Expert-Recommended Trading Books for Finance Professionals

For finance pros, keeping up with market trends and strategies is key. With so many books out there, finding the best can be tough. BetterTrader.co suggests "The Intelligent Investor" by Benjamin Graham and "Reminiscences of a Stock Operator" by Edwin Lefèvre as must-reads.

These books offer deep insights into finance. They cover technical and fundamental analysis, behavioral finance, and risk management. Reading these books helps finance pros understand markets better and craft winning strategies. Whether you're an experienced trader or new to the field, these books are invaluable.

Key Takeaways

- Staying informed with the latest market trends and strategies is key for finance success.

- Books like "The Intelligent Investor" and "Reminiscences of a Stock Operator" are must-haves for finance pros.

- Stock trading books give insights into technical and fundamental analysis, behavioral finance, and risk management.

- Reading top trading books helps finance pros develop winning strategies.

- Having a collection of best trading books is a great resource for finance pros.

Introduction to Trading Literature

Trading literature is key for a trader's education. It offers insights and strategies for success. Top books cover technical and fundamental analysis, helping traders gain skills and confidence.

StockBrokers.com lists "A Random Walk Down Wall Street" by Burton Malkiel and "The Little Book of Common Sense Investing" by John C. Bogle as top picks.

Quality books improve trading skills by deepening market understanding. Technical analysis and fundamental analysis are key. The best books offer a detailed look at these topics.

By learning from top books, traders can get ahead and boost their performance.

Importance of Quality Trading Books

Quality trading books are vital for market success. They lay the groundwork for market understanding and analysis tools. With the right books, traders can craft a solid trading plan.

They can stick to it, even when markets are uncertain or volatile.

