EBITDA Margin Calculation: A Step-by-Step Guide

Knowing how to calculate the ebitda margin is key for financial experts and leaders. It shows how profitable a company is compared to others in different fields. The ebitda margin is the operating profit as a percentage of revenue. It's found by dividing EBITDA by revenue.

This metric is often used in business deals. A high ebitda margin means steady earnings. But a low margin might point to cash flow and profit problems.

The ebitda margin is a powerful tool for financial analysis. It helps companies see how well they're doing and where they can get better. We'll show you how to calculate the ebitda margin step by step. This will help you make smart financial choices.

Introduction to EBITDA Margin

The ebitda margin is a ratio that shows a company's profit compared to its revenue. It's found by dividing EBITDA by net revenue. A higher ebitda margin is seen as better because it means more profit from main activities.

On the other hand, a lower ebitda margin might show problems in the business model.

Key Takeaways

- EBITDA margin is a measure of a company's operating profit as a percentage of its revenue.

- The ebitda margin calculation is a valuable tool for financial analysis and comparison to industry benchmarks.

- A high ebitda margin indicates stable earnings, while a low margin suggests profitability and cash flow issues.

- EBITDA margin is calculated by dividing EBITDA by revenue, expressed as a percentage.

- A higher ebitda margin is usually perceived more favorably, as it indicates higher profits from core operations.

- EBITDA margin can help determine operational efficiency and sustainable profit production.

- EBITDA remains a widely accepted metric for comparison due to its resistance to discretionary accounting and management decisions.

Understanding EBITDA and Its Importance

EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, shows a company's operational efficiency. It's a non-GAAP financial figure. The ebitda margin meaning is found by dividing EBITDA by total revenues. This gives a clear view of a company's profitability and growth.

A company with a high ebitda to revenue ratio shows strong operational performance. This is key for investors to see.

The importance of EBITDA in financial analysis is huge. It excludes non-operating expenses and non-cash items. This makes it easier to compare companies with different structures and industries.

This is very useful when looking at companies like Home Depot and Lowe's. They have different ebitda margin calculations because of their unique operational efficiencies.

What is EBITDA?

EBITDA is a financial metric that shows a company's earnings before interest, taxes, depreciation, and amortization. It's found by adding back non-cash items like depreciation and amortization to a company's net income. This gives a clearer view of its operational performance.

Why EBITDA Matters in Financial Analysis

EBITDA is important in financial analysis because it lets investors and analysts compare companies. It excludes non-operating expenses and non-cash items. This gives a more accurate view of a company's operational efficiency and growth.

This is very useful for companies like Home Depot and Lowe's. They have different ebitda margin calculations because of their unique operational efficiencies.

