Explore Option Contract Example: Insights for Financial Decision-Making

An option contract is a special kind of financial tool. It gives the buyer the right to buy or sell something by a certain time at a set price. Knowing about option contracts is key for those in finance, investors, and big clients. They help in making smart financial choices.

Financial modeling is very important for making decisions. Option contracts are a big part of this. They help in showing how to make more money and manage risks. By looking at an option contract example, people can learn more about the ups and downs of trading options.

Key Takeaways

- Option contracts give the buyer the right, but not the obligation, to buy or sell the underlying asset by a certain date at a specified price.

- Understanding what is an option contract is important for finance pros, investors, and big clients looking for financial data.

- An option contract example shows how to make money and manage risks in finance.

- Financial modeling is key for making decisions, and option contracts are a big part of it.

- Option contracts can show how to make more money and manage risks in financial modeling.

- By looking at an option contract example, investors can learn more about the benefits and risks of trading options.

- Option contracts are approved by brokerage firms based on specific levels of options trading, protecting investors and brokerage firms from excessive risks.

What is an Option Contract?

An option contract is a financial tool that lets the buyer choose to buy or sell something at a set price before a certain time. Knowing what an option contract definition is helps grasp options trading. For stock contracts, it lets investors manage risks and guess the future stock prices.

There are two main types of options: calls and puts. A call option lets the buyer buy a stock at a set price by a certain date. A put option lets the buyer sell a stock at the set price by the same date. Key features of option contracts include:

- Flexibility: Option contracts give the right, but not the duty, to buy or sell.

- Risk management: They help manage risks or speculate on future stock prices.

- Expiration date: They have a set expiration date, after which they expire if not used.

It's vital for investors and financial experts to understand option contracts. Knowing the option contract definition and stock contracts helps make smart choices in options trading.

