Define Accounting and Finance: A Complete Guide

Understanding a company's financial health requires knowing accounting and finance. These areas are key to any business's success. The definition of accounting and finance includes managing money, tracking spending, and using funds wisely. It's crucial for making sense of financial data and tackling complex issues.

Accounting needs precision because a small mistake can greatly affect taxes. Through understanding accounting and finance meaning, smart businesspeople look at financial health. This includes checking debts and what they own. This knowledge helps share accurate financial statements with banks and investors.

Good financial reports help share information within a company. This includes with employees who own shares. Also, creating a budget based on strong accounting practices is key. It helps a business grow and stay stable.

Key Takeaways

- Knowing accounting and finance well is crucial for strategic plans and following rules.

- Becoming a CPA shows you've studied a lot and know your stuff.

- Careers in finance and accounting help each other through shared learning.

- Getting ahead in finance often means earning a master's degree.

- Being a good thinker and communicator is important in both areas.

- Accounting focuses on being exact, while finance is about analyzing and deciding.

What is Accounting?

Accounting is all about keeping track of money for businesses. It shows how healthy an organization's finances are. It's key for obeying the law and making smart business choices.

Definition of Accounting

Accounting means recording all business money movements. It helps make financial statements to check how a company is doing. This work makes sure every penny is counted and keeps the company's financial health clear.

Importance of Accounting

Accounting is super important, not just for following the law. It helps companies decide how to move forward. It's also about managing money well to make a business run smoothly, keeping an eye on what’s owned, owed, and earned.

Types of Accounting

It's crucial to know the different types of accounting. This helps tell apart areas like financial accounting from management accounting. See the table below for the main types of accounting:

| Type | Focus | Primary Users |

|---|---|---|

| Financial Accounting | Recording economic events | External stakeholders (Investors, Regulators) |

| Management Accounting | Internal decision making | Company Managers |

| Tax Accounting | Taxation matters | Tax Authorities, Companies |

| Forensic Accounting | Investigation of financial discrepancies | Legal bodies, Organizations |

Understanding these segments helps spot the key differences. It shows who uses each type of accounting and why. From talking to investors to helping managers make decisions, every type has its role.

What is Finance?

In exploring what is finance, we learn that it's key for both economic and personal stability in various areas. Unlike its relative in fiscal management, the finance accounting difference stands out in its wider range. It deals with managing investments, assets, and strategic planning for growth.

Definition of Finance

Finance involves the smart handling, management, and study of funds. It aids in making financial decisions that help manage capital, invest wisely, and allocate resources. This field fills the gap seen in the finance and accounting pairing, showing a big-picture view of finances and investment chances.

Importance of Finance

The role of finance is crucial in both personal and corporate worlds. It's the foundation for economic growth, keeping up with market changes to boost profits and lessen risks. Finance's strategic parts help maintain financial well-being and help reach long-term money goals.

Types of Finance

- Personal Finance: Manages finances for individuals or families, including budgeting, insurance, retirement planning, and personal investing.

- Corporate Finance: Looks at how corporations handle their finances, which includes finding funding, structuring capital, and making investment choices.

- Public Finance: Controls public spending and economic stability, managing taxes, government budgets, debts, and other governmental financial activities.

- Behavioral Finance: Studies how people's behaviors affect finance decisions and market outcomes.

- Social Finance: Focuses on the social effects of financial choices, aiming for positive impacts like better equality and community involvement.

Knowing what is finance and its key place beside accounting helps people and professionals make wise choices for growth and security. The teamwork and differences between finance and accounting lead to effective methods that are vital for both short and long-term financial health.

The Relationship Between Accounting and Finance

Accounting and finance are key to any organization's strategic operations. Understanding their relationship is crucial. Accounting sets the groundwork with systematic recording and reporting. Finance uses this information for value optimization and strategy. Together, they are vital for making informed decisions and managing finances effectively.

How Accounting Supports Financial Decisions

Accounting is known as the language of business. It is crucial for making financial decisions. By keeping detailed records and adhering to standards like U.S. GAAP or IFRS, accounting shows the true financial state of a company. Financial statements, including income statements and balance sheets, form the base for financial analysis.

This analysis aids in various ways. It helps in budgeting and forecasting, assessing risks, and strategic planning. These tasks allow financial managers to plan for the future and make smart investment choices.

