Expert Insights: Navigating the World of Share Options

Buying share options can be both complex and exciting. It offers traders a chance to make gains and protect their investments. Knowing what are stock options and how they work is key to making smart choices. Stock options are contracts that let the buyer choose to buy or sell an asset at a set price before a certain date.

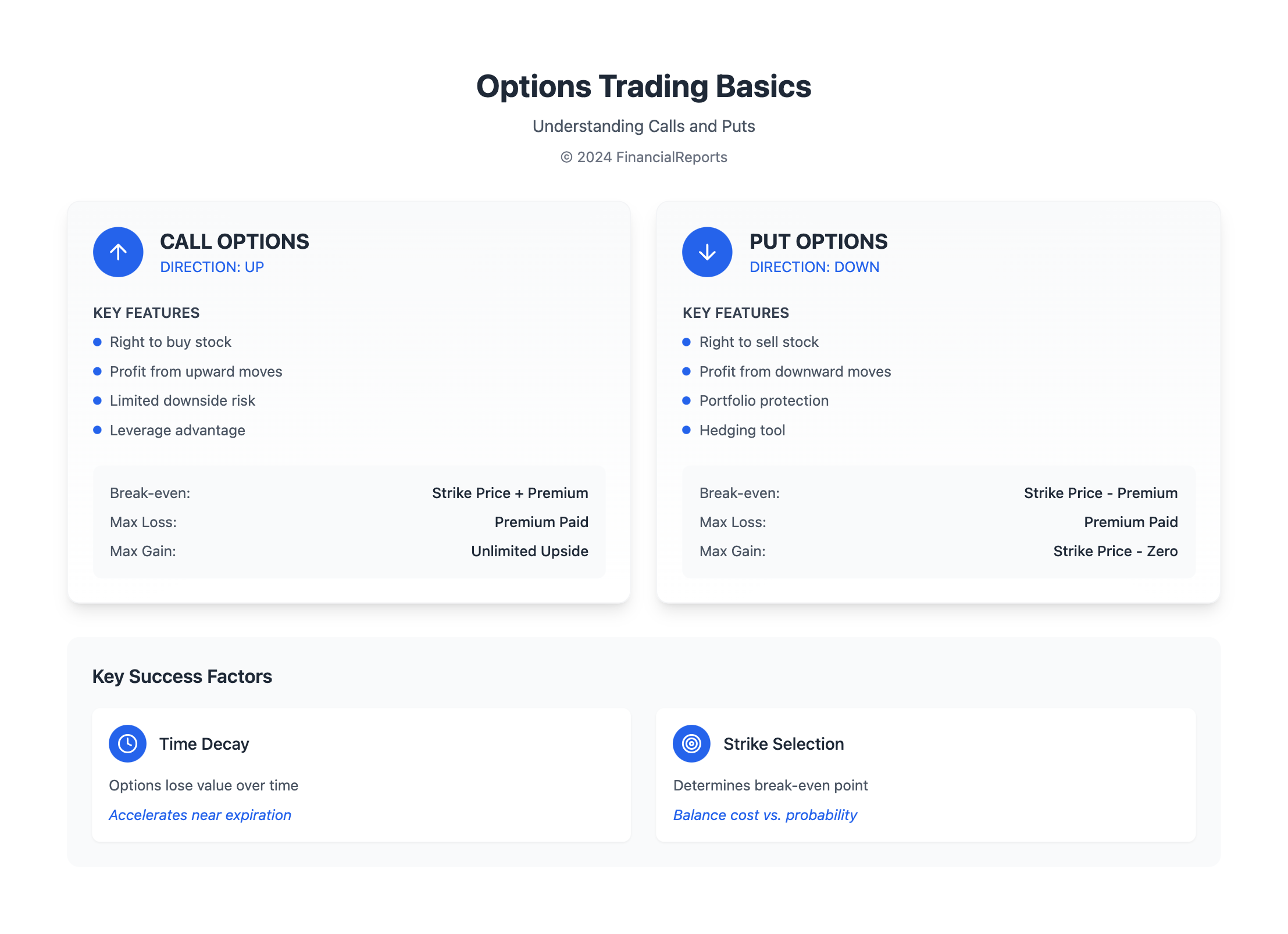

When you think about buying share options, it's important to know the different types. Call options and put options are two main types. Each has its own benefits and risks. Understanding these can help you make successful trades. Learning the basics of share options can give you an edge in the market.

Key Takeaways

- Understanding the basics of share options is vital for making informed decisions when buying share options.

- There are different types of options available, including call options and put options, each with its own set of benefits and risks.

- Stock options explained in simple terms, are contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date.

- Buying share options can be a complex and exciting world that offers traders the opportunity to make gains and hedge their positions in the financial markets.

