Gross Revenue vs Net Revenue: Key Differences

It's important to know the difference between gross revenue and net revenue. This is key for financial experts, investors, and clients looking for detailed financial data. Gross revenue and net revenue are important in financial analysis. They help in making business decisions and understanding revenue.

Gross revenue is the total money earned from sales before any deductions. Net revenue is what you get after subtracting some deductions from gross revenue. Knowing this difference is vital for a business's profit and financial health. It's a big part of financial reporting, showing a company's true financial performance.

Introduction to Revenue Reporting

The Financial Accounting Standards Board (FASB) sets rules for reporting revenue under generally accepted accounting principles (GAAP). Big companies like Apple, with $260 billion in revenue in 2019, must report accurately. Revenue and net revenue are key in financial analysis. Knowing their differences helps in making smart business choices.

Key Takeaways

- Gross revenue represents total sales before deductions.

- Net revenue is calculated by subtracting deductions from gross revenue.

- Gross revenue vs net revenue reporting is key for financial analysis and decision-making.

- Revenue and net revenue are distinct concepts in financial reporting.

- Understanding gross revenue and net revenue is essential for financial professionals and investors.

- The FASB provides guidelines on standardized gross vs net revenue reporting under GAAP.

- Companies must carefully consider their revenue reporting to ensure accuracy and compliance with regulatory requirements.

Understanding Gross Revenue: Definition and Components

Gross revenue is key for businesses, showing the total income from sales before any deductions. It's found by multiplying the price of each item by how many were sold. The formula is: Total Units Sold × Price per Unit.

The main parts of gross revenue are sales, service fees, and other income. Knowing gross revenue helps businesses see their total income from basic operations. It gives insights into their market performance and sales ability.

What is Gross Revenue?

Gross revenue is at the top of the income statement, showing sales income. It's vital for businesses to understand their total revenue. This knowledge helps in making decisions about investments, expansions, and other strategic moves.

Key Components of Gross Revenue

The main parts of gross revenue are:

- Product sales: The income from selling products.

- Service fees: The income from services provided.

- Other income streams: Income from other sources, like investments or rentals.

