How to Calculate Market Value of Any Asset Today

Understanding how to value assets is key for those in finance, investing, and for big clients. It's about knowing the current market value of assets. This means figuring out what they could sell for now in the market. To find an asset's market value, look at its original cost, how much value it's lost, and how much value any upgrades have added. This approach lets people make smart choices by really understanding what an asset is worth and what it could bring in the future.

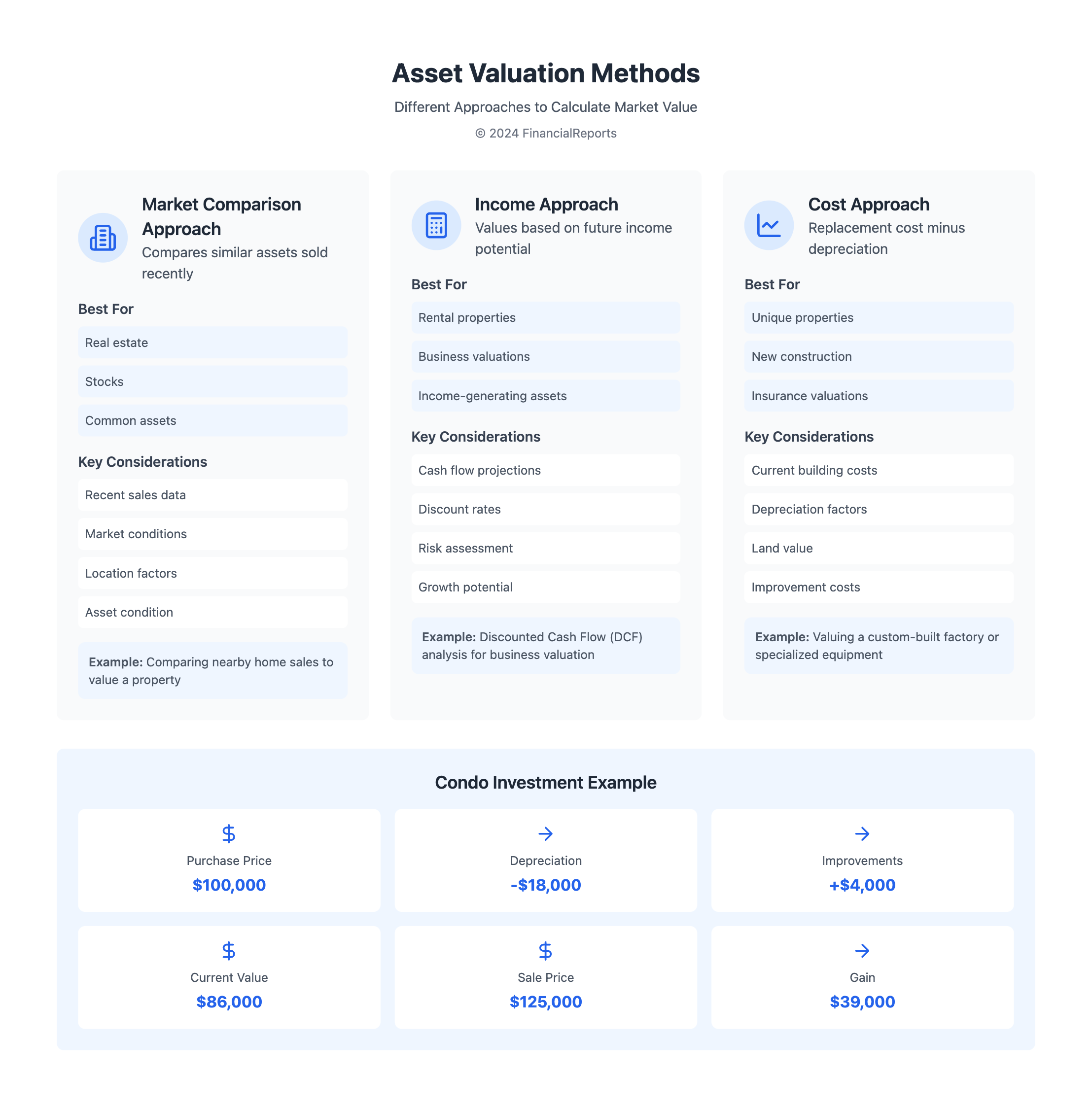

Let's look at a real-life situation with a condo. Imagine you bought it for $100,000. Over five years, it loses $18,000 in value. Then, you improve the kitchen, which adds $4,000 to its value. This makes your condo's cost now $86,000. If you sell it for $125,000, you've made a $39,000 gain. This perfectly shows how the market value works through the life of an investment.