- Budgeting and Forecasting: Accounting data help in crafting accurate budgets and forecasts, enabling financial managers to anticipate future financial needs and performances.

- Risk Assessment: Detailed transaction records aid in assessing the financial risks associated with different investment decisions.

- Strategic Planning: By analyzing financial statements, finance professionals can strategize on resource allocation, investment opportunities, and long-term financial planning.

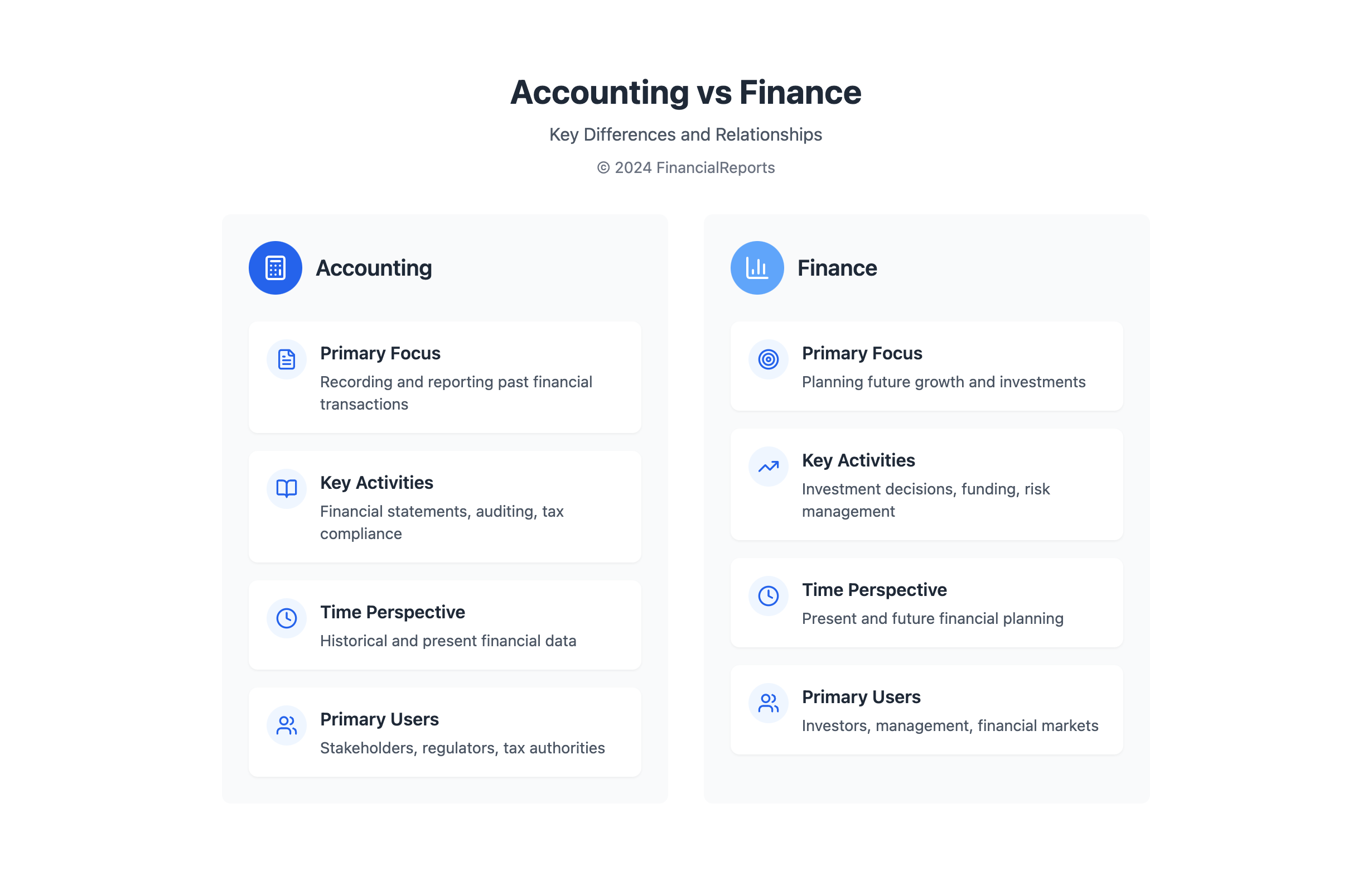

Differences in Focus

Accounting and finance both play unique roles in a business. Accounting focuses on recording past activities accurately. It aims to show a company's financial history. Meanwhile, finance looks ahead, managing assets and liabilities for future growth.

