Insider's Guide: How to Buy Stocks for Beginners

Investing in stocks can help you build wealth. But, it's key to do your own research and set clear goals. If you're new to this, start by learning the basics of stock investing.

To begin, you need to know how to buy stocks and understand the stock market. Stocks have historically offered better returns than safer investments like bonds or gold. It's important to have a solid strategy and know the stock market well.

With the right knowledge and plan, you can make smart investment choices. This guide will help you learn how to buy stocks and start investing. By grasping the basics and the different investment types, you can make informed decisions and grow your wealth.

Key Takeaways

- Investing in stocks can generate higher returns compared to lower-risk investments like bonds or gold.

- Diversification in stock investments helps manage downside risks associated with individual securities or asset classes.

- Full-service brokers offer specialized research and advice, but charge substantial fees.

- Discount brokers are preferred by investors for their affordability and low fees.

- Robo-advisors are automated investing platforms that manage investments based on specific goals and timelines.

- Understanding how to purchase stock and navigating the stock market is key for making informed investment decisions.

- Considering tax implications and aiming for long-term capital gains tax treatment can help maximize returns.

Understanding the Stock Market

The stock market is where companies sell shares to raise money. Investors buy and sell these shares to make a profit. To buy stocks, you need to know the basics, like the different types of stocks and the risks.

Buying and selling stocks can be rewarding, but it takes knowledge and research. For those asking how can i buy stocks, you start by opening a brokerage account and putting in money. Then, you can buy shares in a company through the brokerage firm.

It's important to understand supply and demand. Also, knowing about the New York Stock Exchange (NYSE) and the NASDAQ is key.

Key Terms Every Investor Should Know

Investors should know terms like bulls, bears, and dividends. A bull market has rising stock prices, while a bear market has falling prices. Dividends are payments from companies to their shareholders.

| Term | Definition |

|---|---|

| Bull Market | A market characterized by rising stock prices |

| Bear Market | A market marked by declining stock prices |

| Dividend | A payment made by a company to its shareholders |

Knowing these terms helps investors make smart choices. It boosts their chances of success in the stock market.

