Discover the Different Types of Trading to Grow Your Investments

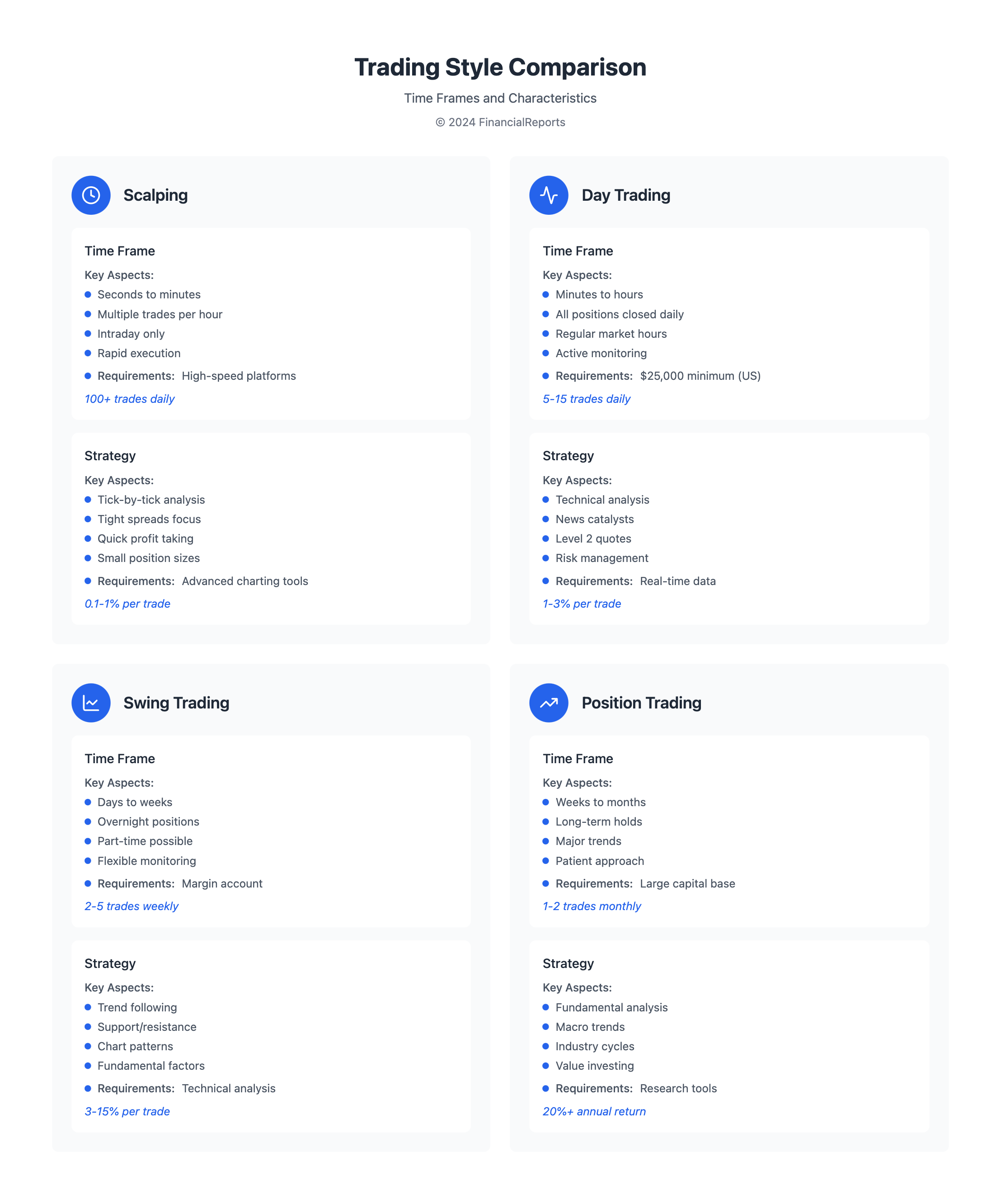

Active traders deal with many financial items like stocks, bonds, and currencies. They use various trading strategies to meet their goals. The financial world has many trading options, like scalping and day trading. Each has its own way of working and needs.

Investors can pick from many trading strategies. Active trading is one, where you buy and sell often to make money from market changes. There are also day trading, swing trading, and position trading. Each has its own risk and reward, helping investors find the right fit for them.

By learning about these trading types, investors can better understand the markets. This knowledge helps them make smarter investment choices.

