Explore the Highest P/E Ratio Stocks Now

High P/E ratio stocks are found in tech and growth sectors. They are seen as having great growth chances. Stocks like PCG, GME, and PWR have high P/E ratios, showing investors believe in their future success.

In the tech world, SHOP and MRK have very high P/E ratios. This shows the tech sector's big growth possibilities. Crowdstrike Holdings, with a P/E ratio of 959.43x, is a top pick for those looking for high growth.

Key Takeaways

- High P/E ratio stocks are often found in technology and growth industries, showing great growth chances.

- Stocks like SHOP and MRK have high P/E ratios, showing market confidence in their future.

- Crowdstrike Holdings' high P/E ratio shows the growth chance in the cybersecurity sector.

- Investors looking for the best pe ratio stocks should check out the tech and growth sectors.

- Stock screening and criteria customization can help investors find high P/E ratio stocks that fit their goals.

- Understanding the P/E ratio and its implications is key for making smart investment choices.

Understanding the Price-to-Earnings Ratio

The Price-to-Earnings (P/E) ratio is a key tool in stock valuation. It shows how much investors are willing to pay for a company's earnings. To find the P/E ratio, you divide the stock price by the earnings per share (EPS). This ratio helps investors see if a stock is overvalued or undervalued.

For example, in April 2024, the S&P 500's P/E ratio was 26.26. This means investors were ready to spend $26.26 for every dollar of earnings. FedEx Corporation (FDX) had a P/E ratio of 14.40, while Hess Corporation (HES) was at 31.64. These numbers can show if a stock is cheap or expensive compared to others.

Definition of P/E Ratio

The P/E ratio is found by dividing the stock price by the earnings per share (EPS). It shows how long it would take for the company to pay back the share price with its earnings. This helps investors understand the company's value and growth expectations.

Importance of P/E in Stock Evaluation

High P/E ratios mean investors expect the company to grow its earnings. Low P/E ratios might show the stock is undervalued or has strong past performance. For example, tech stocks with high P/E ratios are seen as growth stocks, showing investor confidence in their future earnings.

How P/E Ratio is Calculated

To calculate the P/E ratio, you divide the stock price by the earnings per share. You can also use market capitalization and total net earnings. For instance, if a stock is $100 and EPS is $5, the P/E ratio is 20. This shows investors are willing to pay $20 for every dollar of earnings.

When looking at highest pe ratio stocks and best pe ratios, it's important to look at the company's financials. Use other valuation methods and tools to make informed decisions. This helps investors navigate the stock market with confidence.

| Company | P/E Ratio |

|---|---|

| FedEx Corporation (FDX) | 14.40 |

| Hess Corporation (HES) | 31.64 |

| Marathon Petroleum Corporation (MPC) | 7.19 |

Why Do Investors Focus on High P/E Ratio Stocks?

Investors look at companies with high pe ratios because they see growth. The price-to-earnings (P/E) ratio shows how much a stock costs compared to its earnings. A high P/E ratio might mean a stock is pricey, but it also shows hope for the company's future.

Technology and health care sectors often have the highest pe stocks. These companies have high P/E ratios because of their growth and innovation. For instance, Tesla and Amazon have high P/E ratios because of their strong growth and market leadership.

When checking out companies with high pe ratios, investors should think about a few things:

- Growth: Does the company grow and innovate well?

- Market feeling: Is the market feeling good about the company's future?

- Risks: Are there any risks that could affect the stock price?

By looking at these points, investors can decide if they should buy stocks with high pe ratios. Remember, a high P/E ratio is just one thing to look at. It shouldn't be the only thing to decide if a stock is good.

| Company | P/E Ratio | Growth |

|---|---|---|

| Tesla | 120 | High |

| Amazon | 80 | High |

Current Trends in the Stock Market

The stock market is leaning towards highest p e ratio stocks. The S&P 500 P/E ratio is 79.2% above its average. This shows investors are looking at best pe ratio stocks for their growth.

