How Are Investments Entered on a Balance Sheet Guide

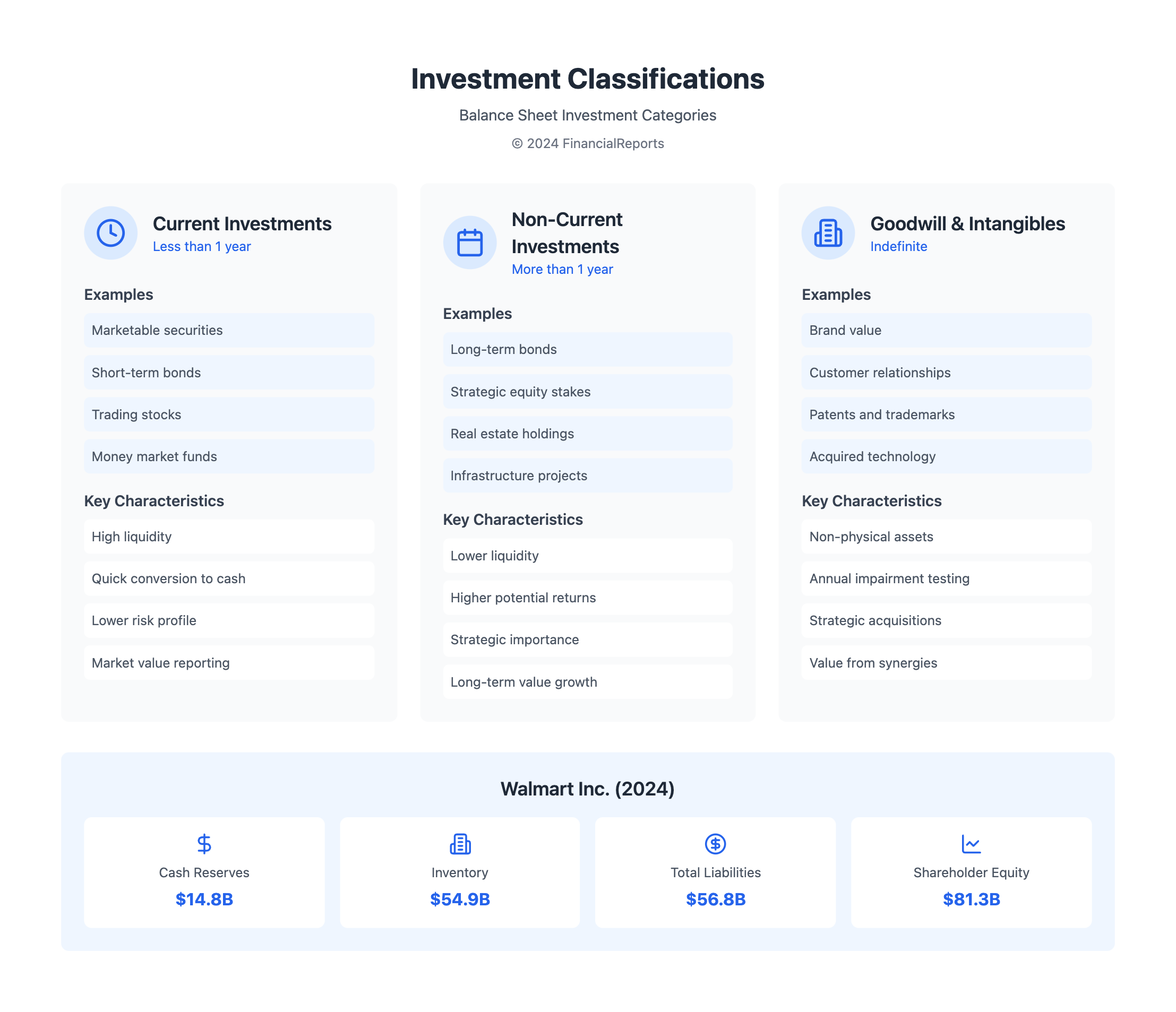

Understanding how investments are noted in balance sheets is key to making accurate financial statements. It's about being strong in finance and following strict accounting rules. For example, Walmart Inc.'s 2024 records show a cash reserve of $14.8 billion and inventories worth $54.9 billion. They owe $56.8 billion but their shareholder equity is impressive at over $81.3 billion. These numbers show Walmart's financial strength and the importance of exact accounting. This shows how committed we are to making financial data easy to understand.

