Improving Your Financial Performance Guide

Financial performance is key for any business. It's about making strong monthly cash flow. Companies like Apple have shown success, with a 31.5% profit margin in 2022.

Financial statements like income and cash flow statements help track this. Managing expenses and labor costs well can boost a company's finances. This leads to better performance and growth.

Forbes Finance Council members say good financial performance comes from a whole approach. This includes strategic planning, being efficient, managing risks, and focusing on customers. By using these strategies, businesses can improve their finances and succeed in the long run.

Understanding and using these strategies is vital. It helps make smart choices about growing the business and investing. Looking at different financial data is key to finding ways to get better.

Key Takeaways

- Financial performance is measured by generating strong monthly cash flow and is critical for business success.

- Effective management of operating expenses and labor costs is essential for driving financial performance.

- Strategic planning, operational efficiency, risk management, and customer-centricity are key components of good financial performance.

- Analyzing financial data, such as income statements and cash flow statements, is critical for identifying areas for improvement.

- Setting realistic and measurable goals is essential for improving financial performance and achieving long-term success.

- Optimizing revenue streams and managing expenses effectively can significantly improve financial performance.

- Regularly reviewing and analyzing financial results helps in identifying gaps and areas for improvement in financial performance.

Understanding Financial Performance Metrics

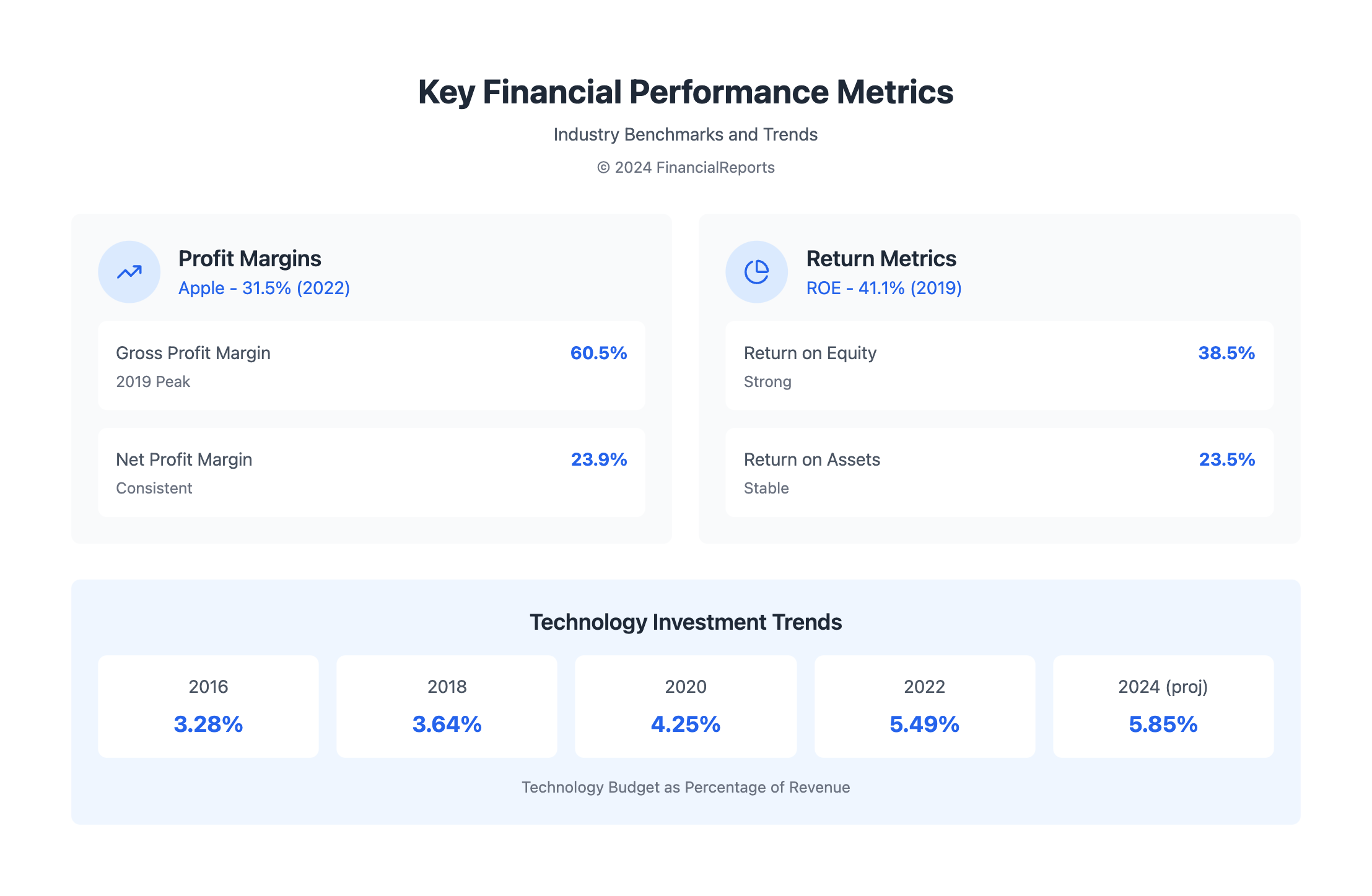

Financial performance metrics are key to checking a company's health and making smart choices. They include things like revenue growth, profit margins, and return on investment. By looking at these, experts can spot where to get better and plan for better finances.