The market is 2.0 standard deviations above its average, showing it's overvalued. The CAPE ratio, which looks at price over the last 10 years' earnings, gives a clearer trend than the P/E ratio.

| Company | Market Capitalization | 1-Year Return |

|---|---|---|

| Zomato Ltd | $10 billion | 20% |

| Adani Green Energy Ltd | $5 billion | 30% |

Investors should be careful with highest p e ratio stocks as they might be too expensive. Look at the company's debt, cash, and growth chances before investing.

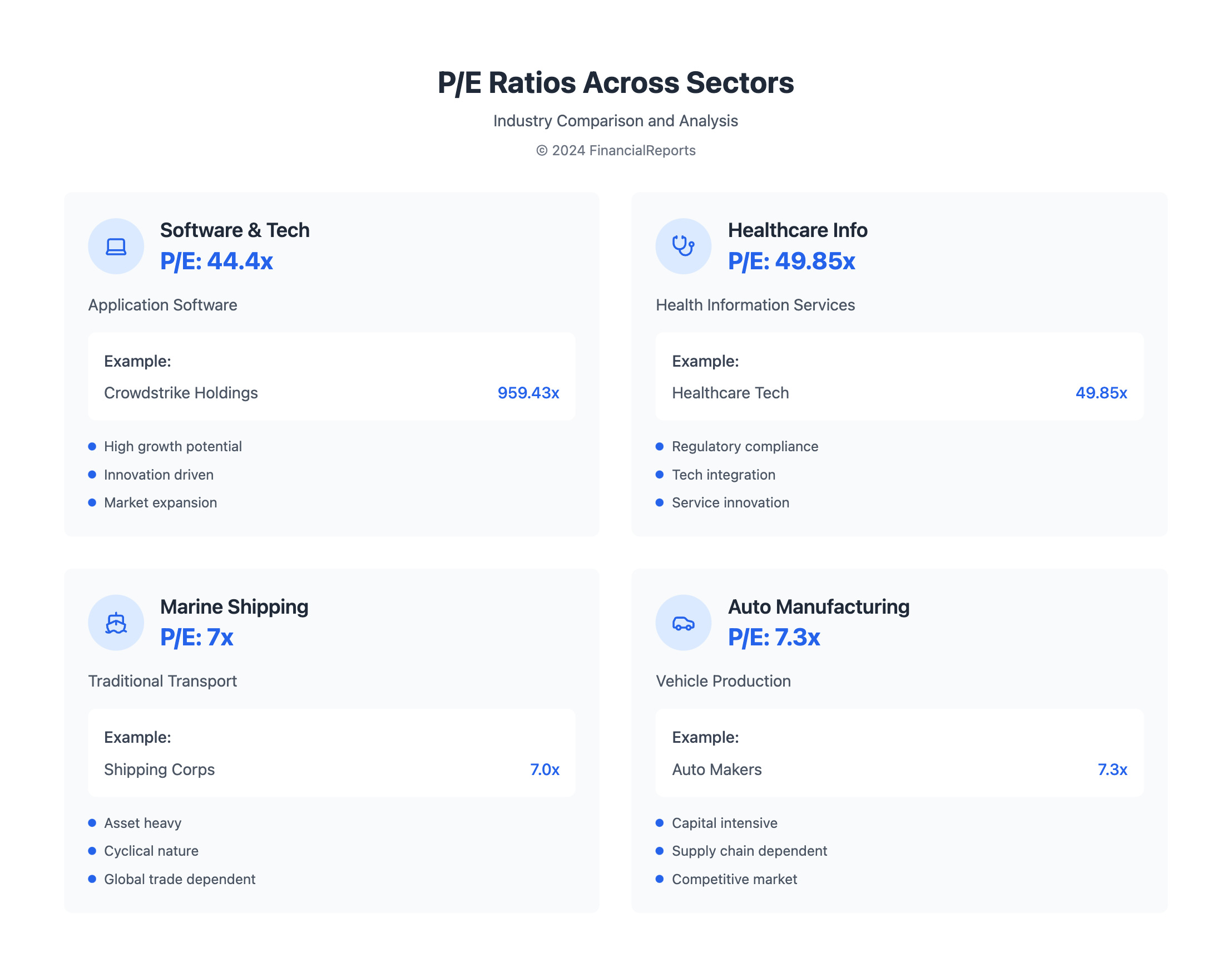

Notable Sectors with High P/E Ratios

Investors looking for growth often choose companies with high pe ratios. These stocks usually do better than the market over time. You can find these high pe ratio stocks in tech, healthcare, and consumer discretionary sectors.

Technology sector leaders like Zomato Ltd have seen big growth, with a 140.63% return in a year. Healthcare innovators such as Adani Green Energy Ltd have also done well, with a 16.82% return in a year. These companies are known for their strong growth and new products or services.

Key Sectors and Companies

- Zomato Ltd: Market Cap of ₹272,572.90 crores, one-year return of 140.63%

- Adani Green Energy Ltd: Market Cap of ₹199,722.74 crores, one-year return of 16.82%

- ABB India Ltd: Market Cap of ₹162,410.82 crores, one-year return of 62.77%

These companies with high pe ratios give investors a chance to benefit from their sectors' growth. By looking at these stocks, investors can understand market trends and find new opportunities.

