Gross Profit: Revenue Minus Cost of Goods Sold

Gross profit is a key financial metric. It's found by subtracting the cost of goods sold (COGS) from total revenue. This shows how well a product is doing and how efficient operations are. The formula Gross Profit = Revenue − COGS helps financial experts see if a company is making money from its products.

The idea of gross profit is important for checking how well a business uses resources like labor and materials. It shows how well a company uses these costs. But, net profit looks at all costs, not just those for making products. Knowing gross profit helps understand a company's financial health and how well it runs.

Key Takeaways

- Gross profit is found by subtracting COGS from total revenue. This is often shown as revenue minus cost of goods sold equals gross profit.

- Gross profit shows a company's profits after production costs. It clearly shows how much money is made after costs are subtracted.

- Gross profit helps see how much money a company has to spend. It shows variable costs that change with output. This means it shows how much money is left after costs.

- Gross margin is found by dividing gross profit by total sales revenue and multiplying by 100. It shows a percentage of financial health.

- Understanding gross profit depends on knowing total revenue. Gross margin gives a clearer picture of profit as a percentage.

- Gross profit and gross margin have different uses. They are calculated differently. But both are important for checking a company's financial health and making decisions.

- By comparing gross profits, you can see which company spends more efficiently. Gross profit is a key metric for this comparison.

Understanding Gross Profit and Its Importance

Gross profit is key for businesses. It shows how well a company is doing financially. It's found by subtracting the cost of goods sold from total revenue. This gives us: revenue minus cost of goods sold equals gross profit.

This metric helps in making decisions about pricing and production. It shows where a company can cut costs or improve efficiency. A higher gross profit means a company is doing well financially.

Several things can affect gross profit. These include product pricing, production costs, and raw material costs. Also, labor costs and manufacturing spoilage play a role. Knowing these can help a business make better choices to boost its profits.

| Factor | Impact on Gross Profit |

|---|---|

| Product pricing adjustments | Can increase or decrease gross profit margin |

| Production costs | Can decrease gross profit margin if not controlled |

| Raw material sourcing | Can impact gross profit margin if costs are high |

In conclusion, gross profit is very important for businesses. It gives insights into a company's financial health. By understanding what affects gross profit and making improvements, companies can do better financially.

Calculating Gross Profit: The Basic Formula

To figure out gross profit, you need to know the parts involved. The formula with sales and gross profit is key. Revenue is the total money made from selling things, minus returns and discounts. The cost of goods sold includes costs like labor and materials directly tied to making the products.

Understanding Revenue and Cost of Goods Sold

The formula needs accurate numbers for revenue and cost of goods sold. Revenue is the income before any deductions. Cost of goods sold includes variable costs like raw materials and direct labor, but not fixed costs.

The Calculation: A Step-by-Step Guide

The gross profit formula is simple: Gross Profit = Total Revenue − Cost of Goods Sold. Let's say a shoe-maker makes $50 and spends $15 on production. Their gross profit is $35, and the margin is 70%. This shows how the formula helps measure how profitable a business is.

| Business Type | Total Revenue | Cost of Goods Sold | Gross Profit | Gross Profit Margin |

|---|---|---|---|---|

| Shoe-Maker | $50 | $15 | $35 | 70% |

| Accounting Firm | $500 | $100 | $400 | 80% |

Using the formula, businesses can check their production efficiency and growth. This helps them make smart choices to succeed.

The Role of Gross Profit in Financial Statements

Gross profit is key in a company's financial reports. It shows how well a company makes money from what it produces. To find gross profit, you just subtract the cost of goods sold from revenue. This helps businesses see where they can do better and make smart choices about prices and production.

Income Statement Overview

An income statement gives a detailed look at a company's income and expenses over time. It shows the gross profit, which is important for a company's health. Looking at the income statement helps investors and analysts see if a company can make money. This helps them decide if they should invest or lend money.

Analyzing Profit Margins

Profit margins are very important for businesses. They show how much of the revenue stays as profit. By looking at profit margins, companies can spot trends and make changes to get better financially. The formula for profit margins is simple: gross profit divided by revenue. It clearly shows how profitable and efficient a company is.

- Gross profit margin is a key indicator of a company's financial health and efficiency.

- Analyzing profit margins helps companies identify areas for improvement and make informed decisions about pricing and production.

- The calculation of gross profit, which is revenue minus cost of goods sold, is a straightforward process that provides insight into a company's production costs and profitability.

Factors Affecting Revenue and COGS

When figuring out the cost of goods sold, several factors come into play. These include pricing, production costs, and market demand. A company's pricing strategy is key to its revenue. It must find a balance between making a profit and keeping prices competitive.

