Day Trader Planner: Your Ultimate Trading Companion

A day trader planner is a detailed tool for traders. It helps them organize and enhance their trading activities. It offers a structured way to trade, allowing traders to set goals, monitor their progress, and improve their strategies with a solid trading plan.

Tradervue says a well-kept trading journal boosts trading performance. A day trader planner makes trading smoother and more effective. It uses a day trader planner and a trading plan to achieve this.

Key Takeaways

- A day trader planner helps traders set goals and track performance with a trading plan.

- It provides a structured approach to trading, enabling traders to refine their strategies and improve their trading plan.

- A well-maintained trading journal, such as the one offered by Tradervue, can improve trading performance and is an essential part of a day trader planner and trading plan.

- Traders can gain valuable insights into their trading patterns and identify areas for improvement using a day trader planner and a trading plan.

- A day trader planner can help traders develop a more disciplined approach to trading, leading to better results and a more effective trading plan.

- By utilizing a day trader planner, traders can make data-driven decisions and elevate their trading performance with a well-planned trading plan.

- A day trader planner is a valuable tool for traders looking to improve their trading skills and create a detailed trading plan.

Understanding the Day Trader Planner

A day trader planner is a key tool for traders. It helps set goals, track progress, and improve strategies. By using it, traders can better understand their trading, find areas to improve, and trade more effectively. This leads to better performance, more discipline, and smarter decisions.

Some key benefits of using a trading planner include:

- Improved trading performance through better goal setting and progress tracking

- Increased discipline and accountability in trading activities

- Enhanced decision-making through data-driven insights and analysis

For instance, Tradervue's Free Plan offers a trading journal that automates tracking. This is great for day traders. It lets them focus on making their trading plan better and improving their performance.

| Feature | Benefit |

|---|---|

| Automated trading journal | Quick and easy performance tracking |

| Goal setting and progress tracking | Improved discipline and accountability |

| Data-driven insights and analysis | Enhanced decision-making and trading performance |