Key Takeaways

- Market Value Definition: It's what an asset would likely sell for today.

- Asset Valuation: Vital for making smart investment and financial decisions.

- Calculation Criteria: Look at original cost, how much value is lost, any upgrades, and what it sells for.

- Market Trends: Asset values change with the economy and industry cycles. It's important to keep analyzing them.

- Professional Input: Talking to valuation experts can make your value estimates more accurate.

- Data-Driven Strategies: Using methods like discounted cash flow, earnings capitalization, and industry comparisons make sure you evaluate an asset's market value well.

- Comprehensive Appraisal: It's important to know both the book value and market value, considering current and future market conditions.

Understanding Market Value: A Fundamental Concept

Market value is key to understanding financial markets. It shows what people think an asset is worth. This value acts as common ground for buyers and sellers. In the business world, it's often seen as market capitalization. This helps measure a company's size and its potential for investment.

Definition of Market Value

Defining market value means finding the price for an asset in a competitive setting. It involves analyzing financial indicators such as Price-to-Earnings (P/E), Return on Equity (ROE), and Debt-to-Equity (D/E) ratios. These elements are crucial for setting its value. Market value changes with investor views and economic conditions, highlighting its ever-shifting nature. Knowing this definition allows people to explain market value well in financial areas.

Importance of Market Value in Investments

Understanding market value is vital for investment valuation. It influences whether to buy, hold, or sell assets. Assessing a company's worth against others in its field is crucial. It helps predict future standings. Market value serves as a reference, showing an asset's place within the larger market trends.

| Financial Metric | Role in Market Value Analysis | Impact on Investment Decisions |

|---|---|---|

| Price-to-Earnings (P/E) Ratio | Evaluates the price paid for each unit of income | Helps determine if a stock is overvalued or undervalued |

| Earnings Per Share (EPS) | Gauges company profitability allocated per outstanding share | Influences investor sentiment and stock price |

| Return on Equity (ROE) | Measures the profitability in generating earnings from shareholders' equity | Assists in assessing company efficiency and profitability |

| Debt-to-Equity (D/E) Ratio | Shows the proportion of equity and debt used to finance a company's assets | Critical in evaluating financial leverage and risk level |

These analytical tools help financial experts explain market value. They assist in strategizing investments to meet long-term goals.

The Role of Supply and Demand

Grasping supply and demand is key to market value meaning and finding market worth. These principles deeply influence supply and demand in market valuation. They show how factors come together to shape our financial world.

How Supply Affects Market Value

The supply curve slopes up. It shows that higher prices motivate producers to supply more. This helps explain how supply can boost or lower market worth.

Costs, new technologies, and resource availability can change the supply curve. For example, more supply usually drops prices unless there's also more demand.

Impact of Demand on Market Value

Demand curves slope down. Lower prices make people want to buy more. This helps us see how demand changes affect prices and product availability.

Price elasticity shows some goods, like staple foods, keep steady demand even when prices change. This helps keep their market value steady.

Real-World Examples

Real events show how outside factors, like misinformation or monopoly, can twist supply and demand. For instance, after 9/11, false fuel shortage rumors raised gas prices. It looked like demand jumped because people thought supply was low.

| Scenario | Impact on Supply | Impact on Demand | Effect on Market Worth |

|---|---|---|---|

| Increased Supply | More products available | Demand unchanged | Lower prices |

| Decreased Supply | Fewer products available | Demand unchanged | Higher prices |

| Increased Demand | Supply unchanged | More consumers want product | Higher prices |

| Decreased Demand | Supply unchanged | Fewer consumers want product | Lower prices |

This talk highlights how supply, demand, and their effects on market value meaning are interconnected. These concepts are central to both economic theory and real-world market strategies.