- What are stock options and how they work is essential knowledge for investors looking to navigate the world of share options.

- By learning about the basics of share options and their benefits, investors can gain a competitive edge in the market.

- Understanding the risks and benefits associated with buying share options is vital for making successful trades.

Understanding Share Options and Their Benefits

Share options are contracts that give the buyer the right to buy or sell an asset at a set price and time. To learn options trading, knowing the basics of share options is key. An explanation of stock options helps investors make smart choices.

Investors can learn how to trade options by understanding call and put options. Here are some key benefits of buying share options:

- Flexibility: Share options can be used to hedge against losses or generate income.

- Leverage: Share options allow investors to leverage their positions, potentially increasing their returns.

- Limited risk: Share options have a limited risk, as the buyer is not obligated to buy or sell the underlying asset.

Understanding the basics of share options and their benefits is vital before investing. This knowledge helps investors make informed decisions and potentially increase their returns.

| Type of Option | Benefit |

|---|---|

| Call Option | Allows the buyer to buy the underlying asset at a predetermined price. |

| Put Option | Allows the buyer to sell the underlying asset at a predetermined price. |

How to Evaluate Share Options Before Buying

Before you buy stock options, it's key to evaluate them well. Look at market trends, company performance, and risks. Knowing how do options work stocks helps you make smart choices.

Start by checking the company's finances, management, and industry trends. This info helps you see the stock options' value. Also, think about trade stock options strategies and the costs of buying and selling.

| Company Valuation | Stock Options Offered | Vesting Schedule |

|---|---|---|

| $1 billion | 500,000 | 4 years |

By carefully looking at share options, you can make good choices. Consider the company's worth, vesting schedule, and market trends. It's also vital to grasp how do options work stocks and the risks and rewards of trade stock options.

Different Types of Share Options

Exploring the world of share options requires knowing the various types. You'll find call options, put options, employee stock options, and exchange-traded options. Each has its own benefits and characteristics. It's key to understand these to make smart investment choices.

Stock market options fall into two main categories: call options and put options. Call options allow you to buy a stock at a set price. Put options let you sell a stock at a set price. Investors use different strategies to buy these options, based on their goals and how much risk they can take.

Employee stock options are special. Companies offer them to their employees. These options let employees buy the company's stock at a set price. They're used to attract and keep employees. To buy these options, you need to know about vesting schedules, exercise prices, and expiration dates.

| Type of Option | Description |

|---|---|

| Call Options | Give the holder the right to buy a stock at a specified price |

| Put Options | Give the holder the right to sell a stock at a specified price |

| Employee Stock Options | Give employees the right to buy the company's stock at a specified price |

| Exchange-Traded Options | Are traded on an exchange and can be bought and sold like other securities |

Knowing about the different stock options and how to buy them is vital. It helps investors understand each option's benefits. This knowledge is essential for creating effective investment plans.

Setting Your Investment Goals

Investing in stock options starts with clear goals. You need to understand the kinds of stock options and how to buy them. Stock options let you buy or sell a stock at a set price before a deadline.

Think about your risk level and how long you can wait for returns. Do you want quick profits or long-term growth? Knowing your risk comfort helps decide where to put your money. For example, if you're cautious, bonds or index funds might be safer choices.

Consider these when setting your goals:

- Time horizon: When do you need the money?

- Risk tolerance: How much risk are you willing to take?

- Financial goals: What are you trying to achieve, such as retirement or a down payment on a house?

Understanding your goals and risk level helps you choose the right stock options. Always research and might want to talk to a financial advisor before investing.

| Investment Goal | Time Horizon | Risk Tolerance |

|---|---|---|

| Retirement | Long-term | Conservative |

| Down payment on a house | Short-term | Moderate |

Selecting a Brokerage for Share Options

Choosing the right brokerage is key when buying share options. It's important to understand the costs involved. For example, Interactive Brokers has a $0 minimum account and charges $0.65 per contract for options on TWS Lite. Charles Schwab also has a $0 minimum account and offers $0 for stock/ETF trades, with $0.65 per contract for options.

When starting to buy share options, look at what a brokerage offers. This includes account types, trading platforms, and customer service. Public and Robinhood have different fees and account minimums. Fidelity, with its $0 minimum account and $0.65/contract for options trades, is great for those who want low costs.

When picking a brokerage, think about convenience and costs. Also, try out different trading platforms to see which one you like best.

Some important things to consider when choosing a brokerage for share options include:

- Account types, such as standard taxable brokerage accounts, Roth IRAs, and solo 401(k)s

- Fees and commissions, including those for services like transferring funds or account closure

- Trading platforms, including mobile-friendly interfaces and access to specific assets like cryptocurrency

- Customer support and education resources

By looking at these factors and using a stock options example, investors can make a smart choice. They can pick a brokerage that fits their needs and goals.

