Comprehensive Technical Stock Trading Platform for Confident Investing

A good technical stock trading platform is key for confident investing. It helps investors make smart choices in the stock market. Fidelity Investments is top-notch, known for being the best online brokerage. It's great for those who want to save money and invest in ETFs, with a rating of 4.8.

Our platform has many tools to spot trends and patterns. It's like having advanced charting tools and technical signals. This is similar to what Webull offers, where you can trade stocks, ETFs, and options without paying commissions. It's perfect for all kinds of investors.

Key Takeaways

- Use a detailed technical stock trading platform for confident investing in the stock market.

- Choose a platform with low costs, like Fidelity Investments, which is great for saving money on trades.

- Use technical indicators, charts, and tools to find trends and patterns in the market.

- Consider Webull for commission-free trading and advanced charting tools for deep market analysis.

- Make sure the platform meets your investment needs with different account types, like Traditional or Roth IRA.

- Look for platforms with strong regulatory oversight, like Webull, which is backed by SEC, FINRA, and SIPC.

- Choose a platform with a high rating, like Fidelity's 4.8, and lots of customer support, like Fidelity's 210 centers.

Introduction to Stock Technical Trading

Stock technical trading uses technical analysis to spot trends and patterns in the market. Traders use charts and indicators to make smart investment choices. Knowing how to use stock for ta is key to analyzing trends and predicting price movements.

Market trends are very important in stock technical analysis. They help traders see the market's direction and make better investment choices. For example, a bullish trend might suggest stock prices will go up, while a bearish trend might suggest they will go down.

