How to Fill Out a Balance Sheet | Complete Guide

Knowing how to write a balance sheet is key for any financial pro. It shows a company's financial strength clearly. This guide focuses on making sure financial statements are accurate and reveal the organization's financial health. A detailed balance sheet is like a mirror, showing the firm’s condition at important times like the end of a quarter or year.

Good balance sheets are crucial for people to understand a business’s financial health. They work with cash flow and income statements to give a full financial view. Also, accounting software has made it easier to prepare these important documents, helping businesses keep their finances in check.

A balance sheet shows a company's financial position at a moment. It's based on the basic accounting equation: Assets = Liabilities + Owner’s Equity. This formula is vital, as it shows if a business can meet its obligations and keep running.

Key Takeaways

- The equation Assets = Liabilities + Owner’s Equity needs to balance for a true balance sheet.

- It's smart to use accounting software to reduce mistakes and improve efficiency when making a balance sheet.

- A balance sheet usually sorts assets and liabilities into current, intermediate, or long-term groups.

- It's important to accurately value assets, from cash to real estate, for a truthful financial view.

- Keeping balance sheets up to date and making precise calculations are key, as they affect business choices and rules.

- Net worth comes straight from the balance sheet equation, showing a business's real financial state.

- Knowing and correctly reporting current, intermediate, and long-term assets and liabilities is essential.

Understanding the Balance Sheet Basics

A balance sheet is a key financial tool. It is used for creating a balance sheet and looking into its parts. It also helps in doing deep dives into financial analyses. This snapshot shows a company's financial health at a certain time. It lists assets, liabilities, and ownership equity. These show a company's value in numbers.

Definition of a Balance Sheet

The balance sheet shows a firm's financial worth. Also called a statement of financial position, it's very important. It shows assets, liabilities, and shareholders' equity at a business period's end. It makes sure assets match liabilities and shareholder equity, following the formula: Assets = Liabilities + Owner’s Equity.

Purpose of a Balance Sheet

A balance sheet has several key uses. It's vital for analyzing a company's financial statements. Both managers and outside people use it to make smart choices. It helps calculate financial ratios to check a company's health, risk, and efficiency.

Key Components

The balance sheet has three main parts, each critical to understanding a company's finances:

- Assets: Current assets like cash and accounts receivable, and long-term ones like investments and fixed assets are included.

- Liabilities: It covers both current liabilities like wages to be paid and customer prepayments, and long-term ones like pension funds and debts.

- Shareholders' Equity: This shows the money put in by owners and investors. It includes common stock, retained earnings, and more.

| Component | Description | Key Metrics |

|---|---|---|

| Assets | Resources owned by the company that have economic value | Current Ratio, Quick Ratio |

| Liabilities | Future sacrifices of economic benefits that the company is obliged to make | Debt-to-Equity Ratio |

| Shareholders' Equity | The residual interest in the assets of the company after deducting liabilities | Return on Assets (ROA) |

Understanding balance sheet parts is more than just accounting. It's crucial for planning and strategy. Knowing the details helps predict financial futures and assess growth possibilities.

The Accounting Equation Explained

The accounting equation, Assets = Liabilities + Equity, is vital in business financial management. It is the foundation of financial balance. This equation ensures financial statements are stable. It shows every asset is covered by liabilities or equity.

Assets = Liabilities + Equity

Take Exxon Mobil Corp.'s balance sheet from March 31, 2024. It lists total assets of $377,918 million. These assets match total liabilities of $164,866 million and equity of $213,052 million. This perfect example shows the equation at work. It makes a company's financial status clear, playing a key role in business financial management.

Importance of the Equation

The accounting equation is critical, not just for bookkeeping. It supports strong financial strategy and operational integrity. It ensures data accuracy and spots errors. Small mistakes in big companies like Exxon Mobil Corp. can show big problems.

How It Applies to Business

Understanding the accounting equation helps keep a business financially balanced. All companies depend on it for clear financial reports. For example, Apple's 2023 earnings showed $352,583 million in assets. These were balanced by $290,437 million in liabilities and $62,146 million in equity. This demonstrates the equation's use in real business situations.

This equation's wide use in business shows how crucial it is. It’s key for company growth and keeping finances healthy. Fintech is now using automation tools with this equation. This makes financial analysis easier, improving business financial management.

