Comprehensive Guide to Option & Day Trading

Option trading and day trading are complex financial strategies. They need a deep understanding of the markets and a solid plan. Experts like David Hewitt say day trading can be profitable if done right. Option trading helps investors manage risk and make returns.

Day trading options aim to profit from short-term price changes. Option trading involves buying and selling contracts for the right to buy or sell a security at a set price. Both require a strong market understanding and a good risk management plan. This includes using stop-loss orders and daily loss limits to control losses.

Introduction to Option Trading and Day Trading

The Pattern Day Trader (PDT) rule requires a $25,000 account balance for four or more day trades in five business days. It's key to know the rules and risks of day trading options. Using stop-loss orders and setting daily loss limits helps manage risk and avoid common mistakes.

Key Takeaways

- Option trading and day trading require a deep understanding of the markets and a well-thought-out approach.

- Day trading options involve buying and selling securities within a single trading day, with the goal of profiting from short-term price movements.

- Option trading involves buying and selling contracts that give the holder the right, but not the obligation, to buy or sell a security at a specified price.

- Stop-loss orders and daily loss limits are essential risk management tools for day traders.

- The Pattern Day Trader (PDT) rule requires a minimum account balance of $25,000 for individuals executing four or more day trades within five business days.

- Successful day traders emphasize staying informed by monitoring market headlines, economic reports, and other influential factors affecting stock and asset prices throughout the trading day.

Introduction to Option Trading and Day Trading

Option trading and day trading are two big names in the financial markets. Daily options trading is about buying and selling options in one day. The goal is to make money from price changes. The debate between options trading and day trading is ongoing, each with its own risks and benefits.

In 2023, 11.1 billion options contracts were traded, up 7.1% from the year before. This shows options trading is getting more popular.

Understanding Options: Calls and Puts

Options trading is about calls and puts. These are contracts that let you buy or sell something at a set price. Calls let you buy, and puts let you sell.

The Role of Expiration Dates

Expiration dates are key in options trading. They show how long you can use the option. Options can be on stocks, indices, or commodities.

Factors Influencing Option Prices

Several things affect option prices. These include the asset's price, how volatile it is, and how much time is left. Knowing these helps in successful trading.

| Factor | Description |

|---|---|

| Underlying Asset Price | The price of the underlying asset affects the option price |

| Volatility | Higher volatility increases the option price |

| Time to Expiration | Options with longer expiration dates are more valuable |

Learning about options trading and what affects prices helps traders. It lets them make smart choices and strategies.

Key Concepts in Option Trading

Learning the basics of option trading is key to success in the financial markets. It's important to know the differences between day trading and options trading. Day trading means buying and selling within the same day. Options trading gives you the right to buy or sell at a set price, but you don't have to.

If you want to learn day trading options, you need to understand what affects option prices. This includes intrinsic value, extrinsic value, and how time affects them. The price you pay for an option is the most you could lose, showing the risk control of options. Options can also be used for protection, making money, or betting on price changes.

Here are some important stats to think about when comparing day trading and options:

- More than 70% of option contracts are closed before they expire.

- About 20% expire worthless, and around 5% are exercised.

- Options trading often includes trading fees, which are a flat fee per trade plus a small fee per contract.

Knowing these concepts and stats helps traders make better choices between day trading and options. It also helps them develop good strategies for trading options.

Fundamental Strategies in Day Trading

Day trading means making many trades in one day to make money from small price changes. If you're thinking about can you day trade options, knowing the basics is key. Option trading day trading needs a strong grasp of the markets and quick decision-making skills.

Popular day trading methods include scalping, momentum trading, and reversal trading. These tactics can be applied to various financial products like stocks, options, and futures. Success in day trading depends on understanding the markets well and managing risks effectively.

Here are some important tips for day traders:

- Begin with small trades to lower risks and tweak strategies as needed

- Stick to trading one or two stocks at a time as a beginner

- Steer clear of penny stocks because they're not liquid and risky

- Use limit orders to limit losses and manage risks well

By sticking to these strategies and tips, day traders can boost their success chances. Day trading is all about short-term trades to profit from price swings. It's vital to know the markets well and handle risks effectively to succeed in option trading day trading.

| Strategy | Description |

|---|---|

| Scalping | Making multiple small trades to profit from small price fluctuations |

| Momentum Trading | Trading based on the momentum of a stock's price movement |

| Reversal Trading | Trading based on the reversal of a stock's price movement |

Tools and Platforms for Day Trading

Day trading options and daily options trading need the right tools and platforms to succeed. With many options, picking the right one can be tough. David Hewitt says a good charting tool can greatly improve your trading.