Understanding that is finance and accounting the same shows their difference. Finance uses accounting data for future-oriented decisions and strategies. This emphasizes the important accounting and finance relationship.

To conclude, accounting provides the facts of financial history. Finance then uses these facts to help the company achieve its goals. Their collaboration is critical for any successful organization.

Key Principles of Accounting

For financial pros, it's key to grasp accounting's core principles. They must accurately handle and report financial info. The methods accrual basis accounting and cash basis accounting are vital. They help record and look into business deals.

Accrual Basis vs. Cash Basis

Accrual basis accounting and cash basis accounting shape financial reports and business choices. Each has unique benefits, fitting different business needs and rules.

| Accounting Method | Definition | Usage Scenario | Regulatory Preference |

|---|---|---|---|

| Accrual Basis Accounting | Records financial transactions when they occur, regardless of cash flow. | Used by public companies and larger enterprises. | Favored under GAAP for its comprehensive financial portrayal. |

| Cash Basis Accounting | Records transactions only when cash is received or paid out. | Preferred by small businesses, freelancers. | Simpler and not commonly used in regulated reports. |

Consistency and Relevance

The use of accounting principles must be consistent. This ensures data accuracy and gains trust from shareholders. At the same time, financial info needs to be relevant. It should be so impactful that it influences decisions.

In essence, using accrual basis accounting and cash basis accounting smartly is crucial. Along with ensuring consistency and relevance, it establishes a strong base. This allows for clear and useful financial stories. These accounting principles are key for financial experts striving for clarity and responsibility in finance.

Key Principles of Finance

Understanding finance principles is key for companies planning their strategies today. These principles help businesses make smart financial choices. They learn to grow profits and handle risks better. We'll look at important ideas like the time value of money and risk and return balance.

Time Value of Money

The time value of money (TVM) tells us money now is worth more than the same amount later. It's a big idea in finance, shaping decisions from saving up to big company investments. For example, $5,000 grows to double in 18 years with 4% compound interest.

Risk and Return

The risk and return concept is crucial in finance. High risks can lead to high rewards. Companies use this idea when looking at investments. For example, stocks can give high returns but are risky. This affects how 58% of Americans owning stocks view their financial strategies.

The chart below shows cash flow types important for smart finance strategies:

| Cash Flow Type | Description | Example |

|---|---|---|

| Operating Cash Flow | Net cash generated from normal business activities | Company A reports $1M from sales |

| Investing Cash Flow | Net cash used for investment activities | Purchase of new plant machinery |

| Financing Cash Flow | Net cash from financial activities like loans or dividends | Issuance of $500K in new equity |

| Free Cash Flow | Net cash after expenses and investments | $200K after all expenditures for the fiscal year |

Learning these principles is key to making better finance strategies. It helps firms stay strong and profitable. For more on finance, look into financial accounting principles. It's vital for finance experts.

Financial Statements

The world of accounting and financial statements is key to knowing how a company is doing. There are three main reports: the balance sheet, the income statement, and the cash flow statement. They give a full picture of a business's financial health. This is important for people who have a stake in the business and for regulation.

Balance Sheet

A balance sheet shows a company's financial standing at a certain moment. It details assets, liabilities, and equity. This gives a clear picture of financial health and ability to operate. For example, ExxonMobil Corporation had $376.3 billion in assets, liabilities of $163.8 billion, and equity of $212.5 billion on December 31, 2023. This report is key for understanding how liquid and solvent a business is.

It affects how much confidence investors have and lending decisions.

Income Statement

The income statement is crucial for financial reporting. It shows the company's financial activities over time. It lists revenues, expenses, and the net income. For FY 2023, ExxonMobil showed revenue of $344.6 billion and expenses of $291.8 billion. This resulted in a net income of $36 billion. This document is vital for seeing how efficient and profitable a company is.

It helps with making investment and strategic choices.