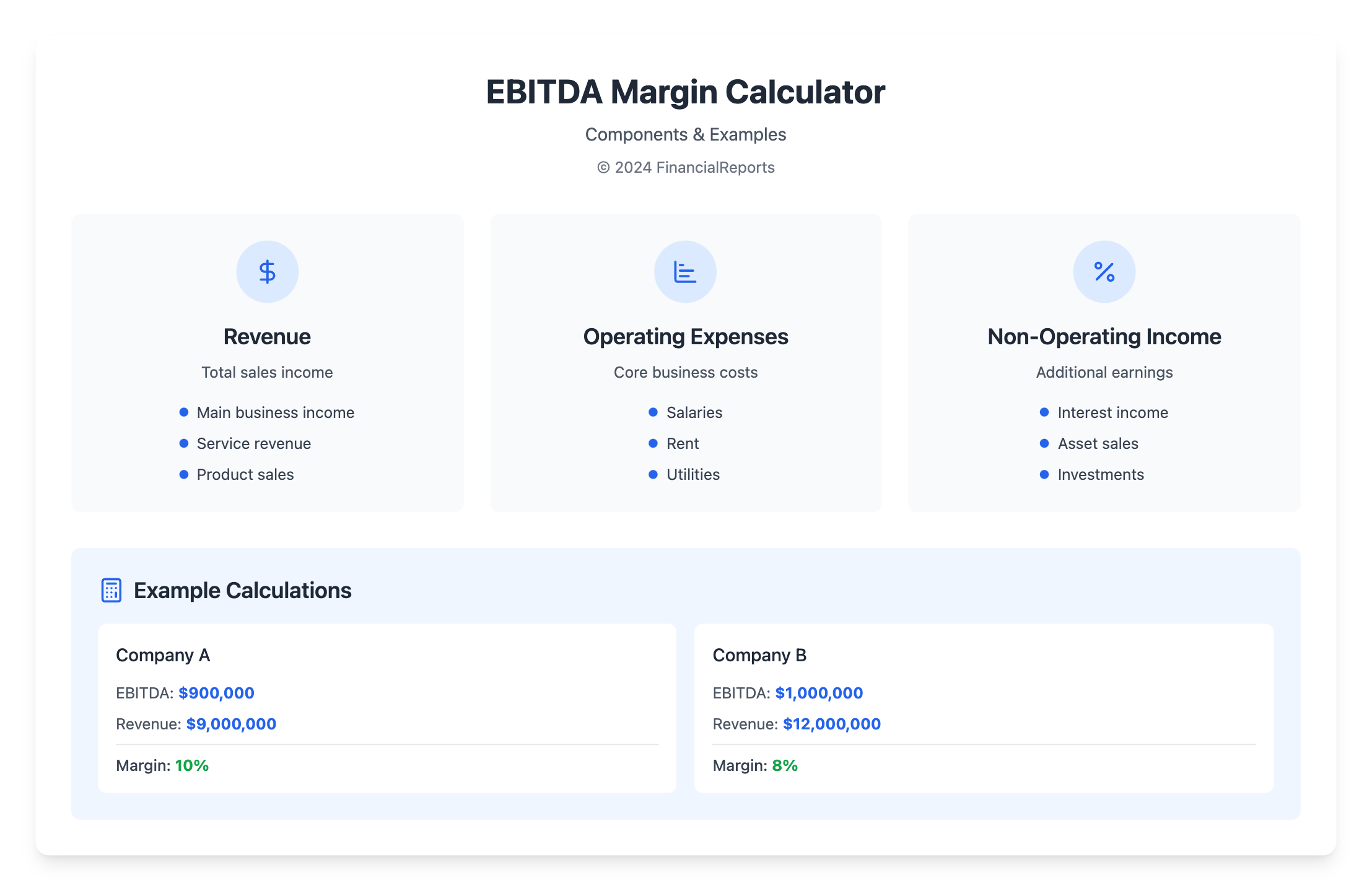

Calculating EBITDA: Key Components

To accurately calculate ebitda margin, you need to know the key parts. EBITDA shows how well a company runs without extra costs. It's found by adding Operating Income (EBIT), Depreciation, and Amortization. Looking at ebitda to revenue helps see how these parts affect a company's health.

EBITDA includes revenue, operating costs, and extra income. By looking at these, experts understand a company's profit. For example, a company with lots of revenue and low costs might do better financially.

Revenue

Revenue is key in EBITDA, showing what a company makes from its main work. To find revenue, look at the income statement. By checking revenue trends, investors see if a company is growing well.

Operating Expenses

Operating costs, like salaries and rent, are important for EBITDA. They affect how profitable a company is. By checking these costs, experts can find ways to save money and boost profit.

Non-Operating Income

Non-operating income, like interest and asset sales, also matters for EBITDA. These aren't from the main business but can change how well a company does. By looking at this income, experts get a full picture of a company's success.

The Formula for EBITDA Margin

The ebitda margin calculation is key for financial experts, investors, and clients. It shows a company's profit by dividing EBITDA by total revenue. For example, a company with $900,000 EBITDA and $9,000,000 revenue has a 10% ebitda margin.

The ebitda to revenue ratio helps understand a company's financial health. A high ebitda margin means lower costs and better cost management. This is why investors and analysts find it so important.

EBITDA Margin Defined

The ebitda margin is a percentage showing a company's profit from its revenue. It's widely used in finance, like in real estate and manufacturing. It's calculated by dividing EBITDA by net revenue, showing how well a company operates.

How to Calculate EBITDA Margin

To find the ebitda margin, just divide EBITDA by total revenue. For instance, Company A with $900,000 EBITDA and $9,000,000 revenue has a 10% margin. This helps compare companies in the same field, showing who's more profitable and efficient.