Understanding Technical Analysis

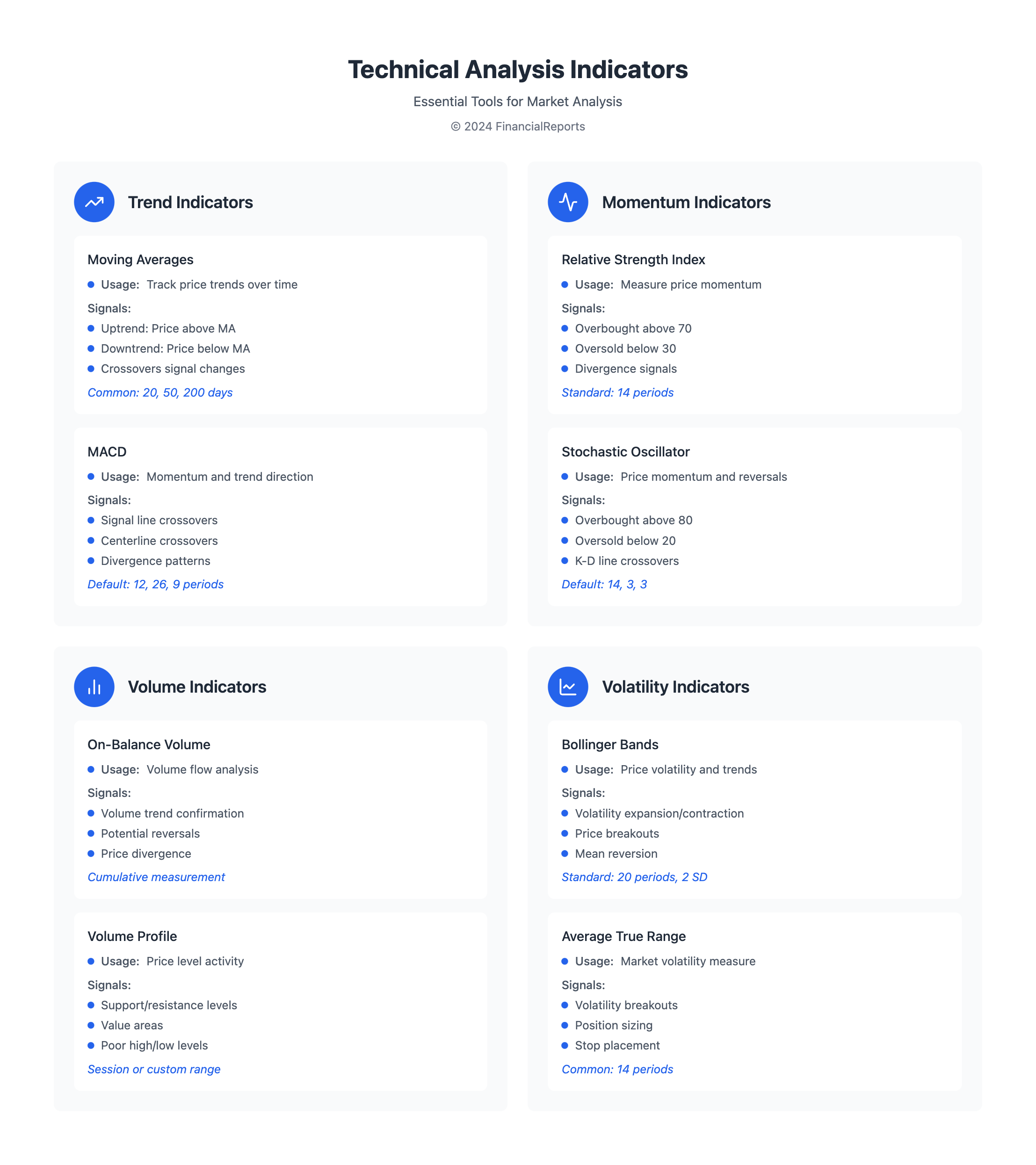

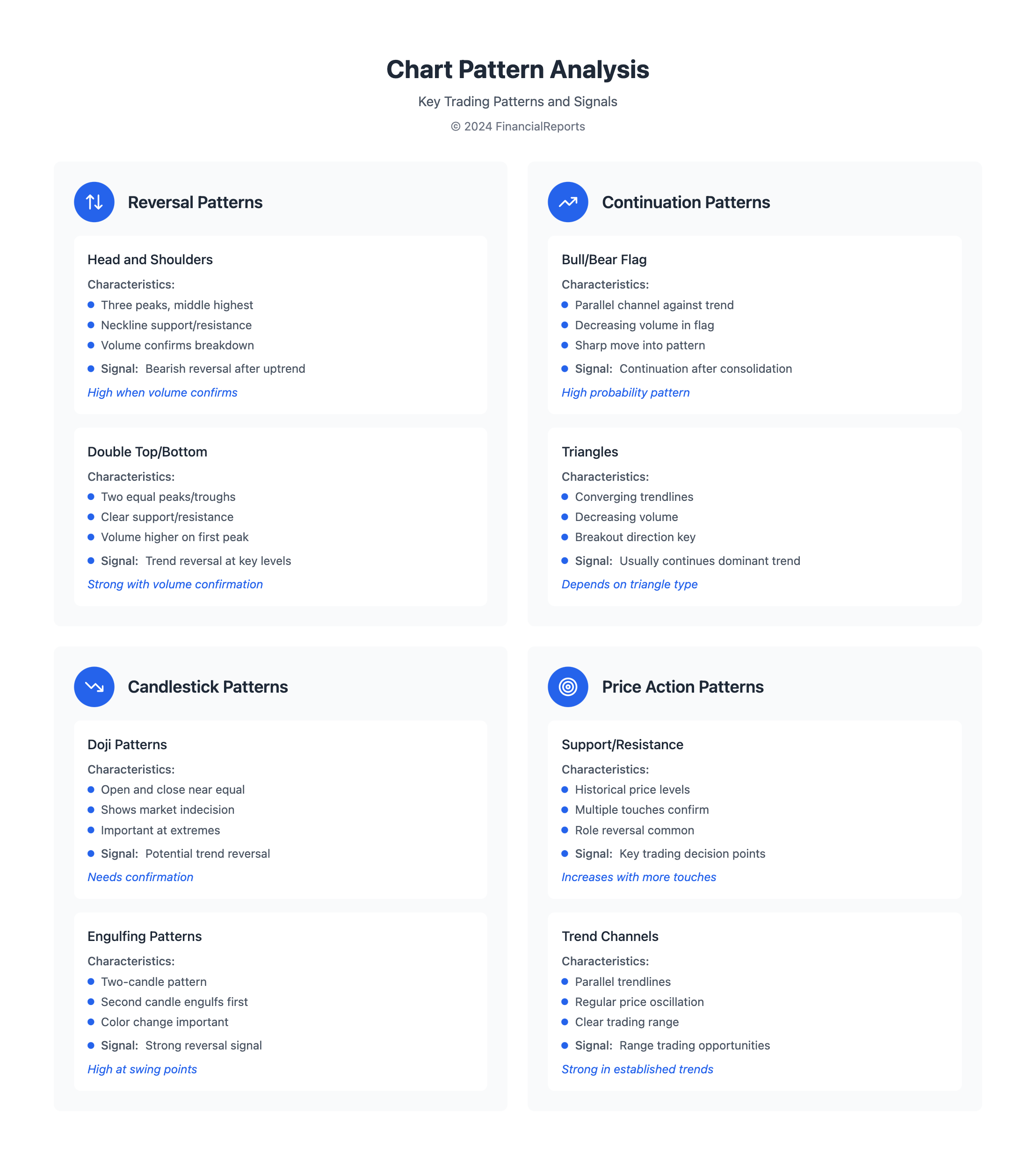

Technical analysis studies price and volume data to find patterns and trends. Traders use indicators like moving averages and oscillators to understand price movements. Common patterns include head-and-shoulders, triangles, and rounded tops or bottoms.

Importance of Market Trends

Market trends are vital in technical analysis. They help traders see the market's direction. By analyzing trends, traders can make smart investment choices and adjust their strategies.

- Identify the trend: Determine the overall direction of the market, whether it's bullish or bearish.

- Analyze the trend: Study the trend to identify patterns and possible support and resistance areas.

- Adjust your strategy: Change your investment strategy based on your trend analysis.

By understanding stock technical analysis, traders can make informed decisions and stay ahead. With the right tools and knowledge, traders can navigate the stock market and reach their goals.

| Technical Indicator | Description |

|---|---|

| Relative Strength Index (RSI) | Measures the magnitude of recent price changes to determine overbought or oversold conditions. |

| Moving Average Convergence Divergence (MACD) | Tracks the relationship between two moving averages to identify trends and predict future price movements. |

| Bollinger Bands | Shows volatility levels with upper, lower bands and a middle band to identify possible breakouts and trends. |

Key Concepts in Technical Trading

Technical trading uses tools and techniques to analyze market trends. It focuses on analysis trading to spot patterns and trends. Charts and visual aids help investors make smart choices.

Share trading technical analysis is another key concept. It uses technical indicators to predict price movements. This helps investors understand the market better and make informed decisions.