Investments can be things like stocks, bonds, real estate, or cash. They're put as current or non-current assets, depending on how long they'll be held. Walmart Inc. has a specific plan for investments, aiming for returns through dividends or value increases. Properly placing investments on a balance sheet shows smart management. Walmart's debt-to-equity ratio of 1.84 tells us a lot about their financial position. This careful detail aligns with our goal to change how the world sees financial data.

Key Takeaways

- A balance sheet should mirror a company’s financial position accurately, showing investments correctly.

- Investments are split into current for short-term opportunities and non-current for long-term gains.

- To keep financial reports clear and within rules, methods like historical cost or fair value are used.

- Financial ratios, such as the debt-to-equity ratio, show how well a company manages its money and operates.

- Reports from Walmart Inc., with their high shareholder equity and smart debt handling, stress the need for correct investment listing on balance sheets.

- Mapping out investments is crucial for wise long-term planning and growth in business.

Understanding the Balance Sheet

The balance sheet, or statement of financial position, is vital for evaluating a company's financial health. It lists a company's assets, liabilities, and owners' equity at a certain time. This snapshot helps in making informed decisions.

Definition and Purpose

The balance sheet is a key financial statement that shows a company's financial status. It is prepared quarterly or monthly. This frequent preparation aids in keeping a check on a company’s financial well-being, benefiting both potential investors and internal management. Its main goal is to outline what the company owns, owes, and the investment from shareholders.

Key Components

The statement of financial position is divided into three main parts:

- Assets: These are resources with economic value expected to benefit the company in the future. Assets include current assets like cash and stock, and fixed assets, like patents.

- Liabilities: These are the company’s debts or financial obligations. They're split into current liabilities, payable within a year, and long-term debt.

- Owners' Equity: This is what's left for shareholders after removing liabilities from assets. It consists of items such as capital stock and retained earnings.

This separation allows for precise calculation of metrics like liquidity ratios and debt-to-equity ratio. These are crucial for detailed financial analysis and planning.

Grasping the balance sheet's core structure—assets equaling liabilities plus owners' equity—is essential. It helps in understanding the allocation and utilization of resources. This knowledge is key for forecasting future profits and cash flow, making the balance sheet a critical tool for financial decisions.

Types of Investments on a Balance Sheet

Investments on a balance sheet tell us a lot about a company's financial health. They show us what the company is aiming for financially. There are two main types: current investments and non-current assets. This difference depends on how long the company plans to hold these investments. Knowing these types helps investors understand the risks and possibilities of their investments.

Current vs. Non-Current Investments

Current investments are what a company plans to turn into cash within a year. These can be stocks or securities that are easy to sell. They help the company maintain good cash flow. On the other hand, non-current assets are kept for more than a year. They include things like long-term bonds, stocks, or investments in equipment or buildings. These are for earning money over many years.

Long-Term Investments Explained

It's key for long-term investors to know about non-current assets. These investments include long-term bonds, equity in other companies, and big projects that support the company's main goals. These options can grow more but also come with higher risks.

| Investment Type | Category | Example | Accounting Treatment |

|---|---|---|---|

| Stocks < 1 Year | Current Investments | Marketable Securities | Valued at fair market value; gains/losses on sales recognized in income statements |

| Stocks > 1 Year | Non-Current Assets | Long-term Stocks | Equity method, consolidation based on ownership |

| Bonds < 1 Year | Current Assets | Trading Bonds | Reported as current assets; interest recognized periodically |

| Bonds > 1 Year | Non-Current Assets | Held-to-Maturity Bonds | Recorded at amortized cost; interest income accrued |

The way investments are recorded affects their presentation in financial statements. This influences how financial analysts see the company. Understanding the different ways to categorize investments is crucial for long-term investors. It helps them make better decisions.

Investment Valuation Methods

The way we value investments on balance sheets is key to showing a company's true financial health. When looking at standard methods for valuing assets, we'll cover historical cost accounting, fair market value, and market value considerations. Each method is vital for reliable financial reporting and analysis.