Identifying Assets on the Balance Sheet

Identifying assets is key in financial reporting and analysis. It influences decisions and checks financial health. Knowing the difference between current and non-current assets helps with documentation and strategy.

Current vs. Non-Current Assets

Current assets, like cash and inventory, turn into cash or get used up in a year. Non-current assets, such as machinery and intellectual property, benefit the company for longer. Putting assets in the right category makes everything clearer and follows accounting rules.

Examples of Common Assets

- Cash and Cash Equivalents: Readily available funds in the company.

- Accounts Receivable: Money owed to the business by its customers for goods or services delivered.

- Inventory: Items that are held for sale in the regular course of business.

- Equipment: Long-term assets such as machinery and computers used in operations.

- Intellectual Property: Assets like patents, trademarks, and copyrights that provide competitive advantages.

Valuation of Assets

Valuing assets gives them a monetary value on the balance sheet. This involves looking at purchase price and depreciation for tangible things like equipment. Valuing things you can't touch, like brands, is trickier and needs special methods.

| Asset Category | Examples | Typical Valuation Method |

|---|---|---|

| Current Assets | Cash, Inventories, Receivables | Lower of Cost or Market Value |

| Non-Current Tangible Assets | Buildings, Machinery | Cost less Accumulated Depreciation |

| Non-Current Intangible Assets | Goodwill, Patents | Amortization, Impairment Tests |

Having a strong system for identifying, categorizing, and valuing assets is vital. It ensures accurate financial reports and supports strategic planning. Good asset management helps companies stay financially stable and grow.

How to List Liabilities

Listing liabilities correctly on a balance sheet is key to showing a company's true financial state. It's important to understand the difference between short-term and long-term liabilities. This helps follow reporting rules and gives insight into the company's financial health and strategy.

