Gain Competitive Edge in Stocks with AI-Powered Algorithm

AI-powered stock trading algorithms are gaining popularity fast. They help traders make quicker and more precise decisions. As the global market for algorithmic trading grows, it's key to know how AI can help in stock trading.

The global algorithmic trading market was worth USD 15.55 billion in 2021. It's expected to grow at a 12.2% CAGR from 2022 to 2030. This growth is thanks to AI algorithms in stock trading. They analyze lots of data to spot trends and patterns. This helps make smart investment choices based on an investor's risk level and goals.

Key Takeaways

- AI-powered stock trading algorithms can provide traders with a competitive edge by giving faster and more accurate trading decisions through stock trading algorithm.

- The global algorithmic trading market is expected to keep growing, with a projected CAGR of 12.2% between 2022 and 2030.

- AI algorithms can handle huge amounts of data to find trends and patterns. They make smart decisions and offer personalized investment advice through algorithmic trading.

- AI is becoming more common in investing, bringing big benefits for making smart choices and possibly leading to more success in stock trading algorithm.

- AI algorithms can work without getting tired. They make trades at low cost and give insights into market changes through algorithmic trading.

- Testing and training AI models are vital for checking if AI trading strategies work well. They help improve prediction accuracy in stock trading algorithm.

- AI algorithms can look at news, financial reports, and social media to understand market feelings. They help make informed decisions through algorithmic trading.

Understanding Stock Trading Algorithms

Stock trading algorithms are computer programs that make trades automatically. They follow set rules based on technical indicators, market trends, and economic data. An algorithmic trader can benefit from these algorithms, as they help reduce emotional bias and improve accuracy.

The use of stock algorithm is growing in the stock market. Many firms and investors use them to make smart decisions. Recent data shows AI algorithms are key in modern stock market trading, changing how traders and firms work.

What Are Stock Trading Algorithms?

Stock trading algorithms automate the trading process. They allow traders to make trades quickly and efficiently. These algorithms are useful for all types of traders, including algorithmic traders who rely on them for informed decisions.

Benefits of Using Algorithms in Trading

The benefits of using algorithms in trading include:

- Faster execution

- Reduced emotional bias

- Improved accuracy

Understanding stock algorithm helps traders decide if they should use them. Algorithmic traders also benefit, as algorithms help reduce market impact and ensure rules-based decisions.

| Algorithm Type | Description |

|---|---|

| Trend-Following | Focuses on moving averages, channel breakouts, and technical indicators to identify profitable trends |

| Mean Reversion | Capitalizes on the concept that asset prices revert to their mean value periodically |

How AI Enhances Stock Trading Algorithms

Artificial intelligence (AI) has changed stock trading for the better. It helps traders get ahead in the markets and do better in their trades. Algorithmic trading, where computers make trades, is now more common. The market for this was worth USD 15.55 billion in 2021 and is growing fast.

AI makes trading algorithms better by using machine learning. Machine learning looks at lots of data to find patterns. This helps traders make smarter choices based on data. For instance, quantitative trading looks at stock prices and volumes, and AI helps compare strategies.

Machine Learning in Stock Trading

Machine learning helps hedge funds guess future stock prices. It looks at past market data to predict price changes. AI also uses natural language processing (NLP) for quick decisions based on market mood. AI has also led to robo-advisors, which offer personalized investment plans.

Predictive Analytics for Better Decisions

Predictive analytics is a big deal in AI for stock trading. It uses past data and trends to guide traders. This includes forecasting earnings and spotting risks. AI in predictive analytics is key for many firms, making trading smarter and more competitive.

