Comprehensive Stock Backtesting: Improve Your Trading Edge

Stock backtesting is key in trading, helping to boost the chance of making money. It uses past data to test trading rules. This way, investors can see if their strategies work.

By looking at how strategies did in the past, investors can weed out bad ones. This builds confidence and helps understand how strategies work.

Investment backtesting picks stocks to test and looks at different time frames. Tools like Tradewell make it easy, with over 65,000 tickers. You don't need to know how to code.

It's vital for traders who handle many stocks. It finds good strategies and gets rid of the bad ones.

Key Takeaways

- Stock backtesting is a technique used to assess the profitability of a trading strategy by applying trading rules to past data.

- Investment backtesting helps eliminate unsuccessful and fragile strategies by evaluating past performance.

- Stock backtesting involves selecting tradable stocks through liquidity filters and testing strategies across different time horizons.

- Platforms like Tradewell provide a no-code interface for backtesting stock trading strategies.

- Stock backtesting is vital for traders dealing with a broad market universe, as it helps in identifying successful strategies and eliminating unsuccessful ones.

- Investment backtesting can be done using various platforms, including Tradewell, TradingView, and QuantConnect, each with its own pricing and features.

- Stock backtesting has its pros and cons, including showing strategy profitability and revealing drawdowns, but also the risk of curve fitting or overfitting.

Understanding Stock Backtesting

Stock backtesting is key in trading. It tests strategies with past data to see how they might do. This helps traders improve their plans, spot problems, and make better choices. Back testing is vital because it shows how strategies worked in the past. This gives traders an advantage today.

Tradewell says stock backtesting lets traders test their plans in a safe space. It helps them know when to buy or sell. This is important for managing risks and improving strategies. Important terms in back testing include daily and intraday data, dividends, stock splits, and economic indicators.

Here are some important metrics for stock backtesting:

- Earnings per share (EPS)

- Price-to-earnings (P/E) ratio

- Revenue

- Debt levels

These metrics give insights into a company's health and performance. They help traders make smart choices.

| Metric | Description |

|---|---|

| Earnings per share (EPS) | A company's profit divided by its total number of shares |

| Price-to-earnings (P/E) ratio | A company's stock price divided by its EPS |

By knowing these metrics and using back testing well, traders can gain an edge. They can make more informed investment choices.

