How to Calculate Beginning Cash Balance

Finding the beginning cash balance is more than just math; it's key for financial planning and cash flow management. It's the first step in understanding your business's finances. This insight reveals how easily your business can access money and run day-to-day operations. The beginning cash balance is critical for the cash flow statement. It impacts final numbers and helps leaders make smart choices.

Knowing where you start is crucial to track every dollar in your company. It helps in making the right decisions for growth and stability.

Key Takeaways

- Beginning cash balance is a crucial starting point for financial analysis and planning.

- It aids in constructing an accurate cash flow statement, impacting overall financial reporting.

- Thorough understanding of cash flow components is vital — including operating, investing, and financing activities.

- An accurate beginning cash balance calculation supports transparency and aids in forecasting future cash positions.

- Technical proficiency in various cash flow formulas and methods is essential for precise financial assessments.

- Operationalize knowledge with concrete examples, such as the net cash flow formula and operating cash flow calculations.

- Be cognizant of common miscalculations to maintain the integrity of cash flow management.

Understanding Beginning Cash Balance

The concept of a beginning cash balance is crucial in financial management. It starts as the cash amount from the last period's end. It helps financial experts check the financial health of a business and plan for cash flow.

Definition of Beginning Cash Balance

A beginning cash balance isn't just cash at hand when a new period starts. It shows a change in financial position. This balance is key for planning upcoming financial actions and reviews.

Analyzing this balance with the cash flow statement helps in preparing for business operations.

Importance in Financial Management

The begining cash balance is vital for strategic planning and checking liquidity. It's critical for:

- Budgeting and Forecasting: A correct cash balance helps in making accurate budgets, important for planning expenses.

- Investment Decisions: It helps in deciding where to invest for the best returns without risking operational funds.

- Stakeholder Confidence: Showing clear beginning balances builds stakeholder trust by showing financial efficiency and financial health.

- Regulatory Compliance: Accurate reporting helps meet legal standards and prevents financial errors that could cause legal issues.

Understanding and using this initial cash balance is key for a business's financial well-being. It makes sure financial decisions are based on solid data.

Components of Cash Flow

Understanding cash flow is key to predicting a business's financial future. It includes cash inflows, cash outflows, and net cash flow. Each plays a big role in showing how liquid and able a business is to operate.

Cash Inflows

Cash inflows are where a company gets its money from. They keep the business going. Inflows can come from sales, investments like stocks or bonds, loans, and selling assets. Knowing and forecasting cash inflows help a company plan how to grow and cover costs.

Cash Outflows

Cash outflows are the opposite; they're the money going out. This includes costs like salaries, rent, utilities, payments to suppliers, taxes, and debt. Keeping an eye on outflows helps keep the cash flow healthy. This ensures the business doesn’t spend more than it should.

Net Cash Flow

The net cash flow is what's left after subtracting outflows from inflows. It shows if a company is doing well financially. A positive net cash flow means there's more money coming in than going out. This is good news for investors and indicates the business's stability and profit.

By understanding cash inflows, outflows, and net cash flow, financial experts can make plans to improve money management. This leads to better business growth based on solid cash flow analysis.

The Cash Flow Statement

Understanding the cash flow statement is key for anyone in finance. It shows how cash moves in and out of a business. This look at money movement helps understand a company's financial health over time.

Structure of the Cash Flow Statement

The cash flow statement breaks down into three sections: operating, investing, and financing activities. Each part gives important info about the company's financial state.

- Operating activities: This shows the cash made or used in the business's main operations. It reveals if the main operations are making enough cash to keep the business growing.

- Investing activities: This part tracks cash used or made from investments, like buying equipment or selling an asset. It shows the company's long-term investment choices.

- Financing activities: This section shows cash movements from loans, stock issues, and dividends. It tells how a company funds its growth and operations using debt or equity.

The cash flow statement combines these parts. It calculates the net change in cash with this formula: Net Change in Cash = Cash from Operating + Investing + Financing Activities.