| Type of Option | Definition |

|---|---|

| Call Option | Gives the buyer the right to buy a stock at a specified price |

| Put Option | Gives the buyer the right to sell a stock at a specified price |

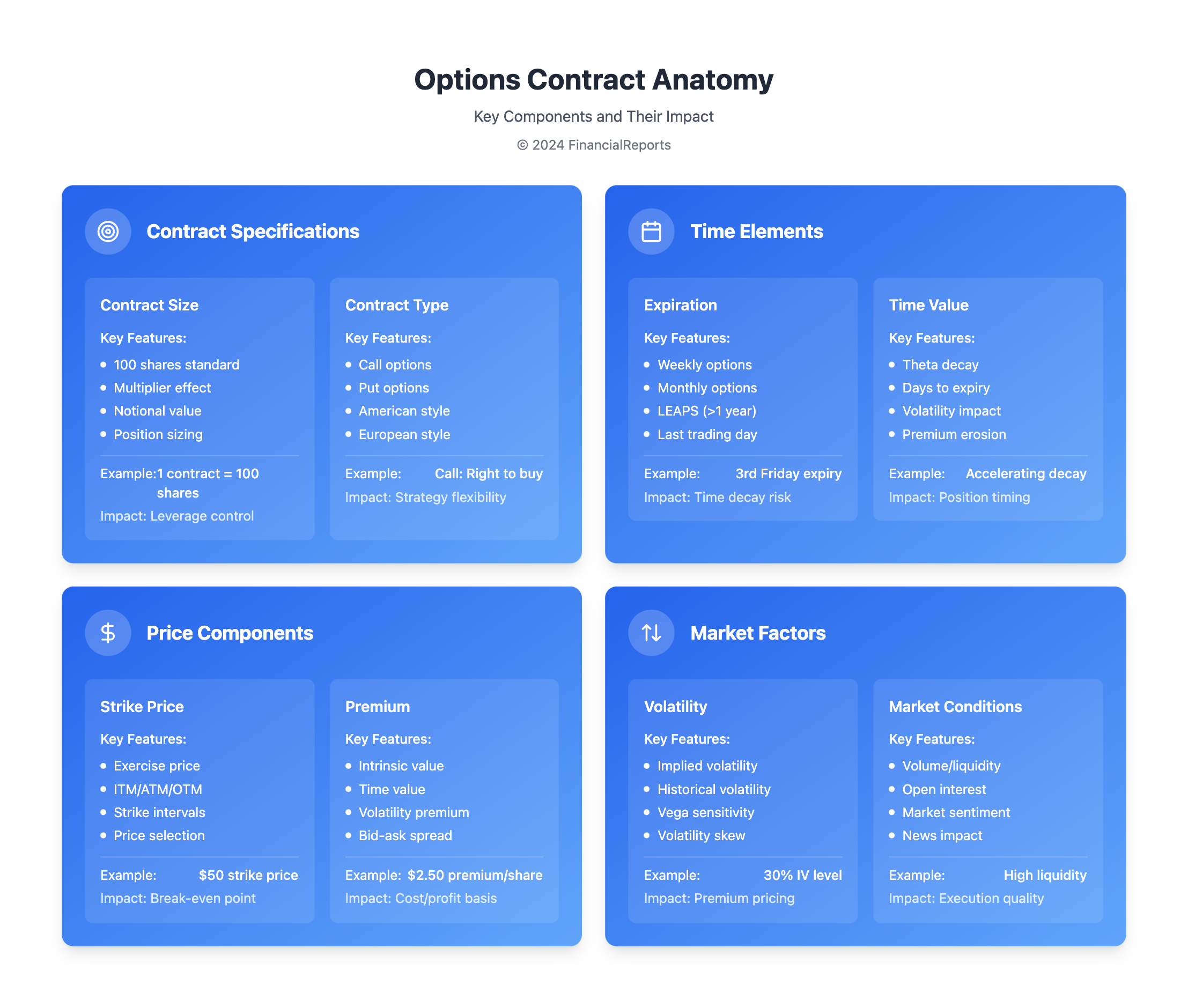

The Structure of an Option Contract

An option contract is a financial tool that lets you buy or sell something at a set price. It's important to know how it works to make smart investment choices. It has key parts like the asset, when it expires, the strike price, and the type of option.

Usually, an option contract deals with 100 shares of something. But, this can change due to things like stock splits. The strike price is the price you can buy or sell at. And the expiration date is when you can last use the option.

Components of an Option Contract

The parts of an option contract help figure out its worth and how much money you can make. For example, the intrinsic value is the difference between the asset's current price and the strike price. The time value is what people pay for the chance to make more money before it expires.

Expiration Dates and Strike Prices

Expiration dates and strike prices are very important. The expiration date is when you can't use the option anymore. The strike price is the price you can buy or sell at. When looking at an option contract, these are key things to think about.

Real-World Example of an Option Contract

An option contract example can be seen in the stock market. An investor buys a call option for ABC stock with a strike price of $25. They pay a premium of $150 for the option, which covers 100 shares of the stock.

If the stock price goes up to $35 by the expiration date, the buyer can exercise the option. They can then buy the stock at $25 and sell it at the current price, making a profit of $1,000. This shows how option contracts can lead to big returns with a small initial investment.

Some key things to consider with option contracts include:

- Expiration dates, which can range from daily to quarterly

- Strike prices, which set the price for buying or selling the underlying asset

- Premiums, which are the costs of buying the option contract

Understanding option contracts can help investors protect against market ups and downs. As shown, option contracts can give both buyers and sellers a strategic edge in finance.

Benefits of Using Option Contracts

Option contracts offer many benefits to investors. They can lead to leveraged returns and help manage risks. By understanding what an option contract is, investors can make better choices. For example, an option contract example shows how options can protect against investment risks, acting like an insurance policy.

Some key benefits of using option contracts include:

- Leverage in financial markets, allowing investors to get positions similar to stocks but at a lower cost

- Potential for higher percentage returns compared to traditional equity investments, leveraging the price movements of underlying assets

- Risk management benefits, providing a dependable form of hedging and limiting possible losses in volatile market conditions

By adding option contracts to their strategies, investors can better control and adjust their portfolios. Whether buying call options or put options, investors can respond to different market situations. With the number of options traded rising to about 10.2 billion by 2023, option contracts are key for investors navigating complex markets.

Risks Associated with Option Contracts

Option contracts come with risks that can affect investors. Market volatility is a big risk. It can change the value of stock contracts quickly, leading to losses.

Time decay is another risk. As the expiration date gets closer, the option's value drops. This is a big deal for stock contracts, where the agreement's terms are set.

Some key risks to consider when trading options include:

- Market volatility impact: Changes in market prices can affect the value of options contracts.

- Time decay: The value of options contracts decreases as the expiration date approaches.

- Potential losses: Investors can lose the entire premium paid for the option contract if it expires worthless.

It's important for investors to know the risks of option contracts and stock contracts. This knowledge helps them make smart choices and avoid big losses. Always review the option contract definition and terms carefully.

| Risk | Description |

|---|---|

| Market Volatility | Changes in market prices can affect the value of options contracts. |

| Time Decay | The value of options contracts decreases as the expiration date approaches. |

| Potential Losses | Investors can lose the entire premium paid for the option contract if it expires worthless. |

How to Trade Options Successfully

To trade options well, you need to know what an option contract is. An example can help explain it. A call option lets you buy an asset at a set price later. A put option lets you sell an asset at a set price later.