Historical Cost Method

Historical cost accounting records assets at their original price. It won't change with the market. This method is transparent and works well for long-term assets, reflecting their worth at purchase. But, it might not show an asset's current value in a changing market.

Fair Value Method

Unlike the historical cost, the fair market value method values assets at today's market price. It adjusts the value for increases or decreases, affecting a company's financial position. This is preferred in fields like real estate and finance where values shift a lot.

Market Value Considerations

Market value looks at an asset's true worth and external factors, like demand and trends. This method depends on how the market views an asset, which can differ from its book value. It matters a lot in stock valuation, where market conditions change value fast.

Using the correct investment valuation methods is crucial. It includes historical cost accounting, fair market value, and market value considerations. This ensures the financial information we report is right and follows accounting rules. It helps with clear financial reports, which are crucial for business growth and keeping investors happy.

Recording Investments at Purchase

Recording investments on a balance sheet is crucial for financial reports and rule-following. It needs accurate journal entries that stick to the rules of accounting. These rules help distinguish between adding to capital and counting as an expense on the balance sheet.

Journal Entries for Initial Investment

When you first put money into an investment, recording it correctly is key. Investments are recorded at the price paid to get them. This price is then used for future accounting. For equity investments, there are specific rules to follow. Under generally accepted accounting principles (GAAP), things like common stock and preferred stock must be listed in the equity part of the balance sheet. The additional paid-in capital (APIC) is found by taking the issue price minus the par value and multiplying by the outstanding shares.

Capitalization vs. Expense

Choosing to capitalize or expense investment costs changes a company's financials big time. Capitalizing adds the costs to the balance sheet as part of the asset's cost. These are then spread out over time. On the other hand, expensing costs take them off the income statement right away. This can lower taxes but also affects reported earnings.

| Type of Cost | Treatment | Effect on Balance Sheet |

|---|---|---|

| Equity issuance costs | Capitalized, netted against APIC | Reduces equity but spreads impact over time |

| Debt capital raising costs | Amortized over the loan's duration | Incremental expense impacting profitability annually |

| Legal and transaction fees (Equity) | Capitalized | Part of asset cost, impacting asset valuation |

| Legal fees (Debt) | Amortized | Periodic expenses affecting annual profits |

The choice between capitalization and expensing must match the company's financial strategy and rules. This ensures clear and consistent financial reports. It also shapes the effect of investments on the company's financial health over time.

How Dividends and Interest Affect Investments

Managing and recording dividend income and interest income are key to correct income recognition in investments. They show how well a company's investments are doing. And they influence what investors think and what financial reports say.

Recording Dividend Income

Dividends are a big part of returns for shareholders and must be recorded carefully. This clarity keeps finances clear. Dividends can come as cash or more stocks.

Each type changes the balance sheet in its way:

- Cash dividends decrease cash and retained earnings.

- Stock dividends raise the number of shares out there, changing shareholders' equity without affecting cash flow.

By recording these correctly, a company stays honest with investors. This helps maintain good dividend policies.

Interest Income on Investments

Interest from bonds or savings needs careful documentation too. This interest adds to a company's earnings. It affects cash flow and investment income on the balance sheet.

Correctly recording interest shows an investment's real worth. It helps in planning and making decisions.

| Dividend Type | Impact on Balance Sheet | Comments |

|---|---|---|

| Cash | Decrease in both cash and retained earnings | Directly lowers available cash and earnings saved |

| Stock | Increases shares outstanding, affects shareholders' equity | Makes each share worth less, doesn't touch cash flow |

Both dividend and interest income are active parts of a company. They need careful watching. They're vital for showing a company's financial health to everyone. They affect how people see the company, its investment choices, and how much trust shareholders have.

Adjusting Investment Values

In finance, keeping investment values accurate on balance sheets is key. Regular investment adjustment on balance keeps financial statements true to market conditions, ensuring investor trust. We look at two main areas: impairment of long-term investments and revaluation of assets. Both are vital for detailed and trustworthy financial records.

Impairment Losses

If an investment's market value falls below its book value, we record an impairment loss. These situations require careful review and financial tweaks. This ensures the book value matches the recoverable amount. For example, when a subsidiary's value drops below its listed value on the parent company's balance sheet, recording an impairment charge is essential. It must also be clearly reported on the income statement. These adjustments don't just alter the impairment books. They also influence how shareholders view their investments and their security.

