Crafting Winning Algo Strategies for Your Trading Success

Algorithmic trading is key in today's financial markets. It lets traders make fast, precise trades. To win at algo trading, you must know the basics. This includes what it is, its benefits, and the different types of trading algorithms.

Algorithmic trading strategies use technical indicators and financial tools. These help create a solid trading plan. By using these strategies, traders can cut down on costs and trade more efficiently.

The secret to success in algo trading is a well-made algorithm. It needs accurate data, technical indicators, and risk management. This way, traders can make smart choices and trade with precision. This leads to better trading results.

Key Takeaways

- Algorithmic trading offers benefits like transaction cost reduction and reducing the implementation gap.

- Creating an effective trading algorithm involves steps like conceptualization, backtesting, and execution.

- Technical indicators like moving averages and Bollinger Bands play a critical role in designing trading strategies.

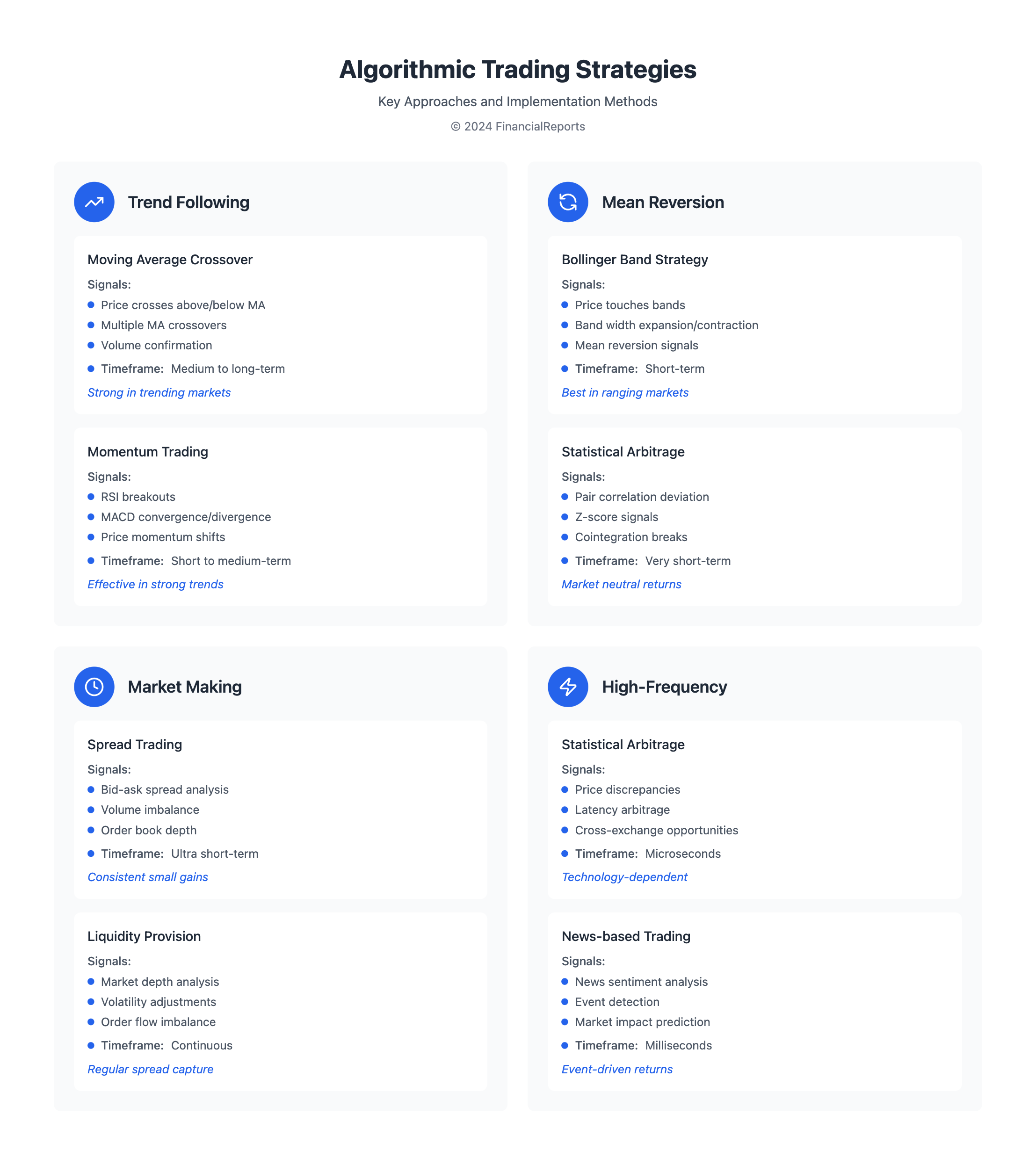

- Advanced algorithmic trading strategies include momentum trading, mean reversion, and arbitrage opportunities.

