Dividend Is What Type of Account - Account Types Guide

In the world of investment, a financial dividend is key for those wanting steady income from their investments. A dividend example shows how corporations share profits with shareholders, moving money from retained earnings. Understanding the dividend definition economics is crucial. This knowledge helps grasp a significant part of shareholder equity important in investment plans. Our guide dives into how dividends work in different accounts. It offers advice for financial experts, investors, and big clients aiming to improve their dividend approaches.

Key Takeaways

- Dividends provide a reliable income stream and are indicative of a company's financial health.

- Not all companies issue dividends regularly; payout intervals can vary significantly.

- Investors should understand the implications of the ex-dividend date in their investment decisions.

- The dividend yield, representing the annual dividend in relation to the stock price, is a valuable metric for investors.

- Industries known for consistent dividends include utilities, consumer goods, and financial institutions.

- Mature companies often maintain a regular record of dividend payouts, while growth-focused companies may reinvest earnings.

- Dividends can be received in various forms, affecting shareholders' taxation and investment strategy.

Understanding Dividends and Their Purpose

Dividends are key for many investors, offering both income and insight into a company's success. They show a company's steady profit-making ability. This steady profit can then be shared with those who own stocks.

What Are Dividends?

Dividends are a share of company profits given to stockholders. They show the company's thanks for the trust investors have placed in them. These profits can be handed out as cash or more shares. Dividends change asset value for shareholders but are not assets themselves. The company’s board decides on the share and frequency, based on how well the company is doing and its cash flow.

How Do Dividends Work?

The method of paying dividends is detailed and clear in financial reports. It's important to know that dividends are listed under retained earnings in the equity section of shareholders. They're not seen as expenses but as profit sharing.

There's a specific timeline companies follow for dividends, including when they announce, set records for, and actually pay them. The dividend yield is key for investors, showing the dividend amount compared to the stock price.

