How to Get Company Equity and Face Value Today

Getting company equity and understanding its face value is key for investors. They look at this to deeply know a company's value. To get company equity and face value, investors blend analysis and math. They find the market equity value by multiplying stock price with shares available. For example, Apple reached a huge market value of $889,867,641,600. This was using a equity value formula, with its stock at $188.72 and 4,715,280,000 shares on March 28, 2019.

To be smart in finance, one must learn how to find equity value. They should look closely at company balance sheets and use known valuation formulas. It's also important to understand market forces that affect stock prices. Knowing these things helps make smart investment choices and grow a diverse portfolio.

Key Takeaways

- Market value of equity is crucial for gauging investor valuation and can be calculated using current stock price and shares outstanding.

- Company size, based on market capitalization, categorizes firms into small caps, mid-caps, or large caps, impacting their market perception.

- Book value and enterprise value provide alternative lenses through which one can assess a firm's financial standing against market value of equity.

- Diverse valuation multiples, such as EV/EBITDA and P/E, offer varied perspectives in assessing investment potential.

- Understanding the dynamics between enterprise value and equity value is essential for comprehending how debt financing influences market valuation.

- The equity value of industry giants like Apple and its comparison to notable players such as Tesla and traditional automakers highlights the diverse scale of equity valuations across sectors.

- Leveraging precise formulas such as the Equity Value and Enterprise Value equation aids in thorough, data-driven investment analysis.

Understanding Company Equity

Company equity is key to a business's financial health and value. It shows the part of the company that goes back to shareholders after paying off debts. It changes with the market price and how many shares are out there. Knowing this helps us see how much investors think the company is worth.

What is Company Equity?

The formula for equity value is simple: Share Price x Number of Shares Outstanding. It tells us the company's worth according to stakeholders. This formula can adjust for dilutive securities. It helps in giving a detailed value in cases like company takeovers.

Types of Company Equity

It's important to know the kinds of company equity. It helps investors pick companies by size and growth chances. Here's a short list:

- Common Stock: Means owning a part of the company and voting on big decisions.

- Preferred Stock: Usually no vote, but you get a steady dividend.

- Retained Earnings: Profit not given out as dividends but used in the company.

- Treasury Shares: Stock bought back by the company, reducing available shares.

Importance of Equity in Business

Equity means more than just numbers. It shows how well a company is doing and its growth future. High equity means people believe in the company. Yet, equity can be different from book value, especially with intangibles. This difference might show hidden investment chances.

There are many ways to boost company equity. This includes private equity with complex deals like buyouts. Such moves are led by big investors and are key in growth, mainly in tech and startups.

So, knowing about equity helps in making smart investment choices. It also helps us see the big picture in corporate finance and investment today.

What is Face Value in Finance?

In exploring finance, the term "face value" is vital. It helps tell apart the nominal value of securities from their market value. Understanding the definition of face value is key for finance professionals. It impacts investment choices and managing corporate finances.

Definition of Face Value

Face value, or par value, is the original value printed on a security. This could be a bond or stock issued to the market. Unlike market value, face value stays the same. Bonds, for example, often have a $1,000 face value. This amount is what the issuer pays back when the bond matures. Stocks may have a face value like AT&T Inc.'s $1 per share. Here, face value mainly serves for bookkeeping and affects the stock's price less.

Relation Between Face Value and Market Value

The relation between face value and market value is crucial in finance. Face value is the security's original value upon issue. Market value, however, shows what it's worth now. This value changes, affected by how investors see the company, its performance, and the economy. For instance, Apple Inc.'s shares closed at $193.12 on June 10, 2024. This price is way above its nominal par value of $0.00001. This shows the big gap that can occur between face value and market value.

| Security Type | Face Value | Market Value (As of June 10, 2024) |

|---|---|---|

| Apple Inc. Shares | $0.00001 | $193.12 |

| AT&T Inc. Shares | $1.00 | Data Not Provided |

| Standard Corporate Bonds | $1,000 | Varies with market conditions |

In conclusion, both face value and market value are essential to investors and analysts. Knowing how these two values relate helps in managing portfolios and making investment decisions. It leads to better planning and assessments in line with market changes.

How to Calculate Company Equity

Understanding company equity and face value is key in finance. This part covers the equity value formula and many common valuation methods. These tools help investors a lot.

