Contribution Margin Per Unit Calculator Tool

A contribution margin calculator helps figure out how much money a business can use to cover fixed costs after paying for variable costs. It's key for financial experts to boost profits by accurately calculating the contribution margin for each product or service. This is done using a contribution margin per unit calculator.

The contribution margin per unit calculator is vital for financial analysis. It helps businesses make smart decisions based on data. A higher contribution margin ratio means more money left over from sales. The formula for contribution margin is simple: it's the selling price minus the variable costs per unit.

Introduction to Contribution Margin Calculator

With a contribution margin per unit calculator, businesses can quickly figure out the contribution margin for their products or services. They consider the selling price, variable costs, and how many units are sold. This info helps guide their financial choices and plans.

Key Takeaways

- Contribution margin per unit calculator is a vital tool for financial analysis and decision-making.

- A higher contribution margin ratio indicates a larger available sales revenue.

- The contribution margin formula involves calculating the difference between the selling price per unit and the variable costs per unit.

- Using a contribution margin per unit calculator enables businesses to make data-driven decisions.

- The calculator provides essential data, including the contribution margin, contribution margin ratio, and profit generated after subtracting all expenses.

- Financial professionals can use the calculator to optimize profitability and inform their financial strategies.

What is Contribution Margin?

Contribution margin is key in business analysis. It shows the profit from each product after variable costs are subtracted. The contribution margin ratio calculator helps figure this out.

If the selling price is more than the variable cost, it's a positive margin. This means more money for fixed costs and profit. But, a negative margin means a loss for each unit. Variable costs include things like raw materials, labor, and shipping.

Definition of Contribution Margin

The contribution margin is the selling price minus the variable cost. It can also be found by subtracting variable costs from sales and dividing by units sold.

Importance in Business Analysis

The contribution margin is vital for checking if a product is profitable. It helps decide where to put resources for the best results. The contribution margin ratio calculator shows how sales changes affect profit. This is useful for planning sales or dealing with seasonal changes.

| Product | Selling Price per Unit | Variable Cost per Unit | Contribution Margin per Unit |

|---|---|---|---|

| Journal | $20 | $12 | $8 |

| Strawberry Bonbons | $10 | $4 | $6 |

The contribution margin is shown in both units and as a percentage. This gives a clearer view of profitability. With the contribution margin ratio calculator, businesses can compare products or time periods. This helps make better decisions for growth.