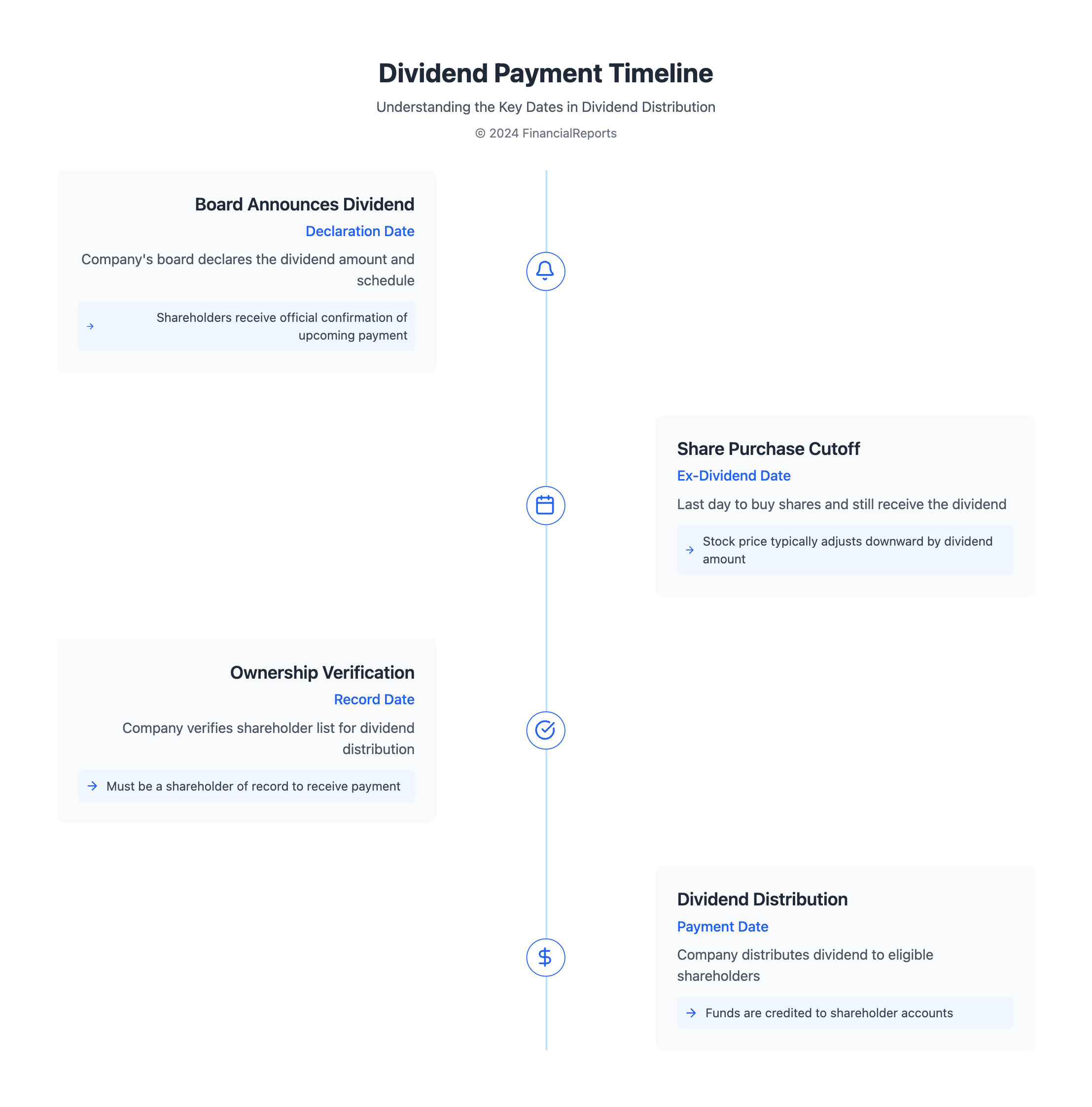

| Date Type | Description | Impact on Investors |

|---|---|---|

| Declaration Date | The date on which the next dividend payment is announced by the company’s board. | Investors get official confirmation of the forthcoming dividend and its size. |

| Ex-Dividend Date | The cutoff date to buy shares and still receive the declared dividend. | Shares bought after this date won't get the declared dividend. |

| Record Date | Date when the company checks its records to see who gets a dividend. | To get a dividend, you must own the stock by this date. |

| Payment Date | Date when the dividend is paid out to stockholders. | On this day, shareholders get their dividend money. |

Knowing the schedule for dividends and how they are paid is vital. This know-how helps investors make the most from stocks that pay dividends.

Types of Dividend Accounts

Investors looking into dividends payable should think about their account type. This choice affects how dividends are managed and their financial results. Dividends are not just a cost but a way to share profits. They open doors to many strategic options based on the account picked.

