Expert Strategies for Mastering Automated Trading

Automated trading uses algorithms to make trades. It includes strategies like Mean Reversion and Trend Following. Learning to trade automatically can boost profits and cut losses.

The market for automated trading grew to USD 2.03 billion in 2022. It's set to nearly double by 2030. This shows how vital automated trading is becoming.

Automated trading gives traders an edge. It lets them make trades fast and without emotions. Traders can use these strategies to follow trends and make money from price differences.

To get good at automated trading, knowing the different systems is key. Platforms like MetaTrader and Algomojo help with this. They offer tools and features for automated trading.

Introduction to Automated Trading

Automated trading has changed the game. It lets traders automate their strategies. This way, they can focus on improving their strategies, not just making trades.

By learning to trade automatically, traders can grow their profits. They also reduce their risk. It's a way to take trading to the next level.

Key Takeaways

- Automated trading strategies can help traders increase their profits and reduce their losses.

- The algorithmic trading market is expected to expand nearly two-fold by 2030.

- Automated trading strategies can provide traders with a competitive edge, enabling them to execute trades instantly and consistently.

- Platforms like MetaTrader and Algomojo offer a range of tools and features for automated trading.

- Automated trading strategies can be used to capitalize on established price trends, profit from price discrepancies, and provide liquidity to the market.

- Learning how to trade automatically can help traders take their trading to the next level, increasing their

Understanding Automated Trading Basics

Automated trading, also known as computerized trading, is now popular among many traders. It uses advanced models and systems to make trades quickly and accurately. For beginners, knowing how it works and its benefits is key.

These systems can process data and make trades in milliseconds. This lets traders take advantage of quick price changes and market gaps. Automated trading removes emotions from trading, follows strict rules, and lets traders test strategies with past data.

Some key benefits include:

- Emotion-free trading, eliminating emotional biases that can lead to impulsive actions driven by fear or greed

- Ability to process data and execute trades at remarkable speed, critical in markets where milliseconds can significantly impact outcomes

- Opportunity to backtest algorithms with historical data to assess performance and optimize them for better adaptability to changing market conditions

Companies like Intrinio offer reliable platforms for automated trading. They provide strong protocols and consistent data. This makes it easier for traders to create and use effective plans. By learning about automated trading, traders can make better choices and start mastering computerized trading.

| Benefits of Automated Trading | Description |

|---|---|

| Emotion-free trading | Eliminates emotional biases that can lead to impulsive actions |

| Speed and precision | Executes trades at remarkable speed, critical in markets where milliseconds can significantly impact outcomes |

| Backtesting and optimization | Allows for backtesting algorithms with historical data to assess performance and optimize them for better adaptability to changing market conditions |

Different Types of Automated Trading Systems

Automated trading strategies are getting more popular, with 70% to 80% of U.S. stock exchange shares traded automatically by 2024. Investors can pick from many automated trading systems, each with its own benefits. Knowing these systems is key to making good automated trading plans.

There are several automated trading systems, like algorithmic trading, high-frequency trading, and copy trading. Algorithmic trading uses complex math to make trades. High-frequency trading makes lots of trades quickly. Copy trading lets investors follow the trades of skilled traders.

Characteristics of Automated Trading Systems

- Ability to trade multiple accounts or strategies simultaneously

- Improved order entry speed through instant responses to indicators

- Minimized emotional trading by executing trades automatically

- Potential for mechanical failures, such as lost orders or connectivity problems

It's important to watch automated trading systems closely to fix tech issues fast. Also, beware of over-optimizing, which can make systems unreliable in real markets.

| Type of Trading System | Characteristics | Advantages |

|---|---|---|

| Algorithmic Trading | Complex mathematical formulas | Improved order entry speed, minimized emotional trading |

| High-Frequency Trading | Large number of trades in a short period | Increased trading volume, improved liquidity |

| Copy Trading | Replicating trades of experienced traders | Access to expert trading strategies, reduced risk |

By learning about the different automated trading systems, investors can create good plans. Whether it's algorithmic, high-frequency, or copy trading, these systems help investors trade automatically and reach their goals.