The Equity Formula Explained

The main way to figure out equity value is simple. Subtract total debts from total assets. This method gives the net financial value of a company. Lets take a company's finance report. Say it shows $500 million in assets and $300 million in debts. Then,

- Total Assets: $500 million

- Total Liabilities: $300 million

- Equity = Total Assets - Total Liabilities = $200 million

This tells us what the company's real value is. It's vital info for investors and analysts.

Common Methods of Valuation

There are more ways than just the basic equity formula. Each method offers deep insights. They show a business's value and potential:

- Market Capitalization: Used for firms on the stock market. It's the share price times the share count. For instance, a firm with 1 million shares at $30 each is worth $30 million.

- Book Value: Gives a cautious look at value. It divides equity by share count.

- Enterprise Value: A broad angle that adds market cap and total debt, minus cash. Great for evaluating buyouts.

Together with knowing how to get company equity and face value, these methods help in making smart investment choices. They let stakeholders accurately see a company's financial health.

Steps to Acquire Company Equity

To get company equity, follow some important steps. This combines knowing about finance and market studies. It's all about understanding the important parts that influence your investment.

Evaluate Investment Options

First, look at all investment choices available. This means analyzing different types of equity and picking what matches your goals and risk comfort. For example, private company investments, like in Koch Industries or Cargill, could bring big returns. However, they need a long-term commitment and handle more risk.

Investing in public companies offers easier exit options and more fluidity. But, getting ready for fundraising and management tasks is key. These can take years, as seen in how Blackstone bought Hilton Hotels. Knowing the time and effort needed helps choose the right investment.

Research Potential Companies

Do deep research before you decide on a company. This isn't just about reading financial reports. It's also grasping market trends, industry standards, and economic climates. For private equity, looking into a company's inner workings and market stance is vital.

Spend time checking the company's assets, debts, and owner's equity. This is seen in how private equity investments usually work.

Understand Risks and Benefits

To decide wisely, fully grasp the risks and gains of equity investments. They can offer big returns if the business grows. Yet, there are risks like market changes and cash flow problems. For example, buying founder stock at very low prices poses big risks if growth doesn't happen.

Knowing about vesting in startups is also important. It means staying with the company long enough to get full benefits. Having knowledge of these risks and benefits helps in making a smart investment mix.

| Investment Type | Time Commitment | Expected Return | Risk Level |

|---|---|---|---|

| Private Equity | 4-6 years | High | High |

| Public Equity | Flexible | Varies | Medium |

| Startup Equity | 4+ years (vesting) | High (if successful) | Very High |

The table clearly shows how to match your investment style with available opportunities. It helps whether you're looking at a high-risk startup or a stable, but slower-growth, established firm. Understanding these factors is essential.

Getting Company Equity Through Stocks

Investors looking to get involved in the financial markets often buy shares. This gives them a part in a company's performance. Knowing how to figure out a share's market price is key to investing. Joining a company by participating in IPOs (Initial Public Offerings) is another way. It requires knowing what you're doing and planning well.

Buying Company Shares

To invest in company shares, knowing their value is crucial. Investors must keep an eye on things that affect this value. This includes market trends, how well the company is doing, and economic signals. Good strategies for buying shares include:

- Checking the company's financial health and growth chances often.

- Looking at outside market factors that may impact stock prices.

- Using financial advisors and tools to make smart choices.

Participating in IPOs

By investing in an IPO, investors can buy shares at the starting price before they hit the open market. IPOs can lead to big returns if the stock's value goes up after it starts being sold to the public. When thinking about IPOs, investors should think about:

- The company's future outlook and how much people want its products or services.

- The pricing strategies used during the IPO to see if it's fair and has growth potential.

- Looking at past data and market forecasts to guess how well the IPO will do.

Investing in shares or IPOs can bring good returns if done thoughtfully and with careful planning. These ways of investing don't just grow personal wealth. They also let you be a part of the growth of exciting companies.

The Role of Equity in Startups

Startups need to understand equity to grow. This involves attracting money and talent, fitting into markets, and planning for success. Equity ties closely with a startup's growth potential and strategies.

Why Startups Issue Equity

Startups give out equity to get the funds they need to expand and operate. It's a way to finance and attract skilled people. Equity can offer big returns to investors because startups are risky. Founders own everything at first but share ownership to fuel growth and development.