For example, a company can use the cost of goods sold formula to figure out its break-even point. This helps set prices that ensure profitability.

Production costs, like labor and materials, directly affect COGS. Companies can cut these costs by improving efficiency or investing in automation. This can boost the gross profit margin.

Market demand trends also matter a lot. They can influence both revenue and costs. By understanding these trends, businesses can make smart choices to reduce risks and increase profits.

Some important stats to keep in mind are:

- A good gross profit margin ratio is usually between 50% to 70% for retailers, restaurants, and manufacturers.

- Service industry companies often have gross profit margins in the high-90% range because of lower production costs.

- Clothing retailing can have gross profit margin ratios ranging from 3% to 13%.

By looking at these factors and using the cost of goods sold formula, businesses can aim for better performance. This helps them make informed decisions to improve their financial health and stay ahead in the market.

| Industry | Gross Profit Margin Ratio |

|---|---|

| Retailers, Restaurants, and Manufacturers | 50% to 70% |

| Service Industry Companies | High-90% range |

| Clothing Retailing | 3% to 13% |

Gross Profit Margin: What It Means for Businesses

Gross profit margin is a key metric for a company's success. It shows how much profit a company makes by subtracting the cost of goods sold from revenue. Then, it divides this by revenue and multiplies by 100. This gives a percentage that shows how well a company is doing financially and how efficient it is.

The formula for gross profit margin is (Revenue - COGS) / Revenue x 100. This means the profit a company makes minus the cost of goods sold equals the gross profit. Then, it shows this as a percentage of the revenue.

Formula for Gross Profit Margin

The formula for gross profit margin is simple: (Revenue - COGS) / Revenue x 100. For example, if a company makes $100,000 in revenue and spends $60,000 on COGS, its gross profit margin is 40%. This means it keeps $0.40 for every dollar it makes after direct expenses.

Importance of Gross Profit Margin

The gross profit margin is very important for businesses. It shows how profitable and efficient a company is. A higher margin means a company keeps more money to invest in growth, research, and development.

Here are some key points about gross profit margin:

- It measures production efficiency and profitability on a unitary scale.

- It serves as a comparative tool across businesses and industries.

- It helps companies identify areas for improvement and refine their product offerings to align with industry benchmarks.

| Revenue | COGS | Gross Profit Margin |

|---|---|---|

| $100,000 | $60,000 | 40% |

In conclusion, gross profit margin is a vital metric for businesses. It gives insight into their financial health and operational efficiency. By calculating revenue minus cost of goods sold equals, companies can find their gross profit. This allows them to make informed decisions and plan strategically.

Impact of Gross Profit on Business Decisions

Gross profit is key in making business decisions. It helps in checking product profits and deciding where to use resources. With gross profit data, companies can make better budgets, forecast costs, and focus on making more money.

A company's gross profit is what's left after subtracting COGS from revenue. The gross margin shows how well a company is doing financially. For example, tech companies with high gross margins often have better profits than those with low margins.

Key Considerations for Business Decisions

- Calculating the cost of goods sold formula with sales and gross profit to determine product profitability

- Analyzing gross margin to identify areas for cost reduction or efficiency improvement

- Using gross profit data to inform investment decisions and prioritize revenue-driving initiatives

Knowing how gross profit affects business choices helps companies grow and stay competitive. The cost of goods sold formula with sales and gross profit gives insights into a company's health and where it can get better.

