Discover 'Good Shares' for Lasting Wealth: Top Long-Term Investment Picks

Long-term investing is a smart way to grow wealth in the stock market. Berkshire Hathaway, for example, has seen nearly 20% annual returns. Choosing the right shares for the long haul can be very profitable. It's important to pick the best stocks for lasting success.

Those aiming for long-term wealth look for shares that will last. The best stocks can be the backbone of a strong portfolio. We'll dive into long-term investments and highlight the top picks for lasting wealth.

Introduction to Long-Term Investing

Long-term investing means holding onto shares for a long time. This allows investors to weather market ups and downs. Stocks like those in Berkshire Hathaway offer stable and significant gains, making them great for long-term investors.

Key Takeaways

- Long-term investing can be an effective way to build wealth in the stock market.

- Good shares for long term investment, such as those held by Berkshire Hathaway, can provide significant returns.

- The best long term stocks often have a strong track record of performance and a solid financial foundation.

- Investing in good long term stocks requires a long-term perspective and a willingness to ride out market fluctuations.

- Diversification is key to minimizing risk and maximizing returns when investing in good shares for long term investment.

- Investors should prioritize expertise and market knowledge when selecting the best long term stocks for their portfolio.

Understanding Long-Term Investments

Long-term investments are key to building wealth. They offer stability and growth over time. When looking at recommended long term stocks, it's important to know the benefits and risks. Long term stocks can help grow your wealth, but you need a smart strategy.

Long-term investments have many benefits. They can offer higher returns and lower risk. The S&P 500 has shown positive returns most years, making it a good choice for best stocks to invest in 2024 for long term. But, it's important to understand the risks, like market ups and downs.

Definition of Long-Term Investments

Long-term investments are held for three years or more. They need patience and discipline. It's important to stay calm during market changes and avoid quick decisions.

Benefits of Holding Shares Long-Term

Holding shares long-term can be rewarding. It can lead to higher returns and lower risk. By sticking with long term stocks, you can grow your wealth over time.

Risks Associated with Long-Term Investments

Long-term investments have risks, like market volatility and losses. It's vital to approach recommended long term stocks with a smart plan. Focus on the long-term, not quick gains.

