Discover the Best Stock Broker for Beginners in 2023

Choosing the right stock broker is key for beginners in the stock market. There are many options, making it hard to pick one. A good broker for beginners should have low fees, easy-to-use platforms, and educational tools.

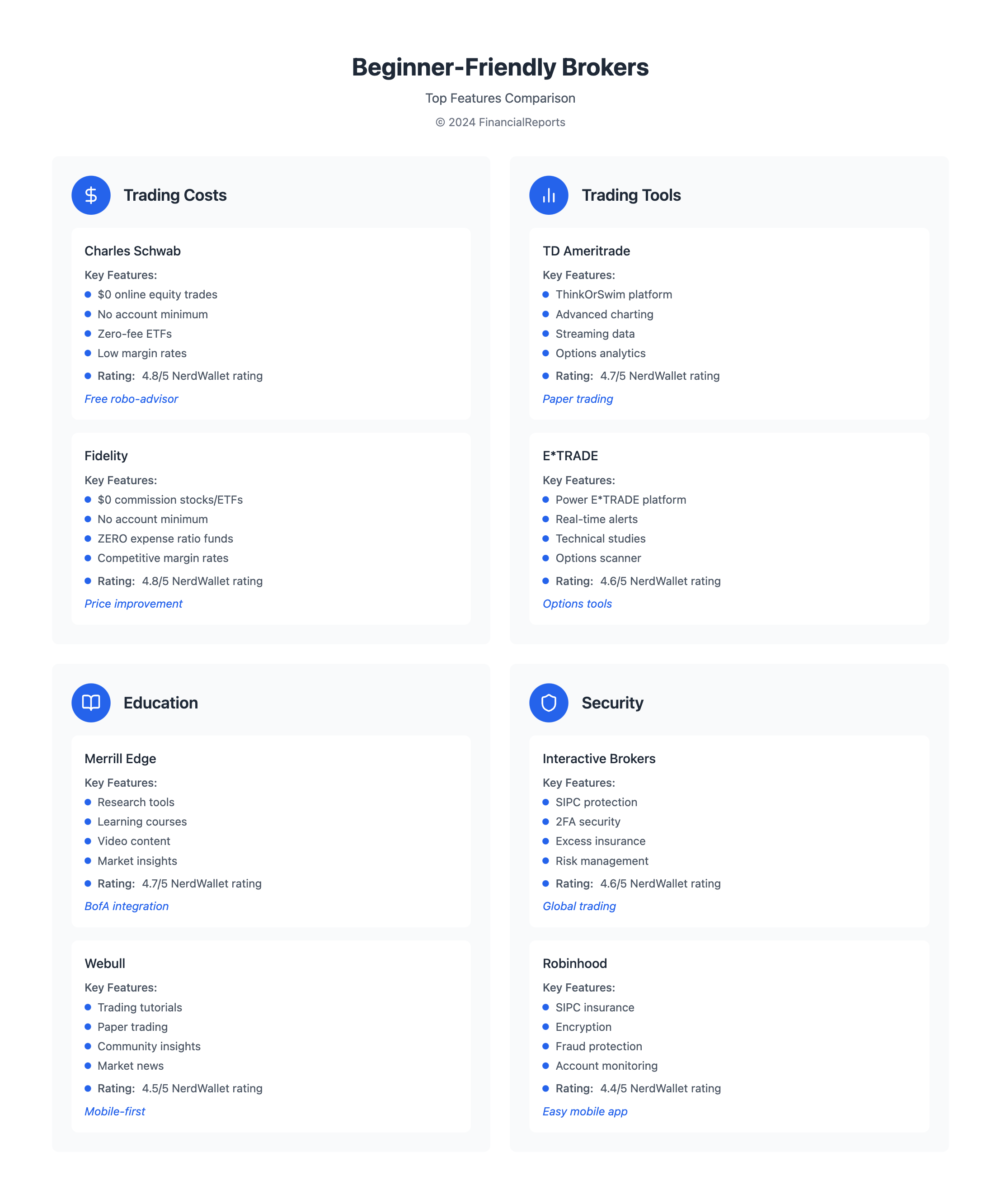

Charles Schwab and Fidelity are top choices for beginners. Charles Schwab has a paper trading platform for practice and a NerdWallet rating of 4.8/5.