Revaluation of Investments

The revaluation of assets updates an investment's listed amount to its current fair value on the balance sheet date. If market conditions have gotten better, this can raise an asset's value. Revaluation is critical, especially with U.S. GAAP rules, where asset classes cannot simply be switched. This means regular value updates are needed to keep real-time market conditions reflected.

| Financial Aspect | Implementation Date | Details | Impact |

|---|---|---|---|

| Accounting for available-for-sale securities | Post December 15, 2017 | Changes by FASB to accurately represent real-time valuation | Greater transparency in security valuation on balance sheets |

| Revaluation Frequency | Ongoing | Adjustments aligned with market conditions | Ensures assets are recorded at closest to market value |

| Impairment Testing | As needed | Assessing long-term investments for decreases in fair value | Prevents overstatement of asset values and protects stakeholders |

Adjusting the valuation of investments and assets is critical, not just for compliance, but for financial strategy too. By keeping up with these methods, companies avoid the risks of asset overvaluation. They also ensure their financial reporting stays strong and truthful.

Impact of Goodwill on Investments

Goodwill on a company's balance sheet can greatly change how we value a business. It becomes very important in mergers and acquisitions. Goodwill is created when one company buys another for more than the worth of its visible assets. This extra value comes from things like the brand, customer loyalty, and employee skills. These are not easy to see in the financial records.

Definition of Goodwill

Goodwill is the extra amount paid beyond what the company being bought is worth in plain assets. It includes things like special tech and strong market positions. These make a company stand out. For example, when big tech or manufacturing companies buy start-ups for their unique tech, that's goodwill at work. The way goodwill is figured out in finance is still a big topic today.

Accounting for Goodwill

How we account for goodwill changed a lot after December 15, 2001. Companies used to write off goodwill over time. Now, they check its value each year to see if it matches how much the assets are really worth. If not, the company might have to write down its value. This can really affect a company's reported profits and its value on paper.

For example, companies like Apple show a lot of goodwill and intangibles on their books. This shows they buy a lot and it affects their finances. How well these purchases work out can be seen in measures like return on net tangible assets.

Goodwill is more than just numbers, though. It reflects the strategic value a company gains. This can lead to better market performance and how investors see the company. So, it's key for financial pros to carefully look at how goodwill is treated. This makes sure reports are right and match up with real market values.

Reporting Investments in Equity

Investments in companies vary, depending on how much control or influence an investor has. There are two key methods: the equity method and consolidation accounting. Both are important for clear, rule-following financial reports.

Equity Method of Accounting

Using the equity method on the balance sheet happens when an investor seriously influences a company. This usually means owning 20% to 50% of the shares. The investment starts at its purchase price. It's then adjusted based on the investor's share of profits and any dividends.

For instance, buying a 30% part of a company for $500,000 and then the company earns $100,000. The investor would add $30,000 (30% of $100,000) to their investment value. This is after subtracting any dividends which lower the investment's value.

- Initial investment is recorded at cost.

- Updates are made for the investor's part of profits or losses and dividends received.

- The investment in associates balance shows the investor's share of the company's earnings.

Consolidation vs. Equity Accounting

Consolidation accounting contrasts with the equity method. It's used when an investor controls a company, often by owning more than 50% of it. In consolidation, a parent company adds all assets, liabilities, income, and expenses of the subsidiary. This gives a full picture of the group's finances.

- Consolidation merges the financial statements of the parent and subsidiary.

- A special section in equity on the balance sheet shows the non-controlling interest.

- Investments start as an asset, and then internal debts and transactions get removed in consolidation.

In the end, choosing between the equity method on the balance sheet and consolidation relates to how much control an investor has. Picking and using the right method matters. It helps show the financial reality, helping stakeholders make smart choices.

Regulations and Standards for Investments

Investors and financial experts navigate a complex world where following strict rules is essential. It's not just about the law, but also about keeping the market honest. Investment accounting rules, IFRS compliance, and GAAP regulations are key to correct financial reporting and investment valuation.