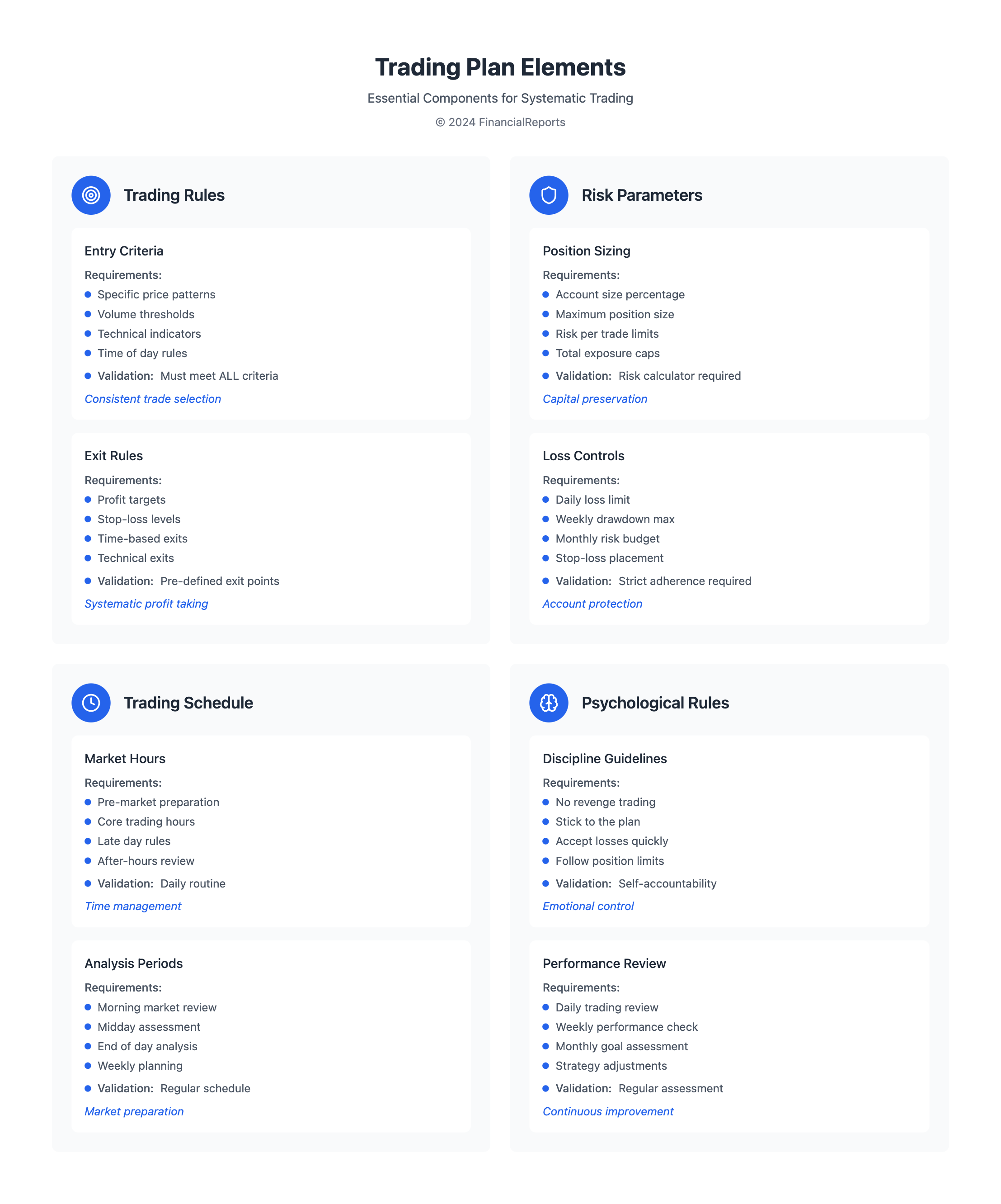

Key Features of a Day Trader Planner

A day trader planner is a must-have for traders. It offers a structured way to trade. It has features like a daily trade log, risk management tools, and performance tracking. These help traders manage risk, track their performance, and find ways to get better.

Some key features of a day trader planner include:

- Daily trade log: This lets traders record and track their trades, including date, time, and details of each trade.

- Risk management tools: These help traders manage their risk exposure, including setting stop-loss orders and determining position sizes.

- Performance tracking metrics: These provide traders with insights into their trading performance, including metrics such as profit/loss, win/loss ratio, and drawdown.

Notion offers a free trading journal template. It includes trade details, profit/loss tracking, and notes sections. This is great for traders who want to develop a trading plan and track their progress. By using a day trader planner, traders can create a plan that includes a day trader planner, trading plan, and risk management strategies. This helps them make informed decisions and reach their trading goals.

| Feature | Description |

|---|---|

| Daily Trade Log | Record and track trades, including date, time, and details |

| Risk Management Tools | Set stop-loss orders, determine position sizes, and manage risk exposure |

| Performance Tracking Metrics | Track profit/loss, win/loss ratio, and drawdown to evaluate trading performance |

Setting Goals with Your Day Trader Planner

Setting clear goals is key to a successful trading plan. A day trader planner helps by giving a structured way to set goals. It lets traders make a plan that matches their short and long-term goals, keeping them focused and motivated.

Setting SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals is important. This method helps traders set realistic goals, like making a certain profit each day or keeping losses under a percentage. With a day trader planner, they can track their progress and change their goals when needed. This keeps them on track to meet their trading goals.

Short-term vs Long-term Goals

Traders should think about both short-term and long-term goals. Short-term goals might be daily or weekly profits, while long-term goals could be about growing their portfolio or being consistent in trading. A day trader planner helps balance these goals, making sure the plan fits their trading strategy.

Adjusting Goals Based on Performance

It's important to regularly review and adjust goals for trading success. A day trader planner helps track performance and adjust goals as needed. By using a day trader planner and setting goals, traders stay focused, motivated, and committed. This leads to better trading performance and more success in the markets.

Building a Daily Trading Routine

A day trader planner is key for a daily trading routine. It helps traders stay consistent and succeed. By following a routine, traders can trade more disciplined, reduce risks, and boost their performance.

Consistency is vital for trading success. A good routine keeps traders focused and away from impulsive choices. With a planner, traders can plan, set goals, and track their progress. This ensures they stay on track and make steady profits.

Some important parts of a daily trading routine include:

- Pre-trading preparation, such as analyzing market trends and news

- Setting clear goals and risk management strategies

- Tracking trades and adjusting the trading plan as needed

Following a daily routine and using a planner can greatly improve trading results. Consistency and discipline are critical for success in trading.

| Trading Routine Element | Importance |

|---|---|

| Pre-trading preparation | High |

| Setting clear goals | High |

| Tracking trades | Medium |

Analyzing Market Trends

To make smart trading choices, understanding market trends is key. A day trader planner offers tools for technical analysis. This helps traders spot opportunities and make better decisions.

