Daily Trading Strategies: Discover the Top Stocks

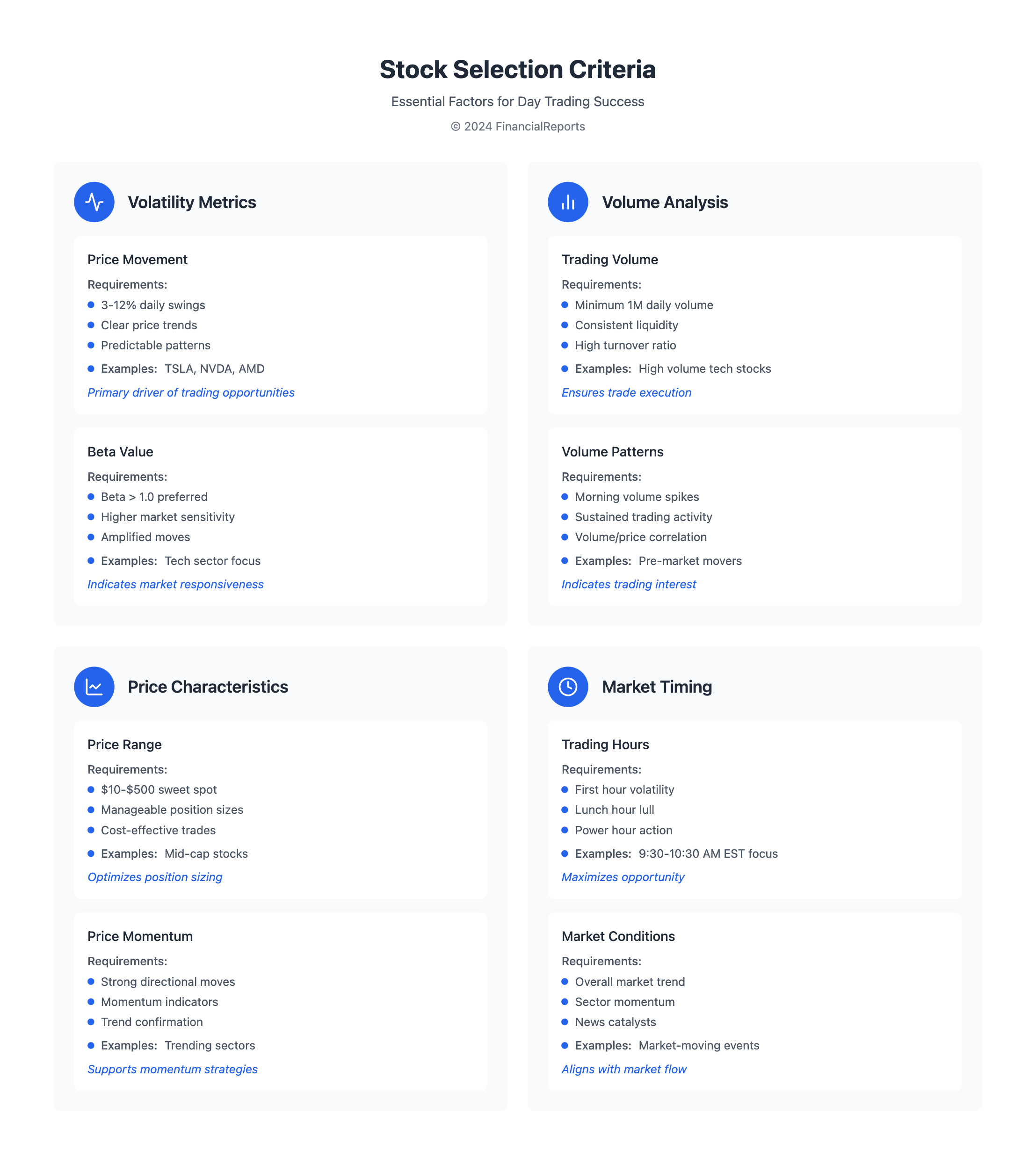

Day trading is all about finding the most volatile stocks. The best ones have lots of momentum, volume, and volatility. For example, TSLA can swing by 3% to 12% in a day, perfect for day trading.

To succeed, you need to know what makes a stock volatile and liquid. You also need to know how to pick the right stocks for day trading. This knowledge helps you make the most of your trades.

When picking stocks, look at their liquidity, volatility, and volume. The best ones have high momentum and volume. This means they're more liquid and volatile, making them great for day trading.

