the different asset classes and investment options

- Investors should have a clear understanding of their financial goals and risk tolerance

- Investing basics, such as compound interest and rate of return, can significantly impact investment outcomes

- A complete intro to investing should include info on investment vehicles, like 401(k) and IRA

Understanding the Basics of Investing

Investing is key to building wealth and securing your financial future. It might seem tough at first, but knowing the basics is essential. Investing means using your money to buy assets that could increase in value. This includes stocks, bonds, and mutual funds.

When you start investing, it's important to know the different types of investments. Stocks can offer high returns but come with higher risks. Bonds provide stable returns but have lower growth possibilities.

What is Investing?

Investing is more than just saving money in a bank. It's about growing your wealth by investing in assets that could increase in value over time.

Types of Investments

There are many types of investments, including:

- Stocks: Represent ownership in companies and offer the chance for long-term growth.

- Bonds: Represent debt obligations and provide regular income with relatively lower risks.

- Mutual Funds: Pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.

Risks and Rewards

Investing always carries some risk, but it also offers big rewards. Knowing the risks and rewards of different investments is key to making smart choices. By starting with the basics, you can succeed in investing.

The Importance of Financial Goals

Understanding your financial goals is key when starting to invest. Investing is a long-term journey. It's important to know if your goals are short-term or long-term.

Short-Term vs. Long-Term Goals

Short-term goals are for less than five years. Long-term goals can last decades. Knowing the difference helps you plan better.

For example, saving for a house down payment is a short-term goal. Planning for retirement is a long-term goal.

Setting SMART Financial Goals

To reach your financial goals, set SMART objectives. This means:

- Defining your goals clearly

- Setting measurable milestones

- Creating a realistic plan

- Ensuring your goals match your values

- Setting a specific timeframe

By following these steps, you'll be on the right path. You'll have a solid investment strategy that fits your goals.