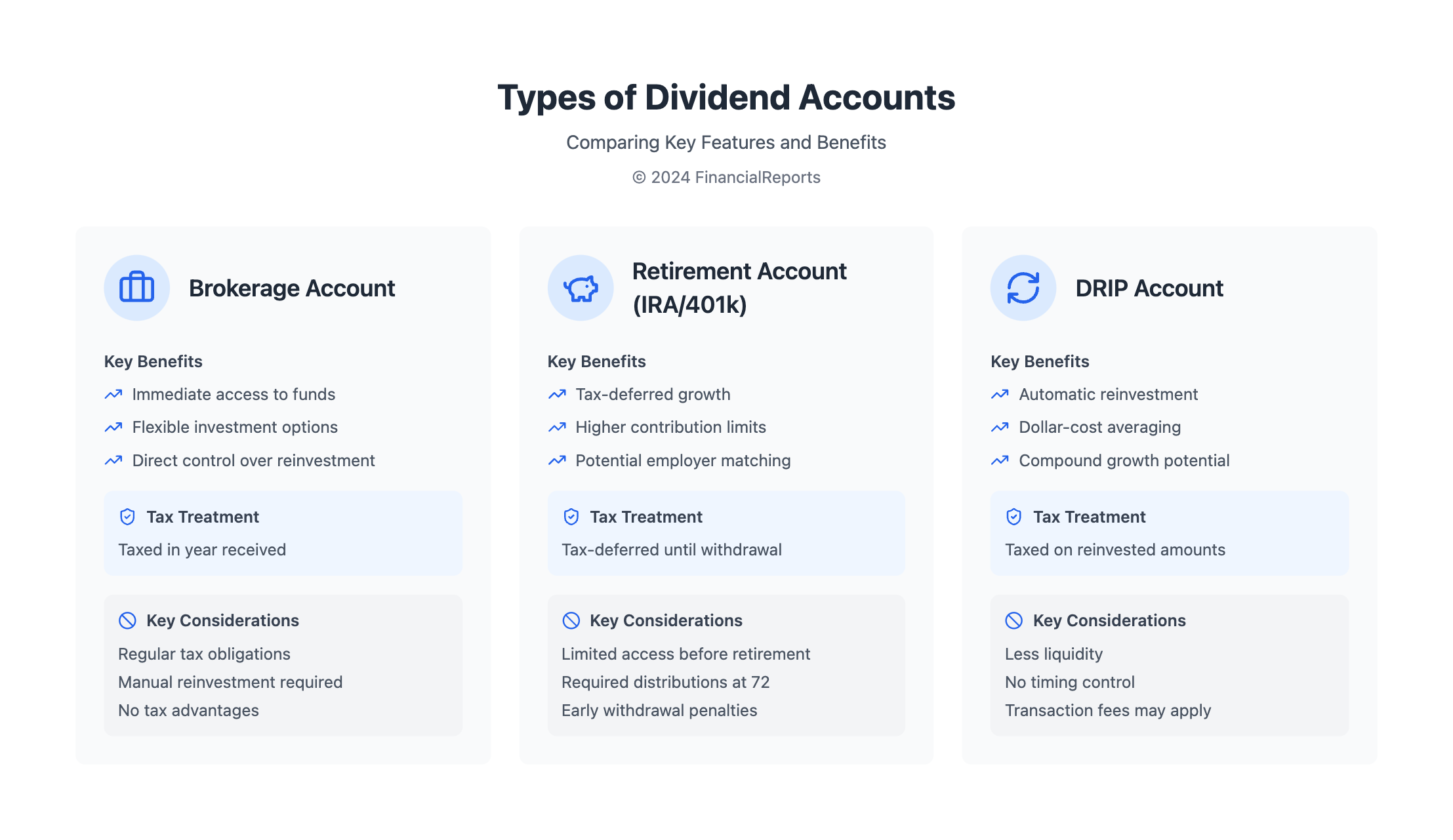

Brokerage Accounts

Brokerage accounts offer flexibility to investors who want to get and handle dividends. When a dividend is announced, it's seen as a cost. The money sits in the dividends payable account until it's given out. Then, it changes the cash amount in the investor's account. This allows them to either put the money back into investments or take it out. It's great for those who actively look after their investments.

Retirement Accounts

Retirement accounts, like IRAs or 401(k)s, are good for dividends because they offer tax breaks. Inside these accounts, dividends grow without taxing the investor right away. They can be put back into investments to increase until retirement. This is very useful for long-term growth. It takes advantage of compounding dividends without the tax hit upfront.

Dividend Reinvestment Plans (DRIPs)

DRIPs use dividends to automatically buy more shares. This makes an investor’s stake grow without immediate taxes. For example, if dividends are $0.25 per share, DRIPs turn this money into additional shares. This boosts the investor's returns without costing them extra right away.

| Account Type | Benefits | Considerations |

|---|---|---|

| Brokerage Accounts | Flexibility in investment choices and immediate access to dividends. | Dividends are taxable upon payment unless reinvested. |

| Retirement Accounts | Tax-deferred growth on dividends, optimal for long-term compounding. | Limited access to funds without potential penalties until retirement age. |

| DRIPs | Automatic reinvestment of dividends, compounding the investment without immediate taxes. | May not have control over timing of reinvestment which could affect buying price. |

In summary, the role dividends play, whether as an expense or a reinvestment chance, really depends on the account used. Knowing the differences between accounts like brokerage ones, retirement ones, and DRIPs is key. It can make a big impact on your investment tactics and growth over time.