Utilizing Technical Analysis

Day traders use technical analysis to make quick decisions. They look at charts and trends to guess future prices. This method helps find support and resistance levels, which are important for judging trade risks.

Fundamental Analysis Tools

Fundamental analysis tools also offer insights into a company's health. They help traders consider both technical and financial aspects. This approach is vital for understanding market trends.

Incorporating Market News

Adding market news to analysis is also important. News can greatly change market trends. A day trader planner keeps traders updated with the latest news. This way, they can adjust their strategies and make better trades.

Risk Management Strategies

A day trader planner is key for managing risks. It helps set a balance between gains and losses. This way, traders make smart choices about their trades.

Key strategies include setting stop-loss orders and diversifying portfolios. These help manage risks and make better trade decisions. For instance, stop-loss orders limit losses, while diversifying reduces risk in one market.

Using a day trader planner helps in applying these strategies. It offers a structure for managing risks and making informed trade decisions. By focusing on risk management, traders can lower their risks and boost their chances of success. Effective risk management means controlling risk with position sizing, cutting losses quickly, and setting a preset maximum risk level.

More risk management techniques include:

- Setting a maximum loss level per trade, per day, and per week

- Determining risk beforehand by factoring in the stop-loss into the trade equation

- Recognizing and avoiding high-risk setups

By adding these strategies to their trading plan, traders can lower their risks and increase their success. A day trader planner offers the tools and resources for effective risk management. This helps traders reach their goals and thrive in the markets.

Developing Trading Strategies

A day trader planner is key for making and improving trading plans. It lets traders try out strategies like scalping, swing trading, and long-term trading. This way, they can find the best strategies for their style and goals.

When making trading plans, it's important to think about the risk and reward. A good ratio is 1:3 or higher. Also, traders should know their risk level and plan wisely. A day trader planner helps with this, including scalping and other methods.

Key Trading Strategies

- Scalping: involves making multiple small trades in a short period

- Swing trading: involves holding positions for a shorter period, typically within a few days

- Long-term day trading approaches: involves holding positions for an extended period, often with a focus on trend following

Using a day trader planner helps traders check their performance and improve. They can use technical analysis, like trend following, to make decisions. This way, they can increase their success in the markets, guided by their planner.