Choosing the Right Trading Platform

For those new to automated trading, picking the right platform is key. Trading platforms offer tools and features for efficient trading. Look for high-speed execution, diverse data use, and backtesting with historical data.

Popular platforms like MetaTrader 4, NinjaTrader, and TradeStation are great for beginners. They have advanced tools, customizable indicators, and backtesting options. They also offer stop-loss limits, averaging techniques, and real-time data feeds to help traders make more money.

When choosing a platform, consider costs, independence, and analytical features. Also, think about security, like connectivity and mechanical failures. By picking the right platform, you can have a successful and profitable trading experience.

Here are some key features to look for in a trading platform:

- High-speed execution

- Diverse data utilization

- Backtesting against historical data

- Advanced charting tools

- Customizable indicators

Developing Trading Strategies

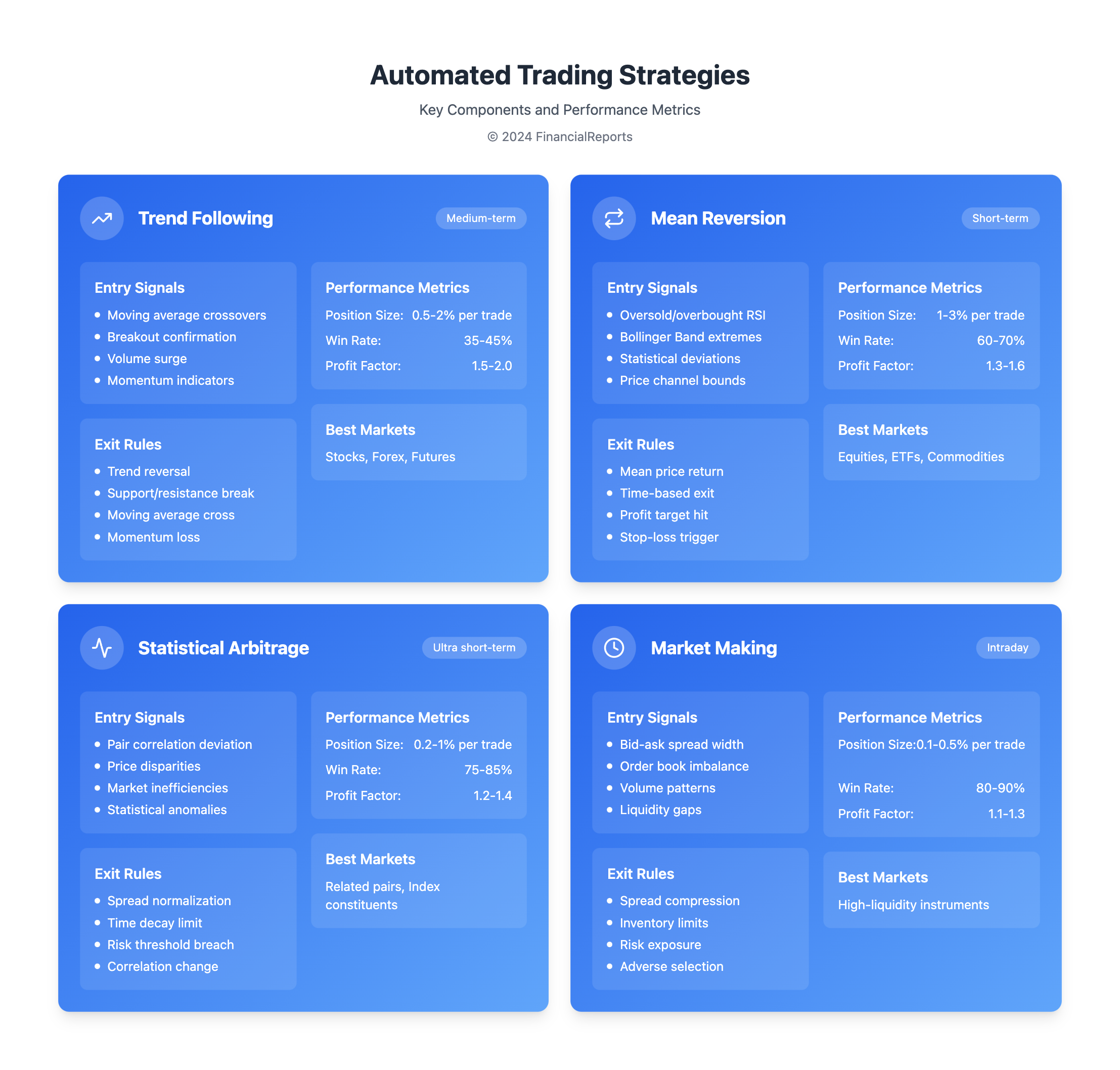

Creating a good automated trading strategy is key. To trade automatically, you need to know about backtesting and risk management. Backtesting checks how a strategy works with past data. It helps traders make their strategy better before using it in real markets.

Finding the best automated trading strategies for a market or asset is important. You might look at trend following, mean reversion, or statistical arbitrage. Knowing how to trade automatically with these strategies helps traders make a solid plan.

Some common strategies for automation include:

- Day Trading Automation

- Mean Reversion Strategy

- Momentum Strategy

- Arbitrage Strategy

These strategies work in different markets like stocks, forex, and futures. By mixing these strategies with good risk management, traders can cut losses and increase gains.

| Strategy | Description |

|---|---|

| Day Trading Automation | Automated trading strategy that involves buying and selling securities within a single trading day |

| Mean Reversion Strategy | Strategy that involves buying assets that are undervalued and selling those that are overvalued, with the expectation that prices will revert to their mean |

By following these tips and using the right tools, traders can make good automated trading strategies. This can help them succeed in the markets. Whether you want to trade automatically or just improve your trading, knowing about strategy and risk management is vital.