Different Equity Structures in Startups

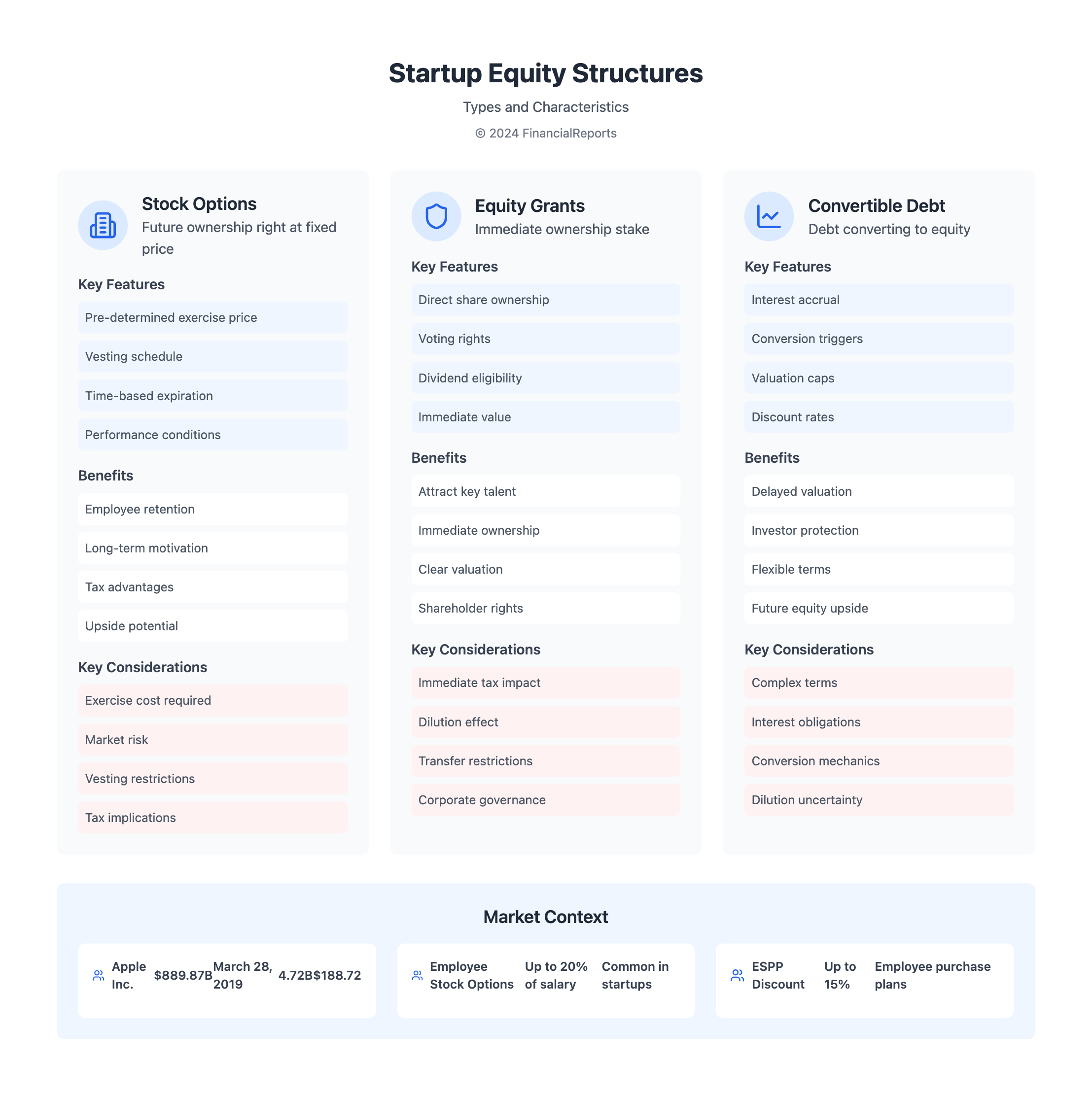

Startups have many options for managing equity. They use stock options, restricted stocks, and convertible debt for various strategies. Each choice has its own impact:

- Stock Options: They let employees buy shares later at a set price, tying them to the company longer.