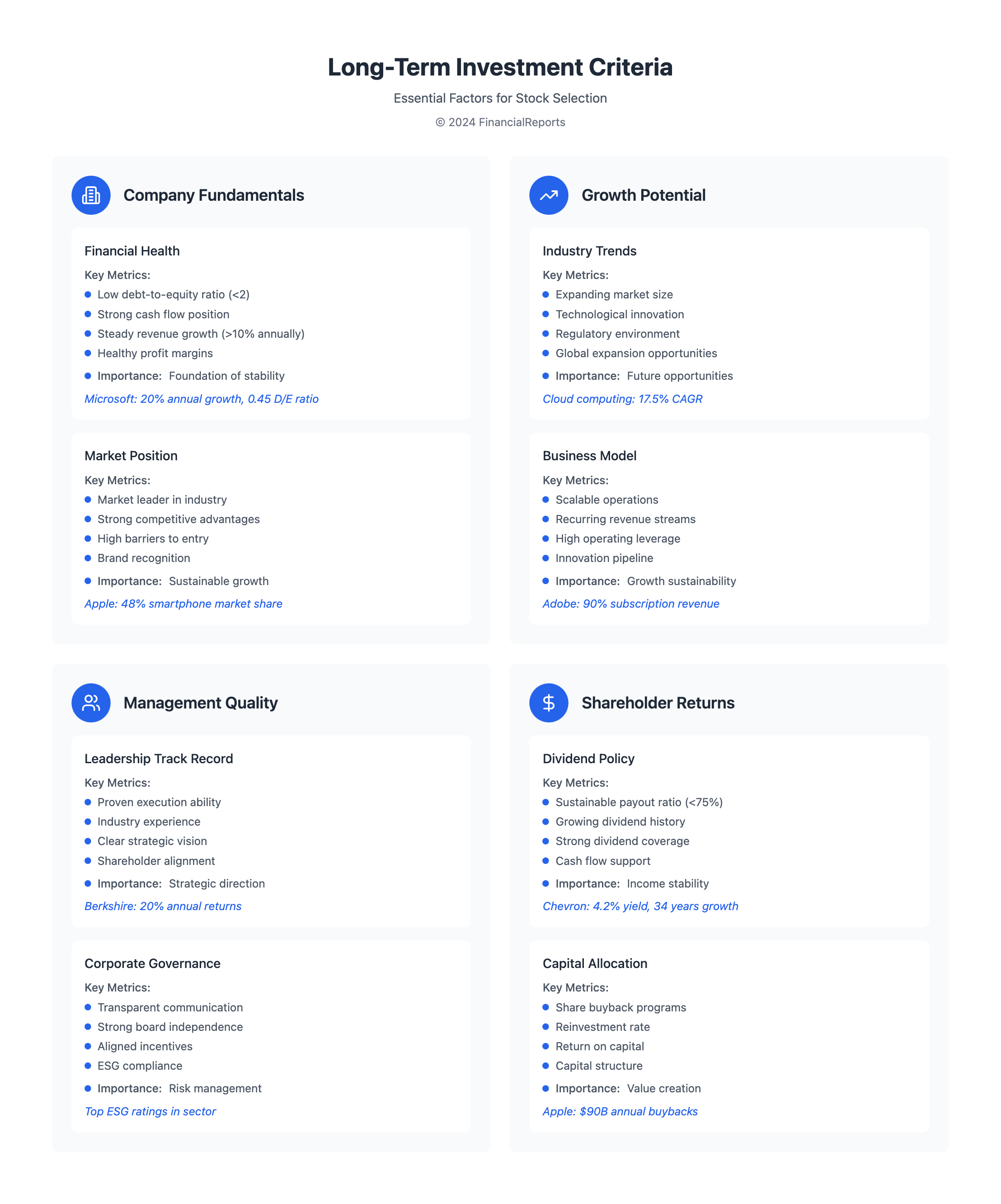

Criteria for Selecting Good Shares

Choosing good shares for long-term investments involves several key criteria. It's important to analyze a company's financial health, market standing, and management team. This approach helps investors make better decisions and reach their goals.

When evaluating stocks, look at financial metrics like revenue growth and profit margins. Also, consider the company's market position and the experience of its management team. These factors help identify the best stocks for long-term investment.

Some key metrics to consider include:

- Revenue growth: A company with a strong track record of revenue growth is more likely to continue growing in the future.

- Profit margins: A company with high profit margins is more likely to be profitable and generate strong returns for investors.

- Return on equity: A company with a high return on equity is more likely to be generating strong returns for shareholders.

By evaluating these factors, investors can make informed choices. This increases their chances of achieving their investment goals with good long-term investments.

