Industry-Specific P/E Ratio Benchmarks for Financial Professionals

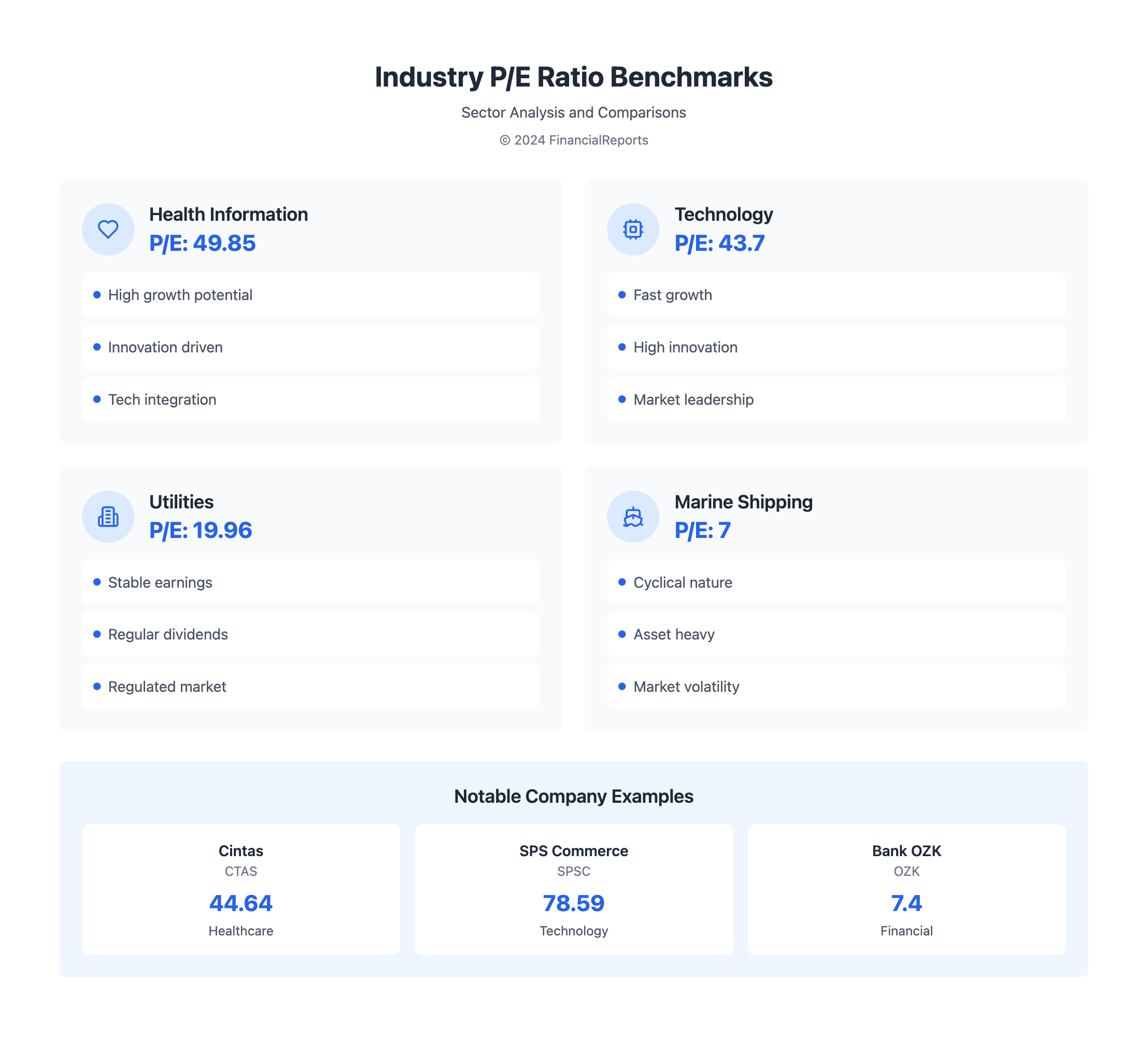

For financial pros, knowing the normal p e ratios by industry is key. This knowledge helps them make smart investment choices. The Health Information Services industry tops the list with a P/E ratio of 49.85. On the flip side, Marine Shipping has the lowest at 7.

