Expert Investing Tips to Grow Your Wealth

Investing is key to building wealth. With the right strategy and knowledge, anyone can start investing and grow their wealth. Our expert tips will give you examples to help you make smart decisions and get the most returns. We'll cover the basics, setting financial goals, and why diversification is important.

By following our tips, you can make a plan that fits your goals and risk level. Whether you're new to investing or experienced, our advice will help you make wise choices. This way, you can reach your financial goals.

Introduction to Investing

Investing in a retirement savings program, like a 401(k) or IRA, can help you build wealth over time. With an average expense ratio of 1.11% for stock mutual funds and 0.55% for stock index funds, picking the right options is key. Our expert tips will guide you through investing and offer advice to get you started.

Key Takeaways

- Start investing early to benefit from compound interest and maximize your returns.

- Choose the right investment options for your portfolio, such as high-yield savings accounts or retirement savings programs.

- Consider consulting a Certified Financial Planner (CFP) or Chartered Financial Assistant (CFA) for personalized investment advice.

- Understand the importance of diversification and how it can help you manage risk and achieve your financial goals.

- Use investing tips and investment advice examples to create a personalized investment plan that meets your needs and goals.

Understanding the Basics of Investing

Investing might seem scary at first, but it's easier to start small. There are experts ready to guide you. It's key to know the different types of investments and how they work. Investing tips stress the need to diversify, spreading your investments to reduce risk.

Investments like stocks, bonds, and mutual funds are common. Stocks let you own part of a company. Bonds are like loans to companies or governments. Mutual funds mix money from many investors into a variety of stocks, bonds, or other securities. Best investment tips suggest starting with these basics.

When choosing investments, think about your financial goals and how much risk you can handle. For a safer choice, bonds or CDs might be better. But if you're ready for more risk, stocks or mutual funds could be the way to go. The goal is to find a mix that fits your financial situation.

| Investment Type | Risk Level | Potential Return |

|---|---|---|

| Stocks | High | High |

| Bonds | Low | Low |

| Mutual Funds | Medium | Medium |

By following these best investment tips and investing tips, you can make smart choices. Always research, think about your risk level, and diversify to lower risk.