Some important financial performance metrics are:

- Gross Profit Margin: shows what's left after sales costs are taken out

- Net Profit Margin: shows net profit as a share of sales

- Return on Equity (ROE): shows how well equity brings in profits for investors

- Return on Assets (ROA): shows how well assets make profits

For instance, let's look at The Coca-Cola Company's financial health. We can use their financial statements to figure out their gross profit margin, net profit margin, and return on equity. This helps experts see trends and where to improve, like the drop in net operating revenues and gross profit from 2019 to 2020.

| Financial Metric | 2019 | 2020 |

|---|---|---|

| Gross Profit Margin | 60.5% | 59.2% |

| Net Profit Margin | 23.9% | 23.5% |

| Return on Equity (ROE) | 41.1% | 38.5% |

By understanding and analyzing financial performance metrics, companies can make smart choices to improve their finances and reach their goals.

Analyzing Your Current Financial Health

To manage your finances well, you need to understand your current financial state. Look at your gross profit margin, net profit margin, and coverage ratio. These metrics help you see where you're doing well and where you need to improve.

When you analyze your finances, check liquidity, solvency, efficiency, and profitability. Use ratios like the current ratio and debt-to-equity ratio. A quick ratio under 1.0 might signal liquidity problems. But a low debt-to-equity ratio means you rely more on shareholders, which is good for the long run.

Using financial management tools helps you understand your financial health better. You can do a SWOT analysis and review income and cash flow statements. This way, you can spot chances to boost your finances and meet your business goals.