A beginner's brokerage account should be easy to use. It should let users trade confidently. Also, a good broker should have low fees, like $0 per online equity trade. This helps beginners start investing.

Introduction to Stock Brokers

A stock broker is important in investing, helping with trades and services. Online stock brokers make it easy for beginners to start investing. It's important to compare different brokers to find the best fit.

Key Takeaways

- Choose a stock broker that offers low fees and user-friendly platforms

- Consider a brokerage account for beginners that provides educational resources and support

- Look for a reputable online stock broker with a high NerdWallet rating, such as Charles Schwab or Fidelity

- Take advantage of features like paper trading platforms to practice before real trading

- Evaluate the services and features offered by different stock brokers to find the best fit for individual needs

- Consider the fees associated with online equity trades, such as $0 per trade offered by Charles Schwab and other brokers

Understanding What a Stock Broker Does

A stock broker is like a middleman between buyers and sellers. They help with buying and selling securities. When you're new to investing, knowing what a stock broker does is key. It helps you find the best investment accounts for beginners.

Stock brokers come in different types. Full-service brokers give advice and manage your portfolio. Discount brokers offer fewer services but cost less. The best investment companies for beginners usually mix these options, letting you pick what you need.

The Role of a Stock Broker

A stock broker's main job is to make trades for their clients. They might also give advice and research to help you decide. Brokers make money from commissions and fees for services like financial planning.

Types of Stock Brokers

Here are some common types of stock brokers:

- Full-service brokers: They offer lots of services, like advice and portfolio management.

- Discount brokers: They have fewer services but cost less.

- Online brokers: You can trade online with them, often for lower fees.

How Stock Brokers Make Money

Stock brokers make money in several ways:

- Commissions: A percentage of the transaction value.

- Fees: For services like financial planning and portfolio management.

- Base salary: Brokers in big firms or institutions get a salary.

| Broker Type | Services Offered | Fees and Commissions |

|---|---|---|

| Full-service broker | Investment advice, portfolio management | Higher fees and commissions |

| Discount broker | Limited range of services | Lower fees and commissions |

| Online broker | Online trading, limited services | Lower fees and commissions |

Key Features to Look for in a Broker

Choosing the right broker is key for beginners in online investing. The best sites for new investors have features that help them feel confident. Look for low fees and commissions. Brokers like Interactive Brokers, Charles Schwab, and Fidelity have $0 fees for stock and ETF trades.

A user-friendly platform is also vital. It should be easy to use, helping beginners who are new to investing. Brokers like Webull and moomoo have mobile apps for easy trading on the go.

Low Fees and Commissions

Low fees and commissions are a must for beginners. Many brokers now offer $0 fees for stock and ETF trades. This makes starting to invest more affordable. Some also have low margin rates and no minimum account requirements.

User-Friendly Platforms

A platform that's easy to use is critical for beginners. It should help you make smart investment choices. Some brokers provide educational tools like webinars and tutorials to teach you more.

When picking a broker, think about what matters most to you. You might want low fees, a simple platform, or educational resources. There are many brokers with features to help you reach your investment goals. By researching and comparing, you can find the best site for beginners that suits your needs.

Top Stock Brokers for Beginners in 2023

Finding the best investment sites for beginners is key. Look at the features and benefits of each brokerage account. Robinhood, E*TRADE, TD Ameritrade, and Charles Schwab are top choices. They offer low fees, easy-to-use platforms, and learning tools.

These brokers have great services like no-commission trading and low fees. Robinhood lets you trade stocks, ETFs, and options for free. E*TRADE also has a $0 commission for online stock and ETF trades.

What makes these brokers stand out? They have:

- Low fees and commissions

- User-friendly platforms

- Educational resources and tools

- Commission-free trading

Charles Schwab is the top online broker for beginners, with a 4.5 out of 5 stars rating. E*TRADE is the best for easy trading. Fidelity is the top pick for young investors.

| Broker | Rating | Features |

|---|---|---|

| Charles Schwab | 4.5/5 | Low-cost ETFs, index investing, $0 fees for stock, ETF, and Schwab Mutual Fund OneSource trades |

| E*TRADE | 4.5/5 | Intuitive platform, $0 commissions for online stock and ETF trades, educational resources |

| Robinhood | 4.5/5 | $0 commissions for stocks, ETFs, and options, user-friendly platform |

Comparison of Commission Structures

For beginners in online investing, knowing about stock broker commissions is key. The right broker for you will have a commission plan that fits your goals and budget. Some brokers don't charge for trading, while others have flat or percentage fees.

