Comprehensive Trading Securities Platform: Data-Driven Insights

The platform helps with tens of thousands of trades every day. The value of these trades is in the billions as of July 2024. It shows how important a good trading platform is for those in finance and investing.

It lets users get real-time data and insights. This helps them make smart choices when trading.

Advanced software helps traders look at lots of data. They can spot trends and guess what the market will do next. NGT works with EquiLend Clearing Services (ECS) for smooth trading. It's open 24/7 for real-time trading, making it key in the trading world.

Introduction to Trading Securities

NGT is involved in many markets, with over 10 types of assets traded. Its ability to handle CCP trades makes it appealing. The monthly report gives insights into trading trends, helping users improve their strategies.

Key Takeaways

- The platform handles tens of thousands of trades daily, with values in the billions.

- NGT is active in several markets, with more than 10 domiciles of assets traded via the platform.

- The platform's connection to EquiLend Clearing Services (ECS) allows for straight-through processing capabilities.

- NGT offers various ways for clients to connect into the eco-system, including an intuitive web-based interface.

- The platform provides real-time data and market-leading insights, enabling users to make informed decisions when trading securities.

- NGT's messaging capabilities allow counterparties to communicate seamlessly for a fully automated trading workflow.

Understanding Trading Securities

Trading securities is key in the financial market. It involves buying and selling things like stocks, bonds, and derivatives. Knowing what trading securities are and why they matter is vital. It's also important to understand the different types and who is involved.

Definition and Importance

Trading securities means buying and selling to make a profit. This happens on stock exchanges, over-the-counter markets, and in private deals. It's important because it helps the market run smoothly, sets prices, and moves money around.