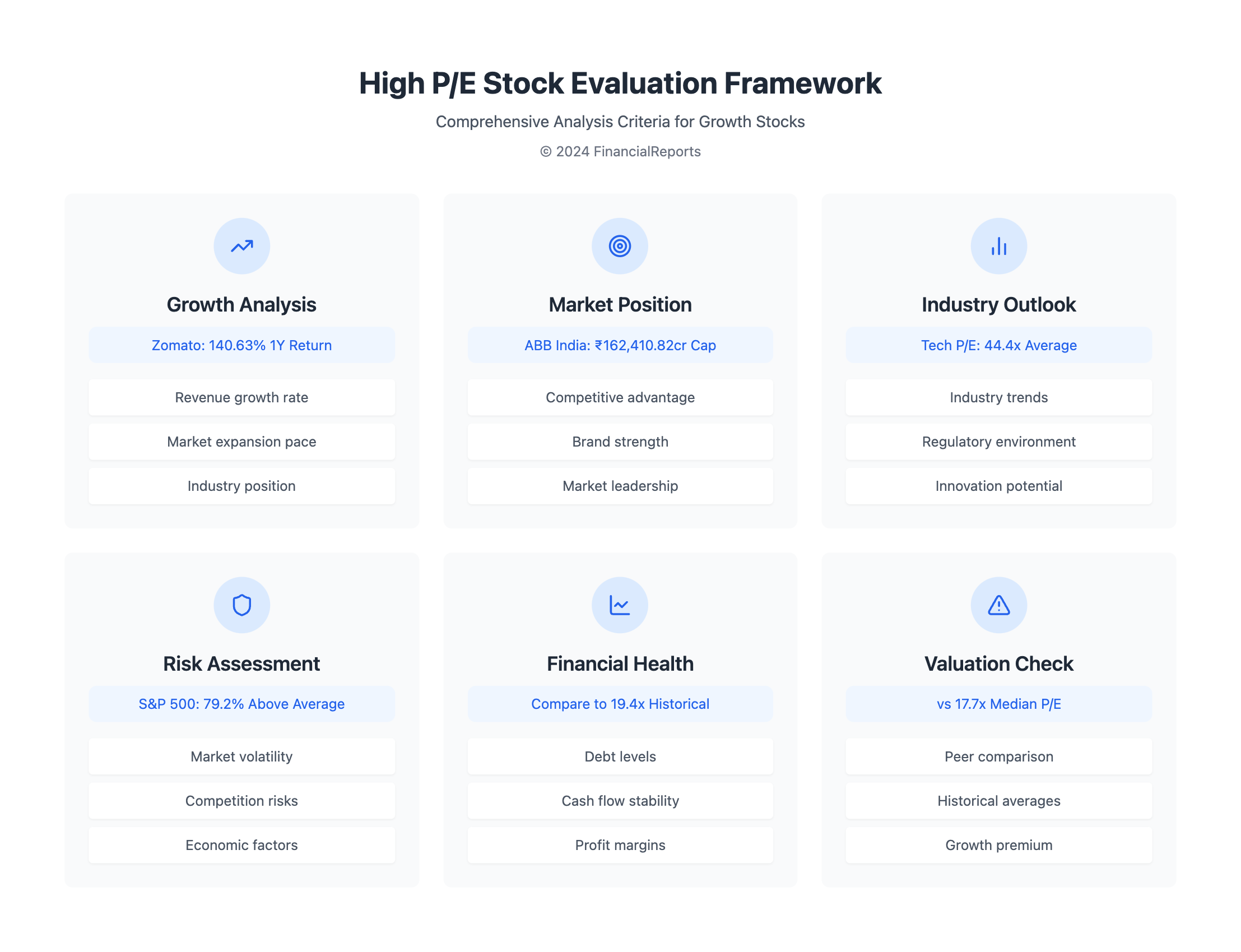

Evaluating Top Stocks with High P/E Ratios

To find the best stocks with high P/E ratios, look at growth rates, market position, and industry outlook. The best pe stocks usually have a strong growth outlook. On the other hand, the highest pe stocks might be more unpredictable. For instance, ABB India Ltd and CG Power and Industrial Solutions Ltd have seen big growth. They have market caps of ₹162,410.82 crores and ₹114,975.88 crores, with 1-year returns of 62.77% and 61.98%, respectively.

When picking high P/E stocks, think about spreading out your investments. This helps balance risk and possible gains. You might put money in tech, healthcare, and consumer goods. Here's a table showing average P/E ratios for different sectors:

| Industry | Average P/E Ratio |

|---|---|

| Health Information Services | 49.85 |

| Software - Application | 44.4 |

| Marine Shipping | 7 |

| Auto Manufacturers | 7.3 |

By looking at these points and spreading out your investments, you can make smart choices. This includes picking the best pe and highest pe stocks.

Historical Performance of High P/E Stocks

High P/E stocks like Hitachi Energy India Ltd and Dolphin Offshore Enterprises (India) Ltd have shown great promise. The S&P 500 P/E ratio averaged 19.4x from January 1971 to June 2017. The median P/E ratio was 17.7x. Yet, some stocks have seen P/E ratios soar above 100x.

When looking at the best pe ratio stocks, it's key to examine their past performance. The table below shows the S&P 500 index's historical P/E ratios:

| Year | S&P 500 P/E Ratio |

|---|---|

| 1971 | 18.1x |

| 1987 | 20.4x |

| 2000 | 29.6x |

| 2017 | 25.7x |

Investors looking for the highest p e ratio stocks must understand the risks and rewards. By studying how markets react to high P/E stocks, investors can make better choices.

Tools for Identifying High P/E Ratio Stocks

Investors looking for highest pe ratio stocks have many tools at their disposal. Stock screeners are one such tool. They let investors filter stocks by criteria like price-to-earnings ratio. This way, they can find companies with high pe ratios and compare them.

Financial news and analysis sites also offer valuable insights. They provide data on a company's past and future price-to-earnings ratios. This data helps investors understand a company's value and growth chances.