Choosing the Right Trading Platform

When picking a trading platform, look at execution quality, trading costs, and research. Top platforms for day trading include Interactive Brokers, Webull, and Fidelity. They offer low fees, fast execution, and lots of trading tools.

Essential Software and Tools

Along with a trading platform, you'll need other software and tools for day trading options. These include:

- Charting software, such as Warrior Charts or TC2000

- Stock scanning software, such as Warrior Trading Scanners

- Technical analysis tools, like moving averages and relative strength index (RSI)

The Importance of Charting Tools

Charting tools are key for day trading options and daily options trading. They help you analyze market trends, spot patterns, and make smart trading choices. The right charting tool can give you an edge in the market and boost your trading success.

Risk Management in Option Trading

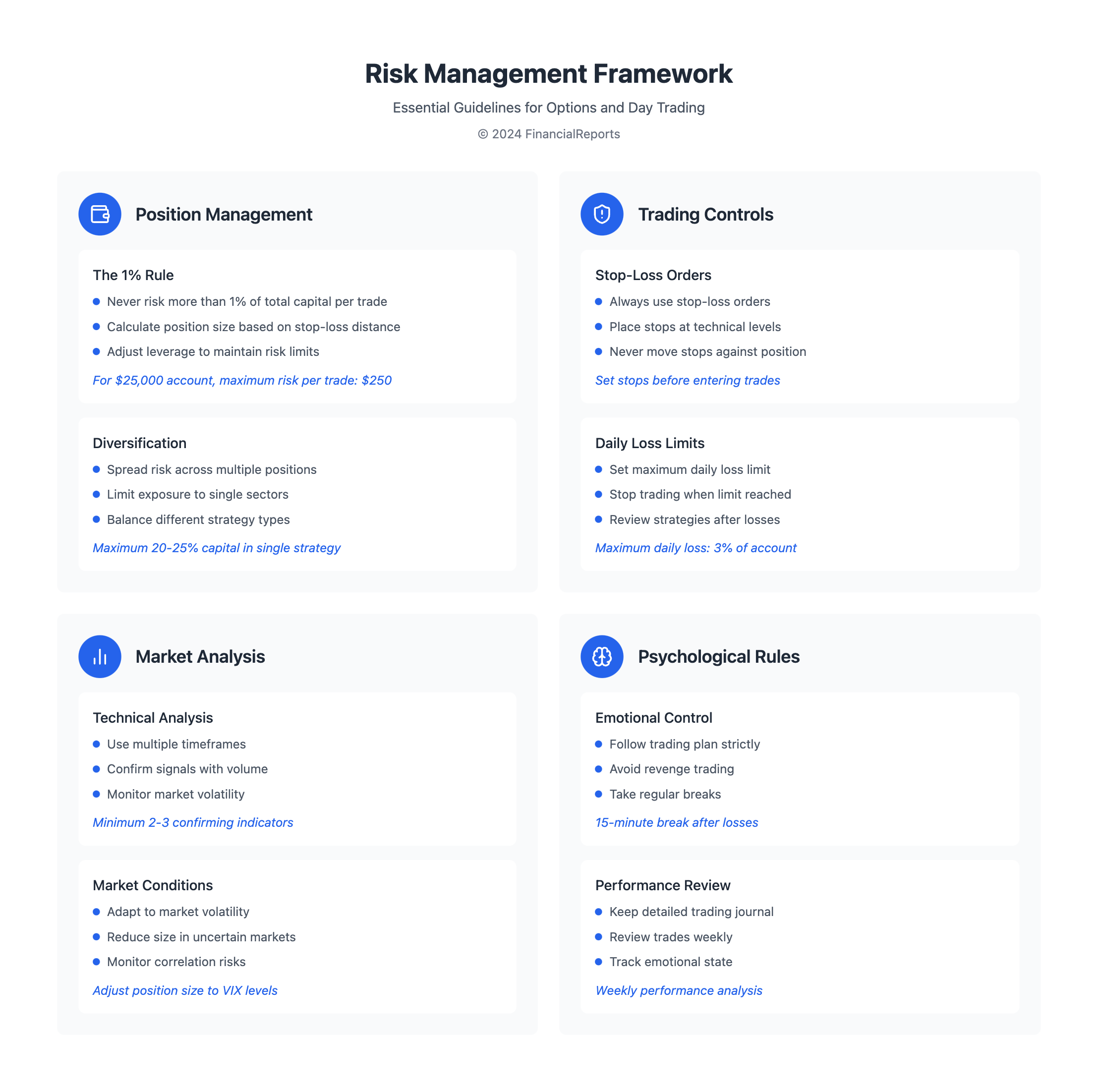

Effective risk management is key in option trading. It helps balance the chance for gains and the risk of losses. Traders risk losing money when they open positions. Bigger positions mean more risk but also more chance for profit.