How It Relates to Cash Balance

The cash flow statement helps figure out the starting cash balance for the next period. It uses data from cash flow operations, adjusts for non-cash transactions, and notes changes in investments and financing. This provides a clear view of cash liquidity changes within a fiscal period.

| Component | Description | Example Values |

|---|---|---|

| Operating Activities | Cash flow from primary business activities | $44,000 |

| Investing Activities | Cash flow used in investments | $5,000 |

| Financing Activities | Cash flow from funding (loans, investments) | $5,000 |

| Starting Cash Balance | Initial amount of cash at the beginning of the period | $50,000 |

| Ending Cash Flow | Total cash at the end of the period | $70,000 |

Steps to Calculate Beginning Cash Balance

To figure out the beginning cash balance, we need to understand cash movements during a period. It's the first step for financial statements. It helps estimate the cash balance well.

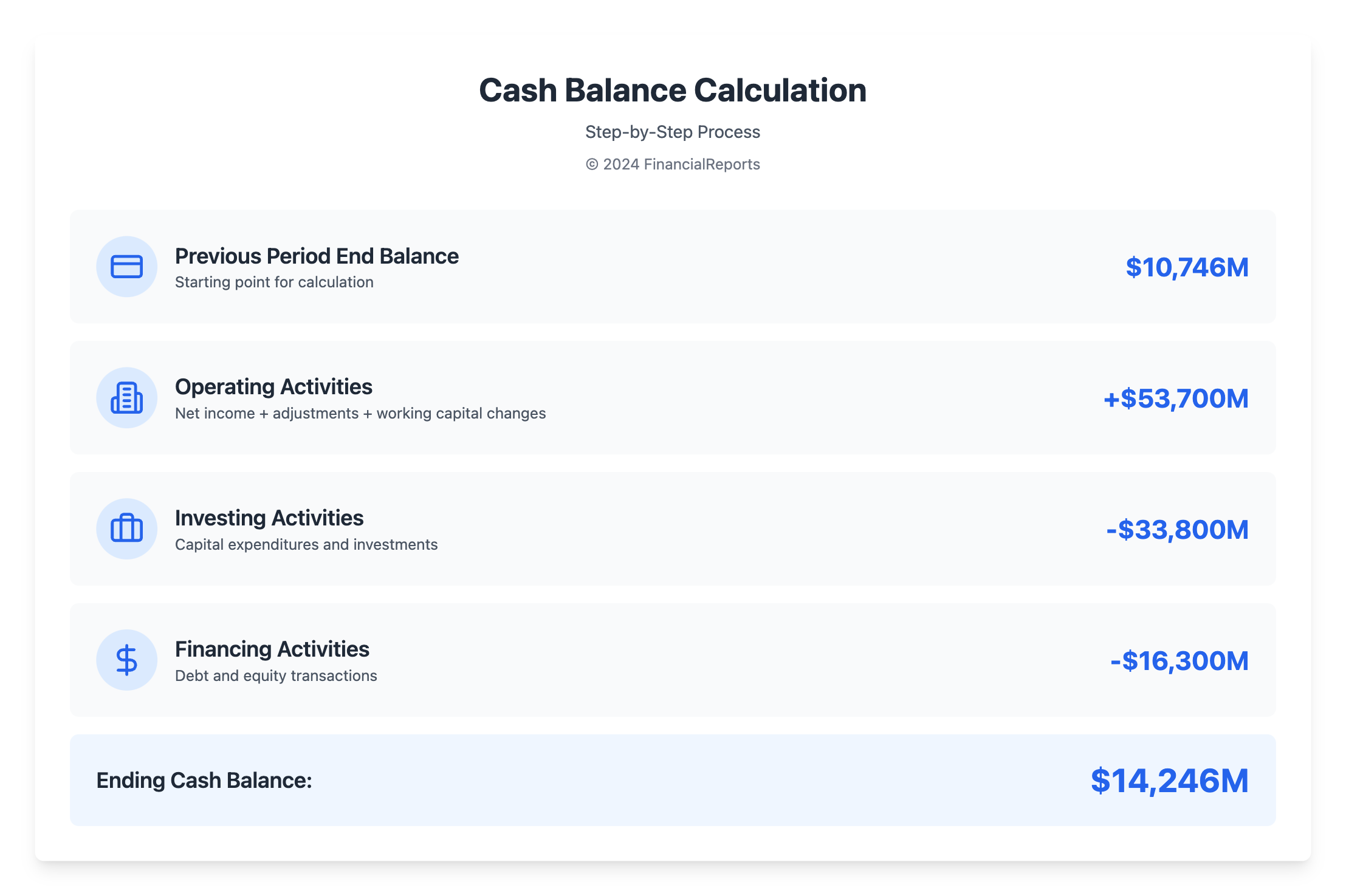

Identify the Ending Cash Balance

Start by finding the previous period's ending cash balance. The ending balance was $14.3 billion recently. This amount is important to figure out new transactions.

Determine Cash Inflows and Outflows

Next, look at the cash that came in and went out. You need to review certain transactions and balances:

- Operating activities: Brought in $53.7 billion, showing strong business.

- Investing activities: Had $33.8 billion in transactions, for things like capital spending.

- Financing activities: Saw $16.3 billion go out, mainly for things like loans and selling shares.

To find the beginning cash balance, start with the last period's ending cash. Add the cash from operations, investments, and financing. Then, subtract the cash that went out. This method makes sure the cash balance is right. It fits well into financial statements.

Learning these steps helps financial experts figure out the starting cash balance. It also improves their forecasting skills.

Using Financial Statements

Financial experts focus a lot on reviewing and analyzing financial statements. It's key in managing finances well. They learn important details from the balance sheet and the income statement. This helps them track cash flow, manage assets, and understand an organization's financial health.

Reviewing the Balance Sheet