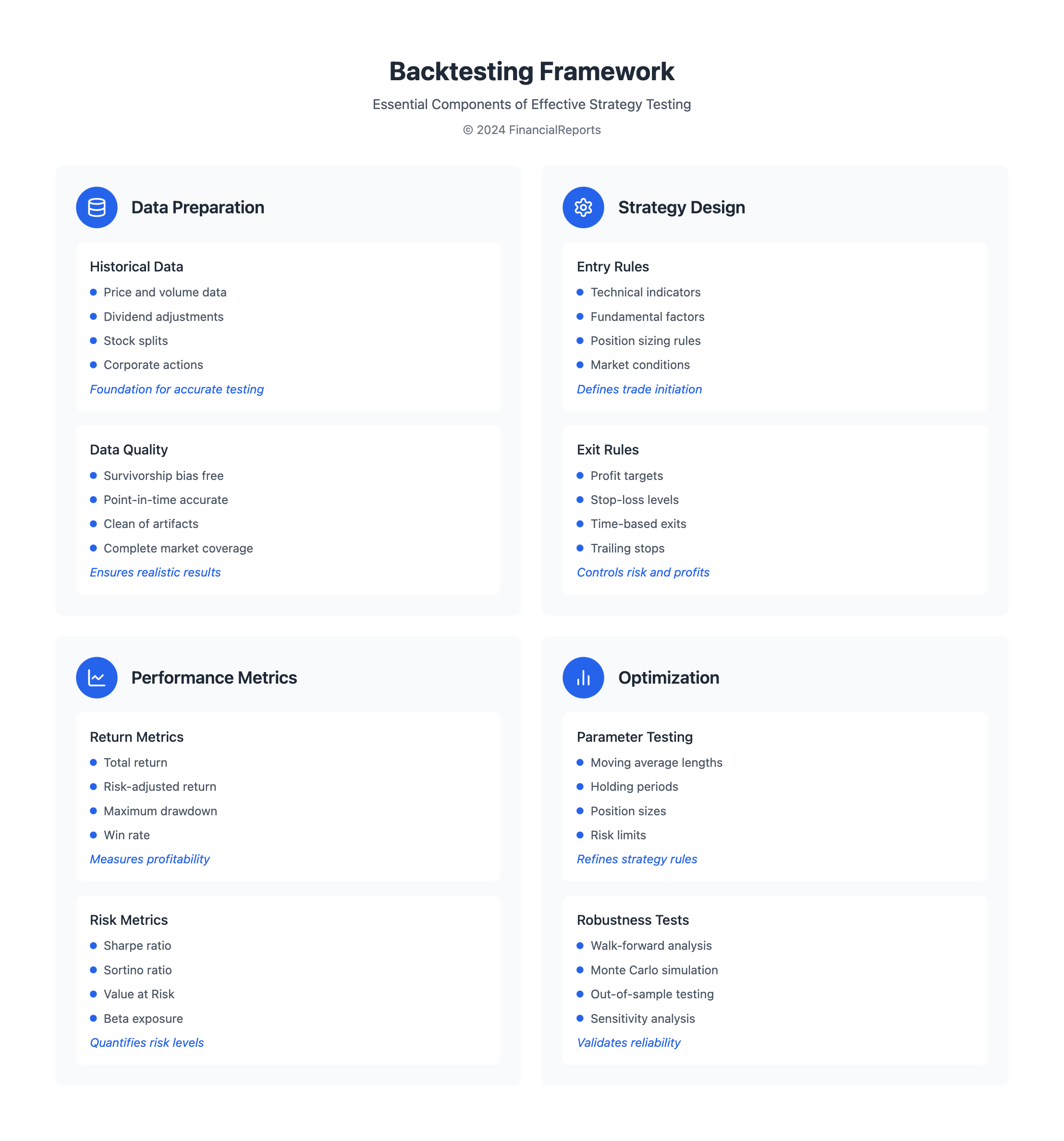

The Backtesting Process

Backtesting is key to checking if a trading strategy works. It uses past data to see if a strategy could make money and how risky it is. The aim is to find what's good and bad about a strategy and tweak it to do better.

Setting up the right parameters, like when to trade, is important. Also, picking the right historical data is vital for getting accurate results. TraderEdge says choosing the right data and parameters is essential for a stock back test to be reliable.

Some important things to think about in backtesting are:

- Net profit/loss

- Return and risk-adjusted return

- Market exposure and volatility

These metrics help traders see how well a strategy does. By using back testing to check and improve a strategy, traders can feel more confident in its success. This helps them make better investment choices.

| Metric | Description |

|---|---|

| Net Profit/Loss | The total profit or loss of a trading strategy over a given period. |

| Return | The percentage gain or loss of a trading strategy over a given period. |

| Risk-Adjusted Return | The return of a trading strategy adjusted for its level of risk. |

Tools and Software for Backtesting

For stock backtesting, the right tools and software are key. Many platforms offer free and paid options, each with unique features. Tradewell and TraderEdge are well-liked for their accurate historical price data and wide range of indicators.

Common KPIs in backtesting software include Profit and loss (P&L), Win rate, and Sharpe ratio. These metrics help traders evaluate their strategies. The platforms cover various markets like Forex, stocks, and crypto.

Notable platforms for stock backtesting include NinjaTrader and MetaTrader 4 and 5. ProRealTime, cTrader, and StrategyQuant are also popular. These tools support different backtesting types, from manual to automated, to fit various trading strategies.

| Platform | Features | Markets Covered |

|---|---|---|

| NinjaTrader | Automated and manual backtesting | Forex, futures |

| MetaTrader 4 and 5 | Automated backtesting using Expert Advisors (EAs) | Forex, stocks, metals, futures, indexes |

| ProRealTime | Backtesting capabilities for stocks, forex, and commodities | Stocks, forex, commodities |

Using these tools and software, traders can improve their strategies and reduce risks. Whether you're looking for free or paid options, there's a platform for you.