Current vs. Long-Term Liabilities

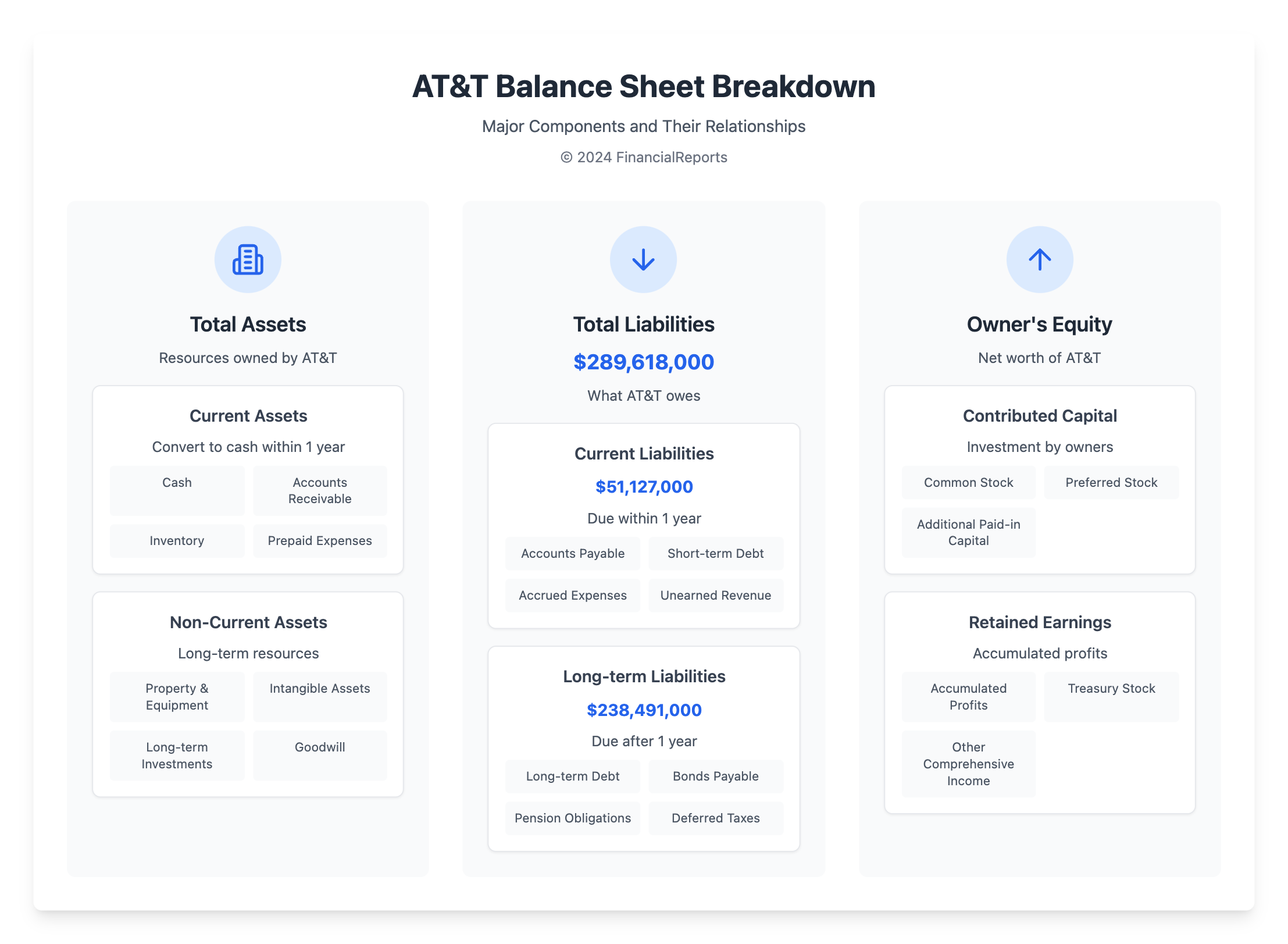

Liabilities are split into short-term and long-term. Short-term liabilities need to be paid within a year. Examples are accounts payable, wages, and unearned revenue. These are vital for everyday operations and keeping the business liquid. For example, AT&T had $51,127,000 in short-term liabilities at the end of 2023.

Long-term liabilities, on the other hand, are due after a year. They include long-term debt and deferred credits. These show a company's plans for long-term financial health.

Common Types of Liabilities

- Current Liabilities: These often include things like wages and interest that need to be paid within a year.

- Long-Term Liabilities: These are bigger commitments, such as bonds. AT&T lists these in its liabilities, which total $289,618,000 at last check.

Reporting Requirements

Correctly classifying and reporting liabilities is a must under financial rules. Breaking them into short-term and long-term helps people understand a company's financial status. By using formulas for current and total liabilities, companies tell a clearer financial story in their balance sheets.

| Liability Type | Examples | AT&T Amount ($) |

|---|---|---|

| Current Liabilities | Wages payable, Dividends payable | 51,127,000 |

| Long-Term Liabilities | Bonds payable, Post-employment benefits | 238,491,000 |

This method of listing liabilities makes the balance sheet clearer. It helps investors and financial experts make better strategic decisions.

Owner’s Equity: What to Include

Owner's equity in a balance sheet is key for evaluating a business's financial strength. It reveals what owners will keep after paying off all debts. This information is vital for making informed choices about a company's stability and worth.

Stakeholders and investors look at this part of the balance sheet to measure a company's value and stability. It helps them understand how financially healthy a company is.

Components of Owner's Equity

Owner’s equity includes items like common and preferred stock, treasury stock, extra paid-in capital, and retained earnings. All these parts are important for figuring out owner's equity. They help assess a company’s financial position in detail.

Retained earnings are especially important. They show the profits a company has reinvested into itself rather than given to shareholders. This shows how a business is doing.

Calculating Retained Earnings

Calculating retained earnings is crucial. It shows how a company uses its profits for growth or saving for future needs. You get this figure by adjusting past retained earnings with net profits or losses, and dividends paid out.

This amount is a key indicator for owners and investors. It represents the part of earnings that stays in the company to help it grow, pay off debts, or save for later.

Impact of Equity on Financial Health

Owner's equity shows if a company is financially healthy and capable of growing. When it goes up, it suggests the company is doing well. But if it drops, the company might be in trouble or paying out a lot in dividends.

Understanding these changes is crucial for investors and analysts. These insights help them make choices about investing. They use it to judge a company's value.

For instance, take a Computer Assembly Warehouse with assets of $3.2 million and debts of $2.1 million. It has an owner's equity of $1.1 million. This shows the business is stable, able to draw in more investment, and ready to grow.