Methods for Calculating Market Value

Getting the market value of an asset right is key for smart decisions and analyzing investments. There are several well-known market valuation methods and methods of asset valuation. Each is suited for different types of assets and situations.

Market Comparison Approach

This method looks at similar assets that were sold recently or are up for sale. It's mainly used for figuring out the value of real estate and stocks. It adjusts for things like size, location, and condition for real estate, or earnings and growth for stocks, to find a fair value.

Income Approach

This is for valuing properties or businesses that generate income. It's about how much money the asset can make in the future. The Discounted Cash Flow (DCF) model is a key tool here. It values an asset based on its expected cash flows, brought into today's dollars.

Cost Approach

The cost approach looks at what it would cost to replace a property with something new that does the same thing. It's used when there's nothing similar to compare to, focusing on the cost to rebuild it today, minus any wear and tear or outdated tech.

| Approach | Description | Common Usage |

|---|---|---|

| Market Comparison | Values assets based on pricing of comparable assets, adjusted for specific features or attributes. | Real estate, stocks |

| Income | Calculates market value based on the present value of future cash flows estimates. | Real estate (rental properties), businesses |

| Cost | Estimates how much it would cost to replace the asset with a new one of equivalent utility. | Insurance industry, specialized properties |

By using these methods of asset valuation, experts use past and predicted data for wise decisions. This is valuable for various needs, like meeting regulations, evaluating investments, or during mergers. Market valuation methods give the crucial data for different financial tactics.

