Earning in the Market: Mastering Stock Trading for Novice Investors

Getting into the stock market might look tough, but learning its basics is key for wealth growth. This guide will help you go from a beginner to a pro. You'll learn about the market's basics, tools for analysis, and strategies for smart investing.

To start, you need to know the basics of stock trading. Day trading is a big part of it. It's about buying and selling within a day to make money from small price changes. Good day traders look at liquidity, volatility, and volume when picking stocks. They also risk only a small part of their money, which is important for beginners.

Key Takeaways

- Mastering stock trading requires a deep understanding of the stock market and how it works.

- For beginners, learning day trading and its strategies is key to making money in the stock market.

- Choosing stocks to buy involves looking at liquidity, volatility, and volume.

- Knowing how to manage risk is essential for trading success. It takes discipline and patience to make money investing.

- A detailed guide can help new investors get started in stock trading and begin earning in the market.

- Technical and fundamental analysis are important for finding the right times to buy and sell stocks.

- Online resources like courses and books offer valuable insights for novice investors wanting to learn about making money in stocks and investing.

Understanding the Basics of Stock Market

To make money in the equity market, you need to know the basics. The stock market is where people buy and sell shares of companies. This gives companies money in exchange for a part of their ownership. Investors can make money through dividends and when the stock value goes up.

For those new to the share market, learning key terms is a good start. You should know about dividends, earnings per share, and market size. For example, the S&P 500 index includes about 500 big U.S. companies. Its performance can affect the whole market. It's also important to spread out your investments to lower risks.

Key Concepts for Beginners

- Dividends: portions of a company's profit paid to shareholders

- Earnings per share: a company's profit divided by its total number of shares

- Market capitalization: the total value of a company's outstanding shares

- Price-to-earnings ratio: a company's stock price divided by its earnings per share

Understanding these basics and learning how to move in the stock market can help. It can lead to better decisions and more success in the equity market.

| Index | Composition | Trading Hours |

|---|---|---|

| S&P 500 | 500 large publicly traded companies | 9:30 a.m. to 4 p.m. Eastern time |

| Dow Jones Industrial Average | 30 large companies | 9:30 a.m. to 4 p.m. Eastern time |

Types of Stocks and Their Characteristics

Investing in the stock market means knowing the different types of stocks. For beginners, understanding common, preferred, growth, and value stocks is key. These stocks are great for building a strong portfolio.

Common stocks give you voting rights and can offer dividends, but they're riskier. Preferred stocks offer fixed dividends and are paid first, but you can't vote. Growth stocks grow faster than the market and rarely pay dividends, making them attractive for some.

Here are some key characteristics of different types of stocks:

- Common stocks: voting rights, possible dividends, higher risk

- Preferred stocks: fixed dividends, paid first, no voting rights

- Growth stocks: high earnings growth, rare dividends

- Value stocks: low price, could grow a lot

Knowing these stock types helps investors make better choices. Whether you're experienced or new, staying informed is key. The market always changes, so it's important to adapt.

| Stock Type | Characteristics | Risk Level |

|---|---|---|

| Common Stocks | Voting rights, possible dividends | Higher |

| Preferred Stocks | Fixed dividends, paid first | Lower |

| Growth Stocks | High earnings growth, rare dividends | Higher |

| Value Stocks | Low price, could grow a lot | Lower |

Getting Started: Opening a Brokerage Account

To start investing in the stock market, you need to open a brokerage account. This is a key step in stock exchange learning. It gives you access to many investment chances. When picking a brokerage, think about fees, commissions, and account minimums.

Some top brokerages have $0 commissions, 1%-2% crypto markups, and low account minimums. This makes it simpler for beginners to begin.

For those asking how can i make money investing in stocks, the answer is to pick the right brokerage account. Invest in good stocks for beginners. With the right platform and knowledge of the stock market, you can make smart choices. This could lead to big returns.

Here are some things to think about when choosing a brokerage account:

- Fees and commissions: Look for brokerages with low or no fees, such as $0 per trade.

- Account minimums: Consider brokerages with low or no account minimums, such as $0 or $1.

- Investment selection: Choose a brokerage with a wide range of investment options, including stocks, ETFs, and cryptocurrencies.

By researching and picking the right brokerage account, you can succeed in the stock market. Start stock exchange learning today.