Careful tracking and managing of owner's equity is essential. It gives companies an advantage in succeeding over the long term. Plus, it builds trust with those who have a stake in the business.

Steps to Fill Out a Balance Sheet

Preparing a balance sheet calls for careful attention to make sure it's accurate and clear. We'll walk you through making a balance sheet step by step. It's key for anyone wanting to clearly show a company's financial condition.

Gathering Necessary Information

Start by gathering all important financial data. This means listing assets that can turn into cash within a year and those meant for the long haul, like property and patents. You should also sort out what the company owes, short-term and long-term, and shareholders' details. Companies like Apple order their assets by how quickly they can be converted to cash to make things clearer.

Organizing Data into Categories

Sorting your data right is crucial for a correct balance sheet. You’ve got assets that will be cash soon versus those that won’t. The same goes for debts: some are due soon, others later. This sorting makes it easier to understand the company’s finances and prepares you for deeper analysis, like figuring out financial ratios.

Using Accounting Software

Using good accounting software makes balancing the balance sheet easier and more accurate. It helps organize and correctly report financial data. In specific industries like real estate, this ensures all things are properly accounted for against what the company owns and owes. Good tech makes the process faster and less prone to errors, leading to a truthful financial report.

Common Balance Sheet Formats

It's key to grasp the various ways balance sheets can be set up. This helps stick to financial reporting standards while showing a company's true financial shape. Whether done monthly or quarterly, balance sheets are crucial. They help us understand a company’s financial health and the risks they might face. They're also vital for making big decisions, like raising money.

Classified Balance Sheet

A classified balance sheet breaks down assets, liabilities, and equity into clear groups. This grouping makes it simpler to see how liquid a company is and its financial solidity. Assets and liabilities are split into current and non-current categories. This split helps work out important financial ratios, such as the acid test and debt-to-equity ratios:

| Current Assets | Non-Current Assets |

|---|---|

| Cash, Accounts Receivable | Property, Plant & Equipment (PP&E) |

| Current Liabilities | Long-Term Liabilities |

| Accounts Payable, Wages | Long-term loans |

Unclassified Balance Sheet

An unclassified balance sheet doesn't sort assets and liabilities. Instead, it lists them by how quickly they can be turned into cash. Though not as common, this type is crucial for beginners. It helps newbies grasp the basics of how assets and liabilities are organized without complicating things.

Comparative Balance Sheet

The comparative balance sheet is key for deep, internal analysis. It also assures stakeholders of a company's reliable financial standing. It lines up financial data from different times next to each other. This meets financial reporting standards like IFRS or GAAP. Having data side-by-side lets stakeholders track how a company is doing over time. They can spot trends or issues with how the company is structured financially:

| Period | Total Assets | Total Liabilities | Equity |

|---|---|---|---|

| 2022 Q1 | $5M | $2M | $3M |

| 2022 Q2 | $5.5M | $2.1M | $3.4M |

Every balance sheet format has its purpose. Whether it's providing a clear view of financial position with a classified layout, making finance simpler for starters with an unclassified form, or helping with planning and analysis through comparative data.

Importance of Regularly Updating the Balance Sheet

Keeping the balance sheet up-to-date is crucial. It's not just about record-keeping. It helps in making better business choices, staying compliant with finance laws, and monitoring the company's financial well-being. Updating the balance sheet regularly gives a clear picture of where the company stands financially. This affects everything from how investors see the company to how plans for the future are made.

Tracking Financial Performance

Updating the balance sheet consistently is key to tracking financial performance. It lets companies follow important financial indicators like cash flow, how much assets are worth, and what they owe. By keeping an eye on these numbers, businesses can spot trends and solve problems early. This improves financial stability and how well the company operates.

Supporting Business Decisions

Having an updated balance sheet is essential for making business decisions. It gives leaders reliable data for making smart choices about the company's future. Knowing about current assets and debts helps in planning for expansion, reducing budgets, or finding new financing. This detailed information is critical for managing the company's finances well. It's key for growth and making money.

Compliance with Regulations

Regularly updating the balance sheet also keeps the company in line with financial laws. Financial statements must meet standards like the U.S.'s GAAP. Staying up-to-date helps pass audits and avoid legal or financial troubles.