| Criteria | Importance |

|---|---|

| Financial Performance | High |

| Market Position | Medium |

| Management Team | High |

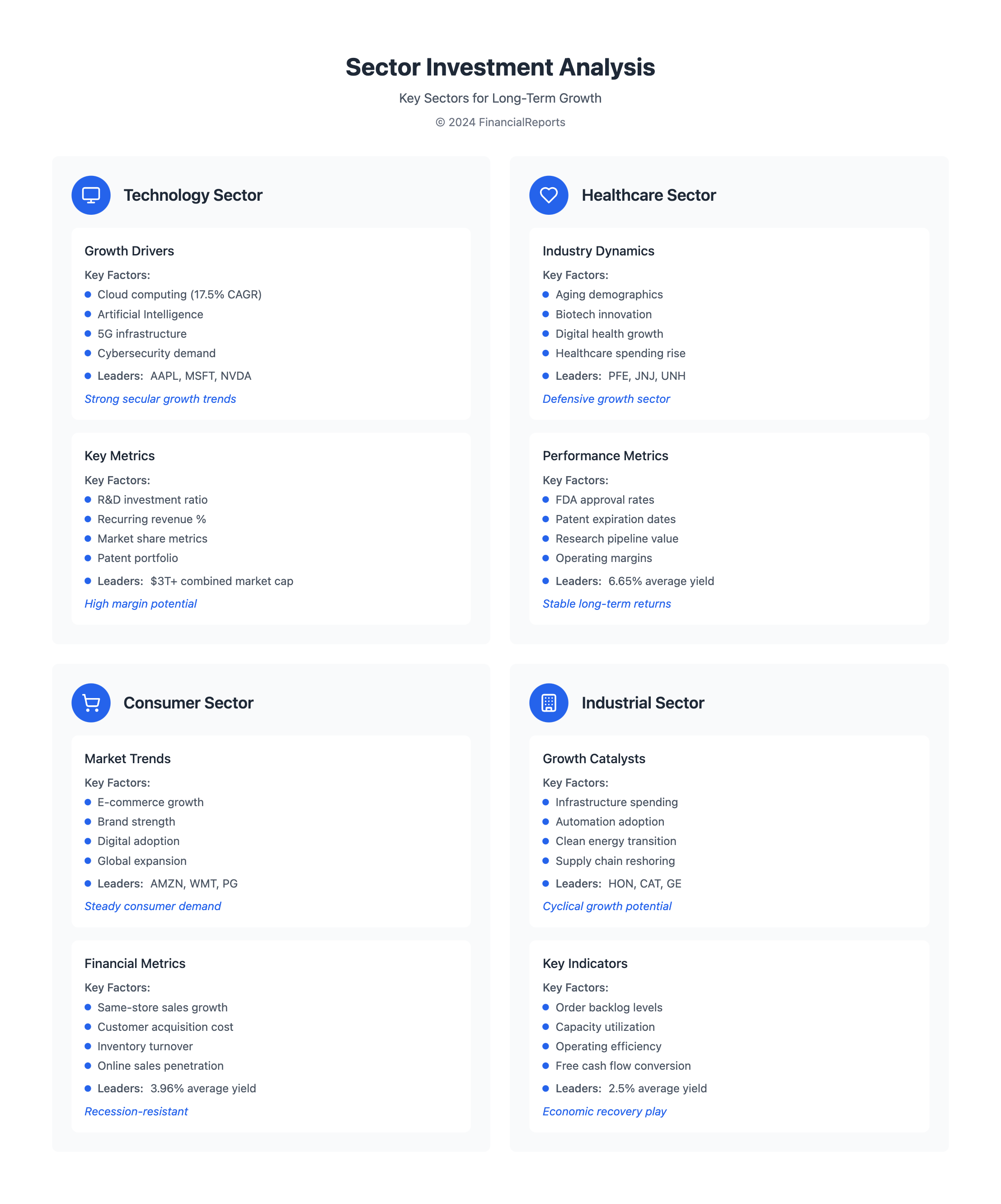

Sector Analysis for Long-Term Shares

When looking at the best long term stock investments, it's key to check out different sectors. The tech sector has often done well, with many companies growing a lot over 20 years. For those aiming to hold stocks for 20 years, tech companies like cloud computing, AI, or cybersecurity ones might be good.

The healthcare sector, on the other hand, is more stable and safe. It includes companies in pharmaceuticals, biotech, or medical devices. This sector can protect against market ups and downs, making it a solid choice for long-term growth. When looking at healthcare companies, consider their new product pipelines, regulatory issues, and competition.

| Sector | Growth Potencial | Risks |

|---|---|---|

| Technology | High | Regulatory risks, intense competition |

| Healthcare | Moderate | Regulatory risks, patent expirations |

| Consumer Goods | Low | Economic downturns, changing consumer preferences |

Doing a deep dive into sector analysis is vital for finding the best long term stock investments. By looking at growth chances and risks in various sectors, investors can build a balanced portfolio. This portfolio should match their investment goals and how much risk they can handle.

Top Good Shares for Long-Term Investment

When looking at the top 10 stocks for long-term investment, it's key to pick companies with a solid financial history and growth chances. Blue-chip stocks, emerging market stocks, and dividend-paying shares are often part of a good strategy. Apple, with a huge market value of $3.39 trillion, is a top choice for those seeking stability and growth.

Chevron and Microsoft are also worth considering. Chevron has a market value of $276.8 billion and a 4.2% dividend yield. Microsoft, with a market value of $3.08 trillion, offers a 0.8% dividend yield. These companies have a strong financial base and a history of giving good returns to investors. Adding these stocks to a long-term plan can help investors grow their wealth and get regular income.