Designing a Trading Strategy

When creating a trading strategy, using stock backtesting is key. It helps make the strategy better. A good strategy includes managing risk and knowing how much to invest. Investment backtesting lets traders test their strategies without risk.

Some important things to think about when making a trading strategy are:

- Defining entry and exit signals

- Establishing risk management rules

- Developing trade management strategies

Trying out different ways to enter and exit trades helps traders see what works. They can make choices based on solid evidence. Backtesting well means having a clear plan and the right data.

Market research shows the Global Backtesting Software Market will hit $5 billion by 2027. It's growing at 12.5% each year. This shows how vital stock backtesting and investment backtesting are in trading and investing.

Evaluating Backtesting Results

When looking at backtesting results, it's key to check important metrics. These include profit factor, drawdown, and volatility. Profit factor shows how well a strategy makes money. Drawdown is the biggest loss a strategy might face. Knowing these helps figure out if a trading plan works.

A good back testing uses top-notch historical data and real trading costs. This makes sure the results are trustworthy. The stock back test should cover a wide range of stocks, even those that are gone. By looking at these metrics, traders can improve their plans and make smart choices.

| Metric | Description |

|---|---|

| Profit Factor | Measure of the strategy's ability to generate profits |

| Drawdown | Maximum loss the strategy can incur |

| Volatility | Measure of the strategy's risk |

By checking these key metrics, traders can really understand how their strategy is doing. They can then tweak their plans as needed. This cycle of back testing and improving is vital for a winning trading strategy. The insights from stock back test results help traders fine-tune their methods for better results.

