Discover the Earnings Per Share Formula

Earnings per share (EPS) is a key way to check if a company is doing well financially. It's found by dividing the company's net income by the number of common shares. Knowing how to calculate EPS is important for investors and analysts to see if a company is strong and growing.

The EPS formula is simple. First, subtract preferred dividends from the net income. Then, divide by the average number of common shares. This gives a clear view of a company's EPS.

The EPS calculation is important for figuring out a stock's value. It's part of the price-earnings (P/E) ratio. By using the EPS formula, investors can understand a company's financial health, earnings trends, and its ability to pay dividends. Companies can also affect EPS by buying back shares. This can increase shareholder value without needing to make more money.

Key Takeaways

- Earnings per share (EPS) is a vital metric used to assess a company's financial strength and profitability.

- The eps formula involves deducting preferred dividends from net income and then dividing by the average number of outstanding common shares.

- Understanding the eps calculation is important for investors and analysts to evaluate a company's financial health and growth.

- EPS gives insights into a company's financial stability, earnings trends, and its ability to reward shareholders through dividends.

- Companies can influence eps by repurchasing shares, which can enhance shareholder value without a need to increase net income.

- The earnings per share formula is a key factor in determining a stock's value, as it forms part of the price-earnings (P/E) valuation ratio.

What is Earnings Per Share (EPS)?

Earnings per share (EPS) shows how much money a company makes per share of common stock. It's found by dividing the company's net income by the number of shares. This tells us how well a company is doing financially.

The earnings per share formula is simple but powerful. It divides the net income by the average number of shares over a time period. This helps investors and analysts see how a company is doing.

Definition of EPS

Earnings per share is easy to understand: it's the net income per share of common stock. To figure it out, you need the company's net income and the number of shares. The formula is: EPS = (Net Income - Preferred Dividends) / Average Outstanding Shares.

Importance of EPS in Finance

Earnings per share is very important in finance. It shows how profitable a company is and helps figure out its value. The price-to-earnings (P/E) ratio uses EPS to judge a company's worth. Knowing what is eps and how to calculate it is key for finance and investing.