Key Takeaways

- Active traders can trade various financial instruments, including stocks, bonds, currencies, and commodities.

- Different types of trading strategies, such as scalping, day trading, swing trading, and position trading, offer unique characteristics and requirements.

- Understanding the different types of trading is essential for making informed investment decisions.

- Investors can choose from a range of trading strategies to suit their investment objectives and risk tolerance.

- Developing a deep understanding of the markets and different types of trading can help investors make more effective investment decisions.

- Successful trading requires time, commitment, and a thorough understanding of the different types of trading and their associated risks and possible returns.

- Investors should carefully consider their investment goals and risk tolerance when selecting a trading strategy.

Understanding Trading: An Overview

Trading means buying and selling financial assets like stocks and bonds to make money. Traders aim to profit from price changes. They use various strategies and analysis to decide when to buy or sell.

There are different types of trading. Day trading, swing trading, and position trading each have their own ways and needs.

What is Trading?

Trading uses technical and fundamental analysis to find good trades. Technical traders look at charts and indicators like the Relative Strength Index (RSI) for signals. Fundamental traders focus on company news, like earnings reports.

Importance of Trading to Investors

Trading is key for investors to make money from market changes. Now, individual investors can easily buy and sell financial assets. In 2021, retail traders made up 23% of US equity trading, buying over $1.9 billion in stocks.

Here are some interesting trading facts:

- Over 13,000 CFD markets are available for trading, including shares, forex, commodities, indices, and bonds.

- 50% of users check their account balances, open positions, and past transactions through the trading app.

- There are more than 17,000 financial assets and markets to trade.

| Type of Trading | Description |

|---|---|

| Day Trading | Involve making dozens or hundreds of trades per day to profit from bid-ask spreads. |

| Swing Trading | Hold positions longer than a day to profit from fundamental changes. |

| Position Trading | Involve holding positions for a longer period, often weeks or months, to profit from long-term trends. |

Day Trading: Fast-Paced Investment Strategies

Day trading is when you buy and sell stocks in the same day. The aim is to make money from quick price changes. Traders close their deals by day's end to avoid overnight price shifts. In the U.S., you need at least $25,000 in your account to be called a day trader.

To succeed in day trading, you must keep up with market news and economic reports. You'll need to make fast decisions in a changing market. Using leverage can help increase your profits. To begin, you need to know the market well, have enough money, and follow a trading plan.

Key Characteristics of Day Trading

- Day traders execute four or more day trades within five business days and maintain margin accounts.

- Pattern day traders often access leverage up to four times the amount in excess of their maintenance margin for trading purposes.

- Day traders usually make multiple trades throughout the day, aiming to profit from minute fluctuations in stock prices.

Pros and Cons of Day Trading

Day trading can be very profitable, but it's also risky. Traders face the risk of big losses if they don't close their deals on time. Yet, with the right skills and discipline, it can be a good way to grow your investments.

| Type of Trading | Description |

|---|---|

| Day Trading | Buying and selling assets within the same trading day |

| Swing Trading | Holding positions for several days or weeks to profit from market swings |

| Position Trading | Holding positions for weeks, months, or years based on fundamental analysis |

Swing Trading: Capitalizing on Market Trends

Swing trading is a way to trade shares for a few days or weeks. It's great for those who want to make money from market trends without being glued to their screens. This method balances risk and reward, making it a popular choice among traders.

Swing trading focuses on technical analysis and uses different time frames. Traders might use the exponential moving average (EMA) crossover system to decide when to buy or sell. The aim is to exit trades near the top or bottom of the channel without being too precise.

To succeed in swing trading, you need initial capital, charting software, and technical analysis skills. It's less risky than short-term trading because it relies on technical analysis and short holding periods. Swing trading is a good option for those looking to make quick gains over days or weeks.

| Trading Strategy | Time Frame | Risk Level |

|---|---|---|

| Swing Trading | Days or weeks | Medium |

| Day Trading | Less than a day | High |

| Position Trading | Weeks or months | Low |

In conclusion, swing trading is a unique way to profit from market trends. By understanding its characteristics and requirements, traders can make better choices about their investment strategies. This helps them pick the right type of share trading for their needs.

Position Trading: Long-Term Strategies Explained

Position trading means holding onto investments for a long time, like weeks, months, or even years. It's different from types of day trading, which look for quick gains. Position traders aim to make money from big market changes over a longer time.