Creating a trading plan is key. You should set goals and know how much risk you can take. Think about the asset, when the option expires, the strike price, and the type of option. For example, a call option might cost $5.50 per share or $550 per contract. The profit can be huge, but the loss is only what you paid.

Key Considerations for Traders

When trading options, consider these important points:

- Underlying asset: The stock, commodity, or currency the option is based on.

- Expiration date: The last day you can use the option.

- Strike price: The price at which you can buy or sell the asset.

- Option type: Call or put, each with its own risks and benefits.

Understanding these points and having a good strategy can help you succeed. Keep up with market news and learn more about options trading. With the right knowledge, you can trade options confidently and make smart choices.

Options Trading Platforms and Tools

Trading options well needs the right platform and tools. Knowing what an option contract definition is key. There are many platforms, each with its own strengths. Beginners should pick one that teaches about stock contracts and options trading.

Popular platforms include E-Trade, Interactive Brokers, and thinkorswim. They offer tools like simulators and live support. It's important to think about fees, what you need to start, and how good the customer service is.

Here are some important features to look for in a platform:

- Low fees and commissions

- Advanced trading tools and features

- High-quality customer service

- Robust security measures

- Educational content and resources

| Platform | Fees | Features |

|---|---|---|

| E-Trade | $0.65 per contract | Trading simulator, live phone support |

| Interactive Brokers | $0.25 per contract | Advanced trading tools, SIPC insurance |

| thinkorswim | $0.50 per contract | Trading simulator, live chat support |

Choosing the right platform and tools helps traders understand option contract definition and stock contracts better. This way, they can make smart choices when trading options.

Tax Implications of Options Trading

Understanding the tax side of options trading is key to smart financial choices. Knowing how gains and losses are taxed is vital. An option contract example shows how it affects your taxes. The tax rules for options trading can be tricky, with different rules for different types and strategies.

For example, 60% of non-equity option gains or losses are taxed at long-term rates. The other 40% is taxed at short-term rates. The tax on equity options depends on whether you're buying or selling. Also, losses on straddles are deferred until the position is closed, as per IRS rules.

Here are some key points to consider about options trading taxes:

- Short-term and long-term capital gains or losses depend on the option or stock's holding period.

- Section 1256 contracts are taxed with a 60/40 split for long-term and short-term rates.

- Stock option trades follow wash sale rules—losses are disallowed if a similar security is bought within 30 days before or after the sale.

Talking to a tax expert who knows options taxation is a good idea. By understanding these taxes, investors can make better choices and lower their tax bills. An option contract can help achieve financial goals while dealing with tax complexities.

| Type of Option | Tax Treatment |

|---|---|

| Non-equity options | 60% long-term capital tax rates, 40% short-term capital tax rates |

| Equity options | Depends on whether buying or selling/writing the option |

| Section 1256 contracts | 60/40 split for long-term and short-term capital tax rates |

Conclusion: Making Informed Financial Decisions

Exploring option contract definition and stock contracts trading shows the importance of smart financial choices. Knowing what an option contract is, its benefits and risks, and trading strategies helps investors. This knowledge lets them trade options with confidence and accuracy.

Options can be used for managing risk or making money, but it's a complex task. It needs thorough research, careful analysis, and understanding market changes. Keeping up with the options trading world's changes is key for making smart financial choices.

Options trading is a journey of learning and getting better. By focusing on financial knowledge and making good decisions, investors can take advantage of the option contract definition and stock contracts market.

FAQ

What is an option contract?

An option contract is a financial tool. It lets the holder buy or sell an asset at a set price. This must happen within a certain time frame.

What are the different types of options?

There are two main types: call and put options. A call option lets you buy an asset. A put option lets you sell it.

What are the components of an option contract?

An option contract has a few key parts. These include the asset, expiration date, strike price, and whether it's a call or put.

Can you provide a real-world example of an option contract?

Sure. Imagine a call option on Apple Inc. stock. It has a strike price of $120 and expires on June 30, 2023. The holder can buy AAPL shares at $120 before the deadline.

What are the benefits of using option contracts?

Options offer leveraged returns and help manage risk. They can be used to hedge against market swings or speculate on prices.

What are the risks associated with option contracts?

Risks include market volatility, time decay, and loss. Traders must manage these risks to succeed.

How can I trade options successfully?

Success in options trading comes from a solid strategy. You need to understand price factors and manage risk well.

What options trading platforms and tools are available?

Many platforms and tools exist, from beginner to advanced. Examples include E*TRADE, TD Ameritrade, and Interactive Brokers.

What are the tax implications of options trading?

Trading options can affect taxes. There are reporting needs and tax rates on gains and losses. Traders should know the tax benefits and drawbacks.