Step-by-Step EBITDA Margin Calculation Process

To find the ebitda margin, first, get the financial statements you need. This includes the income statement. The process is simple: divide ebitda by total revenue. This shows how much of each dollar is left after the core operations.

The formula for ebitda margin is: EBITDA Margin = EBITDA / Revenue. For instance, if a company has an EBITDA of $900,000 and total revenue of $9,000,000, its ebitda margin is 10%. This metric is key for understanding how much revenue stays after core operations.

Gathering Financial Statements

Getting the right financial statements is key for the ebitda margin calculation. You'll need the income statement for this.

Performing the Calculation

With the financial statements in hand, you can do the ebitda margin calculation. First, add back depreciation and amortization to ebit. Then, divide this by total revenue.

| Company | EBITDA | Total Revenue | EBITDA Margin |

|---|---|---|---|

| Company A | $900,000 | $9,000,000 | 10% |

| Company B | $1,000,000 | $12,000,000 | 8% |

The ebitda margin calculation gives a clear view of a company's efficiency and profit. It's a vital tool for financial experts and investors.

The Relationship Between EBITDA and Profit Margins

Understanding EBITDA and profit margins is key for financial analysis. EBITDA margin shows how profitable a company is, by dividing EBITDA by revenue. It shows how well a company does without counting interest, taxes, and depreciation.

The ebitda to revenue ratio shows a company's financial health. It's compared to other profit measures like gross margin and net profit margin. EBITDA includes all costs from making and running the business, unlike traditional profit margins.

The following table shows how to calculate different profit metrics:

| Metric | Calculation |

|---|---|

| Gross Margin (%) | Gross Profit ÷ Revenue |

| Operating Margin (%) | EBIT ÷ Revenue |

| EBITDA Margin (%) | EBITDA ÷ Revenue |

| Net Profit Margin (%) | Net Income ÷ Revenue |

By looking at these metrics, experts and investors can understand a company's profit better. The ebitda margin and ebitda to revenue ratio are key. They give a full picture of a company's financial health.