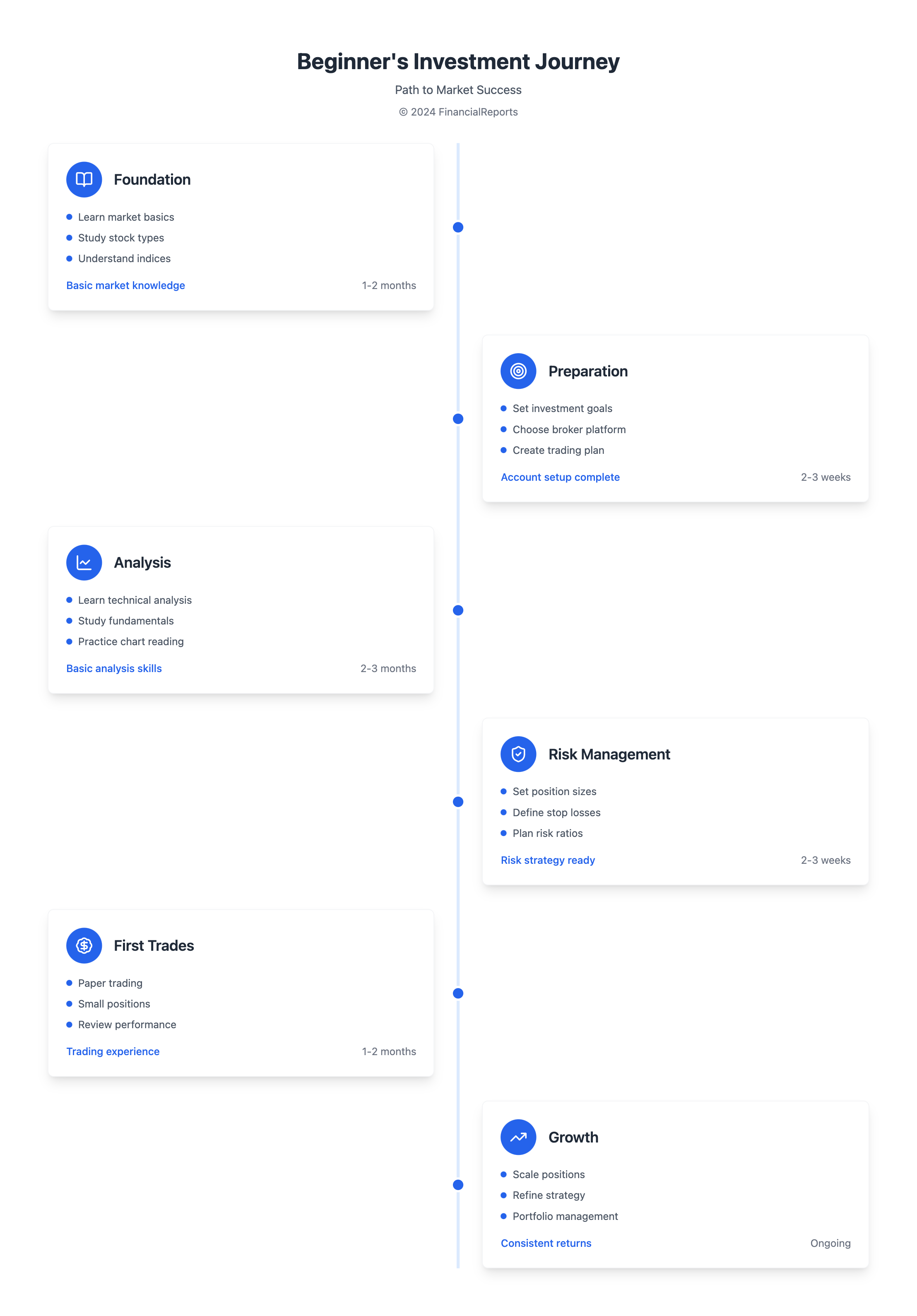

Investment Strategies for Beginners

Investing in the stock market requires a solid strategy for success. It might seem hard to make money by investing, but it's achievable. Beginners should focus on a good starting point, like knowing which stocks are best for them.

The 2024 Financial Regret Survey by Bankrate shows 77% of U.S. adults have financial regrets. 22% regret not saving for retirement early. This emphasizes the need to invest early and think long-term. The stock market can offer about a 10% annual return, like the S&P 500.