Tax Implications of Dividend Accounts

Dividends are important in dividend definition accounting. Their tax treatment depends if they are qualified or ordinary. It's vital for financial pros and investors to know this. This helps them handle taxes well and get the most from their financial dividend investments.

Qualified vs. Ordinary Dividends

Qualified dividends are taxed lower than ordinary ones. For example, in the 35% tax bracket, qualified dividends are only taxed at 15%. On the other hand, ordinary dividends face the full 35% tax. This affects how much money shareholders keep. It's key in planning and reporting dividends.

Tax Rates and Reporting

The IRS sets specific tax rules for dividends. These depend on how much you earn and your filing status. Here's what's expected in tax rates soon:

| Year | 0% Rate Threshold | 15% Rate Threshold | 20% Rate Threshold |

|---|---|---|---|

| 2024 | Up to $40,000 | $40,001 to $441,450 | Above $441,450 |

| 2025 | Up to $41,000 | $41,001 to $450,000 | Above $450,000 |

Investors must report dividends correctly to avoid issues. For example, getting backup withholding for wrong info. Dividends over $1,500 must go on Schedule B (Form 1040). Knowing and following these details aids in smart dividend investing.

Knowing how dividends are taxed is crucial. It demands careful financial planning. With good advice and the IRS's Publication 550, managing dividend taxes becomes easier. This knowledge is a must for successful financial management.

Benefits of Dividend Accounts

Dividend accounts give you two big perks: regular income and the chance for your money to grow. They are great for investors wanting steady cash flow from their investments.

Regular Income Stream

Dividend accounts are known for giving a stable income. This money can cover daily expenses, help grow your savings, or support you when you retire. Dividends are paid out regularly, often every quarter. This makes it easier for investors to manage their money well.

A company in the S&P 500 typically offers a dividend yield of 1% to 3%. This is a strong reason to hold on to these investments for a long time.

Potential for Capital Growth

When you reinvest dividends to buy more shares, you set the stage for capital growth. This approach benefits from compounding, which can boost your investment and the dividends it makes. Through a DRIP, you can reinvest dividends without fees.

Imagine investing $10,000 in dividend stocks, with a 10% return from dividends each year. Compounding over years can vastly increase your shares and the worth of your investment.

This strategy shows how an investment grows over time. By following the "Power of 72" rule, investors can figure out how long it takes to double their investment with a fixed return rate. This way, dividend accounts help with both earning steady income and increasing your wealth through smart reinvestment.

Risks Associated with Dividend Investing

Dividend investments are seen as a steady income source. However, they carry risks that investors must understand. Knowing these risks helps in using dividend stocks well.

Market Risks

Dividend stocks can be affected by market changes, sometimes in subtle ways. A high dividend yield might seem appealing. Yet, it could signal financial trouble in a company. High yields often mean the stock's price has dropped due to problems within the company. Also, interest rate changes affect how attractive these stocks are. With low-interest rates, dividend stocks look better compared to risk-free options. But, if interest rates go up, these stocks might not seem as attractive.

Company Performance Risks

Company-specific issues are a big risk in dividend investing. Dividends can be cut or stopped if a company's earnings drop. Investors look at dividend aristocrats for signs of a stable return. These are companies that have increased dividends for years. However, they can face problems too, especially if the economy turns. Regulated investment companies (RICs) have to give out most of their income as dividends. This can be hard if their income decreases. Also, focusing too much on dividend stocks might make investors miss other growth opportunities.

Dividends offer stability and income but they are not without risks. Managing these risks is key to keeping a well-rounded investment portfolio. It's important to understand how dividends work. This knowledge is essential for anyone wanting a strong financial future.

How to Choose the Right Dividend Account

Choosing the right dividend account is crucial for investors. It involves looking at your investment goals and the account's details. You need to understand dividends fully to make a wise choice.

