High Earnings Per Share Stocks to Invest In

Investing in stocks with high earnings per share can be very profitable. Companies like Apple, Microsoft, and Amazon are great examples. These stocks often show strong financial health and have the chance to grow a lot over time. With an average Price to Earnings (P/E) ratio of 25.61 for debt-free companies, investors can see big returns.

High eps stocks are great for making money and growing your wealth. The highest EPS among debt-free companies is 141.37, showing they are financially strong. For those looking to make more money, these stocks are a good choice. They offer both growth and income.

Key Takeaways

- High eps stocks offer a unique combination of growth and income, making them appealing to investors.

- The average Price to Earnings (P/E) ratio of debt-free companies is 25.61, showing big returns on investment.

- The highest Earnings Per Share (EPS) among debt-free companies is 141.37, showing a strong financial base.

- Investing in high eps stocks can give a steady income and the chance for your money to grow.

- Debt-free companies with high eps stocks have shown impressive financial performance, with an average Return on Capital Employed (ROCE) percentage of 35.70%.

- The average Quarterly Sales Growth of debt-free companies is 59.63%, showing a strong chance for long-term growth.

Introduction to Earnings Per Share (EPS)

Earnings per share (EPS) is key for investors. It shows how profitable a company is and its growth chances. EPS is found by dividing net income by the number of shares outstanding. This gives a clear view of a company's financial health.

Companies with high EPS are seen as more profitable. They attract investors looking for highest earnings per share stocks.

EPS helps spot growth stocks. Its increase over time shows a company's direction and stability. Investors use EPS to check a company's performance and value. They also compare it to others in the same field.

By looking at EPS, investors can see a company's growth chances. This helps them make smart investment choices.

What is Earnings Per Share?

Earnings per share is found by dividing net income by the number of shares outstanding. There are basic and diluted EPS types. These consider the effect of more shares. Knowing about EPS is vital for those looking to invest in highest earnings per share stocks and get good returns.

Importance of EPS for Investors

EPS is very important for investors. It shows a company's financial health and growth chances. By looking at EPS, investors can see how well a company is doing and its value.

EPS also helps calculate other key metrics. Like the price-to-earnings ratio. This ratio helps investors understand a company's value and growth possibilities.

Criteria for Selecting High EPS Stocks

When looking at high eps stocks, it's key to check a few important things. Market size, industry trends, and financial health are all big factors. These help figure out if a stock could grow a lot. By looking at these, investors can pick stocks that fit their goals.

Some important things to think about when picking high eps stocks are:

- Market capitalization: Bigger companies might be more stable, but smaller ones could grow faster.

- Industry trends: What's happening in the sector can really affect how well a stock does.

- Financial health indicators: Looking at revenue growth, profit margins, and debt is important for a company's health.

By looking at these points and using tools like stock screeners, investors can find stocks with high eps growth. This helps them make smart choices and improve their investment portfolio with stocks that could grow a lot.

| Criteria | Description |

|---|---|

| Market Capitalization | Company size, with larger companies often being more stable |

| Industry Trends | Things happening in the sector that can affect how well a stock does |

| Financial Health Indicators | Looking at revenue growth, profit margins, and debt levels |