George Soros made over $1 billion by betting against the British pound in 1992. Another trader made $16 million from holding S&P 500 shares for almost ten years. Philip A. Fisher also made a lot of money by holding onto Motorola shares for decades.

Position trading can be less stressful and gives traders more freedom. They don't have to check their investments every day. But, it needs a lot of money, and traders must be ready for losses. Here are some key points about position trading:

| Characteristic | Description |

|---|---|

| Timeframe | Medium to long term |

| Analysis | Fundamental and technical analysis |

| Return target | 10% or more |

| Leverage | Available for shorting markets |

Position trading is good for those who want a less hectic way to trade. By knowing its benefits and how it works, traders can make smart choices. They can develop strategies to catch big market changes.

Scalping: Quick Trades for Small Gains

Scalping is a way to make money by taking advantage of small price changes. It needs fast thinking and watching positions closely. A good scalper wins more often than they lose, and their profits are close to their losses.

Scalping means making quick trades with small profits. It's about making money from short-term price changes. Scalpers need markets that are easy to trade in, so they can make fast trades without losing much.

How Scalping Works

Scalpers make many trades, sometimes hundreds in one day. Getting orders right is key; wrong orders can lose money. Beginners should watch out for costs from trading a lot and use tools like direct access trading.

Ideal Market Conditions

Scalpers use technical tools for quick signals. They use strategies like time-based and range scalping. To do well, they need fast trading platforms and tools like moving averages and RSI.

| Scalping Strategy | Description |

|---|---|

| Time-based Scalping | Executing trades at specific time intervals |

| Range Scalping | Trading within a defined price range |

| Breakout Scalping | Trading on price breakouts from a defined range |

| Momentum Scalping | Trading on momentum indicators like RSI |

Knowing about scalping and other trade types helps investors make smart choices. They can pick the best strategy for their goals and how much risk they can take.

Algorithmic Trading: The Role of Technology

Algorithmic trading, also known as automated trading or black-box trading, uses computer programs to make trades quickly and systematically. It's a key part of different trading types. It helps investors take advantage of various market trends and conditions.

Algorithmic trading has many benefits. It ensures the best execution, has low latency, and cuts down transaction costs. It also lets traders make trades based on specific criteria, like following trends or finding arbitrage opportunities. But, it also has downsides, like latency issues, unexpected events, and relying too much on technology.

Some common strategies in algorithmic trading include:

- Trend-following strategies, which use moving averages to identify trends

- Arbitrage strategies, which exploit price differentials between markets

- Index fund rebalancing strategies, which can yield profits of 20 to 80 basis points

Overall, algorithmic trading is a strong tool for investors. It offers many benefits and chances for different trading types. By learning about algorithmic trading and its strategies, investors can make smart choices and profit from market trends.