| Company | Net Income | Outstanding Shares | EPS |

|---|---|---|---|

| Example Company | $1,000,000 | 10,000,000 | $0.10 |

The Earnings Per Share Formula Explained

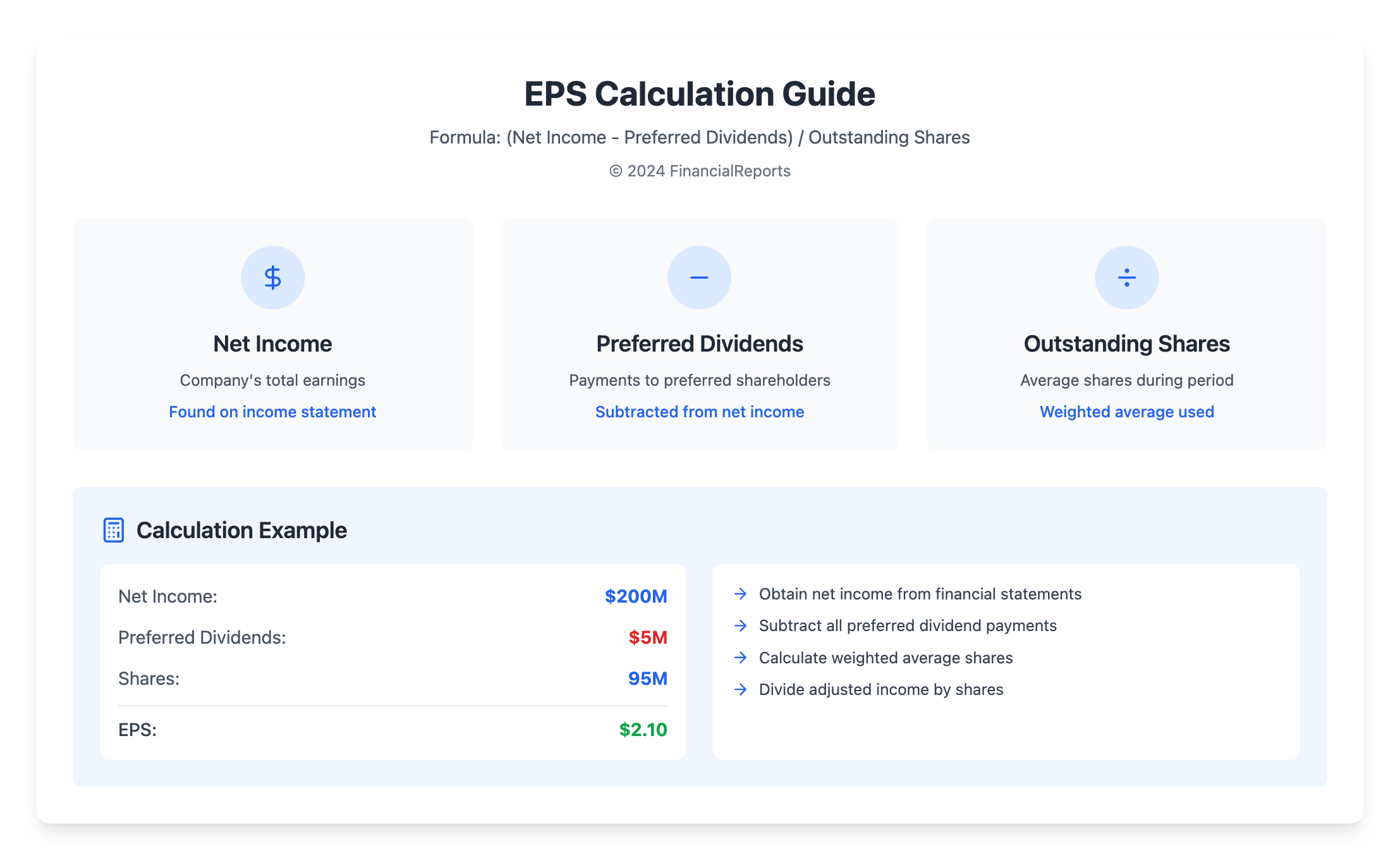

The eps equation is key for investors to value a company. It shows the company's worth on a per-share basis. To figure out earnings per share, we need to understand the formula's parts. The basic formula is (Net Income - Preferred Dividends) / Weighted Average Shares Outstanding.

Basic Structure of the Formula

The earnings per share equation has core parts, even for complex scenarios. Net income, preferred dividends, and weighted average shares outstanding are vital. They help us calculate the eps equation.

Breakdown of Components

When calculating earnings per share, consider these points:

- Net income: The company's total earnings, found on the income statement.

- Preferred dividends: Dividends to preferred shareholders, subtracted from net income.

- Weighted average shares outstanding: The average shares during the reporting period, used in the eps equation.

Understanding the eps equation helps investors make better choices. It's a key tool for evaluating a company's financial health and growth.