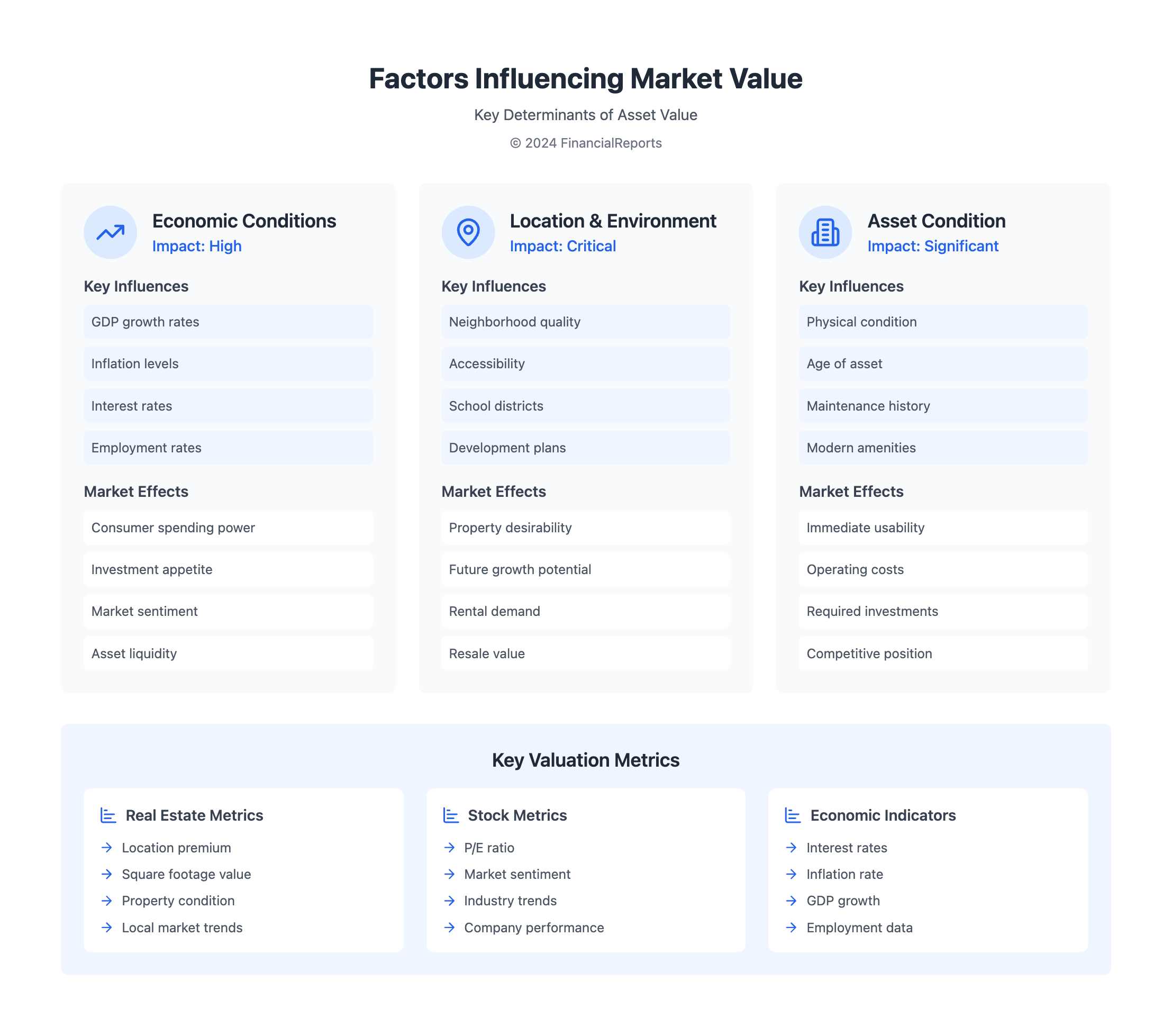

Factors Influencing Market Value

Knowing the factors affecting market value helps investors make smart choices. These factors differ for assets like real estate and stocks. Yet, they are key in determining an asset's value.

Economic Conditions

Economic indicators significantly impact market valuation influence. Key elements, such as inflation rates and GDP growth, affect how people spend. For example, a strong economy boosts spending and investment, which raises market values.

Location and Environment

An asset's location greatly affects its appeal and value. For real estate, factors like good schools and easy access to jobs can raise a property's value. Market value factors show why homes in popular cities are pricier compared to similar ones in less desired areas.

Asset Condition and Age

The condition and age of an asset influence its worth. In real estate, modern homes with less repair needs are more valuable. Similarly, companies that keep their technology up-to-date stay competitive, enhancing their stock value.'

Valuing Real Estate Assets

In the world of finance, knowing the value of property assets is key. It helps with investment choices and making financial plans. To pinpoint a property's market value, a deep dive into critical metrics is necessary. Investors and financial experts always try to match their plans with how the real estate market moves.

Key Metrics in Real Estate Valuation

Figuring out the value of real estate involves several important factors:

- Location: A key factor in property value, affecting how much people want it and its use.

- Lot Size and Floor Plan: Bigger properties are worth more. Good designs make a property more useful and attractive.

- Amenities: Things like security, parking, and fun areas greatly boost property value.

- Scarcity and Transferability: If similar properties are rare and easy to sell, the value goes up.

- Current and Future Benefits: Valuation looks at how a property can make money over time, including possible income.

To find the most accurate market value, these factors are weighed through different appraisal methods. They consider cost, price, and what the real estate is really worth.

Current Trends in Real Estate Market

Keeping up with real estate market trends is vital for valuing property assets. These trends can heavily influence important decisions. The latest trends include:

- Shifts in Buyer Demand: Changes in the economy and new commercial activities can change how much people want properties.

- Adaptation to Economic Conditions: The interest rates, inflation, and job market can shape the real estate market.

- Technological Advancements: New tech in managing and marketing properties is reshaping real estate value.

Understanding how these trends link with economic signals is crucial for accurate appraisals and market analysis.

| Valuation Method | Key Feature | Application |

|---|---|---|

| Sales Comparison Approach | Compares similar properties sold recently | Widely used for residential properties |

| Income Capitalization Approach | Based on income potential | Important for commercial real estate |

| Cost Approach | Sum of land value and depreciated value of improvements | Good for new constructions |

So, getting the real estate market value right means knowing the many parts that play a role. It’s about keeping up with the latest changes and using the right methods for appraisal. This is the way to make sure property estimations are spot on. That way, investing in real estate stays a smart choice.

Evaluating Market Value of Stocks

When examining stocks, experts use certain measures to understand their value and future performance. The price-to-earnings ratio is key. It combines with market feelings. Together, they offer a full view of a stock's market value.