In short, a well-maintained balance sheet does more than record finances. It aids in making strong business choices, ensures the company follows laws, and keeps an eye on financial health. These steps build a solid base for the business, leading to ongoing success and financial security.

Common Mistakes to Avoid

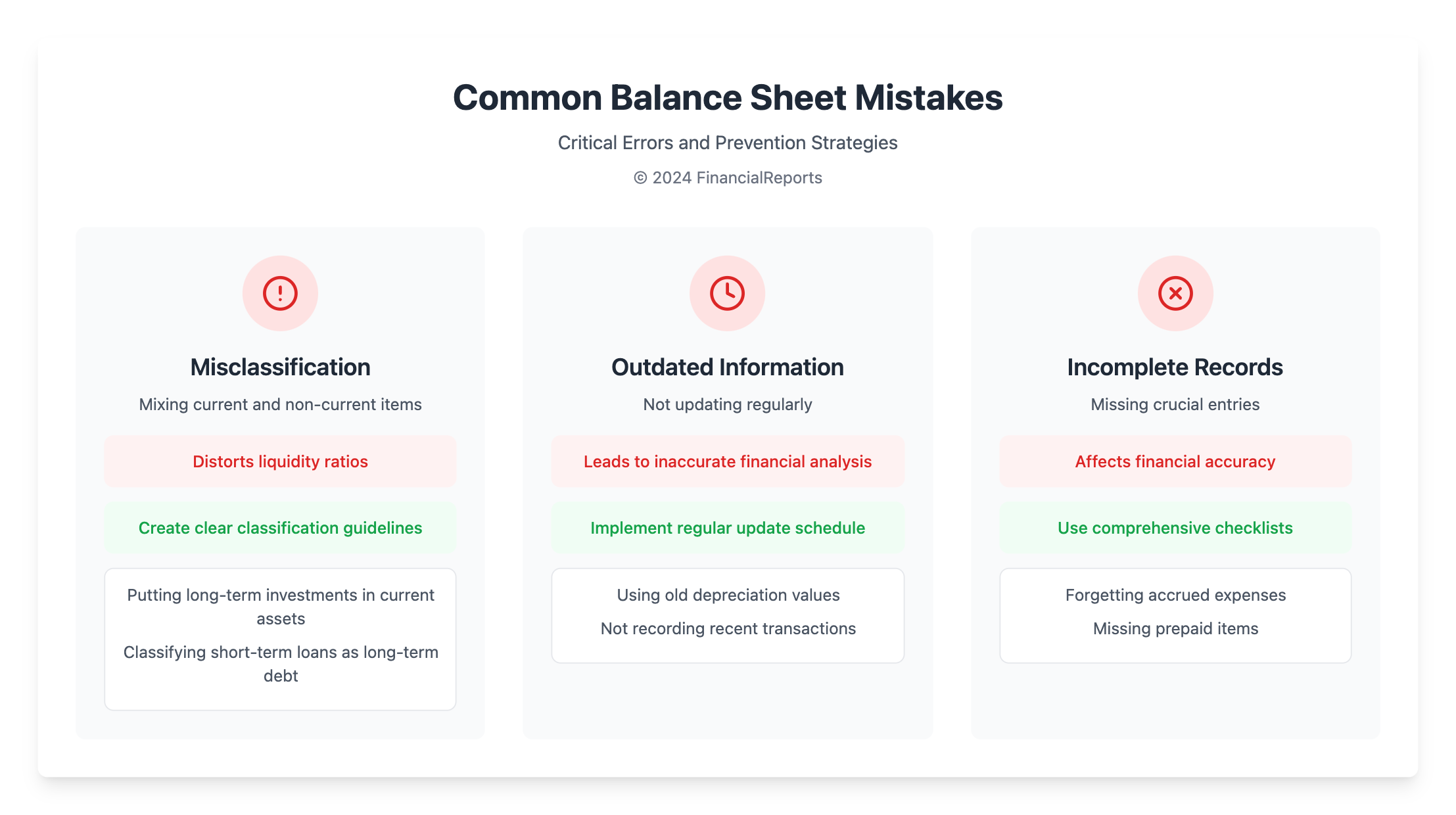

When it comes to financial reporting, keeping balance sheet accuracy is key. Many common financial errors can mess up these important documents. This leads to wrong financial analysis and decisions. Knowing these errors is vital for good financial management.