| Strategy | Risk Level | Time Commitment |

|---|---|---|

| Scalping | High | High |

| Swing Trading | Medium | Medium |

| Long-term Day Trading | Low | Low |

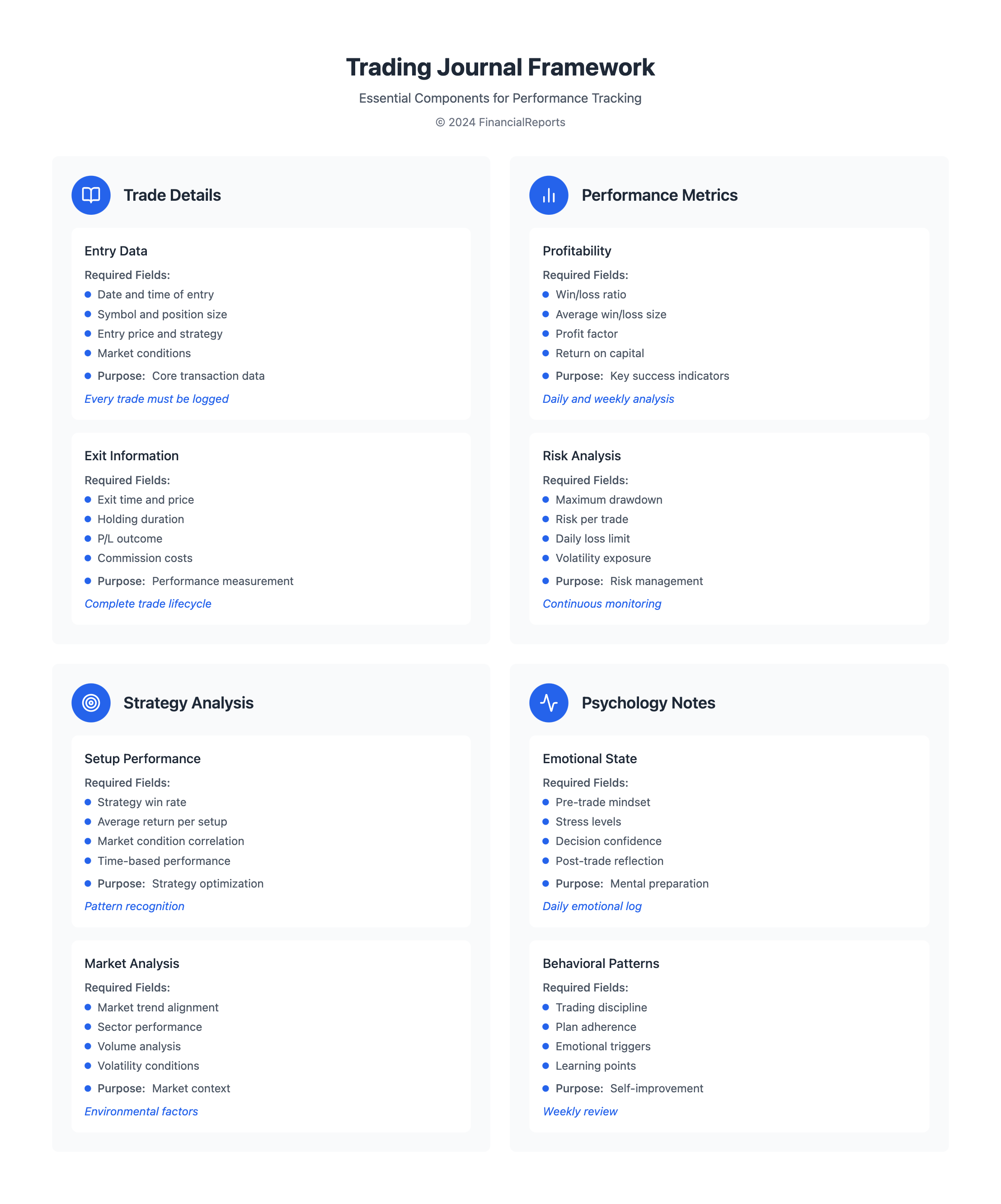

The Role of Journaling in Trading

Journaling is key in trading. It helps traders record their trades and reflect on their performance. A day trader planner offers tools to keep a journal and improve trading skills. By journaling, traders can track their progress, find their strengths and weaknesses, and be accountable for their actions.

A trading journal can have many parts, like details of each trade and comments. Traders can also add personal notes, like their trading environment and mood. Notion's trading journal template helps by having a section for daily trades and reflections. This helps traders see their progress and know where to get better.

Benefits of Keeping a Trading Journal

Keeping a trading journal has many benefits. It helps traders reduce losses, track their growth, and celebrate their achievements. By looking at their trades, traders can find small changes that greatly improve their profits. For instance, saving just a few percentage points can add up over time.

A journal also helps traders avoid making the same mistakes. It shows patterns and areas for improvement. Some important things to track in a journal include:

- Total P&L

- Average winning trade

- Average losing trade

- Average RRR (Risk-to-Reward Ratio)

- Winning % By Trades

- Daily Net Cumulative P&L

Using a day trader planner and journal can elevate a trader's game. They make better decisions and keep improving. Journaling is vital in trading, and those who do it daily will see big improvements in their performance.

Tools and Resources for Day Traders

Day traders need the right tools and resources to succeed. A day trader planner helps find and use these resources. For example, trading tools like StocksToTrade, TradingView, and MT5/MT4 are favorites for their reliability and advanced features.

When choosing trading tools, look for data scanning, charting, and analysis tools. Backtesting tools are also key for testing strategies. They let traders check how well their plans work against past data. News feeds and stock screeners help traders find new opportunities.

Software Recommendations

- StocksToTrade: offers a wide range of data scanning capabilities and a stock screener tool

- TradingView: popular for its versatile charting and analysis tools

- MT5/MT4 platforms: preferred by forex traders for their reliability and advanced features

Mobile Apps for On-the-Go Trading

Apps like eToro and Benzinga Pro let traders trade anywhere. They offer real-time data and news. These apps are great for staying connected to the market anytime.

Online Communities and Forums

Online communities, like Investors Underground, are full of useful info. They offer educational materials and trading strategies. These groups are great for connecting with other traders and keeping up with market trends.