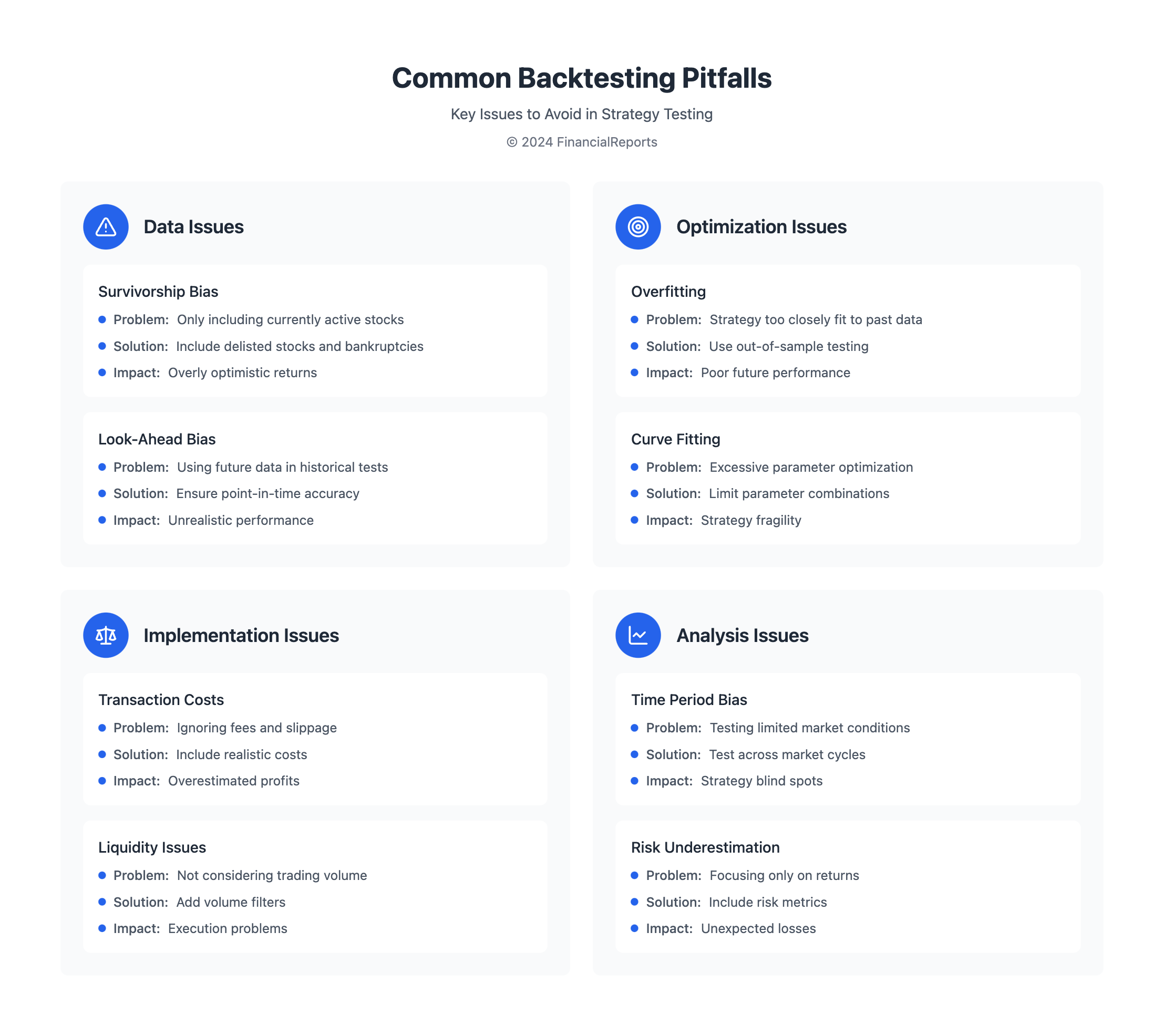

Common Pitfalls in Stock Backtesting

Stock backtesting is key for checking trading strategies. But, it has its own set of challenges. One big mistake is overfitting. This happens when a model is too detailed and matches historical data too well. It picks up random noise instead of real patterns.

This can cause problems when trading live. The model struggles to apply what it learned to new data.

Another issue is ignoring the market's state. Backtesting mistakes can be very costly. It's vital to think about market conditions like bull or bear markets, or times of high volatility.

For instance, a strategy might work great in a bull market but fail in a bear market.

Some common pitfalls to watch out for in stock backtesting include:

- Overfitting: when a model is too complex and fits the historical data too closely

- Ignoring market conditions: such as bull markets, bear markets, or high volatility periods

- Poor quality data: which can lead to misleading results

- Survivorship bias: when backtesting only includes securities that have survived until the end of the period

To avoid these pitfalls, traders and analysts need to be careful. They can use methods like walk-forward optimization and out-of-sample testing. These help check how well trading strategies work.

By using these methods and avoiding common mistakes, traders and analysts can get a clearer picture of their strategies. This helps them make better decisions.

Real-World Case Studies

Investment backtesting is key in checking a trading strategy's worth. It uses past data to see how a strategy would have done. For instance, a stock back test showed a moving average strategy could earn a 15% annual return over five years.

A mean reversion strategy bets on assets that have strayed from their usual value. They're expected to return to the average. This method can be tested with historical price data, like Apple Inc.'s (AAPL) from 2010 to 2022. The Z-score helps decide when to trade.

Some main advantages of investment backtesting are:

- Checking a trading strategy with past market data

- Finding out about profits, risks, win rates, and losses

- Improving a strategy before using real money

By testing stocks and investments, traders can learn about a strategy's possible success. This helps them make better choices with their money.

| Strategy | Annual Return | Drawdown |

|---|---|---|

| Moving Average | 15% | 10% |

| Mean Reversion | 12% | 8% |

Integrating Backtesting with Live Trading

Integrating stock backtesting with live trading is key to improving a trading strategy. Tradewell says this means moving from testing to real trading and always checking and tweaking the plan. With free stock backtesting tools, traders can check their plans and make smart choices.