Long-Term vs. Short-Term Investing

Long-term investing means keeping investments for three to five years. This allows them to grow and reduce market timing risks. Short-term investing, with frequent buying and selling, is riskier and more volatile.

The Importance of Diversification

Diversification is vital for reducing risk and increasing returns. By investing in various assets, like stocks, bonds, and securities, you spread out your risk. Index funds, such as the S&P 500, offer instant diversification and match the index's performance.

Beginners can try strategies like dollar-cost averaging, income investing, or the buy-and-hold method. It's important to consider your risk tolerance and goals before picking a strategy. With the right strategy and knowledge, anyone can profit from the stock market and reach their financial goals.

Analyzing Stocks: Fundamental vs. Technical Analysis

Understanding stock analysis is key to making money in the stock market. Stock market advice often stresses the need to analyze stocks before investing. To succeed, investors must learn how to analyze stocks well.

Understanding Fundamental Analysis

Fundamental analysis looks at a company's financial health through its financial statements. This method is best for long-term investing. By examining these statements, investors can spot undervalued assets and make smart choices.

Basics of Technical Analysis

Technical analysis, in contrast, examines price and volume trends over time. It's used by traders to spot patterns and trends. With tools like moving averages and the stochastic oscillator, traders can predict price movements and profit.

Important factors to consider when analyzing stocks include:

- Revenue growth over three years

- Current year earnings growth

- EPS growth

- Dividend yield

- P/E ratio

By looking at these factors and combining fundamental and technical analysis, investors can make better decisions. This increases their chances of making money in the stock market.

How to Research and Select Stocks

To do well in the stock market, you need to know how to make money fast. This means doing your homework on stocks you might buy. Keeping up with financial news is key because it can change stock prices and market trends.

Day traders must watch market news closely. This includes news from the Federal Reserve and other economic updates. This helps them understand the market better and make smart choices.

Utilizing Online Tools and Resources

There are many online tools to help you pick stocks. You can find financial news sites, stock screeners, and online brokerages. Some top choices include:

- Financial news websites, such as Bloomberg and CNBC

- Stock screeners, such as Yahoo Finance and Google Finance

- Online brokerage platforms, such as Fidelity and Charles Schwab

These tools offer insights and data on stocks. They show historical performance, current trends, and future outlook. Using these tools can help you make better choices and boost your chances of success.

Reading Financial News and Reports

Reading financial news and reports is also vital. It keeps you updated on market trends, economic conditions, and company performance. Key sources include:

- Company earnings reports

- Industry trends and analysis

- Economic indicators, such as GDP and inflation rates

By keeping up with financial news, you can understand the stock market better. This is true whether you want to make money fast, quickly, or in general. Doing thorough research is key to success.

| Resource | Description |

|---|---|

| Financial news websites | Provide up-to-date news and analysis on the stock market and individual stocks |

| Stock screeners | Allow investors to filter and sort stocks based on various criteria, such as price and performance |

| Online brokerage platforms | Provide investors with the tools and resources needed to buy and sell stocks, including research and analysis |

Setting Goals and Creating a Trading Plan

Setting clear goals is key to making money in the stock market. You need to know what you want to achieve and how much risk you can take. A good trading plan outlines when to buy and sell, how to manage risks, and the best strategies for success.

To succeed in trading stocks, you must keep up with market news and trends. Understanding this data helps you make smart choices. Knowing how to manage risks is also vital. For more on setting goals, check out this resource.

Key parts of a trading plan include:

- Defining your investment objectives and risk tolerance

- Developing a risk management strategy

- Creating a plan for entering and exiting trades

- Staying up-to-date with market trends and news

By following these steps and staying focused, you can craft a winning trading plan. This plan will help you make money in the stock market.