Types of Stocks You Can Buy

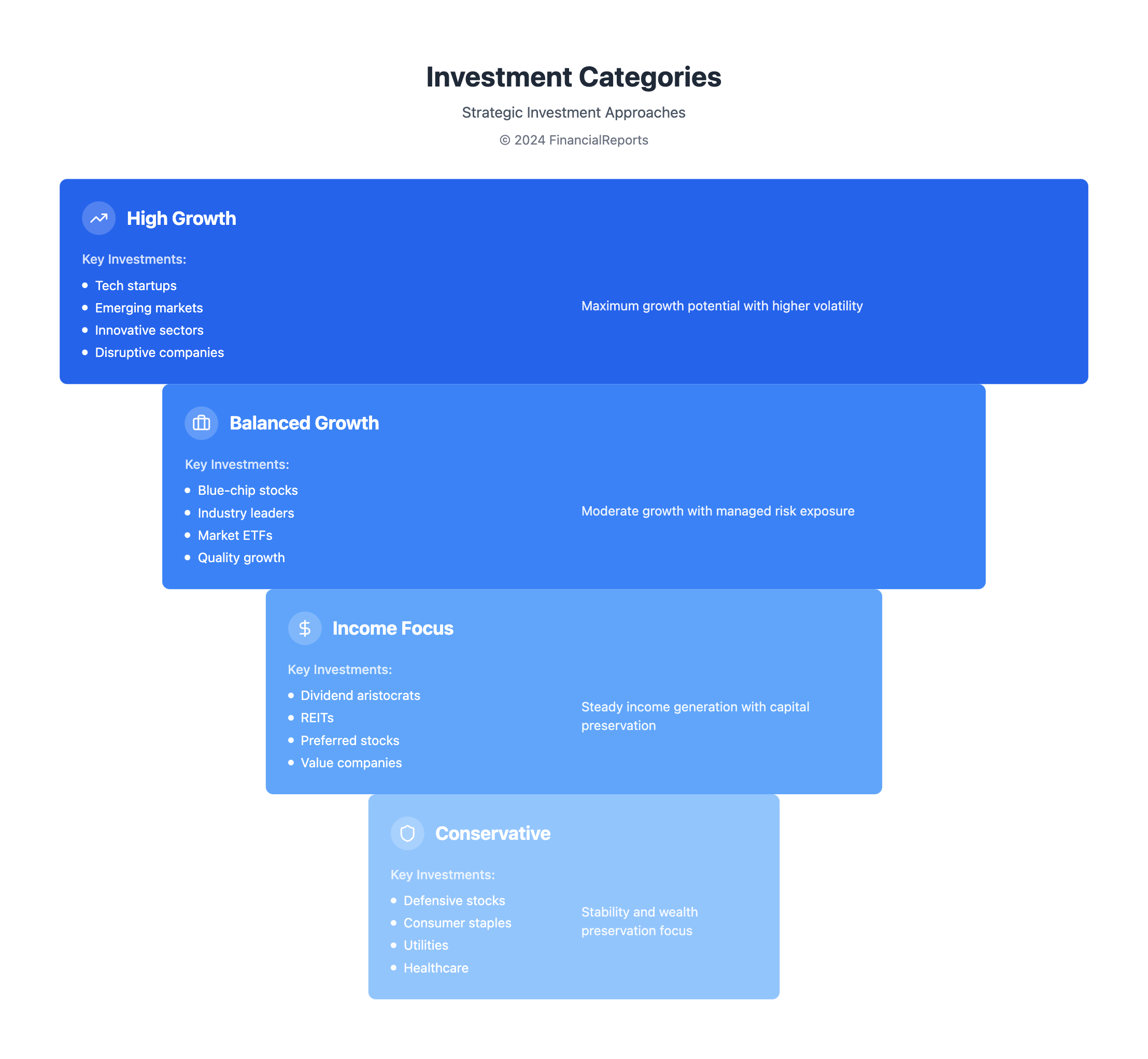

Understanding the different types of stocks is key for smart investing. Whether you're new to stocks or looking to buy, knowing your options is vital. Each type of stock has its own features and benefits.

Common vs. Preferred Stocks

Common stocks let you own a piece of a company and vote on important decisions. Preferred stocks, while having a higher claim on assets and earnings, usually don't offer voting rights. Knowing the difference is important when deciding how to buy shares.

Growth Stocks vs. Dividend Stocks

Growth stocks aim to grow in value over time. Dividend stocks, on the other hand, share a part of the company's earnings with shareholders. Even a small dividend, like $0.01 per share, makes a stock a dividend stock. It's important to consider both types when starting out.

By understanding these stock types, you can make better choices for your portfolio. Whether you're new or experienced, knowing your options is essential for success in the stock market.

Steps to Prepare for Buying Stocks

Before you dive into the stock market, it's key to check your finances and set investment goals. This step helps you figure out how to buy stocks and plan your strategy. Knowing your income, expenses, and savings is vital for deciding how much to invest.

To begin, follow these steps:

- Look at your income and expenses to see how much you can invest.

- Check your savings and emergency fund to cover unexpected costs.

- Set clear investment goals, like your risk level and time frame, to guide your stock choices.

The stock market has seen about a 10 percent annual growth on average. But, some years may drop, while others soar. Investing for the long haul is often advised. Knowing how to buy stocks helps you make smart choices. By taking these steps and researching, you can make informed decisions about buying stocks.

| Investment Type | Risk Level | Potential Return |

|---|---|---|

| Conservative | Low | 4-6% |

| Moderate | Medium | 7-10% |

| Aggressive | High | 11-15% |

Always research and think about your goals and risk level before investing. By understanding how to buy stocks, you can make informed choices and reach your financial targets.

Choosing a Brokerage Firm

Investing in stocks online starts with picking a good brokerage firm. This choice affects how you buy stock and shares online. You should look at different brokerages, their fees, and services they offer.