Cash Flow Statement

The cash flow statement digs into cash movements from operations, investments, and financing. It's key for seeing how a company handles its cash, funding, and financial options. This document is crucial for checking the company's short-term health. Especially, its ability to pay off expenses and debts.

| Statement Type | Total Reported |

|---|---|

| Total Assets | $376.3 billion |

| Total Liabilities | $163.8 billion |

| Total Equity | $212.5 billion |

| Total Revenue | $344.6 billion |

| Total Expenses | $291.8 billion |

| Net Income | $36 billion |

Understanding accounting and financial statements makes things clearer and helps with making smart choices. It shows why being detailed and accurate in financial reporting is so significant.

Accounting Standards and Regulations

Following accounting standards and regulations is crucial for open and honest financial accounting and reporting. In the United States, firms use the Generally Accepted Accounting Principles (GAAP). This set of rules is enforced by the Financial Accounting Standards Board (FASB). Meanwhile, the International Financial Reporting Standards (IFRS) guide companies elsewhere. The International Accounting Standards Board (IASB) manages these standards.

Generally Accepted Accounting Principles (GAAP)

GAAP isn't just a bunch of rules; it's a framework. This framework makes sure financial statements are true, uniform, and fair. The FASB oversees GAAP. They ensure it stays up-to-date with the changing economy. An important rule from the Securities and Exchange Commission (SEC) demands that U.S. listed companies use GAAP in their reports.

International Financial Reporting Standards (IFRS)

IFRS helps the world understand company finances by making them comparable across countries. This set of standards brings different national accounting systems together. It's crucial for businesses that work in several countries. IFRS makes it easier for global investors and companies to make smart money choices.

| Standard | Developed by | Adoption | Key Focus |

|---|---|---|---|

| GAAP | Financial Accounting Standards Board (FASB) | United States | Enhancing transparency and comparability within the U.S. |

| IFRS | International Accounting Standards Board (IASB) | Global, primarily outside the U.S. | Facilitating global trade and economic activities by ensuring consistency across borders |

Accounting standards are more than just rules. They safeguard people who have a stake in businesses and help the world's economy stay steady. They've come a long way since the SEC and early accounting groups started. Today, FASB and IASB are key in making financial info trustworthy in our connected markets.

Financial Analysis Techniques

In the world of finance, knowing how to check if a company is doing well is crucial. We use financial analysis techniques like ratio analysis and trend analysis for this. They help us understand where a company stands today and predict its future.

Ratio Analysis

Ratio analysis takes a deep dive into a company's financial statements. It looks at how well a company is doing in areas like liquidity, profitability, and ability to pay off debts. For example, Return on Assets (ROA) shows how good a company is at making money from its assets. Amazon.com saw its Operating Profit Margins jump from 3.7% in the first quarter of 2023 to 10.7% in the same quarter of 2024.

Trend Analysis

Trend analysis gathers data over time to spot trends and predict future happenings. It's key for smart investing and planning. By looking at financial info over many years, we can see growth patterns. This helps guess how well a company will do later.

Financial analysis looks back at a company’s past performance and guesses its future success. Analysts use complex math like Net Present Value (NPV) and Internal Rate of Return (IRR) to see if investments will pay off. They need to know a lot about financial measures and be experts in tools like Excel. This ensures their work on financial predictions and valuations is accurate.

Courses like those from CFI, such as the Financial Modeling and Valuation Analyst (FMVA) certification, train analysts well. They learn about ratio analysis and trend analysis, among other important things in finance.

