Efficient Gross Profit Calculator for Your Business

A gross profit calculator is a key tool for businesses to check their financial health. It helps them make smart decisions. By using a calculator profit percentage, companies can see how much revenue is left after costs are subtracted. This is vital for checking pricing, managing costs, and growing the business.

A profit margin calc shows where a business can get better. It helps find ways to boost profits. This way, businesses can work smarter to make more money.

Financial experts and investors need accurate gross profit numbers to judge a company's success and growth chances. A gross profit calculator offers deep insights into a business's financial health. It spots trends and patterns for better strategic planning. By comparing profit margins, businesses can see how they stack up against others. This helps them plan to be more profitable and competitive.

Key Takeaways

- Accurate gross profit calculations are essential for evaluating a company's financial health and growth.

- A gross profit calculator can help businesses identify areas for improvement and optimize their operations to increase profitability.

- Using a calculator profit percentage can inform pricing strategies and cost management decisions.

- A profit margin calc can provide valuable insights into a business's financial efficiency and competitiveness.

- Comparing profit margins to industry benchmarks and competitors can help businesses devise strategies to improve their performance.

- A gross profit calculator is a critical tool for financial professionals and investors to evaluate a company's performance and growth.

- Regular calculation of gross profit margin can aid in detecting changes in cost management, pricing, or production efficiency.

Understanding Gross Profit: Definition and Importance

Gross profit is a key financial metric. It shows the profit after subtracting the cost of goods sold from sales revenue. To grasp gross profit, knowing how to calculate margin is essential. A gp calculator can help with this.

The difference between margin and markup is also important. Markup is the amount added to the cost of goods sold to set the selling price. Margin, on the other hand, is the profit after deducting production costs.