How Gross Revenue is Calculated

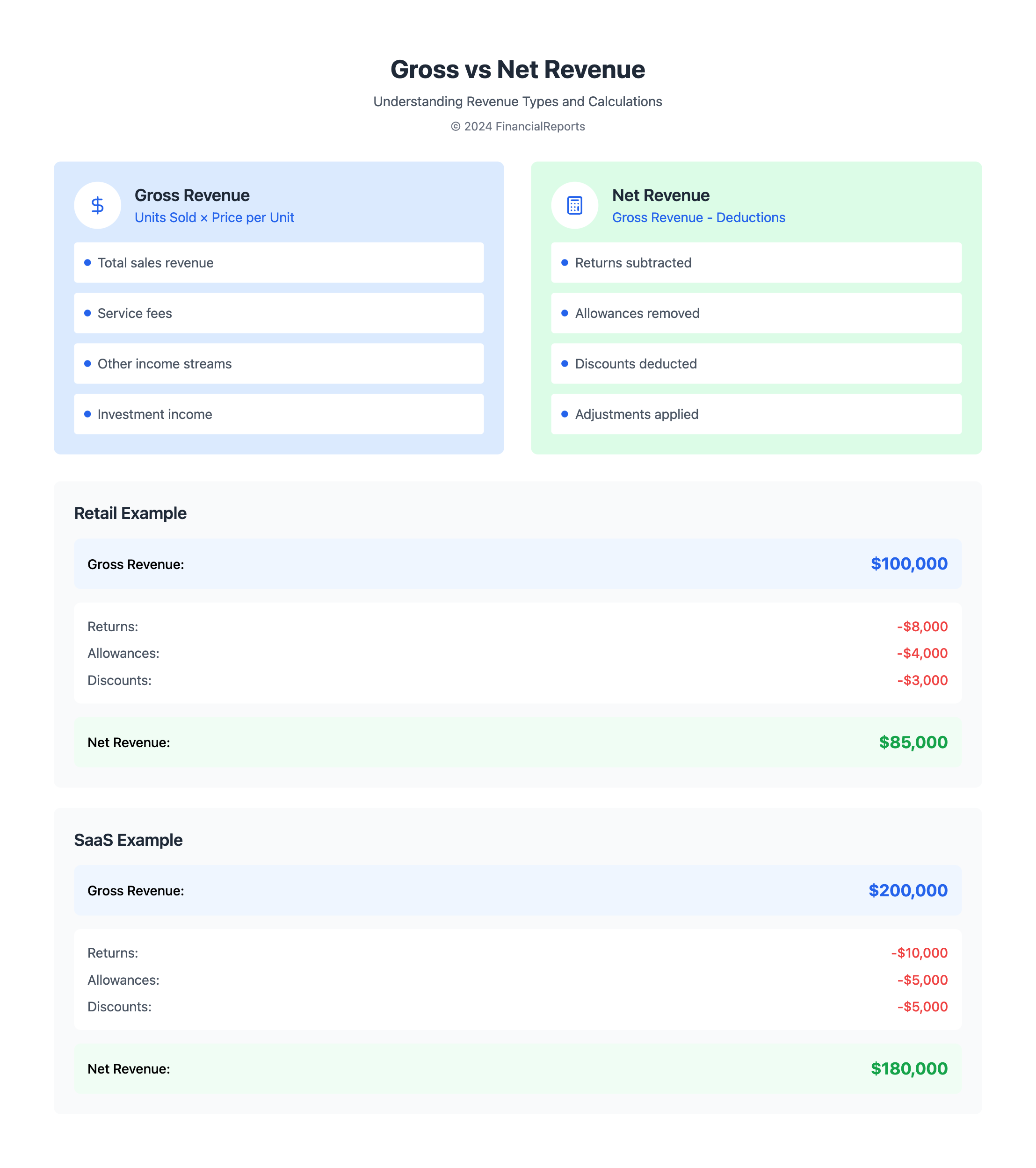

The formula for gross revenue is simple: Total Units Sold × Price per Unit. For instance, if a company sells 100 units at $10 each, the gross revenue is $1,000. It's important to know the difference between gross revenue and net revenue. Net revenue subtracts deductions like returns, allowances, and discounts.

| Revenue Type | Formula | Example |

|---|---|---|

| Gross Revenue | Total Units Sold × Price per Unit | 100 units × $10/unit = $1,000 |

| Net Revenue | Gross Revenue − Returns − Allowances − Discounts | $1,000 - $100 - $50 - $50 = $800 |

Defining Net Revenue: What You Need to Know

Net revenue is key for businesses. It shows the money left after direct costs are taken out of gross revenue. To get net revenue, you first calculate gross revenue by multiplying units sold by price per unit. Then, you subtract deductions like discounts, returns, and allowances from gross revenue.

What is Net Revenue?

Net revenue, or net sales, is what's left after direct costs are removed. It gives a clearer view of a company's financial health. It's vital for checking how profitable and efficient a business is.

Deductions that Affect Net Revenue

The following deductions can impact net revenue:

- Discounts

- Returns

- Allowances

These deductions can greatly change net revenue. Knowing them is key for accurate financial reports.

How Net Revenue is Calculated

The formula for net revenue is: Net Revenue = Gross Revenue - Deductions. This formula shows a company's financial health. It helps investors and lenders see if the company is profitable and growing.

| Gross Revenue | Deductions | Net Revenue |

|---|---|---|

| $100,000 | $20,000 | $80,000 |

Understanding net revenue and gross revenue helps businesses make smart choices. They can manage costs, set prices, and plan for growth.

The Importance of Gross Revenue for Businesses

Gross revenue is key for businesses. It shows the total money made without subtracting costs. This helps track sales and market share growth. It gives insights into how well a business is doing in the market.

When looking at gross revenue vs net revenue, net revenue is what's left after selling costs are taken out. This gives a clearer picture of a company's financial health. Revenue vs gross calculations help businesses decide on pricing, resources, and growth plans.

Tracking gross revenue has many benefits:

- It measures business performance and what investors think.

- It checks market demand and pricing.

- It looks at sales success and market share growth.

Understanding gross revenue's role helps businesses make smart choices. This can lead to growth and better finances.