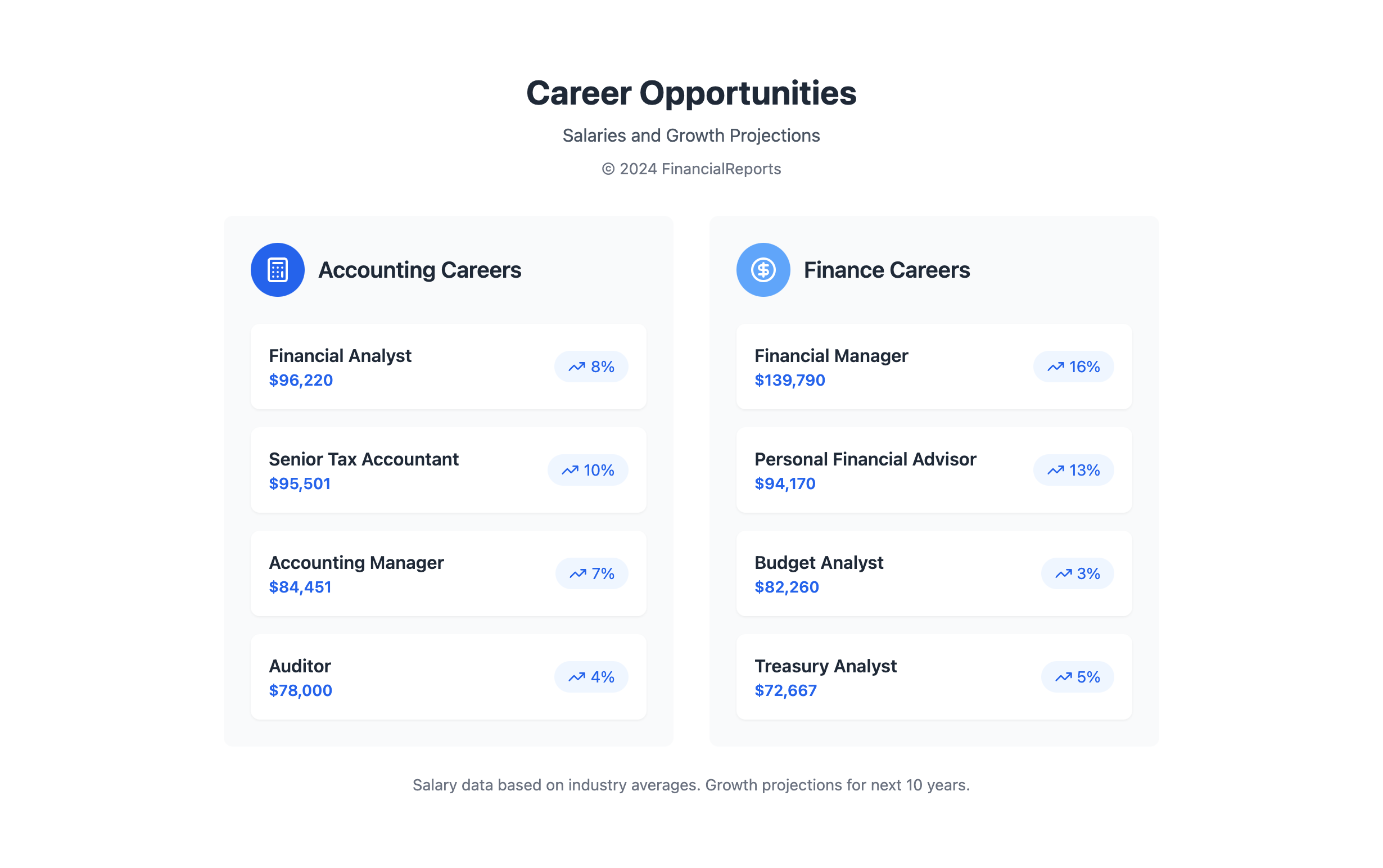

Career Opportunities in Accounting and Finance

The world of career opportunities in finance and roles in accounting is full of promise for eager professionals. Each field offers various paths leading to successful careers. These come with great pay and chances to move up.

Roles in Accounting

Roles in accounting come in many forms. You may start as auditors or accountants and grow into specialized positions. Fields like forensic accounting and compliance are options. Climbing higher can get you to be a Chief Financial Officer (CFO) or Controller. This highlights the great potential in accounting vs finance careers.

- Certified Public Accountants (CPAs) earn about $99,000, while Certified Management Accountants (CMAs) make close to $102,000. This shows how profitable these careers can be.

- Where you work matters too. Accountants in places like New York and California see higher salaries because of the local economy.

Roles in Finance

In finance, the job variety is impressive. You'll find Financial Analysts, Financial Managers, and Personal Financial Advisors in high demand. These jobs need people good at analyzing data and making smart decisions. Such skills help navigate the complex global markets.

- Financial Managers are notable with an average pay of $139,790 and a growth rate of 16%. This points out the excellent career opportunities in finance.

- Personal Financial Advisors are also in demand. They’re expected to grow by 13%, highlighting the need for personal financial advice.