Blue-Chip Stocks to Consider

- Apple: market value of $3.39 trillion

- Microsoft: market value of $3.08 trillion, dividend yield of 0.8%

- Chevron: market value of $276.8 billion, dividend yield of 4.2%

Emerging Market Stocks with Potencial

Investors might also look at emerging market stocks, like those in tech or healthcare. These offer growth and diversification chances. Mixing these with blue-chip and dividend stocks can make a balanced long-term portfolio.

Dividend-Paying Shares Worth Holding

Dividend stocks, like Pfizer, can give a steady income. Pfizer has a market cap of $143 billion and a 6.65% yield. Roche and Nestle are also good choices, with yields of 3.80% and 3.96% respectively.

| Company | Market Capitalization | Dividend Yield |

|---|---|---|

| Pfizer | $143 billion | 6.65% |

| Roche | $231 billion | 3.80% |

| Nestle | $215 billion | 3.96% |

Evaluating Market Trends and Consumer Behavior

Investing in shares for the long term requires understanding market trends and consumer behavior. It's important to analyze economic indicators like GDP growth and inflation rates. This helps investors spot the best stocks for long-term growth and make smart choices.

Consumer behavior, such as spending patterns and preferences, also affects market trends. For example, an increase in online searches for a product shows growing demand. Monitoring these trends helps investors make better investment decisions.

Some key factors to consider include:

- Demographic changes and their impact on consumer spending

- Technological advancements and their influence on market trends

- Shifts in consumer preferences and values

By keeping up with market trends and consumer behavior, investors can boost their chances of success. Whether looking to invest in shares for the long term or find the best share to buy, understanding these factors is vital.

The Importance of Diversification

Diversification is key to a good long-term investment plan. It helps manage risk and can lead to higher returns. By investing in different types of assets, industries, and regions, you can lower the risk of market ups and downs. This is very important when picking good stocks to buy and hold to reduce the risks of individual stocks.

When you invest in stocks for long term investment, having a diverse portfolio is essential. It helps even out returns and lessens the effect of market swings. The Financial Industry Regulatory Authority (FINRA) recommends having 15 to 30 stocks across various industries for the best diversification. Also, index funds and best buy and hold stocks are great for spreading your investment and getting into many assets at once.

To build a balanced investment plan, keep these tips in mind:

- Spread your investments across different asset classes, like stocks, bonds, and cash

- Invest in companies of different sizes, industries, sectors, and locations

- Think about adding commodities, like gold or silver, for more diversification

By following these tips and keeping your portfolio diverse, you can boost your chances of long-term success. And you'll also lower your risk in the market.

The Role of ETFs and Index Funds

Exchange-traded funds (ETFs) and index funds are great for investors looking for long term growth. They offer diversified portfolios, which can lower risk and boost the chance of safe investments.

ETFs are special because they track a specific index, like the S&P 500, and can be traded during the day. This makes them a favorite for those wanting to grow their investments over time. Plus, they usually cost less than actively managed funds, which is good for your wallet.

Some key benefits of ETFs and index funds include:

- Diversification, which can reduce risk and increase the chance of long term growth

- Lower expense ratios compared to actively managed funds

- Flexibility of intraday trading

- Potentially lower risk due to their diversified nature

When looking at ETFs and index funds for long term investing, it's key to check the fees. Also, think about the chance for long term growth. Adding these to your portfolio can help you reach your financial goals. It can also help you invest in stocks and shares for the long haul while keeping risk low and returns high.

| Investment Vehicle | Expense Ratio | Diversification | Fees |

|---|---|---|---|

| ETFs | Lower | High | Lower |

| Index Funds | Lower | High | Lower |

Common Mistakes to Avoid in Long-Term Investing

Investing in stable stocks for long-term growth is key. But, it's important to avoid common mistakes. These can hurt your success. Investing wisely in good stocks for long term growth needs a solid plan and discipline.

One big mistake is emotional investing. It leads to quick, often bad decisions.

To invest in good stocks to buy for long term, do your homework. Set clear goals. Here are some mistakes to dodge:

- Emotional investing and making decisions based on fear or greed

- Ignoring market research and failing to stay informed about market developments

- Lacking diversification and putting too much money into a single investment

Avoid these mistakes to boost your chances of success. Invest in stable stocks with a long-term view. Always check your portfolio and goals to stay on track.