Calculating the P/E ratio involves dividing a company's stock price by its earnings per share (EPS). It shows how much investors are willing to pay for each dollar of earnings. This method is vital for analyzing financial data and making informed decisions.

Introduction to P/E Ratios

Financial experts use the pe ratio by industry sector to check market valuations and spot chances. The average P/E ratio varies a lot between industries. This is because of different growth prospects, cyclicality, and economic cycles.

Key Takeaways

- Understanding normal p e ratios by industry is key for smart investment choices.

- The pe ratio by industry sector changes a lot between different industries.

- Knowing the average pe ratio by sector is vital for checking market valuations.

- The P/E ratio is a data-driven tool for analyzing financial data.

- Financial experts rely on pe ratio by industry sector for market valuations and finding opportunities.

- Normal p e ratios by industry, pe ratio by industry sector, and average pe ratio by sector are key for checking market valuations.

- Industry-specific P/E ratio benchmarks help financial pros make smart investment choices.

Understanding P/E Ratios and Their Importance

The price earnings ratio by sector is key for financial experts. It shows the value of a company's shares. The pe ratios by industry compare companies in the same field. For example, the S&P 500's P/E ratio has varied from about 6 in 1949 to 122 in 2009.

A high P/E ratio might mean a stock is overvalued or investors expect high growth. A low P/E ratio could mean the stock price is too low compared to earnings. To find the P/E ratio, you divide the stock's price by its earnings per share. For instance, a stock at $20 with $1 earnings per share has a P/E ratio of 20.

Definition of Price-to-Earnings Ratio

The price-to-earnings ratio (P/E) is a way to value a company. It shows how much investors pay for each dollar of earnings. You get it by dividing the stock's market value by its earnings per share.

Significance of P/E Ratios in Valuation

P/E ratios are vital for comparing companies across industries. They help investors see if a company is fairly valued. For example, Hess Corporation has a P/E ratio of 31.64, while Marathon Petroleum Corporation has a P/E ratio of 7.19.

Common Misconceptions About P/E Ratios

Some think a high P/E ratio always means a stock is overvalued. But, a low P/E ratio doesn't always mean it's undervalued. P/E ratios can be affected by many things, like earnings consistency and industry trends. It's better to compare a company's P/E to its past or to similar companies in its industry.

| Company | P/E Ratio |

|---|---|

| Hess Corporation | 31.64 |

| Marathon Petroleum Corporation | 7.19 |

An Overview of Normal P/E Ratios by Industry

The average pe ratio by industry can vary a lot. For example, the Health Information Services industry had a high average P/E ratio of 49.85 as of Dec 2024. On the other hand, the Marine Shipping industry had the lowest at 7.0. This shows why it's key to look at the pe ratio average by industry when picking investments.

Many things affect the P/E ratios across different sectors. These include growth chances, risk levels, and special traits of each industry. The average pe by industry changes because of these factors, leading to different P/E ratios for each sector. Knowing these factors helps investors make better choices when comparing companies in the same field.

Variability Across Different Sectors

Industries like tech and healthcare often have higher average P/E ratios. This is because they have a lot of growth and innovation. On the other hand, industries like finance and consumer goods usually have lower P/E ratios. By understanding these differences, investors can better judge the value of companies in each sector and make smarter investment choices.

Historical Trends in P/E Ratios

Looking at historical trends in P/E ratios can give us important insights. It helps us understand the current market and the average pe ratio by industry. By studying these trends, investors can spot patterns and make better guesses about the future market.

Technology Sector P/E Ratios

The technology sector is known for its high growth and often high valuations. This leads to higher normal pe ratios by industry compared to others. As of December 2024, the S&P 500 Information Technology Sector's P/E Ratio is 38.37. This shows a trend of increasing valuation.

The typical pe ratio by industry has ranged from 25.8x to 33x in recent data. This range highlights the sector's high valuations.

Earnings per share average by industry is a key factor in determining P/E ratios. In the technology sector, companies like Broadcom (AVGO), NVIDIA (NVDA), and Apple (AAPL) have shown significant growth. This growth contributes to the sector's high P/E ratios.