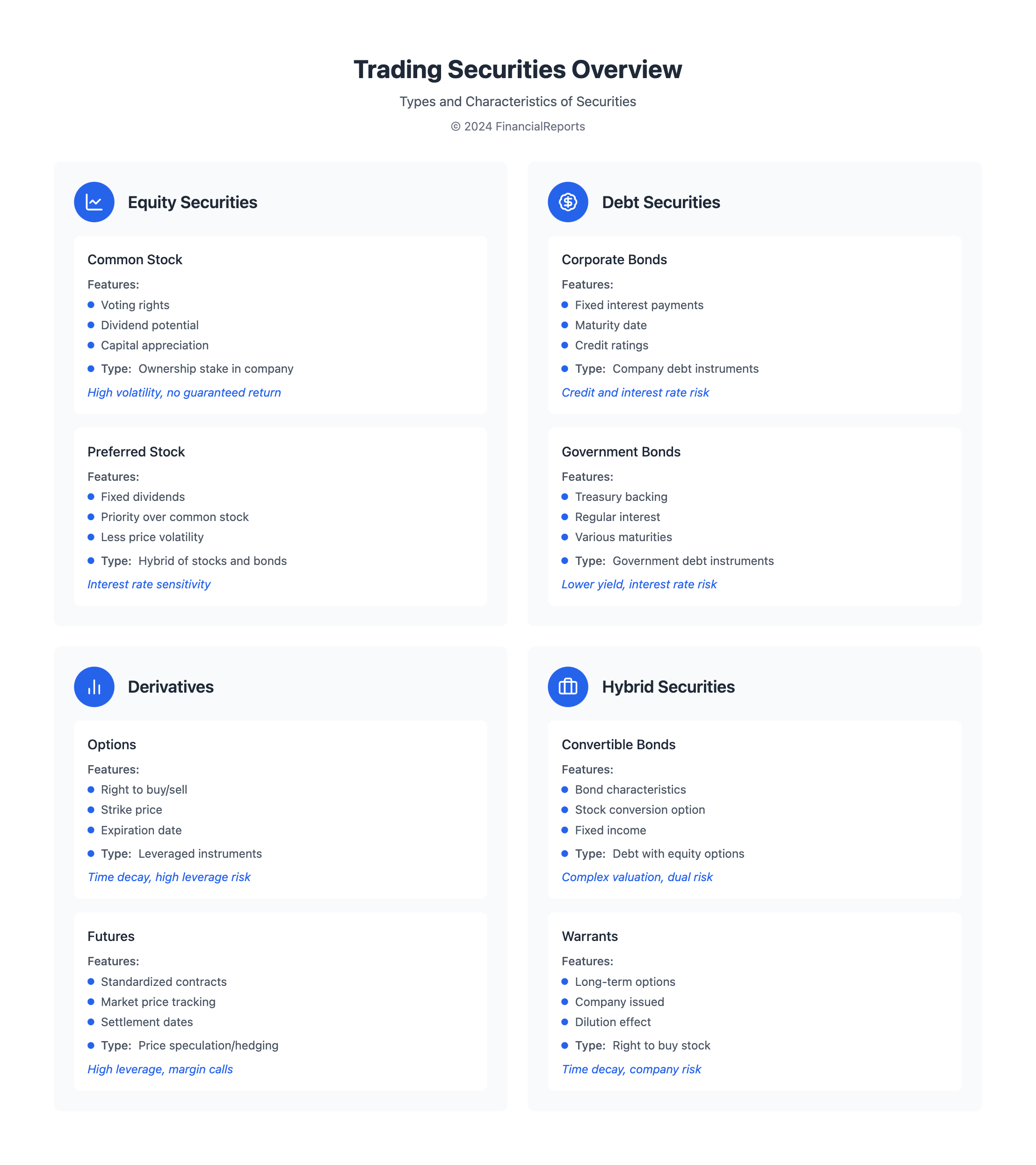

Types of Trading Securities

There are many kinds of trading securities, including:

- Equity securities, which show you own a piece of a company

- Debt securities, which are loans that need to be paid back

- Hybrid securities, which mix features of both equity and debt

- Derivatives, which are contracts based on something else's value

Market Participants

Investors, brokers, and dealers are all important in trading. They work together to buy and sell securities, aiming to make money. The U.S. Securities and Exchange Commission (SEC) makes sure the market is fair and open to everyone.

| Type of Security | Description |

|---|---|

| Equity Securities | Represent ownership interests in entities |

| Debt Securities | Represent borrowed money that must be repaid |

| Hybrid Securities | Combine characteristics of both equity and debt |

| Derivatives | Financial contracts whose value is based on an underlying asset |

Knowing about the different securities and who trades them helps investors make smart choices. As market participants keep trading, the role of trading securities will grow. The goal remains the same: to profit from buying and selling trade securities.

Key Factors Influencing Trading Securities

Trading securities are shaped by many factors, like economic indicators and market sentiment. Economic indicators, such as GDP, inflation, and unemployment rates, greatly affect the market's direction. For example, lower unemployment rates can boost consumer spending, leading to economic growth.

Market sentiment, the overall investor attitude, is also key. It's influenced by news, events, and trends. This sentiment can change quickly, impacting the market.

Some important economic indicators include:

- GDP growth rate

- Inflation rate

- Unemployment rate

These indicators offer insights into the economy's health. They help investors make smart choices about their securities.

Economic Indicators

Economic indicators significantly influence trading securities. A strong GDP growth rate can increase stock demand. But high inflation can lower demand. It's vital for investors to understand these indicators.

Market Sentiment

Market sentiment is also critical. It drives market trends and investor decisions. A positive sentiment can raise stock demand, while a negative one can lower it. Analyzing sentiment helps investors predict market movements.

Trading Strategies in Securities

Trading securities well needs a solid strategy. This means using methods like fundamental, technical, and quantitative analysis. Fundamental analysis looks at a company's financials and trends. Technical analysis uses charts to predict prices.

Understanding markets and data is key. Technical analysis indicators help spot opportunities and risks. Quantitative analysis uses math to improve strategies. These methods help traders create a strong plan.

Some popular strategies include:

- Day trading: for those who quickly trade during the day

- Swing trading: aims to catch market swings for profit

- Trend trading: follows trends using technical tools

Success in trading comes from a strategy that fits you. Keep adjusting it as the market changes. By mixing fundamental, technical, and quantitative analysis, traders can make smart choices and reach their goals.

Regulatory Environment

The regulatory environment is key in trading securities. It protects investors and keeps markets fair and efficient. In the U.S., bodies like the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) watch over trading.

These groups shape the trading market a lot. For instance, the SEC looks after the U.S. bond and equity markets. The CFTC handles derivatives like futures and options. The Financial Industry Regulatory Authority (FINRA) checks on broker-dealers to make sure they're doing the right thing.