Top High EPS Stocks of 2023

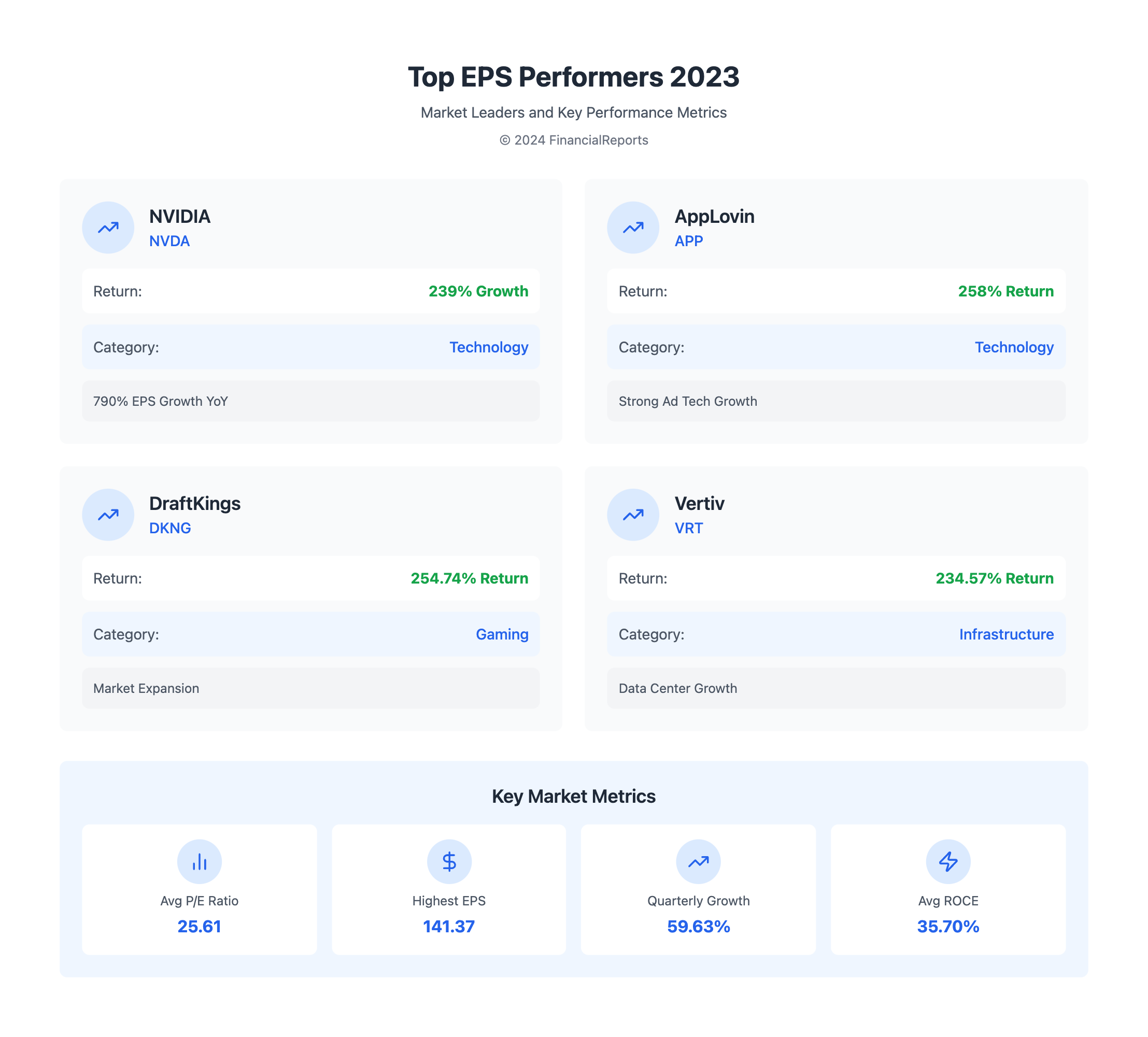

Investors looking to grow their wealth can focus on the top EPS stocks of 2023. The tech sector was a standout, with Nvidia and AppLovin Corporation leading the charge. Nvidia's stock rose by 239%, and AppLovin's surged by 258%.

DraftKings Inc. and Vertiv Holdings Co also made significant gains. DraftKings saw a 254.74% return, and Vertiv's stock rose by 234.57%. These companies highlight the tech sector's growth. Investors should look at market size, industry trends, and financial health when picking stocks.