Timing Your Purchase: When to Buy Share Options

Timing is key when buying share options. Knowing what affects option prices and watching market trends is vital. To figure out how to buy options, it's important to know the different types and the current market state.

Factors Influencing Option Pricing

Several things affect option prices. These include the stock's price, how much it swings, and how long it has until it expires. It's also important to know the types of options, like calls or puts, and how they fit into your investment plan.

Market Conditions to Monitor

Market trends and volatility greatly affect option prices. Keeping an eye on these can help you decide the best time to buy. By understanding the stock market and its options, you can make better choices and boost your chances of success.

Some key things to think about when timing your purchase include:

- Market trends and volatility

- Underlying stock's price and performance

- Time to expiration and option pricing

By carefully considering these factors and knowing the different options, you can make smarter choices. This can help you reach your investment goals.

Strategies for Buying Share Options

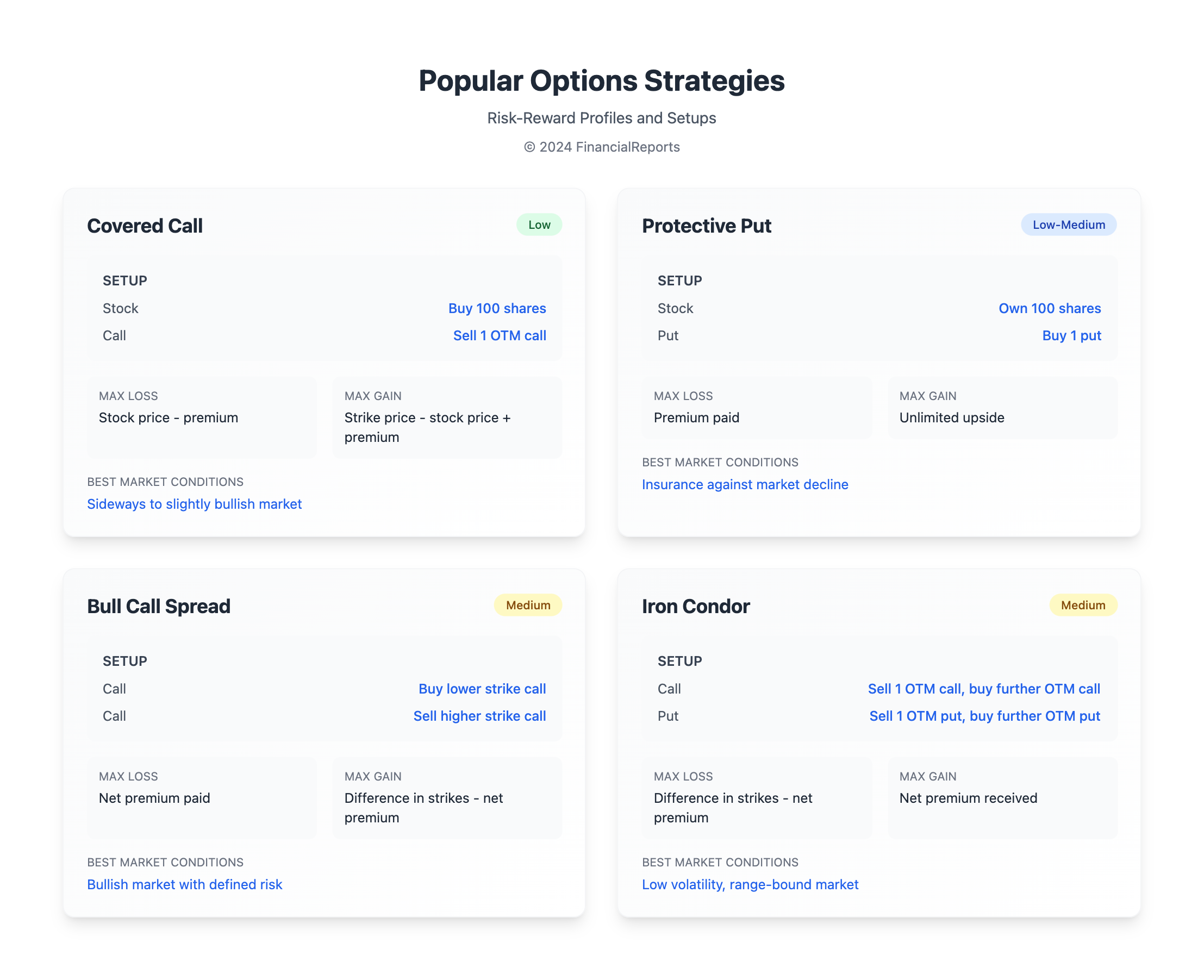

Investors have many strategies to limit risk and increase returns when buying share options. It's key to know how to buy stock options and the types available. Strategies like covered calls, protective puts, and straddles help investors reach their goals.