How to Calculate Contribution Margin Per Unit

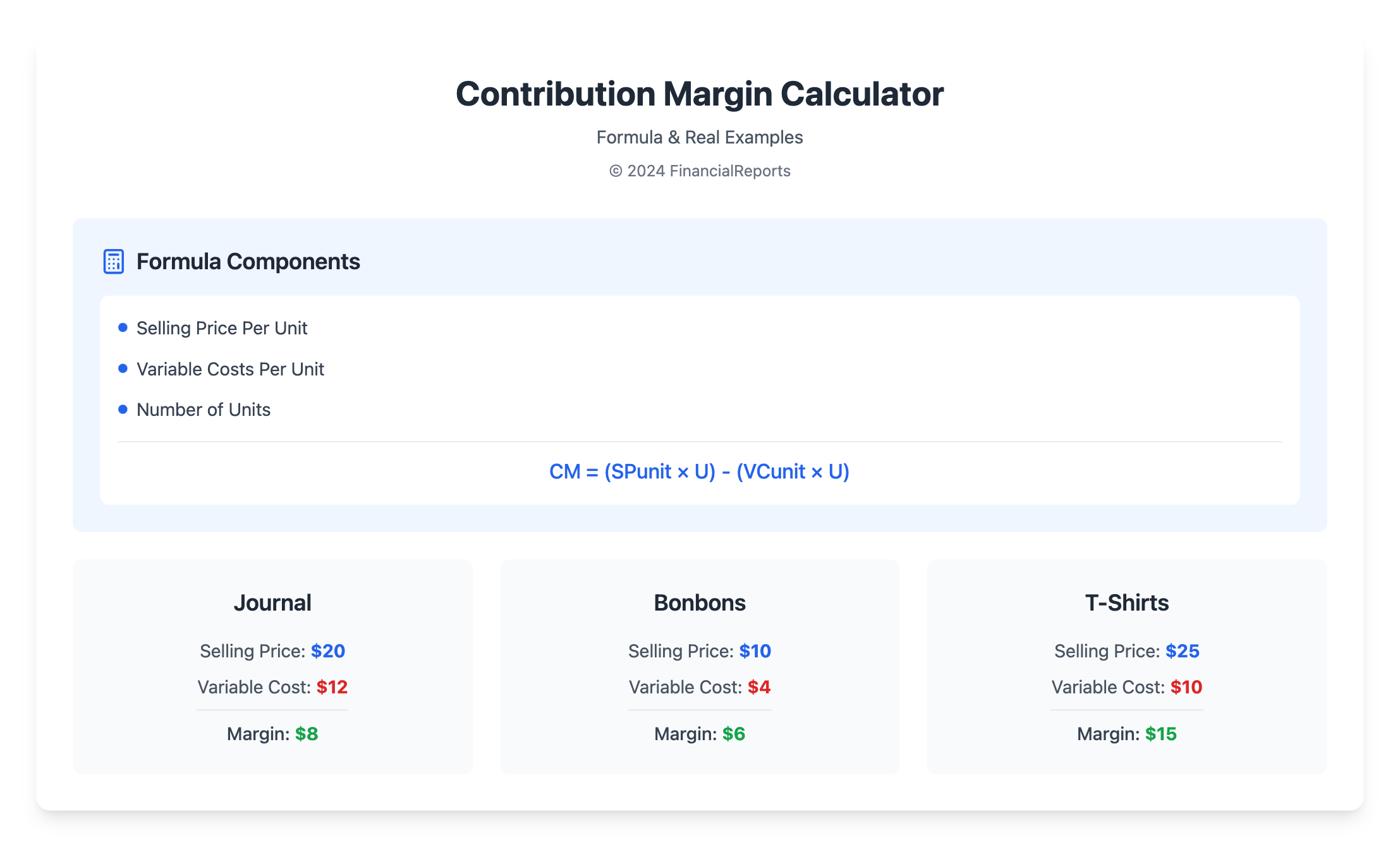

To find the contribution margin per unit, you need to know the formula and its parts. The formula is CM = (SPunit × U) - (VCunit × U). Here, CM is Contribution margin, SPunit is Selling price per unit, U is Number of units, and VCunit is Variable costs per unit.

A contribution margin per unit calculator makes this easier. But knowing how it works is key. For instance, if a product sells for $20 and costs $12 to make, its contribution margin is $8. This is 40% of what it makes per unit.

Formula for Contribution Margin

The formula for unit contribution margin is Selling price per unit – variable cost per unit = Unit contribution margin. This formula helps figure out how profitable different products or services are.

Step-by-Step Calculation Process

To find the contribution margin per unit, do the following:

- Find out the selling price per unit

- Figure out the variable cost per unit

- Subtract the variable cost from the selling price

- Multiply the result by the number of units sold

Using a contribution margin per unit calculator makes this easier. It gives you precise results. Knowing the contribution margin per unit helps businesses decide on pricing, production, and how to use resources.

| Product | Selling Price per Unit | Variable Cost per Unit | Unit Contribution Margin |

|---|---|---|---|

| Toy Slimes | $20 | $12 | $8 |

| Animal Plushies | $10 | $2 | $8 |

By looking at the unit contribution margin, businesses can spot what's making money and what needs work. This helps make better financial choices and boosts profits.

Key Components of the Calculation

To find the contribution margin, you need to know the main parts. The selling price and variable costs are key. Variable costs change with how much you produce, while fixed costs stay the same.