Some of the top stocks of 2023 are:

- Nvidia (NASDAQ:NVDA), with over 790% EPS growth in the last year

- AppLovin Corporation, with a 258% year-to-date return

- DraftKings Inc., with a 254.74% year-to-date return

These companies are great examples of high EPS growth in tech. They are good choices for investors looking for high earnings stocks.

Analyzing Earnings Growth Potencial

When looking at high eps stocks, it's key to check their earnings growth chance. We need to look at their past performance and guess their future earnings. Remember, past results don't always mean future success. So, we must do a deep dive into the analysis.

Investors should think about things like market trends, company news, and the overall economy. These can all affect a company's earnings in the future.

To figure out earnings growth, investors can try different ways, like:

- Looking at EPS trends over time

- Finding patterns or oddities in past data

- Comparing a company's P/E ratio to its past or to others in the same field

By examining these points and using forecasting tools, investors can make smart choices about high eps stocks. They can better understand their growth possibilities.

Understanding Price-to-Earnings Ratio (P/E)

The Price-to-Earnings (P/E) ratio is key for checking if a company's stock price is fair. It's found by dividing the stock's market value by its earnings per share. This ratio helps see if a company is valued right and if it might grow more.

For example, the S&P 500's P/E ratio in April 2024 was 26.26. This shows the market is seen as somewhat pricey.

Looking at highest earnings per share stocks, the P/E ratio is very important. A high P/E might mean the stock is too expensive. On the other hand, a low P/E could mean it's a good deal. For instance, FedEx Corporation (FDX) had a P/E of 14.40 on Feb. 9, 2024. Hess Corporation (HES) had a P/E of 31.64 on the same day. This shows how comparing P/E ratios is key.

Some important things to remember about P/E ratios include:

- Industry-specific P/E ratios vary a lot.

- There are trailing and forward P/E ratios, each with its own use.

- How a company's forward and trailing P/E ratios compare can show earnings changes.

| Company | P/E Ratio |

|---|---|

| FedEx Corporation (FDX) | 14.40 |

| Hess Corporation (HES) | 31.64 |

| Marathon Petroleum Corporation (MPC) | 7.19 |

Knowing about the P/E ratio helps investors make better choices. It's important to look at the P/E ratio with other financial numbers for a full picture.

Risks Associated with High EPS Stocks

Investing in high EPS stocks can be very rewarding. But, it also comes with risks that investors need to think about. Knowing these risks is key to making smart investment choices and protecting your money.

Market Volatility

High EPS stocks, which are often from companies growing fast, face big market risks. Prices can change quickly, leading to big wins or losses. It's important for traders to watch the market closely to avoid big losses.

Economic Factors Influencing EPS

Many economic factors can change a high EPS stock's earnings. Things like interest rates, inflation, and GDP growth play a big role. For example, higher interest rates can make borrowing more expensive, cutting into profits and EPS. Also, when the economy slows down, people spend less, hurting a company's earnings.

High EPS Stocks in Different Sectors

Looking at the highest earnings per share stocks in various sectors can help investors find growth and stability. Each sector has its own benefits, thanks to different industry factors.

Technology Sector

The technology sector is a leader in high EPS stocks, thanks to innovation and growth. Glaxosmithkline Pharma is a top example, with a market value of 38,530.56 Cr. This shows it has strong earnings and a high EPS.

Consumer Goods Sector

Consumer goods companies are known for steady earnings growth and strong brand value. P & G Hygiene is a standout, with a P/E ratio of 69.93. This ratio shows investors have a lot of faith in its earnings.

Financial Services Sector

Financial services firms are known for their stability and high EPS. Nestle India has the highest EPS at 169.08 Rs. This highlights its strong market position and smart financial management.

| Company | Sector | EPS (Rs) | P/E Ratio | ROCE (%) | Dividend Yield (%) |

|---|---|---|---|---|---|

| Nestle India | Financial Services | 169.08 | 16.92 | 57.94 | 2.78 |

| P & G Hygiene | Consumer Goods | — | 69.93 | — | — |

| Glaxosmithkline Pharma | Technology | — | — | — | — |

| Waaree Renewable | Technology | — | — | 107.10 | — |

| Mishtann Foods | Consumer Goods | — | — | — | — |

How to Build a Portfolio with High EPS Stocks

Investing in high eps stocks can be very profitable. But, it needs a careful plan to build a portfolio. It's key to spread out investments and balance risks and rewards. Using index funds and ETFs is a good way to get broad market exposure while reducing risk from single stocks.