| Strategy | Description |

|---|---|

| Trend-following | Uses moving averages to identify trends |

| Arbitrage | Exploits price differentials between markets |

| Index fund rebalancing | Yields profits of 20 to 80 basis points |

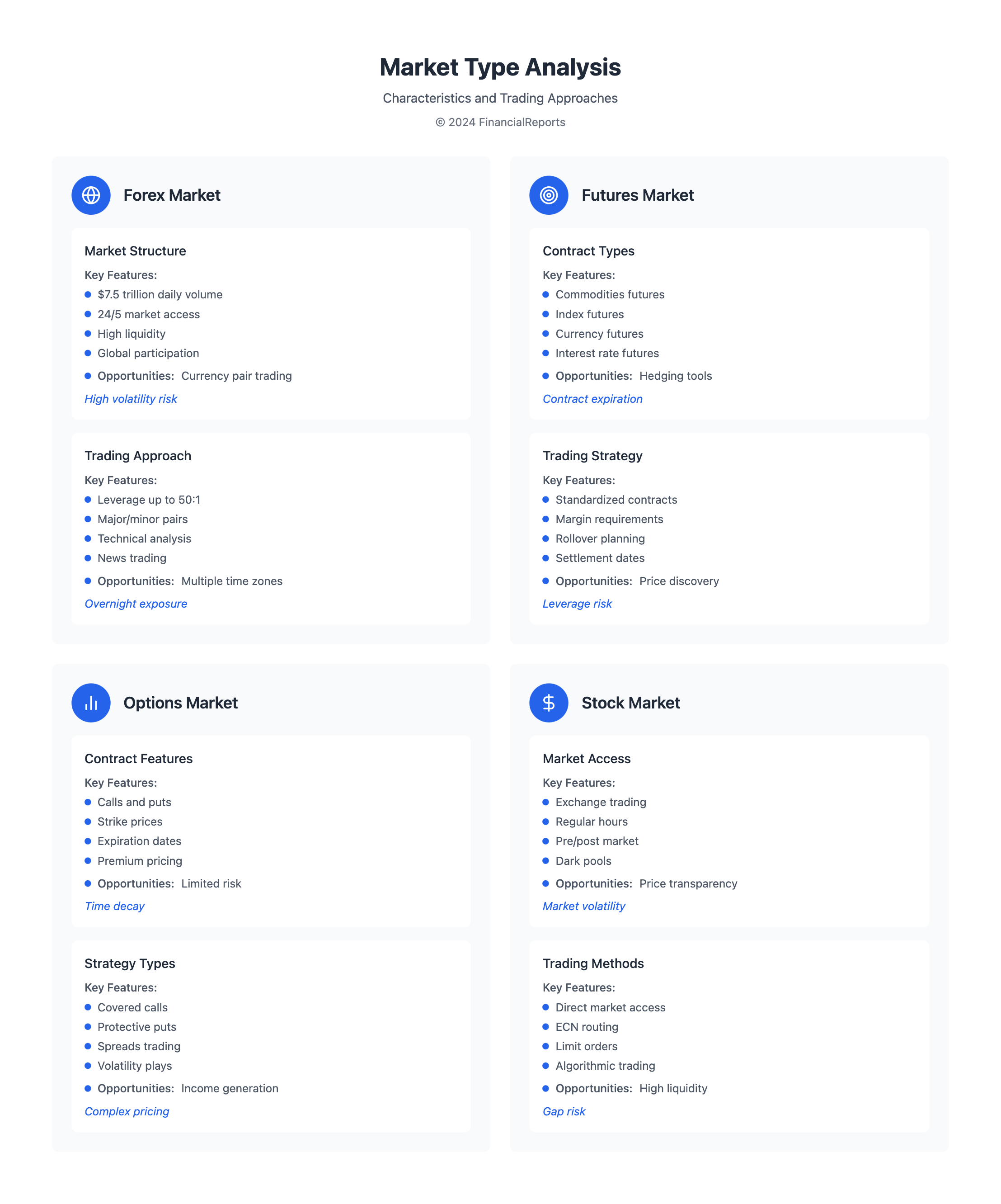

Options Trading: Flexibility with Risk Management

Options trading lets investors manage risk and aim for high returns. It involves buying and selling options contracts. These contracts give the holder the right to buy or sell an asset at a set price. Options trading is known for its flexibility and ability to reduce risk.

Understanding Options Basics

To start with options trading, knowing the basics is key. This includes understanding different options contracts and their features. Options trading lets investors bet on an asset's price without owning it. This is great for managing risk, as it can limit losses.

Strategies to Consider

There are several strategies for options trading to manage risk and increase returns. These include:

- Position sizing: controlling the capital allocated to each trade to limit the impact of losses on the portfolio

- Stop-loss levels and profit targets: setting stop-loss levels to specify the maximum loss acceptable on a trade and profit targets to lock in gains at a predetermined level of profitability

- Diversification strategies: spreading exposure across different options strategies, expiration dates, and underlying assets to minimize risk

By using these strategies, investors can manage risk well and aim for high returns. This is a key part of trading and types of trading.

| Strategy | Description |

|---|---|

| Position Sizing | Controlling the capital allocated to each trade |

| Stop-Loss Levels | Setting a maximum loss acceptable on a trade |

| Diversification | Spreading exposure across different options strategies and assets |

Futures Trading: Speculating on Prices Ahead

Futures trading involves buying and selling contracts that obligate the holder to buy or sell an asset at a set price on a set date. It's a key part of stock trading, letting investors guess on price changes. In the U.S., the Commodity Futures Trading Commission (CFTC) regulates futures, keeping the market fair and preventing bad trading.

There are many types of futures contracts, like those for crops, energy, metals, currencies, and financials. These contracts help two main groups: hedgers and speculators. Hedgers use them to protect against price changes, while speculators try to make money from these changes. For example, a farmer might lock in a crop price, and a trader might bet on oil prices.