Understanding Net Revenue's Role in Financial Health

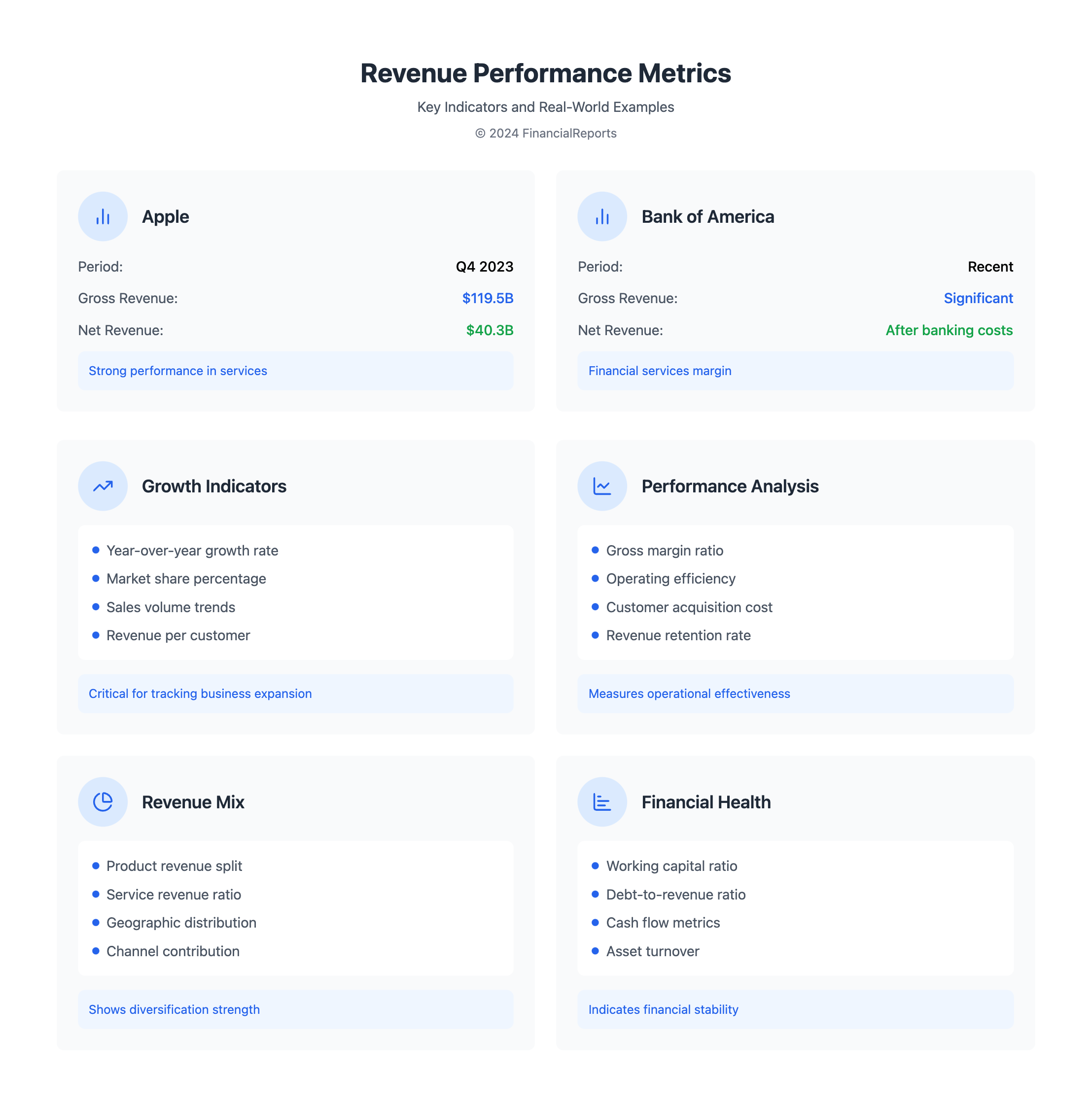

Net revenue gives a clearer view of a company's profit. It subtracts many costs from the total income. For example, Apple's net sales in Q4 of 2023 were $119.5 billion. After subtracting costs, Apple's net income was $40.3 billion. This shows how important net revenue is for a company's financial health.

Calculating net revenue involves several important parts. These include gross revenue, cost of sales, operating expenses, and other income or expenses. By looking at these, businesses can find ways to boost their revenue. They might cut costs or improve sales to increase net revenue.

Net revenue is key for checking if a business can make profits and last long. Investors and financial analysts also look at it. They use it to see how well a company is doing over time. For instance, Bank of America's net revenue shows its financial health, based on its income, expenses, and other factors.

Several things can change net revenue. These include:

- Cost of sales

- Operating expenses

- Other income or expenses

- Taxation

Knowing these factors helps businesses make better choices. They can work on their revenue streams and get better financially.