Understanding Price-to-Earnings Ratio

The price-to-earnings (P/E) ratio is crucial for valuing the stock market. It shows how much people are ready to pay for each dollar a company earns. To find it, you divide the stock's price by its earnings per share. This figure comes from dividing a company's profit by the number of its shares.

- Earnings Per Share (EPS): This helps compare the monetary strength of different companies.

- P/E Ratio: It reveals what investors expect. A lower P/E suggests a stock might be undervalued.

The Role of Market Sentiment

Market sentiment plays a big role in setting stock prices. It's like a mood meter for how investors feel about a stock or the whole market. Good news or strong earnings can push a stock's price up. Bad news can do the opposite, even if a company's basics are strong.

- Investor Perception: This can change stock prices. Sometimes it's more about the mood than the real value.

- Market Conditions: Overall market feelings can be seen in things like the P/E ratios for big stock indexes.

To truly know a stock's value, experts blend P/E ratio facts with feelings from the market. This way, they make better choices for investing and managing money. These tools help make every decision based on solid data and the mood of the market.

The Importance of Professional Appraisals

When diving into the world of asset valuation, professional asset appraisals are key. They are especially vital in real estate and big investments. They matter a lot when dealing with legal issues, insurance, or taxes. Here, knowing the exact market value of something is crucial.

When to Seek Expert Valuation

Expert valuation becomes key in several financial and legal situations. For example, during a mortgage process, a pro appraiser figures out the property's value. This value has a big effect on the loan to value (LTV) ratio. This ratio is essential for getting mortgage insurance. Also, when there's a big gap between a home's selling price and its market value, an expert valuation helps. It helps people find a fair price, even when real estate markets are tough or there are bidding wars.

Benefits of Hiring a Professional

- Credibility and Accuracy: A professional appraiser follows strict guidelines. This ensures accurate valuations. This is very important in complex cases like estate valuations or insurance claims.

- Market Knowledge: Pros understand local areas well. They know how things like crime rates or noise pollution affect property values.

- Enhancement of Property Value: They can suggest improvements. For example, renovating or adding energy-efficient features can increase a property's value.

In summary, choosing to hire an appraiser helps get a precise value of an asset. It also gives the important info needed to deal with financial or legal problems well. Whether adjusting a property's price, arguing against a tax bill, or trying to get the best return on an investment, professional asset appraisals and expert valuation are essential tools in finance.

Adjusting Market Value Over Time

As the financial world changes, updating the adjust market value becomes key. This keeps asset values accurate. Adjustments take into account market trend impacts and seasonal market fluctuations. They keep financial data reliable and up-to-date.

Market Trends and Analysis

Market analysis is essential for keeping up with fast changes. The revaluation model lets us update the worth of fixed assets in real time. This matches their current market value. It offers a more accurate picture of a company's finances. This is especially true in unstable markets.

- Corporate assets are regularly checked to reflect fair market value changes. This is vital for companies under IFRS rules.

- By always watching the market, companies can quickly act on value drops or gains. This gives reliable data to stakeholders.

Seasonal Variations in Market Value

Seasonal market fluctuations are critical in adjusting asset values correctly and on time. These changes notably impact sectors like real estate and agriculture. In these fields, market values change with seasonal demand and supply.

| Year | Initial Market Value ($) | Adjusted Market Value ($) | Percentage Change (%) |

|---|---|---|---|

| 2020 | 1,375,000 | 1,425,000 | 3.6 |

| 2021 | 1,725,000 | 1,900,000 | 10.1 |

| 2022 | 2,340,000 | 2,520,000 | 7.7 |

These numbers show the adjust market value process at work. They show how detailed analysis and understanding market trend impacts lead to smarter financial choices.

Common Misconceptions About Market Value

In the financial world, being precise is key. It's crucial to get the basics of valuing assets right. Many mix up market value with other types of valuation, leading to wrong investment choices. Our goal is to clear these misunderstandings by sharing clear, data-driven advice with our clients.

Misunderstanding Fair Market Value

There's a big mix-up about what "fair market value" means. Some think it's the price of an asset in today's market. But it really assumes a perfect situation where supply meets demand just right. It expects buyers and sellers to know the asset's true worth and not feel rushed to buy or sell. This is often not how things work in real life.