Below is a table showing how well these jobs pay, along with their growth. It proves a stable and lucrative future in these careers.

| Position | Average Salary | Projected 10-Year Growth |

|---|---|---|

| Financial Analyst | $96,220 | 8% |

| Senior Tax Accountant | $95,501 | 10% |

| Accounting Manager | $84,451 | 7% |

| Budget Analyst | $82,260 | 3% |

| Credit Analyst | $78,850 | 4% |

| Auditor | $78,000 | 4% |

| Treasury Analyst | $72,667 | 5% |

The information above confirms the good starting pay and growth in these fields. This makes accounting vs finance careers an appealing path for those looking for steady, well-paying jobs in ever-changing areas.

The Future of Accounting and Finance

The world of accounting and finance is about to change a lot. This is because of new technology and different trends. New tools like artificial intelligence (AI), machine learning (ML), and data analytics are important. They will change old ways of doing things. These changes will make things more efficient and smart.

Technological Advancements in Finance

The finance world is quickly using new tech to stay ahead. A study found that 8% of tax firms are now using GenAI. This number will grow as AI makes things more efficient and improves advice. AI in software will make financial work faster. It will also make sure money records are accurate and reduce legal risks. Tools like ChatGPT show how much AI can do in finance.

Technological advancements are very important in finance today.

Trends in Financial Management

Financial management is also seeing new trends. One big trend is green accounting. This is when companies care about the environment in their financial reports. They want to make money in a way that's good for the planet. A study by The Conference Board says that companies are also changing because of remote work. This means accountants need to be flexible in how they work.

As finance uses more tech, there is a bigger need for people good with data. 59% think that finance and accounting use the most data. Even though AI might take some jobs, 58% of accountants believe their skills are unique. They think humans will always be needed in this field.

The future of accounting and finance will include more automation, intelligence, and focus on being green. It will affect everything from investigating financial crimes to planning finances. Accountants and their firms need to keep up with these changes. They must have the right tools and skills to succeed in this new environment.

FAQ

What are the main differences between accounting and finance?

Accounting tracks and reports financial transactions in great detail. It makes sense of numbers through financial statements. Finance, however, is all about managing money. It involves investing, budgeting, and planning for future growth.

How do accounting and finance relate to each other in business operations?

Accounting provides the numbers needed for financial planning and analysis. It's about past transactions and current reports. Finance looks ahead. It uses this information for investments and planning for growth. Both are vital for smart business decisions.

Can you explain the accrual basis and cash basis in accounting?

Accrual basis accounting records earnings and expenses when they occur, not when cash changes hands. Cash basis accounting waits until the cash is actually received or paid. These methods impact how a company's finances are viewed.

What are the key principles of finance?

Important finance concepts include the time value of money. A dollar now is worth more than one later. There's also a balance between risk and return. Higher returns often mean higher risk. These ideas help in managing money wisely.

What purpose do financial statements serve?

Financial statements show how financially healthy a company is. They're prepared by accountants. You'll find balance sheets, income statements, and cash flow statements. They reveal a company's financial performance and stability.

What are GAAP and IFRS?

GAAP and IFRS are frameworks for financial reporting. GAAP is used mainly in the U.S. IFRS is popular in other countries. They ensure financial information is clear and reliable.

What are some of the common financial analysis techniques?

Financial analysis uses techniques like ratio analysis and trend analysis. Ratio analysis looks at financial health through ratios. Trend analysis predicts future performance by looking at past data.

What career opportunities exist in accounting?

Accounting careers can be in public accounting, auditing, and tax accounting, among others. Accountants prepare financial reports, ensure legal compliance, and give financial advice. They also manage taxes and investigate financial crimes.

What career opportunities exist in finance?

In finance, you can become a financial analyst, manager, or investment banker. There are also personal financial advisors. These professionals handle financial data analysis, manage financial health, raise capital, and offer financial planning.

How are accounting and finance expected to evolve with technological advancements?

Technology like automation and machine learning will transform accounting and finance. These tools will improve accuracy and allow deeper analysis. This means more strategic roles and a focus on value-adding activities.

What trends are shaping financial management today?

Today's financial management trends include sustainability and the use of fintech solutions. There's also a focus on non-financial data for comprehensive strategy planning.