Assessing Your Investment Goals

Before picking a dividend account, think about your financial future. Are you aiming for growth, steady income, or both? This will guide you in choosing the right risk level and dividend type.

If generating income is your goal, consider an account that supports reinvestment. This can make your savings grow more through the power of compounding.

Evaluating Account Fees and Features

Each dividend account has its own fees and features. These can greatly affect your returns. Points to consider include:

- Transaction Costs: Avoid accounts with high fees on buying or selling to protect your profits.

- Annual Fees: Seek out accounts with minimal management fees to keep more of your earnings.

- Dividend Reinvestment Plans: Opt for accounts that offer automatic reinvestment. For example, a $10,000 investment in an S&P 500® index fund with reinvested dividends grew much more than one without, from 1993 to 2023.

- Accessibility and Support: Having easy access to your account and good customer support is important in fast-moving markets.

Comparing different accounts' fees and features will help you choose wisely. This aligns with your investment strategy for better long-term success.

Ultimately, the best dividend account matches your financial goals, how long you’re investing, and how much risk you can handle.

By thoughtfully assessing these aspects and your needs, you can make your dividend investments work great for you.

Popular Dividend Stocks to Consider

For those looking to earn steady income, diving into dividend stocks is key. It's crucial to grasp terms like dividend definition accounting and the concept of are dividends equity. Dividend stocks pay out part of a company's profits to shareholders. They show a company's strong and steady profit-making. We'll begin by exploring blue-chip stocks and Dividend Aristocrats. Both are popular choices for those investing in dividends.

Blue-Chip Stocks

Blue-chip stocks come from large, established companies known for their financial strength. For instance, Walmart has increased its dividends for over 50 years. These stocks offer smaller, but growing dividends. They provide a reliable income and less risk during market downturns.

Dividend Aristocrats

Dividend Aristocrats stand out in dividend investing. They have raised their dividends for at least 25 years. Ares Management is an example, with significant yearly dividend growth. Their resilience demonstrates that are dividends equity, building trust and long-term value among investors.

| Stock | Dividend Yield | Years of Dividend Increase |

|---|---|---|

| Walmart (WMT) | 0.9% | 51 |

| Gaming and Leisure Properties (GLPI) | 6.5% | 10 |

| Ares Management (ARES) | 2.1% | 5+ |

Adding these dividends to a portfolio offers regular income and growth potential. Knowing the dividend definition accounting and are dividends equity aspects helps. Such knowledge aids investors in creating a detailed strategy. This strategy meets both immediate and future financial needs.

Strategies for Dividend Investing

Dividend investing strategies can be quite different, each aiming for growth or income. Based on your financial goals and how much risk you're okay with, picking the right method is key. This choice helps you get steady income and grow your dividends reliably.

Dividend Growth Investing

Some companies regularly increase their dividends. This suggests they're doing well financially and have bright futures. If you're into tracking dividend payments, this trend can hint at a company's future success. This strategy's perks include the chance for your investment to grow and for your income to increase over time. It appeals to those looking to build wealth in the long run.

High-Yield Dividend Investing

This approach focuses on stocks with higher yields than average. Though it promises more income now, it's riskier. High returns might not last. It's vital to deeply understand the dividends a company pays out compared to what it earns. Knowing this helps avoid "dividend traps" during tough economic times. This strategy is best for those who want more income soon but recognize the risks involved.

To do well with dividend stocks, you need a smart plan, continuous analysis, and clear financial goals. Mixing strategies like growth and high-yield investing can create a balanced portfolio. This mix provides good income and the chance for your investment to grow.

Opening a Dividend Account: Step-by-Step

Starting to open a dividend account means picking the right brokerage. This first step is vital and leads to exploring dividends. Then, you move through steps to unlock your investment's true power. This includes investing in stocks or funds that pay dividends.

Choosing a Brokerage Firm

Finding the best brokerage is key for good dividend management. Consider their fees, what investments they offer, and if they have tools to help with dividends. Firms like Fidelity and Interactive Brokers are good for those into dividends. Fidelity is great for beginners with no trade fees or minimums. Interactive Brokers suits all traders with its $0.00 equity commission on TWS Lite and advanced tools.