The industry's current PE ratio is 51.2x, higher than the 3-year average of 39.8x. This shows the sector's high valuations.

Some key trends in the technology sector include:

- Semiconductors have been the most optimistic industry within the U.S. Tech sector, trading above its 3-year average PE ratio of 39.9x.

- Analysts have forecasted annual earnings growth of 27% for the Semiconductors industry.

- The Electronic Equipment and Components industry has shown improved investor sentiment.

These trends show the dynamic nature of the technology sector. They impact normal pe ratios by industry. By understanding these trends, financial professionals can make informed investment decisions.

Healthcare Industry P/E Ratios

The healthcare industry stays stable even when the economy changes. This stability leads to steady earnings and affects P/E ratios. As of December 2024, the S&P 500 Health Care Sector's P/E Ratio is 32.94. This is higher than other sectors, showing investors' high hopes for healthcare.

Some top us stocks with high pe ratio in healthcare are Cintas (CTAS) with a P/E ratio of 44.64, SPS Commerce (SPSC) with 78.59, and Everi Holdings (EVRI) with 90.13. These companies highlight the different pe multiples by sector and the growth possibilities in healthcare.

Here is a summary of P/E ratios for some major healthcare companies:

- Healthcare Services Group, Inc.: 14.41

- Cintas (CTAS): 44.64

- SPS Commerce (SPSC): 78.59

- Everi Holdings (EVRI): 90.13

These companies have P/E ratios ranging from low to very high. This shows the healthcare industry's diversity and the different growth and return expectations.

Knowing the average price to earnings ratio by industry and pe multiples by sector helps investors make smart choices. By looking at the P/E ratios of top us stocks with high pe ratio, investors can spot chances for growth and returns.

Financial Services P/E Ratios

The financial services sector is very diverse. Normal p e ratios by industry can differ a lot. As of December 2024, the average P/E ratio for financial institutions is 8.61. This is lower than many other sectors, suggesting they might be undervalued.

Many factors can affect the pe ratio by sector. These include interest rates, the regulatory environment, and economic cycles.

Some notable financial institutions and their P/E ratios include:

- Webster Financial (WBS): 10.32

- Bank OZK (OZK): 7.40

- Valley National Bancorp (VLY): 12.85

These examples show how different the pe ratio by industry sector can be in the financial services industry. It's important for financial professionals to understand these ratios to make good investment choices.

Looking closer at the data, we see the financial services sector has a Shiller P/E ratio of 20.00 and a Regular P/E ratio of 16.90. This is lower than other sectors, like Technology. The Technology sector has a Shiller P/E ratio of 60.20 and a Regular P/E ratio of 43.70.

| Sector | Shiller P/E Ratio | Regular P/E Ratio |

|---|---|---|

| Financial Services | 20.00 | 16.90 |

| Technology | 60.20 | 43.70 |

By studying the normal p e ratios by industry and pe ratio by sector, financial professionals can learn a lot. They can use this knowledge to make smart investment decisions.

Consumer Goods Sector P/E Ratios

The consumer goods sector includes many products, like household items and food. It's important to look at the price earnings ratio by sector during economic changes. The average pe ratio by sector helps us understand how valued these companies are.

Brand loyalty plays a big role in the price earnings ratio by industry in this sector. Brands with loyal customers often have higher P/E ratios. For example, the Household & Personal Products industry had an average P/E ratio of 28.58 as of Dec 2024. This shows strong demand and brand value.

Some well-known brands and their P/E ratios are:

- Nestle S.A. - 25.97

- PepsiCo, Inc. - 25.49

- Anheuser-Busch InBev - 30.04

Knowing the average pe ratio by sector and price earnings ratio by sector is key for financial experts and investors. By studying the price earnings ratio by industry, they can spot trends and chances in the consumer goods sector.

Utilities and Their P/E Ratio Norms

The Utilities sector is known for its stability and consistent dividends. This affects its pe ratios by industry. As of December 2024, the Utilities - Regulated Electric industry had an average pe ratio by industry of 19.96. This shows the sector's predictable earnings.