Key Differences Between Gross Revenue and Net Revenue

The main difference between gross and net revenue is in the deductions. Gross revenue is the total sales. Net revenue subtracts various deductions, giving a clearer view of earnings. Knowing the difference is key for financial planning and checking performance.

In data access services, third-party providers might send fees to the originator after taking a commission. Figuring out whether to record revenue as gross or net can be tough. The new revenue standard helps decide if you're a principal or agent in a transaction.

Revenue Recognition Policies

When deciding, look at who controls the goods or services and the promise made in the deal. Considerations like cash, credits, or items that reduce what's owed should lower revenue.

Impact of Deductions on Revenue Calculation

When making estimates, only include them if a big change in revenue is unlikely. Knowing how to calculate gross vs net vs revenue is critical for a business's health. Here's a table showing the main differences:

| Revenue Type | Definition | Calculation |

|---|---|---|

| Gross Revenue | Total sales before deductions | Number of Products or Services Sold x Average Sales Price |

| Net Revenue | Revenue after deductions | (Number of Products or Services Sold x Average Sales Price) - Returns - Discounts |

Understanding gross vs net revenue is essential for making smart business decisions. It helps in choosing investments, focusing on products, and expanding markets. By grasping these differences, companies can improve their financial performance and grow through informed decisions.

How to Analyze Gross Revenue Trends

To understand gross revenue trends, knowing what gross revenue is key. It's the total income a business makes, without any costs or expenses. The gross revenue formula is simple: it's the total sales, found by multiplying units sold by the price per unit. For example, selling 1,000 products at $70 each results in $70,000 in gross revenue.

When looking at gross revenue trends, several important metrics are worth watching. These include:

- Year-over-year growth: This shows how revenue changes over time.

- Market share: It tells you where your business stands in the market.

- Sales volume: This metric helps spot trends in sales and revenue.

To figure out gross revenue, use the formula: Gross Revenue = Total Sales Revenue. This means multiplying the number of units sold by the price per unit. For example, selling 1,000 units at $70 each results in $70,000 in gross revenue. Knowing how to calculate gross revenue is vital for making smart decisions on pricing, production, and investments.

| Metric | Description |

|---|---|

| Gross Revenue | Total sales revenue, calculated by multiplying total units sold by price per unit |

| Year-over-Year Growth | Comparison of revenue growth from one year to the next |

| Market Share | Company's position within the market, relative to competitors |

The Role of Net Revenue in Financial Reporting

Net revenue is key in financial reports. It shows how much money a company makes after all costs are subtracted. It's a main part of financial statements like the income statement and cash flow statement.

Looking at net revenue over time helps see how a company is doing. You can use different ways to compare, like:

- Revenue growth rate

- Net profit margin

- Return on investment (ROI)

To find net revenue, you subtract all costs from the total income. The formula is: Net Revenue = Gross Revenue - Total Deductions. Knowing net revenue is important for planning, setting prices, and making investments. It shows how profitable a company is and helps in making smart choices.

| Financial Statement | Net Revenue Component |

|---|---|

| Income Statement | Net revenue from operations |

| Cash Flow Statement | Net cash flows from operations |

In summary, net revenue is very important in financial reports. Its calculation and comparison over time are key to understanding a company's success and growth.

Common Misconceptions About Gross Revenue

When looking at a company's finances, it's key to know the difference between gross and net revenue. Gross revenue is not the profit a company makes. It's the total sales before any costs are subtracted. This mistake can make financial analysis and planning wrong.

Gross revenue is found by adding up all sales. Net revenue is found by subtracting direct costs from gross revenue. Knowing this difference is important. It shows a company's real profit. Investors and financial experts should look at both to understand a company's health.

Myths About Gross Revenue Calculation

Some common myths about gross revenue include:

- Gross revenue is the same as net revenue

- Gross revenue is what a company keeps

- Gross revenue doesn't matter for market demand

In truth, gross revenue is key for sales goals and market demand. Net revenue shows a company's real profit. Knowing the difference helps companies make better financial choices.

Realities of Gross Revenue Reporting

The table below shows the main differences between gross and net revenue:

| Revenue Type | Calculation | Importance |

|---|---|---|

| Gross Revenue | Total Sales | Assessing market demand and setting sales targets |

| Net Revenue | Gross Revenue - Direct Costs | Understanding actual profitability and evaluating sales strategies |

By understanding the difference between gross and net revenue, companies can better see their financial health. This helps them make smart choices to grow and be more profitable.