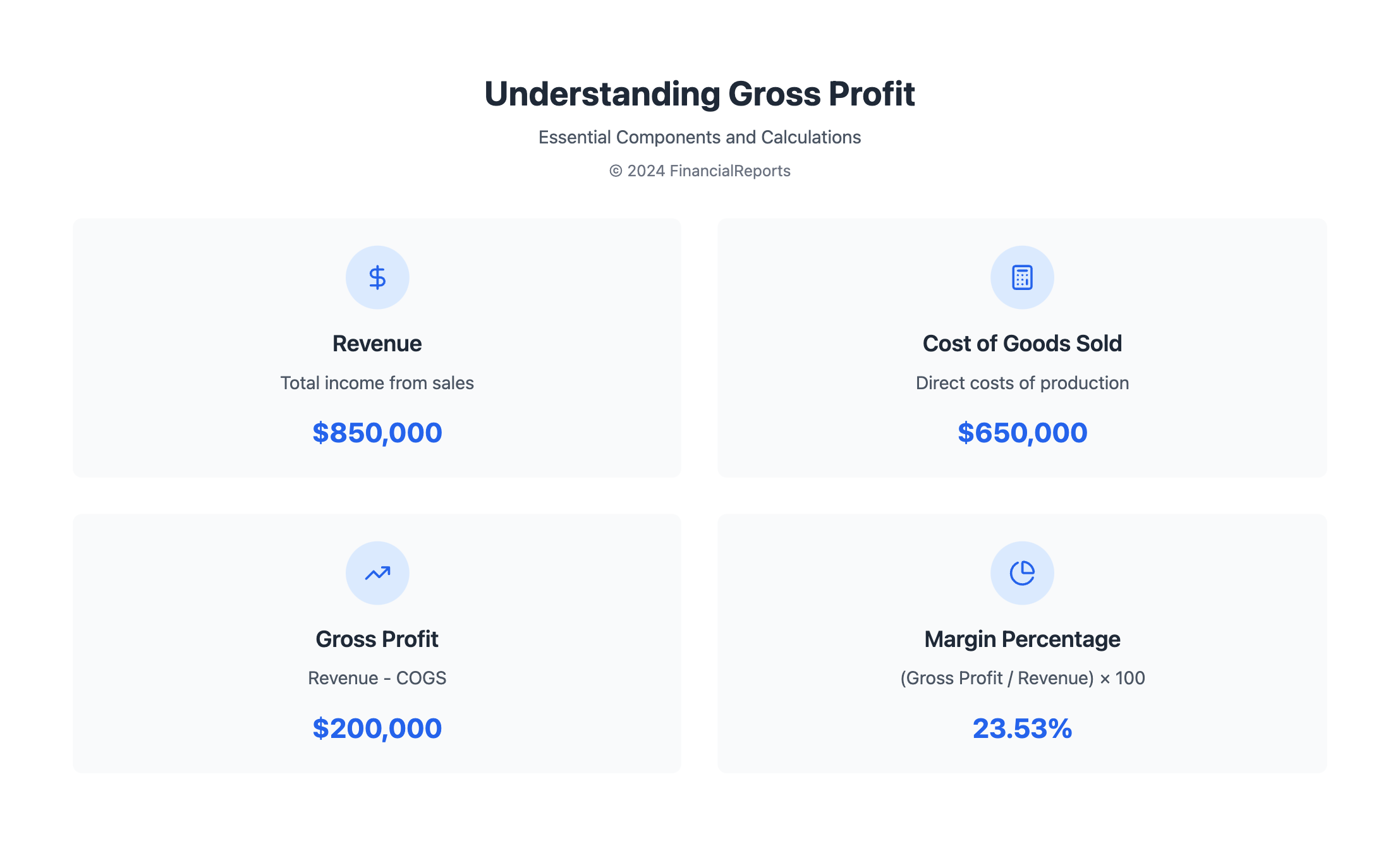

The gross profit formula is simple. It's the revenue minus the cost of goods sold. For instance, if a company makes $850,000 in revenue and spends $650,000 on goods, its gross profit is $200,000. This calculation helps evaluate a company's efficiency and profitability.

What is Gross Profit?

Gross profit is the sales revenue minus the cost of those sales. It's a dollar amount that shows how well a company manages its production costs. Unlike fixed costs, gross profit focuses on variable costs that change with production levels.

Why Gross Profit Matters for Businesses

Gross profit is vital for assessing business performance and setting prices. A positive gross profit means a company covers its basic production costs. The gross profit margin, as a percentage of revenue, is usually between 20% and 40% but varies by industry.

Understanding gross profit and how to calculate margin is critical. It helps companies evaluate product performance, make strategic decisions, and control costs.

| Gross Profit Formula | Example |

|---|---|

| Revenue - Cost of Goods Sold | $850,000 - $650,000 = $200,000 |

| Gross Profit Margin | (Gross Profit / Revenue) x 100 |

| Gross Profit Margin Example | ($200,000 / $850,000) x 100 = 23.53% |

How to Calculate Gross Profit

To find gross profit, you need to know the margin formula. This formula subtracts the cost of goods sold from net sales. A net margin calculator can help with this. It's important to use the right markup and margin for accurate results.

Gross profit is found by subtracting the cost to make a product from its selling price. For example, if a product sells for $300 and costs $120 to make, the profit is $180. This means the gross profit margin is 60%, found by dividing profit by sales.

The Gross Profit Formula

The gross profit formula is simple: Gross profit = Revenue - Cost of Goods Sold. To find the gross profit margin, use this formula: Gross Margin = 100 * (Revenue - Cost of Goods Sold) / Revenue. It's key to know the difference between markup and margin. Markup is based on costs, while margin is based on sales.

Step-by-Step Calculation Guide

Here's how to calculate gross profit step by step:

- Determine the revenue from sales.

- Calculate the cost of goods sold.

- Subtract the cost of goods sold from the revenue to find the gross profit.

- Divide the gross profit by the revenue and multiply by 100 to find the gross profit margin.

Using a net margin calculator can make this easier, even with big datasets. To boost gross profit and margin, increase sales prices, lower production costs, and sell more.

| Revenue | Cost of Goods Sold | Gross Profit | Gross Profit Margin |

|---|---|---|---|

| $300 | $120 | $180 | 60% |

By using the margin formula and understanding markup and margin, businesses can make better pricing decisions. This helps improve their financial health.

Factors Affecting Gross Profit Margins

When using a gp profit calculator, it's key to think about what affects the results. To calculate margin percentage, businesses need to know how pricing, cost of goods sold (COGS), and market conditions play a role. For example, a company can use a gp profit calculator to see how different prices change their gross profit margin.

To figure out margin, businesses should look at their COGS. It directly changes their gross profit. The formula for gross profit margin is (Total Revenue – Cost of Goods Sold) / Total Revenue. By knowing this and using a gp profit calculator, businesses can make smart choices about pricing and costs. Here are important things to keep in mind:

- Pricing strategies: Companies can change their prices to make more money and boost their gross profit margin.

- Cost of goods sold (COGS): Lowering COGS can greatly affect gross profit margins, as it directly changes the calculation.

- Market conditions: Businesses need to know about market trends and adjust their plans to stay competitive.