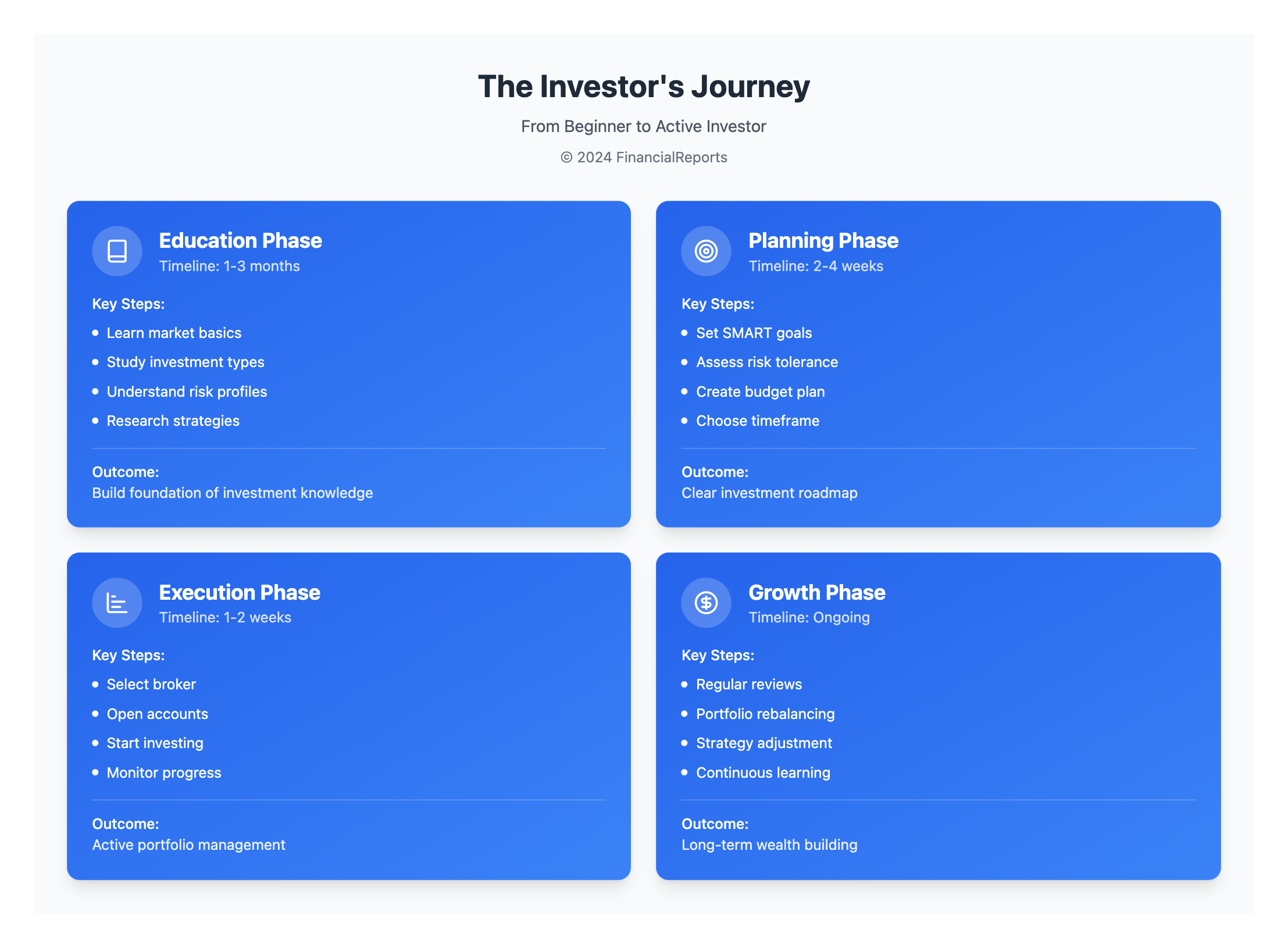

Getting Started with Investing

Starting to invest can feel daunting. But, understanding your finances and having a good plan can help you succeed. Begin by looking at your income, expenses, assets, and debts.

Creating an investment plan is key for beginners. It should match your financial goals and how much risk you can handle. For example, if you're investing for the long term, you might take on more risk for higher returns. But, if you need your money soon, choose safer options.

When making your plan, consider a few things:

- Know your risk tolerance and how it affects your choices

- Set clear goals, like saving for retirement or a house

- Build a diversified portfolio to reduce risk and increase returns

By following these steps and staying informed, you can make a strong investment plan. Always keep learning and be patient. Investing is a long-term journey.