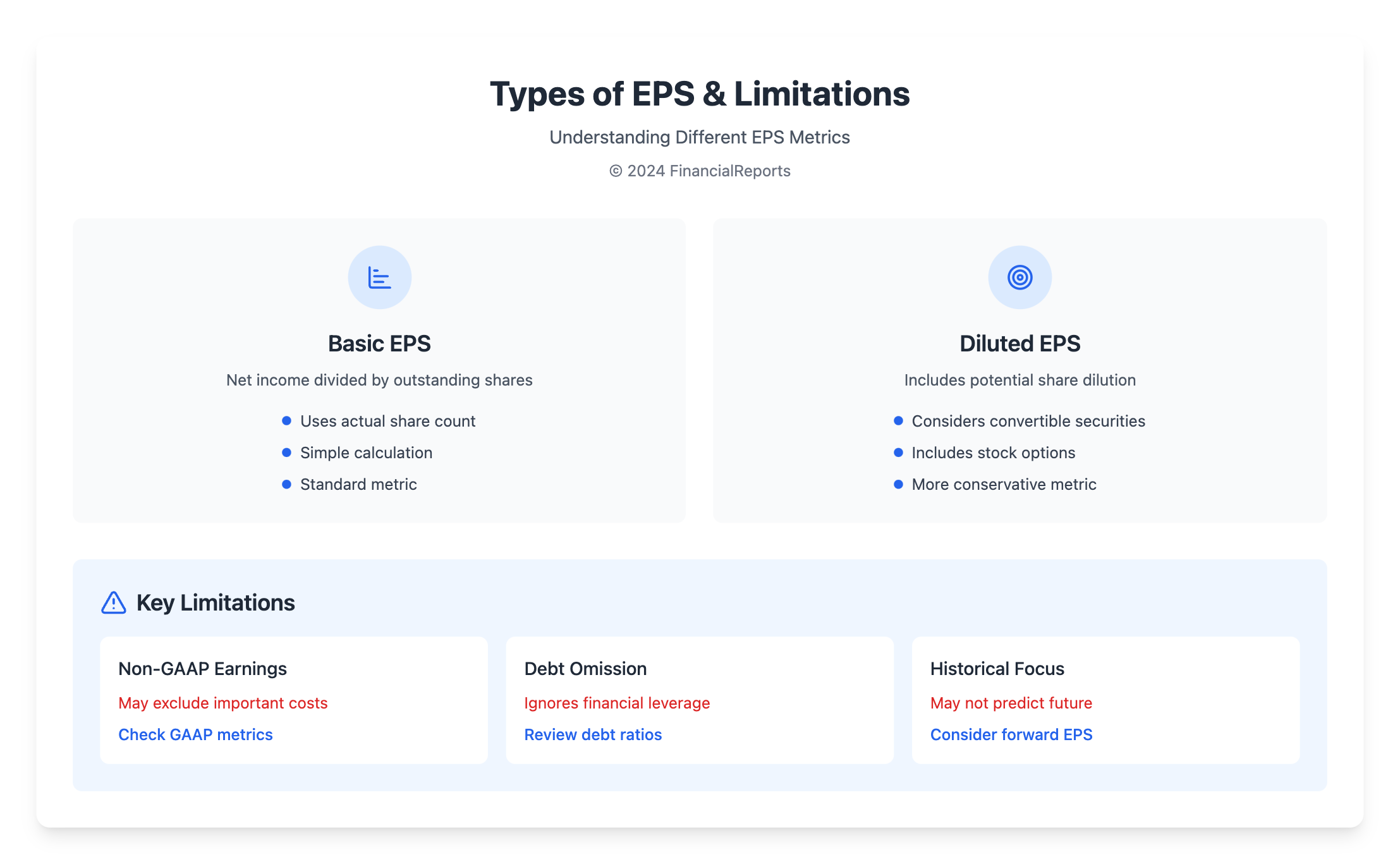

Types of Earnings Per Share

To grasp the earnings per share meaning, it's key to understand the different types of EPS. Basic EPS is found by dividing the company's net income by the total number of shares. Diluted EPS looks at how shares might be diluted by convertible securities and stock options.

When figuring out how to find earnings per share, knowing the eps definition and its types is important. The eps definition includes various types, like trailing EPS, forward EPS, and adjusted EPS. Trailing EPS shows a company's earnings over the last year. Forward EPS is what analysts think a company will earn in the future.

The main types of EPS are:

- Basic EPS: found by dividing net income by shares

- Diluted EPS: takes into account possible dilution from securities and options

- Trailing EPS: shows earnings over the last year

- Forward EPS: is what analysts predict for future earnings

Knowing these EPS types and how to calculate them is essential for good financial analysis. It helps investors make smart choices. By understanding the eps definition and its types, investors can see how well a company is doing and its growth chances.

| Type of EPS | Description |

|---|---|

| Basic EPS | Calculated by dividing net income by outstanding shares |

| Diluted EPS | Considers possible dilution from securities and options |

| Trailing EPS | Shows earnings over the last year |

| Forward EPS | Is what analysts predict for future earnings |

Why EPS Matters for Investors

Earnings per share (EPS) is key for investors. It shows how well a company is doing financially. To get EPS, you need to know the company's net income and the number of shares outstanding. EPS helps figure out the price-to-earnings (P/E) ratio, which shows if a stock is fairly priced.

When looking at EPS, investors should think about a few things:

- Profits per share: A higher EPS means better financial health and more profits for shareholders.

- EPS stock meaning: EPS is a big part of the P/E ratio, which compares companies in the same industry.

- Industry comparisons: EPS can change a lot between industries. So, it's best to compare within the same sector.

Understanding EPS helps investors make better choices. While EPS is just one factor, it gives important insights into a company's financial health and growth possibilities.

How to Calculate EPS

To find EPS, start with the net income. Then, subtract preferred dividends. Lastly, divide by the weighted average number of shares. This method can be tweaked for more complex cases, like diluted EPS. This includes shares from convertible debt and employee stock options.

Knowing how to figure out earnings per share is key for investors. It shows a company's profit and value. The basic EPS formula is: EPS = Net Profit – Preferred Dividends / End-of-Period Common Shares Outstanding.

Step-by-Step Calculation

The steps to find EPS are simple:

- Start with the company's net income

- Subtract preferred dividends to get net earnings for common equity

- Divide the result by the weighted average number of outstanding shares

For example, let's say a company has a net income of $200 million. It has $5 million in preferred dividends and 95 million shares outstanding. The basic EPS would be $2.10. This shows how to figure out profit per share and earnings per share.

| Net Income | Preferred Dividends | Weighted Average Shares Outstanding | Basic EPS |

|---|---|---|---|

| $200 million | $5 million | 95 million | $2.10 |

By following these steps, investors can understand a company's value and growth. This helps in making better investment choices.