- Shares and Equity Grants: They offer instant ownership, attracting top leaders and key talents.

- Convertible Debt: Used early on, this turns into equity under certain terms during more funding.

Different equity methods affect a startup's worth and investment potential. How equity is shared matters for team harmony and motivation. Founders use methods like "fix or fight" or "dynamic split" to fairly distribute equity and recognize early efforts.

| Equity Structure | Description | Common Use |

|---|---|---|

| Stock Options | Options to purchase company stock at a fixed price | Incentivizing long-term employee retention |

| Equity Grants | Direct ownership through shares at no initial cost | Attracting key executives |

| Convertible Debt | Debt that converts to equity during later financing | Early-stage funding |

The right equity structures help startups grow, align interests, and aim for success. They define the startup's value and future.

Understanding Equity Compensation

In today's world, equity compensation is a key tactic used by fast-growing companies and startups. This includes big names like Amazon. They use it to draw in, inspire, and keep the best workers. There are different types like stock options and restricted stock. Each type is designed to link employee success with the company's goals and growth.

Stock Options and Restricted Stock

Stock options and restricted stock units (RSUs) are common equity compensations. Stock options let employees buy company stock at a set price after a certain time. This encourages them to stay and work hard for the company. RSUs give employees actual stock at specific times, tied to the company's goals or how long they've worked there.

There are two main kinds: Incentive Stock Options (ISOs) and Non-Qualified Stock Options (NSOs). Both offer different ways for employees to invest in the company's success. ISOs can lead to lower taxes on profits. NSOs give tax benefits when used. Companies can adjust these options to keep up with the stock market and company value.

Advantages of Equity Compensation

The advantages of equity compensation go well beyond just linking company and employee interests. It creates a strong sense of ownership and belonging among workers. This is key to having a motivated and loyal team. Plus, it's a tax-smart part of pay that really boosts job satisfaction and keeps employees around.

Equity compensation can be up to 20% of someone's salary in startups. This is key to making sure pay is competitive. Offers like up to a 15% discount through Employee Stock Purchase Plans (ESPPs) or the chance to grow wealth as stock values rise boost worker happiness and financial health.

Also, fair and clear rules for getting equity compensation help prevent bias and promote fairness at work. This improves company management and follows laws and rules well.

To wrap it up, using equity compensation plans smartly helps companies succeed in their fields. They become more appealing to the talented people needed to drive innovation and excellence.

Factors Influencing Company Equity Value

Calculating equity value is key in investments and financial analysis. Market conditions and company performance metrics are crucial in this. They set the framework for determining equity value.

Market Conditions

Market conditions greatly influence equity value. They include economic cycles, industry trends, and competitor analysis. These factors can change how investors view and value a company. For instance, biotech and clean energy sectors are getting higher valuations. This is because of favorable market conditions and growth driven by innovation.

Company Performance Metrics

Investors look at company performance metrics to understand financial health and predict future performance. Key indicators include profitability, revenue growth, and efficiency. Assets, both tangible like machinery and intangible like patents, also add value.

Investment decisions often consider metrics like the Price-to-Book (P/B) ratio, Price-to-Earnings (P/E) ratio, and Price-to-Earnings Growth (PEG) ratio:

| Financial Metric | Desirable Range | Implication |

|---|---|---|

| Price-to-Book (P/B) Ratio | below 3.0 | Indicates potentially undervalued stocks, optimal when below 1.0 |

| Price-to-Earnings (P/E) Ratio | 20-25 | Lower ratios generally perceived as better, indicating undervaluation |

| Price-to-Earnings Growth (PEG) Ratio | below 1.0 | Viewed as undervalued, fair value at 1.0, over 1.0 may indicate overvaluation |

| Dividend Yield | Varies | Should consider sustainability and growth potential; high yields could indicate risk |

Both market conditions and company performance metrics are important. They help in understanding and evaluating potential investments. Knowing how to calculate equity value is important. It requires looking at financial metrics, market conditions, and company qualities. This comprehensive approach helps investors make better decisions, maximizing returns and lowering risks.

Common Misconceptions About Equity

Misunderstandings about equity in finance can lead to big mistakes. It's key for all investors to grasp equity's true nature. It's not just about stocks. Equity compensation plans are common from small startups to big companies. They're used in many areas, not just tech. Worldwide, companies use plans like an All Employee Share Plan for their global teams. This shows how corporate finance is becoming more inclusive.