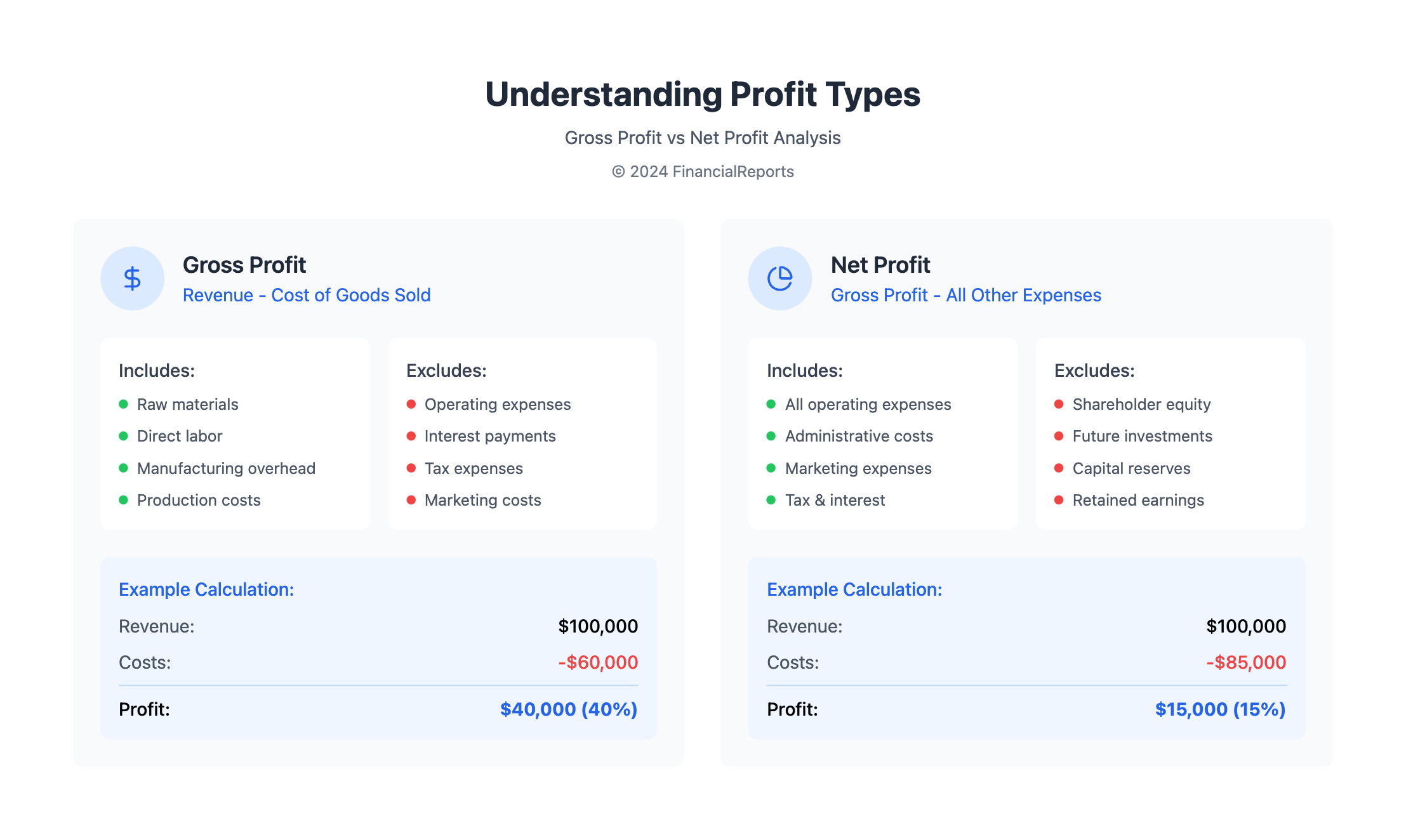

Distinguishing Between Gross Profit and Net Profit

Gross profit looks at how well a company controls its production costs. Net profit, on the other hand, gives a full picture of a business's financial health. Gross profit is found by subtracting the cost of goods sold from total revenue. This shows how well a company manages its production and labor costs.

Net profit, though, includes all costs, like taxes and interest. This gives a clearer view of how profitable a company is and how well it's managed. Knowing the difference between gross and net profit is key for anyone in finance or running a business.

Gross profit shows a company's ability to keep production costs low. Net profit, on the other hand, shows if a company can make money after all expenses are paid. By watching both, people can make better choices about money and planning for the future.

FAQ

What is gross profit, and how is it calculated?

Gross profit is the money left over after a company sells its products and subtracts the costs of making them. You calculate it by: Gross Profit = Total Revenue - COGS.

Why is gross profit an important metric for businesses?

Gross profit shows how well a business runs and its profit from making things. It helps with pricing, using resources, and seeing profit trends.

How are revenue and cost of goods sold (COGS) defined in the gross profit calculation?

Revenue is the money from selling things. COGS includes costs like raw materials and labor. But it doesn't include fixed costs like rent.

Where does gross profit appear on a company's financial statements?

Gross profit is on the income statement. It shows how well a company makes money from its work. The gross profit margin is also key for analysis.

What factors can influence a company's gross profit?

Pricing, production costs, and demand affect gross profit. Companies must balance making money with keeping prices low. They also need to manage costs and react to market changes.

How can businesses use gross profit data to make informed decisions?

Analyzing gross profit helps with budgeting and forecasting. It guides decisions on what to invest in. It shows where to grow the most.

What is the difference between gross profit and net profit?

Gross profit looks at making money from production. Net profit looks at the company's overall health, including all costs and taxes.