A contribution margin ratio calculator helps figure out the contribution margin per unit. It's the profit made from each item sold. Knowing this helps set prices and make smart decisions.

Selling Price

The selling price is how much you charge for something. It's important for the contribution margin. To set a price, you must think about production costs, market, and competition.

Variable Costs

Variable costs change with how much you produce. They include things like materials, supplies, and wages. A contribution margin ratio calculator makes it easier to find the contribution margin per unit.

| Component | Description |

|---|---|

| Selling Price | The amount at which a product or service is sold to customers |

| Variable Costs | Expenses that vary directly with the production volume of a product or service |

Knowing the parts of the contribution margin helps businesses make better choices. A contribution margin ratio calculator is useful. It gives a clear picture of the contribution margin per unit. This helps businesses run better and make more money.

Contribution Margin vs. Gross Margin

When looking at a company's finances, two important metrics stand out: contribution margin and gross margin. They offer different views but both are essential. A contribution margin per unit calculator helps see how profitable each product or service is.

Gross margin and contribution margin differ in what they measure. Gross margin subtracts the Cost of Goods Sold (COGS) from revenue. Contribution margin subtracts variable costs from revenue. This difference is key for making business decisions.

Definitions and Differences

The table below shows the main differences between contribution margin and gross margin:

| Metric | Calculation | Application |

|---|---|---|

| Gross Margin | Revenue - COGS | Overall business profitability |

| Contribution Margin | Revenue - Variable Costs | Product-level profitability analysis |

Situational Applications

For checking how profitable each product or service is, the contribution margin per unit calculator is great. It helps find the most profitable items and allocate resources better. On the other hand, gross margin is better for seeing how profitable the whole business is and making big decisions.