When trading, it's important to manage risks well. This includes setting limits on losses and gains, spreading investments across different areas, and using protective options. The one-percent rule is a common guideline for day traders. It advises not to risk more than 1% of total capital on one trade.

Setting Stop-Loss Orders

Setting stop-loss orders is vital for managing risks. It stops big losses by selling at a set price. This is very important in options trading, where big losses can happen if not managed well. Stop-loss orders help limit losses and protect investments.

Position Sizing: Finding the Right Balance

Position sizing is key to managing risks. It helps find the right mix between gains and losses. Using 1-2% of total account balance for each trade can prevent big losses. Diversifying across different options and assets also helps spread out risks.

| Risk Management Strategy | Description |

|---|---|

| Setting Stop-Loss Orders | Prevents excessive losses by selling at a predetermined price |

| Position Sizing | Finding the right balance between possible gains and losses |

| Diversification | Spreading out risk across different options strategies, expiration dates, and underlying assets |

By using these risk management strategies, traders can reduce losses and increase gains. Effective risk management is critical for successful trading. By following these strategies, traders can protect their investments and reach their trading goals.

Analyzing Market Trends for Day Trading

Day traders need to understand market trends to make smart choices. Knowing how to day trade options and if you can do it is key. They use technical analysis to look at past market behavior and price changes to find good trades.

Technical analysts believe that price history repeats itself. They look at price, volume, and volatility to spot trends. There are three main trends: up, down, and sideways. Traders use tools like moving averages and trendlines to make money from these trends.

For more on technical analysis and trend trading, check out technical analysis resources. By combining technical analysis with day trading knowledge, traders can create winning strategies. Important things to remember include:

- Understanding options pricing and factors like Delta, Theta, Vega, and Gamma

- Recognizing the impact of Implied Volatility (IV) on options premiums

- Managing risk through position sizing, stop-loss orders, and realistic profit targets

By learning these concepts and keeping up with market trends, traders can boost their day trading success.