How Trading Books Can Enhance Your Skills

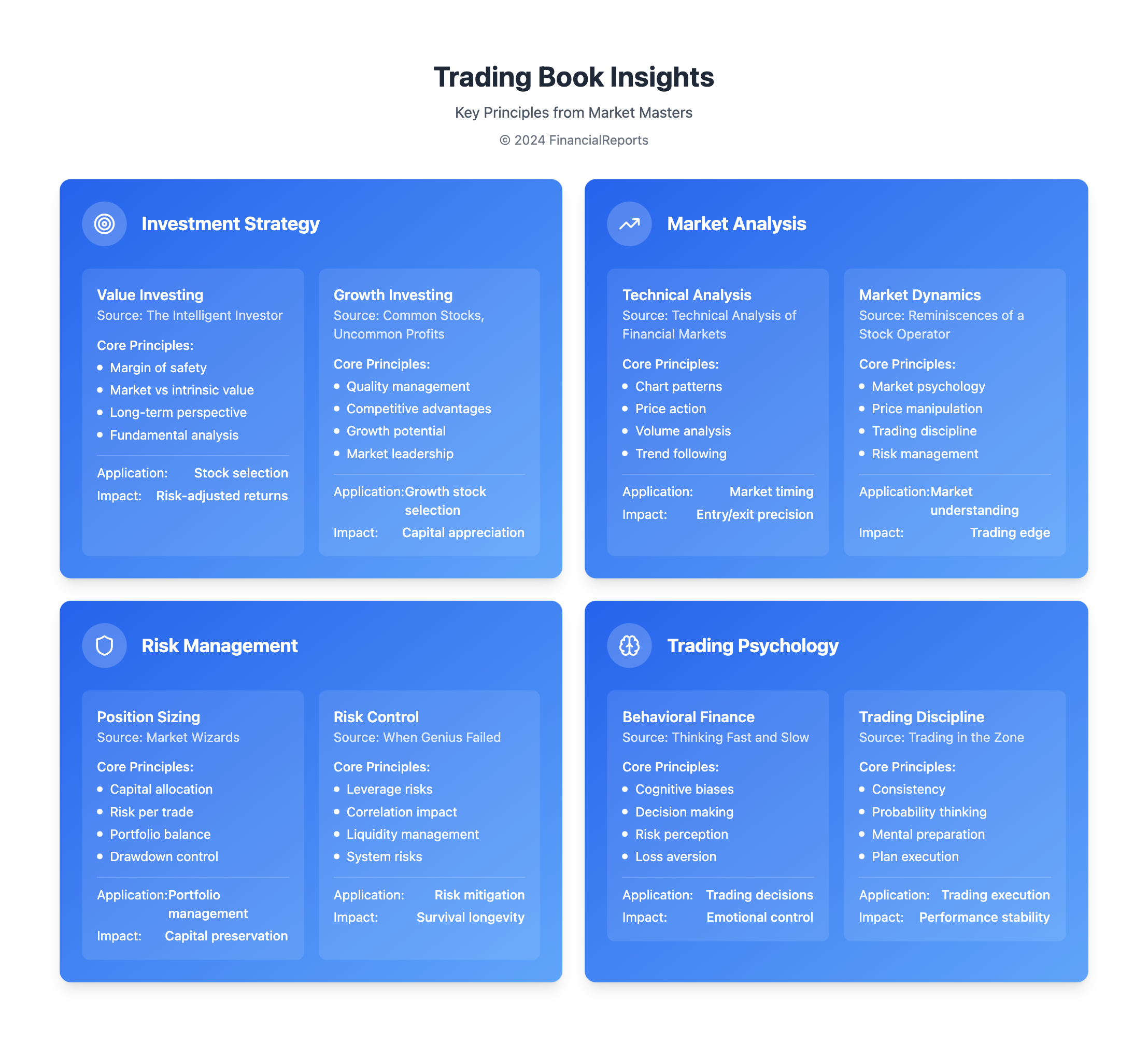

Trading books boost skills by sharing vast knowledge and experience. Reading top books helps traders grasp market dynamics and analysis tools. Key areas include:

- Technical analysis

- Fundamental analysis

- Trading psychology

- Risk management

Classic Trading Books Every Professional Should Have

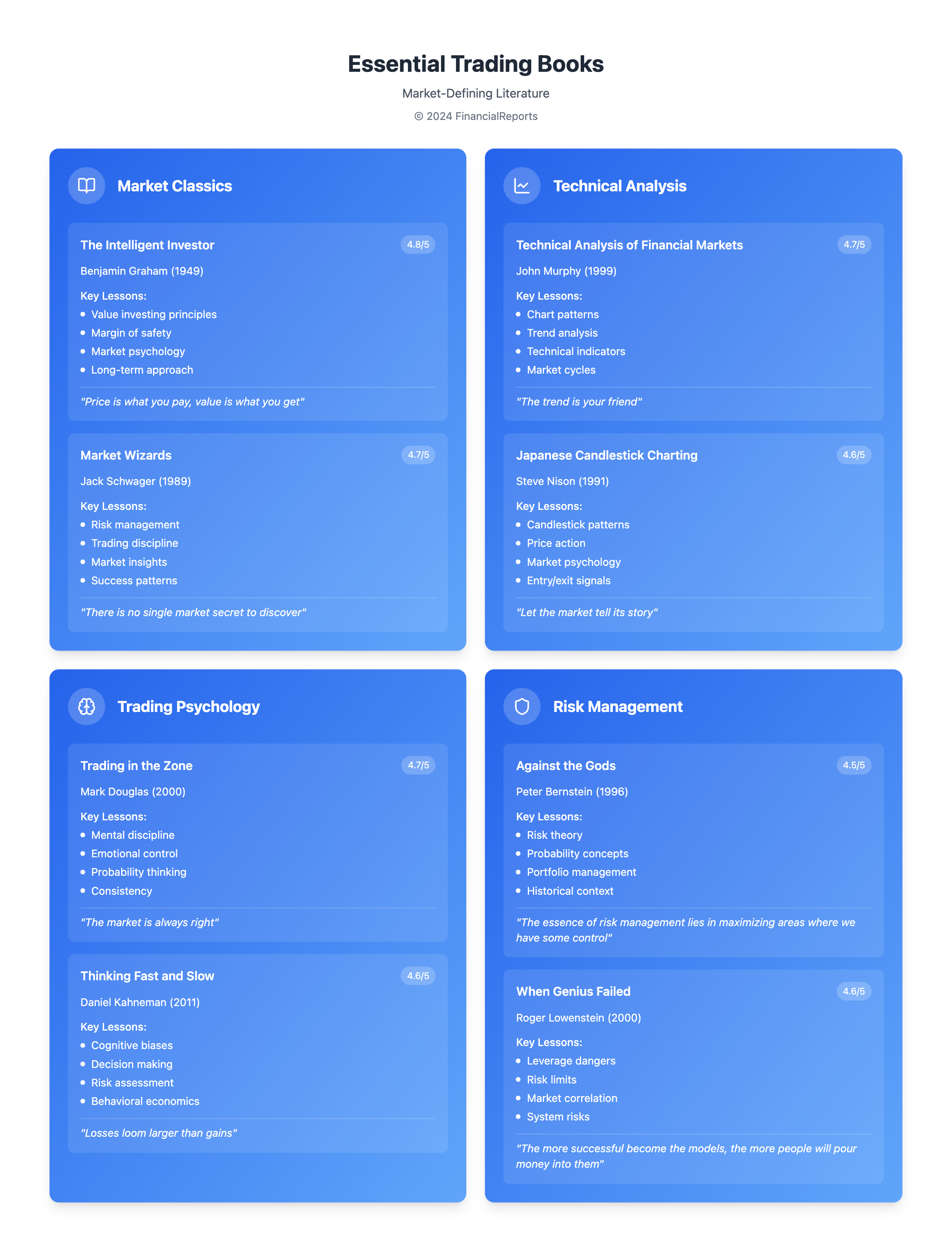

For financial pros and investors, knowing how to trade is key. Reading classic trading books is a great way to build this knowledge. "Market Wizards" by Jack D. Schwager is a top pick. It shares insights from top traders, covering their strategies and mindset.

"Reminiscences of a Stock Operator" by Edwin Lefèvre is another must-read. It gives a peek into the life of a successful trader. These classic trading books are essential for any pro. They offer timeless strategies that work today. Adding them to your library can deepen your market understanding and boost your trading skills.

Some key takeaways from these books include:

- Understanding market trends and patterns

- Developing a trading strategy that works

- Managing risk and emotions in trading

By diving into the wisdom of these market wizards, traders can get ahead. Whether you're experienced or new, these classic trading books are a treasure trove. They help you navigate the complex trading world.

Technical Analysis Resources

Technical analysis is key for traders. It gives them tools and strategies to understand markets and make smart choices. With the right resources, traders can learn a lot and improve their skills.

StockBrokers.com says "Technical Analysis of the Financial Markets" by John J. Murphy is a top guide. It covers many markets, including futures and stocks. It has a 4.5-star rating on Amazon and is a must-have for traders and investors.

"Japanese Candlestick Charting Techniques" by Steve Nison is another great resource. It teaches about using candlestick charts in analysis. It's highly rated on Goodreads and Amazon, and is seen as a classic in technical analysis.

Some important technical analysis resources include:

- "Technical Analysis of the Financial Markets" by John J. Murphy

- "Japanese Candlestick Charting Techniques" by Steve Nison

- "Encyclopedia of Chart Patterns" by Thomas Bulkowski

- "A Complete Guide to Volume Price Analysis" by Anna Coulling

These resources help traders understand markets and make better choices. They are highly recommended for anyone wanting to get better at technical analysis.

Fundamental Analysis Essentials

Fundamental analysis is key in trading. It helps traders understand the markets and make smart choices. "The Intelligent Investor" by Benjamin Graham is a must-read for this, as it teaches valuable lessons. An intelligent investor knows how important it is to check a company's financial health and growth chances.

Looking at a company's financial statements is a big part of fundamental analysis. These include income statements, balance sheets, and cash flow statements. By using these, traders can figure out financial ratios like the price-to-earnings ratio. This helps them understand a company's financial health better.

Some top resources for fundamental analysis are:

- "Security Analysis" by Benjamin Graham and David Dodd

- "The Theory of Investment Value" by John Burr Williams

- "Financial Statement Analysis: A Practitioner's Guide" by Martin Fridson and Fernando Alvarez

These books give traders the tools to do deep fundamental analysis. By mixing this with technical analysis, traders get a full view of the markets. As an intelligent investor, staying current with new techniques is key to success.

| Book Title | Author | Publication Year |

|---|---|---|

| The Intelligent Investor | Benjamin Graham | 1949 |

| Security Analysis | Benjamin Graham and David Dodd | 1934 |

| Financial Statement Analysis: A Practitioner's Guide | Martin Fridson and Fernando Alvarez | 2011 |

Behavioral Finance and Trading Psychology

Behavioral finance and trading psychology are key in trading. They give traders tools to manage their emotions and make smart choices. StockBrokers.com says "Thinking, Fast and Slow" by Daniel Kahneman is a must-read. It sheds light on the biases that shape our financial decisions.