Setting Financial Goals for Success

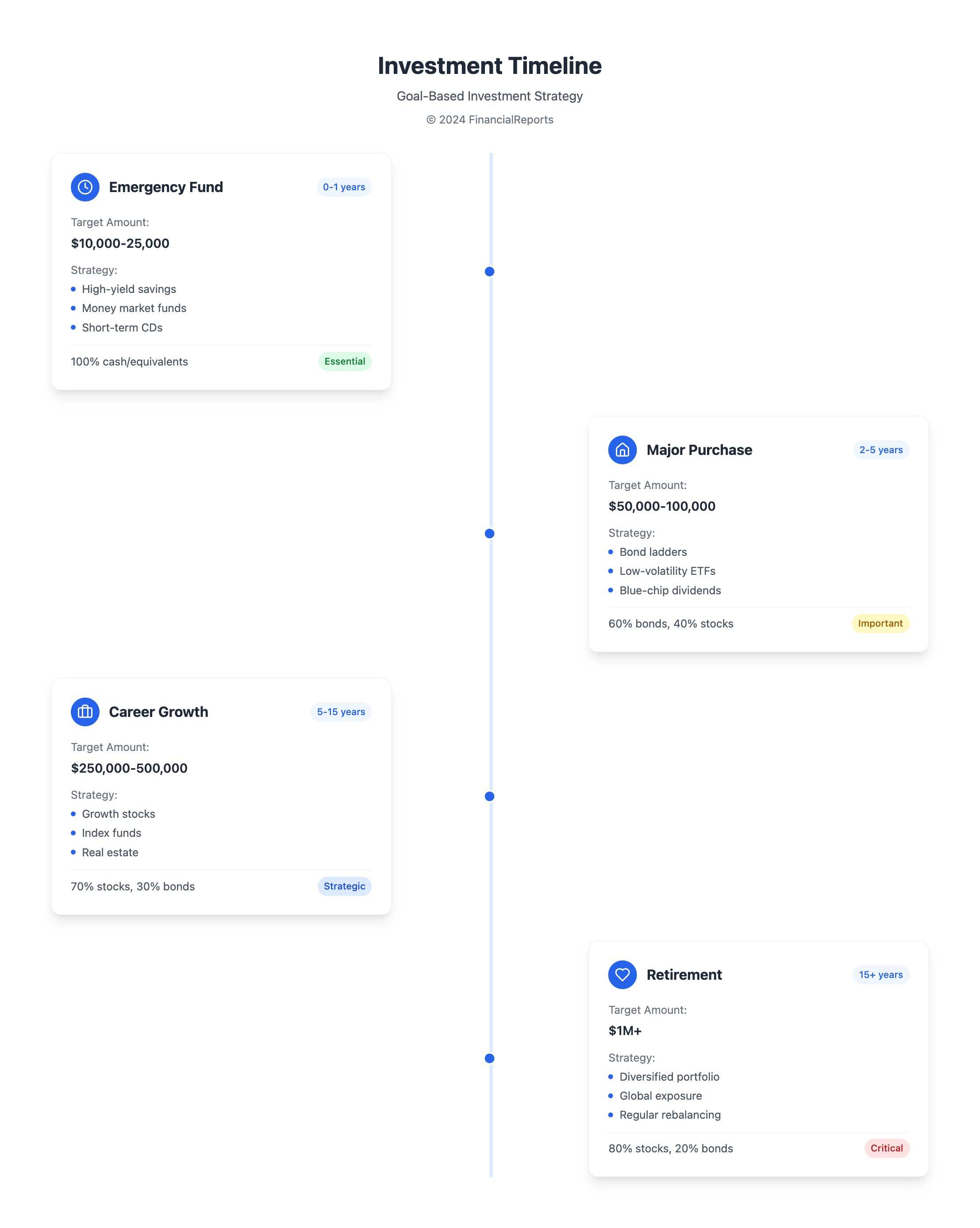

Setting financial goals is key to success in investing. It's important to know what you want, like saving for retirement or a home. Start with short-term and long-term goals and make a plan to reach them.

The best advice is to be patient, disciplined, and well-informed. This will help you stay on track.

When setting goals, it's vital to check on them every year. This helps you see how you're doing. Start with small steps like making a budget and saving for emergencies.

For long-term goals, think about saving for retirement or buying a home. Here are some important tips for setting financial goals:

- Define your short-term and long-term goals

- Create a plan to achieve them

- Review and update your goals annually

- Start by setting short-term goals, such as creating a budget and establishing an emergency fund

- Consider long-term goals, such as saving for retirement or buying a home

By following these steps and tips, you can make a strong financial plan. Always seek professional advice and keep up with new investment trends.

| Financial Goal | Timeframe | Actions |

|---|---|---|

| Short-term | Less than 1 year | Create a budget, reduce debt, establish an emergency fund |

| Long-term | More than 1 year | Save for retirement, buy a home, invest in a diversified portfolio |

The Importance of Diversification

Diversification is key in investing. It reduces risk and can increase returns. By investing in different areas like stocks, bonds, and real estate, you spread out your risk. This is a vital investing tip for reaching your financial goals.

For a good investment advice example, diversify your portfolio. You could put 40% in stocks, 30% in bonds, and 30% in real estate. This strategy can lower your risk and boost your returns over time.

Some main benefits of diversification are:

- Reduced risk: Spreading investments across different areas lowers your risk in any one market.

- Increased returns: Diversification can lead to higher returns over time, as different investments perform differently.

- Improved liquidity: It also makes it easier to sell investments quickly if you need cash.

Remember, diversification isn't the same for everyone. Your financial goals and how much risk you can take on will guide your strategy. It's wise to talk to a financial advisor to find the right mix for you.

| Asset Class | Risk Level | Potential Returns |

|---|---|---|

| Stocks | High | High |

| Bonds | Low | Low |

| Real Estate | Medium | Medium |

Researching Investment Opportunities

Investing wisely means doing your homework. You need to find trustworthy sources and look at important numbers like risk and return. By using the best tips, you can boost your chances of success.

First, find reliable sources. Look at financial news sites, company reports, and expert advice. Important documents like Form 10-K and Form 10-Q offer insights into a company's finances.

Key Metrics to Evaluate

When checking out investments, focus on a few key areas. These include:

- Revenue and net income

- Earnings per share (EPS) and price-earnings ratio (P/E)

- Return on equity (ROE) and return on assets (ROA)

By studying these numbers and following good advice, you can make better choices. Also, think about the company's strengths, management quality, and risks.

Popular choices include stocks, bonds, and mutual funds. Know the costs, like fees for online trades, which can be $0. Research and use tips to build a diverse portfolio that fits your goals.

| Investment Option | Fees | Minimum Investment |

|---|---|---|

| Online Brokerage Account | $0 per trade | $0 |

| Robo-Advisor | 0.25% management fee | $0 |

By following the best tips, you can craft a winning investment plan. Always research, look at key numbers, and explore different options before deciding.

Risk Assessment and Management

Assessing and managing risk is key in investing. It helps you know how much risk you can handle and how to lessen it. Knowing your risk tolerance is vital. For instance, a cautious investor might choose safe options like short-term Treasuries or cash. On the other hand, a bold investor might go for stocks in emerging markets or small companies.

Diversifying your portfolio is a smart move to reduce risk. Spread your investments across different types, like stocks, bonds, and short-term options. Also, think about your time frame and how much risk you can take. By following the best advice on investing, you can make a plan that fits your goals and comfort with risk.

Here are some ways to manage risk:

- Diversify your investments across different asset classes

- Regularly rebalance your portfolio to keep it in line with your goals

- Use fixed income securities, like bonds, to stabilize your investments

By understanding your risk tolerance and using smart risk management, you can safeguard your investments. This way, you can reach your long-term financial goals.

The Role of Timing in Investing

Timing is key in investing, affecting returns a lot. Knowing market trends helps make better choices. For example, investing at market troughs can lead to better returns than investing at peaks. A study by Charles Schwab Company found that holding investments for 20 years never resulted in losses for buy-and-hold investors.