Different Investment Vehicles Explained

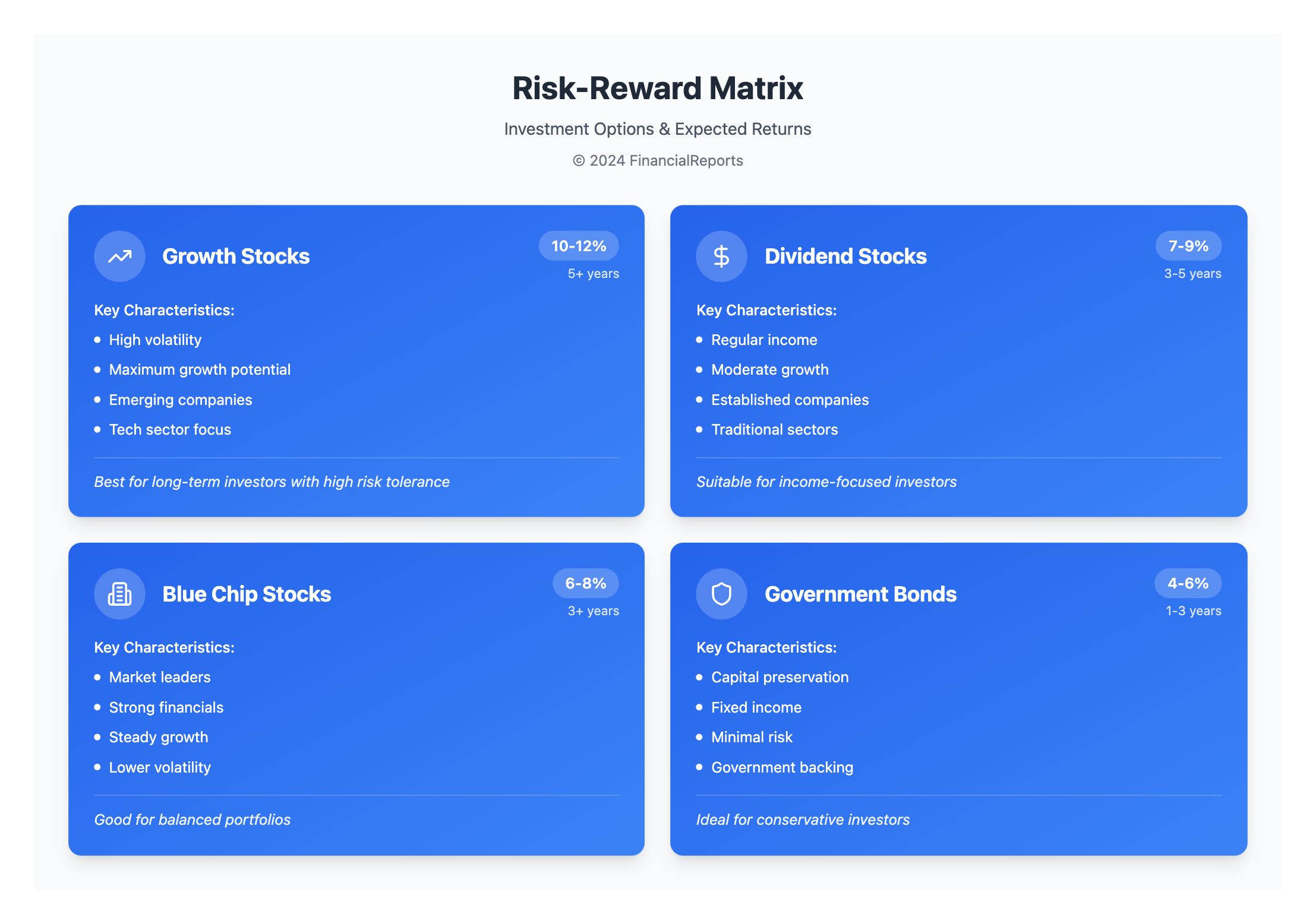

Investing basics cover the many options available to investors. An introduction to investment talks about the types like stocks, bonds, mutual funds, and ETFs. These can be direct or indirect investments.

Direct investments, like stocks and bonds, give investors full control. But, they might have higher fees than indirect investments. Indirect investments, managed by professionals, offer a diversified portfolio with possibly lower fees.

Characteristics of Investment Vehicles

Understanding each investment's traits is key to investing basics. Traits include expected return, risk, liquidity, costs, and structure. For instance, stocks might offer high returns but also high risks. Bonds, on the other hand, provide lower returns with less risk.

- Expected return: based on cash flow, growth expectations, and pricing considerations

- Risk: measured by maximum drawdown and volatility

- Liquidity: reflects how quickly an investment can be converted to cash

- Costs: include commissions, fees to the sponsor, and taxes

- Structure: encompasses organization, accessibility, liquidity terms, costs, and possible leverage

Knowing these traits helps investors make smart choices. They can match their investment goals and risk level.

The Role of Risk Tolerance in Investing

Understanding risk tolerance is key when you start investing. Investing 101 shows us that knowing your risk level is vital. It helps you choose the right investment strategy.

Things like your timeline, financial goals, age, and how much you're investing affect your risk tolerance. For example, people with bigger portfolios might take on more risk. Investors are grouped into aggressive, moderate, and conservative categories based on their risk tolerance.

To figure out your risk level, think about these factors:

- Timeline: How long can you keep your money invested?

- Financial goals: What are you trying to achieve through investing?

- Age: How will your age affect your investment decisions?

- Portfolio size: How will the size of your portfolio impact your risk tolerance?

- Investor comfort level: How comfortable are you with the possibility of losses?

Managing risk is key to successful investing. Knowing your risk tolerance and adjusting your strategy can help. This way, you can reduce losses and increase gains. Investing is a long-term game, and a diverse portfolio can help you reach your goals.

| Risk Level | Expected Annual Return | Expected Annual Volatility |

|---|---|---|

| Conservative | 4-6% | 5-7% |

| Moderate | 7-9% | 8-10% |

| Aggressive | 10-12% | 11-13% |

How to Choose the Right Broker

Choosing the right broker is key when you start investing. With many options, picking the best one can be tough. It's important to know about different brokerage accounts and their fees.

There are several types of brokerage accounts. These include standard taxable accounts, Roth IRAs, Traditional IRAs, and Solo 401(k) accounts. Each has its own rules and benefits. For instance, Roth IRAs let you contribute after taxes but grow tax-free, while Traditional IRAs let you deduct contributions from your taxes.