- Machine learning models like Decision Trees and Random Forests enhance trading algorithm decisions.

- Real-time market data feeds are vital for algorithmic trading decision-making, and accurate data acquisition is essential for successful trading.

Understanding Algorithmic Trading Basics

Algorithmic trading, also known as algo trading, uses computer programs to make trades based on set rules. It's popular because it cuts down on costs and improves trading efficiency. By automating strategies, traders can quickly seize market chances.

One big plus of algo trading is testing strategies with past and current data. This helps traders improve their plans and make informed choices. It also offers fast order confirmations, low delays, and less room for human mistakes.

What is Algorithmic Trading?

Algorithmic trading means using computer programs to make trades based on set rules. These rules might come from technical indicators or market data. It lets traders automate their strategies, grabbing market chances fast and well.

Key Benefits of Using Algorithms

The main advantages of algo trading include:

- Lower transaction costs

- Smaller implementation gap

- Quick order confirmations

- Low delays

- Less human error

Different Types of Trading Algorithms

There are many types of trading algorithms, like trend-following and mean reversion. These can work in various markets, such as stocks and futures. By programming, traders can create and use their own strategies, based on technical indicators and market data.

Essential Components of a Trading Algorithm

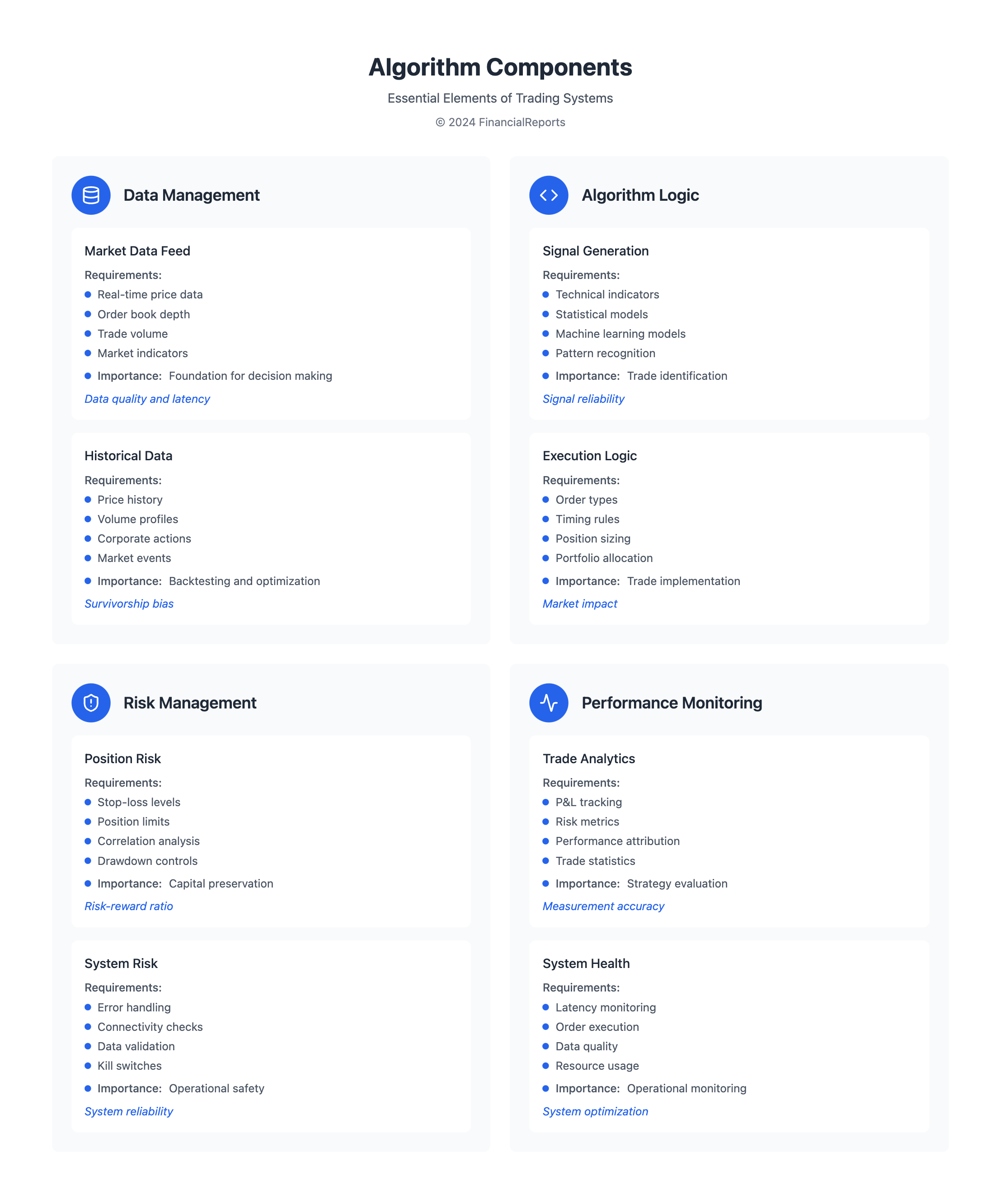

Creating a trading algorithm requires focusing on key components. Algorithmic trading uses data and market analysis for smart decisions. First, find reliable data sources like technical indicators and market feeds to study trends.

Risk management is critical in trading algorithms. It helps avoid big losses and increase profits. Tools like position sizing and stop-loss orders are important. Also, how trades are executed, like with market or limit orders, matters a lot.

Important things to think about when making a trading algorithm include:

- Data quality and reliability

- Risk management techniques, such as position sizing and stop-loss orders

- Execution strategies, such as market orders and limit orders

- Market analysis and trend identification

By using these key parts, traders can build a strong trading algorithm. This can help them reach their investment goals. Algorithmic trading is complex but can be very effective in today's fast markets.

Designing a Trading Algorithm