IFRS vs. GAAP

The difference between IFRS and GAAP is crucial for global finance. IFRS is used outside the United States and focuses on transparency in financial reporting. Meanwhile, GAAP is more common in the United States, with a focus on specific rules. The new GAAP updates in ASU 2023-02, starting after December 15, 2023, introduce fresh standards for public entities' reporting.

Compliance Requirements

Following investment standards is about more than rules. It's crucial for proving financial honesty and keeping investors' trust. For example, SEC rules state that major investments in entities like limited partnerships need special accounting. But this depends on how much control or influence an investor has.

| Regulation | Scope | Key Detail |

|---|---|---|

| IFRS | International | Principle-based standards |

| GAAP | United States | Rule-based standards |

| SEC Equity Method | U.S. Investments | Used for significant influence, generally over 3-5% ownership |

| Prudent Investor Act | 41 States | Guideline for trust management, adopted widely post-1990 |

Both IFRS and GAAP aim to make financial reporting more reliable and comparable. As investments get more complex and global markets link closer together, having standard rules becomes more important. These standards play a big role in the worldwide finance scene.

Common Errors in Reporting Investments

Financial professionals have a big job. They must be very precise with complex data. Yet, mistakes like balance sheet inaccuracies and investment classification errors can mess up a company's financial picture. It's really important to catch these errors early. Practices like checking bank records every month and having strong internal controls help with accurate reports and smart investment choices.

Misclassifying Investments

Putting investments in the wrong category is a big mistake. For example, mixing up short-term and long-term investments can confuse everyone about the company's goals and how much cash they have. These investment classification errors mess up balance sheets. They also give a false picture of how the company is doing financially.

- Error of Omission: Forgetting to put an investment on the balance sheet.

- Error of Duplication: Recording the same investment transaction more than once.

Failure to Adjust Values

It's important to update investment values to match their real market value. Not doing this can make investments look more or less valuable than they really are. This mistake can make financial numbers wrong. It might also lead to bad business choices.

- Checking values often can help fix any mistakes early. This helps the company follow rules and keep their reports accurate.

- Using statistics and technology to watch investments helps prevent mistakes. This way, a company can keep their financials strong and accurate.

By taking steps to prevent mistakes in adjusting investment balances, companies can protect their financial truth. This is key to keeping trust with investors and others involved.

Analyzing Investment Performance

Examining investment performance is key for tracking financial health and making wise decisions. It's about grasping financial indicators and using the right analytical tools. Professionals need this knowledge to succeed.

Key Metrics to Consider

When analyzing investments, certain financial metrics are essential. These include the Return on Investment (ROI), equity ratios, liquidity ratios, and benchmarks. Each one provides a unique look into how investments are performing:

- ROI: Shows the profit of an investment versus its cost. It's a key profitability indicator.

- Equity Ratios: Check how much debt a company uses, showing financial health and stability.

- Liquidity Ratios: Explore a company's ability to pay short-term debts, key for evaluating financial risk.

- Benchmark Comparisons: Look at investment performance against indexes or standards, matching up with market trends.

Tools for Analysis

Financial pros use various tools to gauge investment performance. From simple spreadsheets to advanced software, these tools help in making detailed analyses and strategic plans:

| Tool | Description | Use Case |

|---|---|---|

| Financial Modeling Software | Makes detailed financial forecasts possible, predicting future performance. | Handles complex scenarios with many factors and projections. |

| Spreadsheet Software | Allows easy calculations and data analysis with its features. | Great for working on ROI calculations and liquidity analyses. |

| Portfolio Management Systems | Tracks asset and performance metrics across different portfolios. | Helps keep investments diverse and aligned with goals. |

| Statistical Analysis Tools | Uses stats to find trends and patterns in data. | Good for predicting market moves and making proactive decisions. |

By using these tools with key financial metrics, pros can better review and boost investment outcomes. This blend of analysis and insight aids everyday and strategic financial choices.

Final Thoughts on Reporting Investments

The importance of accurate investment reporting is key to a company's health. A business's balance sheet shows its financial state at a period's end. This could be quarterly or yearly. The right reporting of investments is crucial.

It goes beyond just following rules. It affects how stakeholders see the company, its creditworthiness, and big decisions. That's why the details of assets, debts, and owner’s equity are so important in financial reports.