Misclassifying Assets and Liabilities

Getting assets and liabilities mixed up is a big problem when making a balance sheet. Mistakes like mixing current and long-term assets or liabilities can throw off your financial health check. For example, putting accounts receivable with long-term investments, or mixing up accrued expenses with unearned revenue, could lead to trouble.

Failing to Update Regularly

Balance sheets need constant updates to reflect business changes. Not updating them can make info old and misleading. Not noticing things like more inventory, higher accounts payable, or cash changes can confuse stakeholders about the company’s finances.

Ignoring Depreciation and Amortization

Forgetting about asset depreciation is a common oversight. If you don’t account for depreciation of assets like vehicles or buildings, assets may appear too valuable. This skews profit and value figures. Not amortizing intangible assets like patents also messes up expense reporting and net income.

It's smart to have strict review processes. Stuff like running a trial balance, checking transactions, and fixing errors fast helps. This ensures balance sheets truly show a business's finances. It sets the stage for solid financial planning and analyzing.

Resources for Further Learning

Accuracy is key, especially with financial statements like balance sheets. For those looking to advance financial knowledge, many resources are available. These tools help improve skills in managing financial data. They make it easier to understand complex financial terms and situations.

Recommended Books on Accounting

There is a great selection of books on accounting for keen financial experts. These books are written by knowledgeable authors. They cover everything from financial reporting to asset management.

Reading these can build a strong base for understanding balance sheets. Balance sheets are crucial for all companies. They need to prepare these every quarter.

Online Courses and Tutorials

Online learning has changed how we gain knowledge. Many online courses and tutorials are available. They offer flexibility and practical knowledge.

These courses use real-life examples to teach important concepts. This helps professionals understand financial reports better. It helps them know how a company is doing financially.

Accounting Software and Tools

New accounting software and tools have changed the game. They improve how financial data is handled. It makes sure financial equations are always correct.

Using these tools helps professionals follow reporting rules closely. It helps them support their company's financial goals well.

FAQ

How Do You Begin Writing a Balance Sheet?

Start by picking the date for the balance sheet. Then, list your company's assets as current or non-current. Next, add both current and long-term liabilities. Lastly, figure out owners' equity by subtracting liabilities from assets. Make sure everything adds up correctly.

What Are the Essential Components of a Balance Sheet?

A balance sheet has three main parts: assets, liabilities, and owners' equity. Assets include things the company owns. Liabilities are what the company owes. Owners' equity is the value left after liabilities are paid.

Why Is the Accounting Equation Fundamental?

The equation, Assets = Liabilities + Equity, is key to accounting. It keeps the balance sheet balanced. This shows the company's real financial state.

How Should Assets Be Valued on a Balance Sheet?

Assets get valued at the current market rate or cost minus depreciation. Current assets use the net realizable value. Non-current assets follow cost or revaluation models, based on financial standards.

What Is the Difference Between Current and Long-Term Liabilities?

Current liabilities must be paid within a year. These include bills and short loans. Long-term liabilities, like mortgages and bonds, are due after a year.

What Entails Owner’s Equity on a Balance Sheet?

Owner's equity involves common stock, preferred stock, retained earnings, and extra paid-in capital. It's what owners claim after settling all debts.

How Do You Use Accounting Software to Make a Balance Sheet?

Accounting software sorts transactions into assets, liabilities, and equity as they happen. It calculates automatically, keeping the accounting equation balanced.

What are Some Common Formats for Balance Sheets?

Balance sheets come in classified, unclassified, or comparative formats. Classified ones group assets and liabilities. Unclassified list them in order. Comparative show multiple periods.

Why is Regular Updating of the Balance Sheet Important?

Updating the balance sheet regularly offers a real-time view of finances. It helps with smart decisions and meets regulatory needs.

What Are Common Mistakes to Avoid When Filling Out a Balance Sheet?

Avoid misclassifying items, not updating regularly, and missing depreciations. These errors can distort asset values and financial truth.

Where Can I Find Resources to Further My Understanding of Balance Sheets?

Look into accounting books, online courses, workshops, and seminars for more on balance sheets. Accounting software and tools also help with precision.