Factors Affecting EPS

Understanding what is eps in stocks is key. It's important to know what affects earnings per common share. Net income, the number of shares, and market conditions all play a role. For example, more net income means higher EPS, making the company more appealing to investors.

Shares outstanding also matter. When a company buys back its shares, it has fewer shares out. This can make EPS go up. With fewer shares, the same net income spreads out, increasing the value of each share. Market conditions, like economic changes and trends, also affect EPS.

Some key factors that can impact EPS include:

- Net income: An increase in net income can lead to higher EPS.

- Shares outstanding: A reduction in outstanding shares can result in higher EPS.

- Market conditions: Economic fluctuations and industry trends can influence a company's EPS.

Knowing these factors helps investors understand EPS better. It's vital for making smart investment choices. Whether it's earnings per common share or what is eps in shares, understanding the basics is essential.

The Role of Shares Outstanding in EPS

To figure out EPS, understanding shares outstanding is key. Earnings per share (EPS) is the net earnings divided by the average shares outstanding. Analysts use the weighted average shares to account for changes in shares over time.

Calculating EPS involves dividing net income by weighted average shares. This gives a clearer picture of a company's profitability. The weighted average considers shares outstanding at different times and their weights.

Important factors in EPS calculation include:

- Weighted average shares outstanding

- Net income available to common shareholders

- Preferred dividends

Knowing these factors helps investors understand a company's value. The definition of EPS is vital for comparing companies' profitability.

| Company | Net Income | Weighted Average Shares Outstanding | EPS |

|---|---|---|---|

| Company A | $1,000,000 | 10,000,000 | $0.10 |

| Company B | $500,000 | 5,000,000 | $0.10 |

Using EPS for Company Valuation

To figure out a company's value, investors look at the price-to-earnings (P/E) ratio. This ratio is found by dividing the stock price by the earnings per share (EPS). It's important to know what does eps mean because it shows the profit for each share. The P/E ratio tells if a stock is too expensive or not expensive enough.

A high P/E ratio might mean a stock is too pricey. On the other hand, a low P/E ratio could mean it's a good deal. To calculate the P/E ratio, you need to know how to compute eps. This is because EPS is a big part of the P/E ratio. Knowing what does earnings per share mean helps investors make smart choices. Here are some important things to remember when using EPS for company valuation:

- The P/E ratio is a common way to check a company's value.

- A high P/E ratio might mean a stock is too expensive. A low P/E ratio could mean it's a good deal.

- It's key to understand what does eps mean and how to compute eps to figure out the P/E ratio.

By looking at the P/E ratio and understanding EPS, investors can make better choices. It's important to use EPS with other financial ratios to guess a company's stock value correctly.

| Company | Stock Price | EPS | P/E Ratio |

|---|---|---|---|

| Company A | $50 | $2 | 25 |

| Company B | $100 | $5 | 20 |

Limitations of EPS

Earnings Per Share (EPS) is a key metric for checking a company's financial health. Yet, it has its downsides. Companies might use non-GAAP earnings to show a better EPS. This can be tricky, as it doesn't fully show the company's financial state. To grasp how to calculate EPS, knowing the basic equation is key. It's about dividing net income by the total number of shares.

Some major issues with EPS are:

- Non-GAAP earnings: Companies might leave out some costs or income to show a better EPS.

- Potential misleading figures: EPS doesn't show a company's debt or overall financial health, leading to wrong conclusions.

- Lack of transparency: Companies might not clearly explain how they calculate EPS, making it hard for investors to decide.

Investors should be careful when looking at EPS numbers. They should also check other metrics, like the price-to-earnings ratio. This gives a fuller view of a company's financial health. By understanding the basic EPS equation and how to calculate it, investors can make better choices and avoid common mistakes.

| EPS Type | Description |

|---|---|

| Basic EPS | Divides net income by the total number of outstanding shares |

| Diluted EPS | Assumes all outstanding shares that a company will issue |

Adjustments in EPS Calculation

When we calculate earnings per share (EPS), we make adjustments to get a clearer view of a company's financial health. The earnings per share formula helps us figure out both basic and diluted EPS. We adjust the numbers in the formula to account for things like treasury stock and if-converted methods.

The eps formula looks at the company's net income, preferred dividends, and the average number of shares outstanding. In the eps calculation, we remove items like extraordinary gains or discontinued operations. This gives us a better look at how the company is doing day-to-day.