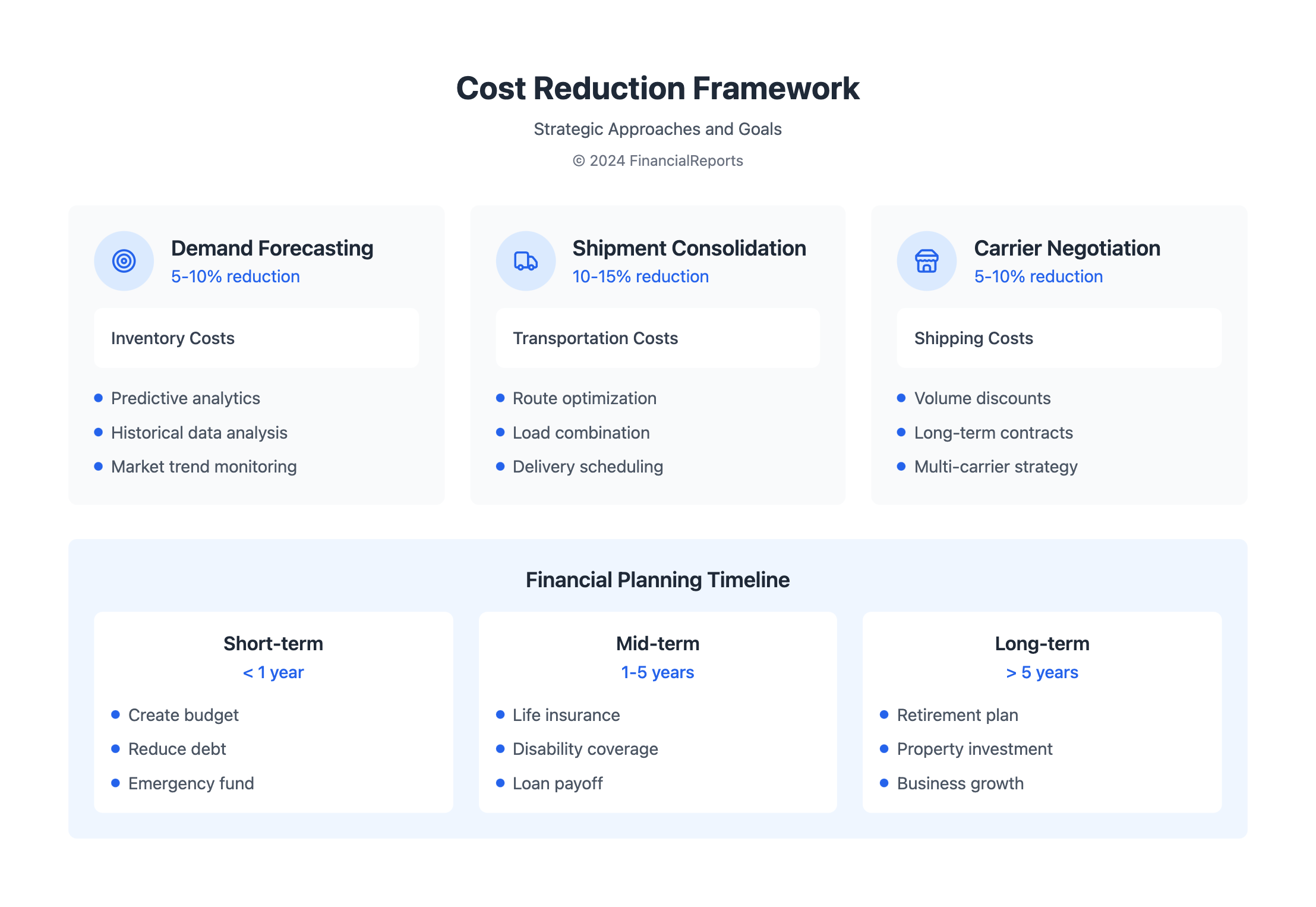

Setting Clear Financial Goals

Setting clear financial goals is key to success. It helps you plan your financial future and stay focused. Goals should be specific, measurable, and have deadlines.

Financial reports are vital for tracking progress and making smart choices. Start with short-term goals like budgeting, paying off debt, and saving for emergencies. Then, focus on midterm goals like getting insurance and paying off student loans.

SMART Goal Framework

The SMART goal framework is great for setting realistic goals. It stands for Specific, Measurable, Achievable, Relevant, and Time-bound. This framework helps you plan and track your progress.

Regularly check your financial reports to stay on track. This way, you can adjust your plans as needed.

| Financial Goal | Timeframe | Actions |

|---|---|---|

| Short-term | Less than 1 year | Create a budget, reduce debt, establish an emergency fund |

| Midterm | 1-5 years | Get life insurance, disability income insurance, pay off student loans |

| Long-term | More than 5 years | Plan for retirement, save for a down payment on a house |

By setting clear goals and using the SMART framework, you can plan for financial success. Regularly reviewing your financial reports helps you stay on track and make smart choices.

Budgeting for Success

Effective budgeting is key to strong financial health. It means making plans for income and expenses, tracking them, and adjusting the budget as needed. This way, people and businesses understand their finances better and make smart choices.

To make a good budget, you must look at your spending and decide what's most important. List your expenses in order of need and find ways to cut costs. It's also wise to save 10 percent of what you earn and have three months' worth of income saved for emergencies. Regularly checking your budget helps you stick to your financial goals and make changes when necessary.

Some important things to remember when budgeting include:

- Evaluating expenditures and prioritizing them

- Saving for emergencies and long-term goals

- Monitoring the budget regularly to ensure adherence and make adjustments as needed

By following these tips and making a detailed budget, you can better manage your finances. This leads to less financial stress and better financial health overall.

Strategies for Cost Reduction

To boost financial health, companies must look closely at their spending. Labor costs are often the biggest expense, showing the need to improve how work is done. Using data and financial tools helps find where money can be saved and how to use resources better.

There are many ways to cut costs. For example, planning better, managing inventory smartly, and combining shipments can help. Also, talking down rates with carriers, using lean methods, and digital tools like predictive analytics can make supply chains more efficient and cheaper. Here are some main ways to save money:

- Demand forecasting to optimize inventory levels

- Consolidation of shipments to reduce transportation costs

- Negotiating with carriers to secure better rates

- Implementing lean manufacturing principles to minimize waste

- Utilizing digital solutions to enhance supply chain visibility and efficiency

By trying these methods and keeping an eye on finances, businesses can save a lot. This can lead to better financial health and growth over time. As Forbes Finance Council members say, looking closely at labor costs and making work more efficient is key to doing well and saving money.

| Cost Reduction Strategy | Expected Savings |

|---|---|

| Demand forecasting | 5-10% reduction in inventory costs |

| Consolidation of shipments | 10-15% reduction in transportation costs |

| Negotiating with carriers | 5-10% reduction in shipping costs |

Revenue Enhancement Techniques

Boosting revenue is key for financial health. Forbes Finance Council members say spreading out income is vital. This way, you're not too dependent on one thing. Information of the financial performance is provided by many sources, like financial reports and market studies.