To blend backtesting with live trading well, traders need to focus on a few important things:

- Switching from testing to real trading: This means fine-tuning the strategy based on test results and real trading.

- Always checking and adjusting: Traders should keep an eye on how their strategy is doing and tweak it as needed for the best results.

By taking these steps and using free stock backtesting tools, traders can improve their strategies. This leads to better trading results. With the right way to mix stock backtesting and live trading, traders can make smart choices and reach their investment goals.

| Backtesting Tool | Features |

|---|---|

| Backtrader | Supports multiple data feeds and brokers, offers a user-friendly interface and extensive documentation |

| Alpaca Securities | Provides a Paper Trading API, offers commission-free trading for self-directed individual brokerage accounts |

Best Practices for Effective Backtesting

Consistency in data usage is key for reliable back testing results. High-quality historical data that mirrors real-world markets is essential. A stock back test should assess a trading strategy's performance over a long period. It should consider different market conditions and scenarios.

To back test effectively, document the process. Include the parameters, data sources, and results. This helps track progress, spot areas for improvement, and refine the strategy. Some top tips for back testing are:

- Use a big enough sample size, like 30 to 50 trades, for significant results

- Include realistic transaction costs, like commissions and slippage, to mimic real trading

- Consider latency and execution delays to accurately measure strategy performance

- Steer clear of look-ahead bias and overfitting to avoid unrealistic expectations and ensure strategy strength

By sticking to these best practices and using top-notch data, traders can back test effectively. This leads to a reliable trading strategy that works well in different market conditions. It's also important to regularly update historical data and check risk metrics and drawdowns during back testing. This is vital for managing risk and improving the strategy.

Future Trends in Stock Backtesting

The world of stock backtesting is set for big changes. Artificial intelligence (AI) and machine learning (ML) are leading the way. These technologies will change how traders look at and improve their strategies.

AI can find hidden patterns and market signals. It can also make the backtesting process faster. This means traders will get better insights and work more efficiently.

Big data and cloud computing will also play a big role. They will help traders test their strategies in many different market conditions. This will help them find the best times to buy and sell.

Even though historical data is key, the future will also look at real-time market trends. Traders will use new data sources and advanced tools. This will help them make better decisions and stay ahead in the financial world.

FAQ

What is stock backtesting and why is it important?

Stock backtesting tests a trading strategy on past market data. It helps traders improve their strategies and avoid mistakes. This way, they can make better decisions to increase their profits.

What are the key terms in stock backtesting?

Key terms include historical data, parameters, risk management, and strategy optimization. Performance metrics are also important.

How do I set up the parameters for my stock backtesting?

To set up parameters, choose the right historical data and time frames. Define the trading rules and indicators you want to test.

What are the best tools and software for stock backtesting?

Many tools and software are available, like QuantConnect, Backtrader, and Interactive Brokers' Trader Workstation. Each has unique features.

How do I design a successful trading strategy for backtesting?

A good strategy considers different strategies and risk management. It's also important to refine the strategy based on backtesting results.

How do I interpret the results of my stock backtesting?

Focus on returns, drawdowns, and volatility when evaluating results. These metrics help assess your strategy's performance and guide adjustments.

What are the common pitfalls in stock backtesting, and how can I avoid them?

Avoid overfitting and ignoring market conditions. Also, document your process well. Consistency and awareness of market dynamics are key.

Can you provide real-world examples of successful and failed stock backtesting strategies?

Yes, we have case studies of successful and failed strategies. They show the lessons learned from each experience.

How do I integrate my stock backtesting results with live trading?

Transition from backtesting to live trading carefully. Monitor your strategy's performance and adjust as needed based on market conditions.

What are the best practices for effective stock backtesting?

Use consistent data, document your process well, and regularly review and refine your strategy. This ensures effective backtesting.

What are the future trends in stock backtesting, and how can I stay ahead of the curve?

Future trends include more use of artificial intelligence and machine learning. Stay updated by learning and adapting to these technologies.