The balance sheet gives a clear picture of a company’s finances at a specific time. This is often at the end of a quarter or year. It shows assets equaling liabilities plus equity. Such details are vital for grasping a company’s financial stance. This is important for figuring out the starting cash balance.

By looking at the balance sheet, one can see asset, liability, and equity changes. Spotting these changes is crucial for determining financial stability and business capability.

Analyzing the Income Statement

Checking an income statement helps to assess a company’s profitability over time. It lists all revenues and expenses, finishing with the net income. The net income is crucial because it kicks off the cash flow statement. It's used under cash flows from operating activities. This link helps understand cash operations and business performance overall.

| Financial Statement | Description | Importance |

|---|---|---|

| Balance Sheet | Snapshot of assets, liabilities, and equity at year-end | Essential for evaluating financial position and capital structure |

| Income Statement | Records revenues and expenses to calculate net income | Crucial for understanding profitability and operational efficiency |

| Cash Flow Statement | Adjusts net income for non-cash items to report cash from operations | Key in tracking cash effectiveness and financial health |

Looking at these financial statements together gives a full picture of a company’s financial situation. It lays the groundwork for making smart decisions and managing finances effectively. By combining data from both the balance sheet and income statement, financial pros can get a sophisticated look at a company’s financial path and business health.

Adjustments to Cash Balance

Managing your cash balance well is key. It makes sure your financial reports show how much money you really have. It's important to include things like depreciation in your plans. This keeps your cash records straight.

Accounting for Non-Cash Transactions

Non-cash transactions tell us a lot about a business’s money moves, without actual money trading hands. These include things like how much equipment loses value over time. Even if these don't impact cash right away, they are key to long-term planning.

Amortization, like spreading out the cost of patents, also doesn't affect your cash now. But, it does change your profit numbers a bit at a time.