It's important to think about the types of investments you'll make. For instance, some brokers might charge for mutual funds but not for stocks or ETFs. Zero commission fees for these trades are available at places like Robinhood, Ally Invest, and Fidelity Investments.

Here's a look at how some well-known brokers charge:

| Broker | Commission Structure |

|---|---|

| Robinhood | Commission-free trades for stocks, ETFs, and options |

| Ally Invest | $0.00 commission for stocks, ETFs, and options |

| Fidelity Investments | Zero commission fees for stock, ETF, and options trades |

In summary, the best broker for beginners depends on their investment plans and budget. By looking at different commission plans, beginners can pick the broker that suits them best.

Importance of Research Tools

Investing wisely starts with the right tools. The best accounts for beginners come with tools like charting, analysis, and market research. These help new investors spot trends and make smart choices.

Top companies for beginners also offer learning resources. They have webinars, tutorials, and articles to guide new investors. These tools help build confidence and knowledge.

Some key tools for beginners include:

- Charting and analysis tools to track market trends

- Market research for the latest trends and opportunities

- Stock screeners to filter stocks by criteria like price and yield

Using these tools, beginners can make better investment choices. Many online brokers, like Robinhood and E-Trade, offer these tools. This makes starting to invest easier.

| Broker | Research Tools | Fees |

|---|---|---|

| Robinhood | Charting and analysis tools, access to market research, stock screeners | $0 per trade |

| E-Trade | Charting and analysis tools, access to market research, stock screeners | $0 per trade |

| TD Ameritrade | Charting and analysis tools, access to market research, stock screeners | $0 per trade |

Evaluating User Experience and Interface

Online investing needs a user-friendly interface and a good mobile app. The top sites for beginners make it easy to use. A bad design can make users unhappy and leave.

Being able to use the site anywhere, anytime is key. The best sites have apps for both iOS and Android. This lets users trade whenever they want. Brokers like TD Ameritrade and Fidelity have great apps for this.

Mobile App Functionality

Looking at a broker's mobile app is important. A good app should have a few things:

- Easy navigation and design

- Real-time market data and quotes

- Ability to trade and manage accounts

- Access to research and analysis tools

By looking at these, beginners can find the best sites for them. These sites offer a smooth experience.

Understanding Account Types Available

Choosing the right account type is key when investing. A brokerage account for beginners is a good start. It offers many investment choices and flexibility. The best accounts for newbies also provide learning tools and support.

Individual Brokerage Accounts

Individual brokerage accounts are popular for beginners. They let you invest in stocks, bonds, and mutual funds. Key features include:

- No contribution limits, providing flexibility as market conditions change

- Option to handle trades on their own or work with an advisor

- Access to margin trading options, allowing investors to access up to 50% of their securities value

Retirement Accounts

Retirement accounts, like 401(k) or IRA, help save for retirement. They offer tax benefits and various investment choices. This makes them ideal for long-term saving.

Education Savings Accounts

Education savings accounts, such as 529 plans, aid in saving for education. They provide tax benefits and many investment options. This makes them perfect for saving for your children's education.

Learning Resources and Educational Support

For those starting with online investing, having good learning resources is key. The top sites for beginners offer many tools and materials. These help users learn more about investing.

Webinars and tutorials are great for learning. They make investing interactive and fun. Articles and podcasts also share important investment insights. Plus, community forums let you connect with other investors and share your experiences.

Experts say the SEC website, NerdWallet, and "The Intelligent Investor" by Benjamin Graham are top picks. Ric Edelman’s podcast and Investopedia.com are also highly recommended. Mobile apps like Stash and Acorns are great for beginners too.

| Resource | Description |

|---|---|

| SEC website | Provides detailed information on investing and the stock market |

| NerdWallet | Offers personalized financial advice and investment guidance |

| Investopedia.com | Provides detailed explanations of investment terms and concepts |

By using these resources, beginners can grow their investment knowledge. This helps them make better choices when investing online.