Characteristics of Futures Contracts

Futures contracts have key features, like being standardized and traded on exchanges. This means they're traded on places like the Chicago Mercantile Exchange, with set rules. Here are some examples:

- Agricultural futures: corn, wheat, soybeans

- Energy futures: crude oil, natural gas, gasoline

- Metal futures: gold, silver, copper

- Currency futures: euro, British pound, yen

Futures trading lets you guess on price changes or protect against losses. Because of leverage, traders only need a small fraction of the contract's value to start. For example, to buy a crude oil contract, a trader might only need $3,000 for a $50,000 oil deal.

| Contract | Underlying Asset | Contract Size |

|---|---|---|

| Crude Oil | 1,000 barrels | $50,000 |

| Gold | 100 troy ounces | $100,000 |

| E-mini S&P 500 | $50 times the price of the S&P 500 Index | $112,500 |

In conclusion, futures trading is complex but understanding futures contracts is key. By speculating or hedging, traders can profit from stock trading.

Forex Trading: The Global Currency Market

Forex trading is all about exchanging currencies worldwide. It's the biggest market, with over $7.5 trillion traded daily. It's open 24/7, five days a week, making it very liquid.

Big players like banks and speculators rule the forex market. It offers different ways to trade, like spot cash and derivatives like options.

Overview of Forex Trading

Forex trading means trading currency pairs, like EUR/USD. It has spot cash and derivatives markets. It's a zero-sum game, where one person wins and another loses. This shows the need to manage risks and aim for steady returns.

Key Players in the Forex Market

The main players in the forex market are:

- Commercial and investment banks

- Dealers and brokers

- Speculators

- Central banks

These players add to the market's liquidity and volatility. Traders need to keep up with trends and news to make smart choices.

Comparing Different Types of Trading

Investing in the stock market doesn't have a single right way. The secret to success is finding a trading style that matches your risk level, goals, and personality. Some traders love the quick action of day trading, while others prefer the longer view of position trading.

Risk levels and how long you plan to hold onto investments are key. Day traders take big risks for quick profits. Swing and position traders, on the other hand, hold onto investments for days or weeks. Knowing your comfort with risk and your investment goals helps pick the right trading style.

There's a wide range of trading strategies to choose from. This lets investors pick what works best for them. By weighing the good and bad of each style, you can make a smart choice. This choice can help you grow your investments in the stock market.

FAQ

What is trading and why is it important for investors?

Trading means buying and selling things like stocks and currencies to make money. It's key for investors to learn about trading. This knowledge helps them grow their money and manage risks better.

What are the different types of trading?

There are many types of trading. These include day trading, swing trading, and position trading. Each type has its own way of working and strategies.

What are the key characteristics of day trading?

Day trading means making trades in the same day. It needs watching market trends closely. Traders use technical analysis and risk management to make profits from small price changes.

How does swing trading work, and what are the tools used by swing traders?

Swing trading looks for trends that last a few days to weeks. Traders use tools like chart patterns to spot price movements. This helps them make money from these trends.

What is the definition and approach of position trading?

Position trading is for the long haul, holding positions for weeks or months. It aims to catch big market trends. This strategy can lead to higher returns with less risk than short-term trading.

What are the key characteristics of scalping, and what are the ideal market conditions for this strategy?

Scalping is fast, aiming to make money from tiny price changes. It needs quick trade execution in markets with lots of liquidity and low volatility.

What is algorithmic trading, and what are its advantages and disadvantages?

Algorithmic trading uses computer programs to make trades automatically. It's fast and precise, handling lots of trades. But, it also risks system failures and unintended consequences.

What are the basics of options trading, and what are some common strategies?

Options trading involves buying or selling contracts for future asset prices. It's flexible and can offer high returns. But, it's risky and requires understanding options mechanics and strategies.

What are futures contracts, and what are the main risks involved in futures trading?

Futures contracts are agreements for future asset prices. Futures trading speculates on price changes. But, it's risky, with the chance of big losses due to leverage and market swings.

What is the forex market, and who are the key players in this global currency market?

The forex market is huge, where currencies are bought and sold. Banks, big investors, retail traders, and central banks all play a part. They influence currency prices and trends.

How can investors choose the right trading style for their risk tolerance and investment goals?

Investors should think about their risk tolerance and goals when picking a trading style. Day trading and scalping are risky but can offer quick profits. Position trading and long-term investing are safer but grow slower. Knowing each style's needs is key to making a good choice.