Some popular tools for finding high P/E ratio stocks include:

- Stock screeners: Filter stocks based on specific criteria, including price-to-earnings ratio

- Financial news and analysis sources: Provide insights into historical and forward price-to-earnings ratios, as well as other valuation metrics

- Investor community platforms: Allow investors to share insights and discuss possible investment opportunities

| Tool | Description |

|---|---|

| Stock Screeners | Filter stocks based on specific criteria, including price-to-earnings ratio |

| Financial News and Analysis Sources | Provide insights into historical and forward price-to-earnings ratios, as well as other valuation metrics |

| Investor Community Platforms | Allow investors to share insights and discuss possible investment opportunities |

Expert Opinions on High P/E Ratios

Financial analysts and investors have different views on high P/E ratios, mainly for the best pe stocks. A study by mastersinvest shows that high P/E ratios can signal a company's growth. Yet, they can also be affected by market and economic factors.

Some experts believe that highest pe stocks can be good investments. They say these stocks show strong earnings growth and high capital return over time. For example, Amazon (AMZN) and Netflix (NFLX) have high P/E ratios because of their growth. But, it's key to look at what drives these high ratios, like narrow profit margins or unusual performance, to make smart choices.

When looking at high P/E stocks, investors should think about a few things:

- Industry and sector trends

- Company-specific growth prospects

- Market and economic conditions

By looking at these factors and listening to expert opinions, investors can make better choices abouthighest pe stocks. This way, they might find chances for long-term growth.

Conclusion: Making Informed Investment Decisions

High P/E ratio stocks offer a chance for high growth but need careful thought. They attract investors with their promise of growth. Yet, understanding the basics and market trends is key.

The highest P/E ratio stocks often come from new tech and healthcare. These areas see new ideas and big changes. But, our study shows, not all high P/E stocks meet expectations. It's important to manage risks well.

To wisely invest in high P/E stocks, you need to do your homework. Know the market and match your investments to your risk level and goals. Stay alert, spread out your investments, and keep checking the basics. This way, you can handle the ups and downs of these stocks.

FAQ

What is the Price-to-Earnings (P/E) ratio and why is it important in stock evaluation?

The P/E ratio shows a company's market value compared to its earnings. It helps investors see if a stock is fairly valued. It's key for understanding a stock's growth and market hopes.

What factors contribute to the growth of high P/E ratio stocks?

Stocks with high P/E ratios often belong to new and growing fields like tech and healthcare. These sectors show strong growth and positive views from investors. The high valuations show what investors think about the company's future earnings.

What are the inherent risks associated with investing in high P/E ratio stocks?

High P/E stocks might look promising but come with risks. They could be overvalued and the market can be unpredictable. It's important to look at the company's real growth chances before investing.

How do macroeconomic factors, such as inflation and interest rates, impact the performance of high P/E ratio stocks?

Big economic changes, like inflation and interest rates, can affect high P/E stocks a lot. Investors need to watch these changes and how they impact the market.

What are some notable sectors that are characterized by high P/E ratios, and what are their key characteristics?

Tech, healthcare, and consumer discretionary sectors often have high P/E stocks. These areas are driven by new ideas and trends. Knowing these sectors well is important for investors.

How can investors effectively evaluate and select high P/E ratio stocks for their portfolios?

To pick high P/E stocks, look beyond just the P/E ratio. Consider growth, market position, and industry outlook. Also, think about diversifying your portfolio and your investment time frame.

What insights can be gained from analyzing the historical performance of high P/E ratio stocks?

Looking at how high P/E stocks have done over time can teach a lot. Studying successes and failures during different economic times helps investors understand the market better.

What tools and resources are available to help investors identify and analyze high P/E ratio stocks?

There are many tools and resources for finding and studying high P/E stocks. Stock screening apps, financial news, and investor forums can help. Using these tools can make choosing stocks easier.

What do financial experts and successful investors recommend when it comes to investing in high P/E ratio stocks?

Talking to financial experts and seasoned investors can offer great advice. They share how to evaluate high P/E stocks and what to expect from the market in the future.