Customer Service: A Key Factor

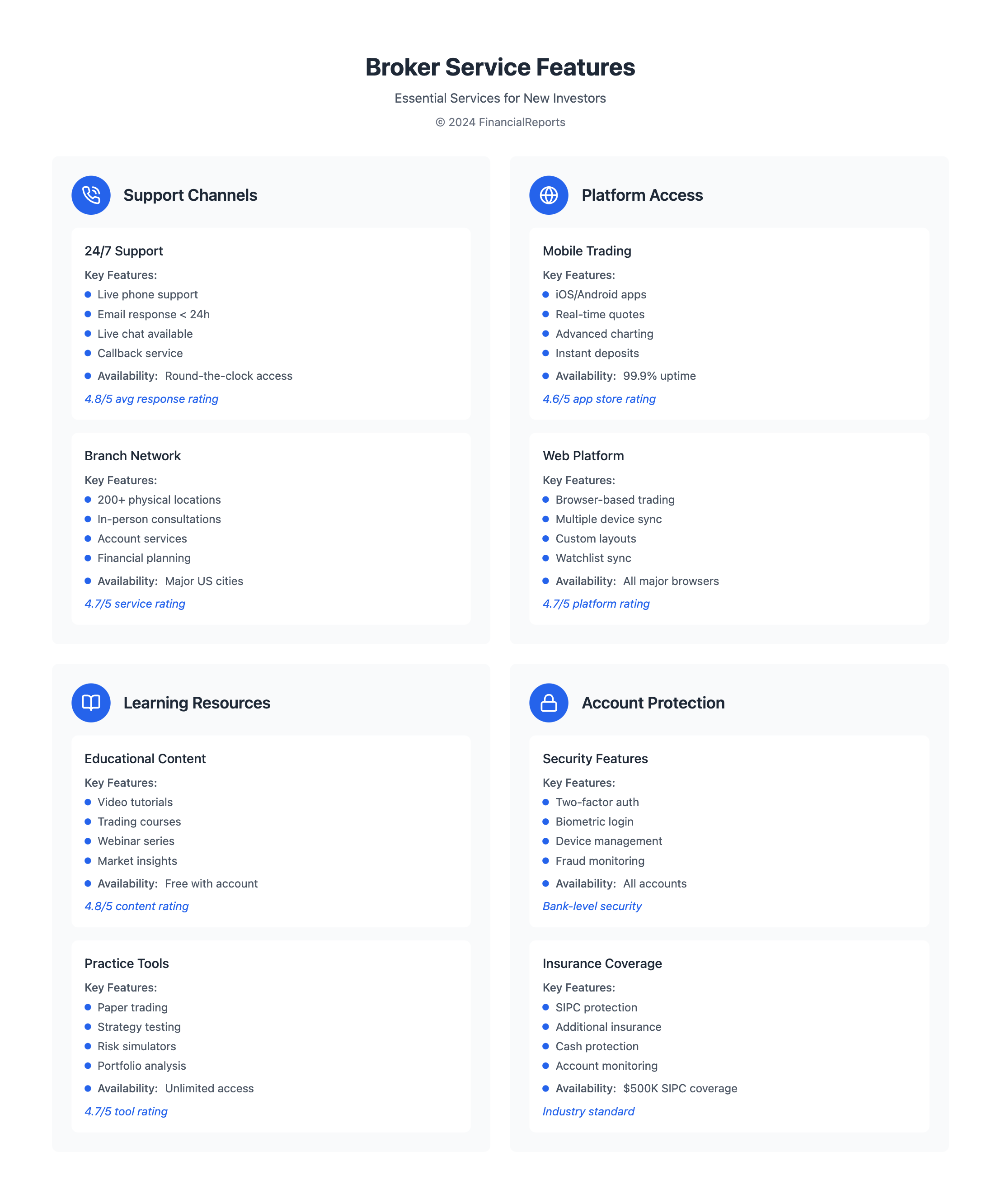

Choosing the right investment site for beginners means looking at customer service. A great customer service team can greatly improve a beginner's investment journey. The best stock broker for beginners should have a team that answers questions quickly and knows a lot.

Online brokerage platforms like Fidelity and Charles Schwab are known for their excellent customer service.