Brokerages come in two types: full-service and discount. Full-service brokerages give advice and research, but cost more. Discount brokerages are cheaper but offer less. For example, Interactive Brokers, Charles Schwab, and Fidelity have $0.00 commissions on stock/ETF trades.

When picking a brokerage, think about these things:

- Commission fees: Look for firms with low or no stock/ETF trade fees.

- Account types: Check the types of accounts they offer, like brokerage and retirement accounts.

- Platforms: Choose a firm with easy-to-use online, mobile, and desktop platforms.

- Asset classes: See what you can invest in, like stocks, bonds, ETFs, and options.

By looking at these points and picking a good firm, you can easily buy stock in a company and buy shares online. Always research and compare before deciding.

| Brokerage Firm | Commission Fees | Account Types |

|---|---|---|

| Interactive Brokers | $0.00 commissions on stock/ETF trades | Brokerage accounts, retirement accounts, custodial accounts |

| Charles Schwab | $0.00 commissions on stock/ETF trades | Brokerage accounts, retirement accounts, custodial accounts |

| Fidelity | $0.00 commissions on stock/ETF trades | Brokerage accounts, retirement accounts, custodial accounts |

Setting Up Your Brokerage Account

To start buying stocks, you first need a brokerage account. You'll need to give out some personal info, like your Social Security number and driver's license. You'll also share your financial situation and what you want to achieve with your investments.

When you figure out how to buy individual stocks, you'll see many options. Brokers offer different services, like research and trading in foreign markets. You can add money to your account in several ways, including electronic transfers and checks.

Some brokers don't charge for stock trades, while others might charge a small fee. Here are some important things to think about when setting up your account:

- Account minimums: Some firms have a minimum of $1, while others have no minimum requirement.

- Commission fees: These can range from $0 for online equity trades to $74.95 per trade for mutual funds not on the no-transaction-fee list.

- Retirement account options: You can choose from Traditional IRAs, Roth IRAs, and other special options for self-employed individuals, such as SIMPLE IRAs, SEP IRAs, and individual 401(k)s.

Fundamental Analysis of Stocks

When you think about buying shares, it's key to do a deep dive into the company's finances. Look at the income statement, balance sheet, and cash flow statement. This helps figure out what the stock is really worth. Knowing how to buy shares online and checking a company's health lets investors make smart choices.

Important ratios like the price-to-earnings (P/E) ratio, earnings per share (EPS), and return on equity (ROE) are vital. They show how well a company is doing and how it stacks up against others. For instance, a low P/E ratio might mean the stock is a good deal.

Some important steps in this analysis are:

- Reviewing financial statements to assess a company's revenue, expenses, and net income

- Calculating key ratios to evaluate a company's performance and valuation

- Assessing the company's management team and industry trends

By following these steps and doing a detailed analysis, investors can make smart choices. This helps them find the right stocks to buy online, matching their investment goals.

Technical Analysis Essentials

Understanding technical analysis is key when buying stock. It helps investors make smart choices by looking at price trends. To start, learning to read stock charts and spot indicators like moving averages and the Relative Strength Index (RSI) is important. This knowledge helps investors navigate the market better and make informed stock purchases.

Technical analysis uses price and volume to predict future stock movements. It examines how supply and demand impact price changes. By using technical tools, investors can spot short-term trading signals. For instance, the technical analysis for stock article on Appreciate Wealth offers great insights.

Some important indicators to keep an eye on include:

- Moving Averages (MA)

- Relative Strength Index (RSI)

- Moving Average Convergence Divergence (MACD)

- Bollinger Bands

Knowing these indicators and how to use them is vital. It helps investors create a solid investment plan. This plan combines both fundamental and technical analysis. It aids in making better stock purchases and reaching long-term financial goals.

How to Place a Stock Order

Buying and selling stocks requires understanding how to place a stock order. It's not just about picking which stocks to trade. You also need to know about different types of orders and when to use them. For new traders, finding the right place to buy stocks is key to a good trading experience.

Types of Stock Orders Explained

There are many types of stock orders, each with its own purpose. Market orders are filled right away but don't promise a certain price. Limit orders, by contrast, set a specific price you're willing to pay or sell for, but they might not be filled right away. Knowing about these and other orders, like stop-loss orders, is important for managing risk and making the most of your trades.