Some important regulatory agencies and their jobs are:

- SEC: oversees U.S. bond and equity markets, enforces securities laws related to public companies, fund and asset managers, and other market participants

- CFTC: regulates derivatives, including futures, options, and over-the-counter markets

- FINRA: oversees U.S. broker-dealers, ensuring brokers are qualified and securities products are suitable for investors

Trading securities follows many rules and regulations. The SEC and CFTC make these rules and listen to public feedback. They then finalize the rules and set deadlines for everyone to follow them. Breaking these rules can lead to fines, jail time, or even a lifetime ban. There are also programs to reward those who help catch wrongdoers.

| Regulatory Agency | Responsibility |

|---|---|

| SEC | Oversees U.S. bond and equity markets, enforces securities laws |

| CFTC | Regulates derivatives, including futures, options, and over-the-counter markets |

| FINRA | Oversees U.S. broker-dealers, ensuring brokers are qualified and securities products are suitable for investors |

The Role of Technology in Trading

Technology has changed trading a lot. Now, traders have many tools and platforms to help them. Algorithmic trading, where computers make trades, is very common. It makes up about 70% of all trades in the U.S. stock market.

The global algorithmic trading market was worth USD 15.55 billion in 2021. It's growing fast, at a rate of 12.2% each year until 2030. This growth is because of better information, big data, and AI in trading. MyTradeVisAN and other platforms offer tools to improve trading skills.

Benefits of Algorithmic Trading

- Increased efficiency and speed in executing trades

- Improved accuracy and reduced risk of human error

- Enhanced ability to analyze and respond to market data

As algorithmic trading and trading platforms grow, trading will get even more complex. But, with the right tools, traders can stay ahead. They can make smart, data-based choices.