By thinking about these factors and using a gp profit calculator, businesses can better their pricing and cost management. This can lead to more revenue and profit, helping the business grow.

| Industry | Gross Profit Margin Range |

|---|---|

| Banks and law firms | 90% |

| Clothing retailers | 5-13% |

Benefits of Using a Gross Profit Calculator

Using a gross profit calculator can greatly help businesses. It gives them key info on how much they make from each product. This info is vital for controlling costs and understanding production ROI.

By looking at gross margins over time, businesses can spot supply chain issues. They can then tweak their processes to boost productivity and margins. Knowing what does margin for a cost mean is key. It helps businesses set the right prices and manage costs wisely.

A gross profit calculator also helps with dollar margin to distributor calculation. This lets businesses fine-tune their pricing to boost profits. By analyzing gross margins, they can find ways to cut costs and improve efficiency. Plus, understanding what see margin in math helps grasp the link between revenue, cost, and profit. This leads to more precise financial reports and analysis.

| Benefits of Gross Profit Calculator | Description |

|---|---|

| Time Savings | Automates calculations, reducing manual errors and saving time |

| Accuracy in Financial Reporting | Provides accurate and reliable financial data, enabling informed decision-making |

| Easier Business Comparisons | Facilitates comparisons with industry benchmarks and competitors, identifying areas for improvement |

In conclusion, a gross profit calculator is a game-changer for businesses. It offers precise data for better financial management and decision-making. With this tool, businesses can refine their pricing, enhance profitability, and make smart choices about costs and investments.

Choosing the Right Gross Profit Calculator

Businesses need a reliable tool to calculate gross profit accurately and quickly. With many options, picking the right one can be tough. It's key to know what to look for, like margin vs markup, and how they differ.

A good calculator should handle various inputs like revenue and expenses. It should also show gross profit margin, which shows a company's profit-making ability. Understanding margin vs markup is important for making smart business decisions.

Key Features to Consider

- Accuracy and reliability in calculating gross profit and gross profit margin

- Ability to handle different types of inputs, such as revenue, cost of goods sold, and operating expenses

- User-friendly interface and ease of use

- Customization options to suit specific business needs

Businesses should also think about the markup formula vs margin when picking a calculator. This helps them see how the calculator works with different pricing and costs. The right calculator can help businesses make better financial decisions and grow.

| Calculator Type | Features | Pricing |

|---|---|---|

| Basic Calculator | Gross profit calculation, margin vs markup definition | Free |

| Advanced Calculator | Gross profit calculation, markup formula vs margin, customization options | Paid |

Customizing Your Gross Profit Calculation

To customize your gross profit calculation, it's key to know the formula for margin and the difference between markup and margin. This knowledge helps in making smart pricing and cost management decisions. A margin vs markup calculator is a great tool for accurate calculations and comparisons.

When adjusting your gross profit calculation for your industry, think about the unique factors affecting your business. This might include extra variables like labor costs, materials, or overhead expenses. This way, you get a clearer picture of your financial health and can make decisions based on data to grow your business.

Some important things to consider when customizing your gross profit calculation include:

- Understanding the margin formula and how it applies to your business

- Knowing the difference between markup and margin and their impact on pricing

- Using a margin vs markup calculator to make your calculations easier and more accurate

By customizing your gross profit calculation, you can uncover important insights into your financial performance. This helps you make informed decisions to achieve success.

Common Mistakes in Gross Profit Calculations

Businesses often make mistakes when calculating gross profit. They might forget to include operating expenses, which can make their margins look wrong. They might also report revenue incorrectly, which messes up their financial view.

To fix these issues, using a good gross profit calculator is key. It helps keep financial reports accurate and consistent. Knowing the difference between profit margin and markup is also important. It affects how companies price their products and predict sales.

Overlooking Operating Expenses

Expenses like salaries, rent, and utilities can cut into a company's profit if not counted right. For instance, a SaaS company might forget about the costs of support and customer success when figuring out its profit margin.

Misreporting Revenue

Getting revenue wrong can mess up profit calculations too. This happens when revenue is counted too early or when some income sources are missed. A gross profit calculator can spot and fix these mistakes, making sure financial reports are correct.

By avoiding these mistakes and using the right tools, like an omni profit calculator, businesses can get their profit calculations right. This helps them make smart financial choices.

| Common Mistakes | Consequences | Solutions |

|---|---|---|

| Overlooking operating expenses | Inaccurate gross profit margins | Use a reliable gross profit cal |

| Misreporting revenue | Distorted financial picture | Implement accurate revenue recognition |

Analyzing Gross Profit Margins

When looking at gross profit margins, it's key to check industry standards and trends. A good margin is usually seen as 50% to 70%. But, this can change a lot based on the industry.