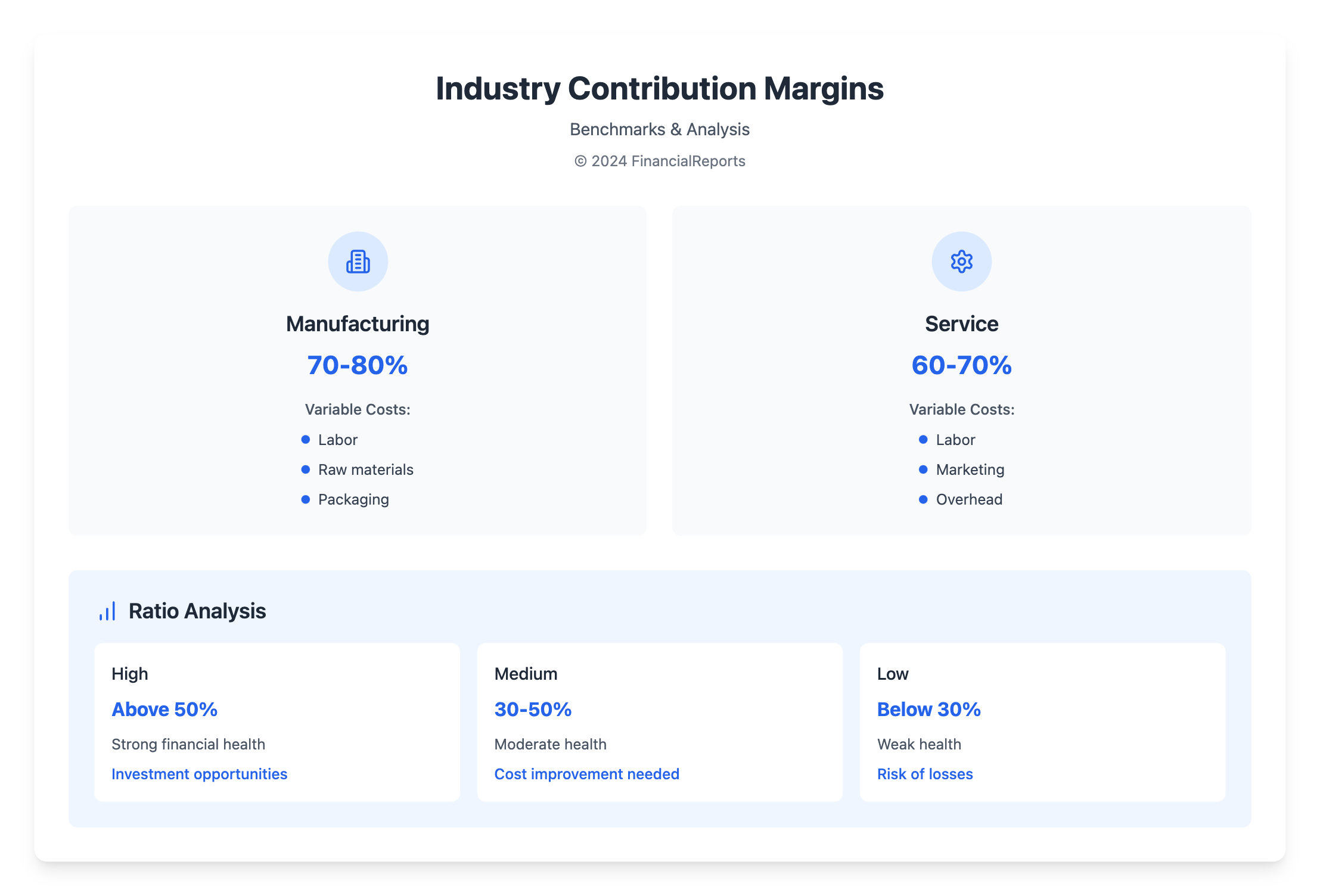

Benefits of Using Contribution Margin

Contribution margin is key in financial analysis. It shows how profitable a company is and its growth chances. With a contribution margin ratio calculator, businesses can set prices, allocate resources, and plan investments wisely. The ratio shows how well a company can cover fixed costs and make profits.

A higher ratio means better financial health. But, it's important to compare it with the industry and competitors. For example, a 40% ratio means $0.40 of each dollar goes to fixed costs and profit. This helps in setting prices, improving product mixes, and cutting costs.

Financial Decision-Making

Contribution margin analysis is key for making financial decisions. It helps businesses see how profitable each product or service is. With a calculator, companies can try out different scenarios to see how they affect finances. This helps in making strategic choices, like investing in new products or stopping unprofitable ones.

Pricing Strategies

Contribution margin is also vital for pricing strategies. It helps businesses find the best price for their products or services. This balance between revenue and costs helps in setting prices. It also shows when to raise or lower prices based on goals and market conditions.

| Contribution Margin Ratio | Interpretation |

|---|---|

| High (above 50%) | Indicates strong financial health and investment opportunities |

| Medium (30-50%) | Suggests moderate health and need for cost improvement |

| Low (below 30%) | Indicates weak health and risk of losses |

By using a contribution margin ratio calculator, businesses can understand their finances better. This helps in making smart decisions to grow and increase profits.

Common Mistakes in Calculation

Calculating contribution margin can be tricky. One big mistake is not understanding variable costs. These costs, like commissions and back-office expenses, change with sales or production levels.

Another mistake is forgetting about fixed costs. These costs, like rent and salaries, stay the same no matter how much you sell. Knowing the difference between variable and fixed costs is key. A contribution margin per unit calculator can help avoid these errors.

Here are some common mistakes to watch out for:

- Misidentifying fixed costs as variable costs

- Overestimating or underestimating production volumes

- Overlooking seasonal fluctuations in sales

- Failing to update calculations with changing costs or prices

By avoiding these mistakes and using a contribution margin per unit calculator, you can make sure your calculations are right. This helps you make smart decisions to grow your business and increase profits.

| Mistake | Description |

|---|---|

| Misidentifying fixed costs as variable costs | Incorrectly classifying fixed costs as variable costs can lead to inaccurate calculations |

| Overestimating or underestimating production volumes | Inaccurate production volume estimates can impact contribution margin calculations |

Contribution Margin in Different Industries

The contribution margin is key in many fields, like manufacturing and services. It shows how profitable a product is and helps set prices. With a contribution margin ratio calculator, companies can quickly see their profit margins. This helps them make smart choices based on data.