When creating a trading algorithm, setting clear goals is key. You need to decide what you want to achieve, like making more money or losing less. Understanding the market and picking the right indicators are important. This helps traders make smart buy and sell decisions.

To make a good trading algorithm, test it with old data first. This means running the algorithm on past data to see how it might do. By looking at how it did, traders can improve their strategies. They can tweak things to make it better.

Some important things to think about when making a trading algorithm include:

- Defining trade objectives and goals

- Selecting technical indicators and market data feeds

- Backtesting the algorithm using historical data

- Refining the algorithm based on backtesting results

By following these steps and using algo trading programming, traders can make advanced strategies. These strategies help make better investment choices.

Programming Languages for Algo Development

Choosing the right programming language is key when making an algo for trading. These strategies need a language that can do complex math, analyze data, and act fast. Python, R, and MATLAB are top picks, each with its own benefits and drawbacks.

The language you pick depends on your trading strategy's needs. For instance, Python is great for its ease, flexibility, and strong libraries. C++ is better for high-speed trading because it offers fast performance and control.

When picking a language, consider a few things:

- Performance: It should handle complex tasks quickly.

- Modularity: It should let you mix different parts easily.

- Development: It should have lots of support from developers.

Also, think about what your strategy needs, like managing risk or optimizing portfolios. The right language helps traders make smart strategies to reach their goals.

| Language | Strengths | Weaknesses |

|---|---|---|

| Python | Simple, versatile, powerful libraries | Slow performance compared to C++ |

| C++ | High performance, control over system resources | Steep learning curve, complex development |

| MATLAB | Specialized for statistical modeling and analysis | Limited support for other programming tasks |

Implementing a Trading Algorithm

When you set up a trading algorithm, it's key to link it with a trading platform. You also need to set up how it will execute trades and how to keep an eye on it. This careful planning ensures the algorithm works well and fast. It can handle lots of data quickly, making trades faster than a person can.

Connecting the algorithm to a trading platform is a big step. It lets the algorithm get market data and make trades. APIs and data feeds help it get the info it needs to make smart trading choices. Popular strategies like following trends, arbitrage, and mean reversion can be used with this programming.