Trading psychology is also essential for success. It helps traders develop the right mindset and discipline. Top books like "Market Wizards," "Trading in The Zone," and "The Psychology of Money" stress the need to control emotions and have a plan.

Some key points from these books are:

- Developing a mindset for success through controlling emotions like fear and greed

- Importance of discipline, consistency, and having a trading plan

- Understanding the psychological biases that affect financial decision-making

By grasping behavioral finance and trading psychology, traders can better understand the markets. They can develop the skills and knowledge needed to succeed. With the right mindset and resources, traders can overcome trading's emotional and psychological hurdles and reach their financial goals.

| Book Title | Author | Key Takeaway |

|---|---|---|

| Thinking, Fast and Slow | Daniel Kahneman | Understanding psychological biases in financial decision-making |

| The Psychology of Trading | Brett Steenbarger | Developing a mindset for success through controlling emotions |

Risk Management Strategies in Trading

Effective risk management is key to success in trading. It helps traders avoid big losses and keep profits safe. A good plan includes risk management techniques like setting stop-loss and take-profit points. It also means diversifying investments and following the one-percent rule.

Traders use different strategies to manage risk. Technical analysis looks at charts and patterns to guess price changes. Fundamental analysis examines financial data and news for trading decisions. Mixing these methods helps traders create a solid risk management plan.

Some important risk management strategies are:

- Limiting risk per trade to 2% of the total trading account balance

- Following the 6% monthly loss rule to prevent significant losses

- Using stop-loss orders to predetermine exit points and prevent emotional decision-making

- Managing leverage carefully to avoid amplifying possible losses

By using these strategies, traders can manage risk well. This increases their chances of success. It's also important to keep learning and adapting to the market. By refining their strategies, traders can stay ahead and reach their goals.

| Risk Management Strategy | Description |

|---|---|

| Stop-loss orders | Predetermine exit points to prevent emotional decision-making |

| Position sizing | Manage the size of trades to limit risk |

| Diversification | Spread investments across different assets to minimize risk |

Algorithmic Trading and Technology

Algorithmic trading uses computer programs to trade based on set rules. It can make money faster than humans, thanks to timing and math. Now, with financial machine learning, traders can analyze big data to make better choices.

StockBrokers.com says "Algorithmic Trading: Winning Strategies and Their Rationale" by Ernie Chan is a top guide. "Advances in Financial Machine Learning" by Marcos Lopez de Prado also shines, covering complex topics. These books help traders craft winning strategies and stay updated.

Some interesting facts about algorithmic trading and tech include:

- It makes up about 70-80% of stock market trades worldwide.

- 60% of books for beginners focus on algorithmic trading.

- 4 out of 5 books stress the need for risk management.

| Book Title | Author | Description |

|---|---|---|

| Algorithmic Trading: Winning Strategies and Their Rationale | Ernie Chan | A detailed guide to algorithmic trading |

| Advances in Financial Machine Learning | Marcos Lopez de Prado | Explores complex topics like risk parity and entropy estimators |

Using algorithmic trading and financial machine learning can give traders an edge. With the right tools and knowledge, they can create winning strategies and reach their goals.

Suggested Readings for Advanced Traders

Advanced traders need to understand the markets deeply. They also need to know the tools and strategies for success. "The Little Book of Common Sense Investing" by John C. Bogle is a must-read for advanced traders, according to BetterTrader.co.

Understanding common sense investing is key for advanced traders. This includes knowing about risk management, diversifying portfolios, and long-term strategies. Books like "The Little Book of Common Sense Investing" and "Options, Futures, and Other Derivatives" by John C. Hull are great resources.