Companies can try different ways to make more money. This includes having more income sources, smart pricing, and selling more to customers. Financial performance measures like ROI and profit analysis help see if these plans work. Some top ways to increase revenue are:

- Diversifying income streams to reduce risks

- Using smart pricing based on market and competitor data

- Upselling and cross-selling to get more from customers

Using data and automation can make pricing and revenue better. For instance, a company can find ways to cut costs and make more money. This leads to better information of the financial performance is provided by many people.

| Revenue Enhancement Technique | Description |

|---|---|

| Diversifying Income Streams | Mitigating risks by diversifying income streams |

| Effective Pricing Strategies | Implementing pricing strategies based on market data and competitor analysis |

| Upselling and Cross-Selling | Maximizing customer value through upselling and cross-selling |

Investing in Technology

Investing in technology is key to boosting financial performance. Forbes Finance Council members say that smart policies and procedures help keep productivity high. They also suggest automating tasks to grow your business.

Using advanced software and tools can make operations smoother. This leads to better financial management and efficiency.

Technology can help in several ways, including:

- Automating financial reporting and analysis

- Streamlining accounts payable and accounts receivable processes

- Improving budgeting and forecasting capabilities

Financial experts can make processes better, cut down on mistakes, and stay ahead by using technology. The Dutch Chamber of Commerce shows that tech spending has grown from 30% to over 40% of the budget. This shows technology's role in business success.

| Year | Tech Budget as a Percentage of Revenue |

|---|---|

| 2016 | 3.28% |

| 2018 | 3.64% |

| 2020 | 4.25% |

| 2022 | 5.49% |

| 2024 (projected) | 5.85% |

Engaging Stakeholders in Financial Performance

Getting stakeholders involved is key to improving financial performance. Forbes Finance Council members say clear talk and openness with everyone are vital. Financial performance reports are important for giving stakeholders the info they need to make smart choices.

The information of the financial performance comes from many places, like financial statements. To get stakeholders on board, it's important to share this info in a simple way. Use charts and graphs to make complex numbers easier to understand. Keeping stakeholders updated regularly helps build trust.

Here are some ways to get stakeholders involved in financial performance:

- Give regular financial updates and reports

- Use visual aids to make complex data simple

- Encourage feedback and two-way communication

- Show transparency and be genuine in your communication

| Strategy | Benefits |

|---|---|

| Regular financial updates | Boosts stakeholder engagement and trust |

| Visual aids | Makes complex data easy to understand |

| Two-way communication | Encourages feedback and strengthens relationships |

Regularly Reviewing and Adjusting Strategies

Keeping your finances flexible is key in today's fast-changing business world. By checking and tweaking your financial plans often, you keep your business strong and ready to adapt. This part stresses the need for ongoing improvement in your financial health.

The Importance of Continuous Improvement

Checking your financial health regularly gives you important insights. Using data tools to spot trends helps you make smart choices. Looking over your budgets, cash flow, and risk plans keeps you ready for challenges and opens up new chances.

Key Questions for Reflection

Starting your journey to better finances? Ask yourself these questions:

• Are your financial plans in line with your business goals?

• Can you cut costs or make more money?

• Are you managing your cash well to stay flexible?

• Have you looked into new ways to make money or set better prices?

• Are you using the best financial tech and tools to improve your work?

By answering these questions and tweaking your financial plans, you set your business up for long-term success.

FAQ

What are the key financial performance metrics covered in this guide?

This guide looks at important metrics like revenue growth and profit margins. It also covers return on investment and financial ratios. These insights help understand an organization's financial health.

How can financial professionals conduct a thorough analysis of their current financial position?

The guide teaches how to do a SWOT analysis. It also shows how to assess income statements and cash flow statements. This helps understand the organization's financial performance fully.

What strategies are discussed for setting clear and achievable financial goals?

The guide talks about short-term and long-term financial goals. It introduces the SMART goal framework. This helps set realistic and measurable targets for better financial performance.

How can financial professionals create a realistic budget that aligns with their financial goals?

The guide offers tips on forecasting income and expenses. It also shows how to monitor budget performance. This helps optimize financial management.

What strategies are covered for reducing costs and improving financial performance?

The guide explains how to use data analytics to find unnecessary expenses. It shows how to cut costs and streamline operations. This optimizes the organization's cost structure.

How can financial professionals enhance revenue and maximize financial performance?

The guide discusses diversifying income streams and pricing strategies. It also talks about upselling and cross-selling. These techniques boost revenue and improve financial outcomes.

What are the benefits of investing in financial management technology and automation?

The guide highlights the benefits of advanced financial management software and AI analytics. It shows how they streamline operations, reduce errors, and provide insights. This supports strategic decision-making for better financial performance.

How can financial professionals effectively engage stakeholders in the organization's financial performance?

The guide stresses the need for clear financial information to stakeholders. It includes investors, board members, and employees. This aligns financial goals and builds a performance-driven culture.

What is the importance of continuous improvement in financial performance management?

The guide offers a framework for regular financial reviews. It provides questions for reflection to guide improvement. This helps identify trends, anticipate challenges, and adjust strategies for sustained success.