Importance of Accurate Reporting

Reporting investments right helps investors and pros see a company's value and future. The rule Assets = Liabilities + Owner's Equity is vital for a balanced book. A clear report of assets, total assets, liabilities, owner's equity, and earnings is important.

This prevents wrong interpretations of a company’s state and builds trust. Also, IRS rules require detailed e-filing of investment gains and losses. This makes accurate reporting even more vital.

Future Trends in Investment Accounting

Looking ahead, trends in financial accounting will change with new tech and rules. Software is becoming more important for handling data and doing math. Also, new tax laws and IRS rules for reporting investment costs show a changing field.

Accounting for investments must be flexible to keep up with these changes. This will ensure reports stay clear and true. It's about being ready for future changes while keeping reports reliable today.

FAQ

How are investments entered on a balance sheet?

Investments go on a balance sheet as current or non-current assets. Current investments will be sold within a year and are listed under short-term assets. Non-current, or long-term investments, stay on the books for more than a year. These are listed under long-term assets.

The first time you buy an investment, you record it with a journal entry. This entry puts the asset on the balance sheet or expenses it on the income statement. This depends on the type of investment.

What is the purpose of a balance sheet?

A balance sheet shows a company's financial health at a certain time. It shows what the company owns, what it owes, and its worth. This info helps people make smart decisions about the company's financial state and performance.

What's the difference between current and non-current investments on a balance sheet?

Current investments are assets meant to be turned into cash within a year. Non-current investments, or long-term investments, are assets held for longer to gain benefits. They are not planned to be sold within the year.

How are long-term investments explained on a balance sheet?

Long-term investments are assets a company plans to keep for over a year to earn returns like dividends, interest, rents, or gains. They are part of non-current assets, helping the company grow and prepare for the future.

What are the investment valuation methods on a balance sheet?

On a balance sheet, investments can be valued by historical cost or fair value method. Historical cost uses the original purchase cost. Fair value assesses investments at their current market price, changing with each reporting period.

What journal entries are made for an initial investment?

For an initial investment, you debit the investment account to show you've acquired an asset. You credit the cash or payable account to show the payment. This records if the investment will be capitalized or expensed.

How are dividend income and interest income recorded?

Dividend and interest incomes are credited on the income statement, boosting the period's earnings. On the balance sheet, you debit cash or receivables when this income is recognized, showing an asset increase.

What are impairment losses and revaluation of investments?

Impairment losses happen when an investment's value drops permanently below its book value. These losses lower the investment's value on the balance sheet to its recoverable amount. Revaluation increases an investment's recorded value to match its higher market value on the balance sheet.

What is goodwill and how is it accounted for?

Goodwill is an intangible asset from buying a company at a price above the fair market value of its net assets. It's listed on the balance sheet and checked for overvaluation by testing for impairment regularly.

How is the equity method of accounting used for investments?

The equity method is used when an investor significantly influences an investee, owning 20% to 50% of the votes. The investment is initially recorded at cost, then adjusted for the investor's share of profits or losses over time. These are shown in the investor's income statement.

What are the key differences between IFRS and GAAP in terms of investment reporting?

IFRS and GAAP differ mainly in valuation methods, impairment testing, and financial instruments classification. IFRS allows more fair value measures and has one impairment model. GAAP has several models and strict rules for classifying assets.

What are common errors in reporting investments on a balance sheet?

Common mistakes include wrongly labeling investments as short-term or long-term, not updating values to reflect market changes, and misapplying accounting rules. These can skew a company’s financial reports.

What tools are available for analyzing investment performance?

Tools for analyzing investment performance include financial statement analysis and ratio analysis, such as ROI and liquidity ratios. Software also offers advanced analysis, helping businesses gauge investment efficiency and profitability.

Why is accurate reporting of investments crucial?

Correct investment reporting keeps things transparent, ensures rule compliance, aids in making wise business choices, and shows stakeholders the real financial status of a company.

How might future trends in investment accounting impact reporting?

Future investment accounting trends, like tech advances, regulatory changes, and a lean towards more fair value accounting, will likely make reporting more accurate. This means better transparency and more relevant financial info for decisions.