Misunderstandings Around Net Revenue

Many people get net revenue mixed up with net income or profit. But net revenue is the total income from sales after subtracting returns and allowances. It's important to know the difference between net revenue, net income, and profit for clear financial reports and smart decisions.

Getting net revenue right is key for clear financial reports and smart choices. People often mix up net revenue with net income or profit, leading to wrong ideas about a company's health. To steer clear of these errors, it's vital to grasp what net revenue is and how it's figured out.

Common Mistakes in Net Revenue Interpretation

Some common errors in understanding net revenue include:

- Confusing net revenue with net income or profit

- Not accounting for deductions, such as returns and allowances

- Not understanding the impact of revenue recognition policies on net revenue

By avoiding these common mistakes and ensuring accurate net revenue reporting, companies can make informed decisions and keep their finances clear. Net revenue is a key part of a company's financial statements. Knowing its importance is essential for financial experts, investors, and clients.

Best Practices for Managing Revenue Reporting

Effective revenue management is key for businesses to grow. They need strong accounting systems, regular account reconciliations, and advanced financial software. It's also important to know the difference between gross revenue vs net revenue to improve financial performance.

Gross revenue is found by multiplying the number of items sold by their price. Net revenue is what's left after subtracting costs like COGS, sales returns, and commissions from gross revenue. Knowing how to calculate these helps businesses understand their financial health and make smart decisions.

Strategies for Improving Revenue Accuracy

- Implementing automated accounting systems to reduce errors and increase efficiency

- Regularly reconciling accounts to ensure accuracy and identify discrepancies

- Utilizing advanced financial software to track and analyze revenue data

Essential Tools for Revenue Management

Financial analytics software, accounting platforms, and data visualization tools are key. They help businesses track and analyze revenue, spot trends, and make growth-driving decisions.

| Business Type | Gross Revenue | Net Revenue |

|---|---|---|

| Retail Business | $100,000 | $85,000 |

| SaaS Business | $200,000 | $180,000 |

By using these best practices and tools, businesses can boost revenue accuracy and make better decisions. Understanding gross revenue vs net revenue and knowing how to calculate gross revenue are vital for effective revenue management.

Conclusion: The Significance of Understanding Revenue Types

As we wrap up our look at gross revenue vs. net revenue, it's clear that knowing the difference is key. Gross revenue shows a company's total sales. Net revenue, on the other hand, shows how much profit is left after expenses are subtracted.

It's also important to keep up with changes in revenue recognition. New tools like advanced data analytics and AI are changing how we track and report revenue. Financial experts, investors, and clients need to stay current to make smart choices and stay ahead.

Understanding the difference between gross and net revenue helps businesses manage their finances better. It also helps them run more efficiently and share their financial health clearly with others. For investors, knowing this can help them see if a company is profitable and sustainable in the long run. This knowledge is essential for making good financial decisions.

FAQ

What is the difference between gross revenue and net revenue?

Gross revenue is the total income a business makes. Net revenue is what the company keeps after subtracting costs like returns and discounts.

How is gross revenue calculated?

To find gross revenue, add up all income sources. This includes sales, service fees, and more. No expenses are subtracted.

What is the formula for calculating net revenue?

The net revenue formula is: Net Revenue = Gross Revenue - Returns - Discounts - Allowances

Why is tracking gross revenue important for businesses?

It shows how well a company is doing in the market. It helps see if sales are growing and the company's market position.

How does net revenue impact a company's financial health?

Net revenue shows if a business can make a profit after costs. It's key for checking if a company is running well and can last long-term.

What are the key differences between gross revenue and net revenue?

Gross revenue doesn't subtract costs like returns and discounts. Net revenue does. This makes net revenue a clearer picture of income.

What tools and metrics can be used to analyze gross revenue trends?

People use tools and metrics like growth rates and market share to study gross revenue. Advanced software helps track and understand this data.

How is net revenue presented in financial statements?

Net revenue is in a company's income and cash flow statements. It shows how well the company is doing over time.

What are some common misconceptions about gross revenue?

Some think gross revenue equals profit. But it doesn't account for costs. It's just one part of a company's financial picture.

What are the possible pitfalls in interpreting net revenue figures?

Mistakes happen when net revenue is confused with net income. Knowing the difference is key to understanding financial data correctly.

What best practices can help improve revenue reporting accuracy?

Use strong accounting systems and check accounts often. Advanced software can also help manage and report revenue accurately and efficiently.