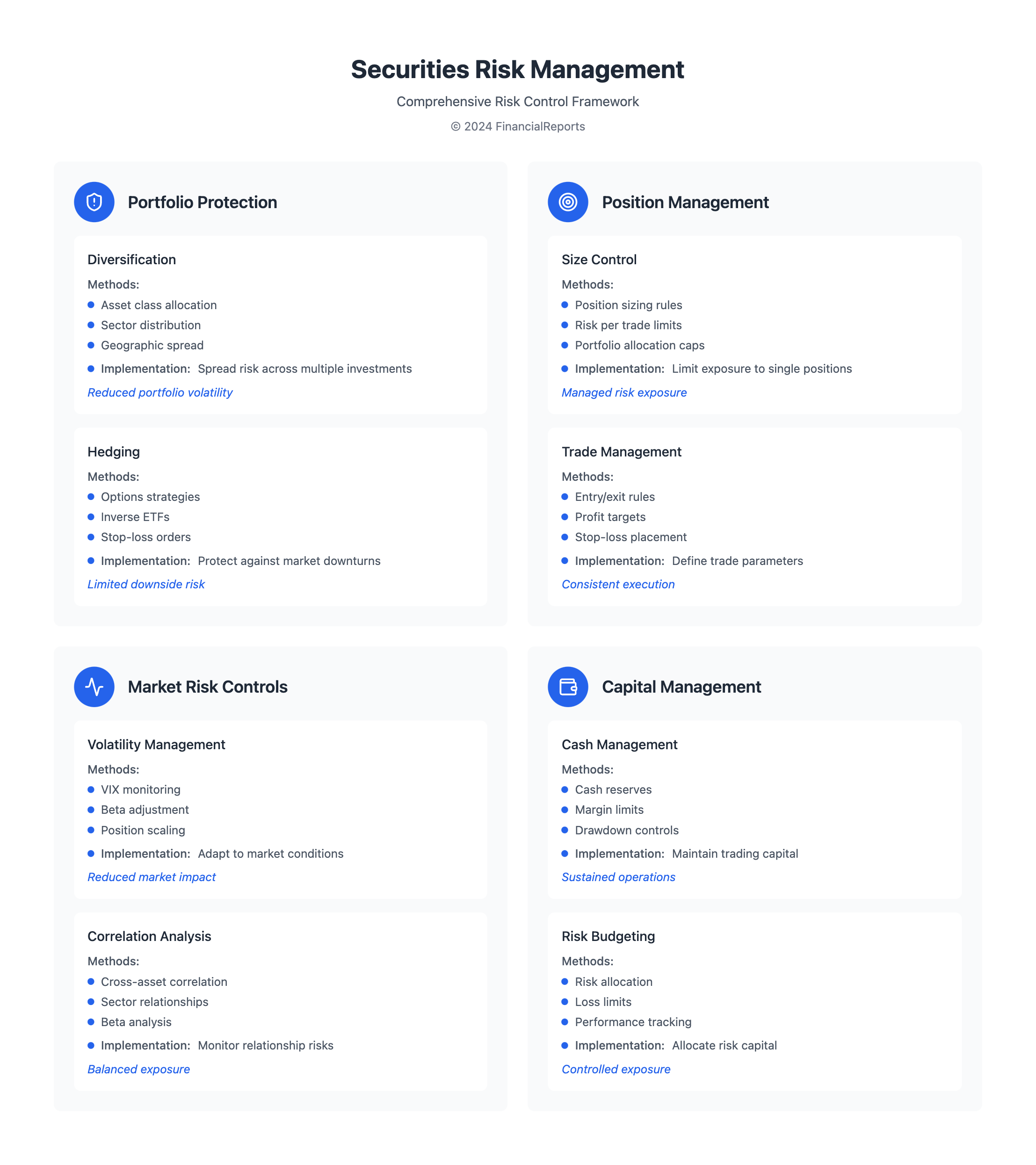

Risk Management in Trading Securities

Risk management is key in trading securities. It balances the chance for gains with the risk of losses. If not managed, traders can lose all their money. Strategies like diversification and hedging help reduce risk and boost profit chances.

For active trading success, a good risk management plan is essential. This includes setting stop-loss and take-profit points. Traders also use technical and fundamental analysis to find these levels. Diversifying investments across different sectors and regions helps manage risk and opens up more opportunities.

Identifying Risks

Identifying risks means analyzing possible losses and finding ways to lessen them. Traders calculate the expected return of a trade and consider the chance of gain or loss. Tools like moving averages help set stop-loss and take-profit levels.

Mitigation Strategies

Mitigation strategies, like hedging with options, protect against market downturns. Diversifying investments across various markets and instruments reduces the impact of poor performance. By following a rational trading strategy and keeping emotions out, traders can reduce risk and increase profit chances. Some key strategies include:

- Diversification across industry sectors, market capitalization, and geographic regions

- Hedging positions through options, such as downside put options or protective puts

- Setting stop-loss and take-profit points using technical analysis and fundamental analysis

Market Analysis Tools

Market analysis tools are key for success in trading securities. They give traders data-driven insights into market trends. Tools like charts and patterns help predict price movements. News and social media analysis tools show market sentiment.

Popular tools include Trading Central and Ally Invest. Trading Central is integrated into many brokers' platforms. Ally Invest uses Trading Central's stock screener. Other platforms like Charles Schwab's StreetSmart Edge and E*TRADE's Power E*TRADE offer advanced tools.

Technical analysis tools are divided into types. These include trend indicators, momentum indicators, and volume indicators. Trend indicators like ADX and MACD show trend strength. Momentum indicators like RSI and Stochastic Oscillator show price changes.

Volume indicators like OBV and A/D line show trading volume. By using these tools, traders can understand markets better. They make informed decisions by staying updated with market changes.

| Tool | Description |

|---|---|

| Trading Central | Provides technical analysis tools integrated into various brokers' platforms |

| Ally Invest | Offers a stock screener powered by Trading Central |

| Charles Schwab's StreetSmart Edge | Features Screener Plus component for real-time streaming data and stock filtering |

The Impact of News on Securities Trading

News is very important in the trading securities market. Economic news and company announcements shape market feelings. Trading is influenced by news, guiding the market's direction.

Economic news, like GDP and inflation, shows the economy's health.

Some key factors in trading securities include:

- Government reports on consumer and industry trends

- Company quarterly reports on future outlook

- Global events that can disrupt trading

News can be good or bad. Good news makes people buy, raising stock prices. Bad news makes people sell, lowering prices. Economic news releases help understand market trends. Traders aim to predict news cycles, not just react.

A table showing news impact on trading is below:

| Type of News | Impact on Trading Securities |

|---|---|

| Positive News | Buying pressure, increase in stock prices |

| Negative News | Selling pressure, decrease in stock prices |

| Economic News Releases | Provides insights into the overall direction of the market |

Knowing how news affects trading is key for smart investing. Keeping up with economic news and company updates helps traders predict trends. This way, they can make better choices about their securities.