Some important things to remember when placing stock orders include:

- Market orders execute immediately at the current market price.

- Limit orders allow investors to set a specific buying price, useful for those looking to buy shares in a company at a particular price.

- Stop-loss orders help manage risk by triggering a market order once a specific stock price is reached.

Timing Your Orders

Timing is critical when it comes to stock orders. Knowing when to use a market order versus a limit order can greatly affect your returns. Buying stocks at the right time can be more profitable than others. Using the best online brokerages for beginners can offer tools and resources to help time orders well.

Strategies for Buying Stocks

Buying stocks needs a good strategy. Two key methods are dollar-cost averaging and value investing. Dollar-cost averaging means investing a set amount regularly, no matter the market. This helps avoid emotional choices and smooths out market ups and downs.

Value investing looks for stocks that are underpriced but have great growth chances. It involves deep analysis of a company's finances and industry trends. This way, investors can pick stocks that are likely to do well in the future.

When buying stocks, consider these important points:

- Look at the company's financial health and growth chances

- Check the industry trends and competition

- Think about the overall market and economy

By using a smart approach to buying stocks, investors can make wise choices. This helps them reach their long-term financial goals.

Monitoring Your Investments

After investing in stocks, it's key to keep an eye on them. Use online tools like Empower, SigFig, or Sharesight to track your portfolio. These sites offer features to help you understand how your investments are doing.

It's important to think about your financial goals and how much risk you can take. Use the how do i invest in stocks online tools to make smart choices. You can also use how can i buy stock in a company and how to buy shares online features to tweak your portfolio.

When checking on your investments, look at a few important numbers. These include:

- Revenue and net income

- Earnings per share and price-earnings ratio

- Return on equity and return on assets

By keeping an eye on these numbers and making changes when needed, you can keep your investments on track. This way, they'll match your financial goals and how much risk you're okay with.

Resources for Ongoing Education

Investing in the stock market is a journey that never ends. As a beginner, it's key to keep learning. There are many resources to help you stay updated and improve your investment skills. You can find books, online courses, and forums to learn from.

Books, Courses, and Websites

Books like "A Random Walk Down Wall Street" by Burton Malkiel and "The Intelligent Investor" by Benjamin Graham are must-reads. Online platforms like Coursera, edX, and Udemy have courses for all levels. Websites likeCNBC, The Motley Fool, and Investopedia offer news, analysis, and learning tools.

Communities and Forums for Investors

Joining communities is a great way to learn more. Sites like Reddit's r/investing, StockTwits, and forums are full of discussions and tips. These places are great for networking and getting answers to your questions.

Remember, learning is key to making smart investment choices. Use the many resources out there to build a strong foundation. This will help you make better investment decisions over time.

FAQ

What is the stock market and how does it work?

The stock market is where companies sell their stocks. It works on supply and demand. Prices change as people buy and sell.

What are the different types of stocks I can buy?

You can buy common, preferred, growth, and dividend stocks. Each type has its own traits and benefits.

How do I prepare for buying stocks?

First, check your finances and set investment goals. Make sure you have an emergency fund ready.

How do I choose a brokerage firm?

Look at the type of brokerage and fees. Consider the services and features they offer.

What documents and information do I need to set up a brokerage account?

You'll need personal info, job details, and bank account info to open an account.

How do I analyze stocks using fundamental and technical analysis?

Fundamental analysis looks at a company's financials. Technical analysis reads stock charts and trends.

What are the different types of stock orders I can place?

You can place market, limit, and stop-loss orders. Each has its own use and timing.

What are some popular strategies for buying stocks?

Dollar-cost averaging and value investing are popular. They involve investing at set intervals and finding undervalued stocks.

How often should I monitor and adjust my investment portfolio?

Review your portfolio every few months or a year. Adjust it to keep your investment strategy on track.

What resources are available for ongoing education on stock investing?

There are books, online courses, websites, and forums for learning. They offer support and knowledge for investors.