Understanding these traits helps you craft effective day trading strategies. By using the right stocks and strategies, you can increase your profits.

Key Takeaways

- Day trading involves finding the most volatile stocks to trade, such as TSLA, which can have intraday swings ranging from 3% to 12%.

- The best stocks for day trading usually possess high momentum, volume, and volatility, making them ideal for day trading strategies.

- Key factors to consider when choosing stocks include liquidity, volatility, and volume, which are essential for developing effective day trading strategies and finding the best stocks to trade daily.

- Traders should develop pattern recognition skills and study beneath mentors to find and effectively trade volatile stocks using day trading strategies.

- Day traders can use tools like candlestick chart patterns, trend lines, triangles, and volume to pinpoint buying points and maximize returns with the best stocks to trade daily.

- Successful day trading relies on traders being diligent, focused, objective, and unemotional in their work, and using effective day trading strategies with the best stocks to trade daily.

- Day trading platforms like Interactive Brokers and Webull offer real-time streaming quotes, charting tools, and the ability to enter and modify complex orders, making it easier to implement day trading strategies and find the best stocks to trade daily.

Understanding Daily Trading

Day trading means buying and selling stocks in the same day. It aims to make money from market changes and trends. This risky strategy needs a good grasp of the markets and fast decision-making. Only 3% of day traders make money, based on over 3.7 billion trades.

What is Daily Trading?

Daily trading involves short-term positions, lasting just minutes or hours. Day traders use different strategies to profit from market shifts. These include technical analysis, fundamental analysis, and market sentiment analysis.

Benefits of Daily Trading

Day trading offers high returns, margin trading, and the chance to trade in various markets. Key benefits include:

- Potential for high returns

- Ability to trade on margin

- Opportunity to trade in various markets

Risks Associated with Daily Trading

Day trading also has big risks, like big losses, high stress, and constant market watching. It's vital to have good trading strategies and manage risks to succeed.

| Statistic | Value |

|---|---|

| National average income of a self-employed day trader | $94,266 per year |

| Average day trader's salary working at investment firms | $133,818 per year |

Factors to Consider When Choosing Stocks

Choosing stocks involves looking at several key factors. Good trading strategies mix technical and fundamental analysis. This includes picking stocks and creating plans that fit your goals and how much risk you can take.

Market Trends

Knowing market trends is vital for picking stocks. It means understanding the market's overall direction and trends in certain sectors. By spotting trends, traders can decide which stocks to buy or sell more wisely.

Company Performance

When picking stocks, look at how well a company is doing. Check its financial health, management team, and its place in its industry. Important numbers like the P/E ratio, D/E ratio, and ROE give clues about a company's success.

Some important numbers to look at include:

- P/E ratio between 15 and 25

- P/B ratio typically between 1 and 3

- Dividend payout ratio below 60-70%

Economic Indicators

Economic signs, like GDP growth, inflation, and unemployment, affect stock prices. Keep up with economic news and trends to make smart choices.

Technical Analysis

Technical analysis looks at charts and patterns to guess future prices. It uses tools like the RSI and moving averages. Mixing technical and fundamental analysis helps traders understand the market better and make better choices.

| Indicator | Description |

|---|---|

| RSI | A measure of the magnitude of recent price changes to determine overbought or oversold conditions |

| Moving Averages | A trend-following indicator that shows the direction and strength of a trend |