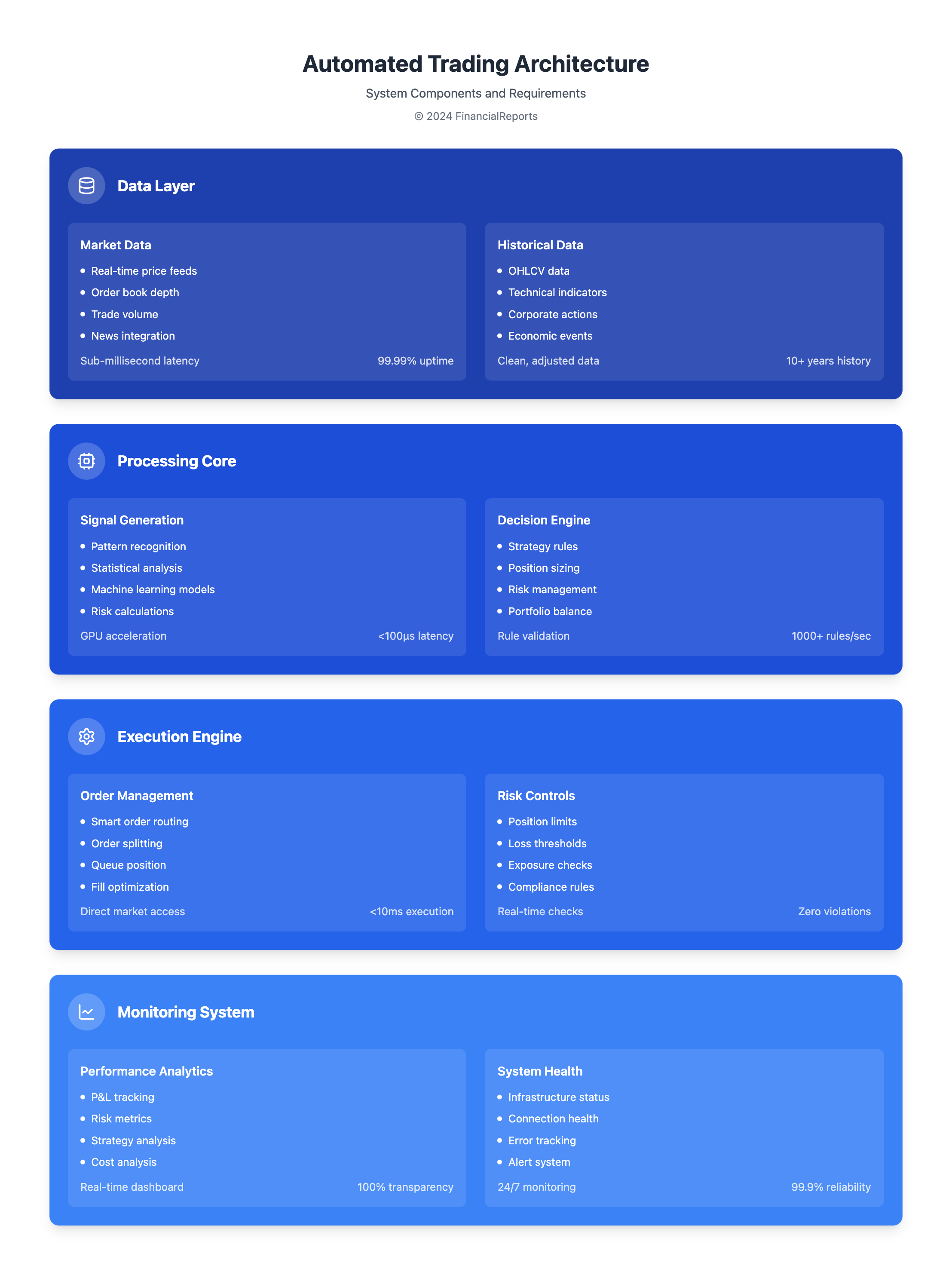

Setting Up Your Automated Trading System

Setting up an automated trading system involves several important steps. For automated trading for beginners, picking a reliable system is key. It should trade fast and accurately. Computerized trading systems help by reducing emotional bias and speeding up trades.

To start, you need the right hardware and software. This includes a strong computer, a stable internet, and software like TradeStation or MetaTrader. You also need to link your system to your brokerage account. This might mean setting up an API or using a third-party service.

When setting up your system, consider a few things:

- Liquidity: Pick instruments that are easy to trade, so you can close positions quickly.

- Trading hours: Decide if your system should trade all the time or just during certain hours.

- Risk management: Set rules for leverage, short selling, and stop losses to protect your money.

By thinking about these points and setting up a good system, you can use computerized trading to your advantage. This can help you trade better overall.

Monitoring and Adjusting Your Trades

Automated trading strategies need constant watch to work best. Real-time monitoring is key to spot issues and tweak the strategy. Automated trading can handle data and trades faster than humans, so it's vital to monitor and adjust trades often.

Importance of Real-Time Monitoring

Real-time monitoring helps traders act fast to market changes. This reduces losses and boosts gains. Automated trading lets traders how to trade automatically and focus on big decisions.

Adjusting Strategies Based on Performance

It's important to check and tweak automated trading strategies often. Look at profit and loss to see how they're doing. Making changes helps traders fine-tune their automated trading strategies and get better results.

Dealing with Market Volatility

Market ups and downs can affect automated trading. It's key to have a plan for these times. Use risk management, like stop-loss orders, and adjust the strategy as needed. By how to trade automatically and adapting to market changes, traders can cut losses and increase gains.

Common Myths About Automated Trading

Automated trading for beginners can seem scary, thanks to many myths. One big myth is that it always makes money. But, this is not true. Automated trading uses set strategies without emotions, but it can't guarantee profits. It's good at finding trends, but it's not perfect.

Another myth is that these systems are easy to use and forget. This is not true. Automated systems need regular checks to work right and avoid problems. Realistic expectations are key with automated trading. It's a tool to help with trading, not replace human thinking and watchfulness.

Debunking Misconceptions

Let's look at the good and bad of automated trading. The benefits are:

- Speed: It can grab quick trading chances fast.

- Discipline: It sticks to plans, even when markets are wild.