Candlestick Patterns

Candlestick patterns are vital in technical share trading. They offer insights into market trends. Patterns like the hammer, engulfing, and doji are commonly used.

Support and Resistance Levels

Support and resistance levels are critical in technical trading. They help identify key market areas. Understanding these levels helps investors make better decisions.

Key points to remember in technical trading include:

- Understanding different technical indicators and their use

- Identifying and analyzing candlestick patterns and other chart patterns

- Knowing how to use support and resistance levels for informed decisions

Essential Tools for Technical Traders

Technical traders use many tools to analyze the share market. They look at trends and patterns to make smart investment choices. This involves using indicators and charting software.

Popular indicators include the On-balance volume (OBV) and the Relative strength index (RSI). These help spot trends and when to trade. Charting software like TradingView and eToro also play a big role.

| Indicator | Description |

|---|---|

| On-balance volume (OBV) | Measures buying and selling pressure |

| Accumulation/distribution (A/D) line | Measures money flow into or out of a security |

| Aroon oscillator | Identifies trend direction and strength |

These tools help traders understand the market better. Whether you're new or experienced, knowing how to use them is key. Staying updated with market trends is also important.

Types of Technical Analysis Strategies

Technical analysis of stocks helps investors make smart choices. It's key in trading, showing trends and patterns. Analysis trading uses tools like charts to guess price changes.

There are many strategies, like day trading, swing trading, and scalping. Day traders buy and sell in one day, aiming to make quick profits. Swing traders hold stocks for days or weeks, aiming for bigger gains.