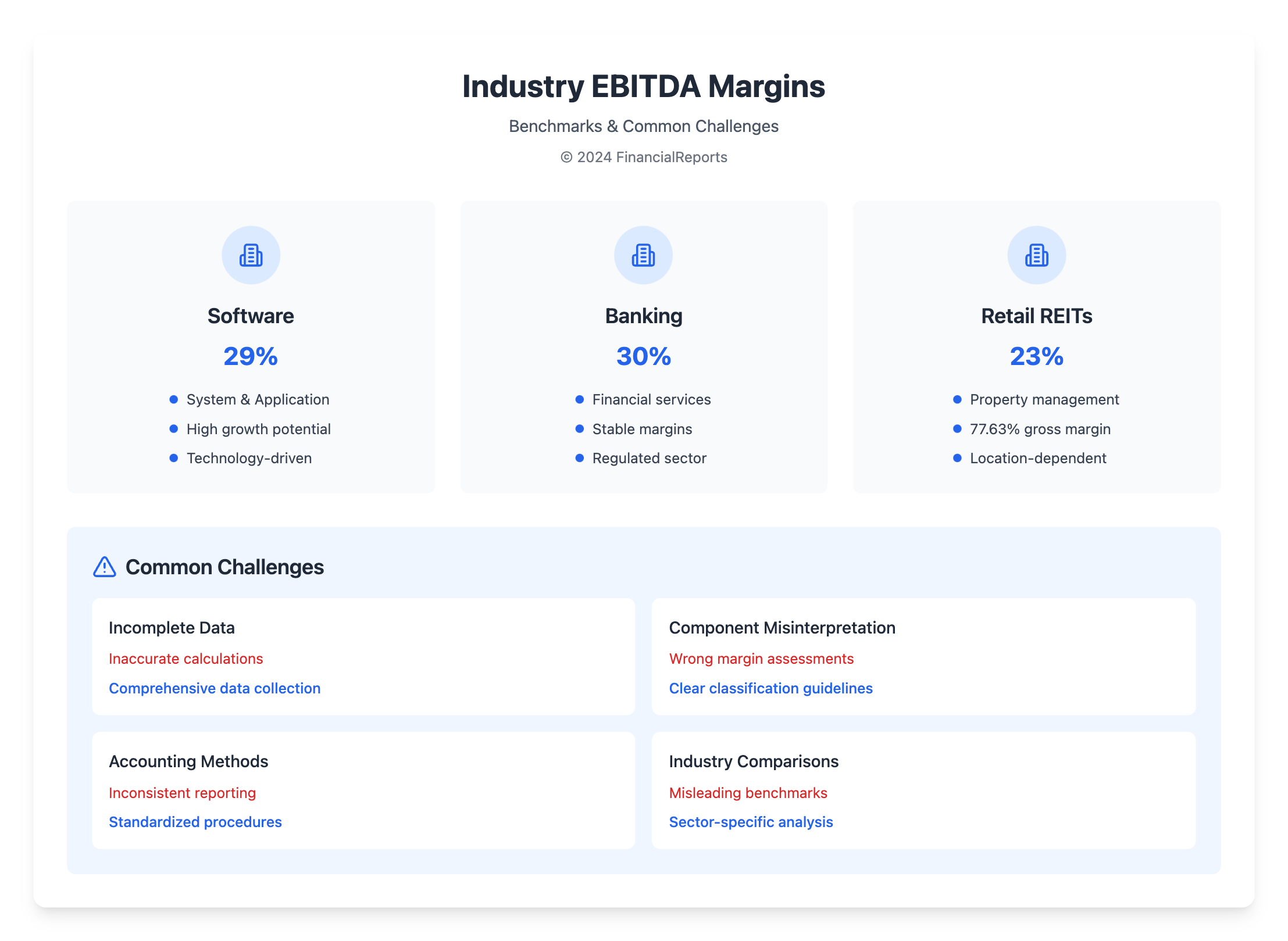

Common Challenges in EBITDA Margin Calculation

Calculating the ebitda margin can be tricky. Financial pros often face issues like missing or mixed-up financial data. This can make the numbers off. Also, getting the ebitda parts right, like depreciation and amortization, is key but can be tricky.

Another hurdle is how different accounting ways can change the numbers. Ebitda isn't set by GAAP, so companies can pick how to figure it out. This can cause differences in how ebitda is reported. To get around these problems, using the same methods and checking the data carefully is important.

Incomplete Financial Data

When financial data is missing, it's hard to get the ebitda margin right. For example, if a company's financial reports are old or missing key details, figuring out the ebitda margin is tough.

Misinterpretation of EBITDA Components

Getting the parts of ebitda wrong, like interest, taxes, depreciation, and amortization, can mess up the calculation. For instance, if a company gets depreciation wrong, the ebitda margin will be off.

| Company | Annual Revenue | EBITDA Margin |

|---|---|---|

| Small Business | $1,000,000 | 12% |

| Larger Company | $15,000,000 | 5% |

| Amazon | $514.0 billion | 10.5% |

By knowing these challenges and using the right methods, financial experts can get the ebitda margin right. This helps make smart choices about a company's money health.

Industry Benchmarks for EBITDA Margins

When looking at a company's ebitda margin meaning, it's key to check industry standards. What's a good EBITDA margin varies by industry. For example, over 300 U.S. software companies started 2023 with an average EBITDA margin of 29%. Publicly traded Nasdaq companies have kept their EBITDA margin around 30% in recent years.

To understand industry standards better, visit industry reports. They offer detailed info on EBITDA margins in different sectors.

Here are some industry benchmarks for EBITDA margins:

- Software (System & Application) industry: 29% average EBITDA margin

- Banking industry: 30% average EBITDA margin

- Retail (REITs) industry: 23% average net profit margin, with a gross profit margin of 77.63%

These benchmarks help companies check their EBITDA margins against others. By comparing, they can spot areas for growth. This way, they can see if their profitability matches that of their peers.

| Industry | Average EBITDA Margin |

|---|---|

| Software (System & Application) | 29% |

| Banking | 30% |

| Retail (REITs) | 23% (net profit margin) |

Tools and Software for EBITDA Calculations

Getting the ebitda margin calculation right is key for businesses. The right tools and software can make this easier. Financial modeling and accounting software help a lot by making ebitda margin calculation smoother and cutting down on mistakes.