Recognizing Timing Differences

Understanding timing differences helps us see money moving through time. Recognizing them helps predict future cash flow. To adjust your cash balance, you add what customers owe but haven't paid yet. Then, subtract checks you've written that haven't cleared.

| Component | Calculation |

|---|---|

| Ending Bank Statement Balance | Add |

| Outstanding Deposits | Subtract |

| Outstanding Checks | Subtract |

| Adjusted Cash Balance | Ending Balance + Deposits - Checks |

Using the accrual method, businesses record transactions as they happen. Switching to a cash method, though, requires careful adjustments. This can make things simpler for smaller businesses or to meet rules, and is detailed in IRS Form 3115.

By focusing on these cash balance adjustments, companies keep their finances in check. This helps experts provide better advice and helps with making big decisions.

Practical Example of Calculation

In this section, we'll show how to calculate cash balance. We use a straightforward step-by-step guide for clarity. We cover each part of cash flow and highlight necessary changes for correct cash balance.

Step-by-Step Calculation

Imagine a company starting the year with $10,746 million. Over the year, it makes various financial moves:

- Net Income: It earns $37,037 million.

- Depreciation and Amortization: It adds back $6,757 million for non-cash costs.

- Deferred Income Tax Expense: This adds $1,141 million to the mix.

- Changes in Working Capital: Includes a $2 million decrease from Accounts Receivable.

- Cash Generated from Operating Activities: This adds up to $53,700 million.

After considering cash used in investing activities ($33,800 million) and financing activities ($16,300 million), we see a cash increase of $3,500 million. So, the end-year cash balance is correctly tallied as $14,246 million. This shows clearly the financial adjustments made.

What to Watch For

Keep an eye on these common mistakes in cash balance calculations:

- Miscalculation of cash flows: It's crucial to accurately track cash coming in and going out.

- Ignoring timing differences: Remember to include accruals and deferrals affecting cash timing.

- Unaccounted for non-cash transactions: Don't forget to adjust for non-cash items like depreciation.

Using this example and noting possible errors, businesses can avoid cash flow issues. Following this guide, companies can achieve clear finances. This supports smart decisions and long-lasting financial health.

Common Mistakes to Avoid

In the financial world, common mistakes can mess up cash flow and report accuracy. It's key to know and fix these mistakes to keep finances right and manage cash flow well.

Miscalculating Inflows or Outflows

Miscalculating money coming in or going out is a big mistake. It can give a wrong idea of how well a business is doing. This could lead to bad decisions. For example, wrong data input causes many financial mistakes. It can make businesses run into legal issues or lose money because of not having enough cash.

Ignoring Timing Differences

Not paying attention to when cash transactions happen is a problem. If you record transactions late, it messes up the financial picture. Many businesses have bumped into this issue. It shows up in their financial reports wrongly. Good cash flow management means recording and fixing every entry on time. This stops any mix-ups.

| Error Type | % of Businesses Affected | % of Financial Accuracy Risk |

|---|---|---|

| Inaccurate data entry | 58% | 61% |

| Phantom duplicates inflating balance | 34% | 29% |

| Missing transactions | 37% | 43% |

| Inaccurate reconciliations | 49% | 53% |

| Delayed recording | 42% | 45% |

Avoiding these common mistakes is crucial for better financial accuracy and strong cash flow management. Balancing your cash drawer carefully, reconciling regularly, and timing everything right can cut down mistakes. This creates a stable financial setting.

Tools for Cash Flow Management

For any business, managing cash flow gets much better with the right cash flow management tools and software solutions. These aren't just for keeping track of money. They also help predict and shape the company's financial future.

Software Solutions

Software solutions make handling cash flow simpler. They bring together different financial tools. This makes it easier to keep an eye on and forecast cash flow. Take, for example, tools like Float. They offer deep insights into money coming in and going out, ensuring tight control over finances.

These tools also do automated cash flow calculations. This predicts future money scenarios based on current info. Such automation helps businesses plan well. Thanks to the strong financial technology behind them, these tools give reliable cash flow forecasts.