Tools and Resources for Investors

Investors have many tools and resources to help them make smart choices. AlphaSense gives access to over 10,000 sources of information. This includes trade journals, news, and SEC filings. It helps investors find the best shares for the long term by analyzing a lot of data.

The Expert Transcript Library is another great tool. It has tens of thousands of transcripts from one-on-one calls with experts. This gives investors valuable insights for long term investment. Wall Street Insights® also offers equity research from over 1,000 firms. It helps in finding the best shares for the long term.

FinViz and PortfolioVisualizer are also important resources. FinViz has a stock screener with 76-factor options. PortfolioVisualizer offers free tools for portfolio analysis. These tools help investors create effective long term strategies and find the right shares.

The Long-Term Investment Mindset

Investing in the stock market needs a long-term view. It's about focusing on best stocks to invest in for long term goals. A study showed that those who pulled out in March 2020 missed the quick recovery. This shows why it's key to stay in good long term investment stocks and not make quick decisions.

A long-term investment mindset means being disciplined, patient, and strategic. It's about keeping your eyes on the long-term goals and not getting swayed by short-term ups and downs. Some ways to stay on track include:

- Dollar cost averaging: investing a fixed amount regularly, no matter the market.

- Diversification: spreading your money across different types to lower risk.

- Regular portfolio reviews: checking and tweaking your investments to match your goals.

Strategies for Staying Focused

Those who stick to their plan and invest in best long term investment stocks during ups and downs are more likely to hit their goals. By avoiding quick decisions and sticking to their strategy, investors can weather market storms. They can also tap into the stock market's long-term growth.

Tracking and Reviewing Your Investments

Keeping an eye on your investments is key to smart choices. It's wise to check your portfolio at least twice a year. Look at changes in your goals, risk level, and how your investments are doing. This helps you see where you can do better and keeps your investments in line with your goals.

When checking how your investments are doing, look at things like returns, fees, and risk. Online tools like Empower, SigFig Wealth Management, and Sharesight can help. They let you track your investments and get advice tailored just for you. These apps have features for tracking your money, showing you how your investments are doing, and helping you balance your portfolio.

Some important things to think about when reviewing your portfolio include:

- Change in investment objectives

- Risk attitude

- Performance differences

- Rebalancing needs

- Cost analysis

- Changes in tax rules or allowances

By regularly checking and tracking your investments, you can make smart choices. This helps you reach your long-term financial goals.

Conclusion: Building Wealth Through Smart Share Investments

Building lasting wealth needs a smart plan. Stocks have often given high returns over time. They are a great choice for growing your money.

Bonds offer steady income and help balance risk in your portfolio. Index funds give broad market access at low cost. They are good for both new and seasoned investors.

Starting early, even with a little, is key. Compound interest can make a big difference. By spreading your investments and using dollar-cost averaging, you can handle market ups and downs.

Platforms like iFlip make it easier to build wealth. They offer chosen stock portfolios and manage risk. These platforms help investors of all levels reach their goals. They focus on low-cost, clear investing, changing how we build wealth.

FAQ

What are the benefits of holding shares for the long term?

Long-term investments offer stability and growth. They help build wealth over time. By holding shares long, investors can benefit from compounding returns and manage market ups and downs.

How do I evaluate the right shares for long-term investment?

When picking shares for the long haul, look at a company's financials and market position. Also, consider the strength of the management team. These factors help spot shares with growth chances.

Which sectors are promising for long-term investment?

The tech, healthcare, and consumer goods sectors are promising. Look at industry trends and growth drivers. This helps find the best sectors for your long-term portfolio.

What are some examples of good shares for long-term investment?

Blue-chip stocks, emerging market stocks, and dividend shares are good options. They often have a solid financial history and growth prospects.

How can I monitor and review my long-term investments?

Regularly check your investment portfolio. Set a schedule to monitor your shares' performance. Look at financial ratios and market trends to keep your strategy on track.

What are the common mistakes to avoid in long-term investing?

Avoid emotional investing and ignoring market research. Don't forget to diversify your portfolio. A disciplined, data-driven approach boosts your chances of success.