Many investors follow the "90/10 rule." This means 90% of the portfolio goes to index funds and 10% to high eps stocks. This mix can help investors enjoy the benefits of high eps stocks while keeping risk low. Proper diversification is vital for managing risk and growing the portfolio over time.

When picking high eps stocks, look at market size, industry trends, and financial health. A balanced portfolio should have a mix of big, medium, and small companies. It should also cover different industries and sectors. Mixing high eps stocks with stable, value-based investments helps balance risk and reward.

| Stock | EPS | Industry |

|---|---|---|

| Apple Inc. | 5.67 | Technology |

| Microsoft Corp. | 7.42 | Technology |

| Johnson & Johnson | 5.51 | Healthcare |

By following these tips and considering important factors, investors can create a portfolio with high eps stocks. This portfolio will meet their investment goals and risk level.

The Role of Dividends in EPS

Dividends are key in investment strategies, giving shareholders a steady income. They show a company's financial health and profits. This makes dividend-paying stocks appealing to investors.

Importance of Dividends

Dividends have many benefits:

- They offer regular income, great for income-focused investors.

- Regular dividend payments show a company's confidence in its profits.

Investors see dividends as a sign of a company's financial health and ability to keep earning.

Stocks with High Dividends and EPS

Finding highest earnings per share stocks with big dividends can boost a portfolio. These companies usually work in stable industries with steady cash flows.

- Consumer Goods: Companies like Procter & Gamble have high dividends and strong EPS.

- Financial Services: Firms such as JPMorgan Chase offer high EPS and reliable dividends.

- Energy Sector: Well-established energy companies provide attractive dividends and strong earnings.

Mixing dividends with high EPS growth can create a strong and diverse investment portfolio. For more on EPS and dividends, check out Investopedia's guide on EPS and Dividends.

Tools for Tracking EPS Performance

Keeping an eye on high eps stocks needs reliable tools. These tools should give real-time data and detailed analysis. The right tools can really help improve your investment plans.

Financial News Platforms

Financial news sites give the latest earnings reports and expert views. These are key for tracking high eps stocks. Here are some top sites:

- Bloomberg: Offers real-time earnings news and deep market analysis.

- Yahoo Finance: Has easy-to-use earnings calendars and news for investors.

- Reuters: Covers corporate earnings and market trends in detail.

Stock Analysis Software

Stock analysis software helps investors sort and study high eps stocks. Here are some top tools:

- FINVIZ: Costs $39.50/month or $299.50/year. It has real-time data, interactive charts, and strong stock screeners for finding high eps stocks.

- Trade Ideas: Offers plans from free to $254/month. It's AI-driven for day trading and has great filters for high eps stocks.

- ZACKS (NASDAQ): Known for its EPS metrics, ZACKS has both free and premium options. It tracks high eps stocks across many sectors.

- Stock Rover: Great for long-term investors, Stock Rover has nearly 500 screening filters. It finds high eps stocks with solid fundamentals.

Using these tools lets investors create custom screens and analyze EPS ratings. This helps make smart choices with detailed financial data. Learning to read financial statements through these platforms helps spot high eps stocks with growth chances.

Case Studies of Successful EPS Investments

The highest earnings per share stocks offer investors big returns through steady EPS growth. Looking at real examples shows how these companies keep their EPS high. This gives us insights for making smart investment choices.