To keep the algorithm running smoothly and cut down on losses, using risk management tools is vital. Tools like stop-loss orders protect your money and help you avoid big losses. With these strategies and programming, traders can build a strong trading system that works all day, every day. This helps them stay on top of the markets.

| Strategy | Description |

|---|---|

| Trend Following | Identifies and follows market trends |

| Arbitrage | Capitalizes on price differences between dual-listed assets |

| Mean Reversion | Operates on the assumption that asset prices tend to return to their average value over time |

Testing a Trading Algorithm

When creating an algo for trading, it's key to test the strategies. This ensures they work well and are strong. Using past data helps check how the strategy performs and spots any problems. Quantstart says backtesting is a must for algorithmic trading strategies.

Strategies can fail due to mistakes or fitting too closely to historical data. A solid test plan is needed. This includes testing with data not used before to see how it handles new situations. Robust trading strategies come from mixing in-sample and out-of-sample data. A common split is 70% in-sample and 30% out-of-sample, or a 50/50 split.

Important things to think about when testing a strategy include:

- Picking the right test period and out-of-sample location

- Creating a strict test plan to ensure the strategy is reliable

- Having humans help design the automated trading process

By following these tips and using tools like Forex Tester, traders can improve their strategies. They can make their trading more profitable and safer. Successful traders might run several strategies at once. This helps build a portfolio that trades better than one strategy alone.

Strategies for Algorithm Optimization

Optimizing algorithmic trading strategies is key to success in financial markets. It means making the algo trading programming better and reducing losses. To do this, you need both technical skills and market knowledge.

Improving algorithms involves tweaking parameters, using machine learning, and avoiding overfitting. These steps help create stronger and more efficient trading programs. This way, traders and investors can make better choices and outperform others.

Parameter Tuning for Improved Performance

Parameter tuning is vital for algorithm improvement. It means adjusting the algorithm's settings for the best results. By tweaking these settings and checking performance, traders can make their programs more effective.

Utilizing Machine Learning Techniques

Machine learning boosts algorithmic trading strategies. It uses tools like neural networks and decision trees to analyze data and predict trends. Adding machine learning to trading programs makes them smarter and more adaptable.

Avoiding Overfitting in Algorithms

It's important to avoid overfitting in trading algorithms. Overfitting happens when an algorithm is too good at the data it was trained on but not elsewhere. Techniques like regularization and cross-validation help prevent this. This keeps trading programs effective across different market conditions.

| Strategy | Description |

|---|---|

| Parameter Tuning | Refining algorithm parameters for optimal performance |

| Machine Learning | Applying machine learning techniques to analyze market data |

| Overfitting Prevention | Using techniques to prevent algorithm overfitting |

By using these strategies, traders and investors can make their trading programs better. This leads to better trading results and helps them reach their financial goals. It also keeps them competitive in the markets.

Real-Life Examples of Successful Algorithms

Algorithmic trading is big in the forex market, making up a lot of trades. It shows that big profits can come from using algorithms in forex trading. These algorithms can use technical indicators and market data feeds.

Algorithmic trading has many benefits. It executes orders fast, makes trading decisions without bias, and can run many strategies at once. It also cuts down on costs and gets better prices because it's efficient. But, relying only on algorithms can be risky because of possible errors and missing human insight.

Successful strategies include following trends and mean reversion. These can work with technical indicators and models to spot good trades. By using algorithms, investors can grab quick market chances and reach their goals.

What makes a trading system successful includes:

- Rapid order execution

- Objectivity in trading decisions

- Ability to deploy multiple strategies concurrently

- Reduced transaction costs and more favorable prices through efficiency

Knowing about algorithmic trading's parts and benefits helps investors make smart choices. This can lead to big returns.

Regulatory Considerations in Algorithmic Trading

Algorithmic trading, or algo trading, is a complex field with strict rules. Various regulatory bodies set guidelines for algo trading practices. It's important to understand these rules to avoid penalties.

Key areas include transparency in algorithm design and preventing market manipulation. Regulators also focus on ensuring fair access to trading venues. The functionality wash concept is another concern, where algorithms may cause unnecessary trades.

To keep up with regulations, algo trading must be designed with compliance in mind. This includes using risk management techniques like position limits and stop-loss orders. It's also important to test and validate trading algorithms before they're used.

| Regulatory Body | Regulation | Description |

|---|---|---|

| ESMA | MiFID II | Regulates algorithmic trading in the EU |

| SEC | Regulatory Notice 16-21 | Requires registration of associated persons involved in algo trading programming |

| FCA | FINRA Rule 3110 | Requires firms to conduct real-time monitoring of automated trading activities |

By following these regulations, algo trading can be safer and more profitable. This ensures that trading strategies are effective and compliant.