The pe ratio average by industry for Utilities companies is influenced by many factors. These include regulatory changes and market conditions. The sector's stability and growth are reflected in its pe ratios by industry. For example, the Gas Utilities industry has a pe ratio close to its 3-year average of 26.7x. On the other hand, Other Utilities are trading below their historical average of 24.0x.

Some notable companies in the Utilities sector include NEE NextEra Energy, PCG PG&E, SRE Sempra, XEL Xcel Energy, and EXC Exelon. These companies have shown significant stock gains in the last 7 days. Their pe ratios by industry are influenced by their individual growth prospects and market conditions. It's essential for financial professionals to monitor these metrics closely.

To evaluate the Utilities sector's pe ratios by industry, financial professionals should consider several factors:

- Regulatory changes and their impact on the sector's stability

- Market conditions and their effect on the sector's growth

- Individual company performance and growth prospects

By analyzing these factors and considering the pe ratio average by industry, financial professionals can make informed investment decisions in the Utilities sector.

Real Estate and P/E Ratio Insights

The real estate sector has its own way of valuing things. It's important to look at the average P/E ratio by industry. For example, the REIT - Residential industry had an average P/E ratio of 33.79 as of Dec 2024. This is higher than many other sectors.

To understand real estate's P/E ratios, let's compare them to other industries. Here are some key points to consider:

- The real estate sector is often compared to other sectors, such as technology or healthcare, to determine its relative valuation.

- The normal pe ratios by industry can vary significantly, with some industries having much higher or lower P/E ratios than others.

- The typical pe ratio by industry is also influenced by factors such as earnings growth, interest rates, and market sentiment.

Major real estate firms, such as Real Estate Investment Trusts (REITs), shape the industry's P/E ratios. By analyzing the average P/E ratio by industry, investors can better understand the real estate sector's valuation. This helps them make more informed investment decisions.

Energy Sector: P/E Ratio Dynamics

The energy sector is known for its ups and downs and how much it depends on commodity prices. As of Dec 2024, the Oil & Gas E&P industry had an average P/E ratio of 11.45. This is lower than many other sectors. This is because the sector is very volatile and oil prices greatly affect its value.

When looking at pe multiples by sector, it's key to see the differences between exploration and production companies. Exploration companies usually have higher P/E ratios because they have more growth. Production companies have lower ratios because they have more stable cash flows. Top US stocks with high PE ratio in the energy sector often include companies with big growth chances or those that have made important discoveries.

Key factors that affect P/E ratios in the energy sector include:

- Oil price changes

- How much it depends on commodity prices

- How capital-intensive and risky it is

- Growth chances and rules from regulators

These factors make the sector's P/E ratio unique. It's very important for financial experts to know these specific traits when checking valuations.

| Industry | Average P/E Ratio |

|---|---|

| Oil & Gas E&P | 11.45 |

| Technology | 20-30x |

| Financials | Mid-teens |

By looking at pe multiples by sector and understanding what affects P/E ratios, investors can make better choices when looking at energy sector stocks.