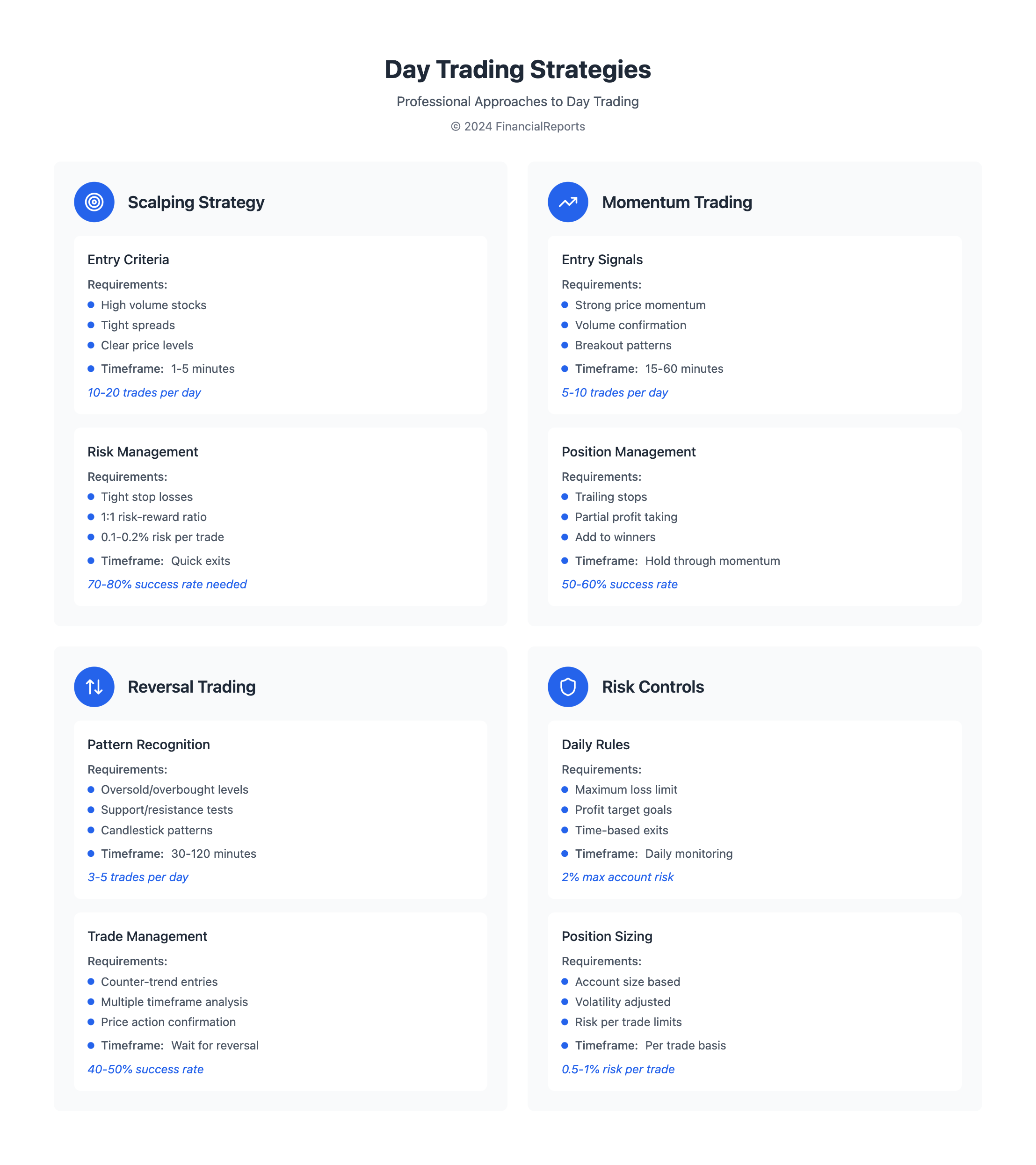

Popular Trading Strategies

Day traders employ various strategies to meet their goals. These strategies fall into several categories, each with unique traits and needs. Some top strategies include:

Scalping

Scalping is all about making many small trades to profit from tiny price changes. It's known for:

- High trading frequency

- Small trade sizes

- Focus on short-term price movements

Momentum Trading

Momentum trading focuses on stocks with strong price trends. It aims to ride these trends. Key aspects are:

- Focus on stocks with high price momentum

- Use of technical indicators like Momentum Indicator and Relative Strength Index (RSI)

- Emphasis on riding the trend

Swing Trading

Swing trading involves holding stocks for a short time, usually overnight or a few days. It aims for bigger price swings. Key points are:

- Focus on short-term price movements

- Holding stocks for a shorter period

- Emphasis on capturing larger price movements

These strategies are key in day trading. They work well with technical and fundamental analysis. Knowing these strategies helps traders develop effective day trading plans and boosts their success chances.

| Trading Strategy | Characteristics |

|---|---|

| Scalping | High frequency, small trade sizes, focus on short-term price movements |

| Momentum Trading | Focus on stocks with high price momentum, use of technical indicators, emphasis on riding the trend |

| Swing Trading | Focus on short-term price movements, holding stocks for a shorter period, emphasis on capturing larger price movements |

Best Stocks for Daily Trading

Day trading stocks requires focusing on the best options. Look for stocks with high momentum, volume, and volatility. The tech sector is a favorite, with Nvidia Corp. (NVDA) and Tesla Inc. (TSLA) leading the way.