Key Components of an Effective Trading Algorithm

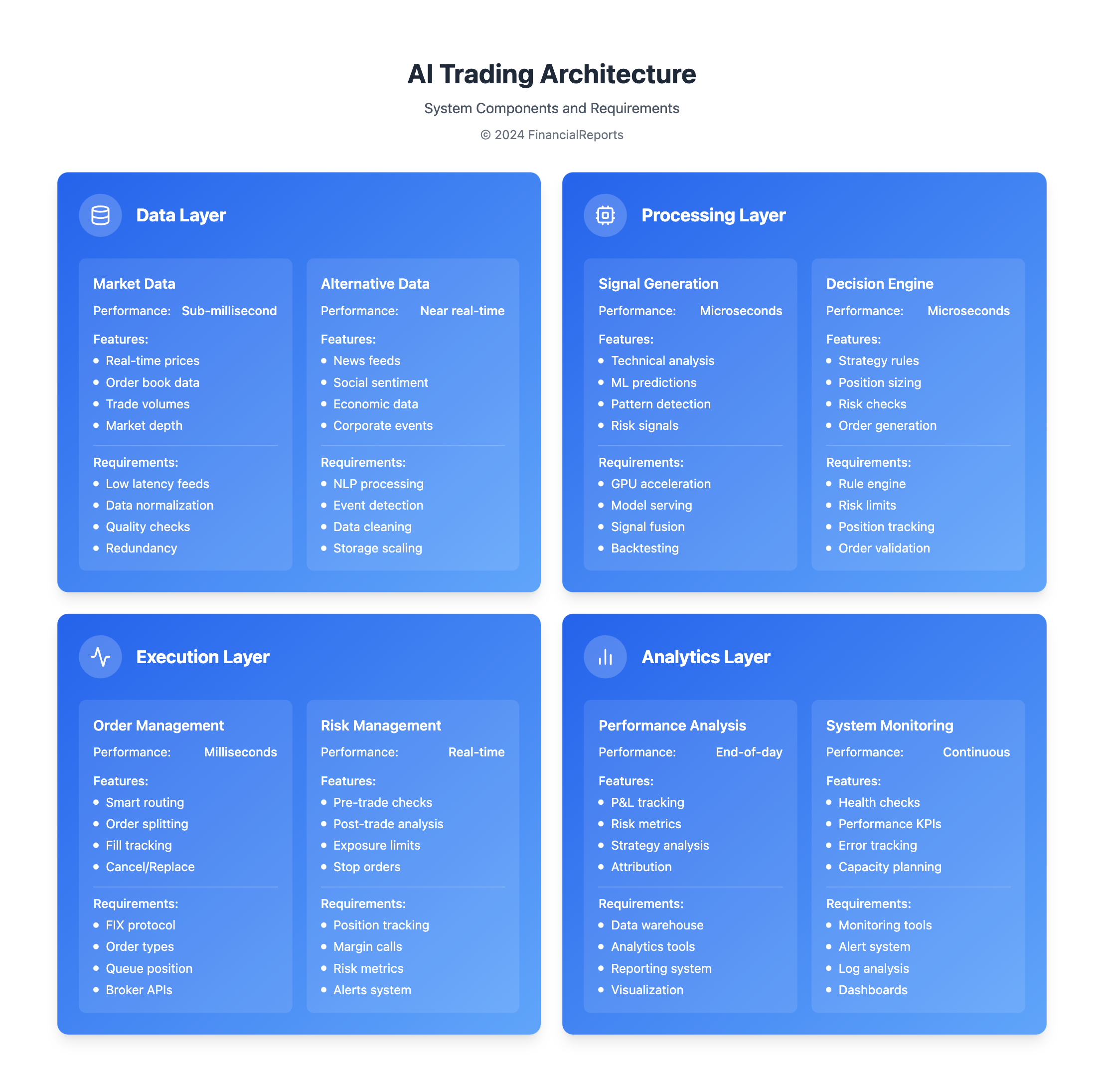

An effective trading algorithm needs several important parts. These include data sources, risk management strategies, and performance metrics. Data sources are key because they help the algorithm make trading choices. A stock algorithm uses good data to understand market trends and make smart decisions.

Risk management strategies are also vital. They help reduce losses and protect the trading capital. This is very important in day trading algorithm applications. Trades happen fast, and market conditions can change quickly. Knowing the key parts of a good trading algorithm helps traders create successful strategies.

Some important things to consider for a good trading algorithm are:

- Data quality and reliability

- Risk management techniques, such as stop-loss orders and position sizing

- Performance metrics, such as total return and Sharpe ratio

By looking at these components and adding them to a trading algorithm, traders can make a strong tool. This tool helps them navigate the markets and reach their investment goals.

Types of Stock Trading Algorithms

Algorithmic trading is key in the financial market. It uses different algorithms to find market chances. These algorithms analyze lots of data and give trading signals.

Trend-following algorithms track market trends. Mean reversion algorithms look for price changes. Most trades today use these algorithms, showing their value.

Trend-Following Algorithms

Trend-following algorithms aim to make money by following market trends. They work well with momentum investing. This strategy uses big market moves on high volume.

Mean Reversion Algorithms

Mean reversion algorithms believe prices will return to their average. They find good trades in these changes. This approach is part of statistical arbitrage, which finds price differences to profit.

Here's a table comparing trend-following and mean reversion algorithms:

| Algorithm Type | Description | Key Characteristics |

|---|---|---|

| Trend-Following | Identify and follow market trends | Use momentum investing strategies, high-volume trading |

| Mean Reversion | Capitalize on deviations from historical means | Use statistical arbitrage strategies, relative pricing inefficiencies |

Knowing about these algorithms helps traders pick the right one. This choice can lead to better and more profitable trading. Algorithmic trading and stock trading algorithms are essential for success.

How to Develop Your Own Stock Trading Algorithm

To make a stock trading algorithm, you need to know programming, data analysis, and trading strategies. You must first decide on your trading strategy and what data to use. This includes picking sources and how to manage risks.

Next, test your algorithm with past data to see how it performs. You might need to tweak it a few times. This step is key to making sure your trading robot works well under different market conditions. Day trading algorithm makers also have to think about when to step in and adjust things.

Here are some important steps to create a trading algorithm:

- Decide on your trading strategy and what's important for it

- Test the algorithm with past data

- Check how it does and make changes if needed

- Link the algorithm to a demo trading account for real tests

By following these steps and using the right tools, you can build a stock algorithm that fits your goals. It's also important to watch how your robot does in real trading. This helps make sure it keeps working well as the market changes.