To figure out how to buy stock options, investors should think about their goals and how much risk they can take. They can buy and sell options online. It's important to know the fees and commissions involved. The price of an option includes its intrinsic and time values. Investors must guess the option's strike price and expiration date based on the stock's expected movement.

Some popular strategies for buying share options include:

- Covered call strategy: involves buying the underlying stock and simultaneously selling a call option on those same shares

- Protective put strategy: involves buying an asset and simultaneously purchasing put options for the same number of shares

- Straddle strategy: involves simultaneously buying a call option and a put option on the same underlying asset with the same strike price and expiration date

By understanding these strategies and how to buy stock options, investors can make informed decisions and achieve their investment goals. It's essential to remember that options trading involves risk. Investors should carefully consider their investment objectives and risk tolerance before buying share options.

| Strategy | Description |

|---|---|

| Covered Call | Buy underlying stock and sell call option |

| Protective Put | Buy asset and buy put option |

| Straddle | Buy call option and put option on same underlying asset |

Tax Implications of Buying Share Options

Understanding the tax implications of buying share options is key. How do options work stocks and their tax treatment can be complex. Knowing define stock options and their tax implications is vital for making smart choices. For stock options for dummies, it's important to note that tax rules change based on the option type and how long you hold them.

The tax effects of buying share options can be big. Here are some important points to remember:

- Capital gains tax applies to the sale of shares acquired through exercising options.

- Short-term vs. long-term tax considerations depend on the holding period of the shares.

- Alternative minimum tax may apply to the exercise of Incentive Stock Options (ISOs).

It's vital for investors to understand these tax implications. By grasping how to handle the tax side of buying share options, investors can make better choices and cut their tax bill. Whether you're experienced or new to stock options for dummies, knowing the tax side is key to getting the most out of your investments.

| Type of Option | Tax Implication |

|---|---|

| Incentive Stock Options (ISOs) | Capital gains tax applies to the sale of shares |

| Nonstatutory Stock Options (NSOs) | Ordinary income tax applies to the exercise of options |

Risk Management Techniques for Investors

Investing in options requires careful risk management to avoid losses and increase gains. To learn options trading, it's key to diversify and use stop-loss orders. Diversifying means spreading investments across various sectors, sizes, and locations to lower risk.

Setting stop-loss and take-profit points is also vital. This involves using a formula to calculate expected returns. By understanding explanation of stock options and applying this formula, investors can make smart choices and manage risks well.

To learn how to trade options, consider hedging with downside put options. This helps protect against losses and reduces risk. Also, using leverage can control bigger positions with less money, but it ups the risk of losses. Knowing the risks and benefits of options trading helps investors manage risks and reach their goals.

Some key risk management techniques for investors include:

- Diversification across different asset classes and industries

- Setting stop-loss and take-profit points

- Hedging positions through downside put options

- Using leverage to control larger positions

Building a Share Options Portfolio

Starting your journey in share options means building a diverse portfolio. Aim for a mix of 30% cash, 50% broad-based equity ETFs, and 20% option-based strategies. This balance helps you manage risks and rewards, adapting to market changes.

When checking your portfolio's performance, look at returns, volatility, and trade consistency. Regularly update your strategies and stay alert to market shifts. This way, you can improve your chances of success in the fast-paced world of share options.

FAQ

What are share options?

Share options are contracts. They give the holder the right to buy or sell shares at a set price. This must be done within a certain time frame.

What are the advantages of buying share options?

Buying share options lets you leverage your investments. It helps you hedge against losses and can generate income.

What are the common misconceptions about share options?

Many think share options are very risky. They also believe only experienced investors should use them.

How do I evaluate share options before buying?

To evaluate share options, look at market trends and company performance. Also, consider the risks involved.

What are the different types of share options?

There are several types of share options. These include call options, put options, employee stock options, and exchange-traded options.

How do I set my investment goals for share options?

Setting goals involves deciding on short-term and long-term strategies. It also means understanding your risk tolerance.

How do I select a reputable brokerage for trading share options?

Choose a brokerage based on key features, fees, and customer service. These factors are important for a good trading experience.

How do I time my purchase of share options?

Timing your purchase means understanding what affects option prices. It also involves keeping an eye on market conditions.

What are some common strategies for buying share options?

Popular strategies include covered call, protective put, and straddle and strangle strategies. These help manage risk and aim for profit.

What are the tax implications of buying share options?

Knowing about capital gains tax is key. It's important to understand the difference between short-term and long-term tax implications.

How do I manage risk when investing in share options?

Managing risk involves diversifying your investments. It also means setting stop-loss orders to limit losses.

How do I build a successful share options portfolio?

A successful portfolio balances risk and reward. Regularly check how your portfolio is doing to make adjustments as needed.