Availability and Responsiveness

A good customer service team should be available 24/7. They should also answer emails and phone calls quickly. Look for features like:

- 24/7 phone support

- Live chat support

- Email support

- FAQ section on the website

Channels of Support

The best investment sites for beginners should offer more than just phone and email support. They should also have live chat and online forums. These options make it easier for beginners to start investing.

Security and Regulation of Brokers

When picking the best investment accounts for beginners, security and regulation are key. The Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC) are vital. They regulate stock brokers and protect investors.

FINRA rules ensure a customer's equity is at least 25 percent of the account's market value. This keeps the account safe.

The best investment companies for beginners must follow rules like Regulation Best Interest (Reg BI) and Form CRS. These rules protect retail investors. Reg BI makes sure broker-dealers act in the best interest of their customers. Form CRS requires a brief summary for retail investors.

Brokerage firms like Interactive Brokers (IBKR) and OANDA US offer safe and regulated platforms. Investors can trade and manage their accounts securely.

| Regulation | Description |

|---|---|

| FINRA | Regulates stock brokers and protects investors' interests |

| SEC | Enforces regulations such as Reg BI and Form CRS to protect retail investors |

| Reg BI | Establishes a "best interest" standard for broker-dealers |

| Form CRS | Requires broker-dealers and investment advisers to provide a brief relationship summary |

In conclusion, the security and regulation of brokers are vital when choosing investment accounts for beginners. Knowing the regulations helps investors make smart choices. They can pick reputable companies to manage their investments.

Tips for New Investors

Starting to invest online is exciting but needs a solid base. You should set a budget, learn the stock market basics, and make smart choices. The best sites for beginners offer learning tools and resources.

Here are some tips for new investors:

- Start with a budget and stick to it

- Spread your investments to reduce risk

- Regularly check your investments and adjust as needed

By following these tips and using the right platforms, beginners can succeed in online investing.

Remember, investing comes with risks, like losing your money. But, with the right plan and patience, you can grow your wealth. As Warren Buffett said, don't invest in something you don't understand. Stay informed and make smart choices to reach your financial goals.

| Investment Type | Risk Level | Potential Return |

|---|---|---|

| Stocks | High | High |

| Bonds | Low | Low |

| ETFs | Medium | Medium |

Conclusion: Choosing the Right Broker

Starting your investment journey means picking the right stock broker is key. Find a broker that matches your financial goals and strategy. Our guide helps you pick the best brokerage account for beginners, focusing on fees, features, and learning resources.

Choosing a stock broker isn't easy. You need to think about your personal needs, how much risk you can take, and what you want to achieve. Use our final checklist to make sure you find the perfect broker for you.

Being a new investor or an experienced trader, staying updated and diversifying your portfolio is important. With the right broker, you're on your way to reaching your investment goals. This will help you build a secure financial future.

FAQ

What are the key features to look for in a stock broker for beginners?

Beginners should look for low fees and commissions. They should also find platforms that are easy to use. Good customer support and educational resources are also important.

What are the different types of stock brokers available?

There are two main types: full-service and discount brokers. Full-service brokers offer personalized guidance. Discount brokers have lower fees and a self-directed approach.

How do stock brokers make money?

Stock brokers make money through commissions and fees. These fees come from executing trades and managing accounts.

What are the top stock brokers for beginners in 2023?

In 2023, top stock brokers for beginners include Robinhood and E*TRADE. TD Ameritrade and Charles Schwab are also great options. They offer features and benefits for new investors.

What types of investment accounts are available for beginners?

Beginners can choose from individual brokerage accounts and retirement accounts. Education savings accounts are also available. Each has its own features and tax implications.

What kind of learning resources and educational support do stock brokers provide for beginners?

Stock brokers offer many educational resources. These include webinars, tutorials, and articles. Podcasts and community forums are also available to help beginners learn.

How important is customer service when choosing a stock broker?

Customer service is very important. It greatly affects the investment experience. Look for brokers with responsive support through phone, email, and live chat.

What regulatory framework governs stock brokers?

Stock brokers are regulated by FINRA and the SEC. These organizations ensure brokers follow strict standards. This includes data protection and compliance.

What tips can you provide for new investors?

Start with a budget and diversify your portfolio. Regularly review your investments. Make sure they match your financial goals and risk tolerance.