Popular Tools and Software for Algorithmic Trading

As an algorithmic trader, the right tools and software are key to success. A stock trading algorithm helps automate trading decisions. This makes trading quick and accurate. Many tools and software are available for this purpose.

Popular platforms include TradeStation, Interactive Brokers, and TrendSpider. These platforms help execute trades and offer features like backtesting. They also provide real-time market data. Tools like Coinrule and PowerX Optimizer let traders create and test their algorithms.

When picking a tool or software, consider cost, functionality, and support. For example, Coinrule's Hobbyist Plan costs $29.99 monthly, while TrendSpider Elite is $29. Some platforms offer free trials or limited periods with full functionality. This lets traders test before buying.

Understanding the options helps traders choose the best tools and software. Whether you're experienced or new, the right tools can greatly improve your trading success.

Legal and Ethical Considerations in Algorithmic Trading

The rise of stock trading algorithm and algorithmic trading brings up important legal and ethical questions. The lack of clearness in AI algorithms makes it hard for investors to grasp how decisions are made. This raises concerns about market manipulation.

A study on ethical implications of algorithmic trading shows regulators are looking into stricter rules for AI in trading. They aim to reduce risks.

Some major ethical issues in algorithmic trading include:

- Market manipulation techniques, such as spoofing and layering

- Lack of transparency in algorithm operations

- Fairness concerns in trading accessibility

- Potential social and economic implications

To tackle these issues, laws and policies are needed to oversee stock trading algorithm and algorithmic trading. This ensures fairness and predictability in trading. By focusing on ethics and transparency, traders can build a reputation for integrity. This helps make the financial market more stable and trustworthy.

Case Studies: Successful AI-Powered Algorithms

AI-powered algorithms have changed the trading world. Renaissance Technologies' Medallion Fund is a great example. It has made over 66% each year before fees from 1988 to 2018. Its success comes from smart AI algorithms that make quick, precise trades.

Real-World Examples of Trading Success

An algorithmic trader uses AI to stay ahead. High-frequency trading (HFT) algorithms make trades in seconds. This boosts market liquidity and cuts down on trading costs. AI also helps spot fraud quickly, keeping transactions safe.

Lessons Learned from Algorithmic Trading Failures

AI algorithms have also faced setbacks. A stock algorithm can struggle with sudden market changes. This shows the need for thorough testing and managing risks. By learning from these failures, traders can improve their skills and become better algorithmic traders.

Future Trends in Stock Trading Algorithms

The future of stock trading algorithms looks very promising. Quantum computing could change everything with its incredible power. It will help make predictions more accurate and manage risks better.

Cryptocurrency trading is also set to make a big impact. Techniques like Automated Market Makers (AMMs) and Decentralized Exchanges (DEXs) will offer better security and transparency. This will be a big plus for traders looking to improve their algorithmic trading game.

AI and machine learning will become even more important in algorithmic trading. We'll see more algorithms that can adjust to market changes on their own. Natural language processing (NLP) will also play a key role in analyzing financial news and social media. This will help traders make better decisions based on market trends.

The history of stock trading algorithms is fascinating. It started with electronic trading in the 1970s and has grown to include algorithmic trading today. This now makes up a big part of the global financial market. As the industry keeps moving forward, it's important for traders and financial experts to keep up with the latest trends. This will help them stay ahead in the fast-changing world of algorithmic trading.

FAQ

What are stock trading algorithms?

Stock trading algorithms are computer programs that make trades automatically. They use rules based on technical indicators, market trends, and economic data.

What are the benefits of using algorithms in trading?

Algorithms help trade faster and reduce emotional bias. They also improve accuracy. Knowing how they work helps traders decide if they should use them.

How does AI enhance stock trading algorithms?

AI boosts trading algorithms by analyzing huge data sets. It finds patterns and trends humans might miss. AI also helps predict future market movements, guiding traders' decisions.

What are the key components of an effective trading algorithm?

Good algorithms need data sources, risk management, and performance metrics. Data sources are key for making decisions. Risk management protects against losses.

What are the different types of stock trading algorithms?

There are many types of algorithms. Trend-following algorithms track market trends. Mean reversion algorithms look for opportunities when prices deviate from the norm.

How can I develop my own stock trading algorithm?

To create an algorithm, you need to know programming, data analysis, and trading strategies. Start by defining your strategy and identifying key components. Then, test it with historical data and refine it as needed.

What are the popular tools and software for algorithmic trading?

Popular tools include trading platforms and algorithm development software. Platforms handle trades, while development tools help create and test algorithms.

What are the legal and ethical considerations in algorithmic trading?

Algorithmic trading must follow SEC rules and be fair. Traders must ensure their algorithms comply with regulations and avoid unfair practices.

What are some examples of successful AI-powered algorithms in the trading industry?

Renaissance Technologies' Medallion Fund is a success story. It has outperformed the market for years. Studying such examples can teach traders about successful algorithms. Also, learning from failures is key to understanding the importance of thorough testing and risk management.

What are the future trends in stock trading algorithms?

The future of trading algorithms is exciting. Quantum computing and cryptocurrency trading will play big roles. Staying updated on these trends can help traders succeed in the changing world of algorithmic trading.