Spreadsheets and Templates

Spreadsheets and templates are still essential. They're great for custom managing of money matters. This is because they can be easily changed to meet a business's specific needs.

Templates speed up making financial reports and keep data management consistent. But, combining them with high-tech software means all data is not just there but also makes sense. This gives a full picture of a business's financial health.

| Tool | Function | User-Friendly | Integration Capability |

|---|---|---|---|

| Float | Forecasting and budgeting | High | Yes, integrates with major accounting software |

| PlanGuru | Budgeting, forecasting, and performance tools | Medium | Limited integration |

| Excel Templates | Customizable financial tracking and analysis | Varies | High, with ability to integrate into various platforms |

| QuickBooks | Overall financial management | High | Extensive integration with other business systems |

In conclusion, the choice of the right cash flow management tools makes a big difference. Combining specific software solutions with adaptable templates gives businesses clear, useful financial info. This supports smart decisions and keeps finances strong.

Conclusion and Best Practices

We've talked about how to figure out your starting cash balance. This is key for keeping your business stable and healthy. Many small businesses struggle with cash flow, as much as 60%. And about 72% say these cash problems really impact their everyday work. To handle these issues, it’s critical to use the best financial management strategies.

Recap of Key Points

We looked at how to understand your cash situation with some examples. Like Company A with a net cash flow of £50,000, Company B with £300,000 in operating cash, and Company E with £125,000 in free cash. These cases show how vital it is to know about cash flow for smart business choices. Free cash flow is super important for investors. It shows money available for growing the business, paying dividends, or reinvesting.

Recommendations for Maintaining Clear Cash Records

To keep clear cash records and a smart financial strategy, regular detailed financial checks are a must. Using tools like the American Express® Business Gold Card helps manage cash flow with up to 54 days for payments. It’s also key to use advanced accounting software and follow standard principles. For investors, looking at a cash flow statement is crucial. It helps evaluate a firm’s health in liquidity, solvency, and its immediate financial stance, which is more than just profit numbers.

Remember, being transparent about your business's cash flow is very important. It shows its financial health clearly to all who are involved. A cash flow statement, broken down into operating, investing, and financing activities, gives a complete snapshot of a firm's financial situation. It shows the importance of having accurate, easy-to-access, and useful financial information, which is what we aim for in our mission.

FAQ

What is the beginning cash balance?

It's the cash a company starts with at the beginning of a new financial period. This comes from the last period's final cash balance.

Why is understanding the beginning cash balance important in financial management?

Knowing the starting cash helps with planning and managing money. It also shows the company's initial financial health for the period.

Which components make up the cash flow within a business?

Cash flow has two main parts: cash coming in and cash going out. The net flow shows how liquid the business is.

What is the structure of a cash flow statement?

A cash flow statement has three sections: operating activities, investing activities, and financing activities. It may also show non-cash activities.

How do you calculate the beginning cash balance?

Start with the last period's ending balance. Then, add cash in and subtract cash out. This gets you the new ending balance.

Which financial statements are used to identify the beginning cash balance?

You need the balance sheet and the income statement. They show the company's finances, including assets, liabilities, and cash movements.

Why must you adjust for non-cash transactions?

Non-cash items like depreciation change net income without actual cash changes. They must be accounted for to know the real cash position.

What should be considered in a step-by-step practical example of cash balance calculation?

Review cash in, cash out, and non-cash items carefully. Look out for errors or timing issues that could affect the calculation.

What are common mistakes when calculating the beginning cash balance, and how can they be avoided?

Mistakes often come from wrong inflow or outflow figures or timing mismatches. Avoid these by tracking all cash movements accurately and knowing the transaction context.

Which tools can facilitate efficient cash flow management?

Digital tools like financial software, spreadsheets, and templates make managing cash flow easier. They help with tracking and calculating cash movements.

What are the best practices for maintaining clear cash records?

Keep your finances in check with regular reviews. Use dependable accounting software and stick to standard accounting rules for clear cash records.