Healthcare and consumer goods also offer chances for day traders. Pfizer Inc. (PFE) and Procter & Gamble (PG) are good examples. They have high volume and volatility, perfect for daily trades. To do well, it's key to pick the right stocks and have good strategies.

Here are some top picks for day trading:

- Nvidia Corp. (NVDA), with an average daily trading volume of 416.6 million

- ProShares UltraPro Short (SQQQ), with an average daily trading volume of 120.1 million

- Tesla Inc. (TSLA), with an average daily trading volume of 93.4 million

These stocks are great for day trading because of their high volume, volatility, and momentum.

Analyzing Stock Performance

Day trading requires a deep look into stock performance. Technical analysis is key here. It helps spot trends and patterns in stock prices. Tools like moving averages and the relative strength index (RSI) offer clues about future price moves.

When checking stock performance, consider these points:

- Volume and volatility: High volume and moderate to high volatility are good for day trading.

- Market trends: Stick to stocks that match the current market trend for better chances of profit.

- Entry and exit strategies: Knowing when to buy and sell is vital for making money and avoiding losses.

By mixing technical analysis with a solid grasp of stock performance, traders can craft a strong strategy. Whether using charts or technical indicators, staying informed and flexible is essential.

| Technical Indicator | Description |

|---|---|

| Moving Averages | Helps identify trends and possible buy/sell signals |

| Relative Strength Index (RSI) | Shows the strength of recent price changes to spot overbought/oversold levels |

Tools for Daily Traders

Day trading needs special tools to succeed. Trading platforms, market research tools, and alerts are key. They help traders make quick, smart decisions.

Lightspeed Financial Broker is a top choice for day traders. It offers fast executions and direct access. Warrior Trading Scanners help find trading opportunities. Warrior Charts are known for their high quality.

Benzinga Pro has two plans: Basic for $37/month and Essential for $197/month. It offers a 2-week free trial. TradingView is used by over 30 million traders. Investors Underground offers a program for $1,297, founded by Nathan Michaud in 2004.

These tools help traders stay ahead. They offer features like:

- Hot keys and direct access routing for fast executions

- Stock scanning to identify opportunities

- High-quality charting with real-time data

- Alerts and notifications for market movements

Using these tools, day traders can get an edge. The right tools and software help traders achieve their goals.

| Tool | Features | Pricing |

|---|---|---|

| Lightspeed Financial Broker | Hot keys, direct access routing, fast executions | Varies |

| Warrior Trading Scanners | Stock scanning, predefined searches | Varies |

| Benzinga Pro | Stock screeners, real-time data | $37/month - $197/month |

Developing a Trading Plan

A good trading plan is key to success in day trading. It keeps traders on track, setting clear goals and managing risks. It also guides when to enter and exit trades.

To make a solid trading plan, traders need to know their goals, how much risk they can take, and how to analyze the market. They should spot key support and resistance levels, understand market conditions, and read price action signals.

Some important parts of a trading plan are:

- Setting realistic goals and objectives

- Defining risk management strategies, such as position sizing and stop-loss orders

- Developing entry and exit strategies, such as trend following and mean reversion

Following a detailed trading plan boosts a trader's success chances. It gives traders the confidence to make quick decisions in the fast-paced world of day trading. A good plan makes trading clearer and more focused.

Timing Your Trades

Getting the timing right is key in day trading. Day trading means making many trades in one day. The timing of these trades can greatly affect success. Market hours, liquidity, trends, and news are all important for timing trades.

Traders must know the day's volume and volatility patterns. Volume often peaks early, drops at midday, and rises again towards the end. This info helps traders plan better and boosts their success chances.

Some use stop orders early to avoid losses. Others limit their trades to a certain percentage of their portfolio, mainly during volatile times. Understanding trade timing and using smart strategies can lead to better results for day traders.

| Time Frame | Description |

|---|---|

| 1 minute (M1) | Ultra-short trading time frame used by scalpers |

| 5 minutes (M5) | Short-term trading time frame used by day traders |

| 1 hour (H1) | Medium-term trading time frame used by swing traders |

By considering these factors and using the right strategies, traders can develop effective trade timing plans and improve their overall performance in day trading.

Building a Watchlist

Creating a watchlist is key in day trading. It helps traders spot good trading chances and keep up with market changes. A good watchlist has stocks from various sectors and industries. It focuses on those with high volatility and lots of trading.