Distinguishing Market Value from Book Value

Understanding the difference between market value and book value is vital. Market value is what someone is currently ready to pay for an asset. It contrasts with what the seller wants. On the other hand, book value is based on accounting records and may not catch up with the market's changes. Recognizing this difference helps in making accurate market valuations. The digital era has made it easier to access the stock market. Online tools have changed the game compared to old methods. This makes it easier for everyone to make smarter investment choices with great financial data.

FAQ

How do you calculate the market value of an asset?

To find the market value of an asset, start with the original cost. Subtract any loss in value over time and add money spent on improvements. Then, see how this compares with the sale price of similar assets. This comparison gives you the market value of your asset.

What does market value mean?

Market value is the price an asset might sell for in the open market. It's influenced by demand, supply, and the current economic state. For companies, market value often means market capitalization.

Why is market value important in investments?

Understanding market value is key for investors. It helps them know what their investments are really worth. This knowledge guides them in buying or selling assets wisely. It shows what everyone else thinks an asset or company is worth.

How can supply affect market value?

If there's not much of an asset available, its market value can go up. This happens because buyers are willing to pay more for something rare. Limited supply makes an asset more desirable and valuable.

In what way does demand impact market value?

Demand boosts market value when many people want to buy an asset. High demand leads to higher prices as buyers compete. This competition increases the asset's market value.

Could you give real-world examples of supply and demand affecting market value?

For example, when few homes are for sale but many want to buy, home prices go up. Similarly, a company's stock can jump if lots of investors want its shares, expecting growth.

What is the Market Comparison Approach?

The Market Comparison Approach looks at what similar assets recently sold for. This helps estimate the value of the asset you're checking.

What does the Income Approach entail?

The Income Approach values an asset by its future income. Analysts use a method called discounted cash flow analysis. It figures out what expected money flows are worth today.

How does the Cost Approach work?

Using the Cost Approach, you estimate what it’d cost to build a similar asset from scratch. You consider current costs and subtract depreciation. This gives an idea of the asset's market value.

What economic conditions affect market value?

Economic conditions like interest rates and inflation can change market value. These factors influence how much people are willing to pay. Thus, they impact an asset's market value.

How do location and environment alter an asset's market value?

Where an asset is located can significantly impact its value. Real estate in popular areas tends to cost more. Good surroundings also raise an asset's market value.

Why are an asset's condition and age important for market value?

An asset's state and how old it is matter a lot. Newer or well-kept items are seen as more valuable. This means they have a higher market value.

What are some key metrics in real estate valuation?

When valuing property, look at its location and size. Local market trends and selling prices of similar places matter too. Interest rates and economic health in the area also play a part.

How do current trends in the real estate market affect valuations?

Market trends, economy changes, and new laws can affect property values. These factors change how buyers and sellers see a property's worth.

How does the Price-to-Earnings Ratio help in assessing stock value?

The Price-to-Earnings (P/E) Ratio compares share price to company earnings per share. A low P/E might mean a stock is undervalued. A high P/E could suggest it's overvalued.

What is the role of market sentiment in stock valuation?

Market sentiment matters a lot for stock prices. If people feel good about a company, its value goes up. If they're worried, the value might drop.

When is it essential to seek expert valuation?

Sometimes, you need an expert's value estimate, like for taxes or legal issues. When big money decisions depend on an asset's value, professional advice is crucial.

What are the benefits of hiring a professional appraiser?

A professional appraiser brings expertise and follows set rules. They can accurately value unique or complicated assets. This is important for official or big decisions.

How are market trends and economic conditions reflected in market value?

Market value changes with things like economic ups and downs or tech advances. Regular updates help keep valuations accurate and relevant.

Why is it important to consider seasonal variations in market value?

Seasons can change asset values, often due to consumer habits or industry patterns. Understanding this can make valuations more accurate.

What is the difference between market value and fair market value?

Market value is what assets really sell for. Fair market value is an ideal price, assuming both buyer and seller are well-informed and not desperate.

How does market value differ from book value?

Market value is an asset's current selling price, changing with the market. Book value, based on financial records, may not reflect current market trends.