In manufacturing, costs like labor and materials affect the contribution margin. A high ratio means a company is covering its costs and making more profit. For instance, if a product sells for $50 and costs $10 to make, the ratio is 80%.

In services, the contribution margin is just as vital. It helps businesses see which services are most profitable. By looking at the margin, companies can spot areas to improve and boost revenue. Here's a table showing how important the contribution margin is across industries:

| Industry | Contribution Margin Ratio | Variable Costs |

|---|---|---|

| Manufacturing | 70-80% | Labor, raw materials, packaging |

| Service | 60-70% | Labor, marketing, overhead |

By using a contribution margin ratio calculator, businesses can understand their profitability better. This knowledge helps them make choices that lead to growth and success.

Real-Life Examples of Contribution Margin

Let's look at how a retail business uses contribution margin. An e-commerce store sells t-shirts for $25.00, with costs of $10.00 per unit. Using a calculator, we find the contribution margin per unit is $15.00. This helps with managing stock and setting prices.

A food service business can also benefit from contribution margin analysis. It helps them set the right prices for menu items. For example, if a dish costs $12.00 to make and sells for $12.00, the profit is $4.00. This info guides their pricing and menu planning.

Case Study: Retail Business

A retail business can analyze its products' profitability with a calculator. It inputs the selling price, costs, and units sold. The calculator shows the profit per unit and other important metrics. This helps them improve pricing and manage stock better.

Case Study: Food Service Industry

In the food service world, contribution margin helps with menu pricing. By calculating profit per item, businesses can set better prices. This info also helps with menu planning and stock management.

Using a contribution margin calculator gives businesses key insights. It helps them make smart choices about pricing, stock, and menus. This can boost revenue, cut costs, and increase profits.

How to Use a Contribution Margin Calculator

To use a contribution margin ratio calculator, you need to know what contribution margin is. It's the difference between what you sell and your variable costs. This shows how profitable a company is.

A contribution margin ratio calculator does more than just calculate the margin. It also gives you the ratio of revenue to fixed costs. This is key for setting prices, checking product profits, and finding ways to save money.

Here are some tips for using a contribution margin calculator:

- Make sure your sales revenue and variable costs are correct for accurate results.

- Compare the profits of different products or services with the calculator.

- Look at the contribution margin ratio to see how much money you have for different needs.

By following these tips and using a contribution margin ratio calculator, you can make your financial analysis easier. This helps you make smart decisions to grow your business.

| Contribution Margin Formula | Contribution Margin Ratio Formula |

|---|---|

| Contribution Margin (C) = Total Sales Revenue (R) - Variable Costs (V) | Contribution Margin Ratio (CR) = (Contribution Margin (C) / Total Revenue (R)) × 100% |

Integration with Financial Statements

The contribution margin per unit calculator is a key tool for financial experts. It helps understand a company's financial health. By looking at the contribution margin, businesses can see how profitable their products or services are. This insight guides decisions on pricing, production, and investments.

It shows up on a company's income statement and balance sheet. It tells how much income is left after all expenses are paid.

Using this calculator helps businesses link their financial statements. It makes predictions about their financial future more accurate. It considers variable costs, which change with production levels. This way, businesses can manage costs better and make smarter decisions.

Connection to Income Statement

The contribution margin is closely linked to the income statement. It shows the revenue left to cover fixed costs and make profits. By analyzing it, businesses can spot areas to boost profitability.

They can adjust pricing and production strategies. The contribution margin per unit calculator, used with the income statement, gives a full picture of a company's financial health.

Importance in Budgeting

The contribution margin per unit calculator is vital for budgeting too. It helps figure out how much to sell to break even or make a profit. Understanding the contribution margin lets businesses create better budgets.