Creating a trading plan is an ongoing task. It's important to regularly update your plan to match your goals and risk level. With a solid plan and the right mindset, you can boost your chances of success in the stock market.

| Trading Plan Component | Importance |

|---|---|

| Defining investment objectives | High |

| Developing a risk management strategy | High |

| Creating a plan for entering and exiting trades | Medium |

| Staying up-to-date with market trends and news | Medium |

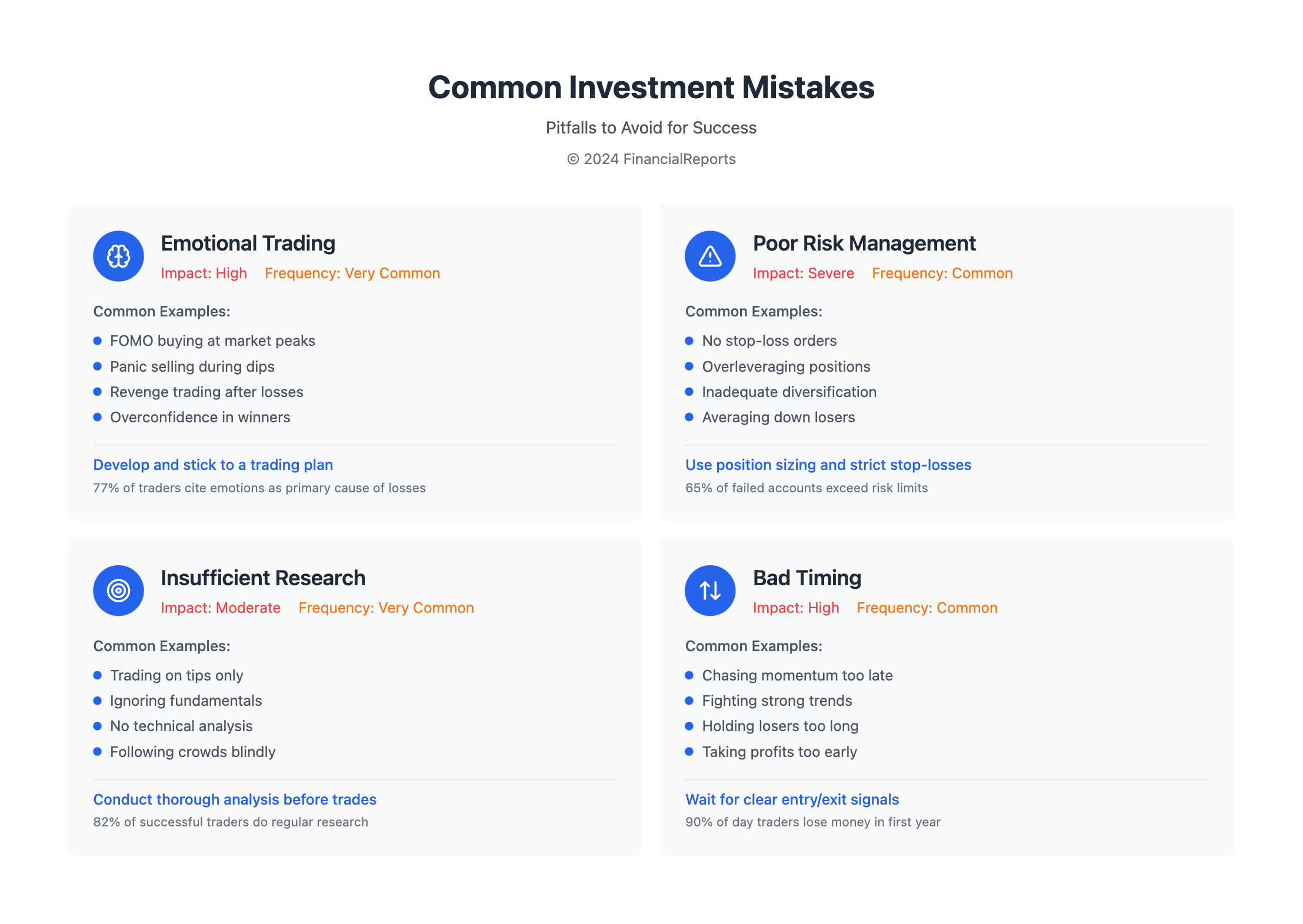

The Role of Emotions in Trading

Emotions are key in trading, and knowing how to handle them is vital for success. Many experts say emotions, like fear and greed, can block smart decisions. These feelings can lead to quick, risky moves that cost money.

To make money in stocks, having a solid plan is essential. Learning to control emotions helps traders focus on long-term goals. For newbies, starting with a strong knowledge base and avoiding common mistakes is key.