When looking at brokers, fees and commissions are important. Brokers like Interactive Brokers, Charles Schwab, and Fidelity charge $0 for stock and ETF trades. Others, like Webull and moomoo, also offer $0 for these trades. Some brokers might charge advisory fees, which can be between 0.25% and 1% of your portfolio each year.

| Broker | Commissions | Account Minimum |

|---|---|---|

| Interactive Brokers | $0 for stock/ETF trades, $0.65 per contract for options | No minimum |

| Charles Schwab | $0 for stock/ETF trades, $0.65 per contract for options | No minimum |

| Fidelity | $0 for stock/ETF trades, $0 plus $0.65/contract for options trades | No minimum |

Knowing about different accounts and fees helps you choose the right broker. This is important for your investing basics and intro to investing.

Strategies for Successful Investing

Investing 101 for beginners is all about understanding different strategies. These strategies help you reach your financial goals. One key method is dollar-cost averaging. It means investing a set amount regularly, no matter the market's state.

Value investing is another approach. It's about buying stocks that are underpriced but have great growth chances. Growth investing focuses on companies that are expected to grow fast, but it comes with higher risks and rewards. For more details, check out investment strategies for beginners.

These strategies offer several benefits. They include:

- Reduced risk through diversification

- Potential for long-term growth

- Lower costs compared to actively managed funds

By learning these strategies, investors can make better choices. Regular portfolio reviews and rebalancing help keep your investments in line with your goals.

| Strategy | Description | Benefits |

|---|---|---|

| Dollar-Cost Averaging | Investing a fixed amount at regular intervals | Reduced risk, long-term growth |

| Value Investing | Buying undervalued stocks with strong growth | High returns, lower risk |

| Growth Investing | Investing in companies with high growth | High returns, higher risks |

Monitoring and Adjusting Your Portfolio

As you keep investing, it's key to watch and tweak your portfolio. This means checking your investments often and making changes when needed. This helps keep your portfolio in line with your goals and how much risk you're okay with. It's a basic rule of investing.

Rebalancing is a big part of managing your portfolio. It's when you sell some investments and buy others to keep your mix right. For instance, if stocks have done well and now make up 70% of your portfolio, you might sell some to buy bonds. This brings your mix back to 60% stocks and 40% bonds.

A guide on managing your portfolio says regular checks and rebalancing are key. They help keep your investments in line with your goals and risk level. Important steps for rebalancing include:

- Looking at your whole portfolio across different accounts

- Checking how much you have in stocks, bonds, and cash

- Seeing if your current mix matches your target

By following these tips and staying up-to-date on investing, you can make smart choices for your portfolio. This helps you reach your financial goals over time.

Continuing Your Investment Education

Starting your investing journey is exciting. But, it's even more important to keep learning and stay current. The world of investing is always changing. The more you know, the better you'll be at handling the financial markets.

There are many ways to learn more about investing. You can read books, take online courses, or join online communities. These resources can give you valuable insights and help you make smart investment choices.

Investing is a journey that never ends. Always be curious and open to new ideas. Your dedication to learning will help you reach your financial goals.

FAQ

What is investing?

Investing means putting money into different things with the hope of making more money. It's about growing your wealth over time by investing in various assets.

What are the different types of investments?

There are many types of investments. These include stocks, bonds, mutual funds, ETFs, real estate, and even things like cryptocurrency and commodities.

What are the risks and rewards of investing?

Investing has both risks and rewards. Higher returns often mean higher risks. Lower-risk investments usually offer lower returns. It's important to understand and manage these risks.

Why are financial goals important in investing?

Financial goals are key to a good investment strategy. They help you know how much risk you can take and how long you can wait for returns. Goals also guide your choice of investments.

How do I get started with investing?

First, check your financial situation and set your investment goals. Then, create a plan that fits your risk level. Choosing the right brokerage account and investments is also important.

What are the different investment vehicles and how do they work?

Investment vehicles include stocks, bonds, mutual funds, ETFs, real estate, and more. Each has its own benefits and risks. They help you reach different investment goals.

How do I choose the right broker?

Look at the types of accounts, fees, research tools, and user experience when choosing a broker. Find one that fits your investment needs and goals.

What are some common investment strategies?

Common strategies include dollar-cost averaging, value investing, and growth investing. Each strategy has its own way of picking and managing investments. They aim to meet your investment goals.

How do I monitor and adjust my investment portfolio?

Regularly check and rebalance your portfolio to stay on track with your goals. This means looking at how your investments are doing and making changes as needed.

What resources are available to continue my investment education?

There are many resources for learning more about investing. These include books, online courses, podcasts, and investment communities. Keeping up with learning can help you make better investment choices.