Myths vs. Facts

Many think equity compensation is only for top executives. But, companies big and small use these plans for many workers. Also, it’s not just for public companies. Private firms use equity compensation, too. While equity can lead to big gains, there's no wealth guarantee. Market changes can affect its value a lot. Knowing the difference between basic and diluted equity is crucial for good financial decisions.

Clarifying Terminology in Equity Discussions

To avoid confusion, we need simple explanations of complex terms. Selling shares in a private firm has strict rules. Knowing your equity plan's terms is vital. Tax effects vary by location, requiring customized strategies. Share value methods also differ by place. Investors and pros must keep learning to navigate these details. They need to become wise in their financial journeys.

FAQ

How Can I Get Company Equity and Understand Its Face Value?

You can get company equity by buying shares. To understand its face value, look at the share's original cost on the certificate. This cost is different from what you see as its market value.

What Exactly is Company Equity?

Company equity, also known as market cap, is the stock's total market value. It’s found by multiplying the share price by the number of shares out there.

What Are The Different Types of Company Equity?

There are types based on company size: small cap (under $2 billion), mid-cap ($2 billion to $10 billion), and large cap (over $10 billion). These types show a company's growth chance and market strength.

Why is Equity Important in Business?

Equity shows a company's market worth and financial health. It helps us see how it might grow and what risks or chances there are for investment.

Can You Define Face Value in Finance?

Face value is what a stock or bond was originally sold for, shown on the certificate. Unlike market value, it doesn’t change over time.

How Does Face Value Relate to Market Value?

Face value is the fixed original issue price of a stock. But market value changes. It depends on what investors are willing to pay now, based on demand and market conditions.

What is the Equity Value Formula?

You can find equity value by multiplying the current stock price by the total shares available.

What are the Common Methods of Valuation Apart from the Equity Formula?

There are other ways to value a company, like enterprise value, Price/Earnings ratios, cash flow models, and comparing book or market capitalization.

What Should I Evaluate When Considering an Investment in Company Equity?

Look at the company's financial results, its place in the market, how it might grow, its equity, market cap, and how it stands in its industry.

How Do Different Equity Types Impact My Research on Potential Companies?

Different equity types have different risks and growth chances. Small-cap may grow fast but are riskier. Large-cap is more stable but grows slower.

What Are the Risks and Benefits of Acquiring Company Equity?

The risks include the chance of losing your money due to market ups and downs. The benefits can be dividends, gain in value, and a share in the company's success.

How Can I Buy Company Shares?

Get shares through a stock exchange by using a brokerage account. You should watch the stock prices and company news closely to make smart choices on buying or selling.

What Should I Know About Participating in IPOs?

IPOs let you buy shares at the company's start. It’s vital to know the company's outlook, pricing approach, and market trends for a wise investment.

Why Do Startups Issue Equity?

Startups give out equity to get money, motivate employees, and make sure everyone wants the company to do well in the long run.

What Are the Different Equity Structures Used by Startups?

Startups might offer stock options, restricted stock, convertible notes, or preferred stock. These choices help meet the needs of different people involved.

What Are Stock Options and Restricted Stock as Forms of Equity Compensation?

Stock options let employees buy shares at a set price later. Restricted stock is given with certain conditions. Both are meant to make employees' goals match the company's goals.

What Are the Advantages of Equity Compensation?

The perks include possible profit from the stock going up in value, feeling part of the company, and tax benefits for the employee and company.

What Market Conditions Can Influence Company Equity Value?

Things like economic trends, what investors feel, and industry changes can raise or lower a company's value in the market.

Why Are Company Performance Metrics Important When Calculating Equity Value?

Metrics like sales growth and profit show a company's health and growth potential. This info is key for a correct value estimate.

What Are Some Common Misconceptions About Equity?

A few myths are that book and market value are the same and that short-term price changes show a company's worth accurately. Knowing a company's full financial picture is crucial to avoid these errors.

Why is Clarifying Terminology Important in Equity Discussions?

Clear terms help investors know the difference between things like basic and diluted equity, equity vs. enterprise value, and how to use multiples in valuation. This prevents confusion and improves investment choices.