| Trend Type | Description |

|---|---|

| Upward Trend | Bull market, characterized by increasing prices |

| Downward Trend | Bear market, characterized by decreasing prices |

| Sideways Trend | Range-bound market, characterized by stable prices |

Options Trading Strategies for Beginners

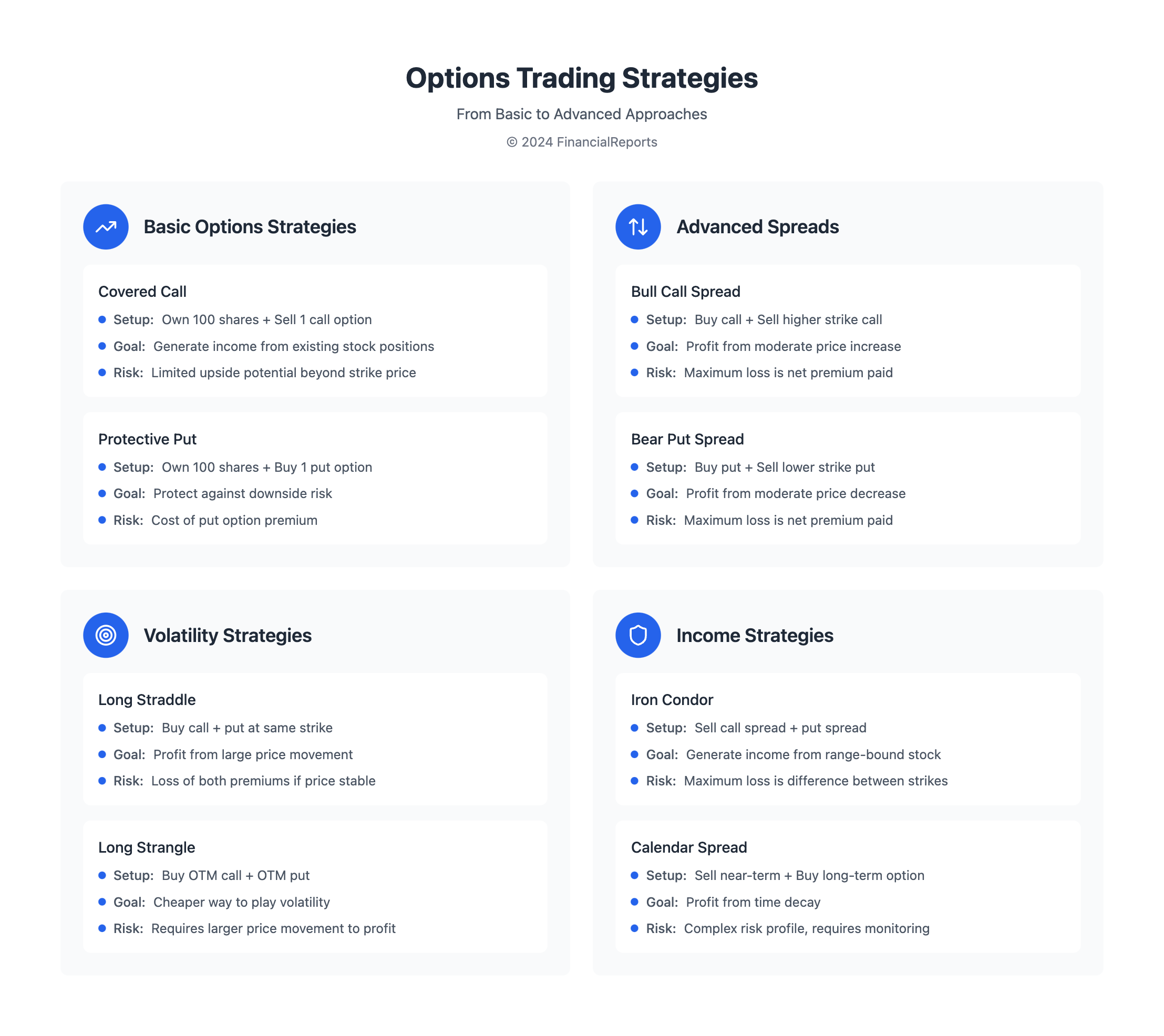

Option trading day trading uses different strategies to make more money. One way is the covered call. It involves selling a call option while owning the stock. This can help investors earn extra money from their stocks.

Another method is the protective put. It's about buying a put option to reduce losses. This is good for those who want to protect their stocks from price drops. Knowing the assets and market trends well is key in day trading options. These strategies help investors make smart choices and control risks.

Some important things to think about in option trading day trading include:

- Understanding the underlying assets and market trends

- Setting clear goals and risk tolerance

- Using technical analysis to inform trading decisions

- Managing risk through hedging and diversification

By following these tips and using the right strategies, investors can feel confident in option trading day trading. It's vital to stay updated and adjust to market changes. With the right strategy, day trading options can be both profitable and fulfilling.

Advanced Options Strategies

Advanced options strategies can be profitable if done right, says David Hewitt. These strategies mix options in various ways to manage risk and boost returns. In daily options trading, knowing the different options types is key to reaching specific goals.

Options trading and day trading have different approaches and strategies. Day trading looks at short-term price changes. Options trading, on the other hand, involves buying and selling options contracts. These contracts give the right, but not the obligation, to buy or sell an underlying asset at a set price before the option expires.

Spreads: Combining Options for Better Outcomes

Spreads combine buying and selling options at the same time. This can limit risk and increase returns. There are many spreads, like bull call spreads and bear put spreads. These strategies help profit from market movements in daily options trading.

Straddles and Strangles: Profit from Volatility

Long straddles and strangles involve buying calls and puts on the same asset. They profit from market movements in any direction. These strategies are often used in options trading vs day trading, as they can protect against losses. Here's a table that shows the main differences between straddles and strangles:

| Strategy | Description |

|---|---|

| Long Straddle | Buy a call and a put on the same underlying asset with the same strike price |

| Long Strangle | Buy a call and a put on the same underlying asset with different strike prices |

In conclusion, advanced options strategies can help manage risk and increase returns in daily options trading. By understanding the different options types and how to combine them, traders can make smart decisions and reach their goals.

Psychological Aspects of Trading

Understanding the psychological side of trading is key to success in day trading vs options. To day trade options well, you need to know how emotions and biases affect your choices. Studies show that biases like confirmation and loss aversion can harm your trading.