To make a great watchlist, traders need to think about a few things:

- Market trends and sector performance

- Stock performance and volatility

- Liquidity and trading volume

- Technical analysis and chart patterns

By using these factors, traders can pick stocks wisely. This boosts their chances of doing well in day trading. A watchlist needs regular checks and updates. This keeps it useful as market conditions shift.

Building a good watchlist takes daily effort and smart management. It's about picking the strongest sectors and stocks. By focusing on volatile and liquid stocks, traders can make a watchlist that fits their strategy. This helps them stay ahead in the market.

Staying Informed

To succeed in day trading, it's key to stay informed about market news and trends. This means getting info from various places like financial news sites, social media, and economic reports. By keeping up with the latest news, traders can make smart choices and tweak their plans as needed.

News Sources for Traders

There are many news sources for traders, like Bloomberg, CNBC, and The Wall Street Journal. These sites offer real-time updates on market trends, economic signs, and company news. Traders can also follow key analysts and industry pros on social media for insights into market trends and trading chances.

Economic Reports and Data

Economic reports and data, like GDP and inflation rates, offer valuable insights into the economy's health. Traders use this info to spot trends and patterns in the market. For instance, a strong GDP report might show a growing economy, while high inflation could signal a slowdown.

| Source | Description |

|---|---|

| Bloomberg | Financial news website providing real-time information on market trends and economic indicators |

| CNBC | Financial news website providing real-time information on market trends and economic indicators |

| The Wall Street Journal | Financial news website providing in-depth analysis of market trends and economic indicators |

By keeping up with market news and trends, day traders can make smart choices and tweak their plans to boost profits. Whether through news sites, economic reports, or following influential analysts, staying informed is key to success in day trading.

Learning from Your Trades

Trading daily is a world that keeps changing. To succeed in the long run, you must always be learning. Keeping a trading journal helps you look back at your trades. It shows you where you can get better and how to reach your money goals.

Looking at your trading choices, wins, and losses can teach you a lot. This thinking helps you spot patterns and learn from mistakes. It also helps you get better at managing risks. Even top traders keep learning and adjusting to new market changes.

Using backtesting and paper trading can also help you understand the market better. These tools let you try out trades without real money. They help you see how your strategies work and make smart changes before risking real money. Becoming a great day trader means always growing, staying disciplined, and always trying to get better.

FAQ

What are the best stocks to trade daily?

The top stocks for daily trading have high momentum, volume, and volatility. Tech stocks like TSLA and AAPL are favorites due to their big price swings. Healthcare and consumer goods sectors also offer good opportunities.

What are the benefits of daily trading?

Daily trading can lead to high returns and the chance to trade on margin. It also lets you trade in various markets. But, it comes with big risks, like losing a lot, high stress, and needing to watch the markets all the time.

What factors should traders consider when choosing stocks for daily trading?

Traders should look at market trends, company performance, and economic indicators. They should also do technical analysis. This helps understand a company's health, industry trends, and market mood, aiding in picking stocks.

What are some popular trading strategies for day traders?

Day traders use scalping, momentum trading, and swing trading. Scalping aims for small profits from many trades. Momentum trading rides strong price trends. Swing trading looks for bigger price swings over a few days.

How can day traders analyze stock performance?

Day traders use technical analysis to study stock performance. They look at indicators like moving averages and RSI. Chart analysis, like trend lines, helps understand price movements and make trading decisions.

What tools do day traders need to succeed?

Day traders need tools like trading platforms, market research tools, and alerts. Platforms help execute trades fast. Research tools give insights into market trends. Alerts keep traders updated, helping make quick decisions.

How can day traders develop an effective trading plan?

A good trading plan is key. It sets goals, manages risks, and outlines entry and exit strategies. A solid plan keeps traders focused and disciplined, boosting success chances.

How important is timing for day traders?

Timing is critical in day trading. Traders must consider market hours, liquidity, and trends. News can also affect prices, causing sudden changes.

How can day traders build an effective watchlist?

A good watchlist is essential. Choose stocks based on momentum, volume, and volatility. Monitor their performance closely. Adjusting the watchlist helps develop effective strategies.

How can day traders stay informed?

Staying informed is vital. Follow news, economic reports, and influential analysts. This provides insights and trading ideas.

How can day traders learn from their trades?

Learning from trades is important. Keep a journal, analyze past trades, and improve strategies. This helps identify areas for growth and develop better trading plans.