Telecommunications Industry P/E Ratios

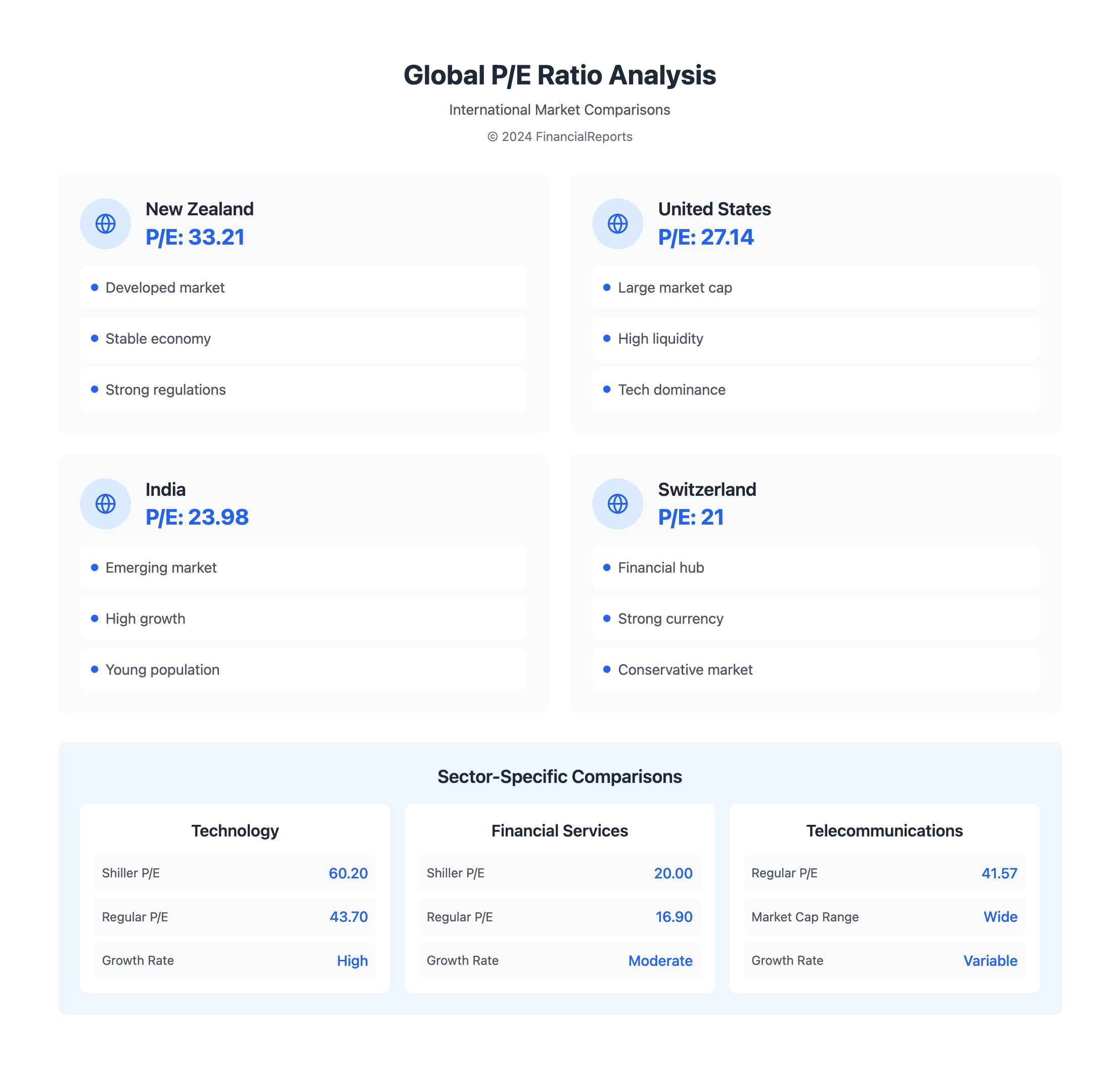

The telecommunications industry has a high average P/E ratio of 41.57 as of Aug 2024. This shows the sector's high capital investments and growth hopes. It's key to look at the pe ratio by sector to see how it varies.

According to investopedia, the sector has seen fast growth, deregulation, and tech advances. These factors make it special to study. The average price to earnings ratio by industry changes based on market and company performance.

Here are some key statistics for the telecommunications industry:

- The top companies in the telecommunications industry have P/E ratios ranging from 0.65 to over 1000.

- The companies are from various countries, including the USA, India, Switzerland, and South Korea.

- Market capitalization values range from a few dollars to several thousand dollars.

The pe ratio by sector helps compare companies in the same field. It shows what the market expects for earnings growth. In the telecommunications industry, the normal p e ratios by industry can differ a lot. It's important to understand the sector's traits and trends.

| Company | P/E Ratio | Market Capitalization |

|---|---|---|

| Meta Platforms | 27.3x | $850 billion |

| Alphabet | 25x | $1.3 trillion |

| T-Mobile US | 25x | $170 billion |

Evaluating International P/E Ratios

When looking at international P/E ratios, it's key to notice the differences in economic growth, market maturity, and investor feelings. The pe ratio by industry sector changes a lot, with some countries having higher or lower ratios. For example, the U.S. has an average pe ratio by sector of about 27.14, while India's is around 23.98.