Some important things to think about in eps calculation include:

- Weighted average of outstanding common shares

- Preferred dividends

- Extraordinary items or discontinued operations

- Dilutive securities, such as options and warrants

Understanding the adjustments in earnings per share formula and eps calculation helps investors see a company's true financial state. This knowledge helps them make better choices.

| EPS Type | Calculation | Example |

|---|---|---|

| Basic EPS | Net Income / Weighted Average Basic Shares Outstanding | $2.45 |

| Diluted EPS | Net Income / Weighted Average Diluted Shares Outstanding | $2.20 |

Real-World Applications of EPS

Earnings per share (EPS) is key in finance. Its eps meaning is vital for investors and analysts. Earnings per share is found by dividing a company's net income by its shares. It shows a company's profit and helps compare it to others in the same field.

In real life, eps helps check a company's financial health. A high earnings per share means a company is more profitable. This makes it more appealing to investors. The eps meaning can change due to many factors, like income, dividends, and shares.

Some main uses of eps are:

- Comparing companies in the same field

- Looking at a company's financial growth over time

- Helping make smart investment choices

Knowing the eps meaning and how it's figured out helps investors and analysts. They can understand a company's financial state better. The earnings per share is a strong tool in finance, used in many ways.

The Future of EPS Reporting

The world of finance is changing fast, and earnings per share (EPS) reporting is no exception. Experts say we'll see more standard and clear reports soon. This is because people want accurate and up-to-date financial information.

Technology will play a bigger role in how we calculate EPS. New tools in data analysis and automation will make these calculations more precise and quick.

Trends in Financial Reporting

Financial rules and standards for EPS reporting are set to get stricter. This will make sure EPS is shown in a consistent way across all companies. This change will help investors make better choices by comparing companies more easily.

The Role of Technology in EPS Calculation

Technology, like machine learning and artificial intelligence, will change EPS reporting a lot. These tools will help make EPS calculations more accurate and fast. This means investors will get quick and reliable information about a company's success and growth.

FAQ

What is Earnings Per Share (EPS)?

Earnings Per Share (EPS) shows how profitable a company is. It's found by dividing the company's net income by the number of shares. This helps investors see how well a company is doing and make smart choices.

Why is EPS important in finance?

EPS is key because it shows if a company is making money for its shareholders. Investors and analysts use it to check how a company is doing. They also compare it to others in the same field to decide if they should invest.

How is the Earnings Per Share formula calculated?

To find EPS, you divide the company's net income (after paying preferred dividends) by the average number of shares. The formula is: EPS = (Net Income - Preferred Dividends) / Weighted Average Shares Outstanding.

What are the different types of Earnings Per Share?

There are two main types: Basic EPS and Diluted EPS. Basic EPS uses the actual number of shares. Diluted EPS includes the effect of securities that could increase the number of shares.

How do investors use EPS in their analysis?

Investors look at EPS to see if a company is making money and growing. It helps them compare companies in the same field. They also use it to see if a stock is cheap or expensive based on its earnings.

What steps are involved in calculating Earnings Per Share?

To calculate EPS, follow these steps: 1) Find the company's net income, 2) figure out the preferred dividends, 3) calculate the weighted average number of shares, and 4) divide the net income (minus preferred dividends) by the weighted average shares.

What factors can impact a company's Earnings Per Share?

Several things can change a company's EPS. These include changes in net income, the number of shares, stock splits, and market conditions.

How do outstanding shares affect the Earnings Per Share calculation?

The number of shares is very important for EPS. The weighted average of shares is used to get a more accurate EPS. This takes into account changes in shares due to actions like stock splits.

How is EPS used in company valuation?

EPS is used to value companies, mainly through the price-to-earnings (P/E) ratio. The P/E ratio compares the stock price to EPS. This helps investors see if the stock is cheap or expensive compared to its earnings.

What are the limitations of using Earnings Per Share as a financial metric?

While EPS is common, it has its limits. Companies might adjust earnings to change EPS. Investors should look at other metrics too to get a full picture of a company's performance.

How are adjustments made in EPS calculations?

Adjustments are made to show a company's true financial health. These include accounting for special items, discontinued operations, and the effects of corporate actions like stock splits.

How can EPS be applied in real-world scenarios?

EPS is used by investors, analysts, and the media to judge company performance. Case studies and comparisons show how EPS helps in making investment choices and comparing companies in a field.

What are the future trends in Earnings Per Share reporting?

EPS reporting will likely change with new standards and technology. Trends include new accounting rules, the use of automation and AI, and more focus on sustainability and ESG factors.