Application Process

The application process requires your info and investment details. It's designed to ensure you can handle dividends well after joining. Once approved, you can set up Dividend Reinvestment Plans (DRIPs). These plans automatically reinvest earnings, boosting your investment growth.

To decide if dividends are right for growing your portfolio, know about dividend payout ratios. Genco Shipping & Trading Ltd with its 7.74% yield and 383.95% payout shows high returns but high risk. Two Harbors Investment Corp also offers high yields at 12.78%, with a payout ratio of 214.31%, indicating similar risks.

It's critical to match these ratios with your money goals and risk tolerance when picking dividend stocks. Choosing a good brokerage secures your interests. It makes investing in financial dividends a smart move for your portfolio.

Frequently Asked Questions About Dividend Accounts

Dividends play a crucial role by sharing a company's profits with its shareholders. Let’s explore key questions about dividends, their importance, and practical examples. Understanding what dividends are and how they work is vital.

What is the minimum investment?

Different brokerage firms have their own rules for starting an investment. Some require no initial amount, while others set a minimum. It's crucial to know that dividends show up in the shareholders' equity section of a balance sheet.

For example, if a company with 100,000 shares announces a $0.50 cash dividend per share, there's a special way to record this. It affects the ‘retained earnings’ and ‘dividends payable’ accounts.

Can I withdraw dividends anytime?

Dividends offer investors a lot of freedom. Once they are paid into your brokerage account, you can usually take them out anytime. This flexibility makes dividends valuable as they increase shareholders' wealth. They also play a part in the company's cash flow statement.

But, withdrawing dividends might lead to tax obligations. Some companies, like Coca-Cola, have paid dividends regularly since 1955. Investors can automatically reinvest these dividends through Dividend Reinvestment Plans (DRIPs). Choosing this or not depends on your financial strategy.

FAQ

What is a dividend?

A dividend is when a company shares its profits with its shareholders. Companies do this as a way to give back to the owners. It lowers the company's saved money.

How do dividends work?

Dividends are given out after the company's directors decide on it. They can be in cash or more shares. There are important dates like when they announce, when you must own the stock, and when they pay.

Dividends affect accounts like "Dividends Payable" but they're not a cost on the income statement.

What are the different types of dividend accounts?

You can get dividends through different accounts. This includes brokerage ones, retirement ones like IRAs, and DRIPs. Each has its pros and cons related to taxes.

Are dividends considered an expense for a company?

Dividends are not an expense for the company. They are shared profits. This sharing reduces the saved earnings or uses a separate dividends account.

What are the tax implications of dividends?

Taxes on dividends can be low like capital gains or higher like regular income. It depends on the dividend type and how long you've had the stock.

What are the benefits of investing in dividend accounts?

Investing in dividend accounts gives you a regular money income. It can help your investment grow and adds up over time. This can increase your portfolio's value.

What risks are associated with dividend investing?

Dividend investing can be risky. Market changes can affect stock prices and dividends. Also, if a company makes less money, it might cut or stop dividends.

How do I choose the right dividend account?

Pick a dividend account that fits your goals and how much risk you're okay with. Look at the fees, ease of access, and what the financial place offers.

What are some popular dividend-paying stocks?

Famous dividend stocks include well-established blue-chip stocks and Dividend Aristocrats. These have raised dividends for 25 years or more.

What are some strategies for dividend investing?

Two strategies are focusing on companies that increase dividends and looking for high-yield stocks. High-yield may mean more risk, though.

What is the process for opening a dividend account?

To start, pick a brokerage, share your personal and financial info, and your investing background. Once you're approved, put money in your account. You might want to set up a DRIP too.

What is the minimum investment required to open a dividend account?

Brokerages vary on the minimum to start a dividend account. Some don't require an initial minimum, while others have a set amount needed.

Can I withdraw dividends anytime?

Typically, you can take out dividends whenever if they are in cash in a brokerage account. Just remember, there might be tax impacts when you do.