Comparing P/E ratios between the U.S. and global markets shows interesting points. The price earnings ratio by sector can be affected by many things. This includes rules, market conditions, and currency changes. Here's a table showing P/E ratios for different countries:

| Country | P/E Ratio |

|---|---|

| New Zealand | 33.21 |

| United States | 27.14 |

| India | 23.98 |

| Switzerland | 21.00 |

By looking at P/E ratios across countries and sectors, financial experts can better understand global market trends. This helps them make smarter investment choices. The pe ratio by industry sector and average pe ratio by sector are key indicators. They show how valued a company or sector is, helping investors spot chances or risks.

Conclusions and Best Practices for Professionals

Looking into price-to-earnings (P/E) ratios is key for financial experts. It helps them check market values and find good investment spots. Knowing the P/E ratios for different industries helps them spot stocks that might be too cheap or too expensive.

To use P/E analysis well, it's important to watch how markets change. These changes affect P/E ratios in different ways. By keeping an eye on trends and new research, experts can adjust their plans and find new chances.

For ongoing P/E ratio studies, experts have many tools at their disposal. They can use industry journals, financial databases, and expert opinions. With this info and a good grasp of their sectors, they can improve their investment tactics. This helps them make better choices, even when the market is shaky.

FAQ

What is the significance of P/E ratios in financial analysis?

P/E ratios are key in financial analysis. They show how much investors are willing to pay for a company's earnings. By comparing these ratios, experts can make smart investment choices and see how companies in the same field are valued.

How do P/E ratios vary across different industries?

P/E ratios change a lot between industries. This is because of things like growth chances, risk levels, and what's special about each industry. Looking at past trends and how market conditions affect these ratios helps us understand valuations better.

Why do technology companies typically have higher P/E ratios?

Tech companies usually have high P/E ratios because investors expect them to grow fast and innovate. Comparing the P/E ratios of new tech startups and established ones helps us see why valuations differ in the tech world.

How do P/E ratios in the healthcare industry differ from other sectors?

Healthcare companies often have stable earnings, which affects their P/E ratios. Regulatory changes also play a big role in how these companies are valued. This is something to think about when looking at healthcare P/E ratios.

What factors influence P/E ratios in the financial services sector?

In the financial services sector, P/E ratios are shaped by interest rates, rules, and the economy. It's important for financial experts to understand how interest rates affect these ratios when they're looking at valuations in this field.

How do consumer confidence and spending patterns affect P/E ratios in the consumer goods sector?

The consumer goods sector's P/E ratios are influenced by the economy, consumer confidence, and spending. Brand loyalty helps keep the P/E ratios of well-known brands high. This is something to consider in this industry.

What unique characteristics of the utilities sector influence its P/E ratios?

The utilities sector is known for being stable and having consistent dividends, which affects its P/E ratios. Understanding the balance between stability and growth is key to grasping valuation trends in utilities.

How do earnings growth and the role of REITs impact P/E ratios in the real estate sector?

The real estate sector's P/E ratios are shaped by earnings growth and REITs. Looking at the differences in P/E ratios between real estate companies and other sectors gives us valuable insights into this industry's valuations.

What is the relationship between oil prices and P/E ratios in the energy sector?

The energy sector's P/E ratios are closely tied to oil prices. Changes in oil prices greatly affect energy company valuations. Comparing the P/E ratios of exploration and production companies helps us understand the risks and costs in this sector.

How do factors like market competition and technology investments affect P/E ratios in the telecommunications industry?

The telecommunications industry faces tough competition and profit challenges, which can affect its P/E ratios. Big tech investments, like 5G, also play a role. They impact the balance between spending now and future growth, shaping what investors expect and value.

What are the key considerations when evaluating P/E ratios in an international context?

When looking at P/E ratios globally, economic growth, rules, and market maturity are important. Currency changes and global risks also affect these ratios. Financial experts need to consider these factors when analyzing global P/E ratios.