Investor Psychology

Investor psychology is key in the world of trading securities. It shapes trading choices and moves the market. Behavioral finance helps traders grasp their own psychology, leading to better decisions.

Greed, fear, and negativity bias affect investor psychology. Greed might make traders buy risky stocks or hold them too long. Fear can cause them to sell too soon or be too cautious. Knowing these biases is vital for smart investing.

To fight these psychological effects, traders need a solid plan. This plan should outline goals, risk levels, and strategies to control emotions. Keeping up with market trends also helps avoid common mistakes in behavioral finance.

| Emotion | Impact on Trading |

|---|---|

| Greed | Overbuying or holding positions too long |

| Fear | Premature trade exits or risk aversion |

| Negativity bias | Focus on negative aspects, missing profitable opportunities |

Understanding behavioral finance and its role in trading securities is key. It helps investors make better choices and avoid pitfalls. Staying informed, having a plan, and managing emotions are essential for success in trading securities and investor psychology.

Future Trends in Trading Securities

The world of trading securities is changing fast. New tech and what investors want are driving these changes. AI and machine learning are key in this shift. They help broker-dealers make customer service better, improve how they invest, and run their operations more smoothly.

AI is making a big impact in communications with customers, investment processes, and operational functions. For example, AI chatbots answer simple questions like account balances. AI also analyzes how customers behave to offer them content that fits their interests.

Rise of AI and Machine Learning

AI and machine learning in trading securities will keep growing. Many firms are setting up special AI teams. This is because they want to trade smarter and have more data to work with. The benefits include:

- Improved risk management

- Enhanced portfolio performance

- Increased efficiency in trading operations

Environmental, Social, and Governance (ESG) Factors

ESG factors are becoming more important in trading securities. Investors want to make choices that help the planet and society. Broker-dealers are creating products like ESG ETFs and SRI portfolios to meet this demand.

| Trend | Description |

|---|---|

| AI and Machine Learning | Use of AI and machine learning to enhance trading strategies and improve operational efficiency |

| ESG Factors | Incorporation of environmental, social, and governance considerations into investment decisions |

As the trading securities world evolves, it's vital for everyone to keep up. By using AI and machine learning and focusing on ESG, investors and broker-dealers can stay ahead. This approach can lead to better results in the trading market.

Conclusion: The Future of Trading Securities

The future of trading securities is set to change a lot. New technologies and what investors want are leading the way. AI and machine learning will change how traders use data. This will make trading smarter and more informed.

Also, more people will care about the planet and society in their investments. They want to make money while doing good. This means looking at how companies act and treat the environment.

The future will bring clearer markets, better risk handling, and easier trading. All thanks to new tech. Traders who use these new ways will do well. They'll be ready for the challenges of trading and might even make more money.

FAQ

What is a complete trading securities platform and how can it help financial experts and investors?

A complete trading securities platform offers real-time data and insights. It uses AI to analyze market data, find trends, and predict market moves. This helps traders make better choices.

What are trading securities, and what types are there?

Trading securities means buying and selling things like stocks, bonds, and derivatives. There are mainly three types: equity, debt, and hybrid securities.

Who are the key players in trading securities?

Key players include investors, brokers, and dealers. They all play important roles in trading.

What factors affect trading securities?

Factors include economic indicators like GDP, inflation, and unemployment. Market sentiment, or how investors feel, also plays a big role.

What are the main trading strategies?

Main strategies are fundamental, technical, and quantitative analysis. They involve looking at financial statements, trends, and models to make trading decisions.

What is the role of the regulatory environment in trading securities?

The regulatory environment, overseen by bodies like the SEC, is key. It protects investors and keeps markets fair and efficient.

How has technology changed trading securities?

Technology has greatly changed trading. It allows for algorithmic trading and advanced platforms. These tools help analyze and improve trading performance.

What are the main risk management strategies in trading securities?

Risk management is critical. It involves identifying risks and finding ways to reduce them, like diversification and hedging.

What types of market analysis tools are available for trading securities?

Available tools include technical analysis tools like charts and patterns. Sentiment analysis tools also help understand market feelings and make decisions.

How can news and investor psychology impact trading securities?

News, like economic data and company announcements, can greatly affect market sentiment and prices. Investor psychology and behavioral finance also influence trading decisions and market dynamics.

What are the future trends in trading securities?

The future will likely see more AI and machine learning. Environmental, social, and governance (ESG) factors will also become more important in investment decisions.