- Diversification: It helps manage many accounts and investments.

The downsides are:

- Over-optimization: It can lead to too many strategies.

- Monitoring challenges: Keeping an eye on systems can be hard.

- System issues: Problems like connectivity issues or glitches can happen.

Knowing these points helps traders make better choices and avoid common mistakes in automated trading.

| Myth | Reality |

|---|---|

| Automated trading guarantees profits | Automated trading does not assure profits; it merely executes preset strategies devoid of emotional bias |

| Automated trading systems are set-and-forget tools | Automated systems need constant monitoring to ensure they perform as intended and to prevent possible glitches |

By understanding the myths and facts of automated trading, traders can use it to improve their strategies and make better choices.

Legal and Regulatory Considerations

Understanding the legal side of automated trading strategies is key. Trading rules change by country and market. It's vital to follow these rules to avoid legal and financial trouble. To trade automatically, your system must meet all legal standards.

Important steps include registering with bodies like FINRA in the USA. You also need to follow Anti-Money Laundering (AML) and Know Your Customer (KYC) rules. Plus, you must report all trades right after they happen. By knowing and following these rules, traders can avoid legal problems and work on their automated trading strategies.

Here are some key points to consider when it comes to legal and regulatory considerations:

- Register with relevant regulatory bodies

- Comply with AML and KYC regulations

- Report all transactions immediately after completion

| Regulatory Body | Registration Requirements |

|---|---|

| FINRA | Registration required for proprietary trading firms in the USA |

| SEC | Registration required for trading firms that deal in securities |

Future Trends in Automated Trading

Looking ahead, the world of automated trading is set for big changes. New technologies like artificial intelligence (AI) and machine learning will change how traders work. They will help traders make better choices based on data, making their systems more accurate and efficient.

Blockchain technology is also on the horizon, bringing better security and transparency to finance. This could lead to more decentralized finance (DeFi) options. As the field grows, rules will be important to keep markets fair and encourage new ideas.

To keep up, traders and financial experts need to keep learning and be open to new ideas. By using the latest tools and being careful with risks, the future looks bright. It's a chance for those ready to use computerized trading to their advantage.

FAQ

What is automated trading?

Automated trading uses computer programs to make trades on financial markets. It automates the decision-making and trading process without human help.

How does automated trading work?

Automated trading systems use rules and algorithms to analyze market data. They find trading opportunities and make trades automatically. These systems are faster than humans and work 24/7.

What are the advantages of automated trading?

Automated trading is quick and reduces human errors. It also lets traders follow consistent strategies. This can lead to more profits and less loss.

What types of automated trading systems are available?

There are several types, like algorithmic, high-frequency, and copy trading. Algorithmic trading uses algorithms, high-frequency trading makes many trades fast, and copy trading follows successful traders.

How do I choose the right trading platform for automated trading?

Look for a platform with API integration, advanced tools, and backtesting options. Also, check its security and regulatory compliance to protect your account.

How do I develop a successful automated trading strategy?

Start by backtesting your strategies and using risk management. Choose strategies that work well with automation. Always monitor and adjust your strategies as the market changes.

How do I set up my automated trading system?

First, pick the right hardware and software. Then, connect your brokerage account and set your trading parameters. Make sure your system is optimized and follows the rules.

How do I monitor and adjust my automated trades?

Keep an eye on your trades in real-time and adjust your strategy as needed. Analyze your performance, handle market changes, and tweak your parameters to stay on track.

What are some common myths about automated trading?

Some myths say automated trading guarantees profits, needs no human oversight, and is a quick way to wealth. But, it requires careful strategy, risk management, and ongoing adjustments to succeed.

What are the legal and regulatory considerations for automated trading?

Automated traders must follow legal and regulatory rules. This includes understanding trading laws, staying compliant with market authorities, and reporting taxes correctly. Not following these can lead to legal problems and fines.

What are the future trends in automated trading?

Automated trading will likely see more use of artificial intelligence and machine learning. These technologies could lead to smarter trading strategies and better market analysis. Traders need to keep up with these trends to stay ahead.