One good tip is to use dollar-cost averaging. It helps avoid waiting too long and regretting it. This method can also reduce the effects of market ups and downs. For instance, Matthew Monthly used this strategy and ended up with $124,248, close to Ashley Action's $127,506.

Here are some key investment advice examples:

- Peter Perfect amassed $138,044 over 20 years by investing perfectly timed $2,000 annually.

- Ashley Action accumulated $127,506 by investing immediately on the first trading day of each year.

- Matthew Monthly, practicing dollar-cost averaging, ended up with $124,248.

These examples show how timing matters in investing. Dollar-cost averaging can offer big benefits. By following these tips, investors can reach their financial goals.

| Investor | Strategy | Return |

|---|---|---|

| Peter Perfect | Perfectly timed investments | $138,044 |

| Ashley Action | Investing on the first trading day of each year | $127,506 |

| Matthew Monthly | Dollar-cost averaging | $124,248 |

Utilizing Technology in Investing

Investors can use technology to find best investment tips and make smart choices. With apps and platforms, starting to invest with little money is easy. Robo-advisors offer expert management at a lower cost, helping investors manage their money better.

Some key benefits of using tech in investing are:

- Enhanced data analysis: Tech helps investors sort through lots of data to find useful insights for better choices.

- Automated portfolio management: Algorithmic trading with robo-advisors automates managing your portfolio. It rebalances and takes tax losses based on your settings.

- Improved risk evaluation: Tech can help evaluate risks by analyzing data to spot or predict volatility, threats, and opportunities in real-time.

By following investing tips and using technology, investors can make their strategies faster and more effective. This leads to better stock picking, risk management, and returns on their portfolios. As the financial world keeps changing, it's key for investors to stay updated and adapt to new tech and trends to reach their goals.

| Technology | Benefits |

|---|---|

| Artificial Intelligence (AI) | Provides near-instant analysis of vast data, market predictions, and automates portfolio management. |

| Robo-Advisors | Offers expert management at a lower cost, automates portfolio management, and provides risk evaluation. |

The Impact of Economic Factors

Economic factors like interest rates and inflation greatly affect investments. It's key to understand these to make smart choices. For instance, rising interest rates can make bond yields go up. This makes bonds with lower yields less appealing to investors.

Investors can learn a lot by looking at economic indicators. The Consumer Price Index (CPI) and the Beige Book are good places to start. They help understand the economy's health. The best advice is to keep up with economic trends and adjust your investments.

Some important economic indicators to watch include:

- Gross Domestic Product (GDP)

- Employment rates

- Consumer spending

- Inflation rates

By keeping an eye on these indicators and staying current with economic news, investors can make better choices. It's vital to regularly check how economic factors affect investments. Their impact can change over time.

| Economic Indicator | Description |

|---|---|

| GDP | Measures the total value of goods and services produced within a country |

| Employment rates | Measures the percentage of the labor force that is employed |

| Consumer spending | Measures the amount of money spent by consumers on goods and services |

| Inflation rates | Measures the rate at which prices for goods and services are increasing |

Continuous Education and Learning

The financial world is always changing. For investors, keeping up with these changes is key to growing their wealth. By using the best resources and staying current with market trends, people can make better choices and adjust their plans as needed.

Experts say it's important to look at different learning materials. This includes finance websites, industry publications, online courses, and workshops. Also, joining professional investment groups online or in person can offer great insights and chances to meet others.

Watching economic signs and market shifts helps investors prepare for changes. This way, they can act quickly when things change.

Investors who keep learning can get better at navigating the world of investing tips and finding investment advice example chances. This commitment to learning boosts confidence and helps achieve long-term financial success.

FAQ

What is investing?

Investing means putting your money into things that might grow, like stocks, bonds, or real estate.

What are the different types of investments?

There are many investments, like stocks, bonds, mutual funds, ETFs, and real estate. Each has its own risk and reward.

Why is setting financial goals important in investing?

Setting goals is key because it helps you know what you want to achieve. Using SMART goals makes sure your goals are clear and reachable.

What is diversification, and why is it important in investing?

Diversification means spreading your money across different areas, like stocks and bonds. It helps lower risk and can increase returns.

Where can I find reliable information to research investment opportunities?

You can find good info from financial news, industry reports, and online research platforms. Always check the risk and return when looking at investments.

How can I assess and manage investment risk?

Knowing how much risk you can handle is important. You can use strategies like diversifying, dollar-cost averaging, and hedging to manage risk.

How does timing affect investment decisions?

Timing is very important because market trends and economic factors can change returns. Using strategies like dollar-cost averaging can help with market ups and downs.

How can technology be used in investing?

Technology makes investing easier, with apps, platforms, and robo-advisors. These tools help you start investing with little money and offer professional advice at a lower cost.

How do economic factors impact investments?

Economic factors like interest rates and inflation can greatly affect investments. Knowing how these factors work is key to making smart investment choices.

How can I stay up-to-date with the latest investing trends and information?

Keeping up with investing is important. Learning about market trends, economic factors, and news helps you make better choices. Use financial news, reports, and educational materials to stay informed.