For instance, banks and law firms often have margins in the high 90% range. This is because they have low costs. On the other hand, clothing sales businesses might see margins between 5% to 13%.

To figure out gross profit margins, businesses can use a margin v markup calculator. They can also learn how to add margin to cost. Knowing how to mark up to margin helps in setting prices wisely. By watching how gross profit margins change, businesses can see if they're getting better financially and running more efficiently.

Some ways to boost gross profit margins include:

- Growing the customer base

- Adjusting pricing

- Reducing the cost of goods sold

- Focusing on more profitable product lines

By using a gross profit calculator and understanding how to add margin to cost, businesses can make smart choices to better their finances. Regularly checking and analyzing gross profit margins helps businesses spot where they can get better and stay ahead in their field.

| Industry | Gross Profit Margin Range |

|---|---|

| Banks and Law Firms | 90%+ |

| Clothing Sales | 5-13% |

| Fast Food Retailers | 30-40% |

Utilizing Gross Profit Data for Business Strategy

To make a good business plan, knowing how to figure out selling prices is key. This means using the markup to margin formula. A chart showing margin versus markup can also help, making it easier to see how costs and prices relate.

Looking at gross profit data helps businesses spot where they can get better. If a company's profit margin is lower than others in its field, it might need to rethink its prices or cut costs. But if its profit margin is higher, it could raise prices or offer more products.

Some important things for businesses to think about include:

- Understanding the markup to margin formula and how to apply it to their pricing decisions

- Using a margin versus markup chart to visualize their costs and markups

- Regularly reviewing and analyzing their gross profit data to identify trends and areas for improvement

- Considering industry benchmarks and averages when developing their pricing strategies

By following these steps and using gross profit data, companies can make better choices. This can help them grow and become more profitable.

| Industry | Average Gross Profit Margin |

|---|---|

| Clothing Sales | 5-13% |

| Banking and Law Firms | 90% |

Conclusion: Elevating Your Business with Accurate Calculations

As we wrap up our look at profit margin calculations, it's clear that knowing your margins is key. A gross profit calculator helps businesses see where they stand financially. This knowledge guides smart decisions and fuels growth.

The calculator profit percentage is a solid base for checking your company's health. It shows where you can get better and how you stack up against others. For anyone in finance or running a business, using these profit margin calc methods can take your success to the next level.

Remember, profit margins are just part of the picture. Keep an eye on your revenue, expenses, and cash flow too. This gives you a full view of your business's path. With a complete financial strategy, you're ready to tackle today's business world and reach your goals.

FAQ

What is a gross profit calculator?

A gross profit calculator is a tool for businesses. It helps calculate the difference between what you earn and what it costs to make or sell your products. This is key to understanding your business's health and success.

Why is gross profit an important metric for businesses?

Gross profit shows how well your main business activities are doing. It helps you check your pricing, manage costs, and see how efficient you are. This info is vital for making smart money choices and growing your business.

How do I calculate gross profit?

To find your gross profit, use this formula: Gross Profit = Revenue - Cost of Goods Sold (COGS). Just subtract the cost of making or buying your products from your total earnings.

What factors can influence a company's gross profit margins?

Several things can affect your gross profit margins. These include your pricing, the cost of goods sold, and market conditions. Good pricing, managing costs well, and keeping up with market trends are key to keeping or improving your margins.

What are the benefits of using a gross profit calculator?

Gross profit calculators save time and make financial reports more accurate. They also help compare businesses easily. These tools make financial analysis easier and provide insights to improve your business's financial health.

How do I choose the right gross profit calculator for my business?

Look for a calculator that fits your needs. Consider if it can be customized, works with your accounting systems, and lets you compare data. Try out different online tools and software to find the best one for your business.

How can I customize my gross profit calculations?

Add variables that matter to your business. This could be shipping costs, inventory changes, or other expenses that affect your profit. Customizing your calculations gives you more accurate and useful financial insights.

What are some common mistakes to avoid in gross profit calculations?

Don't forget to include all costs and report revenue correctly. Accurate tracking and proper revenue recognition are essential for reliable gross profit figures. This helps you make better business decisions.

How can I analyze gross profit margins effectively?

Compare your margins to industry standards and look for trends in your profit over time. Use charts and statistics to understand your data better. This helps guide your business strategy.

How can I use gross profit data to inform my business strategy?

Use gross profit data to shape your pricing and cost management strategies. Analyzing your margins helps you set prices and find ways to cut costs. This drives your profit and business growth.