Some common strategies include:

- Trend-following strategies, which identify price trends

- Mean-reversion strategies, which look for price levels where assets return to their average

- Momentum strategies, which use indicators like MACD and RSI to track price changes

Technical analysis works on any security with price history, like stocks, bonds, and currencies. It helps investors plan better and make informed choices.

| Strategy | Description |

|---|---|

| Day Trading | Buying and selling stocks within a single trading day |

| Swing Trading | Holding stocks for a shorter period to profit from larger trends |

| Scalping | Making multiple small trades in a short period to profit from small fluctuations |

Analyzing Stock Charts

Stock market technical analysis uses tools and techniques to predict stock prices. Stock charts are key, showing a stock's price and trading activity over time. These charts help spot trends and opportunities for trading.

There are many chart types, like line, bar, and candlestick charts. Each offers a different view of the market. For instance, line charts show trends, while candlestick charts highlight reversals or trend changes.

Types of Charts

- Line charts: connect closing prices for a certain time interval, aiding in trend analysis

- Bar charts: show price range for each period, indicating volatility by bar size

- Candlestick charts: display bullish or bearish sentiment through green or red bodies, showing price movements in trending markets

Chart Timeframes

Chart timeframes show the period covered, from minutes to years. Traders use different time frames based on their strategy. Intraday traders look at short time frames, while long-term traders focus on longer ones.

By analyzing charts and time frames, investors can predict a stock's future. This helps them make better investment decisions.

| Chart Timeframe | Description |

|---|---|

| 5-minute chart | Used for intraday trading, provides a detailed view of short-term price movements |

| 15-minute chart | Used for intraday trading, provides a detailed view of short-term price movements |

| Hourly chart | Used for short-term trading, provides a view of price movements over several hours |

| 4-hour chart | Used for short-term trading, provides a view of price movements over several hours |

| Daily chart | Used for long-term trading, provides a view of price movements over several days |

Risk Management in Technical Trading

Risk management is key in technical trading. It involves using strategies to cut down on losses. In stock trading, it's about balancing gains and losses. It also aims to reduce losses and boost gains to protect traders' money.

Effective risk management includes setting stop-loss orders and choosing the right position size. These are vital for analyzing stocks technically.

For traders using stock for technical analysis, risk management is critical. Without it, they can lose all their profits in a few bad trades. To avoid this, the one-percent rule is often followed. It advises not risking more than 1% of your capital on a single trade.

Key Risk Management Strategies

- Setting stop-loss and take-profit points to plan ahead and manage risks effectively

- Using moving averages and trend lines for technical analysis to set stop-loss and take-profit points

- Diversifying investments across sectors, market capitalization, and regions to manage risk and increase opportunities

- Hedging positions through options, such as downside put options, to protect traders from losses

In technical trading, managing risk is vital for protecting traders' accounts and increasing gains. By using these strategies, traders can reduce losses and make better investment choices. A good technical stock trading platform offers tools like historical data analysis. This helps traders find important price levels for making decisions.

Developing a Trading Plan

Creating a detailed trading plan is key for analysis trading and share trading technical analysis success. A good plan helps investors make smart choices, manage risks, and reach their financial targets. It's important to focus on trading strategy, risk control, and how to measure performance when making a plan.

Key Components of a Trading Plan

A strong trading plan must have several important parts, such as:

- Goal definition

- Trading style selection

- Strategy development

- Realistic expectation setting

- Comprehensive market analysis

- Risk management rule development

- Trade management plan

- Trading discipline maintenance

- Monitoring and trade evaluation

- Continuing education

Backtesting Strategies

Backtesting strategies is a vital step in making a trading plan. It means testing a strategy with past data to see how it might perform. By doing this, investors can improve their trading methods and make better choices. Technical share trading plans can be detailed, but with the right tools, investors can craft a plan that fits their needs.

Psychological Aspects of Trading

Understanding the psychological side of trading is key in the share market. Fear and greed often lead to quick decisions. Learning to manage these emotions is vital for a good trading strategy.

Loss aversion, fear of missing out (FOMO), and overconfidence are common biases. They can harm trading decisions. To beat these, having a solid trading plan and managing risks are important. Emotional intelligence also plays a big role.