It guides decisions on how to use financial resources. This helps achieve financial goals more effectively.

Tools and Software for Calculating Contribution Margin

Financial experts and businesses have many tools and software to find contribution margin. A contribution margin ratio calculator helps analyze product or service profitability. It guides businesses in setting prices, managing production, and investing wisely.

Popular choices include Microsoft Excel, Xero, and QuickBooks. These tools help users input sales, variable, and fixed costs. Then, they easily find the contribution margin and contribution margin ratio.

Comparison of Popular Software

- Xero: Offers a complete financial analysis suite with real-time data and insights

- QuickBooks: Provides specialized accounting software for calculating contribution margin and financial analysis

- Microsoft Excel: A well-known spreadsheet program for creating custom contribution margin ratio calculator templates

Choosing the right tool for contribution margin calculation is key. Businesses should match their needs with the software's features. The right tool helps streamline financial analysis and supports better decision-making.

| Software | Features | Benefits |

|---|---|---|

| Xero | Real-time profitability data, financial analysis suite | Streamlined financial analysis, informed decision-making |

| QuickBooks | Specialized accounting software, contribution margin calculation tools | Accurate financial reporting, improved financial performance |

| Microsoft Excel | Customizable spreadsheet templates, contribution margin ratio calculator | Flexible financial analysis, easy data manipulation |

Conclusion: The Value of Contribution Margin

The contribution margin per unit calculator and contribution margin ratio calculator are key for financial experts. They help improve business performance. Contribution margin analysis is vital for understanding profitability and pricing.

Knowing the difference between variable and fixed costs helps companies make better choices. They can decide how to use resources, which products to sell, and how much to charge. The contribution margin shows how much profit each unit sold brings in.

Using our calculators can help financial analysts make better decisions. This leads to better financial results and more value for shareholders. We suggest using these tools to boost your organization's success.

FAQ

What is the Contribution Margin Per Unit Calculator Tool?

The Contribution Margin Per Unit Calculator Tool helps professionals calculate the profit from each product or service. It's a key tool for improving profits by giving insights for better decisions.

What is Contribution Margin?

Contribution margin is the profit made from each item sold after variable costs are subtracted. It's vital for checking product profits, setting prices, and making smart business choices.

How is Contribution Margin Per Unit Calculated?

To find the contribution margin per unit, subtract variable costs from the selling price. Our calculator makes this easy, using accurate data for precise results.

What are the Key Components of the Contribution Margin Calculation?

The two main parts are the selling price and variable costs. Knowing these well is key to getting useful insights from the analysis.

How Does Contribution Margin Differ from Gross Margin?

Contribution margin looks at product profits, while gross margin looks at the whole business. Our tool helps you know when to use each for better decisions.

What are the Benefits of Using Contribution Margin Analysis?

It helps make important financial choices, set prices, and use resources wisely. With our tool, you can make your business more profitable and competitive.

What are Common Mistakes in Contribution Margin Calculations?

Mistakes often come from not understanding variable costs or ignoring fixed costs. Our tool avoids these errors, giving you accurate results.

How Does Contribution Margin Analysis Apply Across Different Industries?

It works in many industries, from making things to services. Our tool adapts to different businesses, giving insights for any industry.

Can You Provide Real-Life Examples of Contribution Margin Analysis?

Yes, we have examples from retail and food service. They show how our tool helps with inventory, pricing, and profit.

How Can Financial Professionals Effectively Use a Contribution Margin Calculator?

Our guide shows how to use the calculator step by step. It offers tips for accurate use, helping you make better decisions.

How Does Contribution Margin Analysis Integrate with Financial Reporting?

It's linked to the income statement and budgeting. Our tool works with financial statements, giving a full view of a company's health.

What Other Tools and Software are Available for Calculating Contribution Margin?

Many tools and software can calculate contribution margin. Our calculator stands out, with unique benefits and integration for financial pros.