Emotions like fear and greed also play a big role. Fear might make you leave trades too soon. Greed can make you take big risks, like holding onto wins for too long. To fight these, set rules, manage risks, and get help from others.

Here are some ways to handle emotions and stay disciplined:

- Know your emotional triggers

- Have a solid trading plan and follow it

- Use risk management tools like stop-loss orders

- Get support from peers and mentors

By tackling these psychological challenges, traders can make better choices. This leads to success in both day trading and options.

| Emotional Bias | Description | Impact on Trading |

|---|---|---|

| Fear | Excessive caution and risk aversion | Prematurely exiting positions, missing out on possible gains |

| Greed | Excessive optimism and risk-taking | Holding onto profitable positions for too long, increasing risk of losses |

Regulatory Considerations in Trading

Understanding the rules is key when trading options. The Securities and Exchange Commission (SEC) watches over trading closely. They say you need at least $25,000 in your account to trade freely.

The Financial Industry Regulatory Authority (FINRA) has rules too. They say you need $25,000 in your account to trade during the day. They also limit how much you can trade based on your account balance. Knowing these rules helps avoid fines and keeps you in good standing.

Understanding SEC Regulations

The SEC makes rules to protect investors and keep the market fair. Traders must follow these rules, including those for day trading options. Some important rules include:

- Minimum equity requirements for pattern day traders

- Day-trading buying power limits

- Margin requirements for option traders

Taxes and Reporting Obligations

Traders also have to think about taxes and reporting. The IRS wants traders to report their gains and losses. It's important to know how trading affects your taxes and keep good records.

Conclusion: Balancing Risk and Reward in Trading

As we wrap up this guide on day trading options and strategies, a key lesson stands out. Balancing risk and reward is essential. To succeed in daily options trading, you need a disciplined mindset. This mindset must weigh both the gains and losses.

Experts suggest aiming for a 1:3 risk-reward ratio. This means risking one dollar to aim for a three-dollar gain. Using stop-loss orders and derivatives like put options can help manage risks better.

The ultimate goal is to make consistent profits. This means maximizing gains while keeping losses low. Understanding market conditions, technical indicators, and trader psychology is key. By balancing your approach to day trading options, you can boost your chances of long-term success and financial stability.

FAQ

What is the difference between option trading and day trading?

Option trading is about buying and selling option contracts. These contracts give the holder the right to buy or sell an asset at a set price and time. Day trading, on the other hand, involves buying and selling financial instruments like stocks within the same day. The goal is to make money from small price changes.

What are the key concepts of option trading?

Key concepts in option trading include calls, puts, and expiration dates. Calls allow the holder to buy the asset, while puts let them sell it. The price of the asset, its volatility, and how much time is left until expiration also affect option prices.

What are the fundamental strategies in day trading?

Day trading strategies include scalping, momentum trading, and reversal trading. Scalping is about making many small trades to profit from small price changes. Momentum trading focuses on following market trends. Reversal trading aims to profit from market changes.

What tools and platforms are used for day trading?

Day traders use various tools and platforms. These include trading platforms, software, and charting tools. The right platform is key for quick and efficient trading. Software and charting tools help analyze market data and find trading opportunities.

How can traders manage risk in option trading?

Traders can manage risk by setting stop-loss orders and choosing the right position size. Stop-loss orders limit losses if the market moves against them. Position sizing means deciding how much capital to use for each trade based on risk tolerance and portfolio size.

How can traders analyze market trends for day trading?

Traders analyze market trends using technical analysis. This involves spotting patterns and signals in market data. It helps identify and capitalize on market trends and reversals.

What are some options trading strategies for beginners?

Beginners can start with covered calls and protective puts. Covered calls involve selling call options on stocks you own. Protective puts are put options bought to protect against stock price drops.

What are some advanced options trading strategies?

Advanced strategies include spreads and straddles/strangles. Spreads involve buying and selling options at the same time. Straddles and strangles involve buying or selling both call and put options on the same asset to profit from volatility.

How can traders manage the psychological aspects of trading?

Traders can manage their emotions by learning to control fear and greed. They need to stay disciplined and focused. This includes managing stress, staying calm, and making decisions based on data.

What regulatory considerations should traders be aware of?

Traders need to know about SEC regulations and tax obligations. This includes understanding reporting requirements, capital gains taxes, and any trading rules.