Financial modeling software has cool features for complex financial tasks, like ebitda margin calculation. It lets users build detailed financial models, predict future earnings, and check different scenarios. This makes it a must-have for businesses looking to improve their financial planning and decision-making.

Accounting software is also very important for ebitda margin calculation. It gives a full platform for managing financial data, tracking expenses, and making financial statements. These tools often have automatic features for calculating important financial metrics, like ebitda margin. This ensures that financial analysis is both accurate and quick.

- Financial modeling software, like Excel or specialized tools, is great for complex ebitda margin calculations.

- Accounting software, such as QuickBooks or SAP, has tools for making financial statements and ebitda margin calculation.

In short, using financial modeling and accounting software is vital for good ebitda margin calculation. By using these tools, businesses can improve their financial analysis, make better decisions, and grow their profits.

Best Practices for Calculating and Analyzing EBITDA Margin

Calculating EBITDA margin needs careful steps to ensure it's right and useful. It's key to update and check these numbers often. The ebitda margin calculation is done by dividing EBITDA by total revenue. This gives a percentage showing how well a company runs.

To really get into EBITDA margin, think about these points:

- Watch ebitda to revenue ratios to see if a company is making money.

- Look at EBITDA margins of different companies and industries. This helps spot trends and ways to get better.

- Use EBITDA margin with other financial numbers like free cash flow and operating cash flow. This gives a full picture of a company's money situation.

By sticking to these best practices and looking at ebitda margin calculation and ebitda to revenue, experts can make smart choices. This helps grow the business.

| Company | Revenue | EBITDA | EBITDA Margin |

|---|---|---|---|

| Example Inc. | $500,000 | $50,000 | 10% |

Conclusion: Mastering EBITDA Margin Calculation

In our guide, we've looked into EBITDA margin calculation and its role in finance. Remember, EBITDA margin is important but not everything. A full view of a company's finances gives the best picture of its health.

Learning how to calculate EBITDA margin opens doors to understanding a business's success. But, it's key to see this metric with other financial data. This way, you can make choices that help a company grow and add value.

The world of business is always changing, and so is the use of EBITDA margin in finance. Keeping up with new trends and using the latest tools is vital. With what you've learned, you're ready to handle EBITDA margin and improve your financial plans.

FAQ

What is EBITDA?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It shows a company's real profit by ignoring financing and accounting choices. This gives a clearer view of a company's true profitability.

Why is EBITDA margin important in financial analysis?

EBITDA margin is key for comparing profits across companies and industries. It helps ignore differences in capital structure and accounting. This makes it easier to see how well a company operates.

What are the key components needed to calculate EBITDA?

To find EBITDA, you need revenue, operating expenses, and non-operating income. These figures come from a company's financial statements. They help you calculate EBITDA for deeper analysis.

How is the EBITDA margin formula calculated?

To find EBITDA margin, divide EBITDA by total revenue. Then, show the result as a percentage. This shows how profitable a company is compared to its revenue.

What are the steps involved in calculating EBITDA margin?

First, get the financial statements. Then, find the right figures for revenue, operating expenses, and non-operating income. Use the EBITDA margin formula to get the final percentage. This ensures accurate and consistent results.

How does EBITDA margin differ from other profit margins?

EBITDA margin looks at profit differently. It ignores financing, taxes, and non-cash expenses. This makes it better for comparing companies with different structures and practices.

What are some common challenges in calculating EBITDA margin?

Challenges include bad data, misreading EBITDA parts, and different accounting methods. Use standard methods and check data carefully to get accurate results.

How can industry benchmarks help in interpreting EBITDA margins?

Benchmarks give context for EBITDA margins. They help see how a company compares to others in its field. This helps make better decisions.

What software solutions are available for calculating EBITDA margin?

Many financial and accounting software packages help with EBITDA margin. They make the process more accurate and faster. This lets financial experts focus on analysis.

What are best practices for maintaining and analyzing EBITDA margin over time?

Keep EBITDA margin up to date and consistent. Share the results clearly with others. Use EBITDA margin in financial reports and decisions to get the most value.