Apple Inc.: A Success Story

Apple Inc. is often at the top of the list for highest earnings per share stocks. Its success in the tech world comes from new products and growing its market. Apple also manages costs well and spreads out its income, giving big returns to its investors.

Lundin Gold: Lessons Learned

Lundin Gold has seen EPS grow by 16% each year for the last three years. The company does well financially and its insiders are confident. But, investors should look closely at the risks. A recent warning shows we need to look at more than just EPS when we're thinking about investing.

| Company | Annual EPS Growth | Key Financial Metrics | Insider Activity | Notable Insights |

|---|---|---|---|---|

| Apple Inc. | Consistent Growth | Revenue Diversification, Cost Management | Significant insider buying | Market expansion and innovation drive EPS |

| Lundin Gold | 16% per annum | EBIT margins increased to 49% | Insiders hold US$58M | Strong growth with emerging risks |

Conclusion: Evaluating Investment Opportunities

As we wrap up our look at high earnings per share (EPS) stocks, it's key to stress the need for deep research. High EPS stocks might look promising, but past success doesn't always mean future gains. Investors need to look at many factors before making a choice.

When checking out high EPS stocks, consider the company's growth, its place in the industry, its financial health, and its market value. It's also important to mix EPS analysis with wider market and economic data. This helps get a full picture of what's out there.

Investors should balance the chance for big gains with the risks involved. A mix of high EPS stocks and other investments can reduce risk and make your portfolio stronger. Keeping up with market changes is vital for success.

When adding high EPS stocks to your portfolio, match them with your risk level and investment time frame. This way, you can grow your wealth over time. But, always be ready for the special challenges and chances these investments bring.

FAQ

What are high earnings per share (EPS) stocks?

High EPS stocks are from companies that are growing fast, often in tech. They have a high earnings per share ratio. This ratio shows how profitable a company is and how much investors might make.

Why is EPS important for investors?

EPS shows how well a company is doing financially. It's used to figure out a company's value. This helps investors see if a company is growing and how it compares to others in its field.

What are the key criteria for identifying and selecting high EPS stocks?

To pick high EPS stocks, look at market size, industry trends, and financial health. Check revenue growth, profit margins, and debt levels. It's key to find companies with steady EPS growth.

Which are the top-performing high EPS stocks in 2023?

In 2023, the best high EPS stocks are in the S&P 500, mainly in tech. These companies have shown strong financials and high EPS growth.

How can investors analyze the earnings growth of high EPS stocks?

Look at a company's past EPS trends over time. Also, check future earnings forecasts and market conditions. This helps guess a stock's earnings growth.

What is the relationship between EPS and the Price-to-Earnings (P/E) ratio?

The P/E ratio is linked to EPS. Changes in EPS can change a stock's P/E ratio. This affects its value. Knowing how to read P/E levels is key for high EPS stocks.

What are the possible risks of investing in high EPS stocks?

Risks include market ups and downs, economic factors, and earnings cycles. Also, stocks can be overvalued or have unsustainable growth. Always do your homework and diversify to reduce risks.

How do high EPS stocks perform across different sectors?

High EPS stocks exist in tech, consumer goods, and finance. Each sector has its own factors that affect EPS. Knowing these trends helps build a diverse portfolio.

How can investors build a balanced portfolio with high EPS stocks?

A balanced portfolio needs stocks from different sectors and sizes. Mix high-growth stocks with stable ones. This balances risk and aims for long-term goals.

What is the relationship between dividends and EPS?

Dividends and EPS are connected. Dividend payments can affect EPS. Finding stocks with high EPS and good dividends is a smart strategy for some.

What tools and resources are available for tracking and analyzing EPS performance?

Use financial news sites, earnings calendars, and stock analysis tools. Knowing how to read financial statements is also key for EPS analysis.

Can you provide case studies of successful and unsuccessful investments in high EPS stocks?

Look at companies with successful EPS growth and big returns. Also, see examples where high EPS didn't lead to expected gains. These stories offer real insights into EPS analysis.