- Overconfidence bias, which leads investors to overestimate their investing abilities

- Loss aversion bias, which results in investors stressing more about avoiding losses than making gains

- Herd behavior, which makes investors follow the crowd

Knowing these emotional traps helps traders manage their feelings. Techniques like mindfulness and journaling can help stay aware. Also, getting support from peers and taking breaks can keep traders sharp and avoid burnout. By sticking to a disciplined plan, traders can boost their success and reach their financial targets.

| Emotion | Description |

|---|---|

| Fear | Prompting traders to close positions too soon or avoid risks |

| Greed | Causing traders to take big risks or hold onto winning trades too long |

| Regret | Leading traders to jump into trades after missing out due to fast price changes |

Keeping Up with Market Trends and News

To do well in the stock market, you need to know what's happening. This means watching market trends and reading economic reports. You can find the latest news on investing websites.

For making money in stocks, think long-term. Invest in a mix of stocks, including those that pay dividends. Hold onto them for at least five years. This way, you can get better returns than from bonds or savings accounts.

Here are some smart ways to make money in the equity market:

- Dollar-cost averaging: invest a set amount regularly, no matter the market.

- Dividend investing: earn money from stocks that pay dividends.

- Index fund investing: buy a mix of stocks through index funds.

By keeping up with news and using these strategies, you can boost your chances of success. Investing is a long-term game. Be patient and stay disciplined to reach your financial goals.

| Investment Strategy | Description |

|---|---|

| Dollar-Cost Averaging | Invest a fixed amount regularly |

| Dividend Investing | Earn from dividend-paying stocks |

| Index Fund Investing | Invest in a mix of stocks through index funds |

Learning from Mistakes: Common Pitfalls

For beginners, the stock market can be tricky. One big mistake is overtrading, which can cause big losses. It's key to understand the risks when starting out.

To steer clear of these traps, do your homework and keep up with market trends. Don't skip research and rely only on tips. A well-informed investor makes better choices.

Here are some tips for beginners:

- Start with a solid understanding of the market and its risks

- Conduct thorough research before making investment decisions

- Stay informed about market trends and news

- Avoid overtrading and emotional decision-making

By avoiding common mistakes, beginners can do well in the stock market. With the right strategy and mindset, making money and reaching financial goals is possible.

Continuous Education and Improvement

Investing in the stock market is a journey of learning and growth. As a beginner, it's key to keep learning about market trends and investment strategies. This way, you can make better decisions that help you reach your financial goals.

There are many resources to help you learn more. Online courses like "Stocks, Bonds, and Investing; Oh My!" and "The Analysis and Valuation of Stocks" offer in-depth training. Also, joining investment clubs and forums can connect you with experienced traders and investors who share their knowledge.

Learning more about investing will help you navigate the market better. Embrace the idea of always improving, and you'll be on your way to becoming a successful investor.

FAQ

What is the stock market and how does it work?

The stock market is where companies' shares are bought and sold. It uses stock exchanges. Stock prices change based on demand, company performance, and the economy.

What are the key terminologies every beginner should know?

Beginners should know about dividends, earnings per share, and market capitalization. Also, the price-to-earnings ratio is important. These terms help navigate the stock market.

What are the different types of stocks and their characteristics?

There are common, preferred, growth, and value stocks. Each type has its own traits and risks. Understanding these helps beginners.

How do I open a brokerage account and what should I consider?

Choose a good broker and know the account types. Be aware of fees and commissions. This makes trading smooth and affordable.

What are the different investment strategies for beginners?

Beginners should invest for the long term and diversify. Long-term investing uses compounding. Diversification helps manage risk.

How do I analyze stocks using fundamental and technical analysis?

Fundamental analysis looks at a company's financials. Technical analysis studies price and volume patterns. Both are useful for beginners.

How can I effectively research and select stocks?

Use online tools and financial news to find stocks. Stay updated with market trends and news.

Why is setting goals and creating a trading plan important?

Clear goals and a trading plan help beginners stay focused. They improve discipline and chances of success.

How can I manage my emotions and avoid common emotional traps?

Emotional control is key in trading. Be aware of fear and greed. Develop strategies to stay disciplined and rational.

Why is it important to keep up with market trends and news?

Staying informed helps beginners make better decisions. It's important for adapting to market changes.

What are some common pitfalls that beginners should avoid?

Avoid overtrading and ignoring research. These can lead to big losses and poor decisions.

How can I continue to educate myself and improve my skills?

Keep learning through resources, clubs, and forums. This helps stay updated and improve trading skills.