Common Challenges in Algorithm Development

Algorithmic trading strategies are complex. They involve many parts to work well. Yet, issues like bad data, market slippage, and over-leveraging are common. Research shows these problems can hurt a trading algorithm's performance.

Key challenges in algorithm development include:

- Data quality issues: Bad data can mess up how well an algorithm works.

- Managing market slippage: Volatility can make the price of trades different from what's expected.

- The impact of over-leveraging: Too much borrowing can lead to big losses if not managed right.

To beat these challenges, traders need good data, smart risk plans, and thorough testing. By tackling these issues, traders can make better algorithms. This leads to better trading results.

| Challenge | Solution |

|---|---|

| Data quality issues | Use reliable data feeds and robust data analysis processes |

| Managing market slippage | Implement risk management strategies and monitor market volatility |

| The impact of over-leveraging | Understand leverage and margin, and use them judiciously |

Understanding and solving these common problems helps traders do better. It's all about knowing how to make and use good algorithms for trading.

Future Trends in Algorithmic Trading

The world of algo trading programming is changing fast. Artificial intelligence (AI) is making big waves, helping algorithms understand huge amounts of data. This lets them spot complex market patterns.

Predictive analytics, powered by AI, is becoming more important. It helps traders guess market moves better. This is thanks to advanced statistical models and AI.

Cryptocurrencies and blockchain are set to change algo trading too. They bring new chances for automated trading. Experts say we'll see more use of cryptocurrency exchanges and DeFi platforms in algo trading.

The future of algorithmic trading strategies looks bright. It will be more complex and automated. Traders will work on making their algorithms better and more accurate.

Regulators will keep improving rules and oversight. This will help traders stay on the right path. Quantum computing will also play a big role, bringing new power and insights to trading algorithms.

FAQ

What is algorithmic trading?

Algorithmic trading uses computer algorithms to buy and sell financial instruments. This includes stocks, bonds, and currencies. These algorithms work fast and accurately, taking advantage of market chances and reducing human error.

What are the key benefits of using algorithms in trading?

Algorithms help reduce costs and improve trade speed and accuracy. They also help traders find market opportunities and manage risks better. This leads to more diverse trading strategies.

What are the different types of trading algorithms?

There are several types of trading algorithms. Trend following algorithms follow market trends. Mean reversion strategies aim to exploit price deviations. Arbitrage algorithms take advantage of price differences in different markets.

What are the essential components of a trading algorithm?

A trading algorithm needs data sources, risk management, and execution strategies. Traders must choose the right data and risk management techniques. They also need to select effective execution strategies for optimal trade execution.

How do I design a successful trading algorithm?

To design a successful algorithm, define clear trade goals and select the right indicators. Backtest the algorithm with historical data to ensure its effectiveness. This ensures the algorithm is robust and works well.

What programming languages are commonly used for algo development?

Python, R, and MATLAB are popular for algo development. Each has its strengths and weaknesses. Python is easy to use and has extensive libraries. MATLAB is known for its advanced numerical and visualization capabilities.

How do I implement a trading algorithm?

To implement an algorithm, integrate it with a trading platform. Set up execution mechanisms and develop monitoring strategies. Ensure the algorithm communicates well with the platform and configure the right execution methods. Regular monitoring and maintenance are key for success.

How do I test and optimize my trading algorithm?

Test your algorithm with historical data to ensure it handles market volatility. Use performance metrics like Sharpe ratio to evaluate its effectiveness. Make adjustments based on these metrics to improve performance.

What are some real-life examples of successful algorithmic trading strategies?

Successful strategies include trend following and mean reversion. Trend following capitalizes on market trends. Mean reversion exploits price deviations. High-frequency trading innovations also lead to sophisticated strategies.

What are the regulatory considerations in algorithmic trading?

Traders must follow compliance requirements and regulations. This includes understanding market manipulation and front-running rules. Effective risk management and compliance monitoring are essential to stay compliant.

What are some common challenges in algorithm development?

Challenges include data quality issues and managing market slippage. Traders must ensure accurate and up-to-date data. They also need to manage slippage and leverage risks to avoid losses.

What are the future trends in algorithmic trading?

Future trends include more use of artificial intelligence and predictive analytics. Traders will rely on advanced analytics and AI to find market opportunities. Blockchain technology and cryptocurrency exchanges may also lead to new strategies.