Common Mistakes to Avoid

A day trader planner is key to spotting and dodging common trading errors. Overtrading, for example, can cause big losses if not controlled. With a day trader planner, traders can craft better strategies and steer clear of expensive blunders.

Some common trading errors include:

- Trading without a plan

- Emotional trading

- Guessing in trades without proper preparation

- Not using stop-loss orders

- Overleveraging

These mistakes can harm a trader's success and lead to big financial losses. A day trader planner gives traders the tools and resources to spot and dodge these common errors. This leads to better decision-making and improved trading results.

Knowing the dangers of overtrading and other common mistakes helps traders take steps to reduce risks. With the right tools and resources, like a day trader planner, traders can cut down losses and increase gains.

| Mistake | Consequence |

|---|---|

| Overtrading | Significant losses |

| Emotional trading | Impulsive decisions |

| Guessing in trades | Unnecessary losses |

Evaluating Trading Performance

A day trader planner is key for checking how well you trade and finding ways to get better. It helps you keep track of your progress, set goals, and tweak your trading plan. Checking your performance is vital, as it lets you see how you're doing and make smart choices based on data.

Regular checks can show you trends, patterns, and what you need to work on. A day trader planner gives you the tools to review your trading, like total profit, profit factor, and biggest loss. Using these, you can fine-tune your strategy and hit your trading goals.

Some important metrics for checking your trading performance include:

- Total net profit: the total profit made by your trading strategy

- Profit factor: the ratio of profit to loss

- Maximum drawdown: the biggest drop in your trading account

By watching these metrics and using a day trader planner, you can learn a lot about your trading. This helps you make better choices to boost your results.

Staying Disciplined and Motivated

Maintaining discipline and motivation is key for day traders aiming for long-term success. A day trader planner can be a great tool. It helps traders stay disciplined and motivated on their trading journey. By following a consistent routine and setting goals, traders can beat common challenges like impatience, fear, and greed.

Research shows that successful traders focus on their health and take breaks. They do activities that reduce stress to stay alert and focused. Rewarding themselves for reaching goals also boosts motivation. Getting advice from experienced traders or mentors can help improve performance.

The secret to staying disciplined and motivated in day trading is finding the right strategy. With a detailed day trader planner, traders can develop the discipline and motivation needed. This way, they can confidently navigate the fast-paced world of day trading.

FAQ

What is a Day Trader Planner?

A day trader planner is a tool for traders to organize their activities. It helps set goals, track performance, and improve strategies.

What are the benefits of using a trading planner?

Using a trading planner can improve your trading skills. It increases discipline and helps make better decisions. It makes planning, executing, and evaluating trades easier.

How does a day trader planner enhance trading performance?

It sets goals, tracks progress, and refines strategies. This helps traders understand their activities better. It also helps identify and improve areas.

What are the key features of a day trader planner?

Key features include a daily trade log and risk management tools. It also tracks performance. These features help traders make better decisions.

How can a day trader planner help with goal setting?

It helps set and achieve trading goals. Traders can set short-term and long-term goals. It also helps adjust goals based on performance.

Why is building a daily trading routine important?

A daily routine is key for consistent success. A day trader planner helps develop discipline. It reduces risk and improves performance.

How can a day trader planner help with analyzing market trends?

It provides tools for analyzing trends. Traders can use technical and fundamental analysis. It also helps incorporate market news for better decisions.

What risk management strategies can a day trader planner offer?

It helps develop risk management strategies. This includes setting risk/reward ratios and stop-loss orders. It also promotes diversification to protect capital.

How can a day trader planner assist in developing trading strategies?

It offers tools for developing strategies. Traders can explore different approaches. This helps achieve trading objectives.

What is the role of journaling in a day trader planner?

Journaling is vital in trading. A day trader planner encourages consistent journaling. It helps record trades and reflect on performance.

What tools and resources are available for day traders through a day trader planner?

It recommends software, apps, and online communities. These resources streamline trading. They also provide valuable insights.

What common mistakes can a day trader planner help traders avoid?

It helps avoid common mistakes like overtrading. It also warns against ignoring trends and failing to adapt. This leads to a more effective strategy.

How can a day trader planner help with evaluating trading performance?

It encourages regular performance evaluations. It provides metrics for success. This helps refine strategies and achieve goals.

How can a day trader planner help traders stay disciplined and motivated?

It promotes a disciplined trading routine. It helps set achievable goals and maintain a positive mindset. This supports success in trading.