Here are some ways to handle emotions and get better at trading:

- Find a trading style that fits you and your goals

- Use tools like On-Balance Volume (OBV) and Accumulation/Distribution (A/D) to understand market trends

- Stay calm and avoid making decisions based on emotions

- Keep up with market changes and use data to guide your trades

By grasping the psychological side of trading and learning to control emotions, investors can do better. Whether using technical trading or other methods, being informed and disciplined is key to success.

| Psychological Bias | Description | Impact on Trading |

|---|---|---|

| Loss Aversion | Fear of losses outweighs the value of gains | Conservative trading, avoiding risk |

| Fear of Missing Out (FOMO) | Fear of missing out on gains | Impulsive trading, chasing trends |

| Overconfidence | Too much confidence in trading skills | Aggressive trading, taking too much risk |

Current Trends in Technical Trading

Technical trading keeps changing, with technical analysis of stocks key in predicting prices. Algorithmic trading and social platforms are becoming more popular. They help traders improve their strategies. By using equity technical analysis, traders can make better choices.

Important trends include using advanced analysis trading tools and machine learning. Traders are also using social platforms to share and learn. This move towards teamwork and data is expected to grow. Technical analysis of stocks will keep being a key part of trading.

- Algorithmic trading for automated decision-making

- Social trading platforms for community-driven insights

- Advanced analysis trading tools for predictive modeling

As technical trading evolves, it's vital for traders to keep up with new trends and tech. By using equity technical analysis and other tools, traders can be more confident and precise in the markets.

Conclusion and Next Steps in Stock Trading

Stock trading is always changing, needing a strong commitment to learning and connecting with others. Successful traders know the value of continuing education. They keep up with new strategies, tools, and trends.

By staying current with technical analysis of stocks, traders can improve their skills. Our platform offers many educational tools. These include tutorials, webinars, and market analysis to help investors learn and get better at trading.

Also, joining trading communities is very helpful. These groups are full of fellow investors who share ideas and insights. By working together, traders can learn a lot and stay ahead in the fast-paced world of stock technical trading.

FAQ

What is a complete technical stock trading platform and why is it essential for confident investing?

A complete technical stock trading platform offers many tools to help investors make smart choices. It includes technical indicators, charts, and analysis tools. These tools help spot trends and patterns in the market, leading to more confident trading.

What is technical analysis and why is it key for stock trading?

Technical analysis uses charts and indicators to find trends and patterns. It helps investors understand a stock's future performance. This knowledge is vital for making smart investment decisions.

What are candlestick patterns and support and resistance levels, and how can they be used in technical trading?

Candlestick patterns and support and resistance levels help identify market trends and levels. They guide investors in making informed decisions and building a strong trading strategy.

What are the essential tools for technical traders, and how can they be used to enhance trading performance?

Charting software and indicators are key for technical traders. They provide a visual market view and insights. These tools help spot trading opportunities.

What are the different types of technical analysis strategies, and how can they be applied to stock trading?

There are day trading, swing trading, and scalping strategies. Each suits different market conditions and trends. They help traders capitalize on various market situations.

How can investors analyze stock charts to gain insights into the market?

Stock chart analysis is vital in technical analysis. It involves using various charts and timeframes. Understanding these helps investors predict a stock's future performance.

What are the key risk management strategies in technical trading, and how can they be used to minimize losses?

Risk management is critical in technical trading. It includes setting stop-loss orders and using position sizing strategies. These methods help reduce losses and increase gains.

What are the key components of a trading plan, and how can backtesting strategies be used to refine a trading approach?

A trading plan is essential for success. It outlines the strategy, risk management, and performance metrics. Backtesting strategies evaluate a plan's performance using historical data.

What are the psychological aspects of trading, and how can investors overcome trading fear and develop discipline?

Trading psychology is important. It involves overcoming fear and developing discipline. Addressing these aspects improves trading performance and helps achieve investment goals.

What are the current trends in technical trading, and how can investors stay up-to-date with the latest developments in the field?

Trends include algorithmic trading and social trading platforms. Staying informed with these trends helps refine trading approaches and make better investment decisions.