Some important topics in advanced trading books include:

- Order and range trading strategies

- Volatility and systems trading

- Fundamental analysis and trading psychology

- Entry and exit strategies, as well as probability trading and money management

Mastering these topics is essential for success in the markets. Reading books on advanced trading and common sense investing helps traders achieve their goals.

| Book Title | Author | Description |

|---|---|---|

| The Little Book of Common Sense Investing | John C. Bogle | A classic book on investing that provides valuable insights for advanced traders |

| Options, Futures, and Other Derivatives | John C. Hull | A complete guide to advanced trading topics, including options, futures, and other derivatives |

Developing a Personalized Trading Strategy

A disciplined trader knows how vital a personalized trading strategy is. It lets traders shape their methods to fit their unique needs and risk levels. Mark Douglas, from "The Disciplined Trader", says this tailored approach is key to success.

Some key parts of a personalized trading strategy are:

- Setting clear trading goals and risk tolerance

- Creating a trading plan and following it

- Keeping an eye on and tweaking the strategy when needed

Van K. Tharp, in "Trade Your Way to Financial Freedom", stresses the need to understand one's psychology. He suggests making a trading system that's personal. This way, traders can better their strategy and manage risks, leading to more effective personalized trading.

| Book Title | Author | Key Takeaway |

|---|---|---|

| The Disciplined Trader | Mark Douglas | Importance of psychological discipline in trading |

| Trade Your Way to Financial Freedom | Van K. Tharp | Creating a personalized trading system for improved strategy development and risk management |

Conclusion: The Continued Relevance of Trading Books

Trading books are as important as ever in the fast-changing financial markets. They are filled with valuable insights, strategies, and techniques. These can help traders of all levels stay ahead in the game.

By reading and learning from these books, finance professionals can improve their skills. This is key to success in today's competitive markets. Building a strong trading library is essential for lifelong learning.

The books mentioned in this article are a great starting point. Classics like "Market Wizards" and "The Intelligent Investor" are timeless. Modern books on algorithmic trading and behavioral finance also offer valuable lessons.

These resources are beneficial for both experienced and new traders. They provide insights and encourage traders to keep improving. Reading and applying these lessons can lead to long-term success.

As the markets evolve, the role of trading books will become even more critical. By using these resources, traders can master their financial futures. Dedication to learning from these books is key to achieving success.

FAQ

What are the best trading books for finance professionals?

This article offers a detailed guide to top trading books. They cover technical and fundamental analysis, behavioral finance, and risk management.

Why are quality trading books important?

Quality trading books offer valuable insights and strategies. They help traders improve their performance and achieve their goals. They also deepen market understanding and develop necessary skills.

What are some classic trading books every professional should have?

Every trader should have "Market Wizards" by Jack D. Schwager and "Reminiscences of a Stock Operator" by Edwin Lefèvre. These classics provide timeless insights and strategies.

What are some essential resources for technical analysis?

Key resources for technical analysis include "Technical Analysis of the Financial Markets" by John J. Murphy and "Japanese Candlestick Charting Techniques" by Steve Nison. They equip traders with tools for market analysis and decision-making.

What are some fundamental analysis essentials?

Essential books for fundamental analysis are "The Intelligent Investor" by Benjamin Graham and "Security Analysis" by Benjamin Graham and David Dodd. They offer tools and strategies for market analysis and decision-making.

What resources cover behavioral finance and trading psychology?

Resources on behavioral finance and trading psychology include "Thinking, Fast and Slow" by Daniel Kahneman and "The Psychology of Trading" by Brett Steenbarger. They help traders manage emotions and make informed decisions.

What are some key risk management strategies in trading?

Key risk management strategies are found in "Risk Management and Financial Institutions" by John C. Hull and "The New Trading for a Living" by Dr. Alexander Elder. These books provide tools for risk management and capital protection.

What resources cover algorithmic trading and technology?

Resources on algorithmic trading and technology include "Algorithmic Trading: Winning Strategies and Their Rationale" by Ernie Chan and "Advances in Financial Machine Learning" by Marcos Lopez de Prado. They offer tools for market analysis and decision-making with technology.

What are some suggested readings for advanced traders?

Advanced traders should read "The Little Book of Common Sense Investing" by John C. Bogle and "Options, Futures, and Other Derivatives" by John C. Hull. These books provide a deeper market understanding and success strategies.

How can traders develop a personalized trading strategy?

Traders can craft a personalized strategy with "The Disciplined Trader" by Mark Douglas and "Trade Your Way to Financial Freedom" by Van K. Tharp. These books offer tools for developing a strategy that meets individual needs and goals.